Notícias do Mercado

-

23:27

Currencies. Daily history for Jul 27’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1674 -0,61%

GBP/USD $1,3063 -0,42%

USD/CHF Chf0,96499 +1,55%

USD/JPY Y111,30 +0,17%

EUR/JPY Y129,95 -0,43%

GBP/JPY Y145,411 -0,24%

AUD/USD $0,7963 -0,60%

NZD/USD $0,7483 -0,49%

USD/CAD C$1,25577 +0,98%

-

23:03

Schedule for today, Friday, Jul 28’2017 (GMT0)

01:30 Australia Producer price index, y/y Quarter II 1.3%

01:30 Australia Producer price index, q / q Quarter II 0.5% 0.6%

05:30 France GDP, q/q (Preliminary) Quarter II 0.5% 0.5%

05:30 France GDP, Y/Y (Preliminary) Quarter II 1.1%

06:00 United Kingdom Nationwide house price index July 1.1% -0.2%

06:00 United Kingdom Nationwide house price index, y/y July 3.1% 2.7%

06:45 France CPI, m/m (Preliminary) July 0.0% -0.4%

06:45 France CPI, y/y (Preliminary) July 0.7%

07:00 Switzerland KOF Leading Indicator July 105.5 106

09:00 Eurozone Consumer Confidence (Finally) July -1.3 -1.7

09:00 Eurozone Business climate indicator July 1.15 1.12

09:00 Eurozone Industrial confidence July 4.5 4.3

09:00 Eurozone Economic sentiment index July 111.1 110.8

12:00 Germany CPI, m/m (Preliminary) July 0.2% 0.2%

12:00 Germany CPI, y/y (Preliminary) July 1.6% 1.5%

12:30 Canada GDP (m/m) May 0.2% 0.2%

12:30 U.S. PCE price index, q/q(Preliminary) Quarter II 2.4% 1.2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 2.0% 0.8%

12:30 U.S. GDP, q/q (Preliminary) Quarter II 1.4% 2.6%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) July 95.1 93.1

17:00 U.S. Baker Hughes Oil Rig Count July 764

17:20 U.S. FOMC Member Kashkari Speaks

-

14:53

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1700 (EUR 1.3bln) 1.1735 (355m) 1.1800 (465m)

USDJPY: 111.00 (USD 385m) 111.30 (1.2bln) 111.50 (470m)

GBPUSD: 1.3000(GBP 1bln ) 1.3100 (375m)

EURGBP: 0.8885 (EUR 280m)

AUDUSD: 0.7950 (AUD 250m) 0.7965-75 (750m) 0.8050 (370m)

AUDNZD: 1.0855 (515m)

USDCAD: 1.2475 (USD 275m)

EURSEK: 9.6200 (EUR 270m)

-

13:32

U.S.: Chicago Federal National Activity Index, June 0.13 (forecast 0.35)

-

13:31

U.S.: Durable goods orders ex defense, June 6.7%

-

13:30

U.S.: Durable Goods Orders ex Transportation , June 0.2% (forecast 0.4%)

-

13:30

U.S.: Continuing Jobless Claims, 1964 (forecast 1950)

-

13:30

U.S.: Initial Jobless Claims, 244 (forecast 241)

-

13:30

U.S.: Goods Trade Balance, $ bln., June -63.86 (forecast -65)

-

13:30

U.S.: Durable Goods Orders , June 6.5% (forecast 3%)

-

12:07

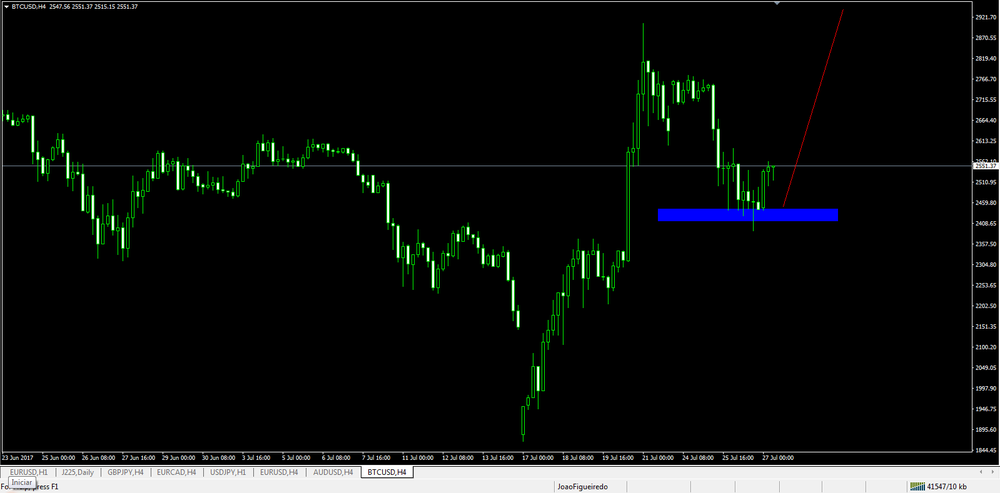

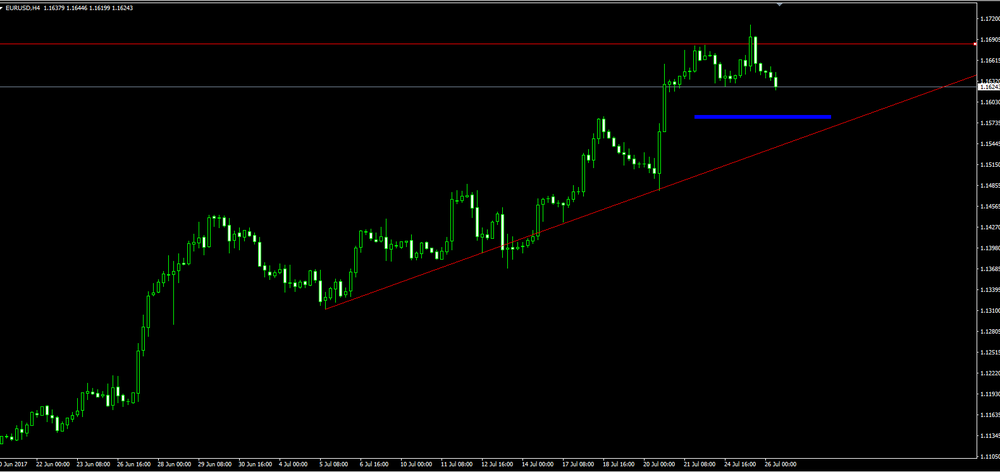

BITCOIN long; EUR/USD long

Bitcoin - Long

Ao longo dos últimos 7 dias observámos uma ligeira correção do bitcoin face ao dólar e sucessiva rejeição de um nível de h4 (retângulo azul) , sensivelmente @2398.85.

Espera-se agora, após a correção, a formação de um novo máximo.

EURUSD - long

EURUSD após ter rompido uma resistência importantíssima a, sensivelmente, @1.115000 tem continua com a sua tendência bullish.

Durante o dia de ontem e antes de saírem noticias por parte do Banco federal americano (FED) o euro estava a corrigir o ultimo grande movimento altista face ao dólar. Assim dessa correção e após a conferencia ter falado, euro atingiu novos máximos.

Esta tendência bullish, até ao momento nada nos indica que é para inverter.

-

11:01

United Kingdom: CBI retail sales volume balance, July 22 (forecast 10)

-

10:03

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1700 (EUR 1.3bln) 1.1735 (355m) 1.1800 (465m)

USDJPY: 111.00 (USD 385m) 111.30 (1.2bln) 111.50 (470m)

GBPUSD: 1.3000(GBP 1bln ) 1.3100 (375m)

EURGBP: 0.8885 (EUR 280m)

AUDUSD: 0.7950 (AUD 250m) 0.7965-75 (750m) 0.8050 (370m)

AUDNZD: 1.0855 (515m)

USDCAD: 1.2475 (USD 275m)

EURSEK: 9.6200 (EUR 270m)

-

09:01

Eurozone: Private Loans, Y/Y, June 2.6% (forecast 2.7%)

-

09:00

Eurozone: M3 money supply, adjusted y/y, June 5% (forecast 5%)

-

07:45

Options levels on thursday, July 27, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1830 (2943)

$1.1798 (1688)

$1.1774 (2084)

Price at time of writing this review: $1.1735

Support levels (open interest**, contracts):

$1.1688 (549)

$1.1662 (1348)

$1.1628 (1153)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 84109 contracts (according to data from July, 26) with the maximum number of contracts with strike price $1,1500 (4840);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3198 (1731)

$1.3172 (3021)

$1.3152 (2244)

Price at time of writing this review: $1.3134

Support levels (open interest**, contracts):

$1.3069 (543)

$1.3045 (498)

$1.3015 (437)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 29385 contracts, with the maximum number of contracts with strike price $1,3100 (3021);

- Overall open interest on the PUT options with the expiration date August, 4 is 28219 contracts, with the maximum number of contracts with strike price $1,2800 (3054);

- The ratio of PUT/CALL was 0.96 versus 0.98 from the previous trading day according to data from July, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:00

Germany: Gfk Consumer Confidence Survey, August 10.8 (forecast 10.6)

-

02:30

Australia: Import Price Index, q/q, Quarter II -0.1% (forecast 0.7%)

-

02:30

Australia: Export Price Index, q/q, Quarter II -5.7% (forecast -6.3%)

-