Notícias do Mercado

-

23:01

Schedule for today, Thursday, Oct 23’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia NAB Quarterly Business Confidence Quarter II 6

01:35 Japan Manufacturing PMI (Preliminary) October 51.7 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) October 50.2 50.2

06:58 France Manufacturing PMI (Preliminary) October 48.8 48.6

06:58 France Services PMI (Preliminary) October 48.4 48.2

07:28 Germany Manufacturing PMI (Preliminary) October 49.9 49.6

07:28 Germany Services PMI (Preliminary) October 55.7 55.0

07:58Eurozone Services PMI (Preliminary) October 52.4 52.0

07:58 Eurozone Manufacturing PMI (Preliminary) October 50.3 50.0

08:30 United Kingdom Retail Sales (MoM) September +0.4% -0.1%

08:30 United Kingdom Retail Sales (YoY) September +3.9% +2.8%

08:30 United Kingdom BBA Mortgage Approvals September 41.6 41.5

09:00 Eurozone EU Economic Summit

10:00 United Kingdom CBI industrial order books balance October -4 -3

12:30 U.S. Initial Jobless Claims October 264 269

13:00 U.S. Housing Price Index, m/m August +0.1% +0.4%

13:00 U.S. Housing Price Index, y/y August +4.4%

13:45 U.S. Manufacturing PMI (Preliminary) October 57.5 57.2

14:00 Eurozone Consumer Confidence October -11 -12

14:00 U.S. Leading Indicators September +0.2% +0.8%

21:45 New Zealand Trade Balance, mln September -472 -620

-

22:45

New Zealand: CPI, y/y, Quarter III +1.0%

-

22:45

New Zealand: CPI, q/q , Quarter III +0.3% (forecast +0.5%)

-

17:04

Bank of Canada cancelled its press conference due to Ottawa shooting

The Bank of Canada cancelled its press conference with Governor Stephen Poloz after a Canadian soldier was shot at the War Memorial in Ottawa.

-

16:39

Foreign exchange market. American session: the Canadian dollar traded higher against the U.S. dollar after the Bank of Canada's interest rate decision

The U.S. dollar traded mixed against the most major currencies after the better-than-expected U.S. consumer price inflation. The U.S. consumer price inflation rose 0.1% in September, exceeding expectations for a flat reading, after a 0.2% decrease in August.

On a yearly basis, the U.S. consumer price index increased 1.7% in September, in line with expectations, after a 1.7% gain in August.

The U.S. consumer price inflation excluding food and energy climbed 0.1% in September, missing expectations for a 0.2% rise, after a flat reading in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose 1.7% in September, in line with expectations, after a 1.7% increase in August.

The euro traded lower against the U.S. dollar. News that the European Central Bank is considering to buy corporate bonds still weighed on the euro.

Reuters reported yesterday that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

News by Spanish newswire Efe also weighed on the euro. Efe reported today that at least 11 banks had failed ECB stress tests. The ECB is expected to announce the results of stress tests on Sunday.

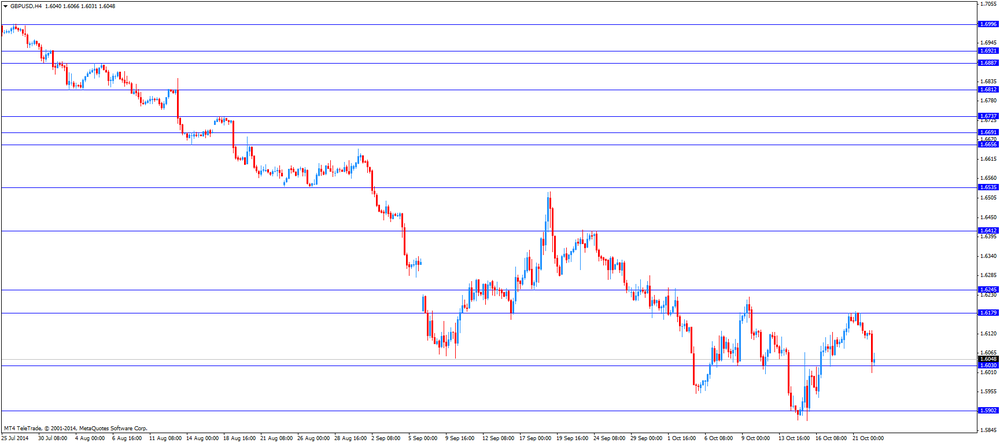

The British pound traded higher against the U.S. dollar. In the morning trading session, the pound dropped against the greenback after the Bank of England's minutes of the monetary policy committee meeting. The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The tone of the BoE's minutes was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

The Canadian dollar traded higher against the U.S. dollar after Canadian retail sales and the Bank of Canada's interest rate decision. Canadian retail sales dropped by 0.3% in August, missing expectations for a 0.2% increase, after a 0.1% decline in July. That was the largest drop this year.

Canadian retail sales excluding automobiles fell 0.3% in August, missing forecasts of a 0.3% gain, after 0.5% drop in July. July's figure was revised up from a 0.6% decrease.

The Bank of Canada (BoC) kept its interest rate unchanged at 1.00%. The BoC said in its statement that "the current stance of monetary policy is appropriate".

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. Australia's consumer price index climbed 0.5% in the third quarter, beating forecasts of a 0.4% rise, after a 0.5% increase in the second quarter.

On a yearly basis, Australia's consumer price inflation increased 2.3% in the third quarter, in line with expectations, after a 3.0% gain in the second quarter.

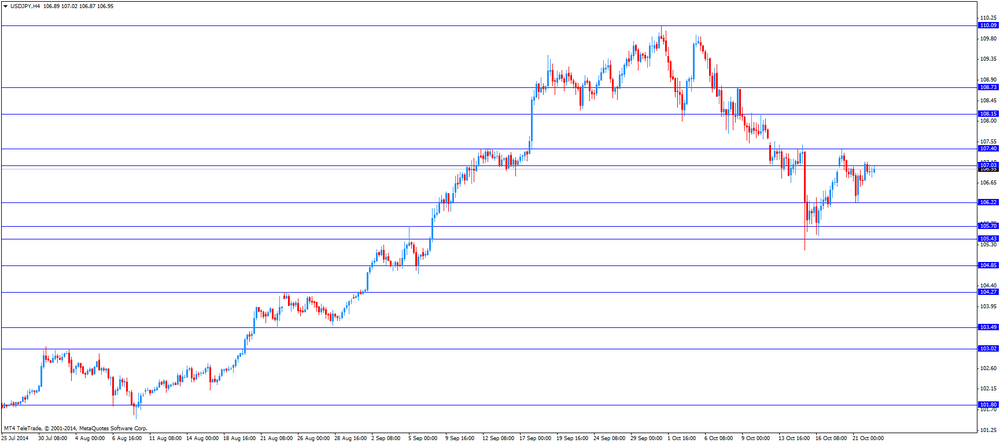

The Japanese yen fell against the U.S. dollar. Japan's adjusted trade deficit widened to ¥1,070.14 billion in September from a deficit of ¥912.40 billion in August. August's figure was revised up from a deficit of ¥924.40 billion. Analysts had expected a deficit of ¥910.0 billion.

-

15:32

Bank of Canada kept its interest rate unchanged at 1.00%

The Bank of Canada (BoC) released its interest rate today. The central bank kept its interest rate unchanged at 1.00%.

The BoC said in its statement that "the current stance of monetary policy is appropriate".

The central bank expects the real GDP growth will be about 2.5% over the next year and 2% by the end of 2016.

Canada's economy is expected to reach its full capacity in the second half of 2016, so the BoC.

The central bank noted that the risks are "roughly balanced", but it removed the word "neutral".

-

15:30

U.S.: Crude Oil Inventories, October +7.1

-

15:00

Canada: Bank of Canada Rate, 1.00% (forecast 1.00%)

-

14:53

U.S. consumer price inflation rose 0.1% in September

The U.S. Labor Department released consumer price inflation data today. The U.S. consumer price inflation rose 0.1% in September, exceeding expectations for a flat reading, after a 0.2% decrease in August.

On a yearly basis, the U.S. consumer price index increased 1.7% in September, in line with expectations, after a 1.7% gain in August.

The U.S. consumer price inflation excluding food and energy climbed 0.1% in September, missing expectations for a 0.2% rise, after a flat reading in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose 1.7% in September, in line with expectations, after a 1.7% increase in August.

Energy prices declined 0.7% in September, while food prices rose 0.3%.

Shelter costs climbed 0.3% last month, while medical-care services prices rose 0.1%.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2650(E400mn), $1.2665(E710mn), $1.2675(E276mn), $1.2680(E432mn), $1.2685(E201mn), $1.2750(E294mn), $1.2800(E433mn), $1.2840(E869mn)

USD/JPY: Y106.10($653mn), Y106.15-20($352mn), Y107.50($252mn)

EUR/JPY: Y135.20(E844mn)

EUR/GBP: Stg0.7800(E391mn), stg0.7850(E100mn)

AUD/USD: $0.8700(A$764mn), $0.8790-800(A$745mn)

NZD/USD: $0.7980(NZ$375mn)

USD/CAD: C$1.1200($200mn), C$1.1300($300mn)

-

14:09

Canadian retail sales dropped 0.3% in August

Statistics Canada released retail sales data today. Canadian retail sales dropped by 0.3% in August, missing expectations for a 0.2% increase, after a 0.1% decline in July. That was the largest drop this year.

The decline was driven by lower gasoline prices. Sales at gasoline stations fell 2.1% in August

Canadian retail sales excluding automobiles fell 0.3% in August, missing forecasts of a 0.3% gain, after 0.5% drop in July. July's figure was revised up from a 0.6% decrease.

-

13:31

Canada: Retail Sales ex Autos, m/m, August -0.3% (forecast +0.3%)

-

13:30

U.S.: CPI, m/m , September +0.1% (forecast 0.0%)

-

13:30

U.S.: CPI excluding food and energy, m/m, September +0.1% (forecast +0.2%)

-

13:30

U.S.: CPI, Y/Y, September +1.7% (forecast +1.7%)

-

13:30

U.S.: CPI excluding food and energy, Y/Y, September +1.7% (forecast +1.7%)

-

13:30

Canada: Retail Sales, m/m, August -0.3% (forecast +0.2%)

-

13:00

Orders

EUR/USD

Offers $1.2800

Bids $1.2680, $1.2650, $1.2625

GBP/USD

Offers $1.6080, $1.6050

Bids $1.6005/95

AUD/USD

Offers $0.8900, $0.8840/50, $0.8800

Bids $0.8720/00, $0.8650

EUR/JPY

Offers Y137.20, Y136.80, Y136.45/50, Y136.00

Bids Y135.50, Y135.00, , Y134.50, Y134.00

USD/JPY

Offers Y107.80/00, Y107.50, Y107.15/20

Bids Y106.50, Y106.10/00, Y105.80

EUR/GBP

Offers stg0.8066

Bids stg0.7870/65, stg0.7850, stg0.7800

-

13:00

Foreign exchange market. European session: the euro traded lower against the U.S. dollar

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, q/q Quarter III +0.5% +0.4% +0.5%

00:30 Australia CPI, y/y Quarter III +3.0% +2.3% +2.3%

08:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. consumer price inflation. The U.S. consumer price inflation is expected to be flat in September, after a 0.2% decline in August.

The U.S. consumer price index excluding food and energy is expected to rise 0.2% in September, after a flat reading in August.

The euro traded lower against the U.S. dollar. News that the European Central Bank is considering to buy corporate bonds still weighed on the euro.

Reuters reported yesterday that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

News by Spanish newswire Efe also weighed on the euro. Efe reported today that at least 11 banks had failed ECB stress tests. The ECB is expected to announce the results of stress tests on Sunday.

The British pound dropped against the U.S. dollar after the Bank of England's minutes of the monetary policy committee meeting. The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The tone of the BoE's minutes was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian retail sales and the Bank of Canada's interest rate decision. Canadian retail sales are expected to increase 0.2% in August, after 0.1% decline in July.

Canadian retail sales excluding automobiles are expected to rise 0.3% in August, after 0.6% drop in July.

Analysts expect that the Bank of Canada will keep its interest rate unchanged at 1.00%.

EUR/USD: the currency pair fell to 1.2680

GBP/USD: the currency pair dropped to $1.6010

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m August -0.1% +0.2%

12:30 Canada Retail Sales ex Autos, m/m August -0.6% +0.3%

12:30 U.S. CPI, m/m September -0.2% 0.0%

12:30 U.S. CPI, Y/Y September +1.7% +1.7%

12:30 U.S. CPI excluding food and energy, m/m September 0.0% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y September +1.7% +1.7%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

15:15 Canada BOC Press Conference

21:00 Australia RBA's Governor Glenn Stevens Speech

21:45 New Zealand CPI, q/q Quarter III +0.3% +0.5%

21:45 New Zealand CPI, y/y Quarter III +1.6%

-

10:11

GBPUSD dropped after the Bank of England’s minutes of the monetary policy committee meeting

The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The votes split was not new, but the wording was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

-

09:54

Foreign exchange market. Asian session: the Australian dollar rose against the U.S. dollar after the Australian consumer price inflation

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, q/q Quarter III +0.5% +0.4% +0.5%

00:30 Australia CPI, y/y Quarter III +3.0% +2.3% +2.3%

08:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed to lower against the most major currencies, but remained supported by yesterday's better-than-expected existing home sales in the U.S. Existing home sales in the U.S. climbed 2.4% to a seasonally adjusted annual rate of 5.17 million in September from 5.05 million in August. That was the highest level of the year.

The New Zealand dollar traded higher against the U.S. dollar, following the Australian dollar. No major economic reports were released in New Zealand.

The Australian dollar rose against the U.S. dollar after the Australian consumer price inflation. Australia's consumer price index climbed 0.5% in the third quarter, beating forecasts of a 0.4% rise, after a 0.5% increase in the second quarter.

On a yearly basis, Australia's consumer price inflation increased 2.3% in the third quarter, in line with expectations, after a 3.0% gain in the second quarter.

The Japanese yen traded mixed against the U.S. dollar. Japan's adjusted trade deficit widened to ¥1,070.14 billion in September from a deficit of ¥912.40 billion in August. August's figure was revised up from a deficit of ¥924.40 billion. Analysts had expected a deficit of ¥910.0 billion.

EUR/USD: the currency pair rose to $1.2730

GBP/USD: the currency pair increased to $1.6129

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m August -0.1% +0.2%

12:30 Canada Retail Sales ex Autos, m/m August -0.6% +0.3%

12:30 U.S. CPI, m/m September -0.2% 0.0%

12:30 U.S. CPI, Y/Y September +1.7% +1.7%

12:30 U.S. CPI excluding food and energy, m/m September 0.0% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y September +1.7% +1.7%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

15:15 Canada BOC Press Conference

21:00 Australia RBA's Governor Glenn Stevens Speech

21:45 New Zealand CPI, q/q Quarter III +0.3% +0.5%

21:45 New Zealand CPI, y/y Quarter III +1.6%

-

06:27

Options levels on wednesday, October 22, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2837 (3218)

$1.2793 (1663)

$1.2765 (1665)

Price at time of writing this review: $ 1.2722

Support levels (open interest**, contracts):

$1.2682 (1111)

$1.2643 (2171)

$1.2587 (2137)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 56013 contracts, with the maximum number of contracts with strike pric $1,2900 (6988);

- Overall open interest on the PUT options with the expiration date November, 7 is 57400 contracts, with the maximum number of contracts with strike price $1,2600 (6336);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from October, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.6402 (1491)

$1.6304 (1640)

$1.6207 (1995)

Price at time of writing this review: $1.6120

Support levels (open interest**, contracts):

$1.6090 (1181)

$1.5994 (2122)

$1.5896 (1312)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 26434 contracts, with the maximum number of contracts with strike price $1,6200 (1995);

- Overall open interest on the PUT options with the expiration date November, 7 is 31818 contracts, with the maximum number of contracts with strike price $1,5400 (2398);

- The ratio of PUT/CALL was 1.20 versus 1.21 from the previous trading day according to data from October, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:30

Australia: CPI, q/q, Quarter III +0.5% (forecast +0.4%)

-

01:30

Australia: CPI, y/y, Quarter III +2.3% (forecast +2.3%)

-

00:52

Japan: Adjusted Merchandise Trade Balance, bln, September -1070.14 (forecast -910.0)

-

00:30

Australia: Leading Index, September -0.1%

-

00:01

Australia: Conference Board Australia Leading Index, August -0.2%

-