Notícias do Mercado

-

23:26

Gold Price Forecast: XAU/USD builds cushion around $1,650 as yields set to bleed further

- Gold price is forming a base of around $1,650.00 for a fresh rebound amid a joyful market mood.

- Yields have dropped to near 4.10% and are making way for more downside amid S&P500’s bullish bets.

- Households have dropped their plans of buying a new house due to accelerating interest obligations.

Gold price (XAU/USD) is building a base around the critical support of $1,650.00 after correcting from Tuesday’s high at $1,662.45. The precious metal could resume its upside journey as the spirits of market participants are extremely optimistic.

A third consecutive bullish settlement of the S&P500 has brought a sense of optimism to the market. On the contrary, alpha on US Treasuries has dropped sharply and may display more decline ahead as optimism will stay for longer. In the opinion of economists at Morgan Stanley, the rally in S&P500 could be extended well into the 4000/4150 area.

This indicates that the market mood will remain cheerful, which could have a devastating impact on yields. At the press time, the 10-year US Treasury yields are trading at 4.10% and could surrender the cushion of 4.0% ahead as clouds of uncertainty are fading away.

Meanwhile, the US dollar index (DXY) has been dragged to 110.75 as the appeal for safe haven has trimmed significantly. In today’s session, the New Home Sales data will be a major trigger. The economic data is seen lower at 0.585M vs. the prior release of 0.685M on a monthly basis. Accelerating interest rates have resulted in higher installment obligations for households, which are forcing them to postpone their demand for a new house.

Gold technical analysis

On an hourly scale, gold prices have bounced back sharply after dropping below the horizontal support placed from Thursday’s high at $1,640.55. The precious metal is expected to display a sideways movement ahead as the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range. The 20-period Exponential Moving Average (EMA) near $1,651.50 is acting as major support for the counter.

Gold hourly chart

-

23:10

AUD/USD Price Analysis: Bears step in after big volatility

- AUD/USD bulls start to move out ahead of CPI data today.

- Big moves in the forex space keep prospects of volatility alive.

Aussie Consumer Price Index is on the cards for the day ahead and the market structure is showing the data could make or break for the pair after a series of whipsaw in recent sessions.

The sentiment around the Federal Reserve monetary tightening and the policy direction of top trading partner China after President Xi Jinping have seen a lot of volatility in the price with the ATR picking up to over 100 pips for any given day.

if the data comes in hot, given that the Reserve Bank of Australia only delivered a smaller-than-expected 25 basis point rate hike earlier this month, then there could be [prospects of stronger action next time around that will only feed into the bullish AUD playbook.

AUD/USD daily chart

The daily charts are neutral with both the upside and downside to play for at this juncture. However, the double top on the hourly chart shows the price under pressure:

AUD/USD H1 chart

The price is coiling within a geometrical pattern and is forming an M-top with prospects of a move into mitigating the price imbalance of the hourly impulse towards trendline support.

-

23:07

EUR/USD Price Analysis: Reclaims the 50-DMA and 0.9900 as bulls’ eye parity

- EUR/USD broke solid resistance levels and reclaimed 0.9900 on overall US Dollar weakness.

- Short term, the EUR/USD formed a bullish-pennant that targets 1.0010 as its profit target.

The EUR/USD remains above the descending channel drawn from February 2022 highs and above the 50-day Exponential Moving Average (EMA) on Tuesday as the US Dollar weakened. Factors like speculations of a Fed pivot and solid US corporate earnings keep risk-perceived assets bid. At the time of writing, as the Asian session begins, the EUR/USD Is trading at 0.9967, slightly up by 0.05%.

EUR/USD Price Analysis: Technical outlook

Even though the EUR/USD hurdle several resistance levels, the major is neutral-to-downward biased, as depicted by the daily chart. EUR buyers should be aware that to shift the bias to neutral, they need to reclaim parity and hold prices above it so they can challenge the 100-day EMA at around 1.0091. Once cleared, the following resistance would be the 1.0200 figure. Conversely, if the EUR/USD tumbles below 0.9900, it would exacerbate a re-test of the YTD lows around 0.9530s.

In the near-term, the EUR/USD formed a bullish-pennant in the hourly chart, meaning further upside pressure mounting on the pair. The Relative Strength Index (RSI) is at overbought conditions at 70.91, suggesting that the EUR/USD is consolidated before resuming the uptrend. Therefore, the EUR/USD first resistance would be October 25 daily high at 0.9976. The break above will expose the 1.0000 figure, followed by the bullish-pennant profit target, the R1 daily pivot at 1.0010, and the R2 pivot point at 1.0060. On the flip side, the EUR/USD key support levels lie at 0.9930, the daily pivot point, followed by the 20-EMA at 0.9910, ahead of the 0.9900 figure.

EUR/USD Key Technical Levels

-

22:56

NZD/USD marches towards 0.5800 amid upbeat market mood, US GDP in focus

- NZD/USD is aiming to reclaim 0.5800 as the risk profile soars.

- The 10-year US Treasury yields have dropped to 4.10% while the DXY has shifted its business below 111.00.

- Higher consensus for the US GDP could fetch demand for the DXY ahead.

The NZD/USD pair is gradually heading towards the round-level resistance of 0.5800 as the risk-on profile is strengthening significantly. The asset witnessed fresh demand from 0.5680 on Tuesday, which turned into a vertical rally to near 0.5780. The major is holding its gains amid an improvement in investors’ risk appetite.

S&P500 rose consecutively for the third day and has turned the table in the favor of risk-perceived assets. The 500-stocks basket has settled above 3,800 amid a stellar start of the quarterly result season. The US dollar index (DXY) displayed a perpendicular fall due to a vigorous drop in safe-haven’s appeal and surrendered the cushion of 111.00.

Meanwhile, returns on US government bonds have witnessed an intense drop as investors shifted their liquidity into bonds due to a steep fall in the DXY. The 10-year U Treasury yields have dropped dramatically to 4.10%. However, the odds of a fourth consecutive 75 basis point (bps) rate hike by the Federal Reserve (Fed) for the first week of November are rock solid.

Now, investors are focusing on the release of the US Gross Domestic Product (GDP) data, which will release on Thursday. The annualized GDP is expected to improve significantly to 2.4% vs. a decline of 0.6% reported earlier.

But before that, the US New Home Sales data will hog the limelight. The economic data is expected to decline to 0.585M vs. the prior release of 0.685M on a monthly basis. As interest rates are accelerating sharply, individuals have postponed their real estate demand due to higher interest obligations.

-

22:00

South Korea BOK Manufacturing BSI above expectations (72) in November: Actual (75)

-

21:30

GBP/USD bulls head toward critical resistance as DXY sinks below 111.00

- GBP/USD bulls step it up towards key resistance.

- US dollar bears eye a run to test DXY critical support.

GBP/USD stays bid into the close of Wall Street near 1.1475 and tallies up over 1.7% in gains as the US dollar sinks below a key micro trendline and UK politics save the day for sterling bulls.

Investors have welcomed Rishi Sunak as the new UK prime minister where, in his first speech, he reiterated to place economic stability and confidence at the heart of the government's agenda. Generally, there has been bullish sentiment around his appointment, with the FTSE 100 and sterling both rallying on the news..It comes as a relief after the pound fell as low as 1.1100 vs the greenback on Friday and government borrowing costs rose amid fresh warnings about the UK economy.

Sunak, a former banker, is more moderate than Liz Truss and had criticized many of her policies, including the unfunded tax cuts that started this whole mess. Financial markets have steadied since the country U-turned on those policies. Nevertheless, there is a mountain to climb and GBP/USD remains on the front end of a bearish trendline, as illustrated below, as traders get set for a slew of central bank meetings that kick off this week with the Europen Central Bank, Bank of Canada, Bank of Japan and conclude next month with the Federal Reserve and Bank of England. Experts are mixed on the UK’s future and there are questions as to whether the UK may be forced to ask the IMF for a bailout.

Meanwhile, despite the appointment of Sunak, the bar for a dovish pivot is high. UK bond yields have already fallen sharply and the UK can expect austerity, low growth and rising inflation as utility bills continue to increase, analysts at ANZ Bank argued. ''Markets are now pricing in only a 20% chance of a 100bp rate rise when the Bank of England meets next week but are fully priced for 75bps.''

GBP/USD technical analysis

The price is headed towards a key resistance line while the US dollar sinks:

The outcome of these moves will be dependent on the central bank meetings next month. However, the weekly M-formation is compelling in the DXY as price heads towards a critical layer of support that could result in a correction into the neckline near 112.00. In such a scenario, GBP will struggle to make much headway beyond the daily resistance line in the foreseeable future unless we see a sizeable and convincing break of the DXY weekly support.

-

21:19

Forex Today: Dollar nearing an interim bottom?

What you need to take care of on Wednesday, October 26:

The American dollar gave up in the US session, finishing the day with losses against all of its major rivals. The EUR/USD pair trades near parity early Wednesday and ahead of first-tier events scheduled for next Thursday, when the United States is expected to report that the economy grew in the three months to September. The Q3 Gross Domestic Product growth is foreseen at 2.4%, reversing the negative trend from the previous two quarters.

At the same time, the European Central Bank will announce its latest monetary policy decision. The central bank is expected to hike rates by 75 bps, upgrading the pace of tightening amid signs of a fast deterioration in economic conditions. The focus will be more on what policymakers are planning ahead rather than on the actual hike. Market players would be quite surprised if President Christine Lagarde comes out with a hawkish message.

US data and central banks’ announcements will define whether the dollar reached an interim bottom.

On Wednesday, the focus will be on the Bank of Canada's monetary policy decision.

The GBP/USD pair settled at 1.1465, helped by the broad dollar’s weakness and despite of continued political noise in the United Kingdom. The UK's new Prime Minister, Rishi Sunak, was once again on the wires, anticipating “difficult decisions” ahead. Meanwhile, Justice Secretary Brandon Lewis and Business Secretary Jacob Ress-Mogg have resigned. Jeremy Hunt has been reappointed as Chancellor.

Commodity-linked currencies benefited from higher US equities. AUD/USD flirts with 0.6500 while the USD/CAD is about to pierce the 1.3600 level.

A dollar’s sell-off unexpectedly aided the Bank of Japan. USD/JPY trades below 148.00 as investors moved away from the safe-haven greenback.

Gold edged marginally higher and trades at around $1,653, while crude oil prices finished the day little changed. WTI currently trades around $84.90 a barrel.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:04

EUR/GBP steadies below 0.8700 following a reversal from 0.8750

- Euro's reversal from the 0.8900 area finds support at 0.8750.

- The pound appreciates as Sunak cams the market.

- EUR/GBP likely to reach 0.90 in the coming months – SocGen.

The euro has given away gains on Tuesday against a stronger British pound, buoyed by the market’s enthusiasm as Rishi Sunak became Prime Minister.

The pair has reversed Monday’s gains pulling back from levels neat 0.8760 to session lows at 0.8665 area where it seems to have found support to consolidate below 0.8700.

The pound rallies as Sunak calms the markets

UK’s new Prime Minister Rishi Sunak's first speech, pledging to restore economic stability has brought back confidence to the markets. Furthermore, the re-appointment of Jeremy Hunt as chancellor of the exchequer has increased hopes of a market-friendly cabinet, which has buoyed the pound across the board.

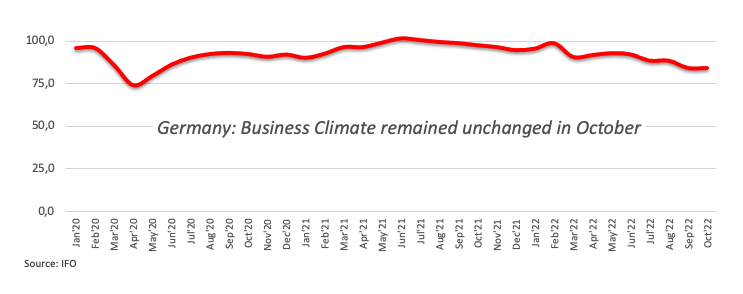

On the macroeconomic docket, the German IFO Business Climate Index showed that sentiment remains practically unchanged from the previous month. These figures have passed virtually unnoticed, as the focus is set on the outcome of the ECB’s monetary policy meeting, due next Thursday.

EUR/GBP expected to crawl towards 0.90 – SocGen

In a bigger picture, Kit Juckes, Chief Global FX Strategist at Société Générale, sees the pair advancing toward 0.90: “With the economy surely already in recession and set to suffer from possibly even tighter fiscal policy, sterling is unlikely to enjoy much more of a relief bounce and over time, EUR/GBP is likely to meander slowly up to 0.90 or so.”

Technical levels to watch

-

20:56

Gold Price Analysis: XAU/USD meanders around $1650, capitalizing on a weak US Dollar

- Gold price grinds higher by 0.24%, though facing solid resistance around $1660.

- If XAU/USD clears $1670, a test of $1700 is on the cards.

- A formation of a bullish flag in the XAU/USD hourly chart opens the door for further upside.

Gold price advances steadily during the North American session, though it remains capped below the 20-day Exponential Moving Average (EMA), despite falling US Treasury yields underpinning the yellow metal prices, as gold recovers after hitting a daily low of $1638.40. At the time of writing, the XAU/USD is trading at $1653 a troy ounce, above its opening price by 0.24%.

XAU/USD Price Forecast: Technical outlook

From a daily chart perspective, XAU/USD is downward biased, as it has remained since sliding below the 200-EMA in mid-June 2022. Worth noting that Tuesday’s daily high was shy of hitting a downslope trendline, drawn from October highs, which confluences with the 20-day EMA. So XAU buyers need to clear $1670, to exacerbate a rally towards the 100-day EMA at $1690, ahead of $1700. On the flip side, a daily close below Monday’s low of $1644 would cement gold’s downward biased, which would be unable to capitalize, despite lower US bond yields, opening the door for further losses.

Short-term, the XAU/USD hourly chart illustrates the formation of a bullish flag, opening the door for further gains. Worth noting that gold is neutral-to-upward biased, and once it clears, the October 24 high of $1670 will exacerbate a rally toward $1700.

The XAU/USD first resistance would be the R1 daily pivot at $1665, ahead of $1670. Break above will expose the R2 pivot at $1681, followed by the R3 daily pivot level at $1692.42, ahead of $1700.

On the other hand, if XAU/USD slumps below the confluence of several EMAs, lead by the 50, 20, and 200-EMA around $1647-$1651, would send the yellow-metal price toward the convergence of the 100-EMA and the S1 daily pivot around $1639-41. Once cleared, the following demand zone would be the bullish-flag bottom trendline around $1636.

XAU/USD Key Technical Levels

-

20:19

Silver Price Analysis: XAG/USD clears solid resistance, eyeing the 100-DMA around $19.60

- Silver (XAG/USD) advances sharply in the New York session after hitting a weekly low of $18.79.

- XAG/USD remains neutral-to-downward biased, though a break above the 100-DMA will pave the way to $20.00.

- Short term, the XAG/USD could clear the R1 daily pivot at $19.58, putting in play the 100-day EMA.

Silver price reclaims the 50 and 20-day Exponential Moving Averages (EMAs) on Tuesday amidst broad US Dollar weakness, as risk-perceived assets advance while US bonds rally. Consequently, US Treasury yields fall, a tailwind for the white metal. At the time of writing, XAG/USD is trading at $19.37, above its opening price by 0.77%.

XAG/USD Price Forecast: Technical outlook

The XAG/USD daily chart portrays silver as neutral-to-downward biased, even though it reclaimed the 20 and 50-day EMAs. For XAG/USD buyers to further cement the case of turning the bias to neutral, they need to reclaim the 100-day EMA at $19.61, which could send XAG/USD rallying to $20.00 a troy ounce, before testing the 200-day EMA at $21.65. Additionally, the Relative Strength Index (RSI) at bullish territory, with a minimal-bullish slope, suggests prices could aim higher, opening the door for a test of the 100-day EMA.

In the near term, XAG/USD is neutral-to-upward biased, as depicted by the hourly chart, with prices oscillating around the daily pivot level at $19.30. The Relative Strength Index (RSI), around 58.64, is in bullish territory, though directionless. Therefore, XAG/USD might consolidate amid the lack of a catalyst.

Upwards, the first resistance would be the R1 daily pivot at $19.58, followed by the October 24 high at $19.67, ahead of the R2 pivot level at $19.95. On the flip side, the XAG/USD first support would be the confluence of the 50 and 20-EMAs at $19.23 and $19.18, respectively, followed by the S1 daily pivot point at $18.94. Break below will expose the 100 and 200-EMAs, each at $18.90 and $18.78, ahead of the S2 pivot level at $18.65.

XAG/USD Key Technical Levels

-

20:17

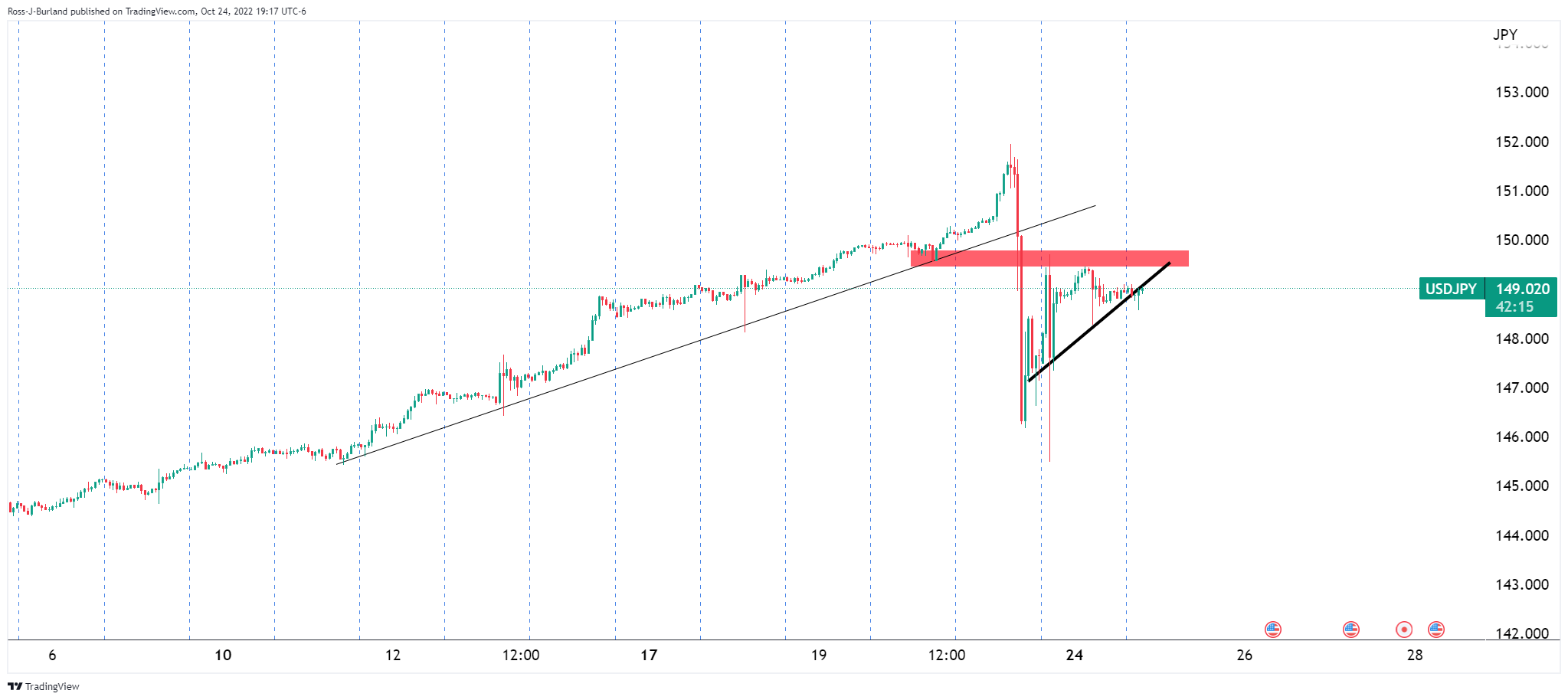

USD/JPY is attempting to regain 148.00 after bouncing from 147.50 lows

- US dollar's reversal from the 149.00 area found support at 147.50.

- The US dollar loses ground on hopes of Fed easing.

- The yen will remain on the defensive on BoJ's dovishness.

The greenback dropped sharply across the board on Tuesday and the USD/JPY retreated from levels right below 149.00 to session lows at 147.50, where the pair has found buyers to attempt to regain the 148.00 level.

US dollar dives on Fed easing hopes

The US dollar plunged in the early US session on Tuesday following downbeat US housing prices and consumer confidence readings. These figures and the disappointing S&P PMI index released on Monday have revived fears that the Federal Reserve might be damaging growth with its radical monetary tightening plan.

Investor’s hopes that the Fed might be open to slowing down its rate hike path over the next months have boosted risk appetite. US stock markets extended gains after a mixed opening, while Treasury yields retreated, weighing on the USD.

Today’s decline gives some respite to the Japanese authorities, which are suspected of having stepped in, two times, attempting to curb yen weakness.

Last week, an alleged intervention by the Bank of Japan and the Ministry of Finance pulled the part from levels close to 152.00 to 146.20 area. The dollar, however, managed to retake more than half of the ground lost over the next couple of days.

A dovish BoJ will keep hurting the yen

In the longer term, the Japanese yen remains weighed by the monetary policy differential, an aspect that might gain relevance over the coming days.

While the Bank of Japan is expected to maintain its ultra-expansive policy on Friday, keeping bond yields near zero, the Fed is widely expected to hike rates by 75 basis points over the next week. This is highly likely to negative pressure on the JPY.

Technical levels to watch

-

20:15

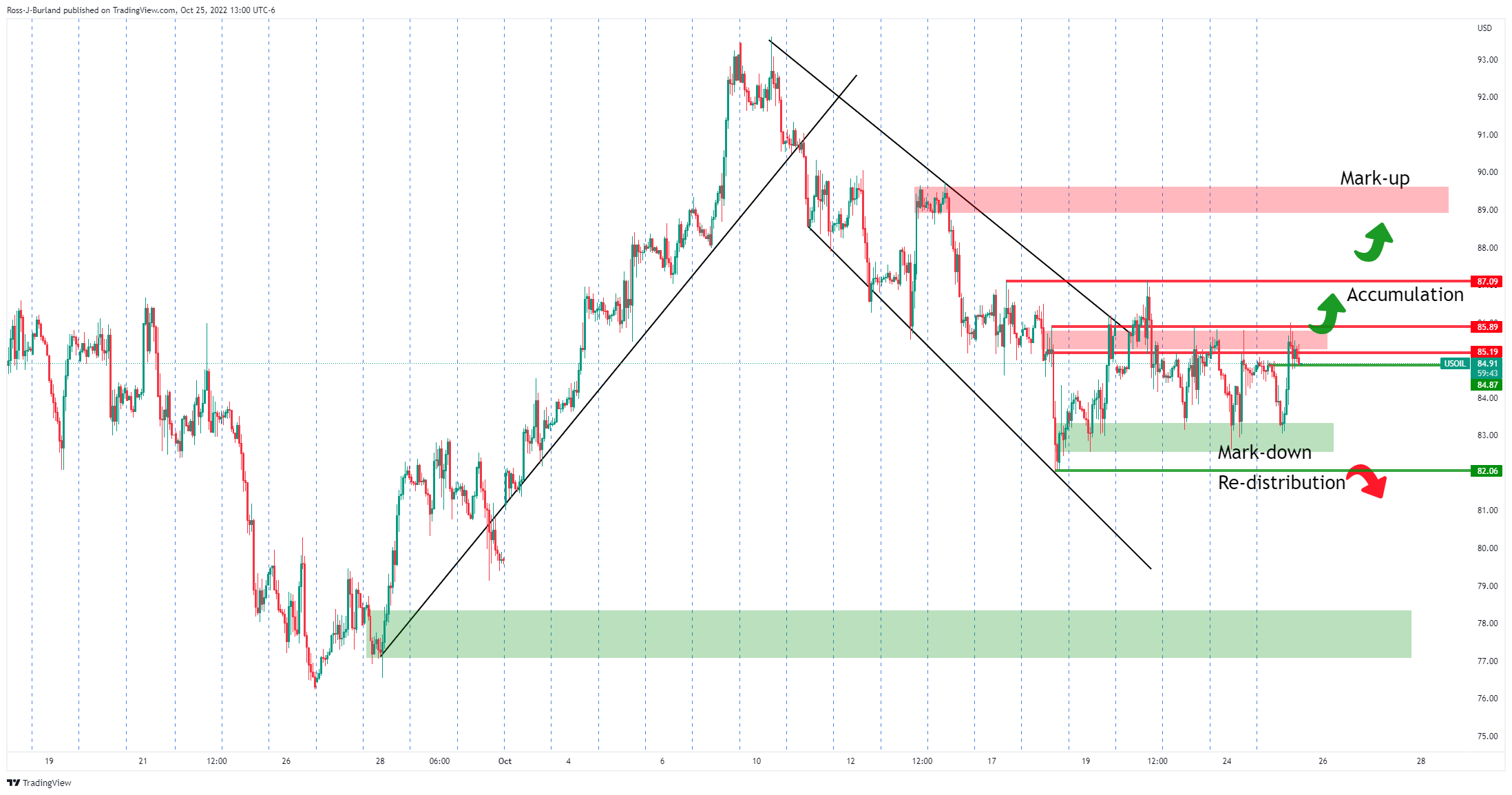

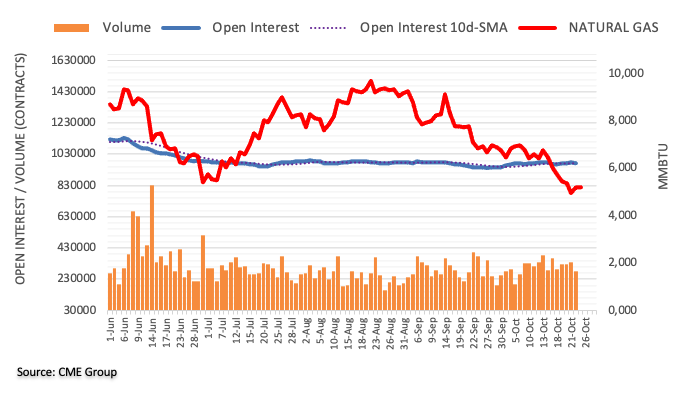

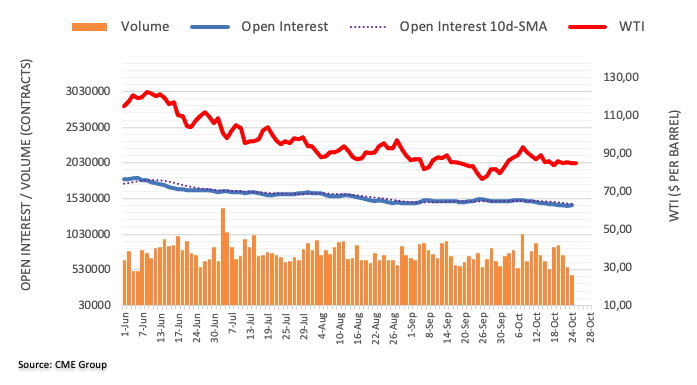

WTI sits within key territories as risk apatite lifts

- WTI bulls eye a break of key resistance on the backside of the bear channel.

- Bears will look for failures here and a move down to test prior lows of $82bbls.

West Texas Intermediate, (WTI), crude oil rose on Tuesday as US recession concerns continue, sapping up the hawkish sentiment in markets and enabling risk assets to rally. This comes ahead of production cuts next month from OPEC+ and the Federal Reserve meeting. WTI crude oil was last seen at $85bbls, trading 0.17% higher between a low of $83.08 and $86.01.

The black gold is trying to recover from the start of the week's slump that followed weak delayed economic data in China that raised concerns over demand. The third quarter Gross Domestic Demand came in at 3.9% YoY, while Retail Sales growth slowed to 2.5% in September due to the spectre of ongoing virus controls which weighed on sentiment.

''President Xi Jinping secured a third term in power and installed loyalists in the top ranks of the party. He didn’t indicate any departure from the zero-COVID strategy that has weighed on economic activity. The recent recovery in China’s oil imports faltered in September. Independent refiners failed to utilise increased quotas amid ongoing lockdowns weighing on demand. This was exacerbated by falling refinery margins and product export curbs,'' analysts at ANZ Bank explained.

However, the focus is back on the tight physical market amid ongoing supply constraints and the prospects for the implications with regard to the EU sanctions on Russian oil. Seaborne shipments from Russia fell to a five-week low in the seven days to 21 October. Meanwhile, the oil price correction came in light of better earnings reports and speculation that the monetary policy tightening cycle may be nearing its end.

US economic data released shows consumer confidence is still falling while house prices are also now dropping, indicating the monetary policy tightening may be starting to impact consumer decisions and therefore ease inflationary pressures. This in turn is stripping out the Fed narrative and pointing to an earlier pivot from the central bank, enabling risk to rally.

Nonetheless, analysts at TD Securities who noted that crude oil prices have remained range-bound since the OPEC+ group of producers announced their largest output cut since the pandemic, argue that time spreads have rallied sharply in a sign of tighter markets ahead. ''Our gauge of energy supply risk remains at its highest levels of the year, highlighting that supply risk premia are still offering an insulating force for the complex with an 'imminent Iran deal' off the table. In the imminent term, a buying program in Brent crude is expected to follow suit, after a trend following selling program was whipsawed by range-bound trading.''

WTI technical analysis

The price could be on the verge of an upside rally on a break of structure, with bulls accumulating the recent price drop. However, regardless that the price is now on the backside of the channel, the prior bullish trend's support could be regarded as the most dominant and should bulls fail to break above $87bbls, below $82 will be regarded as the mark-down level and open risks to lower prices for the foreseeable future.

-

19:34

EUR/USD rises to fresh weekly highs around 0.9960, ahead of ECB’s decision

- The EUR/USD cleared the confluence of a descending channel up trendline and the 50-DMA, exacerbating a move beyond 0.9900.

- US economic data hints at an economic slowdown spurred by Fed’s aggression.

- As measured by the Ifo, business sentiment in Germany was unchanged, though recession fears remain.

- EUR/USD Price Forecast: To test parity if it breaks 0.9980; otherwise, a fall to 0.9800 is on the cards.

The EUR/USD advances sharply due to a soft US Dollar blamed on the Fed’s pivot narrative surrounding the financial markets. Also, solid US corporate earnings keep investors’ mood positive, despite the ongoing global economic slowdown. At the time of writing, the EUR/USD is trading at 0.9969 after hitting a three-week high at around 0.9976.

US equities remain trading in the green, supported by earnings. Meanwhile, US economic indicators continue to paint a gloomy picture for the economy, as conditions in the housing market continue to dampen, albeit Fed officials prepare to slow down the pace of tightening. According to St. Louis Fed President James Bullard, discussions of “where the Fed should go and then become data-dependent” will be held at the November meeting.

In the meantime, early in the US session, housing data reported that prices cooled down, reflecting the impact of higher borrowing costs, given that the Fed had tightened 300 bps during the year. The S&P CoreLogic Case Shiller Price Index for August increased by 13%, less than July’s 15.6%, while the Federal Housing Finance Agency showed that home prices in August rose by 11.9% YoY, lower than the previous month’s 13.9%.

Of late, the Conference Board (CB) Consumer Confidence missed forecasts of 105.9, falling to 102.5 in October. Consumers’ worries are high inflation in food and energy, alongside a possible recession in 2023.

The EUR/USD continued its advance, despite the narrative of bad data for the US being good data. However, the sudden shift regarding a possible “lower size” of Fed interest-rate hikes was headwinds for the US Dollar, as Euro buyers capitalize in the short term.

Across the pond, in the European session, business conditions in Germany continued to deteriorate, as shown by the IFO Business Climate Conditions, at 84.3, vs. September’s downward revised 84.3 reading, unchanged. According to sources cited by Reuters, “Today’s business climate reading does nothing to change the looming recession. In the coming months, further gloom is more likely than an increase.”

Worth noting that the ECB is expected to hike rates by 75 bps in the October meeting, despite recession fears and worries growing in the Eurozone. Money market futures estimates rates to peak at around 2.50% by March of 2023.

EUR/USD Price Forecast: Technical outlook

The EUR/USD is neutral-downward biased, though traders should note that the major cleared the descending channel drawn since February 2022 to the upside, meaning buyers are gathering momentum ahead of the ECB monetary policy meeting. Also, the 50-day Exponential Moving Average (EMA), at 0.9893, was broken, exacerbating a rally toward a three-week high. If the EUR/USD reclaims parity, the following supply zone to be tested would be the 100-day EMA around 1.0099. Once cleared, the next stop would be 1.0200. On the other hand, the EUR/USD first support is the 0.9900 mark. Break below will expose the 50-day EMA at 0.9893, which, if broken, will send the EUR/USD sliding toward the 20-day EMA at 0.9805.

-

19:31

NZD/USD consolidates at 0.5750 after rallying from 0.5670 lows

- The New Zealand dollar rallies from 0.5670 to consolidate at the 0.5750 area.

- Risk appetite and a weak US dollar are underpinning kiwi's rally.

- NZD/USD is expected to be capped at 0.5800 – UOB.

The New Zealand dollar appreciated sharply on Tuesday, after bouncing from session lows at 0.5670, to retrace Monday’s reversal and consolidate around 0.5750.

The USD tumbles amid Fed easing hopes

The US dollar depreciated across the board on Tuesday, weighed by lower US Treasury bonds, as a set of downbeat US indicators have spurred concerns about the negative impact of the Federal Reserve's sharp tightening path.

A larger-than-expected contraction in US housing prices and the second consecutive decline in consumer confidence seen Tuesday, plus the disappointing PMI data released on Monday are increasing pressure on the Fed to start contemplating lower hikes over the coming months.

Furthermore, the UK's new Prime Minister, Rishi Sunak’s first speech, committing to restore market confidence, and the re-appointment of Jeremy Hurt as Chancellor of the Exchequer have been welcomed by the investors. The sentiment-linked New Zealand dollar has appreciated nearly 1.20% on the day with the safe-haven US dollar losing ground.

NZD/USD: seen capped below 0.5800 – UOB

On the longer run, FX analysts at UOB expect the pair to remain in the current range, with the upside capped below 0.5800: “The price actions appear to be part of a consolidation phase and we expect NZD to trade between 0.5590 and 0.5800 for the time being. Looking ahead, NZD has to break clearly above 0.5810 before a sustained advance is likely.”

Technical levels to watch

-

19:12

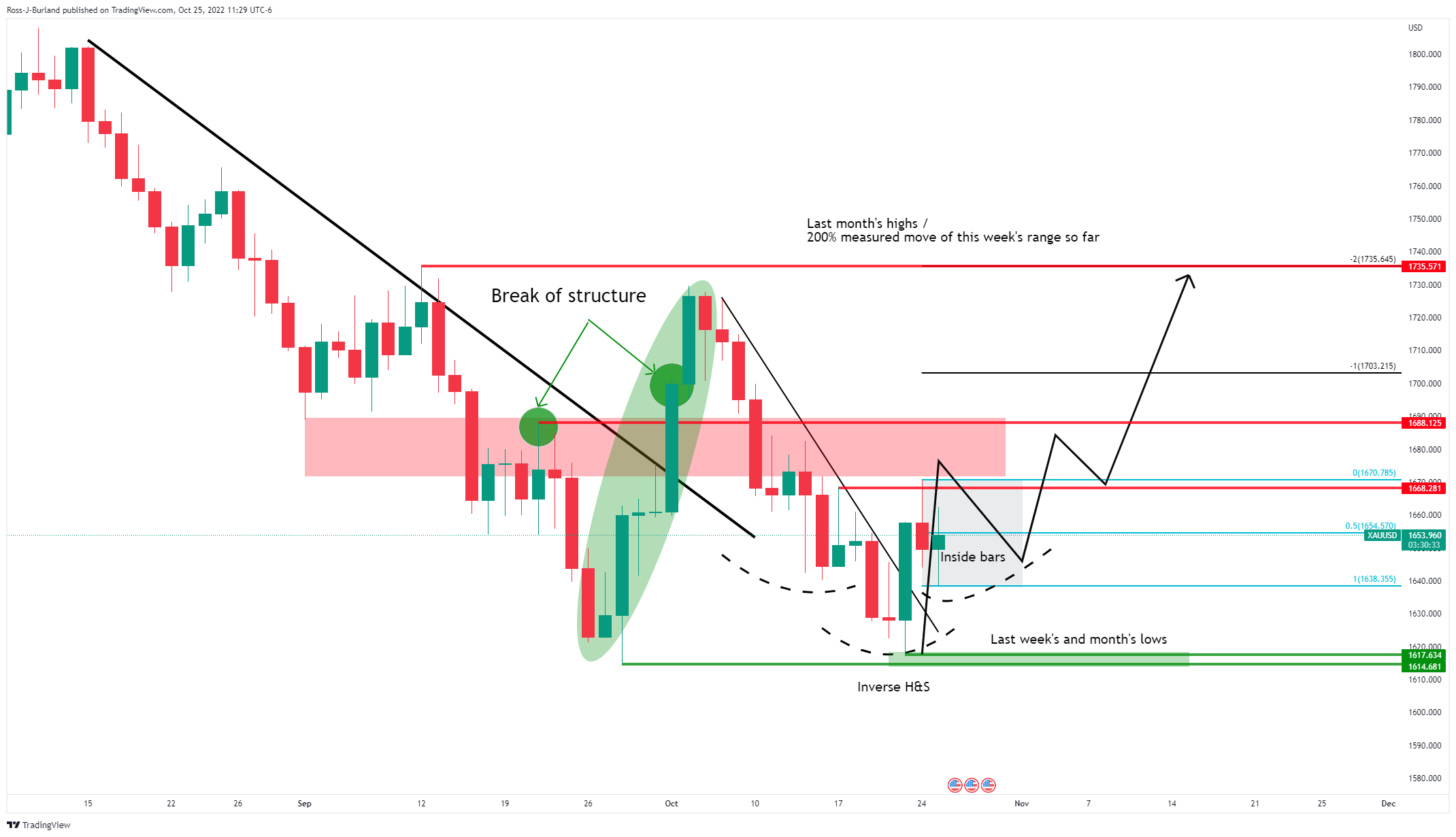

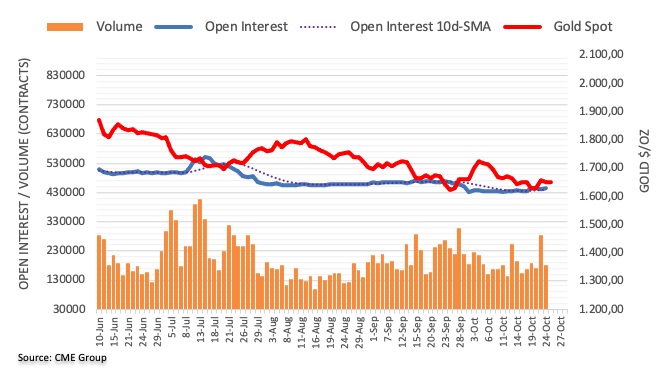

Gold Price Forecast: XAU/USD bulls are accumulating on the backside of key bearish trendlines

- The tide could be going out on the greenback with speculation of a less hawkish Fed.

- Gold is poised for a significant correction, setting up for next week's Fed.

The gold price is higher by some $1,654 on the day following a switch up in confidence in the Federal Reserve's path of interest rate hikes given the cracks in the economy. Consequently, fixed income has seen a rally, sinking yields and the US dollar along with it. Gold has benefitted as the move in the greenback makes it less expensive for buyers of gold.

The dollar index, DXY, which measures the greenback vs. a basket of currencies fell to a low of 110.759 on Tuesday from a high of 112.127 in a sizeable drop that led to strong and rapid gains in risk assets and forex. The index is now below the 111 mark, a level not seen in almost three weeks, as speculation that the Federal Reserve would slow the pace of interest rate hikes later this year has diminished the greenback's appeal.

US stocks and risk have climbed following weaker consumer confidence and manufacturing readings. The Dow Jones Industrial Average climbed to 31,805, with the S&P 500 up 1.1% and the Nasdaq Composite 1.5% higher. The 10-year yield sank to 4.052%, and the 2-year rate dropped 4.398%.

In data, the Conference Board's measure of consumer confidence dropped to 102.5 in October from 107.8 in September. This came in below the 105.3 expected and was the weakest since July. Meanwhile, the Richmond Fed's monthly manufacturing index fell to minus-10 in October from 0 in September, below expectations for a decline to minus-5. The Philadelphia Federal Reserve Bank's monthly nonmanufacturing activity index fell to minus-14.9 in October from 2.5 in the previous month, indicating a sharp contraction in the sector. All in all, this is accompanying poorer data of late and shaking the foundations for continued aggressive tightening expectations from the Fed ahead of next week's expected 75bps hike.

Big moves in the greenback

The moves in the US dollar have stemmed from, 1) Bank of Japan's suspected intervention through the Ministry of Finance, 2) arguably due to the pronounced selling activity in the greenback against the British pound as investors welcomed Rishi Sunak as the new UK prime minister, and 3), last Friday's Wall Street Journal article, entitled, ''Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes''.

However, some analysts would argue that it is too soon to expect the Fed, and other banks for that matter, to pivot. ''Notably, despite the recent move lower in natural gas prices longer-term market-based inflation expectations continue to creep higher,'' analysts at Danske Bank wrote in a note. ''In our view, that highlights that it is still too early for central banks including the Fed to turn into a more accommodative mode since this risks jeopardizing the fight against higher inflation.''

In any case, markets are thinking twice with regard to next week's hike, positioning for a possible hike of less than 75bps. Moreover, speculators switched to net short positions of 20,633 contracts in COMEX gold in the latest week, as per the U.S. Commodity Futures Trading Commission (CFTC) data on Friday. This leaves the market wide open for a capitulation of shorts should we see a less hawkish Fed next week.

Gold technical analysis

As for the technical outlook, we had a break in daily structure back on Oct 3 to take the gold price on the back side of the daily trendline resistance. The price moved back into Wednesday 22 Sep bullish peak formation lows in a micro daily bear trend. We have broken on the backside of the micro (secondary) daily trendline on Fri 22 Oct and we have two inside days including today so far. This could be the formation of an inverse head and shoulders for a 200% measured move of this week's inside range so far to target last month's highs of near $1,735. A break of and close above the $1,670 neckline could be the trigger point to start looking for the set-up on lower time frames.

-

19:00

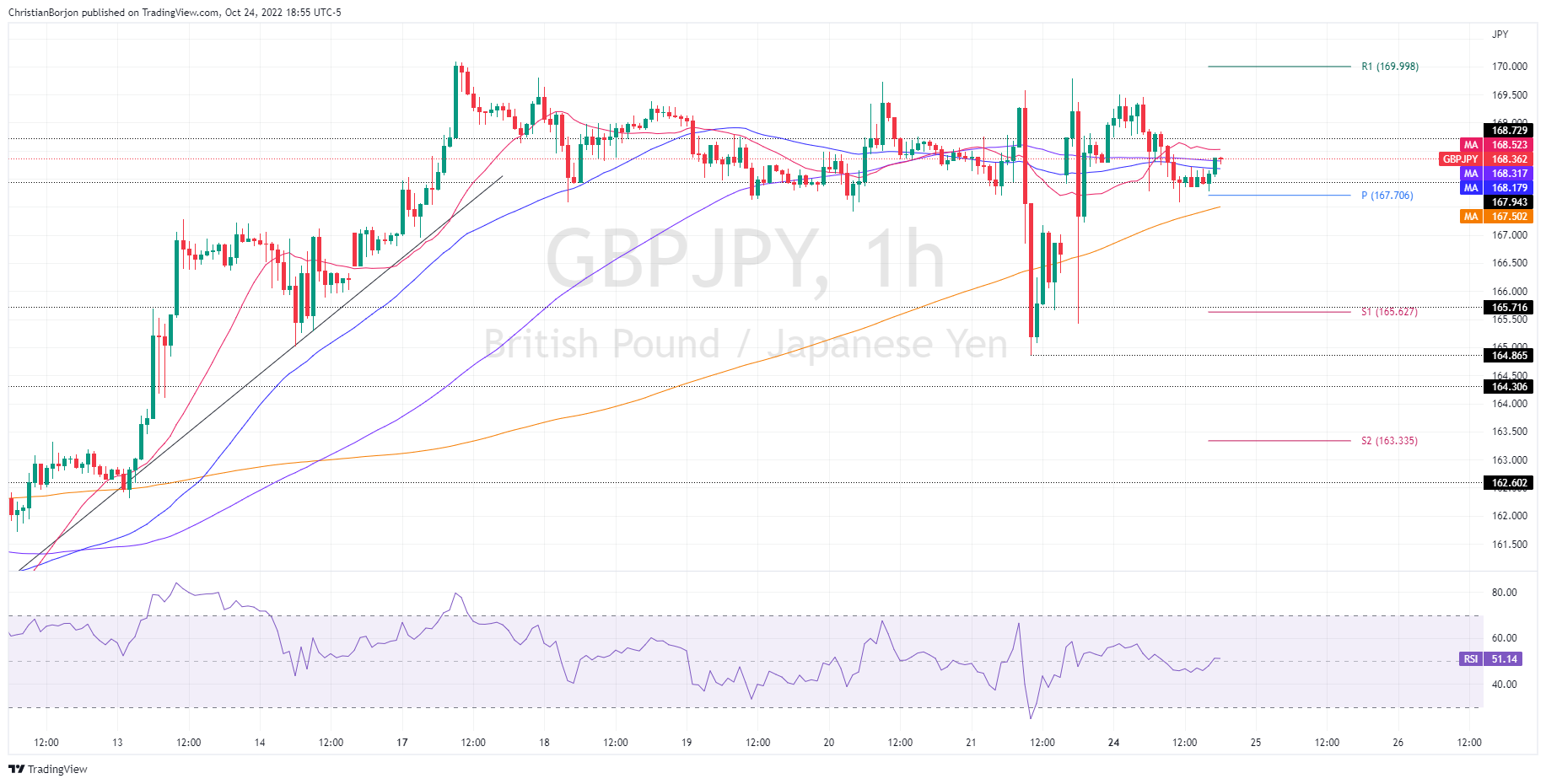

GBP/JPY Price Analysis: Testing a key resistance area at 170.00

- GBP/JPY pares losses and reaches 170.00 area.

- Breach of 170.00 might drive the pair to 175.00.

- Downside attempts remain limited above 168.00.

The pound rallied across the board on Tuesday, fuelled by the market enthusiasm about the victory of Rishi Sunak in the Tory race to Downing Street. The GBP/JPY has extended its rebound from levels right below 168.00 earlier today to scratch the door of 170.00 which might activate an inverted “Head & Shoulders” pattern, driving the pair to the 175.00 area.

Technical indicators show the pair biased higher, supported above the 50 and 100-period SMA in the 4-hour chart. The RSI, however, is approaching overbought territory suggesting that bulls might take a pause.

Downside attempts remain limited above 167.75/168.00 where session lows meet the 50-period SMA. Below here, the next downside targets would be at 165.25 (October 14 and 21 lows) and 162.45 (October 13 lows).

GBP/JPY 4-hour chart

Technical levels to watch

-

18:20

USD/CHF dives back below 1.0000 on Fed easing hopes

- The dollar dives below parity, gives away previous gains.

- Downbeat US data spur hopes of a slower Fed tightening pace.

- USD/CHF: Further depreciation below 0.9950 might increase negative pressure.

Greenback’s recovery from the 0.9940 area has been capped at 1.0030 on Tuesday’s US trading session, as the pair gave away gains and retreated to the mid-range of the 0.99s.

The USD tumbles following weak US data

The US dollar is dropping sharply across the board as a set of downbeat US indicators has increased concerns that the Federal Reserve’s fast tightening pace might be damaging economic growth.

US housing prices contracted at a 0.7% pace in August, beyond the -0.3% expected and consumer confidence deteriorated for the second consecutive month in October. On Monday, the S&P PMIs reflected a further contraction in business activity. These figures are putting pressure on the Fed to consider shorter rate hikes in the coming months.

Hopes of Fed easing have boosted risk appetite. US stock markets expanded gains after a lackluster opening and Treasury bond yields dropped sharply. The US dollar, as a result, lost ground across the board.

USD/CHF: Breach of 0.9950 support might increase negative pressure

The pair is now trading right above the 100-period SMA in the four-hour chart, at 0.9950, below here, bears might increase their pressure, pushing the pair towards 0.9780 (Oct. 4 and 6 lows) and 0.9740 (Sept. 30 low).

On the upside, October 24 high at 1.0035 should be cleared to aim toward 1.0065/75 (October 13 and 14 highs). Confirmation above that level would set the pair at three-year highs, aiming for May 20, 2019 high.

Technical levels to watch

-

18:18

United States 2-Year Note Auction rose from previous 4.29% to 4.46%

-

17:51

USD/CAD hovers around 1.3630 after hitting a three-week low, ahead of BoC’s decision

- USD/CAD slumps below its opening price by 0.57% as a Fed pivot narrative weakens the US Dollar.

- Poor US housing data and consumer confidence deterioration, headwinds for the greenback, justify the Fed pivot.

- TD Securities estimates that the Bank of Canada (Boc) will lift rates by 75 bps on Wednesday.

The USD/CAD creeps lower in the North American session as the greenback weakens due to the Federal Reserve’s slowing the pace of tightening, while unfavorable US economic data was headwinds for the US Dollar. Also, US companies reporting better-than-expected earnings keep a risk-on appetite. At the time of writing, the USD/CAD is trading at 1.3613, below its opening price, after hitting a high of 1.3734.

The Canadian dollar appreciates as the BoC’s decision looms

The financial markets narrative shifted since last Friday on news that the Federal Reserve might slow the pace of interest-rate hikes, further clarified by the San Francisco Fed President Mary Daly and the St. Louis Fed President James Bullard, with both saying that 75 bps would not be the standard. At the same time, Bullard added that would be discussed at November’s Federal Reserve Open Market Committee (FOMC).

Data-wise, the US docket featured US housing data, which added to the ongoing economic slowdown in the US. August’s Home Prices rose by 13%, less than July’s 15.6% reading, as reported by S&P CoreLogic Case Shiller. Meanwhile, the Federal Housing Finance Agency featured that home prices in August jumped by 11.9% YoY, below July’s 13.9%.

Meanwhile, the Conference Board (CB) Consumer Confidence dropped to 102.5, below estimates of 105.9, primarily blamed on growing concerns about inflation and a possible recession in 2023.

Lynn Franco, Senior Director of Economic Indicators at The Conference Board, commented that consumers plan to buy a home over the next six months, even though borrowing costs are increasing. She added that “inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers.”

Aside from this, the Canadian calendar is empty ahead of Wednesday’s Bank of Canada (BoC) monetary policy decision. TD Securities analysts said that they expect the BoC to lift 75 bps in October and a further 25 bps in December and forecast the BoC rates to peak at around 4.25%.

USD/CAD Key Technical Levels

-

17:39

AUD/USD rallies to 0.6400 as the US dollar dives

- The Australian dollar shrugs off weakness and jumps to 0.6400.

- Hopes of Fed easing have sent the US dollar tumbling.

- AUD/USD is now testing resistance at 0.6410.

The Australian dollar has shrugged off previous weakness and surged nearly 100 pips in the early US Trading session, reaching levels right above 0.6400. The pair appreciates 1.3% on the day, to erase Monday’s reversal amid a broad-based US dollar weakness.

The US dollar plunges on Fed easing hopes

The downbeat US housing prices and consumer confidence, contracting beyond expectations, and the disappointing S&P PMIs seen on Monday have increased concerns about the negative impact on the economy of the Federal Reserves' sharp tightening path, boosting hopes that the bank might ease its normalization cycle over the coming months.

Stock markets have extended gains after a mixed US session opening and the US Treasury bonds dropped sharply, with the 10-year gilt falling from 4.25% to 4.06 so far. The brighter market sentiment has hurt the USD, which lost ground against its main peers.

The Australian dollar, which had retreated to the 0.6300 area after the Labor Cabinet released its first budget, bounced up sharply during the early US session. Risk appetite has pushed the aussie to test 0.6400 resistance area, which, so far remains unbroken, with the pair trading at 0.6385.

AUD/USD testing resistance at 0.6410

The aussie lies now right below 0.6410 (October, 24 high) which could hold for some time, as the pair seems a bit exhausted following a nearly 100-pip rally. Above here, the next potential targets would be 0.6430 (October 7 high) and the 200-period SMA in the 4-hour chart, now at the 0.6500 area.

On the downside, a negative reaction below 0.6300 might give air to bears and drive the pair towards 0.6275 (Oct 24 low) on the way to 0.6215 (Oct 21 low).

Technical levels to watch

-

17:14

USD/INR seen at 84.00 by year-end – MUFG

Last week, the USD/INR hit a new record high at 83.28, before pulling back under 82.50. Analysts at MUFG Bank continue to see weakness ahead for the Indian rupee and see USD/INR at 84.00 by year-end.

Key Quotes:

“USD/INR volatility picked up last week after it rose to a record high of 83.29 versus its Mumbai close at 82.35 on 14 October. The INR’s depreciation to new record lows against the USD last week was mainly driven by stronger USD demand by oil importers. According to newswires, the RBI may have sold off USD1 bn last Thursday to bring USD/INR back below 83.00.”

“We maintain our view that the sharp decline in foreign reserves by around USD101 bn so far this year limits the scope for aggressive RBI intervention in the near term, with future rounds of intervention to be done sporadically. This puts more upside risks to USD/INR particularly during bouts of USD strength.”

“We are maintaining our year-end USD/INR forecast at 84.00. For the week ahead. 83.00 is likely to be the first level of topside resistance for USD/INR, followed by 83.50.”

-

17:08

BoC: The last 75 basis points rate hike – Rabobank

On Wednesday, the Bank of Canada will announce its decision on monetary policy. Analysts at Rabobank expect at rate hike of 75 basis points to 4%. They see it as the last hike of 75 bps, before returning to a 50 bps increase at the next meeting on December 7.

Key Quotes:

“We expect the Bank of Canada to raise rates another 75bp on Wednesday, October 26th, taking the policy rate up to 4.00%. Canada has not felt interest rates that high since the beginning of 2008, after rates had been cut 50bp (two 25bp) from the 4.50% peak in 2007.”

“Given the divergence of views heading into this meeting, we are likely to see significant repricing of the curve and FX volatility in the aftermath of the decision. This will be compounded by the release of a new Monetary Policy Report and all the projections within, and volatility won’t end there given that Governor Macklem will hold a press conference an hour after the decision. In short, this week’s decision could prove a lively one for BoC watchers and CAD traders.”

“In terms of the Bank’s forecasts, expect upward revisions to inflation and downward revisions to growth. At Rabo, we expect GDP growth of 1% in 2023 and CPI inflation of 3.4% by 2023 yearend, with risk skewed to lower growth and stickier inflation.”

“We remain of the view that USD/CAD will trade north of 1.40 before the end of this year.”

-

17:02

USD/KRW: Subject to risk sentiments and domestic data announcement – MUFG

The Korean won weakened last week amid risk aversion, point out analysts at MUFG Bank. They forecast USD/KRW at 1470 by the end of the fourth quarter and at 1420 by the second quarter of next year.

Key Quotes:

“Despite a zero net change of US dollar and KOSPI index, Korean won weakened 0.8% last week as the postponement of China’s key figures release last week. The weakness of the Japanese yen which hit a 32-year low in the week has a negative spill-over effect on KRW.”

“Newly released trade data accentuated concerns over the export outlook for South Korea.

“There was news saying South Korea is considering temporarily banning short selling of shares and activating a stock market stabilization fund if there is a risk that the benchmark stock index will fall below 2,000 level.”

“Look ahead, the rise in US Treasury yields could continue to weigh on the KRW, but potential smoothing operations by authorities may help limit the degree of the currency’s depreciation. Q3 data will be released this week.”

-

16:55

USD/MXN Price Analysis: Looking for a test of 19.80

- USD/MXN with bearish bias while under 19.95.

- Consolidation under 19.80, opens the doors to more losses.

- Immediate resistance at 19.95; critical barrier at 20.15/20.

The USD/MXN is falling on Tuesday on the back of a weaker US dollar across the board. The pair has been consolidating under 19.95, leaving the doors open to more losses. So far, it bottomed at 19.86, the lowest level in a month.

The critical support is located at 19.80. Some rebound from this level might be seen, but in the case of a daily close below, the bearish bias would be reinforced, exposing the 19.50 key level (intermediate support at 19.70).

The 19.95 has become the immediate resistance is the previous support at 19.95. A recovery above would alleviate the bearish pressure and would point to a consolidation between 20.15 and 19.95.

On the upside the zone is 20.15/20.20. A break higher would suggest more gain ahead, targeting 20.45, with intermediate resistance at 20.30.

USD/MXN daily chart

-638023100637444210.png)

-

16:51

GBP/USD jumps to 1.1500 area as the USD loses ground

- The pound rallies to 1.1500 on the back of broad-based USD weakness.

- Rishi Sunak's victory has restored investors' confidence.

- GBP/USDaiming to 1.10 later this year – ING.

The pound has surged from levels right above 1.1300 on Tuesday’s early US market session, rallying all the way to 1.1500 where it seems to have found some resistance. The pair appreciates about 1.70% on the day to erase previous losses and test its highest levels in more than one month.

Sunak’s victory has eased investors’ fears

The victory of Rishi Sunak in the Tory race and his pledge to restore economic stability are bringing back confidence to the markets, terrified with his predecessor’s economic plan. The re-appointment of Jeremy Hunt as chancellor of the exchequer has increased hopes that the next cabinet will be more market-friendly, which is acting as a tailwind for the British pound.

On the other end, the weaker-than-expected US housing prices and consumer confidence data on Tuesday, coupled with the downbeat S&P PMIs released on Monday are increasing concerns about the negative impact on the economy of the Federal Reserve’s radical tightening pace. These latest figures are offering further reasons for the Central Bank to take its foot off the pedal over the coming months.

In this backdrop, the US dollar is losing ground against its main peers, with US Treasury Bonds dropping sharply. The benchmark 10-year yield has plunged from 4.25% earlier on Tuesday to 4.06% at the moment of writing.

GBP/USD expected to drop towards 1.10 later in the year – ING

FX analysts at IONG, however, are skeptical about the pound’s current bullish reaction: “Clearly, 31 October is going to be another massive day for UK financial markets as Sunak/Hunt present their fiscal fix. But backing the dollar as we do, we doubt GBP/USD needs to trade above 1.15 and retain sub 1.10 targets for later in the year.”

Technical levels to watch

-

16:20

Gold Price Forecast: XAU/USD marches firmly towards $1660 on falling US bond yields

- Gold price rises as US Treasury bond yields fall due to market players’ expectations of the Fed slowing the pace of tightening.

- The US housing market continues to deteriorate, while the CB Consumer Confidence missed estimations on inflation concerns.

- Gold Price Forecast: Buyers need to clear $1668, to test the 50-DMA; failure will pave the way towards $1617.

Gold price advances early in the New York session, up by 0.33% courtesy of falling US Treasury yields, while bonds climb amidst the ongoing narrative in the markets that the US Federal Reserve might slow the pace of its rate hikes. All that said, the US Dollar (USD) weakened, a tailwind for the yellow metal. Therefore, XAU/USD is trading at $1655 a troy ounce at the time of writing.

Fallings US T-bond yields weaken the US Dollar, a tailwind for XAU

The sentiment is upbeat, as shown by global equities trading in the green. As previously mentioned, market players are positioning for a possible Fed pivot, while economic data in the US continues to show further deterioration in the country, which, coupled with high inflation and lower bond yields, boosted gold prices.

On Tuesday, US economic data flashed that the housing market, as shown by housing prices cooling down due to higher mortgage rates, which climbed to almost 7%, as the Fed embarked on a tightening cycle trying to tame inflation. Further data revealed by the Conference Board (CB), reported that Consumer Confidence dropped from 107.8 to 102.%, less than estimates of 105.9, decreasing for the second consecutive month, according to the survey.

Lynn Franco, Senior Director of Economic Indicators at The Conference Board, commented that inflation is the primary concern, with gas and food prices serving as the main drivers. She added that “inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers.”

Aside from this, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, edges down by 0.88%, down at 111.00, weighed by falling US Treasury yields, as the 10-year rate slips from 4.230% to 4.089%.

XAU/USD Price Forecast: Technical outlook

XAU/USD remains downward biased, as shown by the daily chart, with price action remaining below the 20, 50, 100, and 200-day Exponential Moving Averages (EMAs). Gold unsuccessfully tested the 20-day EMA in the last seven days at around $1668, with prices falling afterward. So a break above the latter is needed to clear the way towards the 50-day EMA at $1690.63. Otherwise, a retest of the MTD low at $1617.30, ahead of $1600, is on the cards.

-

16:11

USD/JPY drops sharply below 148.00 on USD weakness

- US Dollar tumbles across the board amid lower US yields.

- Japanese yen up versus dollar but holds onto loses against other rivals.

- USD/JPY down more than a hundred pips, no intervention seen.

The USD/JPY is falling on Tuesday on no signs of interventions and driven by a weaker US Dollar across the board. The pair is trading under 148.00 after ending with hours of calm hovering around 148.80.

The pair bottomed at 147.50 and then rebounded modestly, unable to hold above 148.00. Below the daily low, the next support stands at 147.00.

Following the beginning of the American session, the greenback fell sharply. The DXY is falling by 0.90%, and trades under 111.00, at the lowest level in 19 days.

US yields are sharply lower, favoring the downside in USD/JPY. The US 10-year yield stands at 4.08%, down 3.70% for the day; while the 2-year stands at 4.43%, after hitting at 4.40%, the lowest since October 13.

The demand for Treasuries rose despite weaker US data and even amid the improvement in market sentiment. US equity markets are rising after trading in negative ground during the pre-market. The Dow Jones is up by 0.57% at fresh monthly highs, and the Nasdaq gains 1.60%.

The decline in USD/JPY offers some relief to Japanese authorities. On Thursday, the Bank of Japan will have its monetary policy meeting. Also that day, the US will release the first estimate of Q3 GDP growth.

Technical levels

-

15:58

Australian CPI Preview: Forecasts from seven major banks, vindicating the RBA’s dovish approach

Australian Consumer Price Index (CPI) figures are due on Wednesday, October 26 at 00:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers of seven major banks regarding the upcoming inflation data.

The headline inflation is set to accelerate to 7.0% vs. the prior release of 6.1% on an annual basis. If so, headline would be the highest since Q2 1990 and further above the 2-3% target range. Meanwhile, Q3 Trimmed Mean is expected at 5.6% year-on-year vs. 4.9% in Q2. Quarter-on-quarter inflation is expected at 1.5%.

ANZ

“We have lifted our Q3 trimmed mean inflation forecast to 1.6% QoQ (previous forecast: 1.4% QoQ), which represents a modest acceleration from the Q2 pace, but left our headline inflation forecast unchanged at 1.6% QoQ. This would see annual inflation reach 7.0% YoY for headline and 5.6% YoY for trimmed mean in Q3. This would not be inconsistent with the RBA’s current Q4 picks of 7.75% YoY and 6% YoY respectively. An upside surprise would be problematic for the RBA after it slowed the pace of hiking in October, but a 25 bps cash rate hike in November still seems the most likely outcome in this case. It would make a move in December more likely than we currently anticipate though.”

Westpac

“We forecast a 1.1% print, lifting the annual pace from 0.4% to 6.5%. The reason for the step down from 1.8% print in Q2 is the significant state energy rebates, particularly in WA and Victoria. Due to these rebates, utility cost are forecast to fall 10.5% subtracting 0.48% from the September quarter CPI. Without the rebates, our CPI forecast would have been 1.8%. The Trimmed Mean is forecast to lift 1.5% in September, matching the March and June quarters, taking the annual pace to 5.6% YoY from 4.9%, well up from the March 2021 low of 1.1% YoY. Our forecast peak is 5.8% YoY in December 2022.”

ING

“We don’t think the 6.1% inflation reading in Q2 22 was the peak, and look for the inflation rate to increase to 6.4% YoY, following a 1.0% QoQ increase. The Reserve Bank of Australia has already stated that it expects inflation to rise further, so this doesn’t necessarily imply any deviation from their recent slower pace of tightening at forthcoming meetings, or for that matter, the outlook for the AUD.”

TDS

“We expect a more dovish headline CPI print at 1.3% due to the significant offset from the rebates and lower pump prices. However, trimmed-mean CPI may stay elevated at 1.6% QoQ as broader price pressures are still brewing, especially in the housing and food categories. Unless trimmed-mean inflation surprises strongly higher, we expect the RBA to stick with 25 bps hikes till March 2023.”

NAB

“We forecast headline of 1.3% QoQ and 6.7% YoY. For the more closely watched core trimmed mean measure, we look for an increase of 1.6% QoQ and 5.7% YoY. For the November RBA meeting, we expect a 25 bps hike, but a shift back to 50 bps cannot be fully discounted if the CPI surprises sufficiently high and broad.”

SocGen

“Headline and core (i.e., trimmed mean) inflation are likely to have risen further in Q322 (1.3% and 1.5%, respectively), which would continue to support the RBA’s rate-hike campaign. Trimmed mean and weighted median inflation may also rise further in YoY terms (5.6% and 4.7%), confirming the broad-based nature of the ongoing rise in inflation. We expect an additional jump in Q4 22 headline inflation, as retail electricity prices should finally rise to reflect the recent energy price increase in Q4.”

Citibank

“Australia’s CPI should see headline and underlying CPI rise by 1.6% over the quarter, implying a yearly reading of 7% and 5.4%, respectively. But the bar for a hawkish surprise for the RBA is high because the Bank already has bullish year-end inflation forecasts for headline and underlying CPI at 7.8% and 6%, respectively.”

-

15:38

The breadth of the USD move will extend its reaches – TDS

The question on most investors' minds is when will the USD peak and what are the catalysts? The USD could reinforce recent gains until the Fed pivots or growth elsewhere bounces back, economists at TD Securities report.

Stagflation risks easing but not out of the woods yet

“Most importantly, a peak in the USD will require a shift in global growth and a pause in Fed terminal rate pricing (we're at 5%).”

“While a Fed shift could stall the rally, a nadir in the global growth outlook is likely a more crucial signal to start leaning against the USD.”

“There are some early signs of stagflation risk peaking, but we think it will take a bit more pain before moving on to a new set of themes.”

“We don't expect Plaza 2.0 to reverse the USD, while sporadic FX intervention, ironically, works in its favor.”

-

15:19

EUR/USD: New unexpectedly bad news needed to keep the channel trending down – SocGen

EUR/USD has been in a very clearly defined downward-sloping channel since February. Unexpected bad news is needed to keep the channel trending down, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

Is the weather going to break EUR/USD out of its downtrend?

“Warm weather is fuelling (relative) optimism about the energy crisis, even if Germany’s IFO data is deep into recessionary territory and the ECB’s Bank Lending survey shows financing conditions getting tougher.”

“If recession is ‘in the price’ maybe a hawkish ECB message, 75 bps rate hike and plans for mid-23 QT won’t come as a surprise, but still could trigger some short-covering in EUR/USD.”

“Some new unexpectedly bad news would be needed to keep the channel trending down.”

-

15:03

US: Consumer Confidence Index declines to 102.5 in October

- Consumer confidence in the US deteriorated in October.

- US Dollar Index trades deep in negative territory below 111.00.

The data published by the Conference Board showed on Tuesday that the Consumer Confidence Index declined to 102.5 in October from 107.8 in September (revised from 108). This reading came in worse than Reuters' estimate of 105.9.

Further details of the publication revealed that the Consumer Present Situation Index fell to 138.9 from 150.2 and the Consumer Expectation Index dropped to 78.1 from 79.5.

Market reaction

The dollar selloff picked up steam with the initial reaction to the disappointing sentiment data and the US Dollar Index was last seen losing 1.1% on the day at 110.78.

-

15:00

United States Richmond Fed Manufacturing Index below expectations (-2) in October: Actual (-10)

-

14:50

AUD/USD to dip back a little further in the near-term – Rabobank

AUD/USD remains at the mercy of the robust greenback. Therefore, economists at Rabobank believe that the aussie could sustain further losses in the short-term.

EUR/AUD could drop below 1.50

“Given our expectation that USD strength is set to persist, we see risk of AUD/USD dipping back a little further in the near-term. However, Australian fundamentals are relatively strongly positioned.”

“We favour the AUD vs. both the EUR and the GBP (despite the likelihood of larger incremental rate hikes from the ECB and the BoE) and see scope for AUD/USD to move back to 0.64 early next year.”

“We see scope for EUR/AUD to drop below 1.50 on a three-month view.”

-

14:47

USD Index: Sellers regain control and drag the dollar to 3-week lows

- The index gathers downside momentum and approaches 111.00.

- The appetite for the risk complex picks up pace and weigh on the USD.

- The CB Consumer Confidence gauge comes next in the docket.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main rivals, accelerates its decline to the vicinity of the 111.00 neighbourhood, or 3-week lows.

USD Index looks to data

The index sinks further and maintains the negative tone for the second consecutive week on the back of the strong improvement in the sentiment surrounding the risk-associated universe.

The knee-jerk in the dollar follows the equally marked pullback in US yields across the curve, where the short end and the belly flirt with multi-day lows.

Data wise in the US, the FHFA House Price Index contracted at a monthly 0.7% in August, while the Consumer Confidence print tracked by the Conference Board will be in the limelight later in the session.

What to look for around USD

The dollar comes under heavy selling pressure and puts the 111.00 zone to the test on turnaround Tuesday.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: FHFA House Price Index, CB Consumer Confidence (Tuesday) – MBA Mortgage Applications, New Home Sales, Building Permits, Advanced Goods Trade Balance (Wednesday) – Flash Q3 GDP Growth Rate, Durable Goods Orders (Thursday) – PCE/Core PCE Price Index, Personal Income/Spending, Pending Home Sales, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is retreating 0.77% at 111.13 and the breach of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13). On the other hand, the next up barrier lines up at 113.88 (monthly high October 13) seconded by 114.76 (2022 high September 28) and then 115.32 (May 2002 high).

-

14:18

EUR/USD: Regaining parity would add to the positive technical tone – Scotiabank

EUR/USD holds gains near key resistance above 0.99. The pair could gain more positive momentum recapturing parity, economists at Scotiabank report.

Ifo highlights recession risk

“Germany’s Ifo survey revealed slightly firmer than expected business confidence in Oct; the index fell only marginally from Sep’s upwardly revised 84.4 to 84.3. Expectations data were also slightly better than forecast (75.6) and up a fraction from Sep’s reading but the combination of a weak current assessment and expectations clearly point to recession risks in Germany.”

“We think gains above 0.9900/10 should allow for a test of major trend (off the Feb high) at 0.9935/40. Regaining 1.00+ would add to the positive technical tone in the near-term.”

“Support is 0.9810/15.”

-

14:18

EUR/USD Price Analysis: A solid resistance emerges at 0.9900

- EUR/USD’s bullish attempt falters ahead of 0.9900 once again.

- The 55-day SMA at 0.9923 offers interim hurdle so far.

The weekly upside in EUR/USD appears to have met quite a solid hurdle around the 0.9900 region so far.

The surpass of this barrier could expose a rapid move to the interim resistance at the 55-day SMA at 0.9923 prior to the 8-month resistance line, today near 0.9940. Beyond the latter, the selling pressure is expected to mitigate.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0522.

EUR/USD daily chart

-

14:12

S&P 500 Index can continue to rally toward 4000 or 4150 – Morgan Stanley

S&P 500 Index enjoyed its best week since the summer highs in June. In the opinion of economists at Morgan Stanley, the rally could be extended well into the 400/4150 area.

The door is left open for a trade higher

“Given the strong technical support just below current levels, the S&P 500 can continue to rally toward 4000 or 4150 in the absence of capitulation from companies on 2023 earnings guidance. Conversely, should interest rates remain sticky at current levels, all bets are off on how far this equity rally can go beyond current prices. As a result, we stay tactically bullish as we enter the meat of what is likely to be a sloppy earnings season.”

“We just don't have the confidence that there will be enough capitulation on 2023 earnings to take 2023 earnings per share forecasts down in the manner that it takes stocks to new lows. Instead, our base case is, that happens in either December when holiday demand fails to materialize or during fourth-quarter earnings season in January and February when companies are forced to discuss their outlooks for 2023 decisively. In the meantime, enjoy the rally.”

-

14:12

Malaysia: Inflation seems to have peaked in August – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest inflation figures in Malaysia.

Key Takeaways

“Headline inflation eased for the first time in six months to 4.5% y/y in Sep, confirming our view that consumer price pressures had tentatively peaked at 4.7% in Aug. The reading came in a tad lower than our estimate and Bloomberg consensus of 4.6%. The faster-than-expected abatement was primarily thanks to lower prices of food, non-subsidized fuels and maintenance & repair of dwelling despite a weaker currency and year-ago low base effects.”

“Owing to base effects, stickier global inflation conditions and heightened currency volatility, we keep the view that Malaysia’s consumer price inflation will likely stay above the 4.0% level for the rest of the year before decelerating towards the 2.0% level by 4Q23. Hence, we maintain our full-year inflation forecast at 3.5% for 2022 (MOF est: 3.3%, 2021: 2.5%) and 2.8% for 2023 (MOF est: 2.8%-3.3%), barring any changes in domestic policy particularly the fuel and electricity subsidies as well as ceiling prices for staple food.”

“Given that inflation expectations are anchored to official targets and risks to the domestic growth outlook are tilting to the downside, we believe Bank Negara Malaysia (BNM) will tread more cautiously despite a more aggressive Fed rate hike path. We expect BNM to take an intermittent pause to assess the effect of its cumulative 75bps rate hikes to date, domestic policy outcomes, as well as higher external risks and weaker global outlook. We expect the Overnight Policy Rate (OPR) to be left unchanged at 2.50% at the coming 2-3 Nov meeting, which is the final monetary policy meeting for the year.”

-

14:03

US: Housing Price Index at -0.7% in August vs. -0.3% expected

- House prices in the US continued to decline in August.

- US Dollar Index trades in negative territory below 112.00.

The monthly data published by the US Federal Housing Finance Agency showed on Tuesday that the Housing Price Index fell by 0.7% on a monthly basis in August. This print followed July's decrease of 0.6% and came in lower than the market expectation of -0.3%.

Meanwhile, the S&P/Case-Shiller Home Price Index arrived at 13.1% on a yearly basis in August, compared to analysts' estimate of 14.4%.

Market reaction

With the initial market reaction, the greenback weakened against its rivals with the US Dollar Index losing 0.17% on the day at 111.80.

-

14:00

Belgium Leading Indicator fell from previous -11.8 to -15.5 in October

-

14:00

United States Housing Price Index (MoM) registered at -0.7%, below expectations (-0.3%) in August

-

14:00

United States S&P/Case-Shiller Home Price Indices (YoY) below expectations (14.4%) in August: Actual (13.1%)

-

13:55

United States Redbook Index (YoY): 8.2% (October 21) vs 8%

-

13:45

USD Index Price Analysis: Extra losses look likely below 111.50

- DXY keeps the erratic performance well in place near 112.00.

- The loss of the 111.50 area could trigger a deeper pullback.

DXY fades the optimism seen at the beginning of the week and retreats to the 112.00 neighbourhood, where it now attempts to consolidate.

If the index drops below recent lows near 111.50 (October 24), sellers could then attempt to challenge the October low near the key 110.00 support (October 4,5).

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 8-month support line near 108.30, an area coincident with the 100-day SMA.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 103.86.

DXY daily chart

-

13:32

Saudi Arabia Energy Minister: Current crisis may be the worst energy crisis

Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said on Tuesday that Saudi Arabia is the most secure and reliable oil supplier and argued that the current crisis may be the worst energy crisis, as reported by Reuters.

Additional takeaways

"We are engaged with many European governments regarding the current crisis."

"Last year Saudi Aramco was supplying Europe with 490,000 barrels, this September it was 950,000 barrels."

"It’s not about recession, it's about how severe the recession might be."

"People are depleting their emergency stock and using it as a mechanism to manipulate the market when its purpose was to mitigate shortages of supply."

"Using emergency stocks may become painful in the months to come."

Market reaction

Crude oil prices continue to decline on Tuesday and the barrel of West Texas Intermediate was last seen trading at $83.65, where it was down 1.4% on a daily basis.

-

13:09

Gold Price Forecast: XAU/USD could soar when end to aggressive rate hikes comes into view – Commerzbank

Gold price has recently settled down at just below $1,650. The yellow metal remains under pressure due to rate hike outlook, strategists at Commerzbank report.

Investors are still giving gold the cold shoulder

“There have been some indications of late that the pace of rate hikes could slow following the 75 bps step that is anticipated next week. This drove gold up to $1,670. This can be interpreted as a sign that gold will have substantial upside potential just as soon as an end to the aggressive rate increases comes into view. This is not the case as yet, however, which is why most of the price gains were reversed again.”

“Investors are still giving gold the cold shoulder, thereby generating persistent headwind. Speculative financial investors significantly expanded their net short positions in the last reporting week, i.e. the majority are continuing to bet on a falling gold price. ETF investors sold sizeable holdings again last week. Here too, only signs of an end to the aggressive rate hikes are likely to trigger a shift in sentiment.”

-

13:00

Brazil Mid-month Inflation above expectations (0.05%) in October: Actual (0.16%)

-

12:40

ECB: A 75 bps hike will not be a game-changer for EUR/USD – ING

Economists at ING expect the European Central Bank (ECB) to hike by 75 bps at the October meeting. Nonetheless, the hike should fail to offer substantial and long-lasting support to the euro, according to economists at ING.

Hawks can’t lend their wings to the euro

“We see limited upside risks for EUR/USD in the aftermath of the ECB announcement. This is mainly due to the weakened correlation between short-term rates and currency dynamics in the eurozone. This means that additional tightening being priced into the EUR curve on the back of a hawkish statement still looks unlikely to offer a sizeable, and above all, sustainable support to the euro.”

“In line with our expectations of a stronger dollar, as the Fed keeps tightening policy and keeps risk sentiment weak into the new year, we expect a drop below 0.9500 in EUR/USD by the end of this quarter.”

-

12:29

Reuters Poll: 18 of 30 economists expect BoE to hike by 75 bps on November 3

18 of 30 economists surveyed by Reuters said that they expect the Bank of England (BoE) to hike its policy rate by 75 basis points at the next policy meeting on November 3. The remaining 12 economists expect a bigger rate increase.

The BoE is projected to reach the upper limit of its policy rate at 4.25% in the first quarter of 2023, the same as the September 30 poll, Reuters further noted.

Market reaction

Thie headline failed to trigger a noticeable market reaction. As of writing, the GBP/USD pair was up 0.43% on the day at 1.1323.

-

12:20

USD/IDR faces a robust hurdle at 15,900 – UOB

The ongoing upside momentum is expected to keep the bullish bias around USD/IDR unchanged, according to Markets Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We highlighted last Monday that ‘USD/IDR is still strong and further advance to 15,580 would not be surprising’. We added, ‘For this week, a break of the next resistance at 15,750 appears unlikely’. Our view for USD/IDR to strengthen was not wrong as it rose to a high of 15,633.”

“While overbought, further USD/IDR strength appears likely and a break of 15,750 would not be surprising. For this week, the next major resistance at 15,900 is unlikely to come into the picture. Support is at 15,500, followed by 15,400.”

-

12:13

EUR/JPY Price Analysis: Looks consolidative ahead of potential extra gains

- EUR/JPY keeps the erratic activity around the 147.00 area.

- Immediately to the upside comes the 2022 peak at 148.40.

EUR/JPY corrects lower after climbing to the 147.40 region earlier on the session on Tuesday.

Considering the current price action in the cross, the door still looks open to extra upside. That said, the immediate target now emerges at the 2022 high at 148.40 (October 21) prior to the December 2014 top at 149.78 (December 8).

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 137.00.

EUR/JPY daily chart

-

12:11

USD/JPY could reach 160 if US 10Y yields rise to 5% – SocGen

The yen is steadier after Friday’s fireworks. When will it be a buy? Kit Juckes, Chief Global FX Strategist at Société Générale, analyzes the USD/JPY pair.

US yields could get USD/JPY under 140

“If Bank of Japan Governor Kuroda were to spring a surprise u-turn on BOJ policy, that would have a major impact on the currency, but I can’t see it.

“On the basis of the move this year, a 5% 10-year Note would get USD/JPY above 160. A 3.5% 10-year Note yields might get USD/JPY under 140. We’re not yet at the point where the latter is on the horizon.”

-

12:00

USD/MYR: A sustained move above 4.7500 looks unlikely – UOB

USD/MYR faces prospects for extra gains, although a convincing breakout of 4.7500 appears not favoured for the time being, notes Markets Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We expected USD/MYR to strengthen last week but we were of the view that ‘4.7500 is unlikely to come into view’.” Our view was wrong as USD/MYR rose to a high of 4.7370 before closing at 4.7360. Not surprisingly, conditions are overbought.”

“However, as long as 4.7000 is not breached (minor support is at 4.7150), USD/MYR could rise above 4.7500 this week. In view of the overbought conditions, USD/MYR is unlikely to be able to maintain a foothold above this level. Looking ahead, the next resistance above 4.7500 is at 4.7650”.

-

11:58

UK PM Sunak: Won't leave next generation with debt to settle

New British Prime Minister, Rishi Sunak, said on Tuesday that they are currently facing a profound economic crisis and added that he will place economic stability at the heart of government agencies, as reported by Reuters.

Additional takeaways

"I understand I have to restore trust."

"There will be difficult decisions."

"Will bring compassion to challenges we face."

"Won't leave next generation with debt to settle."

"We will have professionalism and accountability at every level."

"Will deliver 2019 mandate."

"Will build an economy that makes most of the Brexit opportunities."

"Ukraine war must be seen successfully to its conclusion."

Market reaction

The British pound showed no immediate reaction to these comments and was last seen gaining 0.45% on the day at 1.1325.

-

11:50

USD could gain around a further 4% over the next three to six months – Wells Fargo

Economists at Wells Fargo expect to see further gains in the greenback, anticipating a peak in Q1-2023.

US dollar has yet to reach its cyclical peak

“Our view remains for further gains in the trade-weighted US dollar, with a forecast cyclical peak in the greenback expected in Q1 2023.”

“Relative US economic resilience and ongoing Fed rate hikes, combined with unsettled global markets, are factors that should see the trade-weighted dollar gain around a further 4% over the next three to six months.”

“With US policy rates likely to remain elevated even in the face of US recession, we forecast only a modest softening in the greenback as 2023 progresses.”

-

11:21

EUR/USD: The hurdle for a return towards the low nearer 0.9550 is high – SocGen

EUR/USD advanced for a fourth day on Monday. If bad news is ‘in the price’, the pair is unlikely to slip back to the 0.9550 low, economists at Société Générale report.

The 0.9950 area is significant resistance

“The bad news is priced in and so the hurdle for a return towards the low nearer 0.9550 is high even with the German economy flirting with recession.”

“The 0.9950 area is significant resistance for those targeting a test of parity.”

See – EUR/USD: There will likely be a deadlock for now – Commerzbank

-

11:06

S&P Global Ratings: Australian budget won't greatly add to inflationary pressures

Following the release of the Australian Federal Budget, S&P Global Ratings was quick to offer its review on the same.

Key takeaways

“The budget won't greatly add to inflationary pressures.“

“High commodity prices delivering large windfall in Australia budget.”

“Improved fiscal outcomes underpins sovereign rating for Australia.“

“Sharp correction in commodity prices could reverse recent gains in Australia's external accounts and, along with rising interest costs, could present downside to the AAA rating.”

Market reaction

AUD/USD is keeping its range just above 0.6300 on the above headlines. The spot is trading at 0.6310, almost unchanged on the day.

-

10:53

AUD/USD revisits 0.6300 support after Australia unveils Labor's first budget