Notícias do Mercado

-

19:20

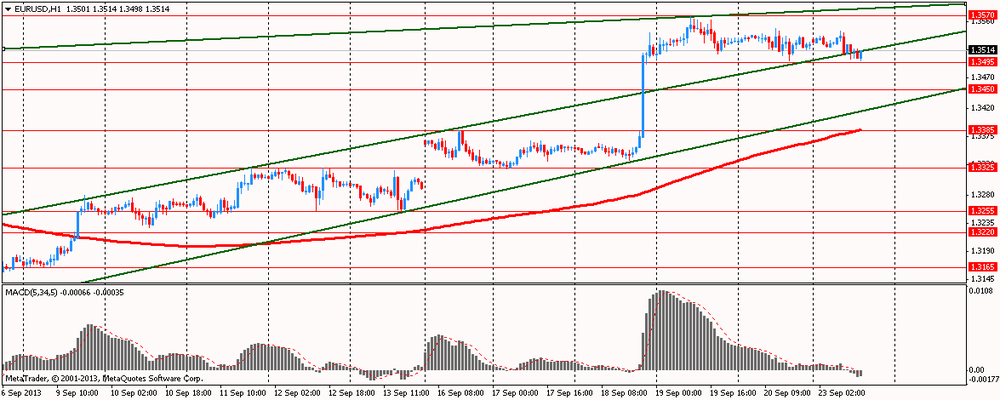

American focus : the euro fell slightly against the dollar

The yen rose against most major currencies, against the background of the fact that U.S. Treasuries rose and yields fell on their heads discussing the Fed's rate of economic growth. The yield on 10-year bonds fell 1 basis point to 2.726 %. The yield on 30 -year bonds also fell 1 basis point to 3.755 %, and 5 - year securities - 1.5 bp to 1.469 %.

Speeches by leaders of the Fed after the decision not to reduce the asset purchase program again raised the question of when the Fed is ready to stop loose monetary policy.

Atlanta Fed President Dennis Lockhart said the U.S. economy has lost some strength, noting that improving growth requires a significant amount of innovation. Meanwhile, Lockhart , who is now not a voting member of the FOMC, did not comment on the size of the solutions asset purchase .

President of the New York Fed , William Dudley, who is a voting member of the FOMC, said that the budget brake generated tax increases and budget sequestration , continues to justify a very stimulating monetary policy. Dudley said that last week he supported the Fed's decision to maintain the current pace of asset purchase .

The dollar rose slightly against the euro, which was due to release data on manufacturing activity in the euro area. Despite the fact that the Purchasing Managers 'Index rose , data on manufacturing activity were weaker than economists' expectations .

In the eurozone, the preliminary consolidated production index rose in September more than expected to a 27- month high of 52.1 compared with 51.5 in August. Economists had expected a rise to 51.7 . The index of purchasing managers in the services sector reached 52.1 compared with 50.7 in August. Activity in the services sector rose a second month in a row , has expanded at the fastest pace since June 2011 . Meanwhile , the index of manufacturing activity fell to 51.1 in September from 51.4 in August. However , industrial production increased for the third consecutive month.

In addition, the course of trading was influenced by the statements of President Atlanta Fed 's Lockhart , as well as the head of the New York Fed Dudley .

Meanwhile, we add that little pressure on the U.S. dollar had data on the index of business activity in the industry. Note that in September, the index of manufacturing activity in the U.S. PMI Markit weakened to 52.8 vs. 54.2 and 53.1 above. The decrease was primarily due to a reduction in new orders , including export , as well as the deterioration of the employment situation .

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3300, $1.3400, $1.3500, $1.3520

USD/JPY Y97.50, Y97.75, Y98.00, Y99.00, Y99.40, Y99.60, Y99.90, Y100.00, Y101.00

AUD/USD $0.9350, $0.9450

NZD/USD $0.8370

AUD/JPY Y93.50

EUR/NOK Nok7.9760

EUR/GBP stg0.8370, stg0.8430

-

13:58

U.S.: Manufacturing PMI, September 52.8 (forecast 54.2)

-

13:30

U.S.: Chicago Federal National Activity Index, August +0.14 (forecast -0.05)

-

13:22

European session: the euro fell

06:58 France Manufacturing PMI (Preliminary) September 49.7 50.2 49.5

06:58 France Services PMI (Preliminary) September 48.9 49.3 50.7

07:00 Switzerland KOF Institute Economic Forecast Quarter IV

07:28 Germany Manufacturing PMI (Preliminary) September 51.8 52.3 51.3

07:28 Germany Services PMI (Preliminary) September 52.8 53.2 54.4

07:58 Eurozone Services PMI (Preliminary) September 50.7 51.1 52.1

08:00 Eurozone Manufacturing PMI (Preliminary) September 51.4 51.8 51.1

10:00 Germany Bundesbank Monthly Report September

The euro fell slightly against the dollar after data on manufacturing activity in the euro area. Despite the fact that the Purchasing Managers 'Index rose , data on manufacturing activity was weaker than economists' expectations . The increase was primarily due to improved activity in the services sector.

In the eurozone, the preliminary consolidated production index rose in September more than expected to a 27- month high of 52.1 compared with 51.5 in August. Economists had expected a rise to 51.7 . The index of purchasing managers in the services sector reached 52.1 compared with 50.7 in August. Activity in the services sector rose a second month in a row , has expanded at the fastest pace since June 2011 . Meanwhile , the index of manufacturing activity fell to 51.1 in September from 51.4 in August. However , industrial production increased for the third consecutive month.

In Germany, the seasonally adjusted Composite Index , a measure of activity in the manufacturing sector and the service sector reached 53.8 eight-month high in September, compared with 53.5 in August. Values above 50 indicate expansion, while a decrease below 50 per sector. Activity in the private sector rose a fourth straight month in September , driven by continued growth in new orders , which rose at the fastest pace since June 2011 . In response to an increase in new orders , employers, private sector employment increased in September, while the pace of job creation were the most prominent in March 2012 . The rise in the overall performance of the private sector reflects the strong improvement in activity in the services sector. Purchasing Managers' Index (PMI) for the service sector rose to 54.4 in September from 52.8 the previous month , reaching the highest level in seven months. Economists had expected the index to rise to 53. Meanwhile, the activity indicator for the manufacturing sector fell to 51.3 in September from 51.8 in August. Economists' expectations were at the level of increase to 52 . Sub-indicator level of production at German factories fell to three-month low 52.7 from 54.8 in August.

Market participants continue to assess the results of the elections in Germany , held last Sunday , and began talks on forming a new coalition government led by Angela Merkel . Angela Merkel won a landslide victory over his opponent Peer Steinbrueck and his party of Social Democrats ( center-left ) , which won only 26 % of the vote . However, to obtain an absolute majority in the Bundestag Christian Democratic Party Merkel did not have any of three places. Her former colleagues in the coalition, the Free Democratic Party failed to gain 5 % of the vote to win seats in Parliament. As a result, Merkel will have to negotiate with the other party is likely to Peer Steinbrück party to form a coalition .

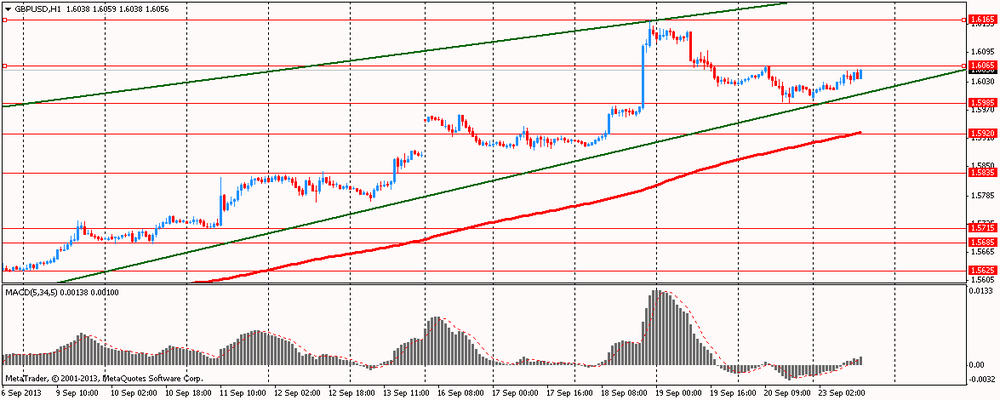

Dollar loses second day against the yen ahead of today's speech, the president Federal Reserve Bank of New York and Atlanta Fed Dudley Dennis Lockhart . Recall that last week, the Fed unexpectedly refrained from lowering monthly asset purchases , saying that more signs of sustainable recovery of the labor market .

The Australian dollar rose after today's publication of the preliminary data of the manufacturing index from HSBC PMI on China's economy. This month the index rose to 51.2 , from 50.1 in August , while analysts had expected growth of only 50.9 .

EUR / USD: during the European session, the pair fell to $ 1.3498

GBP / USD: during the European session, the pair rose to $ 1.6059

USD / JPY: during the European session, the pair fell to Y98.86

At 13:00 GMT the United States will leave the index of business activity in the manufacturing sector in September.

-

13:01

Orders

EUR/USD

Offers $1.3650/60, $1.3620, $1.3600, $1.3575/80, $1.3550

Bids $1.3500, $1.3485/80, $1.3455/50, $1.3420/00

GBP/USD

Offers $1.6180/85, $1.6145/50, $1.6090/100, $1.6075/80

Bids $1.6000, $1.5980, $1.5960/50, $1.5920, $1.5900

AUD/USD

Offers $0.9540/50, $0.9525/30, $0.9500, $0.9480, $0.9450

Bids $0.9385/80, $0.9350, $0.9300, $0.9280

EUR/GBP

Offers stg0.8520, stg0.8500, stg0.8480, stg0.8460/65, stg0.8450

Bids stg0.8400, stg0.8355/50, stg0.8320, stg0.8300

EUR/JPY

Offers Y135.20, Y135.00, Y134.50, Y134.20/25

Bids Y133.50, Y133.00, Y132.80, Y132.60/50, Y132.20

USD/JPY

Offers Y99.90/0.00, Y99.80, Y99.60, Y99.50, Y99.15/20

Bids Y98.80, Y98.60, Y98.50, Y98.25/20

-

10:45

Eurozone private sector growth at 27-month high

The Eurozone private sector recovery strengthened further in September largely due to a strong upturn in services, preliminary data from Markit Economics showed Monday.

The flash composite output index rose more-than-expected to 52.1 in September, a 27-month high, from 51.5 in August. It was forecast to rise to 51.7.

The Purchasing Managers' Index for the service sector came in at 52.1, up from 50.7 in August. Services activity rose for the second month running, expanding at the fastest rate since June 2011.

Meanwhile, the manufacturing PMI fell to 51.1 in September from 51.4 in August. Nonetheless, manufacturing output rose for the third straight month.

"The overall rate of growth signaled by the Eurozone PMI remains modest, however, consistent with gross domestic product rising by a meager 0.2 percent in the third quarter," said Chris Williamson, chief economist at Markit.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3300, $1.3400, $1.3500

USD/JPY Y97.50, Y97.75, Y98.00, Y99.00, Y99.40, Y99.60, Y99.90, Y100.00, Y101.00

AUD/USD $0.9350, $0.9450

NZD/USD $0.8370

AUD/JPY Y93.50

EUR/NOK Nok7.9760

-

08:59

Eurozone: Services PMI, September 52.1 (forecast 51.1)

-

08:59

Eurozone: Manufacturing PMI, September 51.1 (forecast 51.8)

-

08:29

Germany: Manufacturing PMI, September 51.3 (forecast 52.3)

-

08:28

Germany: Services PMI, September 54.4 (forecast 53.2)

-

07:59

France: Services PMI, September 50.7 (forecast 49.3)

-

07:59

France: Manufacturing PMI, September 49.5 (forecast 50.2)

-

07:00

Asian session: The euro was 0.3 percent from a seven-month high

01:45 China HSBC Manufacturing PMI (Preliminary) September 50.1 50.9 51.2

The euro was 0.3 percent from a seven-month high against the dollar after Angela Merkel won an overwhelming endorsement from German voters, putting her on course for the biggest election tally since Helmut Kohl’s post-reunification victory of 1990. Merkel’s Christian Democratic bloc took 41.5 percent of the vote in yesterday’s election, to 25.7 percent for the Social Democrats of Peer Steinbrueck, according to results from all 299 districts. That leaves her short of a majority and party leaders are due to meet today to discuss coalition talks.

Merkel’s choice is limited to a re-run of her first-term “grand coalition” with her traditional SPD rivals or the first-ever national alliance with the Greens. Neither party rushed to endorse a coalition.

European Central Bank President Mario Draghi will speak in the European Parliament today.

The dollar declined for a second day versus the yen before Fed Bank of New York President Dudley and Bank of Atlanta President Dennis Lockhart are scheduled to speak today. The Fed last week unexpectedly refrained from reducing its $85 billion in monthly asset purchases, saying it needs to see more signs of sustained labor market gains.

Australia’s dollar advanced after a report today indicated manufacturing expansion in China, the nation’s biggest trading partner. The preliminary reading for a Chinese manufacturing Purchasing Managers’ Index from HSBC Holdings Plc and Markit Economics rose to 51.2 this month from 50.1 in August. The Bloomberg survey median was for 50.9.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3520-30

GBP / USD: during the Asian session, the pair traded in the range of $ 1.5995-30

USD / JPY: during the Asian session the pair fell to Y99.05

Monday sees the release of flash manufacturing and services PMI data on both sides of the Atlantic. French flash PMI data is set for release at 0658GMT, to be followed by German data at 0728 GMT and the combined EMU data at 0758GMT. The 'flash' Purchasing Managers' Index data for September will be followed by the German Ifo benchmark economic sentiment index Tuesday. Both are expected to establish the trend of solid forward-looking indicators in the Eurozone but are also expected to contrast markedly with the continually weak data from the real economy. There is no other data, but EU Economics and Monetary Affairs Commissioner Olli Rehn speech discusses eurozone challenges in New York at 1200GMT. ECB President Mario Draghi is set to hold his quarterly hearing before the European Parliament, in Brussels.

Across the Atlantic, the US September Markit flash PMI data will be released at 1258GMT. ECB President Mario Draghi is set to hold his quarterly hearing before the European Parliament, in Brussels. There is a full calendar of Fedspeak following on from Friday's raft of policymaker speeches. At 1320GMT, Atlanta Federal Reserve Bank President Dennis Lockhart will deliver a speech in New York. At 1330GMT, New York Federal Reserve Bank President William Dudley will hold a speech in New York. Later, at 1730GMT, Dallas Federal Reserve Bank President Richard Fisher will deliver a speech on banking and too-big-to-fail in San Antonio. Late data sees the release of the September Treasury Allotments data at 1900GMT. Late, at 2230GMT, Mexican President Enrique Pena Nieto will give a speech in New York.

-

06:00

Schedule for today, Monday, Sep 23’2013:

01:45 China HSBC Manufacturing PMI (Preliminary) September 50.1 50.9

06:58 France Manufacturing PMI (Preliminary) September 49.7 50.2

06:58 France Services PMI (Preliminary) September 48.9 49.3

07:00 Switzerland KOF Institute Economic Forecast Quarter IV

07:28 Germany Manufacturing PMI (Preliminary) September 51.8 52.3

07:28 Germany Services PMI (Preliminary) September 52.8 53.2

07:58 Eurozone Services PMI (Preliminary) September 50.7 51.1

08:00 Eurozone Manufacturing PMI (Preliminary) September 51.4 51.8

10:00 Germany Bundesbank Monthly Report September

12:30 U.S. Chicago Federal National Activity Index August -0.15 -0.05

13:00 Eurozone ECB President Mario Draghi Speaks

13:00 U.S. Manufacturing PMI (Preliminary) September 53.1 54.2

13:30 U.S. FOMC Member Dudley Speak

15:15 Switzerland SNB Chairman Jordan Speaks

18:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

-