Notícias do Mercado

-

23:28

Currencies. Daily history for Nov 20’2014:

(pare/closed(GMT +2)/change, %)

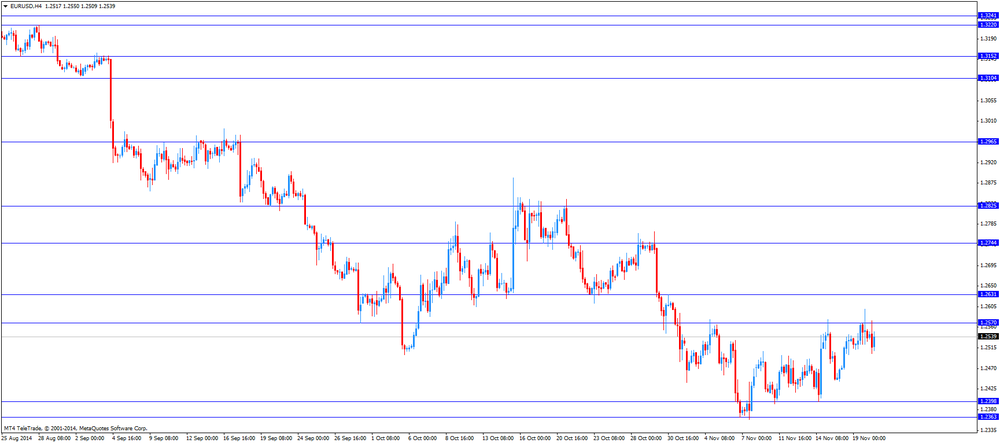

EUR/USD $1,2538 -0,12%

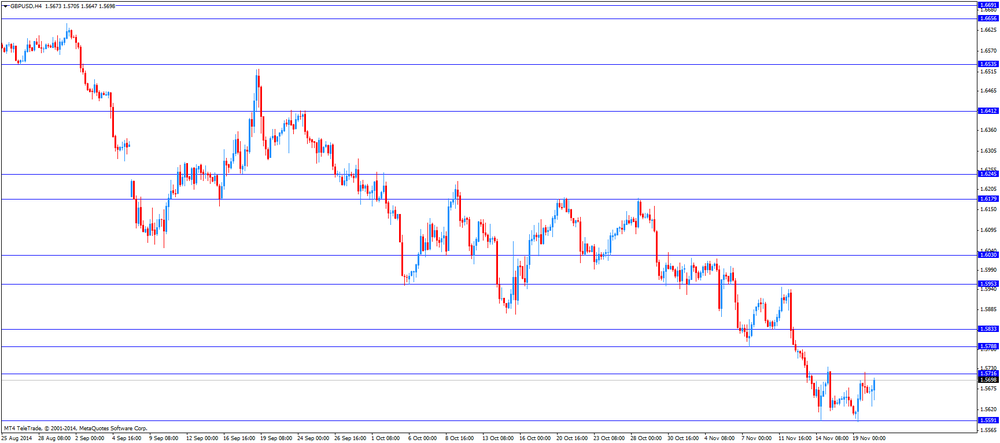

GBP/USD $1,5691 +0,06%

USD/CHF Chf0,9582 +0,15%

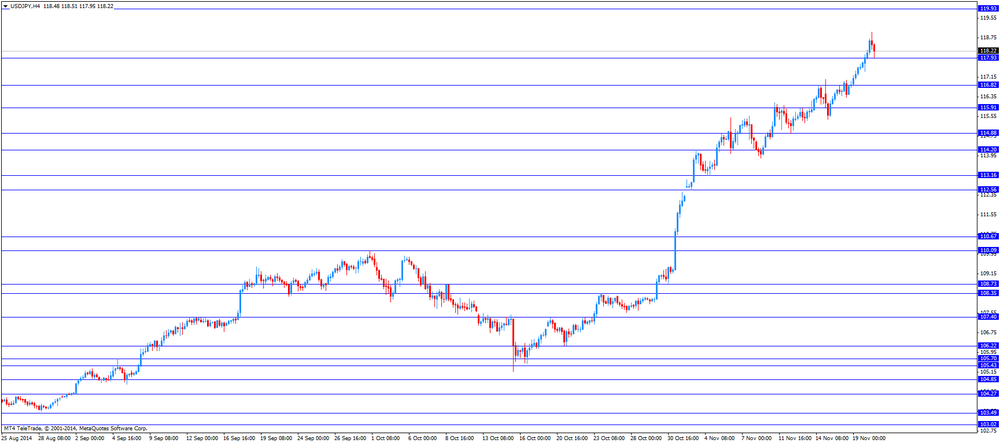

USD/JPY Y118,20 +0,20%

EUR/JPY Y148,21 +0,09%

GBP/JPY Y185,46 +0,27%

AUD/USD $0,8619 +0,03%

NZD/USD $0,7868 +0,22%

USD/CAD C$1,1303 -0,32%

-

23:00

Schedule for today, Friday, Nov 21’2014:

(time / country / index / period / previous value / forecast)

02:00 New Zealand Credit Card Spending October +4.4%

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October 11.1 6.9

13:30 Canada Consumer price index, y/y October +2.0% +2.0%

13:30 Canada Consumer Price Index m / m October +0.1% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m October +0.2% +0.2%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October +2.1% +2.2%

-

16:44

Foreign exchange market. American session: the U.S. dollar mixed to lower against the most major currencies despite the mostly better-than-expected U.S. economic data

The U.S. dollar mixed to lower against the most major currencies despite the mostly better-than-expected U.S. economic data. The Philadelphia Federal Reserve Bank' manufacturing index surged to 40.8 in November from 20.7 in October. That was the highest level since December 1993. Analysts had expected the index to decline to 18.9.

Sales of existing homes in the U.S. climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013. September's figure was revised up from 5.17 million units. Analysts had expected an increase to 5.16 million units.

The U.S. consumer price inflation was flat in October, beating expectations for a 0.1% decrease, after a 0.1% increase in September.

Falling gasoline prices held down inflation in the U.S.

On a yearly basis, the U.S. consumer price index remained unchanged at 1.7% in October, beating forecasts of a decline to 1.6%.

The U.S. consumer price inflation excluding food and energy climbed 0.2% in October, in line with expectations, after a 0.1% rise in September.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.8% in October from a 1.7% gain in September, in line with expectations.

The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 54.7 in November from 55.9 in October, missing expectations for a rise to 56.2.

The euro traded mixed against the U.S. dollar. Eurozone's consumer confidence index declined to -11.6 in November from -11 in October. Analysts had expected the index to remain unchanged at -11.

Eurozone's preliminary manufacturing PMI fell to 50.4 in November from 50.6 in October, missing expectations for a rise to 50.9.

Eurozone's preliminary services PMI declined to 51.3 in November from 52.3 in October. Analysts had expected the index to remain unchanged.

Germany's preliminary manufacturing PMI decreased to 50.0 in November from 51.4 in October, missing forecasts of an increase to 51.5.

Germany's preliminary services PMI fell to 52.1 in November from 54.4 in October, missing expectations for a gain to 54.5.

France's preliminary manufacturing PMI dropped to 47.6 in November from 48.5 in October, missing forecasts of a rise to 48.9.

France's preliminary services PMI climbed to 48.8 in October from 48.3 in October, exceeding expectations for a gain to 48.6.

The British pound traded mixed against the U.S. dollar. Retail sales in the U.K. rose 0.8% in October, exceeding expectations for a 0.4% increase, a 0.4% decline in September. September's figure was revised down from a 0.3% fall.

On a yearly basis, retail sales increased 4.3% in October, beating forecasts of a 3.8% rise, after a 2.3% gain in September. September's figure was revised down from a 2.7% increase.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance climbed to 3% in November from -6% in October, beating expectations for an increase to -3%.

The Canadian dollar traded higher against the U.S. dollar after the better-than-expected Canadian wholesale sales. Wholesale sales in Canada jumped 1.8% in September, exceeding expectations for a 0.7% gain, after the flat reading in August. August's figure was revised down from a 0.2% increase.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's trade surplus widened CHF3.26 billion in October from CHF2.49 billion in September, exceeding expectations for a rise to CHF 2.57 billion. September's figure was revised down from a surplus of CHF2.45 billion.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

In the overnight trading session, the kiwi traded lower against the greenback due to a stronger demand for the U.S. currency.

China's economic data also weighed on the kiwi. China's HSBC preliminary manufacturing purchasing managers' index dropped 50.0 in November from 50.4 in October, missing expectations for a decline to 50.2.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports from Australia.

In the overnight trading session, the Aussie fell against the greenback due to a stronger demand for the U.S. currency. The Aussie recovered its losses in the morning trading session.

China's economic data also weighed on the Aussie.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen declined against the greenback. The yen recovered its losses in the morning trading session.

Decision by Japan's Prime Minister Shinzo Abe still weighed on the yen. He announced a delay in the sales-tax increase for 18 months on Tuesday, and called a snap election to take place next month.

Japan's adjusted trade deficit declined to ¥977.53 billion in October from a deficit of ¥1,070.14 billion in September. Analysts had expected a deficit of ¥1,020.0 billion.

-

16:09

FOMC’s October minutes: Fed said nothing about the timing

The Fed released its October policy minutes on Wednesday. Investors had expected to get insight into when the Fed will start to hike its interest rate. They were disappointed. The Fed said nothing about the timing. The central bank decided to say nothing about the timing in order that it could be misinterpreted by financial markets.

Analysts expect the first interest rate hike by the Fed in the mid-2015.

The Fed discussed the need to monitor declining inflation expectations. The recent decline in oil prices is adding to downward pressure on inflation.

The Fed kept its interest unchanged, and said that interest rates would remain unchanged for a "considerable time".

The central bank noted that the recovery of housing market is slow despite low interest rates.

-

15:44

Philadelphia Federal Reserve Bank’s manufacturing index hits the highest level since December 1993

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index surged to 40.8 in November from 20.7 in October. That was the highest level since December 1993.

Analysts had expected the index to decline to 18.9.

A reading above zero indicates expansion.

-

15:37

U.S. existing homes sales rose 1.5% in October

The National Association of Realtors released existing homes sales figures in the U.S. on Thursday. Sales of existing homes climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013.

September's figure was revised up from 5.17 million units.

Analysts had expected an increase to 5.16 million units.

-

15:17

Canada’s wholesale sales surged 1.8% in September

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales jumped 1.8% in September, exceeding expectations for a 0.7% gain, after the flat reading in August. August's figure was revised down from a 0.2% increase.

The increase was driven by the building material and supplies subsector. Building material and supplies rose 5.5%. Machinery, equipment and supplies climbed 2.2%.

-

15:09

U.S. consumer price inflation was flat in October

The U.S. Labor Department released consumer price inflation data today. The U.S. consumer price inflation was flat in October, beating expectations for a 0.1% decrease, after a 0.1% increase in September.

Falling gasoline prices held down inflation in the U.S.

On a yearly basis, the U.S. consumer price index remained unchanged at 1.7% in October, beating forecasts of a decline to 1.6%.

The U.S. consumer price inflation excluding food and energy climbed 0.2% in October, in line with expectations, after a 0.1% rise in September.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.8% in October from a 1.7% gain in September, in line with expectations.

Energy costs dropped 1.9% in October.

Gasoline prices declined 3.0% in October, while food prices rose 0.1%.

Housing expenses climbed 0.3% in October, while medical costs gained 0.2%.

-

15:00

Eurozone: Consumer Confidence, November -11.6 (forecast -11)

-

15:00

U.S.: Existing Home Sales , October 5.26 (forecast 5.16)

-

15:00

U.S.: Leading Indicators , October +0.9% (forecast +0.6%)

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, October 40.8 (forecast 18.9)

-

14:45

U.S.: Manufacturing PMI, November 54.7 (forecast 56.2)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2430(E1.31bn), $1.2450(E627mn), $1.2475(E248mn), $1.2500(E2.4bn), $1.2525(E630mn), $1.2550(E851mn), $1.2580(E789mn), $1.2600(E1.85bn), $1.2610(E278mn)

USD/JPY: Y117.00($821mnn), Y117.50($801mn), Y117.75($670mn), Y118.00($1.31bn)

AUD/USD: $0.8550(A$1.29bn), $0.8600(A$1.25bn), $0.8735($457mn)

USD/CAD: Cad1.1275($430mn), Cad1.1320($216mn), Cad1.1400($545mn)

USD/CHF: Chf0.9590($526mn), Chf0.9600($370mn)

EUR/GBP: stg0.7910(E550mn), stg0.7925(E755mn), stg0.7980(E250mn), stg0.8000(E200mn), stg0.8080(E200mn)

EUR/AUD: A$1.4450(E1.56bn)

-

13:35

CBI industrial order books balance jumped to 3% in November

The Confederation of British Industry (CBI) released its industrial order books balance. The CBI industrial order books balance climbed to 3% in November from -6% in October, beating expectations for an increase to -3%.

The CBI's director for economics Rain Newton-Smith said that the manufacturing output remained strong, but the slowdown of the growth is expected due global risks.

He noted that manufacturers have problems in exports markets due to a slowdown of the economic growth in the Eurozone or in China.

-

13:31

U.S.: CPI excluding food and energy, m/m, October +0.2% (forecast +0.2%)

-

13:31

U.S.: CPI, Y/Y, October +1.7% (forecast +1.6%)

-

13:31

U.S.: CPI excluding food and energy, Y/Y, October +1.8% (forecast +1.8%)

-

13:30

U.S.: Initial Jobless Claims, November 291 (forecast 286)

-

13:30

Canada: Wholesale Sales, m/m, September +1.8% (forecast +0.7%)

-

13:30

U.S.: CPI, m/m , October 0.0% (forecast -0.1%)

-

13:10

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the mostly weaker-than-expected purchasing managers’ indices (PMI) from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) November 52.4 52.7 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) November 50.4 50.2 50.0

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (MoM) October 0.0% -0.2% -0.2%

07:00 Germany Producer Price Index (YoY) October -1.0% -0.9% -1.0%

07:00 Switzerland Trade Balance October 2.49 Revised From 2.45 -0.3% 2.57 3.26

07:58 France Manufacturing PMI (Preliminary) November 48.5 48.9 47.6

07:58 France Services PMI (Preliminary) November 48.3 48.6 48.8

08:28 Germany Manufacturing PMI (Preliminary) November 51.4 51.5 50.0

08:28 Germany Services PMI (Preliminary) November 54.4 54.5 52.1

08:58 Eurozone Services PMI (Preliminary) November 52.3 52.3 51.3

08:58 Eurozone Manufacturing PMI (Preliminary) November 50.6 50.9 50.4

09:30 United Kingdom Retail Sales (MoM) October -0.4% Revised From -0.3% +0.3% +0.8%

09:30 United Kingdom Retail Sales (YoY) October +2.3% Revised From +2.7% +3.8% +4.3%

11:00 United Kingdom CBI industrial order books balance November -6 -3 3

12:45 U.S. FOMC Member Tarullo Speaks

The U.S. dollar mixed to lower against the most major currencies ahead of the U.S. economic data. The U.S. consumer price inflation is expected to decline 0.1% in October, after a 0.1% rise in September.

The U.S. consumer price index excluding food and energy is expected to rise 0.2% in October, after a 0.1% gain in September.

The number of initial jobless claims in the U.S. is expected to decline by 4,000 to 286,000.

The existing home sales in the U.S. are expected to decline to 5.16 million units in October from 5.17 million units in September.

The euro traded mixed against the U.S. dollar after the mostly weaker-than-expected purchasing managers' indices (PMI) from the Eurozone. Eurozone's preliminary manufacturing PMI fell to 50.4 in November from 50.6 in October, missing expectations for a rise to 50.9.

Eurozone's preliminary services PMI declined to 51.3 in November from 52.3 in October. Analysts had expected the index to remain unchanged.

Germany's preliminary manufacturing PMI decreased to 50.0 in November from 51.4 in October, missing forecasts of an increase to 51.5.

Germany's preliminary services PMI fell to 52.1 in November from 54.4 in October, missing expectations for a gain to 54.5.

France's preliminary manufacturing PMI dropped to 47.6 in November from 48.5 in October, missing forecasts of a rise to 48.9.

France's preliminary services PMI climbed to 48.8 in October from 48.3 in October, exceeding expectations for a gain to 48.6.

The British pound traded higher against the U.S. dollar after the better-than-expected retail sales from the U.K. Retail sales in the U.K. rose 0.8% in October, exceeding expectations for a 0.4% increase, a 0.4% decline in September. September's figure was revised down from a 0.3% fall.

On a yearly basis, retail sales increased 4.3% in October, beating forecasts of a 3.8% rise, after a 2.3% gain in September. September's figure was revised down from a 2.7% increase.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance climbed to 3% in November from -6% in October, beating expectations for an increase to -3%.

The Canadian dollar rose against the U.S. dollar ahead of the Canadian wholesale sales. Wholesale sales in Canada are expected to climb 0.7% in September, after a 0.2% decline in August.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's trade surplus widened CHF3.26 billion in October from CHF2.49 billion in September, exceeding expectations for a rise to CHF 2.57 billion. September's figure was revised down from a surplus of CHF2.45 billion.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair climbed to $1.5705

USD/JPY: the currency pair fell to Y117.95

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m September +0.2% +0.7%

13:30 U.S. Initial Jobless Claims November 290 286

13:30 U.S. CPI, m/m October +0.1% -0.1%

13:30 U.S. CPI, Y/Y October +1.7% +1.6%

13:30 U.S. CPI excluding food and energy, m/m October +0.1% +0.2%

13:30 U.S. CPI excluding food and energy, Y/Y October +1.7% +1.8% 14:45

U.S. Manufacturing PMI (Preliminary) November 55.9 56.2

-

10:28

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2430(E1.31bn), $1.2450(E627mn), $1.2475(E248mn), $1.2500(E2.4bn), $1.2525(E630mn), $1.2550(E851mn), $1.2580(E789mn), $1.2600(E1.85bn), $1.2610(E278mn)

USD/JPY: Y117.00($821mnn), Y117.50($801mn), Y117.75($670mn), Y118.00($1.31bn)

AUD/USD: $0.8550(A$1.29bn), $0.8600(A$1.25bn), $0.8735($457mn)

USD/CAD: Cad1.1275($430mn), Cad1.1320($216mn), Cad1.1400($545mn)

USD/CHF: Chf0.9590($526mn), Chf0.9600($370mn)

EUR/GBP: stg0.7910(E550mn), stg0.7925(E755mn), stg0.7980(E250mn), stg0.8000(E200mn), stg0.8080(E200mn)

EUR/AUD: A$1.4450(E1.56bn)

-

10:23

Press Review: Yellen Gets That Sinking Feeling Greenspan Once Knew

BLOOMBERG

Yellen Gets That Sinking Feeling Greenspan Once Knew

Alan Greenspan couldn't control long-term interest rates a decade ago, and bond investors are betting Janet Yellen's luck will be no better.

When then-Federal Reserve Chairman Greenspan raised the benchmark overnight rate from 2004 to 2006, long-term borrowing costs failed to increase, thwarting his attempts to tighten credit and curb excesses that contributed to the worst financial crisis in 80 years.

REUTERS

Oil price rout to curb U.S. drilling costs even with mega merger

Low oil prices that threaten producers' profits may be a boon in one way, as they force service companies to keep prices low for the drill bits, cement and piping for oil extraction, even if two of the largest providers of such products merge.

Halliburton Co, said on Monday it will buy Baker Hughes Inc, in a $35 billion deal that would create an oilfield services company to take on global oil services leader Schlumberger NV.

Some experts have raised concerns that the deal, which would merge the world's second- and third-largest service companies, will reduce competition and potentially raise the price of materials vital for drilling.

REUTERS

China factories stall; Japanese exports enjoy rare bounce

China's factories looked to have hit an air pocket in November as a private survey showed output falling for the first time in six months, adding to concerns about slowing economic momentum and to the case for further policy easing from Beijing.

Yet there was a rare glimpse of good news from Japan, which reported surprisingly strong growth in exports for October, a shift that should get a boost from the latest dive in the yen.

Source: http://www.reuters.com/article/2014/11/20/us-global-economy-idUSKCN0J407V20141120

-

10:05

United Kingdom: upbeat retail sales data

The British pound slightly recovered against the U.S. dollar after upbeat U.K. retail sales data. Retail sales MoM improved by +0.8% beating forecasts by +0.5%, on a yearly basis data showed an increase to +4.3%, above forecasts for a gain of +3.8%. But the greenback remained broadly supported after the minutes of the Fed's October meeting.

GPB/USD: the pound recouped losses against the dollar after the data

-

09:30

United Kingdom: Retail Sales (MoM), October +0.8% (forecast +0.3%)

-

09:30

United Kingdom: Retail Sales (YoY) , October +4.3% (forecast +3.8%)

-

09:00

Eurozone: Manufacturing PMI, November 50.4 (forecast 50.9)

-

09:00

Eurozone: Services PMI, November 51.3 (forecast 52.3)

-

08:01

France: Services PMI, November 48.8 (forecast 48.6)

-

08:00

France: Manufacturing PMI, November 47.6 (forecast 48.9)

-

07:30

Foreign exchange market. Asian session: U.S. dollar continues its rally against the Japanese yen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) November 52.4 52.7 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) November 50.4 50.2 50.0

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (MoM) October 0.0% -0.2% -0.2% -0.2%

07:00 Germany Producer Price Index (YoY) October -1.0% -0.9% -1.0%

07:00 Switzerland Trade Balance October 2.45 2.57 3.26

The U.S. dollar traded stronger against its peers during Asian Trade with the greenback only moving marginally on the euro despite dovish Fed meeting minutes. The Fed left interest rate unchanged and said it was closing its monthly bond-buying program as broadly anticipated by the markets.

The Australian dollar dropped sharply after China's preliminary HSBC Manufacturing PMI dropped to 50 and couldn't meet forecasts predicting 50.2. The level exceeding 50 points indicates the manufacturing industry increase, while the level below 50 indicates a reduction. Australia is heavily reliant on resource exports to China's manufacturing sector. Falling iron ore prices also weigh on the currency.

The New Zealand dollar also further declined against the U.S. dollar. Lower milk prices pushed down in- and output producer prices in New Zealand.

The Japanese yen continued to weaken against the U.S. dollar and struck new seven-year lows at USD118.98 and six-year lows against the euro and is currently trading at USD118.80. Japan's October Adjusted Merchandise Trade Balance showed a deficit of -977.53 billion, better-than-expected but still a shortfall. Prime Minister Shinzo Abe has called snap elections and delayed an increase to the sales tax after the world's third-largest economy fell back into recession last quarter. Yesterday the Bank of Japan (BoJ) released its interest rate decision keeping its monetary policy unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen.

EUR/USD: the euro traded steady against the greenback

USD/JPY: the U.S. dollar traded stronger against the Japanese yen at new seven-year highs

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

07:58 France Manufacturing PMI (Preliminary) November 48.5 48.9

07:58 France Services PMI (Preliminary) November 48.3 48.6

08:28 Germany Manufacturing PMI (Preliminary) November 51.4 51.5

08:28 Germany Services PMI (Preliminary) November 54.4 54.5

08:58 Eurozone Services PMI (Preliminary) November 52.3 52.3

08:58 Eurozone Manufacturing PMI (Preliminary) November 50.6 50.9

09:30 United Kingdom Retail Sales (MoM) October -0.3% +0.3%

09:30 United Kingdom Retail Sales (YoY) October +2.7% +3.8%

11:00 United Kingdom CBI industrial order books balance November -6 -3

12:45 U.S. FOMC Member Tarullo Speaks

13:30 Canada Wholesale Sales, m/m September +0.2% +0.7%

13:30 U.S. Initial Jobless Claims November 290 286

13:30 U.S. CPI, m/m October +0.1% -0.1%

13:30 U.S. CPI, Y/Y October +1.7% +1.6%

13:30 U.S. CPI excluding food and energy, m/m October +0.1% +0.2%

13:30 U.S. CPI excluding food and energy, Y/Y October +1.7% +1.8%

14:45 U.S. Manufacturing PMI (Preliminary) November 55.9 56.2

15:00 Eurozone Consumer Confidence November -11 -11

15:00 U.S. Leading Indicators October +0.8% +0.6%

15:00 U.S. Philadelphia Fed Manufacturing Survey October 20.7 18.9

15:00 U.S. Existing Home Sales October 5.17 5.16

17:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks

18:30 U.S. FOMC Member Mester Speaks

-

07:01

Switzerland: Trade Balance, October 3.26 (forecast 2.57)

-

07:00

Germany: Producer Price Index (MoM), October -0.2% (forecast -0.2%)

-

07:00

Germany: Producer Price Index (YoY), October -1.0% (forecast -0.9%)

-

06:24

Options levels on thursday, November 20, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2695 (3944)

$1.2637 (2063)

$1.2597 (1251)

Price at time of writing this review: $ 1.2548

Support levels (open interest**, contracts):

$1.2502 (2567)

$1.2460 (3111)

$1.2400 (3874)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 101122 contracts, with the maximum number of contracts with strike pric $1,3000 (5265);

- Overall open interest on the PUT options with the expiration date December, 5 is 104247 contracts, with the maximum number of contracts with strike price $1,2500 (6580);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from November, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5901 (685)

$1.5804 (629)

$1.5707 (1129)

Price at time of writing this review: $1.5671

Support levels (open interest**, contracts):

$1.5594 (1419)

$1.5497 (883)

$1.5398 (931)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 39231 contracts, with the maximum number of contracts with strike price $1,6000 (1949);

- Overall open interest on the PUT options with the expiration date December, 5 is 39778 contracts, with the maximum number of contracts with strike price $1,5900 (2304);

- The ratio of PUT/CALL was 1.01 versus 1.01 from the previous trading day according to data from November, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:45

China: HSBC Manufacturing PMI, November 50.0 (forecast 50.2)

-

01:35

Japan: Manufacturing PMI, November 52.1 (forecast 52.7)

-