Notícias do Mercado

-

19:00

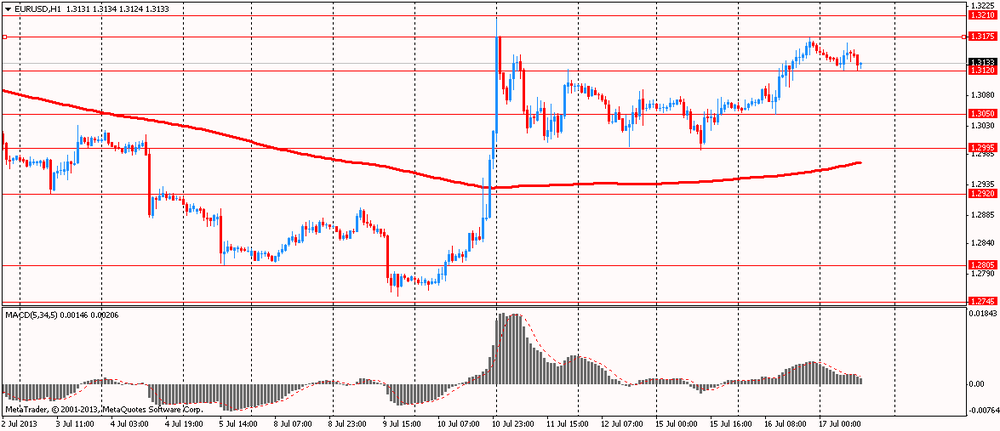

American focus: the euro regained previously lost ground against the dollar

The euro rose against the dollar, having played with most of the previously lost positions, which was due to comments from Fed Chairman Ben Bernanke.

Fed Chairman Bernanke said that the course program of bond purchases is not predetermined. From the comments, it became clear that folding is expected, although he added that the Fed intends to keep policy highly accommodative for the foreseeable future. The program of bond purchases is flexible and will respond to the reports.

During the question and answer session, Bernanke said that the Committee is supported in its quest to use the 7% rate of unemployment as an indicator of recovery in the economy that the Fed must see before you decide to end the program.

He stressed, however, that 7% is not a goal for the Fed, but rather "the exponent of labor market recovery, which we want to see."

Also, the Fed chief said that the U.S. is in a difficult financial situation, but the markets have begun to understand how the Fed says. He said that monetary policy is too focused on the short term.

The cost of the Canadian dollar declined significantly against its U.S. counterpart, which followed immediately after the announcement of the Bank of Canada interest rates. As expected, the central bank left interest rates unchanged - at 1.0%. This level of BC commented on the level of a "substantial fiscal stimulus measures that are currently in force, are appropriate to the situation." The Bank of Canada also confirmed that total and core inflation expected to be low in the near future, before it is essentially grow to 2% by mid-2015, as the economy will return to full use of resources, and inflation expectations remain subdued.

Meanwhile, the Bank of Canada raised its GDP forecast for 2013 to 1.8% from 1.5%, and lowered its forecast for 2014 to 2.7% from 2.8%. We also add that the Bank of Canada lowered its forecast for GDP in the 2nd quarter to 1%, and raised its forecast for the third quarter to 3.8%

Also contributed to the drop in currency declaration governor of the Bank of Canada runners who reported that economic growth in Canada is expected to be "uneven". According to his estimates, the annual GDP growth of 1.8% in 2013 and 2.8% in 2014 and 2015. Furthermore, he added that demand from developing economies is growing. He also expressed his optimism about the prospects for Canadian exporters. In his view, the main domestic risk - the "imbalances in the household sector."

The British pound rose against the dollar after strong labor market data and the minutes of the last meeting of the Bank of England. Also in the course of trade was influenced by comments of Fed Bernanke, who first dropped the value of the currency, and then brought her back to their former positions.

As for the data, is to provide a report from the National Statistics Agency, which showed that in June, the number of unemployed Britons fell by 21.2 million versus 16.2 million a month earlier. It was the strongest decline since June 2010. The number of applications for benefits totaled 1.48 million analysts expected a drop of 8 thousand unemployment rate fell to 4.4% from 4.5% previously, while analysts had expected the index to remain unchanged. The ILO unemployment rate in May remained at 7.8% in line with expectations. Average earnings excluding bonuses rose by 1% versus 0.9% previously forecast and 1.1%. Earnings including bonuses rose by 1.7% vs. 1.3% forecast of 1.4%.

We also add that the protocols presented today showed that all nine members of the monetary policy of the Bank of England in July voted to keep unchanged the existing program to stimulate the economy. At the same time, within the committee remained disagreement over the need for additional incentives. At the first meeting of the Committee on Monetary Policy, chaired by Mark Carney, all nine members of the committee decided not to change the program of buying government bonds. Such absolute unanimity was observed for the first time since October 2012. However, some committee members see the need to increase incentives. They want to understand what tools, in addition to asset purchases, it will be possible to apply under the direction of Carney to boost the economy.

-

15:30

U.S.: Crude Oil Inventories, July -6.9

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3000, $1.3055, $1.3070, $1.3100, $1.3175, $1.3200

USD/JPY Y98.50, Y99.00, Y99.25, Y99.30, Y99.50, Y100.00, Y100.25

EUR/JPY Y131.00

GBP/USD $1.5100, $1.5150, $1.5270

USD/CHF Chf0.9500(large)

AUD/USD $0.9050, $0.9200, $0.9300

AUD/JPY Y92.75

USD/CAD C$1.0325, C$1.0400, C$1.0490

-

14:00

Swiss economic sentiment improves in July: ZEW

Switzerland's economic confidence improved slightly in July after staying stable in the previous month, a monthly survey by the Centre for European Economic Research in cooperation with Credit Suisse showed Wednesday.

The ZEW-CS Indicator of economic expectations advanced to 4.8 points in July from 2.2 points in June. The indicator, which reflects expectations of surveyed financial market experts regarding economic development in Switzerland on a six-month time horizon, has now remained at a broadly stable level for the last three months.

In July, a higher number of analysts said they expect economic conditions to remain unchanged in the next six months. Their share increased by 8.4 percentage points month-on-month to 71.4 percent in July.

At the same time, the indicator of experts' views of the current economic situation improved notably in July, by 4.5 points from the previous month to 26.2 points.

Meanwhile, experts' views of the current economic situation in the euro area turned more pessimistic, with the share of pessimists increasing by 4.9 percentage points from the previous month to 80.5 percent in July. The survey further indicated that expectations for the stock markets in Switzerland, Europe and the US were positive in July, with the respective indicators hovering well above their long-term averages.

-

13:50

U.S. housing starts unexpectedly show steep drop in June

Housing starts in the U.S. unexpectedly showed a notable decrease in the month of June, according to a report released by the Commerce Department on Wednesday.

The report showed that housing starts tumbled 9.9 percent to an annual rate of 836,000 in June from the revised May estimate of 928,000.

The steep drop came as a surprise to economists, who had expected housing starts to climb to an annual rate of 951,000 from the 914,000 originally reported for the previous month.

The Commerce Department also said building permits fell 7.5 percent to an annual rate of 911,000 in June from the revised May rate of 985,000.

Building permits, an indicator of future housing demand, had been expected to rise to an annual rate of 990,000 from the 974,000 originally reported for May.

-

13:30

U.S.: Housing Starts, mln, June 0.836 (forecast 0.950)

-

13:30

Canada: Foreign Securities Purchases, May 6.74 (forecast 10.23)

-

13:30

U.S.: Building Permits, mln, June 0.911 (forecast 1.000)

-

13:16

European session: the pound rose

08:30 United Kingdom ILO Unemployment Rate May 7.8% 7.8% 7.8%

08:30 United Kingdom Average Earnings, 3m/y May +1.3% +1.4% +1.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +1.1% +1.0%

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom Claimant count June -8.6 -7.9 -21.2

08:30 United Kingdom Claimant Count Rate June 4.5% 4.5% 4.4%

09:00 Eurozone Construction Output, m/m May +2.0% -0.3%

09:00 Eurozone Construction Output, y/y May -6.6% -5.1%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 2.2 4.8

Euro traded moderately lower against the U.S. dollar in anticipation of speeches by Fed Chairman Ben Bernanke (Wednesday before the Committee on Financial Services of the House of Representatives and on the Thursday before the Senate Committee on Banking). Experts note that the probability that Bernanke will surprise the market is low - most likely the option of maintaining QE in the previous volumes will be confirmed, but such an alignment is already embedded in the dynamics of the EUR / USD and tangible drawdown dollar on the news seems to be unlikely.

The pressure on the single currency had data on production in the construction sector. In May, the volume of production in the construction sector of the euro area fell by 0.3% compared to growth of 2% a month earlier, as reported by the agency Eurostat. In the annual comparison figure fell by 5.1% against a decline of 6.6% in the previous month.

The British pound rose against the dollar after strong labor market data and the minutes of the last meeting of the Bank of England.

In June, the number of unemployed Britons fell by 21.2 million against 16.2 million the previous month, as reported by the national statistics agency. It was the strongest decline since June 2010. The number of applications for benefits totaled 1.48 million analysts expected a drop of 8 thousand unemployment rate fell to 4.4% from 4.5% previously, while analysts had expected the index to remain unchanged. The ILO unemployment rate in May remained at 7.8% in line with expectations. Average earnings excluding bonuses rose by 1% versus 0.9% previously forecast and 1.1%. Earnings including bonuses rose by 1.7% vs. 1.3% forecast of 1.4%.

All nine members of the monetary policy of the Bank of England in July voted to keep unchanged the existing program to stimulate the economy. At the same time, within the committee remained disagreement over the need for additional incentives. At the first meeting of the Committee on Monetary Policy, chaired by Mark Carney, all nine members of the committee decided not to change the program of buying government bonds. Such absolute unanimity was observed for the first time since October 2012. However, some committee members see the need to increase incentives. They want to understand what tools, in addition to asset purchases, it will be possible to apply under the direction of Carney to boost the economy.

EUR / USD: during the European session, the pair is trading in the range of $ 1.3121 - $ 1.3166

GBP / USD: during the European session, the pair rose to $ 1.52455

USD / JPY: during the European session, the pair rose to Y99.83

At 12:30 GMT in Canada will the volume of transactions with foreign securities in May. U.S. at 12:30 GMT will publish the volume of building permits issued, the number of Housing Starts in June. At 14:00 GMT we will know the decision of the Bank of Canada Interest Rate and the accompanying statement will be made of the Bank of Canada. At 14:00 GMT the chairman of Board of Governors of the Federal Reserve Ben Bernanke testifies. At 14:30 GMT will be the publication of the report of the Bank of Canada's Monetary Policy for the 3rd quarter. At 15:15 GMT will be a press conference by the Bank of Canada. At 16:30 GMT a speech FOMC member Sarah Bloom Raskin. At 18:00 GMT the United States will publish economic survey of the Fed's regional "Beige Book."

-

13:00

Orders

EUR/USD

Offers $1.3250/60, $1.3225/30, $1.3170-90

Bids $1.3110/00, $1.3080, $1.3060/50, $1.3020

GBP/USD

Offers $1.5340/50, $1.5295/305, $1.5280/85, $1.5250/60

Bids $1.5150, $1.5125/15, $1.5080, $1.5060/45

AUD/USD

Offers $0.9350, $0.9335/40, $0.9300, $0.9280, $0.9255/60, $0.9225/30

Bids $0.9185/80, $0.9150, $0.9120, $0.9110/00, $0.9050

EUR/GBP

Offers stg0.8845/50, stg0.8830/35, stg0.8790/95, stg0.8760-70, stg0.8740/45

Bids stg0.8630, stg0.8615-00, stg0.8575/65

EUR/JPY

Offers Y132.50, Y132.20, Y132.00, Y131.50

Bids Y130.50/45, Y130.05/00, Y129.50

USD/JPY

Offers Y100.75/80, Y100.45/50, Y100.05/10, Y100.00

Bids Y99.30/25, Y99.00, Y98.80, Y98.55/50

-

10:53

Eurozone May construction output falls

Eurozone construction output fell 0.3 percent month-on-month in May, following a 1 percent rise in April, Eurostat reported Wednesday.

On a yearly basis, construction output declined 5.1 percent, but slower than the 6.8 percent drop seen in April.

Building construction decreased 0.6 percent on month after rising 0.5 percent in the prior month. At the same time, growth in civil engineering slowed sharply to 0.1 percent from 4.3 percent.

In the EU27, production in the construction sector dropped 0.2 percent month-on-month and by 5.1 percent annually.

-

10:39

UK jobless claims fall more than forecast

The number of people claiming jobless allowance in the UK declined more than expected in June, the latest data from the Office for National Statistics showed Wednesday.

The claimant count for June was 1.48 million, down 21,200 from May. Economists expected the figure to fall by 8,000. The claimant count rate edged down to 4.4 percent in June from 4.5 percent in May.

The ILO unemployment rate was 7.8 percent in the March to May period. This was in line with forecasts.

Total pay, including bonus, rose 1.7 percent in March-May compared with the same period in 2012. This was faster than the expected 1.4 percent gain. Regular pay rose 1 percent over the same period.

-

10:23

Option expiries for today's 1400GMT cut

EUR/USD $1.3000, $1.3055, $1.3070, $1.3100, $1.3175, $1.3200

USD/JPY Y98.50, Y99.00, Y99.25, Y99.50, Y100.00, Y100.25

EUR/JPY Y131.00

GBP/USD $1.4875, $1.5000, $1.5100, $1.5150

USD/CHF Chf0.9500(large)

AUD/USD $0.9050, $0.9200

USD/CAD C$1.0400, C$1.0490

-

10:00

Switzerland: Credit Suisse ZEW Survey (Expectations), July 4.8

-

09:32

United Kingdom: Average Earnings, 3m/y , May +1.7% (forecast +1.4%)

-

09:31

United Kingdom: Average earnings ex bonuses, 3 m/y, May +1.0% (forecast +1.1%)

-

09:30

United Kingdom: ILO Unemployment Rate, May 7.8% (forecast 7.8%)

-

09:30

United Kingdom: Claimant count , June -21,2 (forecast -7.9)

-

09:23

Asia Pacific stocks close

Most Asian stocks rose, with a regional benchmark index extending gains from a seven-week high, as material producers advanced ahead of Federal Reserve Chairman Ben S. Bernanke’s address to the U.S. Congress today.

Nikkei 225 14,615.04 +15.92 +0.11%

Hang Seng 21,349.65 +37.27 +0.17%

S&P/ASX 200 4,981.68 -4.33 -0.09%

Shanghai Composite 2,044.92 -20.80 -1.01%

BHP Billiton Ltd. added 2.3 percent in Sydney after the world’s biggest mining company said fourth-quarter iron-ore production gained 17 percent.

Mitsubishi Motors Corp. jumped 11 percent in Tokyo on a report the carmaker will pay its first dividend in 16 years.

China Resources Power Holdings Co. slumped 9.6 percent after a Xinhua News Agency reporter said the power generator and the chairman of its state-owned parent intentionally overpaid for a 2010 acquisition.

-

07:04

Asian session: The yen fell

00:30 Australia Leading Index May +0.7% Revised From +0.6% +0.2%

02:00 China Leading Index June +0.3% +0.1%

The yen fell after the Bank of Japan released minutes of its June 10-11 policy meeting today, in which one board member said it’s appropriate for the central bank to limit the period of its monetary stimulus to about two years and review it thereafter. If expectations rise in markets that the measures will continue for a longer period or “extreme” additional steps will be implemented, that would lead to economic instability in the medium to long term, the member said.

The dollar rose against a majority of its peers with Federal Reserve Chairman Ben S. Bernanke due to testify to Congress today. The Fed purchases $85 billion of Treasuries and mortgage debt each month as part of its latest round of quantitative easing to cap borrowing costs, a program that tends to debase the currency.

The Bloomberg Dollar Index snapped a two-day decline before U.S. data that may show housing starts increased for a second month, adding to the case for the Federal Open Market Committee to slow monetary stimulus. The U.S. Commerce Department is likely to say today that housing starts climbed 5 percent in June from a month earlier to a 960,000 annualized rate, according to the median estimate of economists surveyed by Bloomberg News.

The pound fell toward a four-month low against the euro before the Bank of England releases minutes of its July 3-4 policy meeting today amid speculation Governor Mark Carney will tie central bank guidance on interest rates to economic developments.

EUR / USD: during the Asian session the pair fell to $ 1.3130

GBP / USD: during the Asian session the pair fell to $ 1.5105

USD / JPY: during the Asian session the pair rose to Y99.55

Wednesday sees a full calendar on both sides of the Atlantic, but without doubt, the main focus will be on Fed Chair Bernanke's testimony on Capitol Hill. The European data calendar kicks off at 0700GMT, with the release of the May industrial orders data. At 0900GMT, the Euro area May construction output data will be published. At the same time, German Deputy Finance Minister Thomas Steffen is set to brief on the upcoming trip of German FinMin Wolfgang Schaeuble to Athens and on upcoming G20 Moscow meet.

-

06:22

Currencies. Daily history for Jul 16'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3153 +0,66%

GBP/USD $1,5147 +0,30%

USD/CHF Chf0,9397 -0,89%

USD/JPY Y99,15 -0,83%

EUR/JPY Y130,43 -0,12%

GBP/JPY Y150,18 -0,49%

AUD/USD $0,9240 +1,47%

NZD/USD $0,7887 +0,91%

USD/CAD C$1,0375 -0,51%

-

06:00

Schedule for today, Wednesday July 17’2013:

00:30 Australia Leading Index May +0.7% Revised From +0.6% +0.2%

02:00 China Leading Index June +0.3% +0.1%

08:30 United Kingdom ILO Unemployment Rate May 7.8% 7.8%

08:30 United Kingdom Average Earnings, 3m/y May +1.3% +1.4%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +1.1%

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom Claimant count June -8.6 -7.9

08:30 United Kingdom Claimant Count Rate June 4.5% 4.5%

09:00 Eurozone Construction Output, m/m May +2.0%

09:00 Eurozone Construction Output, y/y May -6.6%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 2.2

12:30 Canada Foreign Securities Purchases May 14.91 10.23

12:30 U.S. Building Permits, mln June 0.974 1.000

12:30 U.S. Housing Starts, mln June 0.914 0.950

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada BOC Rate Statement

14:00 U.S. Fed Chairman Bernanke Testifies

14:30 Canada Bank of Canada Monetary Policy Report

14:30 Canada BOC Press Conference

14:30 U.S. Crude Oil Inventories July -9.9

16:30 U.S. FOMC Member Raskin Speaks

18:00 U.S. Fed's Beige Book July

-