Notícias do Mercado

-

23:32

Japan: National Consumer Price Index, y/y, December 1% (forecast 0.3%)

-

23:31

Japan: Tokyo Consumer Price Index, y/y, January 1.3% (forecast 0.7%)

-

23:31

Japan: Tokyo CPI ex Fresh Food, y/y, January 0.7% (forecast 0.8%)

-

23:30

Japan: National CPI Ex-Fresh Food, y/y, December 0.9% (forecast 0.9%)

-

23:29

Currencies. Daily history for Jan 25’2018:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2397 -0,08%

GBP/USD $1,4139 -0,67%

USD/CHF Chf0,941 -0,47%

USD/JPY Y109,40 +0,18%

EUR/JPY Y135,62 +0,09%

GBP/JPY Y154,678 -0,50%

AUD/USD $0,8024 -0,51%

NZD/USD $0,7322 -0,21%

USD/CAD C$1,23717 +0,23%

-

23:16

Schedule for today, Friday, Jan 26’2018 (GMT0)

07:45 France Consumer confidence January 105 106

09:00 Eurozone Private Loans, Y/Y December 2.8% 2.9%

09:00 Eurozone M3 money supply, adjusted y/y December 4.9% 4.9%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter IV 0.4% 0.4%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter IV 1.7% 1.4%

10:00 Eurozone ECB's Benoit Coeure Speaks

13:00 U.S. FOMC Member James Bullard Speaks

13:30 Canada Consumer Price Index m / m December 0.3% -0.3%

13:30 Canada Bank of Canada Consumer Price 1.3% 1.5%

13:30 Canada Consumer price index, y/y December 2.1% 1.9%

13:30 U.S. Goods Trade Balance, $ bln. December -69.68 -68.6

13:30 U.S. Durable goods orders ex defense December 1% 0.3%

13:30 U.S. Durable Goods Orders ex Transportation December -0.1% 0.5%

13:30 U.S. Durable Goods Orders December 1.3% 0.8%

13:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter IV 1.3% 1.6%

13:30 U.S. PCE price index, q/q (Preliminary) Quarter IV 1.5% 1.8%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV 3.2% 3%

14:00 United Kingdom BOE Gov Mark Carney Speaks

14:00 Japan BOJ Governor Haruhiko Kuroda Speaks

18:00 U.S. Baker Hughes Oil Rig Count January 747

-

15:09

U.S new home sales declined 9.3% in December

Sales of new single-family houses in December 2017 were at a seasonally adjusted annual rate of 625,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 9.3 percent below the revised November rate of 689,000, but is 14.1 percent above the December 2016 estimate of 548,000. An estimated 608,000 new homes were sold in 2017. This is 8.3 percent (±4.1 percent) above the 2016 figure of 561,000.

The median sales price of new houses sold in December 2017 was $335,400. The average sales price was $398,900.

-

15:01

U.S.: Leading Indicators , December 0.6% (forecast 0.5%)

-

15:00

U.S.: New Home Sales, December 0.625 (forecast 0.679)

-

14:16

Belgium: Business Climate, January 1.8 (forecast 0.5)

-

14:06

Draghi says large FX movements bound to have pass-through

-

Don't target fx rates

-

Issue is whether fx movements have impact on inflation path

-

Too early to assess whether pass-through has taken place

-

Cause of forex, rate change is heightened mkt sensitivity to perceived changes in ECB comms

-

-

14:04

Euro extends gains, up more than 1 pct on day

-

13:48

Draghi says deviation from capital key does not affect neutrality of APP

-

Says stock is metric, not flow for pspp

-

Reinvestments sometimes distributed over three months

-

-

13:42

ECB's Draghi says headline inflation likely to hover around current levels in coming months before increasing again

-

Underlying inflation subdued

-

Downside risks relate to global factors, forex

-

Support provided by bond buys, stock, reinvestment, guidance on rates

-

Underlying inflation to rise gradually over medium term

-

Recent forex vol is source of uncertainty

-

-

13:38

Draghi says strong cyclical momentum strengthen further confidence that inflation will converge to tgt

-

Ample degree of monetary stimulus necessary for underlying inflation

-

Domestic price pressures muted, yet to show convincing upward trend

-

Information confirms robust pace of economic expansion

-

Economy accelerated more than expected

-

-

13:31

U.S initial jobless claims lower than expected last week

In the week ending January 20, the advance figure for seasonally adjusted initial claims was 233,000, an increase of 17,000 from the previous week's revised level. The previous week's level was revised down by 4,000 from 220,000 to 216,000. The 4-week moving average was 240,000, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised down by 1,000 from 244,500 to 243,500.

-

13:30

Canada: Retail Sales YoY, November 6.5%

-

13:30

U.S.: Initial Jobless Claims, January 233 (forecast 240)

-

13:30

U.S.: Continuing Jobless Claims, January 1937 (forecast 1925)

-

13:30

Canada: Retail Sales, m/m, November 0.2% (forecast 0.7%)

-

13:30

Canada: Retail Sales ex Autos, m/m, November 1.6% (forecast 0.8%)

-

13:26

ECB holds the interest rate at 0.00%

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases".

-

12:45

Eurozone: Deposit Facilty Rate, -0.4% (forecast -0.4%)

-

12:45

Eurozone: ECB Interest Rate Decision, 0% (forecast 0%)

-

11:00

United Kingdom: CBI retail sales volume balance, January 12 (forecast 12)

-

10:48

Hawkish ECB statement expected today. The euro already priced in the news?

-

10:46

Davos - Mnuchin says U.S. wants more trade, but 'reciprocal, fair' trade

-

U.S has most open trade and investment market in the world

-

-

10:27

Davos - IMF's Lagarde says current global economy is in a 'sweet spot'

-

Says international trade growing even faster than economic growth

-

Rules of the game on trade have to be clear, fair, enforced

-

Calls for fair rules on international trade

-

Says 'any measure' that could try to slow down trade would slow down growth

-

-

10:25

German ifo Business Climate Index rose to 117.6 points in January

Sentiment among German businesses was very strong going into the year. The ifo Business Climate Index rose to 117.6 points in January from 117.2 points in December. This was due to far better assessments of the current business situation, with the sub-indicator hitting a record high. Business expectations for the next six months, by contrast, were slightly scaled back, but remain at a high level. The German economy made a dynamic start to the year.

In manufacturing the index rose to a new record high. This also applies to assessments of the current business situation, which were better than ever. Fewer manufacturers, however, expect to see any further short-term improvement in their very good business situation. Capacity utilisation rose by 0.6 percentage points to 87.9 percent, significantly above its long-term average of 83.7 percent.

-

10:07

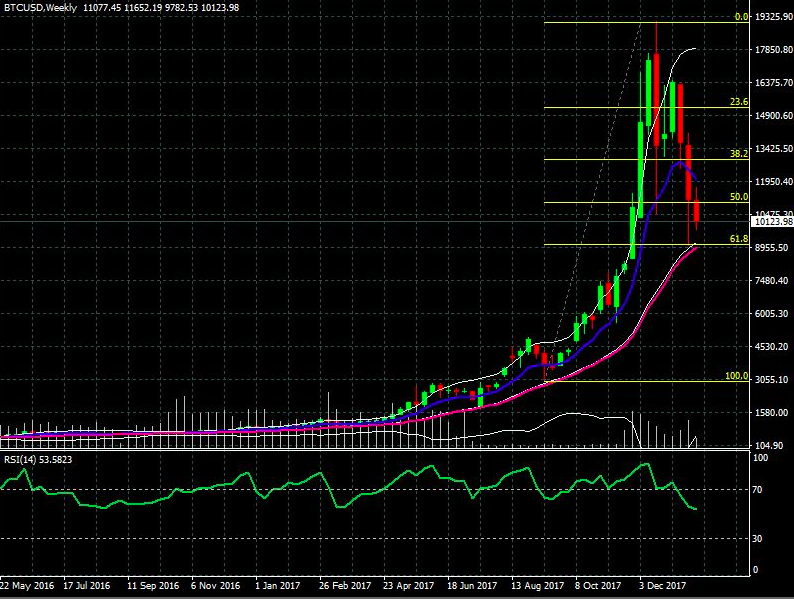

ANALISE BITCOIN - USD (GRÁFICO SEMANAL)

ANALISE BITCOIN - USD (GRÁFICO SEMANAL)

Para nossa análise utilizamos os seguintes indicadores técnicos:

*Média móvel exponencial de 9 períodos (azul)

*Média móvel simples de 21 períodos (magenta)

*Bandas Bollinger

*RSI

*Volume

*Retração (amarela) de Fibonacci sobre tendência

Conforme mencionamos em nossa ultima análise os preços do bitcoin vem passando por uma correção (61.8% da retração de Fibonacci) do gráfico semanal. Essa correçao neste ponto específico é uma zona de forte resistência onde os investidores posicionam ordens de compra na média de 21 períodos (buy zone). Percebe-se que as médias móveis estão distantes seguindo o padrão de alta de longo prazo. O RSI recuou e agora esta abaixo dos 70 fato que garante mais fôlego para que os touros retomem a força e o bitcoin continue sua escalada a valores mais altos no longo prazo.

*Apontamos a retração de Fibonacci de 61.8% como um bom ponto de entrada para um swing trade (longo prazo).

*O stop Loss para esta operação fica um pouco abaixo da média móvel de 21 períodos

* Se a tendencia de alta de longo prazo for retomada temos nosso alvo (Profit) acima do último topo histórico de alta

ARTIGO ESCRITO PELO PARCEIRO DA TELETRADE - André Alvarenga

-

09:46

United Kingdom: BBA Mortgage Approvals, December 36.115 (forecast 39.7)

-

09:13

Crytocurrency trading unlikely to have major impact on monetary policy for now - BoJ official

-

Japan's approach on cryptocurrency regulation is to curb excessive risk-taking without discouraging innovation

-

Imposing global, across-the-board regulation on cryptocurrency trading won't be easy

-

-

09:00

Germany: IFO - Expectations , January 108.4 (forecast 109.4)

-

09:00

Germany: IFO - Current Assessment , January 127.7 (forecast 125.4)

-

09:00

Germany: IFO - Business Climate, January 117.6 (forecast 117.1)

-

08:36

Major stock markets in Europe trading mixed: FTSE 7648.12 +4.69 + 0.06%, DAX 13369.97 -44.77 -0.33%, CAC 5505.63 +10.47 + 0.19%

-

08:35

UK finance minister says government is "very happy" with where sterling is right now - Bloomberg tv

-

08:20

U.S Tsy Sec. Mnuchin: not concerned with where the dollar is in short term @livesquawk

-

08:19

Mnuchin says as soon as UK is ready, prepared to negotiate an attractive trade deal

-

Very clearly supportive of UK on Brexit

-

Wants to see a successful transition on Brexit that is good for UK and markets

-

Had good discussion with BoE's Carney on Brexit

-

-

07:46

New Zealand inflation much lower than expected in Q4

Weaker than expected inflation at the end of 2017 will see the Reserve Bank delay interest rate hikes for at least six months, ANZ is tipping.

Statistics New Zealand said on Thursday that the consumer price index (CPI) lifted by 0.1 per cent in the final three months of 2017, below the 0.4 per cent rise economists were expecting.

A sharp rise in petrol at the end of 2017 boosted the transport component of inflation, while construction prices also rose. However food prices dropped, as did a range of retail goods, including new cars, clothing and appliances, Stats NZ said.

The increase was lower than the rise at the end of 2016, meaning annual inflation dropped to 1.6 per cent, the lowest in annual rate in 12 months. At the end of September, inflation was 1.9 per cent.

-

07:43

10-year U.S. treasury yield at 2.639 percent vs U.S. close of 2.654 percent on wednesday

-

07:41

Options levels on thursday, January 25, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2496 (1659)

$1.2481 (3691)

$1.2462 (4122)

Price at time of writing this review: $1.2417

Support levels (open interest**, contracts):

$1.2329 (374)

$1.2299 (777)

$1.2264 (1982)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 127928 contracts (according to data from January, 24) with the maximum number of contracts with strike price $1,1850 (7038);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4368 (138)

$1.4344 (1133)

$1.4323 (746)

Price at time of writing this review: $1.4256

Support levels (open interest**, contracts):

$1.4145 (12)

$1.4098 (84)

$1.4036 (176)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 42199 contracts, with the maximum number of contracts with strike price $1,3600 (3473);

- Overall open interest on the PUT options with the expiration date February, 9 is 35630 contracts, with the maximum number of contracts with strike price $1,3400 (3057);

- The ratio of PUT/CALL was 0.84 versus 0.88 from the previous trading day according to data from January, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:27

Consumer optimism rises again at the beginning of 2018 - GfK

Both economic and income expectations, as well as propensity to buy, are on the increase in January. GfK forecasts an increase in consumer climate for February 2018 of 0.2 points compared to the previous month to 11.0 points

Consumers in Germany are making an extremely optimistic start to 2018. They see the German economy as experiencing a clear economic boom. Economic expectations have clearly risen accordingly, climbing to a new seven-year high. Income expectations and the propensity to buy are also showing moderate growth. They have improved slightly on what was already a very high level.

-

07:00

Germany: Gfk Consumer Confidence Survey, February 11.0 (forecast 10.8)

-