Notícias do Mercado

-

23:45

New Zealand: PPI Output (QoQ) , Quarter II -0.5% (forecast +0.8%)

-

23:45

New Zealand: PPI Input (QoQ), Quarter II -1.0% (forecast +0.7%)

-

23:21

Currencies. Daily history for Aug 18'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3361 -0,28%

GBP/USD $1,6725 +0,22%

USD/CHF Chf0,9064 +0,46%

USD/JPY Y102,56 +0,21%

EUR/JPY Y137,03 -0,12%

GBP/JPY Y171,53 +0,41%

AUD/USD $0,9322 +0,03%

NZD/USD $0,8477 -0,08%

USD/CAD C$1,0886 -0,09%

-

23:00

Schedule for today, Tuesday, Aug 19’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III +2.4%

08:00 Eurozone Current account, adjusted, bln June 19.5 21.3

08:30 United Kingdom Retail Price Index, m/m July +0.2%

08:30 United Kingdom Retail prices, Y/Y July +2.6% +2.6%

08:30 United Kingdom RPI-X, Y/Y July +2.7%

08:30 United Kingdom Producer Price Index - Input (MoM) July -0.8% -0.8%

08:30 United Kingdom Producer Price Index - Input (YoY) July -4.4%

08:30 United Kingdom Producer Price Index - Output (MoM) July -0.2% +0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July +0.2%

08:30 United Kingdom HICP, m/m July +0.2%

08:30 United Kingdom HICP, Y/Y July +1.9% +1.8%

08:30 United Kingdom HICP ex EFAT, Y/Y July +2.0% +1.9%

12:30 U.S. Building Permits, mln July 0.963 1.000

12:30 U.S. Housing Starts, mln July 0.893 0.970

12:30 U.S. CPI, m/m July +0.3% +0.1%

12:30 U.S. CPI, Y/Y July +2.1%

12:30 U.S. CPI excluding food and energy, m/m July +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July +1.9%

20:30 U.S. API Crude Oil Inventories August +2.0

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Adjusted Merchandise Trade Balance, bln July -1080.8 -770.0

-

16:34

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected NAHB housing market index

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected NAHB housing market index. The NAHB housing market index climbed to 55.0 in August from 53.0 in July. Analysts had expected the index to remain unchanged at 53.0.

Market participants continued to monitor closely geopolitical tensions.

The euro declined against the U.S. dollar due to speculation that the European Central Bank will add new stimulus measures.

Eurozone's trade surplus dropped to 13.8 billion euros in June from a surplus of 15.2 billion euros in May, missing expectations for a decline to 14.9 billion euros. May's figure was revised down from a surplus of 15.3 billion euros.

The British pound traded mixed against the U.S. dollar. The UK currency was supported by the BoE governor's comments. The Bank of England Governor Mark Carney told the Sunday Times on Sunday that the Bank of England don't need to wait for wage growth to rise its interest rate.

The Canadian dollar traded slightly lower against the U.S. dollar after the foreign securities purchases in Canada. Canada's foreign securities purchases dropped by C$1.07 billion in June, missing expectations for a C$14.68 billion rise, after an increase of C$21.42 billion in May. May's figure was revised down from a rise of C$21.43 billion.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after weaker new motor vehicle sales in Australia. New motor vehicle sales in Australia declined 1.3% in July, after a 1.7% rise in June.

On a yearly basis, new motor vehicle sales in Australia fell 0.4% in July, after a 2.2% drop in June.

The Japanese yen decreased against the U.S. dollar in the absence of any major economic reports in Japan.

-

15:00

U.S.: NAHB Housing Market Index, August 55 (forecast 53)

-

14:45

Option expiries for today's 1400GMT cut

USD/JPY Y101.75-80, Y102.15, Y102.65, Y102.80, Y103.00

EUR/GBP stg0.7965, stg0.8000, stg0.8010

EUR/CHF Chf1.2000, Chf1.2150

AUD/USD $0.9310

USD/CAD C$1.0925-30

-

13:30

Canada: Foreign Securities Purchases, June -1.07 (forecast 14.68)

-

13:09

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the weaker-than-expected trade data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) July +1.7% -1.3%

01:30 Australia New Motor Vehicle Sales (YoY) July -2.2% -0.4%

09:00 Eurozone Trade Balance s.a. June 15.2 Revised From 15.3 14.9 13.8

10:00 Germany Bundesbank Monthly Report August

The U.S. dollar traded mixed against the most major currencies ahead of the NAHB housing market index. The NAHB housing market index is expected to remain unchanged at 53 in August.

The euro traded mixed against the U.S. dollar after the weaker-than-expected trade data from the Eurozone. Eurozone's trade surplus dropped to 13.8 billion euros in June from a surplus of 15.2 billion euros in May, missing expectations for a decline to 14.9 billion euros. May's figure was revised down from a surplus of 15.3 billion euros.

The British pound traded mixed against the U.S. dollar. The UK currency was supported by the BoE governor's comments. The Bank of England Governor Mark Carney told the Sunday Times on Sunday that the Bank of England don't need to wait for wage growth to rise its interest rate.

The Canadian dollar traded mixed against the U.S. dollar ahead of the foreign securities purchases in Canada. Foreign investment in Canada is expected to climb by C$14.68 billion in June.

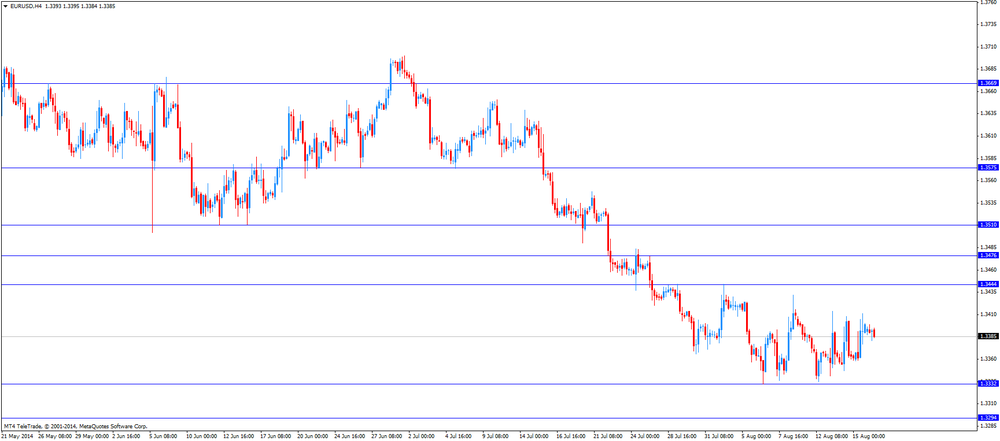

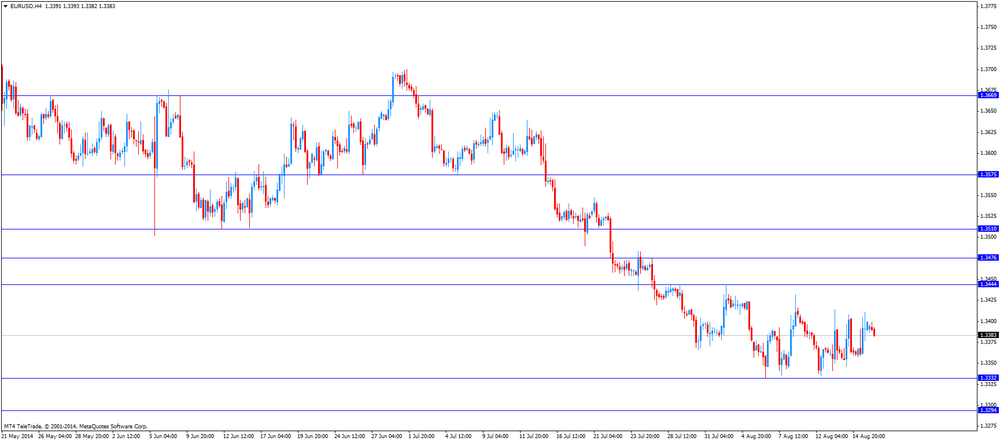

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

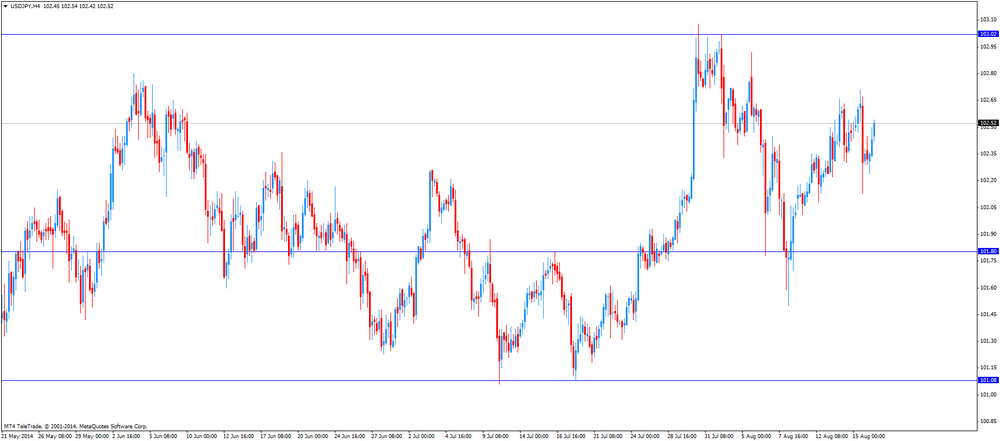

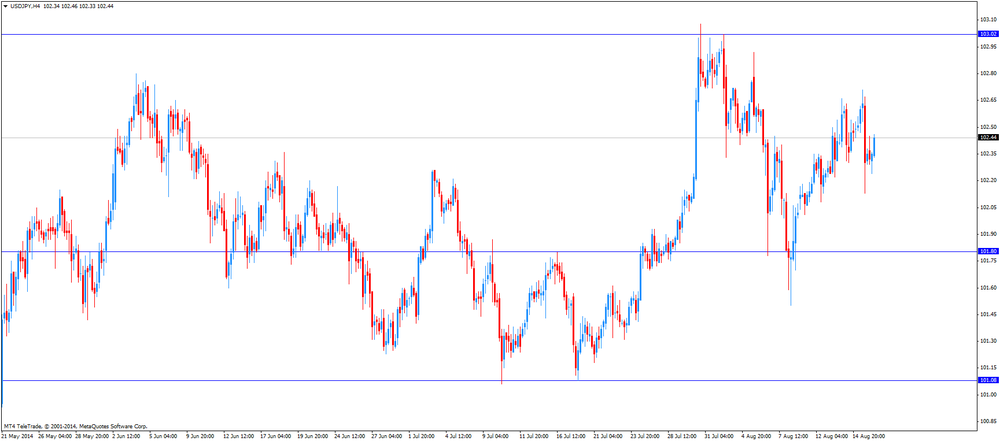

USD/JPY: the currency pair rose to Y102.54

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases June 21.43 14.68

14:00 U.S. NAHB Housing Market Index August 53 53

22:45 New Zealand PPI Input (QoQ) Quarter II +1.0% +0.7%

22:45 New Zealand PPI Output (QoQ) Quarter II +0.9% +0.8%

-

13:00

Orders

EUR/USD

Offers $1.3500, $1.3485, $1.3445, $1.3415

Bids $1.3335-30, $1.3300-3295, $1.3230

GBP/USD

Offers $1.6845, $1.6800/10, $1.6770

Bids $1.6650, $1.6620, $1.6600

AUD/USD

Offers $0.9400, $0.9370, $0.9350, $0.9330

Bids $0.9285/80, $0.9240, $0.9220/00

EUR/JPY

Offers Y138.20, Y138.00, Y137.60

Bids Y136.80/75, Y136.50, Y136.25/20

USD/JPY

Offers Y103.50, Y103.00, Y102.80/85, Y102.65/70

Bids Y102.15, Y102.00, Y101.80, Y101.50

EUR/GBP

Offers stg0.8100, stg0.8035

Bids stg0.7980, stg0.7950/40, stg0.7900

-

12:45

Bank of England Governor Mark Carney: interest hike is possible without a rise in real wages

The Bank of England Governor Mark Carney told the Sunday Times on Sunday that the Bank of England don't need to wait for wage growth to rise its interest rate.

The average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

-

10:18

Option expiries for today's 1400GMT cut

USD/JPY Y101.75-80, Y102.15, Y102.65, Y102.80, Y103.00

EUR/GBP stg0.7965, stg0.8000, stg0.8010

EUR/CHF Chf1.2000, Chf1.2150

AUD/USD $0.9310

USD/CAD C$1.0925-30

-

09:35

Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after weaker new motor vehicle sales in Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) July +1.7% -1.3%

01:30 Australia New Motor Vehicle Sales (YoY) July -2.2% -0.4%

The U.S. dollar traded mixed to lower against the most major currencies. Tensions over the crisis in Ukraine weighed on markets. The Ukrainian government said on Friday its troops attacked a military convoy that entered the country from Russia.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after weaker new motor vehicle sales in Australia. New motor vehicle sales in Australia declined 1.3% in July, after a 1.7% rise in June.

On a yearly basis, new motor vehicle sales in Australia fell 0.4% in July, after a 2.2% drop in June.

The Japanese yen traded slightly higher against the U.S. dollar due to demand for safe-haven currency as tensions between Russia and Ukraine rose. No major economic reports were released in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6763

USD/JPY: the currency pair declined to Y102.24

The most important news that are expected (GMT0):

09:00 Eurozone Trade Balance s.a. June 15.3 14.9

10:00 Germany Bundesbank Monthly Report August

12:30 Canada Foreign Securities Purchases June 21.43 14.68

14:00 U.S. NAHB Housing Market Index August 53 53

22:45 New Zealand PPI Input (QoQ) Quarter II +1.0% +0.7%

22:45 New Zealand PPI Output (QoQ) Quarter II +0.9% +0.8%

-

06:14

Options levels on monday, August 18, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3464 (5846)

$1.3443 (1262)

$1.3428 (1262)

Price at time of writing this review: $ 1.3393

Support levels (open interest**, contracts):

$1.3374 (4529)

$1.3358 (1786)

$1.3336 (5160)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 54699 contracts, with the maximum number of contracts with strike price $1,3400 (5846);

- Overall open interest on the PUT options with the expiration date September, 5 is 59628 contracts, with the maximum number of contracts with strike price $1,3100 (6682);

- The ratio of PUT/CALL was 1.09 versus 1.05 from the previous trading day according to data from August, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2688)

$1.6901 (2200)

$1.6803 (1661)

Price at time of writing this review: $1.6728

Support levels (open interest**, contracts):

$1.6596 (1947)

$1.6498 (1845)

$1.6399 (752)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 27064 contracts, with the maximum number of contracts with strike price $1,7000 (2688);

- Overall open interest on the PUT options with the expiration date September, 5 is 29380 contracts, with the maximum number of contracts with strike price $1,6800 (4033);

- The ratio of PUT/CALL was 1.09 versus 1.07 from the previous trading day according to data from August, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Australia: New Motor Vehicle Sales (MoM) , July -1.3%

-

02:31

Australia: New Motor Vehicle Sales (YoY) , July -0.4%

-

00:02

United Kingdom: Rightmove House Price Index (YoY), August +5.3%

-

00:01

United Kingdom: Rightmove House Price Index (MoM), August -2.9%

-