Notícias do Mercado

-

23:22

Currencies. Daily history for Aug 21'2014:

(pare/closed(GMT +2)/change, %)

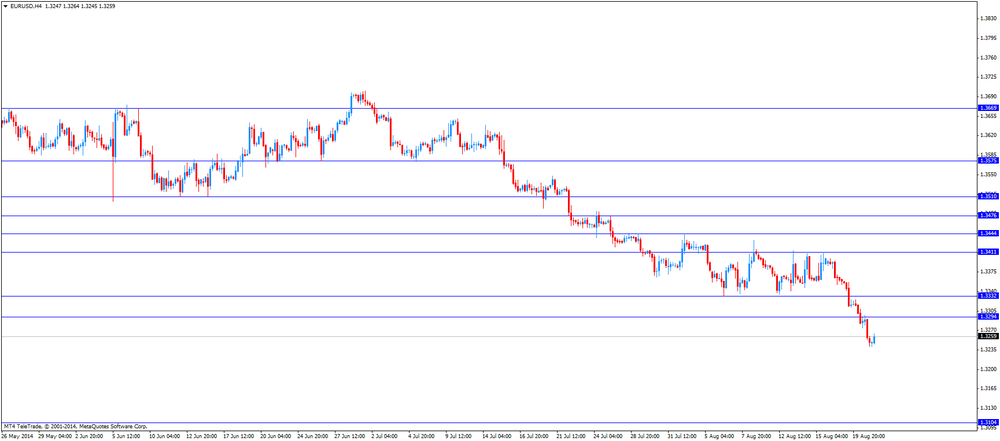

EUR/USD $1,3281 +0,18%

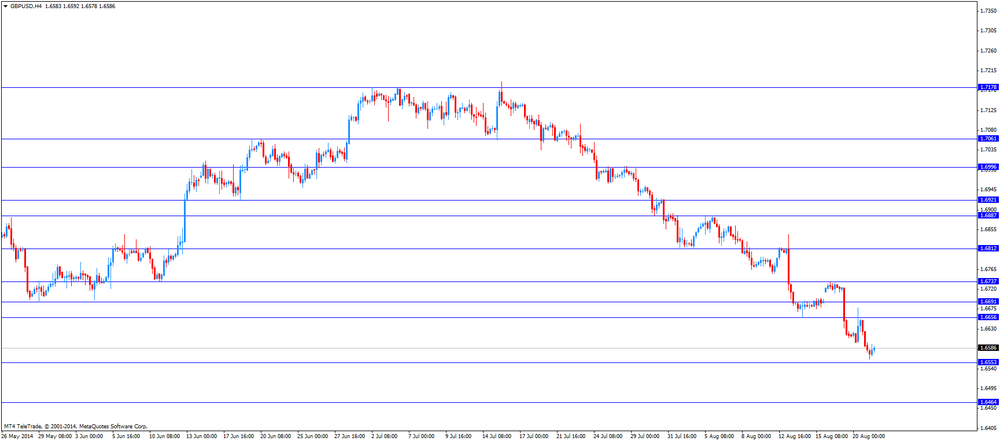

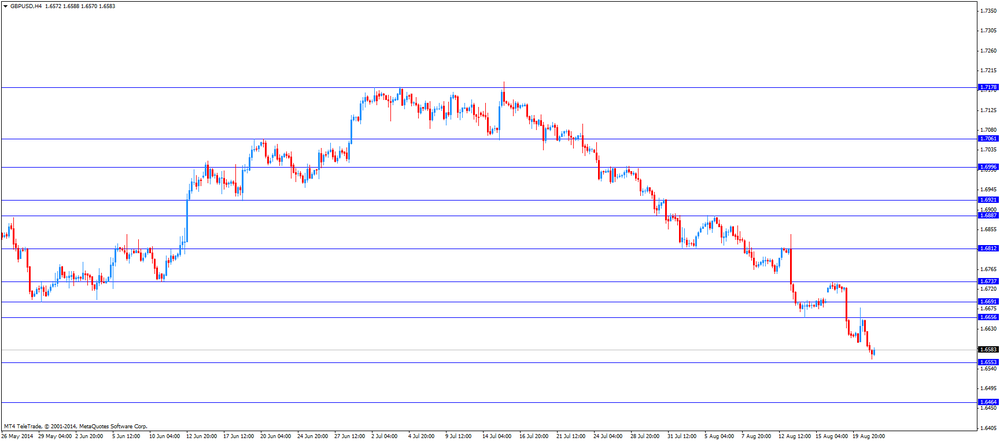

GBP/USD $1,6578 -0,09%

USD/CHF Chf0,9112 -0,24%

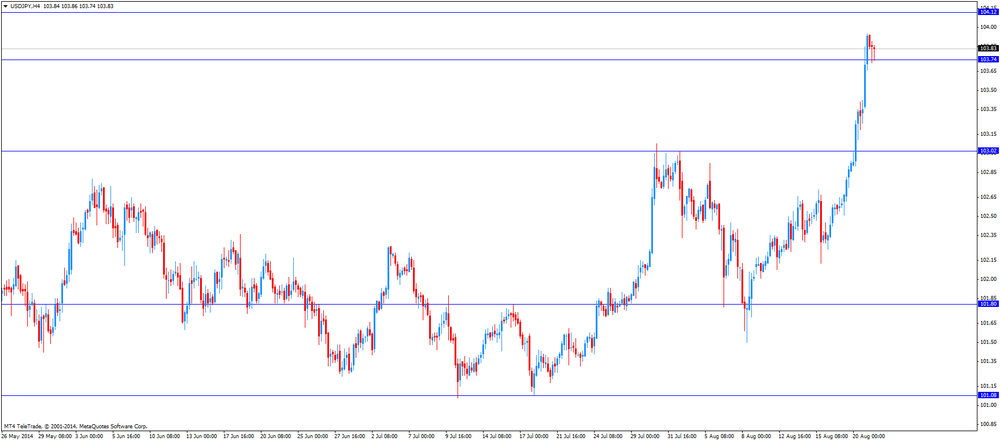

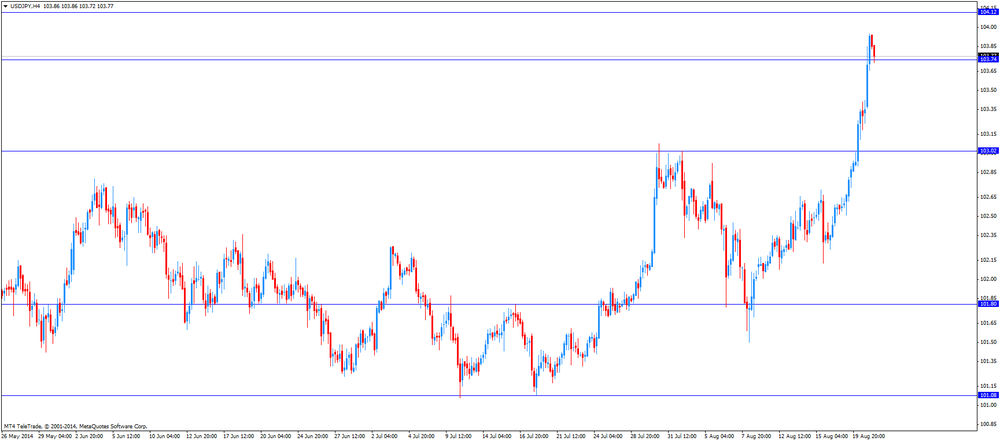

USD/JPY Y103,82 +0,12%

EUR/JPY Y137,90 +0,30%

GBP/JPY Y172,12 +0,04%

AUD/USD $0,9301 +0,18%

NZD/USD $0,8404 +0,45%

USD/CAD C$1,0938 -0,27%

-

23:00

Schedule for today, Friday, Aug 22’2014:

(time / country / index / period / previous value / forecast)

00:00 U.S. Jackson Hole Symposium

12:30 Canada Retail Sales, m/m June +0.7% +0.6%

12:30 Canada Retail Sales ex Autos, m/m June +0.1% +0.6%

12:30 Canada Consumer Price Index m / m July +0.1% -0.1%

12:30 Canada Consumer price index, y/y July +2.4%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m July -0.1% 0.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July +1.8%

14:00 U.S. Fed Chairman Janet Yellen Speaks

18:30 Eurozone ECB President Mario Draghi Speaks

-

16:37

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the mostly positive U.S. economic data

The U.S. dollar traded lower against the most major currencies after the mostly positive U.S. economic data. Market participants are awaiting a speech by the Federal Reserve Chair Janet Yellen in Jackson Hole on Friday.

The number of initial jobless claims in the week ending August 16 in the U.S. fell by 14,000 to 298,000 from 312,000 in the previous week. The previous week's figure was revised from 311,000. Analysts had expected number of initial jobless claims to decrease by 13,000 to 299,000.

The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 58.0 in August from 55.8 in July, beating expectations for a decline to 55.7.

The Federal Reserve Bank of Philadelphia's manufacturing index climbed to 28.0 in August from 23.9 in July, beating expectations for a drop to 20.3.

The existing home sales in the U.S. rose 2.4% to 5.15 million units in July from 5.03 million units in June. June's figure was revised down from 5.04 million units. Analysts had expected a decrease to 5.01 million units in July.

The euro traded higher against the U.S. dollar. Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.8 in August from 51.8 in July, missing expectations for a fall to 51.4.

Eurozone's preliminary services purchasing managers' index (PMI) fell to 53.5 in August from 54.2 in July, missing expectations for a decline to 53.6.

Germany's preliminary manufacturing purchasing managers' index (PMI) decreased to 52.0 in August from 52.4 in July, beating expectations for a fall to 51.8.

Germanys' preliminary services purchasing managers' index (PMI) fell to 56.4 in August from 56.7 in July, beating expectations for a decline to 55.5.

French preliminary manufacturing purchasing managers' index (PMI) declined to 46.5 in August from 47.8 in July, missing forecasts of a rise to 47.9.

French preliminary services purchasing managers' index (PMI) rose to 51.1 in August from 50.4 in July, beating expectations for a fall to 50.3.

The British pound traded slightly higher against the U.S. UK retail sales increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase.

On a yearly basis, U.K. retail sales climbed 2.6% in July, after a 3.4% rise. June's figure was revised down from a 3.6% gain.

The U.K. public sector net borrowing posted a deficit of £1.1 billion in July, after a surplus of £9.79 billion in June. June's figure was revised from a surplus of £9.51 billion. Analysts had expected a surplus of £10.1 billion.

The Swiss franc traded higher against the U.S. dollar. Switzerland's trade surplus rose to 3.98 billion Swiss francs in July from a surplus 1.41 billion Swiss francs in June, exceeding expectations for an increase to a surplus of 1.91 billion Swiss francs. June's figure was revised up from a surplus of 1.38 billion Swiss francs.

The New Zealand dollar traded lower against the U.S dollar due to the strong U.S. currency and the weaker-than-expected economic data from China and New Zealand, but later recovered its losses.

China's preliminary HSBC manufacturing purchasing managers' index dropped to 50.3 in August from 51.7 in July, missing expectations for a decline to 51.5.

China is New Zealand's second biggest export partner.

Credit card spending in New Zealand rose 4.5% in July, after a 6.0% gain in June. June's figure was revised down from a 7.0% increase.

The Australian dollar traded lower against the U.S. dollar due to the strong U.S. currency and the weaker-than-expected economic data from China, but later recovered its losses.

The Conference Board released its leading index for Australia. The index climbed 0.4% in June, after a 0.2% rise in May.

The Japanese yen traded slightly higher against the U.S. dollar.

Japan's preliminary manufacturing purchasing managers' index rose to 52.4 in August from 50.5 in July, exceeding expectations for an increase to 51.5.

-

15:29

Federal Open Market Committee's minutes: some members are ready for interest hike

The Federal Reserve released on Wednesday the FOMC' minutes of the meeting held on July 29-30, 2014. Some FOMC members believe that the Fed could tighten its monetary policy sooner than expected due to improvements in labour market conditions and strengthening recovery in U.S. economy.

Most FOMC members want to wait for more information.

Most Fed officials believe that the Fed can wait until 2015 before hiking its interest rate.

At the last meeting, the FOMC reduced its monthly bond purchasing program by $10 billion and kept its interest rate near zero.

The Fed's next move could depend on the economy performs in the second half of 2014. The unemployment rate was 6.2% in July. The U.S. economy expanded at a 4% annual rate in the second quarter after contracting 2.1% in the first quarter.

The Fed also said that inflation had moved closer to its 2% target.

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, August 28.0 (forecast 20.3)

-

15:00

U.S.: Existing Home Sales , July 5.15 (forecast 5.01)

-

15:00

U.S.: Leading Indicators , July +0.9% (forecast +0.6%)

-

15:00

Eurozone: Consumer Confidence, August -10 (forecast -9)

-

14:45

U.S.: Manufacturing PMI, August 58.0 (forecast 55.7)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3250(E325mn), $1.3350-55(E225mn), $1.3400(E461mn)

USD/JPY Y102.00($250mn), Y102.50($450mn), Y102.75-80($200mn), Y103.00($985mn)

EUR/JPY Y136.65(E184mn)

GBP/USD $1.6650(stg184mn)

USD/CHF Chf0.9100($440mn)

AUD/USD $0.9225(A$149mn), $0.9335(A$149mn)

USD/CAD C$1.0880($276mn), C$1.0900($130mn)

-

13:30

U.S.: Initial Jobless Claims, August 298 (forecast 299)

-

13:17

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the weaker-than-expected UK retail sales

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index June +0.2% +0.4%

01:35 Japan Manufacturing PMI (Preliminary) August 50.5 51.5 52.4

01:45 China HSBC Manufacturing PMI (Preliminary) August 51.7 51.5 50.3

03:00 New Zealand Credit Card Spending July +6.0% Revised From +7.0% +4.5%

06:00 Switzerland Trade Balance July 1.41 Revised From 1.38 1.91 3.98

06:58 France Manufacturing PMI (Preliminary) August 47.8 47.9 46.5

06:58 France Services PMI (Preliminary) August 50.4 50.3 51.1

07:28 Germany Manufacturing PMI (Preliminary) August 52.4 51.8 52.0

07:28 Germany Services PMI (Preliminary) August 56.7 55.5 56.4

07:58 Eurozone Manufacturing PMI (Preliminary) August 51.8 51.4 50.8

07:58 Eurozone Services PMI (Preliminary) August 54.2 53.6 53.5

08:30 United Kingdom Retail Sales (MoM) July +0.1% +0.4% +0.1%

08:30 United Kingdom Retail Sales (YoY) July +3.6% +2.6%

08:30 United Kingdom PSNB, bln July 9.5 10.1 -1.1

12:00 U.S. Jackson Hole Symposium

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 12,000 to 299,000.

The U.S. preliminary manufacturing purchasing managers' index (PMI) is expected to fall to 55.7 in August from 55.8 in July.

The existing home sales in the U.S. are expected to decrease to 5.01 million units in July from 5.04 million units in June.

The euro traded slightly higher against the U.S. dollar after flash PMIs from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.8 in August from 51.8 in July, missing expectations for a fall to 51.4.

Eurozone's preliminary services purchasing managers' index (PMI) fell to 53.5 in August from 54.2 in July, missing expectations for a decline to 53.6.

Germany's preliminary manufacturing purchasing managers' index (PMI) decreased to 52.0 in August from 52.4 in July, beating expectations for a fall to 51.8.

Germanys' preliminary services purchasing managers' index (PMI) fell to 56.4 in August from 56.7 in July, beating expectations for a decline to 55.5.

French preliminary manufacturing purchasing managers' index (PMI) declined to 46.5 in August from 47.8 in July, missing forecasts of a rise to 47.9.

French preliminary services purchasing managers' index (PMI) rose to 51.1 in August from 50.4 in July, beating expectations for a fall to 50.3.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected UK retail sales. U.K. retail sales increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase.

On a yearly basis, U.K. retail sales climbed 2.6% in July, after a 3.4% rise. June's figure was revised down from a 3.6% gain.

The U.K. public sector net borrowing posted a deficit of £1.1 billion in July, after a surplus of £9.79 billion in June. June's figure was revised from a surplus of £9.51 billion. Analysts had expected a surplus of £10.1 billion.

The Swiss franc traded slightly higher against the U.S. dollar after the better-than-expected trade data from Switzerland. Switzerland's trade surplus rose to 3.98 billion Swiss francs in July from a surplus 1.41 billion Swiss francs in June, exceeding expectations for an increase to a surplus of 1.91 billion Swiss francs. June's figure was revised up from a surplus of 1.38 billion Swiss francs.

EUR/USD: the currency pair rose to $1.3277

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims August 311 299

13:45 U.S. Manufacturing PMI (Preliminary) August 55.8 55.7

14:00 U.S. Consumer confidence August -8 -9

14:00 U.S. Existing Home Sales July 5.04 5.01

14:00 U.S. Philadelphia Fed Manufacturing Survey August 23.9 20.3

-

13:00

Orders

EUR/USD

Offers $1.3485, $1.3445, $1.3415, $1.3400, $1.3370, $1.3325

Bids $1.3240, $1.3230, $1.3200

GBP/USD

Offers $1.6845, $1.6800/10, $1.6750, $1.6680

Bids $1.6550, $1.6510, $1.6500

AUD/USD

Offers $0.9400, $0.9370, $0.9350, $0.9315

Bids $0.9240, $0.9220, $0.9200

EUR/JPY

Offers Y138.20, Y138.00, Y137.90

Bids Y137.00, Y136.75, Y136.50, Y136.25/20

USD/JPY

Offers Y104.90, Y104.45, Y104.10, Y104.00

Bids Y103.10, Y102.70, Y102.30, Y102.15, Y102.00

EUR/GBP

Offers stg0.8100, stg0.8035

Bids stg0.7970, stg0.7950/40, stg0.7900

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3200(E855mn), $1.3360(E359mn), $1.3300(E1.06bn), $1.3340(E204mn)

USD/JPY Y103.00($834mn), Y103.35($400mn

EUR/JPY Y136.65(E184mn)

EUR/GBP stg0.7925(E403mn), stg0.7985(E250mn), stg0.8000(E686mn)

AUD/USD $0.9250(A$250mn), $0.9290(A$130mn), $0.9350-60(A$297mn), $0.9375(A$726mn)

USD/CAD C$1.0850($434mn), C$1.0945($330mn)

-

10:02

Foreign exchange market. Asian session: the U.S. dollar traded higher against the most major currencies after the Federal Open Market Committee’s minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index June +0.2% +0.4%

01:35 Japan Manufacturing PMI (Preliminary) August 50.5 51.5 52.4

01:45 China HSBC Manufacturing PMI (Preliminary) August 51.7 51.5 50.3

03:00 New Zealand Credit Card Spending July +6.0% Revised From +7.0% +4.5%

06:00 Switzerland Trade Balance July 1.41 Revised From 1.38 1.91 3.98

06:58 France Manufacturing PMI (Preliminary) August 47.8 47.9 46.5

06:58 France Services PMI (Preliminary) August 50.4 50.3 51.1

07:28 Germany Manufacturing PMI (Preliminary) August 52.4 51.8 52.0

07:28 Germany Services PMI (Preliminary) August 56.7 55.5 56.4

07:58 Eurozone Manufacturing PMI (Preliminary) August 51.8 51.4 50.8

07:58 Eurozone Services PMI (Preliminary) August 54.2 53.6 53.5

08:30 United Kingdom Retail Sales (MoM) July +0.1% +0.4% +0.1%

08:30 United Kingdom Retail Sales (YoY) July +3.6% +2.6%

08:30 United Kingdom PSNB, bln July 9.5 10.1 -1.1

The U.S. dollar traded higher against the most major currencies after the Federal Open Market Committee's (FOMC) minutes. Some FOMC members believe that the Fed could tighten its monetary policy due to improvements in labour market conditions and strengthening recovery in U.S. economy.

Most FOMC members want to wait for more information.

Investors speculate that the Fed may hike its interest rate sooner than expected.

The New Zealand dollar traded lower against the U.S dollar due to the strong U.S. currency and the weaker-than-expected economic data from China and New Zealand.

China's preliminary HSBC manufacturing purchasing managers' index dropped to 50.3 in August from 51.7 in July, missing expectations for a decline to 51.5.

China is New Zealand's second biggest export partner.

Credit card spending in New Zealand rose 4.5% in July, after a 6.0% gain in June. June's figure was revised down from a 7.0% increase.

The Australian dollar traded lower against the U.S. dollar due to the strong U.S. currency and the weaker-than-expected economic data from China.

The Conference Board released its leading index for Australia. The index climbed 0.4% in June, after a 0.2% rise in May.

The Japanese yen declined against the U.S. dollar due to the strong greenback.

Japan's preliminary manufacturing purchasing managers' index rose to 52.4 in August from 50.5 in July, exceeding expectations for an increase to 51.5.

EUR/USD: the currency pair declined to $1.3241

GBP/USD: the currency pair fell to $1.6562

USD/JPY: the currency pair increased to Y103.95

The most important news that are expected (GMT0):

12:00 U.S. Jackson Hole Symposium

12:30 U.S. Initial Jobless Claims August 311 299

13:45 U.S. Manufacturing PMI (Preliminary) August 55.8 55.7

14:00 U.S. Consumer confidence August -8 -9

14:00 U.S. Existing Home Sales July 5.04 5.01

14:00 U.S. Philadelphia Fed Manufacturing Survey August 23.9 20.3

-

09:31

United Kingdom: PSNB, bln, July -1.1 (forecast 10.1)

-

09:30

United Kingdom: Retail Sales (MoM), July +0.1% (forecast +0.4%)

-

09:30

United Kingdom: Retail Sales (YoY) , July +2.6%

-

09:00

Eurozone: Manufacturing PMI, August 50.8 (forecast 51.4)

-

09:00

Eurozone: Services PMI, August 53.5 (forecast 53.6)

-

08:30

Germany: Manufacturing PMI, August 52.0 (forecast 51.8)

-

08:30

Germany: Services PMI, August 56.4 (forecast 55.5)

-

08:00

France: Manufacturing PMI, August 46.5 (forecast 47.9)

-

08:00

France: Services PMI, August 51.1 (forecast 50.3)

-

07:00

Switzerland: Trade Balance, July 3.98 (forecast 1.91)

-

06:27

Options levels on thursday, August 21, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3344 (1125)

$1.3299 (50)

$1.3269 (27)

Price at time of writing this review: $ 1.3245

Support levels (open interest**, contracts):

$1.3221 (5007)

$1.3197 (4586)

$1.3166 (5661)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 55697 contracts, with the maximum number of contracts with strike price $1,3400 (6503);

- Overall open interest on the PUT options with the expiration date September, 5 is 61990 contracts, with the maximum number of contracts with strike price $1,3100 (6427);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from August, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.6801 (1832)

$1.6703 (902)

$1.6606 (324)

Price at time of writing this review: $1.6567

Support levels (open interest**, contracts):

$1.6497 (1869)

$1.6399 (747)

$1.6300 (643)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 28530 contracts, with the maximum number of contracts with strike price $1,7000 (2764);

- Overall open interest on the PUT options with the expiration date September, 5 is 29217 contracts, with the maximum number of contracts with strike price $1,6800 (4027);

- The ratio of PUT/CALL was 1.02 versus 1.06 from the previous trading day according to data from August, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:00

New Zealand: Credit Card Spending, July +4.5%

-

02:45

China: HSBC Manufacturing PMI, August 50.3 (forecast 51.5)

-

02:35

Japan: Manufacturing PMI, August 52.4 (forecast 51.5)

-

01:00

Australia: Conference Board Australia Leading Index, June +0.4%

-