Notícias do Mercado

-

23:28

Currencies. Daily history for Apr 23’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0820 +0,91%

GBP/USD $1,5056 +0,15%

USD/CHF Chf0,9542 -1,73%

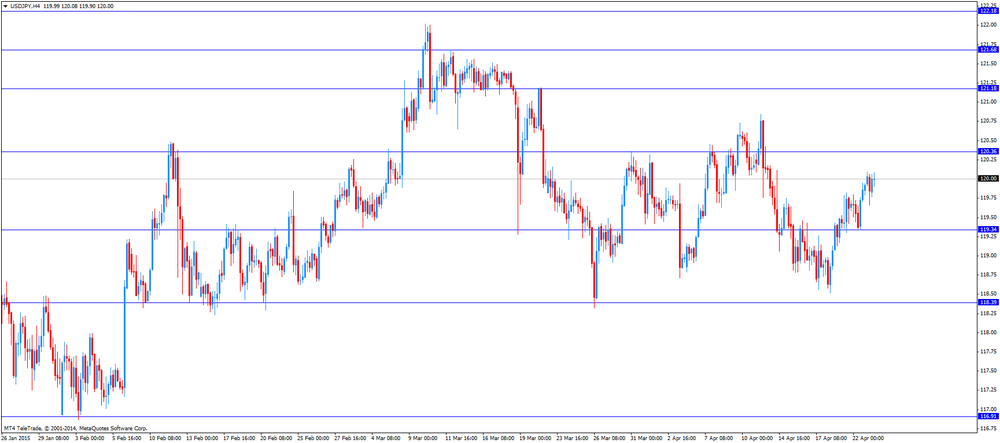

USD/JPY Y119,58 -0,28%

EUR/JPY Y129,39 +0,63%

GBP/JPY Y180,04 -0,13%

AUD/USD $0,7778 +0,40%

NZD/USD $0,7596 -0,66%

USD/CAD C$1,2149 -0,79%

-

23:00

Schedule for today, Friday, Apr 24’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m February 1.9% -0.9%

08:00 Germany IFO - Business Climate April 107.9 108.5

08:00 Germany IFO - Current Assessment April 112.0 112.4

08:00 Germany IFO - Expectations April 103.9 104.5

09:00 Eurozone Eurogroup Meetings

12:30 U.S. Durable Goods Orders March -1.1% Revised From -1.4% 0.7%

12:30 U.S. Durable Goods Orders ex Transportation March -0.6% Revised From -0.4% 0.2%

12:30 U.S. Durable goods orders ex defense March -1.0%

13:00 Belgium Business Climate April -6.3 -5.8

14:30 Canada BOC Gov Stephen Poloz Speaks

-

19:20

American focus: the dollar dropped significantly against major currencies

The dollar depreciated significantly against the euro, breaking the mark of $ 1.0800, which was associated with the publication of weak US data. The Labor Department said that the number of Americans who first applied for unemployment benefits, increased slightly last week but remained at a level that indicates that the economy has been steadily adding jobs. Initial claims for unemployment insurance, an indicator of layoffs throughout the US economy grew by 1000 and reached a seasonally adjusted 295,000 in the week ended April 18. On Thursday. Economists had expected 290,000 hits. The data for the previous week were revised. The four week moving average of initial claims, which smooths weekly volatility, rose by 1750 to 284 500. This is slightly above the post-crisis minimum 282,500 made earlier this month. The report also showed that the number of repeated applications for unemployment benefits rose by 50,000 to 2.33 million in the week ended April 11. And the four-week moving average of continuing claims is the lowest rate since December 2000.

Meanwhile, the data provided by the Ministry of Commerce, showed that new home sales fell sharply in March, becoming another sign of fluctuating demand for housing, despite the persistently low mortgage rates and steady job growth. New home sales fell by 11.4% in February and to a seasonally adjusted annual rate reached 481 000. Thus ended three months of strong growth, and noted the sharpest decline since July 2013. Economists had expected sales to decline to the level of 514 000. The report on Thursday showed that sales in the previous months were stronger than previously thought. Over the past year, the purchase of new homes rose by 19.4%. The average price of a new home, which was sold in March was $ 277,400, which is 1.7% lower than a year earlier. The ratio of supply of homes, which reflects how much time it would take to exhaust all the houses on the market given the pace of sales in March rose to 5.3, the highest level since November.

The pound rose sharply against the dollar, having played all positions previously lost today, and updating the maximum session, which was caused by the release of weak statistics on the US housing market. Earlier today the pound came under pressure against the publication of data on retail sales in the UK. Office for National Statistics said retail sales, including automotive fuel, decreased by 0.5 percent on a monthly basis in March, offset by an increase of 0.6 percent in February. It was the first decline in six months. Economists had forecast growth of 0.4 percent in March. Sales in food stores rose 0.4 percent, while the volume of non-food sales fell 0.1 percent in February. Except automotive fuel, sales rose by 0.2 percent from the previous month, slower than the 0.6 percent increase in February, and the expected growth of 0.5 percent. In annual terms, retail sales, including automotive fuel, rose 4.2 percent after rising 5.4 percent in February. It was expected that sales growth will be 5.4 per cent again. Meanwhile, growth in sales excluding automotive fuel improved to 5 percent from 4.8 percent. But was weaker than expected expansion of 5.5 percent.

The Swiss franc has appreciated significantly against the US currency returned with all the ground lost during the last session. Support the currency had data on the trade balance in Switzerland, as well as weak statistics on the US housing market. Recall, the trade surplus fell to 8.2 billion Swiss francs for the three months ended in March, from 8.4 billion Swiss francs in the previous quarter. In real terms, exports fell by 1.7 per cent per annum in the first quarter, in contrast to the 0.4 percent growth in the previous quarter. At the same time, imports increased by 0.8 per cent in the March quarter, replacing the 1.8 percent fall in the fourth quarter. In nominal terms, exports and imports decreased by 1.4 percent and 4.4 percent, respectively. In March, the trade surplus rose to 2.5 billion Swiss francs to 2.3 billion Swiss francs in the previous month. He was expected to fall to 2.16 billion Swiss francs. Exports rose by 4.2 percent in real terms 17.9 billion Swiss francs in March year on year. In nominal terms, the volume of deliveries rose by 3.2 percent. Imports reached 15.4 billion Swiss francs, which is 6.8 percent higher in real terms by 0.7 per cent higher in nominal terms.

-

15:57

New home sales plunge 11.4% in March, the steepest fall since July 2013

The U.S. Commerce Department released new home sales data on Thursday. New home sales dropped 11.4% to a seasonally adjusted annual rate of 481,000 units in March from 543,000 units in February. It was the steepest fall since July 2013.

February's figure was revised up from 539,000 units.

Analysts had expected new home sales to reach 514,000 units.

The drop was driven by lower sales in the Northeast in the South. New home sales in the Northeast plunged 33.3% in March, while new home sales in the South slid 15.8%.

The median sales price of new houses sold was $277,400 in March, down from $281,600 in February.

-

15:28

U.S. preliminary manufacturing purchasing managers' index (PMI) declines to 54.2 in April

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Thursday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 54.2 in April from 55.7 in March, missing expectations for a decline to 55.6.

A reading above 50 indicates expansion in economic activity.

The Markit Chief Economist Chris Williamson said that "key to the slowdown was a weakening of export orders, in turn a symptom of the loss of competitiveness arising from the dollar's strength".

He added that domestic demand remained robust.

The preliminary new orders index slid to 55.4 in April from 57.2 in March.

-

15:10

European Central Bank Chief Economist Peter Praet: quantitative easing by the ECB is “now gaining traction”

The European Central Bank (ECB) Chief Economist Peter Praet said on Thursday that quantitative easing by the ECB is "now gaining traction".

"The recovery is firming, and inflation expectations seem to be moving towards values more consistent with our aim," Praet said.

The ECB chief economist pointed out that there is the beginnings of a cyclical recovery, "but it is not yet a structural one".

-

15:00

U.S.: New Home Sales, March 481K (forecast 514)

-

14:48

Swiss trade surplus rises to CHF2.52 billion in March

The Swiss trade surplus climbed to CHF2.52 billion in March from CHF2.32 billion in the previous month. Analysts had expected the surplus to decline to CHF2.16 billion.

Exports increased 4.2% in March, while imports were up 6.8%.

The trade surplus declined to CHF8.2 billion in the first quarter from CHF8.4 billion in the previous quarter.

Exports dropped 1.7% in the first quarter, while imports climbed 0.8%.

-

14:45

U.S.: Manufacturing PMI, April 54.2 (forecast 55.6)

-

14:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0650(E608mn), $1.0700(E400mn), $1.0735(E600mn), $1.0800(E717mn), $1.0835(E455mn)

USD/JPY: Y119.35($380mn), Y120.00($740mn), Y120.50($350mn)

EUR/JPY: Y129.00(E226mn)

GBP/USD: $1.4900(Gbp623mn)

USD/CHF: Chf0.9535($540mn)

AUD/USD: 0.7700(A$608mn), $0.7750(A$307mn), $0.7800(A$600mn)

AUD/NZD: NZ$1.0200(A$3bn)

NZD/USD: $0.7615(NZ$240mn)

USD/SGD: Sgd1.3500($1.3bn)

-

14:19

European Central Bank Executive Board Member Benoit Coeure: there are signs of the economic recovery in the Eurozone

The European Central Bank (ECB) Executive Board Member Benoit Coeure said in an interview on Thursday that there are signs of the economic recovery in the Eurozone. He added that business and household confidence indicators increased.

He pointed out that Eurozone's recovery is still "insufficient and somewhat unequally spread from country to country".

-

13:50

Reserve Bank of New Zealand Assistant Governor John McDermott: the interest rate hike is possible if demand weakens and inflation in New Zealand declines

The Reserve Bank of New Zealand (RBNZ) Assistant Governor John McDermott ruled out the interest rate hike, and noted that the interest rate hike is possible if demand weakens and inflation in New Zealand declines.

"Evidence of weakening demand and domestic inflationary pressures would prompt us to consider lowering interest rates," McDermott said on Thursday.

The RBNZ assistant governor pointed out that "monetary policy should remain stimulatory for a prolonged period".

He also said that the labour market should improve and inflation should rise before hiking interest rate.

McDermott noted that the central bank will continue to monitor wages and price-setting outcomes.

-

13:30

U.S.: Initial Jobless Claims, April 295K (forecast 290)

-

13:30

U.S.: Continuing Jobless Claims, April 2323K

-

13:24

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weaker-than-expected PMIs from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia NAB Quarterly Business Confidence Quarter I 2 0

01:35 Japan Manufacturing PMI (Preliminary) April 50.3 50.8 49.7

01:45 China HSBC Manufacturing PMI (Preliminary) April 49.6 49.4 49.2

03:00 New Zealand Credit Card Spending March 5.8% 5.2%

06:00 Switzerland Trade Balance March 2.32 Revised From 2.47 2.16 2.52

07:00 France Manufacturing PMI (Preliminary) April 48.8 49.4 48.4

07:00 France Services PMI (Preliminary) April 52.4 52.5 50.8

07:30 Germany Manufacturing PMI (Preliminary) April 52.8 53.1 51.9

07:30 Germany Services PMI (Preliminary) April 55.4 55.6 54.4

08:00 Eurozone Manufacturing PMI (Preliminary) April 52.2 52.6 51.9

08:00 Eurozone Services PMI (Preliminary) April 54.2 54.5 53.7

08:30 United Kingdom Retail Sales (MoM) March 0.6% Revised From 0.7% 0.4% -0.5%

08:30 United Kingdom Retail Sales (YoY) March 5.4% Revised From 5.7% 5.4% 4.2%

08:30 United Kingdom PSNB, bln March 4.8 Revised From 6.2 6.6 -6.74

The U.S. dollar traded mixed against the most major currencies ahead the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decrease by 4,000 to 290,000.

The U.S. preliminary manufacturing PMI is expected to fall to 55.6 in April from 55.7 in March.

New home sales in the U.S. are expected to decline to 514,000 units in March from 539,000 units in February.

The euro traded higher against the U.S. dollar despite the weaker-than-expected PMIs from the Eurozone. Eurozone's preliminary manufacturing PMI decreased to 51.9 in April from 52.2 in March, missing expectations for a rise to 52.6.

Eurozone's preliminary services PMI declined to 53.7 in April from 54.2 in March. Analysts had expected the index to climb to 54.5.

Germany's preliminary manufacturing PMI fell to 51.9 in April from 52.8 in March, missing forecasts of an increase to 53.1.

Germany's preliminary services PMI decreased to 54.4 in April from 55.4 in March, missing expectations for a gain to 55.6.

The decline was driven by lower new orders and by a rise in prices.

France's preliminary manufacturing PMI was down to 48.4 in April from 48.8 in March, missing forecasts of a rise to 49.4.

France's preliminary services PMI dropped to 50.8 in April from 52.4 in March, missing expectations for a gain to 52.5.

The Greek debt crisis remains in focus. Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

The British pound traded higher against the U.S. dollar despite weaker-than-expected U.K. retail sales. Retail sales in the U.K. decreased 0.5% in March, missing expectations for a 0.4% rise, after a 0.6% gain in February. February's figure was revised down from a 0.7% increase.

It was the first decline in six months.

The decrease was driven by a drop in fuel sales. Fuel sales plunged 6.2%, the biggest drop since April 2012.

On a yearly basis, retail sales in the U.K. climbed 4.2% in March, missing forecasts of 5.4% increase, after a 5.4% rise in February. February's figure was revised down from a 5.7% gain.

The public sector net borrowing in the U.K. rose to £6.74 billion in March from £4.8 billion in February, missing expectations for a rise to £6.6 billion. February's figure was revised down from £6.2 billion.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected trade data from Switzerland. The Swiss trade surplus climbed to CHF2.52 billion in March from CHF2.32 billion in the previous month. Analysts had expected the surplus to decline to CHF2.16 billion.

Exports increased 4.2% in March, while imports were up 6.8%.

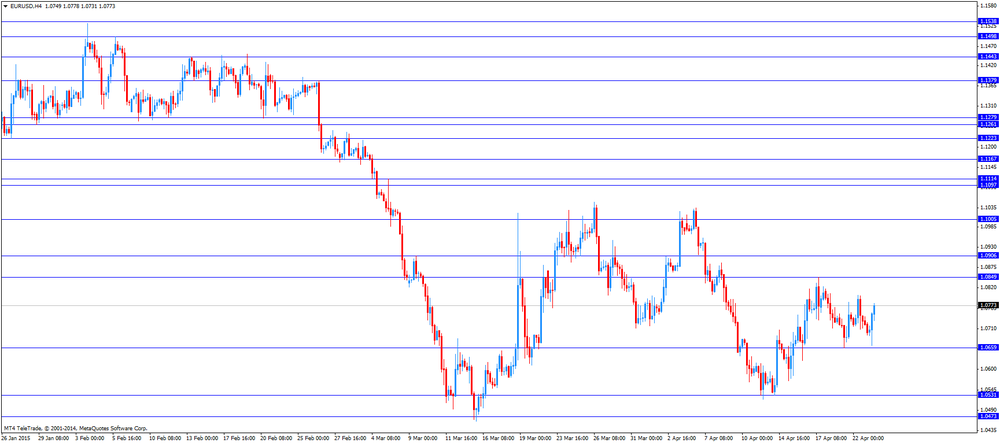

EUR/USD: the currency pair increased to $1.0778

GBP/USD: the currency pair climbed to $1.5033

USD/JPY: the currency pair rose to Y120.08

The most important news that are expected (GMT0):

12:30 U.S. Continuing Jobless Claims April 2268

12:30 U.S. Initial Jobless Claims April 294 290

13:45 U.S. Manufacturing PMI (Preliminary) April 55.7 55.6

14:00 U.S. New Home Sales March 539 514

-

13:02

Chinese HSBC manufacturing Purchasing Managers' Index (PMI) falls to 49.2 in April

The Chinese HSBC manufacturing Purchasing Managers' Index (PMI) declined to 49.2 in April from 49.6 in March, missing expectations for a decrease to 49.4.

A reading below 50 indicates contraction of activity.

The decrease was driven by declines in new orders and prices.

-

13:00

Orders

EUR/USD

Offers 1.0700 1.0730 1.0750 1.0780 1.0800 1.0820 1.0840

Bids 1.0660 1.0645 1.0620 1.0600 1.0585

GBP/USD

Offers 1.5025 1.5040-50 1.5080 1.5100-10 1.5130 1.5165-70

Bids 1.4980 1.4965 1.4940 1.4925 1.4900 1.4880 1.4850 1.4830 1.4800

EUR/JPY

Offers 128.40 128.70 129.00 129.30 129.50

Bids 127.80 127.60 127.40 127.00 126.50

USD/JPY

Offers 121.50 121.00 120.50 120.35/40

Bids 119.85/80 119.50 119.00

EUR/GBP

Offers 0.7135 0.7150 0.7165-70 0.7185 0.7200 0.7210 0.7225-30

Bids 0.7115 0.7100 0.7080-85 0.7060 0.7035-40

AUD/USD

Offers 0.7760 0.7780 0.7800 0.7825 0.7850-60

Bids 0.7725 0.7700 0.7675-80 0.7650

-

10:35

Public sector net borrowing in the U.K. climbs to £6.74 billion in March

The Office for National Statistics released public sector net borrowing for the U.K. on Thursday. The public sector net borrowing in the U.K. rose to £6.74 billion in March from £4.8 billion in February, missing expectations for a rise to £6.6 billion. February's figure was revised down from £6.2 billion.

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0650(E608mn), $1.0700(E400mn), $1.0735(E600mn), $1.0800(E717mn), $1.0835(E455mn)

USD/JPY: Y119.35($380mn), Y120.00($740mn), Y120.50($350mn)

EUR/JPY: Y129.00(E226mn)

GBP/USD: $1.4900(Gbp623mn)

USD/CHF: Chf0.9535($540mn)

AUD/USD: 0.7700(A$608mn), $0.7750(A$307mn), $0.7800(A$600mn)

AUD/NZD: NZ$1.0200(A$3bn)

NZD/USD: $0.7615(NZ$240mn)

USD/SGD: Sgd1.3500($1.3bn)

-

10:14

UK retail sales declines 0.5% in March, the first fall in six months

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. decreased 0.5% in March, missing expectations for a 0.4% rise, after a 0.6% gain in February. February's figure was revised down from a 0.7% increase.

It was the first decline in six months.

The decrease was driven by a drop in fuel sales. Fuel sales plunged 6.2%, the biggest drop since April 2012.

Sales at department stores declined, while sales at clothing and household-goods stores rose.

Food sales gained 0.4% in March.

On a yearly basis, retail sales in the U.K. climbed 4.2% in March, missing forecasts of 5.4% increase, after a 5.4% rise in February. February's figure was revised down from a 5.7% gain.

-

09:51

European Central Bank Executive Board Member Benoit Coeure: the Greek exit from the Eurozone was “out of the question”

The European Central Bank (ECB) Executive Board Member Benoit Coeure said on Wednesday that the Greek exit from the Eurozone was "out of the question".

"The euro area needs Greece just as Greece needs the euro," he said. Coeure noted that "quick and decisive action by the Greek authorities" is needed.

He pointed out that the ECB will continue to fund Greek banks as long as they remain solvent and have adequate collateral.

-

09:31

United Kingdom: PSNB, bln, March £ -6.74B (forecast 6.6)

-

09:30

United Kingdom: Retail Sales (MoM), March -0.5% (forecast 0.4%)

-

09:30

United Kingdom: Retail Sales (YoY) , March 4.2% (forecast 5.4%)

-

09:24

Bank of Japan Governor Haruhiko Kuroda: the BoJ is unlikely to expand its quantitative easing programme

The Bank of Japan Governor Haruhiko Kuroda said on Thursday the central bank is unlikely to expand its quantitative easing programme. He noted that Japan's economy continued to recover moderately.

Kuroda pointed out that the BOJ's 2% inflation target is likely to be reached between next March and the end of the first half of the fiscal year starting next April.

-

09:01

Eurozone: Manufacturing PMI, April 51.9 (forecast 52.6)

-

09:01

Eurozone: Services PMI, April 53.7 (forecast 54.5)

-

08:30

Germany: Manufacturing PMI, April 51.9 (forecast 53.1)

-

08:30

Germany: Services PMI, April 54.4 (forecast 55.6)

-

08:00

France: Services PMI, April 50.8 (forecast 52.5)

-

08:00

France: Manufacturing PMI, April 48.4 (forecast 49.4)

-

07:21

Options levels on thursday, April 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0845 (1413)

$1.0796 (601)

$1.0769 (69)

Price at time of writing this review: $1.0705

Support levels (open interest**, contracts):

$1.0653 (2534)

$1.0602 (4796)

$1.0538 (6432)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 61177 contracts, with the maximum number of contracts with strike price $1,1200 (6663);

- Overall open interest on the PUT options with the expiration date May, 8 is 74506 contracts, with the maximum number of contracts with strike price $1,0000 (9299);

- The ratio of PUT/CALL was 1.22 versus 1.22 from the previous trading day according to data from April, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5306 (1272)

$1.5209 (1027)

$1.5113 (1600)

Price at time of writing this review: $1.5025

Support levels (open interest**, contracts):

$1.4986 (1885)

$1.4890 (1537)

$1.4793 (2342)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 23681 contracts, with the maximum number of contracts with strike price $1,5000 (2707);

- Overall open interest on the PUT options with the expiration date May, 8 is 33101 contracts, with the maximum number of contracts with strike price $1,4400 (2763);

- The ratio of PUT/CALL was 1.40 versus 1.42 from the previous trading day according to data from April, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:20

Foreign exchange market. Asian session: The Australian dollar gained

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia NAB Quarterly Business Confidence Quarter I 2 0

01:35 Japan Manufacturing PMI April 50.3 50.8 49.7

01:45 China HSBC Manufacturing PMI April 49.6 49.4 49.2

03:00 New Zealand Credit Card Spending March 5.8% 5.2%

The greenback is becoming a drag on the U.S. bond market. The currency is heading for its first losing month since June, according to the Bloomberg Dollar Spot Index. Why is that a problem for bonds? It threatens to curb demand from investors outside the U.S, who own about half of the securities in the world's biggest debt market.

Treasuries due in a year and longer have fallen 0.3 percent in April when accounting for changes in both the bonds and the currency, based on data compiled by Bloomberg and the European Federation of Financial Analysts Societies. The decline puts them among the 10 worst-performing sovereign debt securities.

While U.S. job gains topped 200,000 in January and February, they slowed to 126,000 in March. Retail sales, gross-domestic-product growth and inflation are other weak spots in the economy.

EUR / USD: during the Asian session the pair fell to $ 1.0690

GBP / USD: during the Asian session the pair traded in the range of $ 1.5010-30

USD / JPY: during the Asian session the pair traded near the level of Y120.00

-

07:01

Switzerland: Trade Balance, March CHF 2.52B (forecast 2.16)

-

04:04

New Zealand: Credit Card Spending, March 5.2%

-

02:58

Nikkei 225 20,196.41 +62.51 +0.31 %, Hang Seng 28,167.35 +233.50 +0.84 %, Shanghai Composite 4,417.07 +18.58 +0.42 %

-

02:45

China: HSBC Manufacturing PMI, April 49.2 (forecast 49.4)

-

02:31

Japan: Manufacturing PMI, April 49.7 (forecast 50.8)

-