Notícias do Mercado

-

23:29

Currencies. Daily history for Apr 20’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0741 -0,61%

GBP/USD $1,4905 -0,37%

USD/CHF Chf0,9559 +0,40%

USD/JPY Y119,21 +0,27%

EUR/JPY Y128,02 -0,37%

GBP/JPY Y177,68 -0,10%

AUD/USD $0,7725 -0,74%

NZD/USD $0,7659 -0,30%

USD/CAD C$1,2228 -0,13%

-

23:01

Schedule for today, Tuesday, Apr 21’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Meeting's Minutes

09:00 Eurozone ZEW Economic Sentiment April 62.4 63.7

09:00 Germany ZEW Survey - Economic Sentiment April 54.8 56.0

12:30 Canada Wholesale Sales, m/m February -3.1%

20:00 Canada Annual Budget

20:30 U.S. API Crude Oil Inventories April 2.6

23:50 Japan Trade Balance Total, bln -425 50

23:50 Japan Adjusted Merchandise Trade Balance, bln March -639 -410

-

19:20

American focus: the dollar rose against the British pound

The pound fell against the US dollar, reaching $ 1.4900, which is associated with the anticipation of the publication of important statistics (Wednesday the Bank of England will release the minutes of the meeting, and on Thursday, there are data on retail sales). Meanwhile, experts note that the uncertainty associated with the upcoming elections in the country, will continue to put pressure on the pound in the coming weeks. Little impact on the pound also provided data on house prices in the UK. The average asking price for a house in the UK rose by 1.6 percent for the month in April, said Monday website tracking estate Rightmove. The price reached a record 286,133 pounds. This is followed by a 1.0 percent increase in March. In annual terms, house prices rose by 4.7 percent, noting slowing from 5.4 percent in the previous month. Site called shortage of new homes built as one of the main reasons for the spike in prices.

Euro played some ground against the dollar, but still continues to trade lower. Little influenced by data on producer prices in Germany showed that the producer price index in March rose slightly by 0.1% compared to February due to falling oil prices. Compared with the same period last year, producer prices fell 1.7% after falling 2.1% in February. In March, a major factor in producer prices were energy prices, which have remained unchanged compared to the previous month, but fell by 4.7% compared to the same period of the previous year. Basic PPI, which excludes volatile energy prices, rose by 0.1% compared to February and fell by 0.5% per annum.

The focus of investors is the situation with the Greek debt. Greece will probably not be able to at a meeting of eurozone finance ministers this week to conclude an agreement with creditors on a plan of economic reforms in the country, according to most experts. New date to be set as the deadline for reaching an agreement, it may be the day of the summit of the eurozone - May 11.

Slight pressure exerted statements ECB Governing Council member Vitor Constancio, who noted that the negative yield bonds eurozone countries is a side effect of the program QE, conducted by the ECB. He added that the program was not an issue to achieve negative returns, but now the Central Bank closely watching developments on this front.

The Australian dollar depreciated significantly against the US dollar, approaching the level AUD0.7700, which was related to statements Stevens. Managing RBA Stevens said that if necessary, the Central Bank may lower interest rates. Stevens also believes that the Australian dollar is likely to continue to fall over time. About low interest rates, he said that they help stimulate the housing and welfare of households. Committee approached the question of rate changes with great caution, added the head of the RBA. In addition, Stevens noted that the rise in house prices and high debt load should not determine the course of monetary policy, however, and completely ignore these aspects is impossible.

The Canadian dollar rose against the US dollar, thus returning to a session high against the background commentary runner and rising oil prices. The head of the Bank of Canada said he expects an economic recovery in the 2nd quarter of this year, and that the policies of the Central Bank will increasingly depend on macroeconomic indicators. He added that the country is ready to raise rates in the US and that this will be a positive factor for Canada, as will indicate the "recovery of the US economy."

-

16:44

Reserve Bank of Australia (RBA) Governor Glenn Stevens: the central bank could lower its interest rate

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in New York on Monday that the central bank is ready to cut its interest rate if it would be helpful in securing sustainable economic growth.

Stevens noted that the Australian dollar will decline further.

-

16:35

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies in the absence of any major U.S. economic reports

The U.S. dollar traded mixed against the most major currencies in the absence of any major U.S. economic reports.

The euro traded higher against the U.S. dollar. Concerns over Greece's debt problems continue to weigh on the euro. Greece is still running out of cash, and it needs a new tranche of loans. The Greek government hopes to unblock a new tranche of loans at the Eurogroup meeting on April 24. Germany's Finance Minister Wolfgang Schäuble said last week that he did not expect that a solution will be found on April 24.

The European Central Bank Governing Council Member Ewald Nowotny said in an interview to CNBC on Monday that he does not expect an agreement between Greece and its creditors will be signed this week. He added that the Greek exit from the Eurozone would not have the same impact on the Eurozone as it would have had two years ago.

The Bundesbank released its monthly report on Monday. The central bank said that strong private consumption will be a driver of the economic growth in Germany. "The exceptionally good environment for consumption, based on the solid state of the labour market and strong growth in real wages point to this development continuing for some time," the Bundesbank noted.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback despite the weaker-than-expected consumer inflation data from New Zealand. New Zealand's consumer price inflation fell 0.3% in the first quarter, after a 0.2% decline in the fourth quarter.

On a yearly basis, the consumer price index in New Zealand rose 0.1% in the first quarter, after a 0.8% increase in the fourth quarter.

That could mean that the Reserve Bank of New Zealand will leave its interest rate on hold for a longer period.

The Australian dollar declined against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback in the absence of any major economic reports from Japan.

-

16:17

Federal Reserve Bank of New York President William C. Dudley hopes that the Fed will hike its interest rate this year

The Federal Reserve Bank of New York President William C. Dudley said on Monday that he hopes that the Fed will hike its interest rate this year.

The Federal Reserve Bank of New York president noted that long-term interest rate target could be 3.5%.

Dudley is a voting member of the Federal Open Market Committee.

-

16:03

People's Bank of China will inject will inject more than $60 billion of foreign exchange reserves into two state-owned policy banks

According to a report in the financial news magazine Caixin, the People's Bank of China will inject more than $60 billion of foreign exchange reserves into two state-owned policy banks to support the government's overseas development plans. China's central bank will inject $32 billion into China Development Bank and $30 billion into Export-Import Bank of China.

-

15:41

China will launch three new free-trade zones on Tuesday

According to Chinese news, China will launch three new free-trade zones on Tuesday. The free-trade zones will be opened in Guangdong and Fujian provinces in the south and the northern port of Tianjin. Each free-trade zone will cover around 120 sq km.

-

15:25

Japanese Prime Minister Shinzo Abe said in an interview with The Wall Street Journal that Japan and the U.S. are close to sign an agreement on a Trans-Pacific Partnership (TPP) free-trade pact

-

15:08

Bank of Canada Governor Stephen Poloz: further interest rate cut by the central bank is not needed

The Bank of Canada (BoC) Governor Stephen Poloz said in an interview with The Wall Street Journal on Sunday that the further interest rate cut by the BoC is not needed.

"We've got the right monetary policy," Poloz noted.

The BoC governor described a shock January interest rate cut as "insurance".

Poloz also said that demand in machinery equipment and building materials from the U.S. increased.

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0740(E276M)

USD/JPY: Y118.00($310M), Y119.50($210M), Y120.25($280M)

AUD/USD: 0.7600(A$200M)

USD/CNH: Cnh6.2100($150mn)

-

14:47

European Central Bank President Mario Draghi is confident the economic growth in the Eurozone will become more robust

The European Central Bank (ECB) President Mario Draghi said in the central bank's 2014 annual report that the economic growth in the Eurozone will become more robust and that inflation will return to the central bank's 2% target "without undue delay".

-

14:17

European Central Bank Governing Council Member Ewald Nowotny does not expect an agreement between Greece and its creditors will be signed this week

The European Central Bank Governing Council Member Ewald Nowotny said in an interview to CNBC on Monday that he does not expect an agreement between Greece and its creditors will be signed this week. He added that the Greek exit from the Eurozone would not have the same impact on the Eurozone as it would have had two years ago.

Nowotny pointed out that a lower euro is not the target of the central bank's quantitative easing.

-

13:57

Bundesbank’s monthly report: strong private consumption will be a driver of the economic growth in Germany

The Bundesbank released its monthly report on Monday. The central bank said that strong private consumption will be a driver of the economic growth in Germany.

"The exceptionally good environment for consumption, based on the solid state of the labour market and strong growth in real wages point to this development continuing for some time," the Bundesbank noted.

The central bank pointed out that the industrial data was disappointing for the second month in a row, but the economy continued to grow.

-

13:30

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's debt problems continue to weigh on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Producer Price Index (MoM) March 0.1% 0.2% 0.1%

06:00 Germany Producer Price Index (YoY) March -2.1% -2.6% -1.7%

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded higher against the most major currencies. The greenback recovered from last week's weaker-than-expected U.S. economic data.

There will be released no major U.S. economic reports today.

The euro traded lower against the U.S. dollar as concerns over Greece's debt problems continue to weigh on the euro. Greece is still running out of cash, and it needs a new tranche of loans. The Greek government hopes to unblock a new tranche of loans at the Eurogroup meeting on April 24. Germany's Finance Minister Wolfgang Schäuble said last week that he did not expect that a solution will be found on April 24.

The Bundesbank released its monthly report on Monday. The central bank said that strong private consumption will be a driver of the economic growth in Germany. "The exceptionally good environment for consumption, based on the solid state of the labour market and strong growth in real wages point to this development continuing for some time," the Bundesbank noted.

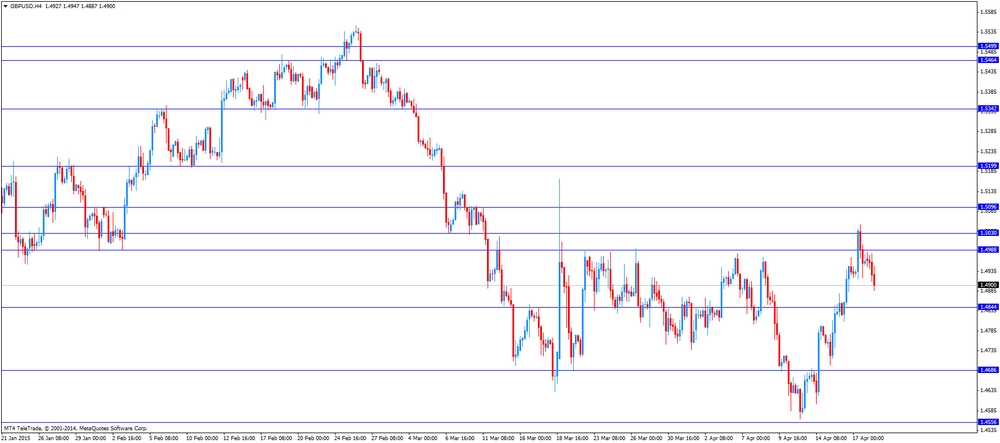

The British pound declined against the U.S. dollar in the absence of any major economic reports from the U.K.

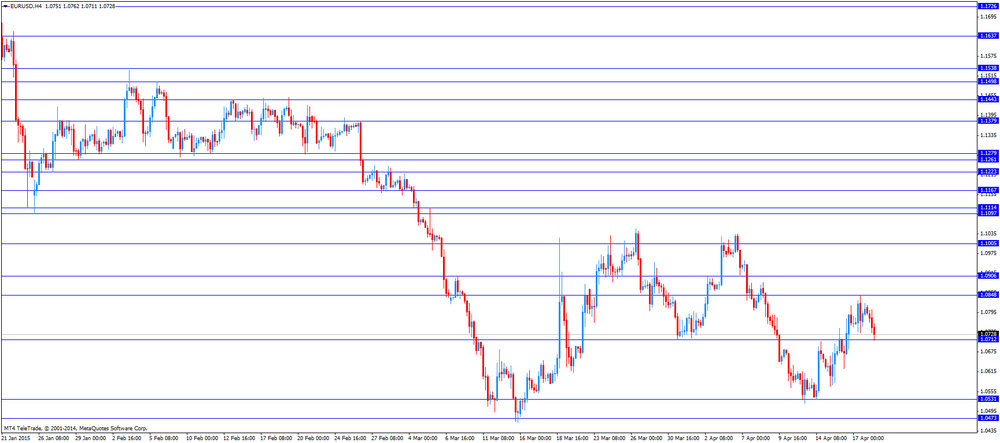

EUR/USD: the currency pair decreased to $1.0711

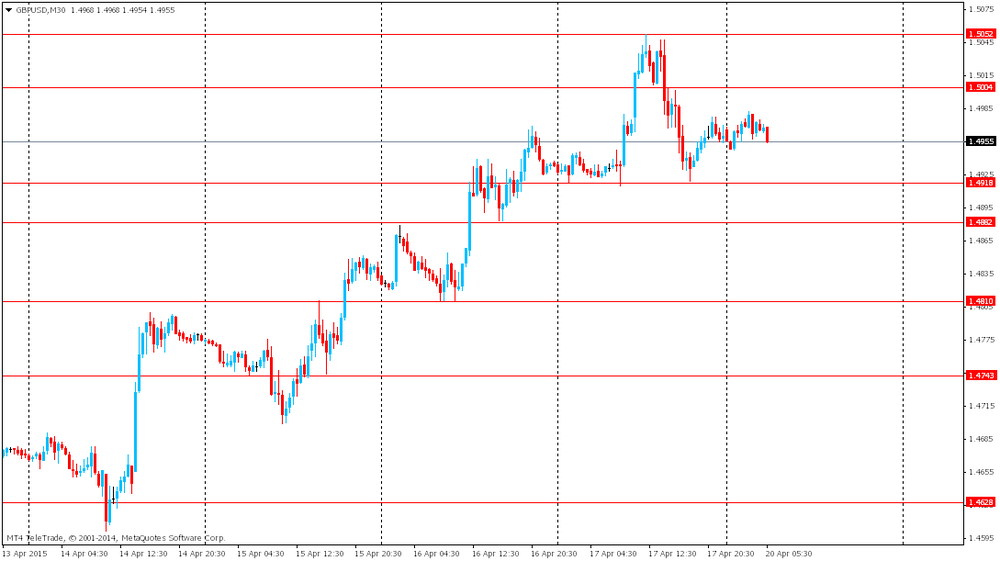

GBP/USD: the currency pair fell to $1.4887

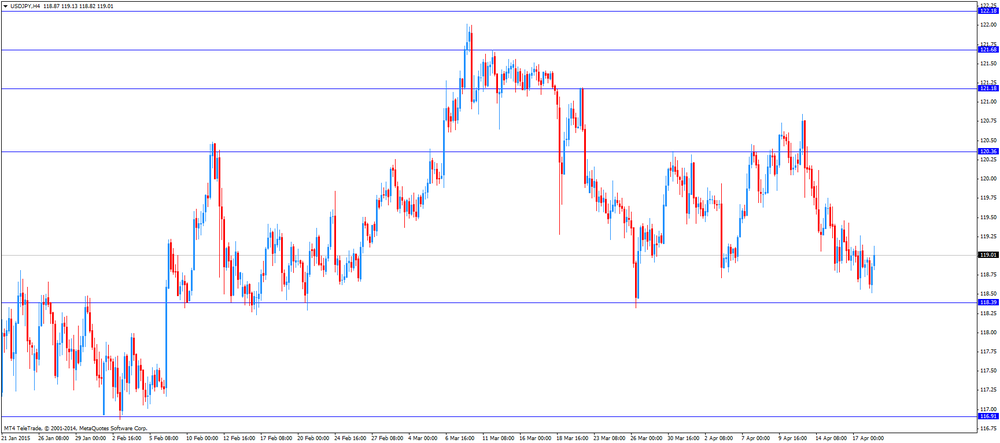

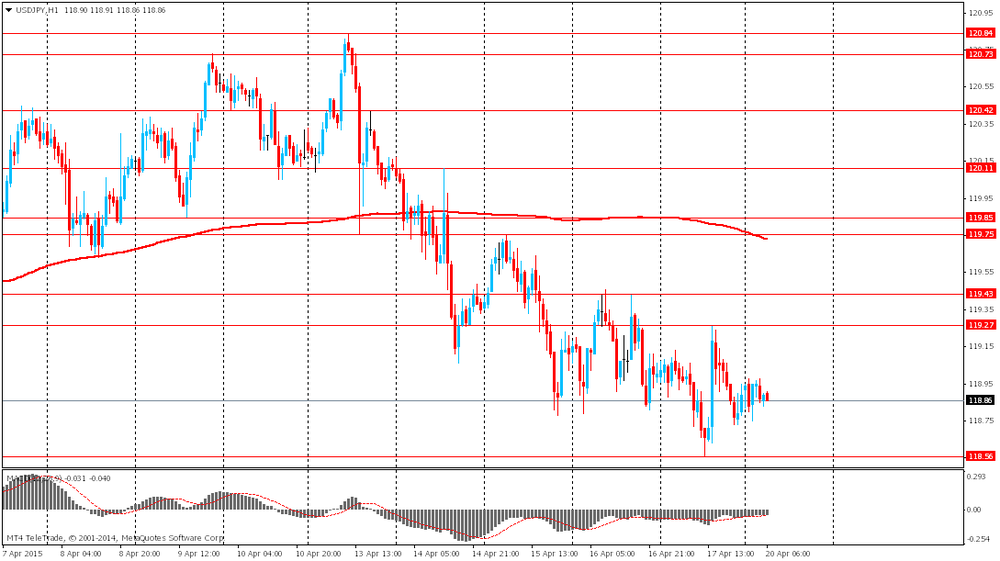

USD/JPY: the currency pair rose to Y119.13

The most important news that are expected (GMT0):

15:05 Canada BOC Gov Stephen Poloz Speaks

16:30 Australia RBA's Governor Glenn Stevens Speech

-

13:04

China’s central bank adds further stimulus measures

The People's Bank of China (PBOC) announced on Sunday that it lowered the amount of cash that banks must hold as reserves. The government hopes to spur bank lending and combat slowing growth. The central bank cut the reserve requirement ratio for all banks by 100 basis points to 18.5%.

The cut is effective from April 20.

The reserve requirement ratio will be lowered by another percentage point for rural banks, two additional percentage points for the central bank's Agricultural Development Bank, and a further 0.5% for banks lending to agriculture and small businesses.

-

12:50

Orders

EUR/USD

Offers 1.0850

Bids 1.0700

GBP/USD

Offers 1.5000

Bids 1.4900 1.4855/50 1.4800 1.4705/00

EUR/JPY

Offers 129.50 129.00 128.45/50 128.00

Bids 127.50 127.10/00 126.50

USD/JPY

Offers 120.00 119.50

Bids 118.50 118.00 117.50

EUR/GBP

Offers 0.7290 0.7220-25

Bids 0.7150

AUD/USD

Offers 0.7950 0.7900 0.7850

Bids 0.7750 0.7720 0.7705/00 0.7650

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0740(E276M)

USD/JPY: Y118.00($310M), Y119.50($210M), Y120.25($280M)

AUD/USD: 0.7600(A$200M)

USD/CNH: Cnh6.2100($150mn)

-

10:20

Thomson Reuters/University of Michigan preliminary consumer sentiment index increases to 95.9 in April

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 95.9 in April from a final reading of 93.0 in March, exceeding expectations for an increase to 93.8.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said that "the cumulative improvement in a broad range of economic assessments are now comparable to the peak levels recorded in the mid 2000's".

A gauge of consumers' current economic conditions climbed to 108.2 in April from 105.0 in March.

The index of consumer expectations increased to 88.0 from 85.3.

The one-year inflation expectations in April declined to 2.5% from 3.0% in March.

-

09:57

U.S. leading economic index rises 0.2% in March

The Conference Board released its leading economic index for the U.S. on Friday. The leading economic index climbed by 0.2% in March, missing expectations a 0.3% gain, after a 0.1% increase in February.

February's figure was revised down from 0.2% rise.

Lower building permits, average working hours and manufacturing new orders weighed on the index.

The Conference Board economist Ataman Ozyildirim said that the leading economic index "still points to a moderate expansion in economic activity", but the slower pace over recent months "suggests weaker growth may be ahead".

-

07:25

Foreign exchange market. Asian session: Australian dollar rose

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

---

Australian dollar rose as China steps up economy help with reduced bank reserve ratios. China's leaders swung into stimulus mode, cutting the amount of cash lenders must set aside as reserves by the most since the global financial crisis just days after a report showed the slowest economic growth in six years. The reserve-requirement ratio was lowered 1 percentage point effective Monday, the People's Bank of China said. While that was the second reduction this year, the new level of 18.5 percent is still high by global standards. The move puts China more firmly in the easing camp with the European Central Bank and the Bank of Japan and follows a vow by Premier Li Keqiang to step in if the economy's slowdown hurts jobs as well as PBOC Governor Zhou Xiaochuan's weekend comment that China has room to act. The cut will allow banks to boost lending, unleashing about 1.2 trillion yuan ($194 billion).

EUR / USD: during the Asian session the pair traded in the range of $1.0785-20

GBP / USD: during the Asian session the pair traded in the range of $1.4945-80

USD / JPY: during the Asian session the pair traded in the range Y118.75-00

A data light day in the UK Monday with attention turning to Wednesday's BOE Minutes, followed Thursday by UK borrowing numbers and retail sales. Upcoming General Election also in focus and seen as a counter for sterling strength, though some reports suggest this may be dissipating. -

07:11

Options levels on monday, April 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0935 (2718)

$1.0892 (1391)

$1.0860 (2985)

Price at time of writing this review: $1.0787

Support levels (open interest**, contracts):

$1.0744 (1102)

$1.0710 (1809)

$1.0665 (2299)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 57654 contracts, with the maximum number of contracts with strike price $1,1200 (5933);

- Overall open interest on the PUT options with the expiration date May, 8 is 73692 contracts, with the maximum number of contracts with strike price $1,0000 (8849);

- The ratio of PUT/CALL was 1.28 versus 1.27 from the previous trading day according to data from April, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5208 (768)

$1.5110 (1597)

$1.5015 (2369)

Price at time of writing this review: $1.4963

Support levels (open interest**, contracts):

$1.4885 (1536)

$1.4789 (2347)

$1.4692 (2465)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 22631 contracts, with the maximum number of contracts with strike price $1,5000 (2369);

- Overall open interest on the PUT options with the expiration date May, 8 is 31678 contracts, with the maximum number of contracts with strike price $1,4400 (2726);

- The ratio of PUT/CALL was 1.40 versus 1.43 from the previous trading day according to data from April, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:01

Germany: Producer Price Index (YoY), March -1.7% (forecast -2.6%)

-

07:00

Germany: Producer Price Index (MoM), March 0.1% (forecast 0.2%)

-