Notícias do Mercado

-

19:20

American focus: the dollar got a boost from strong statistics

The dollar rose against the euro after better-than-forecast U.S. data analysts increased speculation that the Federal Reserve will cut bond purchases.

As shown by recent data that has been provided by the Ministry of Commerce, at the end of last month the demand for expensive manufactured goods increased significantly, thereby exceeded the forecasts of experts, and fixing the second consecutive monthly increase. According to the report, the seasonally adjusted total number of orders for durable goods rose in May by 3.6%, reaching at the same level of $ 231 billion, which was followed after an increase of 3.5% in the previous month, which was revised increase of 3.3%. According to experts the average value of this indicator was to increase by 3.0%.

Sales of new U.S. homes rose in May to its highest level in nearly five years, an important indicator of prices of existing homes also rose. This indicates a significant resistance U.S. housing sector, despite recent concerns about rising rates on mortgage loans. Sales in the primary housing market in May rose 2.1% and adjusted for seasonal variations were 476,000 homes a year, reaching the highest level since July 2008. According to another report, the housing price index Case-Shiller 20-city in April rose by 12.1% compared to April 2012. Housing prices in 20 metropolitan areas in April showed the biggest monthly increase since the beginning of the data, up 2.5% compared with March.

Consumer confidence in the U.S. in June rose to its highest level in five years. This is evidenced by the report, a private research group Conference Board, released Tuesday. According to the data, the index of consumer confidence in the U.S. in June rose to 81.4 from a revised 74.3 in May values. Earlier it was reported that in May, the index was 76.2. The June index was the highest since January 2008. Economists had expected the index falling to 75.6 in June.

The yen earlier rose, retreating from a two-week low against the U.S. dollar, against the background of a two-day decline of Asian shares and the liquidity problems of Chinese banks. Recall that at the end of last week due to the lack of liquidity rate of one-day and weekly repo interbank lending rose to its highest level in five years, reaching the historic mark June 20 in 13.44%. Yesterday, the People's Bank of China has warned the country's banks on the need for greater control over their own liquidity, as well as on its risks. In this regard, Goldman Sachs analysts downgraded China's GDP growth forecast for 2013 from 7.8% to 7.4%, citing weaker macro-economic indicators and the tightening of financial conditions.

Value of the pound earlier rose against the U.S. dollar, which was associated with the speeches of the representatives of the Bank of England, as well as the publication of the data.

Note that the report of the British Bankers' Association showed that the number of approved applications for mortgage loans increased significantly in May, thereby exceeded the forecasts of most experts, since the scheme lending contributed to the entry of those first decided to buy a home.

According to a report on the results of May, the number of approved applications for mortgage loans aimed at buying a home has increased to the level of 36,102, compared with 32,952 in the previous month. It is worth noting that according to the average forecasts of experts the value of this index would grow to the level of 33100.

In addition, it was reported that the total number of mortgage approvals rose in May to the level of 65,752, compared with 61,262 a month ago.

In the British Bankers Association also reported that the increase in the number of permits for house purchase continued its upward trend, which is celebrated from the beginning of this year. Meanwhile, it was noted that the assistance from the scheme of mortgage lending is expected to continue to attract more and more new buyers into the housing market.

-

15:00

U.S.: New Home Sales, May 476 (forecast 462)

-

15:00

U.S.: Consumer confidence , June 81.4 (forecast 75.6)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3000, $1.3180, $1.3220, $1.3250, $1.3300

USD/JPY Y97.50, Y98.00, Y98.75, Y99.00

EUR/JPY Y127.00

CBP/USD $1.5400

EUR/CBP £0.8525

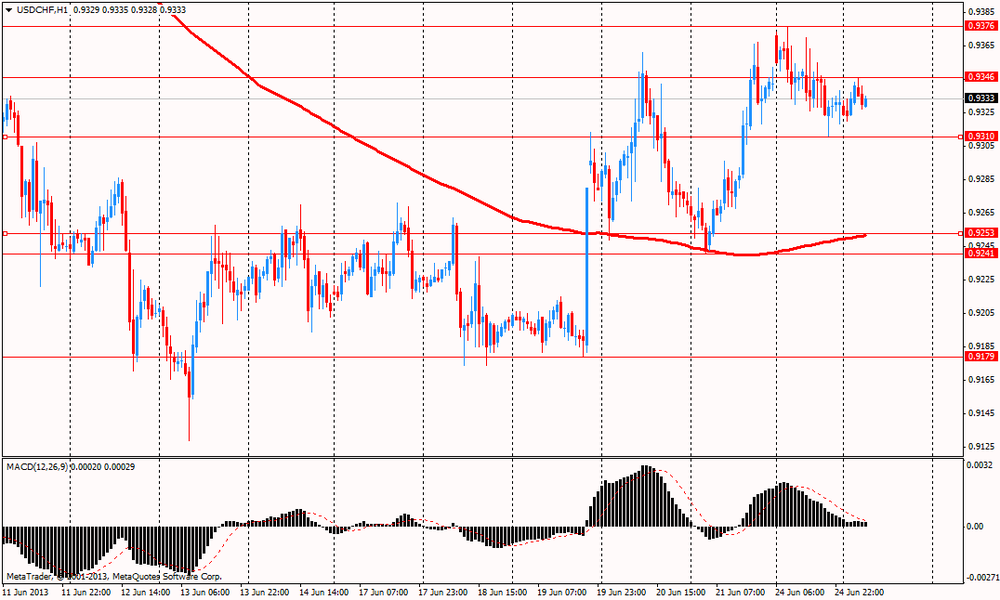

USD/CHF Chf0.9200, Chf0.9350, Chf0.9400

AUD/USD $0.9150, $0.9200, $0.9300, $0.9405, $0.9500

-

14:01

U.S.: Housing Price Index, y/y, April +7.4%

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, April +12.1% (forecast +10.6%)

-

14:00

U.S.: Housing Price Index, m/m, April +0.7% (forecast +1.2%)

-

13:31

U.S.: Durable goods orders ex defense, May +3.5%

-

13:30

U.S.: Durable Goods Orders ex Transportation , May +0.7% (forecast -0.1%)

-

13:30

U.S.: Durable Goods Orders , May +3.6% (forecast +3.0%)

-

13:15

European session: the euro fell from highs against the dollar

Data

08:30 United Kingdom BBA Mortgage Approvals April 32.2 33.1 36.1

09:00 United Kingdom BOE Gov King Speaks

09:00 United Kingdom BOE Chief Economist Spencer Dale Speaks

09:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

09:00 United Kingdom MPC Member Weale Speaks

09:00 United Kingdom Inflation Report Hearings Quarter I

11:30 Switzerland Gov Board Member Fritz Zurbrugg Speaks

The euro exchange rate fluctuates against the dollar, as many market participants are in the publication of U.S. data on orders for durable goods and new home sales. Note that after a significant drop in March, orders for durable goods rose in April by 3.3%. The increase in orders was noted in all categories, but most of the increase was due to a significant growth in the sector of defense and civilian aircraft orders. However, over the past couple of months, orders for durable goods excluding volatile transportation and defense sector showed a slight growth. We also add that recent studies have shown that the ISM manufacturing index came in May, to the territory of reduction, and the main components showed weakness.

As for the other report, it is worth adding that sales of new homes continued to learn the dynamics of sales of existing homes. Add that with the reduction of the number of problem transactions, it is clear that many potential buyers are looking to build new homes. The data showed that new home sales rose in April by 2.3%, which followed a similar rise in March. In addition, it was reported that the level of sentiment among builders finally moved above the threshold, which indicates that more builders assess the current conditions as "good" than "bad". Recall that it was the first time since April 2006, when the index rose above that mark. In addition, today it was announced today that Spain held an auction on state debt, during which it was sold to the third nine-month bonds worth 3.07 billion euros, higher than the maximum target. The country sold a 9-month bonds worth 2.14 billion euros at yield 1.441% vs. 0.789% previously, and 3-month bonds worth 0.93 billion euros at yield 0.869% vs. 0.331% previously.

The yen rose, retreating from a two-week low against the U.S. dollar lower against the two-day Asian shares and the liquidity problems of Chinese banks. Recall that at the end of last week due to the lack of liquidity rate of one-day and weekly repo interbank lending rose to its highest level in five years, reaching the historic mark June 20 in 13.44%. Yesterday, the People's Bank of China has warned the country's banks on the need for greater control over their own liquidity, as well as on its risks. In this regard, Goldman Sachs analysts downgraded China's GDP growth forecast for 2013 from 7.8% to 7.4%, citing weaker macro-economic indicators and the tightening of financial conditions.

Recall that this week will hold a series of speeches by the Fed. Performances by the Federal Reserve Bank of Atlanta President Dennis Lockhart, president of the Federal Reserve Bank of Richmond, Jeffrey Lacker, president of the Cleveland Fed President Sandra Pianalto and San Francisco Fed John Williams.

Value of the pound was higher against the U.S. dollar, which has been associated with the speeches of the representatives of the Bank of England, as well as the publication of the data.

Note that the report of the British Bankers' Association showed that the number of approved applications for mortgage loans increased significantly in May, thereby exceeded the forecasts of most experts, since the scheme lending contributed to the entry of those first decided to buy a home.

According to a report on the results of May, the number of approved applications for mortgage loans aimed at buying a home has increased to the level of 36,102, compared with 32,952 in the previous month. It is worth noting that according to the average forecasts of experts the value of this index would grow to the level of 33100.

In addition, it was reported that the total number of mortgage approvals rose in May to the level of 65,752, compared with 61,262 a month ago.

In the British Bankers Association also reported that the increase in the number of permits for house purchase continued its upward trend, which is celebrated from the beginning of this year. Meanwhile, it was noted that the assistance from the scheme of mortgage lending is expected to continue to attract more and more new buyers into the housing market.

EUR / USD: during the European session, the pair fell from $ 1.3151 to $ 1.3110

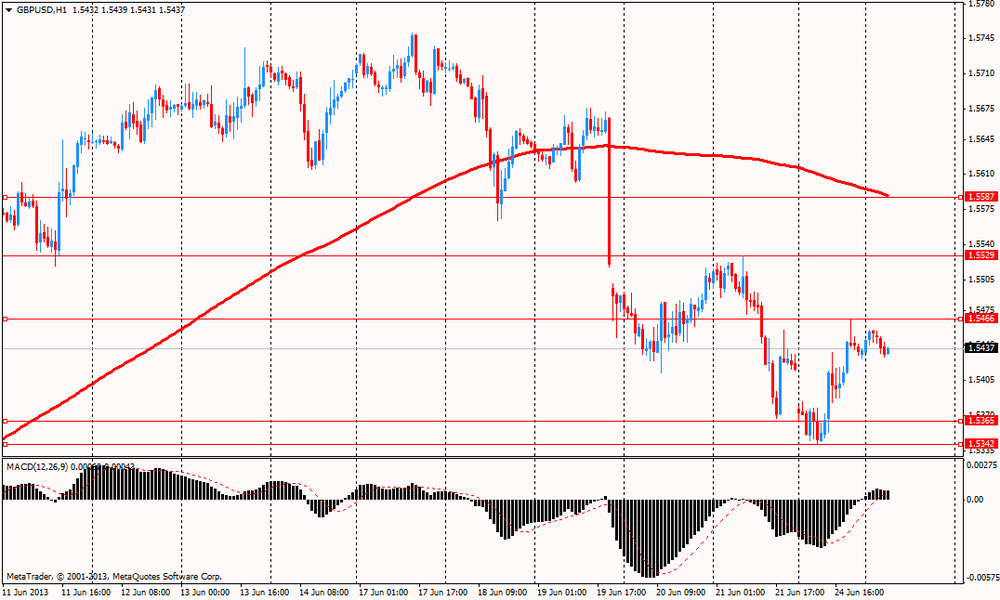

GBP / USD: during the European session, the pair is trading in the range of $ 1.5423-$ 1.5472

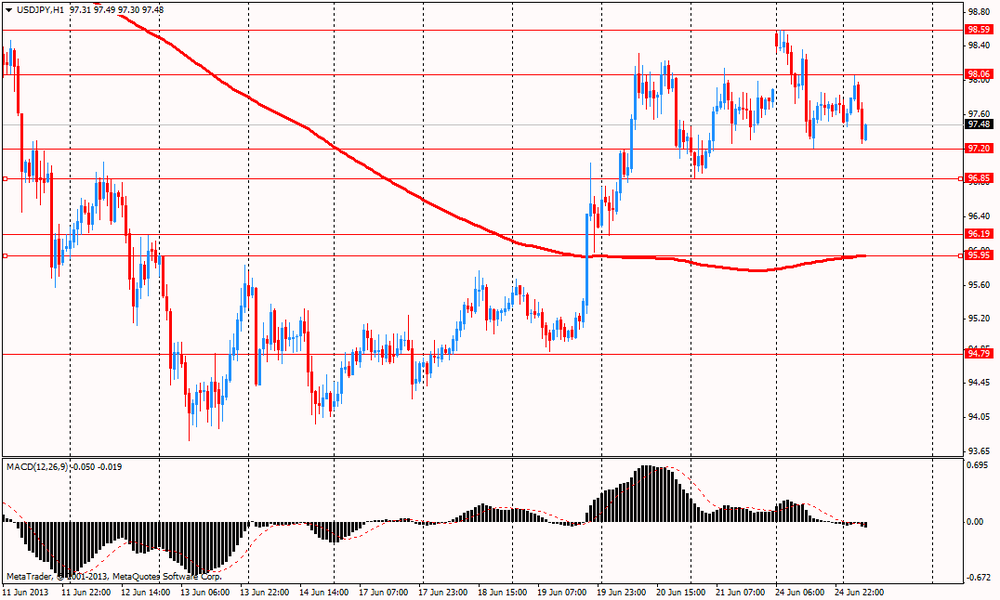

USD / JPY: during the European session, the pair fell to Y96.93

At 12:30 GMT the United States will announce a change in orders for durable goods in May. At 13:00 GMT the U.S. will release the index of home prices in 20 major cities S & P / Case-Shiller in April, as well as a national composite house price index S & P / CaseShiller for April. At 14:00 GMT the United States will present an indicator of consumer confidence in June, and will announce the amount of sales in the primary market in May.

-

13:00

Orders

EUR/USD

Offers $1.3235/40, $1.3200/10, $1.3175/80, $1.3160/65

Bids $1.3100, $1.3074, $1.3030-20, $1.3000

GBP/USD

Offers $1.5565/70, $1.5550, $1.5530/35, $1.5495/500, $1.5480

Bids $1.5420, $1.5405/00, $1.5380/70, $1.5345/40, $1.5330

AUD/USD

Offers $0.9370/75, $0.9350, $0.9325, $0.9300

Bids $0.9220, $0.9200, $0.9180/75, $0.9150

EUR/GBP

Offers stg0.8595/600, stg0.8575/80, stg0.8542, stg0.85125

Bids stg0.8485/80, stg0.8475/70, stg0.8465/60, stg0.8445/40, stg0.8420

EUR/JPY

Offers Y129.21/39, Y128.95/00, Y128.80, Y128.45/50, Y128.00

Bids Y127.10/00, Y126.50, Y126.20, Y126.00

USD/JPY

Offers Y98.65/70, Y98.35/40, Y98.05/10, Y97.94, Y97.60/65

Bids Y96.90/85, Y96.80, Y96.20, Y96.00

-

09:31

United Kingdom: BBA Mortgage Approvals, April 36.1 (forecast 33.1)

-

07:23

Asian session: The dollar rose

The yen advanced from near a two-week low versus the U.S. dollar as Asian stocks slumped for a second day amid concern a cash crunch in China will curb economic growth, supporting demand for haven assets. Goldman Sachs Group Inc. and China International Capital Corp. yesterday joined banks from Barclays Plc to HSBC Holdings Plc in paring growth projections for China this year. The cuts followed a tightening in central bank liquidity that yesterday left the overnight repurchase rate more than double the year's average.

The yen strengthened for a second day with a host of U.S. central bankers scheduled to speak this week after two Federal Reserve presidents yesterday emphasized that policy remains accommodative. The dollar retraced some gains yesterday after Dallas Fed President Richard Fisher said investors shouldn't overreact to the central bank's plan to slow bond purchases. Minneapolis Fed President Narayana Kocherlakota said to reporters in a conference call that the central bank must emphasize that policy will remain accommodative "for a considerable time" after the end of quantitative easing. This week will see speeches from Fed Bank of Atlanta President Dennis Lockhart, Richmond Fed President Jeffrey Lacker, Cleveland Fed President Sandra Pianalto and San Francisco Fed President John Williams.

The Dollar Index held a four-day gain before reports that economists said will show durable-goods orders rose and house prices increased. U.S. durable-goods orders probably increased 3 percent in May after rising a revised 3.5 percent the previous month, according to a Bloomberg News survey of economists before the Commerce Department report today. The S&P/Case-Shiller index of home values for 20 cities climbed 10.6 percent for the year ended April after a 10.9 percent gain in March that was the biggest since 2006, a separate survey showed.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3110/35

GBP / USD: during the Asian session the pair fell to $ 1.5425/55

USD / JPY: during the Asian session the pair traded in the range of Y97.25/05

There is a heavy calendar Tuesday, with data on both sides of the Atlantic and a slew of European central bank speakers on the schedule. The calendar gets underway at 0600GMT, with the release of the latest German construction orders data. There is a raft of French data released at 0645GMT, with The French June business climate indicator, along with the manufacturing and service sector sentiment indices due. The Business confidence Indicator is expected to tick up to 93 from May's 92. Also at 0645GMT, French May housing starts/permits data will be published. At 0700GMT, Spanish May PPI numbers will be released, and are seen up 0.1% on month, but down 0.3% on year.

-

07:00

-

06:44

-

06:23

Currencies. Daily history for Jun 24'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3123 -0,78%

GBP/USD $1,5435 -0,44%

USD/CHF Chf0,9335 +0,70%

USD/JPY Y97,72 +0,39%

EUR/JPY Y128,24 -0,36%

GBP/JPY Y150,81 -0,03%

AUD/USD $0,9251 +0,51%

NZD/USD $0,7753 -0,14%

USD/CAD C$1,0501 +1,16%

-

06:22

-

06:02

Morning tech for EUR/USD

Resistance 3: $ 1.3290/1.3305 (MA (200) H1, high of the Asian session on Jun 20)

Resistance 2: $ 1.3255 (Jun 21 high)

Resistance 1: $ 1.3145 (Jun 24 high)

Current price: $ 1.3115

Support 1: $ 1.3040/55/80 (Jun 4 and 24 low, MA (200) N4)

Support 2: $ 1.2940/50 (May 30 and Jun 3 lows)

Support 3: $ 1.2915 (low of the American session on May 29)

-

06:00

Schedule for today, Tuesday, June 25’2013:

08:30 United Kingdom BBA Mortgage Approvals April 32.2 33.1

09:00 United Kingdom BOE Gov King Speaks

09:00 United Kingdom BOE Chief Economist Spencer Dale Speaks

09:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

09:00 United Kingdom MPC Member Weale Speaks

09:00 United Kingdom Inflation Report Hearings Quarter I

11:30 Switzerland Gov Board Member Fritz Zurbrugg Speaks

12:15 Eurozone ECB President Mario Draghi Speaks

12:30 U.S. Durable Goods Orders May +3.3% +3.0%

12:30 U.S. Durable Goods Orders ex Transportation May +1.3% -0.1%

12:30 U.S. Durable goods orders ex defense May +2.1%

13:00 U.S. Housing Price Index, y/y April +1.3% +1.2%

13:00 U.S. Housing Price Index, y/y April +7.2%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April +10.9% +10.6%

14:00 U.S. Consumer confidence June 76.2 75.6

14:00 U.S. New Home Sales May 454 462

20:30 U.S. API Crude Oil Inventories June -4.3

21:00 U.S. Treasury Sec Lew Speaks

-