Notícias do Mercado

-

23:25

Currencies. Daily history for Oct 24’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1763 +0,12%

GBP/USD $1,3128 -0,52%

USD/CHF Chf0,99082 +0,60%

USD/JPY Y113,91 +0,39%

EUR/JPY Y134,00 +0,51%

GBP/JPY Y149,546 -0,13%

AUD/USD $0,7773 -0,44%

NZD/USD $0,6898 -1,11%

USD/CAD C$1,26761 +0,24%

-

23:00

Schedule for today, Wednesday, Oct 25’2017 (GMT0)

03:30 Australia CPI, q/q Quarter III 0.2% 0.8%

03:30 Australia CPI, y/y Quarter III 1.9% 2%

03:30 Australia Trimmed Mean CPI q/q Quarter III 0.5% 0.5%

03:30 Australia Trimmed Mean CPI y/y Quarter III 1.8% 2.0%

09:00 Switzerland UBS Consumption Indicator September 1.53

11:00 Germany IFO - Expectations October 107.4 107.3

11:00 Germany IFO - Current Assessment October 123.6 123.5

11:00 Germany IFO - Business Climate October 115.2 115.2

11:30 United Kingdom BBA Mortgage Approvals September 41.807 41.9

11:30 United Kingdom GDP, y/y (Preliminary) Quarter III 1.5% 1.4%

11:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.3% 0.3%

15:30 U.S. Durable Goods Orders ex Transportation September 0.2% 0.5%

15:30 U.S. Durable Goods Orders September 1.7% 1.0%

15:30 U.S. Durable goods orders ex defense September 2.2%

16:00 U.S. Housing Price Index, m/m August 0.2% 0.4%

17:00 Canada Bank of Canada Rate 1% 1%

17:00 Canada Bank of Canada Monetary Policy Report

17:00 Canada BOC Rate Statement

17:00 U.S. New Home Sales September 560 0.555

17:30 U.S. Crude Oil Inventories October -5.731 -2.500

18:15 Canada BOC Press Conference

-

16:27

O que precisamos saber sobre o hard fork Bitcoin Gold

Qualquer pessoa que possua bitcoin em sua custódia recebeu uma nova criptografia a partir da mineração do bloco 491.407 (ocorrida ontem 23/10/17) da cadeia de bitcoin. A partir desse bloco outra versão alternativa do protocolo foi criada, resultando em uma nova altcoin denominada Bitcoin Gold (BTG).

Esta nova altcoin busca melhorar a tecnologia do bitcoin, alterando a forma como a concorrência pelas recompensas da mineração é conduzida, através de um processo chamado "hard fork".

Quais os objetivos do Bitcoin Gold?

· A primeira mudança é a forma como a mineração funciona, deixando de lado as máquinas de mineração mais poderosas (chamadas ASIC), portanto elas não poderão mais ser usadas no caso do Bitcoin Gold.

· Em segundo lugar, ao atrair mais usuários para este sistema, espera-se liberar a rede bitcoin das grandes empresas que oferecem esses produtos (ASIC), e argumentam comandar a influência indevida na rede.

Quem está por tras do Bitcoin Gold

A equipe por trás deste "hard fork" parece ser um grupo relativamente pequeno. O CEO da LightningAsic, com sede em Hong Kong, Jack Liao, que é um crítico franco do estado atual da mineração bitcoin, especulou a idéia do Bitcoin Gold em julho. Sua empresa LightningAsic vende equipamentos de mineração, incluindo GPUs, tipo de hardware em que o Bitcoin Gold será validado na rede.

Desde a primeira apresentação a equipe expandiu-se para incluir o desenvolvedor principal pseudônimo h4x3rotab, bem como uma equipe de outros cinco voluntários que agora estão trabalhando no desenvolvimento e promoção da nova altcoin no tempo livre. O projeto pode ser rastreado no Github e no grupo Slack da comunidade.

-

14:59

U.S.: Richmond Fed Manufacturing Index, October 12 (forecast 17)

-

14:50

October data indicated a robust and accelerated expansion of U.S. private sector - Markit

October data indicated a robust and accelerated expansion of U.S. private sector business activity. The upturn was supported by the fastest rise in manufacturing production for eight months, alongside another robust increase in service sector output.

The seasonally adjusted IHS Markit Flash U.S. Composite PMI Output Index rose to 55.7 in October, from 54.8 in September. As a result, the latest reading signalled the fastest upturn in private sector output since January.

However, growth of overall new business volumes moderated further from the two-year peak seen in August. This reflected a slowdown in the service sector, as manufacturing firms reported the strongest rise in new work since March.

-

14:45

U.S.: Services PMI, October 55.9 (forecast 55.6)

-

14:45

U.S.: Manufacturing PMI, October 54.5 (forecast 53.5)

-

14:30

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1800 (EUR 1.55bln) 1.1830 (560m) 1.1850 (985m)

USDJPY: 112.50 (USD 950m) 113.00 (600m) 113.50-55 (900m) 114.00 (880m) 114.50 (620m)

GBPUSD: Ntg of note

AUDUSD: 0.7900 (AUD 380m) 0.7920 (275m) 0.7938 (320m)

-

13:59

Belgium: Business Climate, October 0.5 (forecast -3.0)

-

12:09

UK finance minister Hammond says UK businesses should have confidence that we will provide them with certainty they require on Brexit transition

-

10:54

Russian deputy finance minister says possibility of introducing capital controls at time of crisis to be discussed with govt

-

10:39

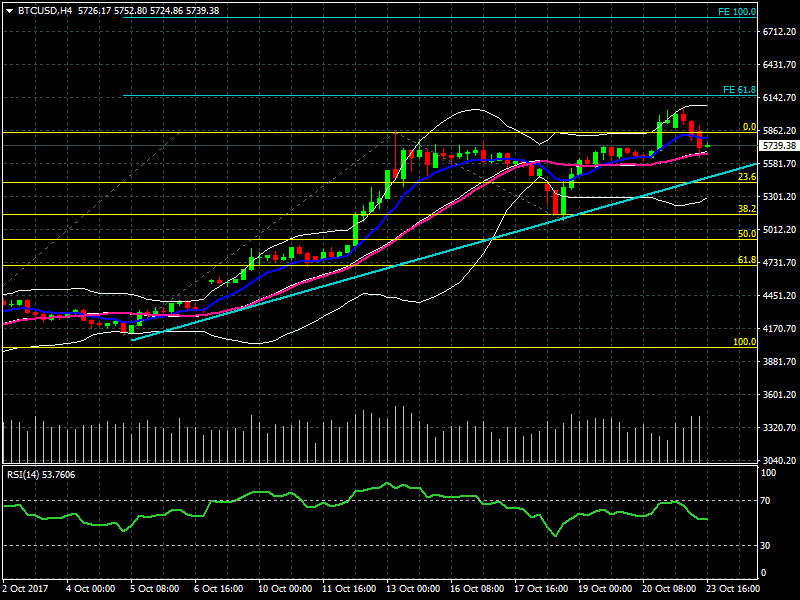

BTC/USD Análise H4

Para a nossa análises utilizamos geralmente os seguintes indicadores:

*Média móvel exponencial de 9 períodos (azul)

*Média móvel simples de 21 períodos (magenta)

*Bandas Bollinger*RSI

*Volume

*Extensão (azul) e retração (amarela) de Fibonacci sobre tendência

*Resistências e suportes

Percebe-se que ambas as médias móveis estão direcionadas para cima seguindo a linha de tendência ascendente (azul). O RSI esta entre 30 e 70 apontando a consolidação do preço, portanto é um momento de atenção. Após tocar as bandas Bollinger superiores percebemos uma correção dos preços em direção ao centro, onde os vendedores retomaram o controle.

*Apontamos uma linha de tendência ascendente (azul) importante em nossa análise e caso a mesma seja rompida para baixo pode haver uma correção maior nos preços do ativo (níveis entre 50.0% e 61.8% da retração de Fibonacci).

* Devido ao fork que irá ocorrer, recomendamos precaução para operar, pois, há uma grande indecisão em qual sentido o ativo ira seguir. Contudo, se a tendência de alta for mantida temos possíveis alvos próximo a FE 61.8% (alvo primário) e FE 100.0% (alvo secundário) da extensão de Fibonacci.

-

09:39

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1800(1.55 b), 1.1830(553 m), 1.1850(987 m), 1.2000(908 m)

USD/JPY: 110.40-50(650 m), 112.50(946 m), 112.95-113.00(602 m), 113.50-55(895 m), 113.95-114.00(879 m), 114.50(620 m)

USD/CHF: 0.9840(405 m)

AUD/USD: 0.7900(376 m), 0.7920(271 m), 0.7938(322 m)

NZD/USD: 0.7100(558 m), 0.7125(359 m)

USD/CAD: 1.2550(491 m)

EUR/GBP: 0.8950(722 m)

EUR/JPY: 133.00(300 m), 133.80(643 m)

AUD/JPY: 86.75(400 m)

-

09:26

The recent strong growth of the euro area economy was maintained in Q4

The recent strong growth of the euro area economy was maintained at the start of the final quarter of the year, driven by another marked improvement in new orders. Rising workloads encouraged firms to take on extra staff at the sharpest pace in over a decade.

The headline IHS Markit Eurozone PMI posted 55.9 in October, according to the preliminary 'flash' estimate (based on approximately 85% of final replies), down from 56.7 in September

-

09:25

Germany’s private sector economy maintained strong growth momentum at the start of the fourth quarter - Markit

Germany's private sector economy maintained strong growth momentum at the start of the fourth quarter, with inflows of new orders increasing at the fastest rate for six-and-a-half years in October, according to flash PMI survey data from IHS Markit.

Overall business activity rose sharply, albeit at a slightly slower rate than in September, while the pace of job creation accelerated to a five-month high. The survey meanwhile showed a further pick-up in inflation pressures, as average prices charged for goods and services rose at one of the fastest rates seen since mid-2011.

The IHS Markit Flash Germany Composite Output Index was at 56.9 in October, down slightly from September's 77-month high of 57.7, but nonetheless registering one of the highest readings seen since 2011.

-

09:12

Banks expect unchanged credit standards for corporate loans in Q4, further easing for housing loans - ECB lending survey

-

Corporate credit standards eased in Germany, tightened in Spain and were unchanged in France, Italy and the Netherlands in q3

-

Credit standards broadly unchanged for corporates in q3 but eased for mortgages, consumer credit

-

Demand for corporate loans, consumer credit, mortgages to rise further in q4

-

Banks reported improved access to retail and wholesale funding in q3, see further improvement in q4

-

-

09:09

French composite PMI rose more than expected in October

Flash France Composite Output Index at 57.5 in October (77-month high).

Services Activity Index rises to 57.4 in October (57.0 in September), 7-month high.

Manufacturing Output Index rises to 58.1 (57.6 in September), 78-month high.

Manufacturing PMI increases to 56.7 (56.1 in September) 78-month high.

According to latest flash data, the resurgence in the French private sector showed no sign of abating at the start of the fourth quarter. Indeed, the rate of growth accelerated from September with the IHS Markit Flash France Composite Output Index, which is based on around 85% of usual monthly survey replies, posting 57.5, up from 57.1 in September and a near-six-and-a-half-year high.

-

09:00

Eurozone: Services PMI, October 54.9 (forecast 55.6)

-

09:00

Eurozone: Manufacturing PMI, October 58.6 (forecast 58.2)

-

08:30

Germany: Services PMI, October 55.2 (forecast 55.6)

-

08:30

Germany: Manufacturing PMI, October 60.5 (forecast 60.2)

-

08:00

France: Manufacturing PMI, October 56.7 (forecast 56)

-

08:00

France: Services PMI, October 57.4 (forecast 56.9)

-

07:47

Options levels on tuesday, October 24, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1890 (3367)

$1.1831 (1321)

$1.1796 (406)

Price at time of writing this review: $1.1760

Support levels (open interest**, contracts):

$1.1715 (2963)

$1.1691 (3000)

$1.1662 (4926)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 101590 contracts (according to data from October, 23) with the maximum number of contracts with strike price $1,2000 (6678);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3352 (3314)

$1.3297 (3975)

$1.3262 (2367)

Price at time of writing this review: $1.3209

Support levels (open interest**, contracts):

$1.3169 (2155)

$1.3124 (1671)

$1.3093 (2274)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 39840 contracts, with the maximum number of contracts with strike price $1,3200 (3975);

- Overall open interest on the PUT options with the expiration date November, 3 is 35516 contracts, with the maximum number of contracts with strike price $1,3000 (3178);

- The ratio of PUT/CALL was 0.89 versus 0.88 from the previous trading day according to data from October, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:42

Trump tells reporters he is "very, very close" to making his decision on the Fed chair

-

07:40

10-year U.S. treasury yield at 2.371 percent vs U.S. close of 2.375 percent on Monday

-

07:37

Flash Japan Manufacturing PMI signals solid growth, but edges lower to 52.5 in October - Markit

-

Flash Manufacturing Output Index at 52.6 (53.2 in September)

-

Business confidence softens to 11-month low

Commenting on the Japanese Manufacturing PMI survey data, Joe Hayes, Economist at IHS Markit, which compiles the survey, said: "Although still improving solidly, the Japanese manufacturing sector appeared to lose some momentum in October, as growth eased from September's fourmonth high. Softer expansions were seen for both output and new orders. Meanwhile, firms continued to largely absorb cost pressures, with output price inflation only marginal again in October. "Signs of slowing growth coincided with faltering optimism, as the level of positive sentiment fell to an 11- month low."

-

-

01:30

Japan: Manufacturing PMI, October 52.5 (forecast 53.1)

-