Notícias do Mercado

-

21:12

The main US stock indexes finished trading in negative territory

Major US stock indices fell significantly on Friday, weighed down by weak earnings reports of blue chip companies, and also due to the fact that a reliable US employment report raised bond yields to multi-year highs to 2.85%. So, employment growth in the US accelerated in January, and wages increased, recording the largest annual profit for more than 8.5 years, confirming expectations that inflation will rise this year, as the labor market will reach full employment. The number of people employed in the non-agricultural sector jumped by 200,000 jobs last month after rising by 160,000 in December, the Ministry of Labor said on Friday. The unemployment rate was unchanged at the 17-year low of 4.1%. Average hourly earnings rose by nine cents, or 0.3%, in January to $ 26.74, after rising 0.4% in December. This increased the annual increase in the average hourly earnings to 2.9%, which is the biggest increase since June 2009 compared to 2.7% in December.

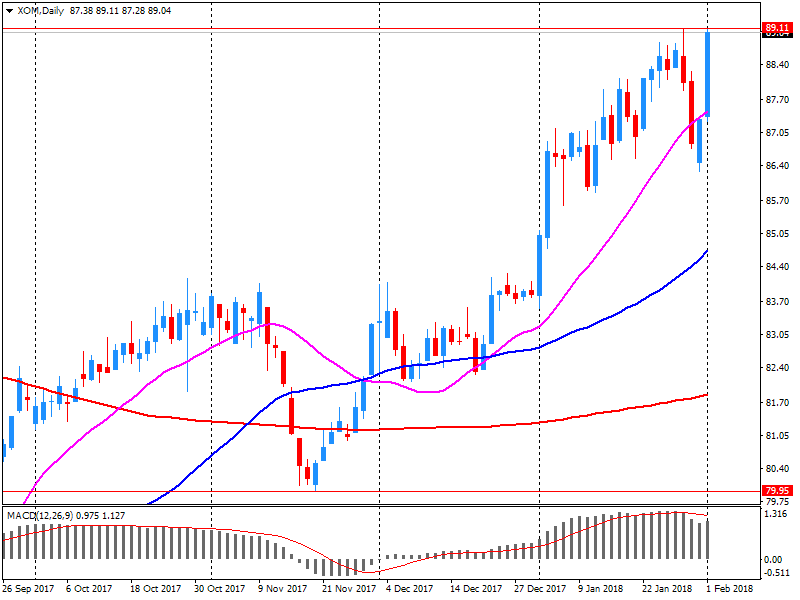

All components of the DOW index finished trading in the red (28 of 30). Outsider were shares of Exxon Mobil Corporation (XOM, -6.12%).

All sectors of the S & P index recorded a decline. The largest drop was shown by the main materials sector (-3.6%).

At closing:

Dow -2.54% 25,520.96 -665.75

Nasdaq -1.96% 7,240.95 -144.92

S & P -2.12% 2.762.13 -59.85

-

20:00

DJIA -2.12% 25,632.45 -554.26 Nasdaq -1.66% 7,263.23 -122.64 S&P -1.94% 2,767.23 -54.75

-

18:03

U.S.: Baker Hughes Oil Rig Count, February 765 (forecast 758)

-

17:00

European stocks closed: FTSE 100 -46.96 7443.43 -0.63% DAX -218.74 12785.16 -1.68% CAC 40 -89.57 5364.98 -1.64%

-

15:29

Sterling falls nearly one percent on day, biggest daily fall since nov 2017

-

15:06

U.S new orders for manufactured durable goods in December increased $7.0 billion or 2.9 percent

New orders for manufactured durable goods in December increased $7.0 billion or 2.9 percent to $249.4 billion, the U.S. Census Bureau announced today. This increase, up four of the last five months, followed a 1.7 percent November increase. Excluding transportation, new orders increased 0.6 percent. Excluding defense, new orders increased 2.2 percent. Transportation equipment, also up four of the last five months,led the increase, $6.0 billion or 7.4 percent to $87.2 billion.

Shipments of manufactured durable goods in December, up seven of the last eight months, increased $1.5 billion or 0.6 percent to $246.8 billion. This followed a 1.3 percent November increase. Fabricated metal products, also up seven of the last eight months, led the increase, $0.5 billion or 1.5 percent to $33.5 billion. -

15:00

U.S.: Factory Orders , December 1.7% (forecast 1.5%)

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, January 95.7 (forecast 95)

-

14:52

ECB's Villeroy says we will monitor impact of exchange rate evolution – which is a source of uncertainty - and be ready to reassess if necessary

-

14:48

U.S. 10-year treasury yield hovers close to near 4-year high, last at 2.788 pct

-

14:33

U.S. Stocks open: Dow -0.79% Nasdaq -0.49%, S&P -0.60%

-

14:26

Before the bell: S&P futures -0.52%, NASDAQ futures -0.23%

U.S. stock-index futures fell on Friday as strong U.S. labour market data bolstered expectations that inflation would push higher and pushed up bond yields further.

Global Stocks:

Nikkei 23,274.53 -211.58 -0.90%

Hang Seng 32,601.78 -40.31 -0.12%

Shanghai 3,462.94 +15.96 +0.46%

S&P/ASX 6,121.40 +31.30 +0.51%

FTSE 7,467.57 -22.82 -0.30%

CAC 5,392.36 -62.19 -1.14%

DAX 12,838.45 -165.45 -1.27%

Crude $65.81 (+0.02%)

Gold $1,342.10 (-0.43%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

245.46

-2.48(-1.00%)

1385

ALCOA INC.

AA

52

-0.42(-0.80%)

615

ALTRIA GROUP INC.

MO

69.71

-0.22(-0.31%)

1450

Amazon.com Inc., NASDAQ

AMZN

1,469.90

79.90(5.75%)

240684

American Express Co

AXP

99.13

-0.87(-0.87%)

1024

Apple Inc.

AAPL

166.84

-0.94(-0.56%)

3185925

AT&T Inc

T

38.88

-0.28(-0.72%)

35001

Barrick Gold Corporation, NYSE

ABX

14.25

-0.17(-1.18%)

20325

Boeing Co

BA

355

-1.94(-0.54%)

23384

Caterpillar Inc

CAT

161.23

-1.01(-0.62%)

6002

Chevron Corp

CVX

122.51

-3.06(-2.44%)

93472

Cisco Systems Inc

CSCO

41.2

-0.50(-1.20%)

52985

Citigroup Inc., NYSE

C

79

0.12(0.15%)

32408

Deere & Company, NYSE

DE

165.65

-2.20(-1.31%)

774

Exxon Mobil Corp

XOM

86.47

-2.60(-2.92%)

156839

Facebook, Inc.

FB

192.05

-1.04(-0.54%)

252649

Ford Motor Co.

F

10.87

-0.05(-0.46%)

70474

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.22

-0.23(-1.18%)

5063

General Electric Co

GE

15.91

-0.11(-0.69%)

448449

General Motors Company, NYSE

GM

42

-0.43(-1.01%)

4145

Goldman Sachs

GS

271.82

-0.41(-0.15%)

10288

Google Inc.

GOOG

1,130.63

-37.07(-3.17%)

28394

Hewlett-Packard Co.

HPQ

22.95

-0.35(-1.50%)

5638

Home Depot Inc

HD

198.9

-1.00(-0.50%)

4696

HONEYWELL INTERNATIONAL INC.

HON

158.9

-0.75(-0.47%)

599

Intel Corp

INTC

47.49

-0.16(-0.34%)

43223

International Business Machines Co...

IBM

161.87

-0.53(-0.33%)

9788

Johnson & Johnson

JNJ

139.05

-0.97(-0.69%)

7610

JPMorgan Chase and Co

JPM

117.23

0.36(0.31%)

7955

McDonald's Corp

MCD

170.65

-1.25(-0.73%)

4092

Merck & Co Inc

MRK

59.75

-0.11(-0.18%)

15754

Microsoft Corp

MSFT

94.05

-0.21(-0.22%)

122233

Nike

NKE

67.13

-0.52(-0.77%)

1710

Pfizer Inc

PFE

36.6

-0.23(-0.62%)

17566

Procter & Gamble Co

PG

85.51

-0.34(-0.40%)

6972

Starbucks Corporation, NASDAQ

SBUX

55.75

-0.25(-0.45%)

10535

Tesla Motors, Inc., NASDAQ

TSLA

347

-2.25(-0.64%)

39279

The Coca-Cola Co

KO

47.19

-0.26(-0.55%)

5896

Travelers Companies Inc

TRV

149.18

-0.82(-0.55%)

1148

Twitter, Inc., NYSE

TWTR

26.87

-0.27(-0.99%)

129609

United Technologies Corp

UTX

136.32

-2.00(-1.45%)

1339

UnitedHealth Group Inc

UNH

233.23

-1.99(-0.85%)

1616

Verizon Communications Inc

VZ

54

-0.30(-0.55%)

2307

Visa

V

123

-2.72(-2.16%)

25377

Wal-Mart Stores Inc

WMT

105

-0.52(-0.49%)

6017

Walt Disney Co

DIS

109.65

-0.84(-0.76%)

6960

Yandex N.V., NASDAQ

YNDX

38.73

-0.68(-1.73%)

3200

-

13:51

Rating reiterations before the market open

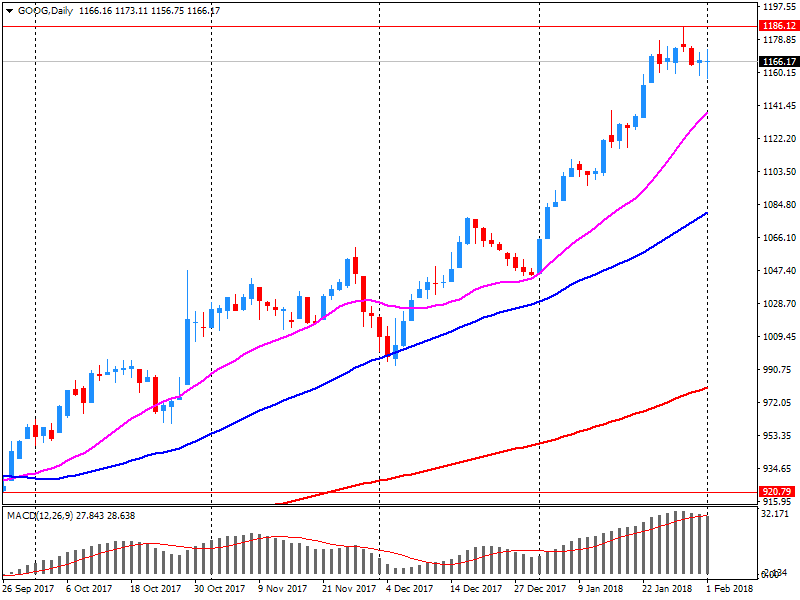

Alphabet A (GOOGL) reiterated with a Buy at Needham; target $1,350

-

13:50

Target price changes before the market open

Alphabet A (GOOGL) target lowered to $1,350 from $1,375 B. Riley FBR; Buy

-

13:49

Downgrades before the market open

Alphabet A (GOOGL) downgraded to Hold from Buy at Stifel; target $1,150

HP (HPQ) downgraded to Neutral from Buy at Mizuho; target $23

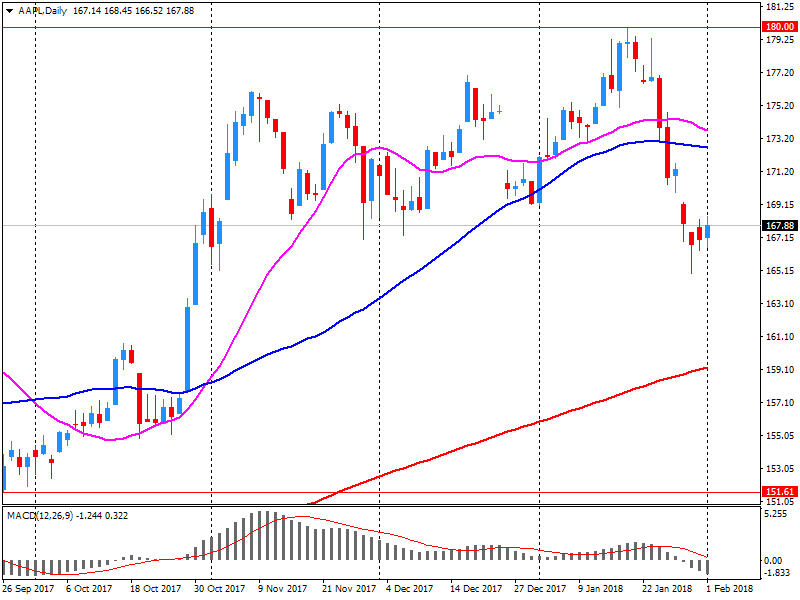

Apple (AAPL) downgraded to Mkt Perform from Outperform at Bernstein

Apple (AAPL) downgraded to Sector Weight from Overweight at KeyBanc Capital Mkts

-

13:49

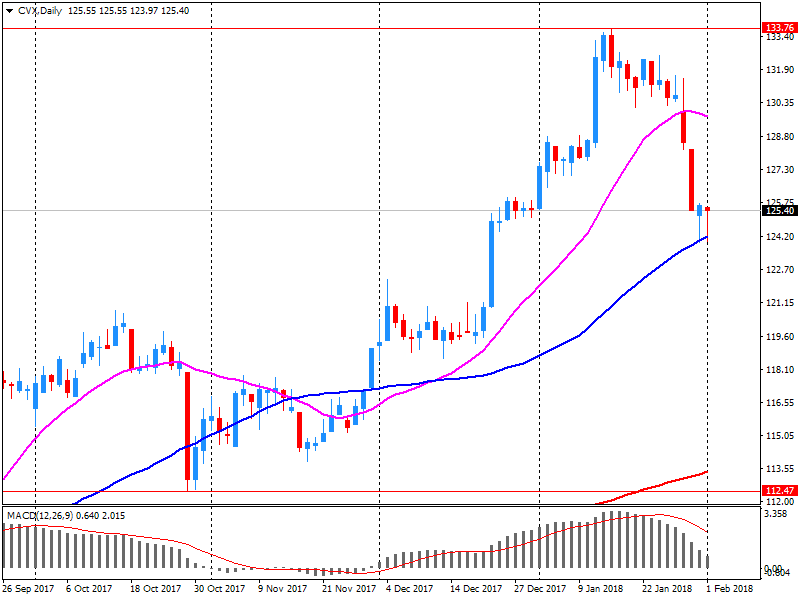

Company News: Chevron (CVX) quarterly revenues miss analysts’ estimates

Chevron (CVX) reported Q4 FY 2017 earnings of $1.64 per share (versus $0.22 in Q4 FY 2016), may not be comparable to the analysts' consensus estimate of $1.24.

The company's quarterly revenues amounted to $37.616 bln (+19.4% y/y), missing analysts' consensus estimate of $38.425 bln.

The company's Board of Directors also approved a $0.04 per share increase in the quarterly dividend to $1.12 per share, payable in March 2018.

CVX fell to $122.12 (-2 75%) in pre-market trading.

-

13:39

U.S average hourly earnings rose 0.3% in January, as expected

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 9 cents to $26.74, following an 11-cent gain in December. Over the year, average hourly earnings have risen by 75 cents, or 2.9 percent. Average hourly earnings of private-sector production and nonsupervisory employees increased by 3 cents to $22.34 in January.

-

13:36

U,S NFP rose more than expected in January

Total nonfarm payroll employment increased by 200,000 in January, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in construction, food services and drinking places, health care, and manufacturing.

In January, the unemployment rate was 4.1 percent for the fourth consecutive month. The number of unemployed persons, at 6.7 million, changed little over the month. -

13:30

U.S.: Private Nonfarm Payrolls, January 196 (forecast 180)

-

13:30

U.S.: Average hourly earnings , January 0.3% (forecast 0.3%)

-

13:30

U.S.: Labor Force Participation Rate, January 62.7% (forecast 62.8%)

-

13:30

U.S.: Nonfarm Payrolls, January 200 (forecast 180)

-

13:30

U.S.: Unemployment Rate, January 4.1% (forecast 4.1%)

-

13:30

U.S.: Average workweek, January 34.3 (forecast 34.5)

-

13:30

U.S.: Manufacturing Payrolls, January 15 (forecast 20)

-

13:30

U.S.: Government Payrolls, January 4

-

13:10

Company News: Exxon Mobil (XOM) quarterly results miss analysts’ estimates

Exxon Mobil (XOM) reported Q4 FY 2017 earnings of $0.88 per share (versus $0.41 in Q4 FY 2016), missing analysts' consensus estimate of $1.03.

The company's quarterly revenues amounted to $66.515 bln (+9.0% y/y), missing analysts' consensus estimate of $74.408 bln.

XOM fell to $86.35 (-3.05%) in pre-market trading.

-

13:02

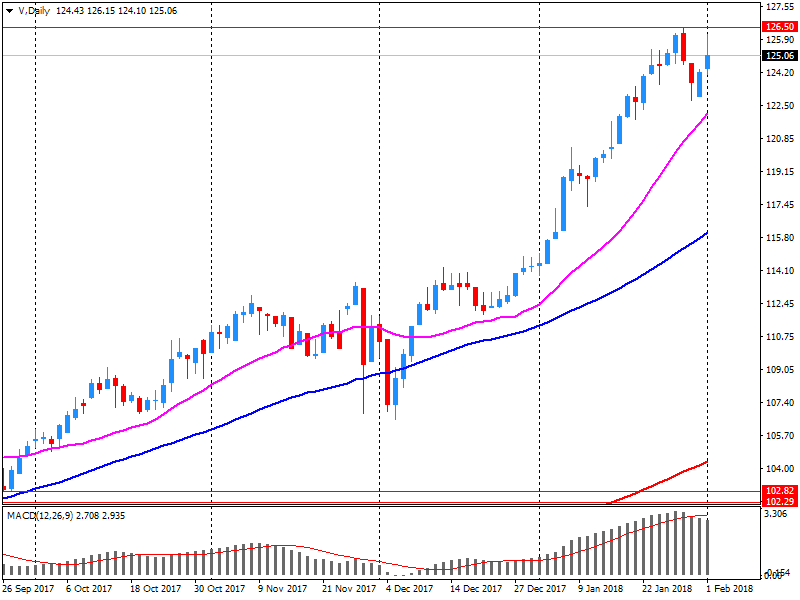

Company News: Visa (V) quarterly earnings beat analysts’ expectations

Visa (V) reported Q1 FY 2018 earnings of $1.08 per share (versus $0.86 in Q1 FY 2017), beating analysts' consensus estimate of $0.98.

The company's quarterly revenues amounted to $4.862 bln (+9.0% y/y), generally in-line with analysts' consensus estimate of $4.824 bln.

V fell to $123.60 (-1.69%) in pre-market trading.

-

13:02

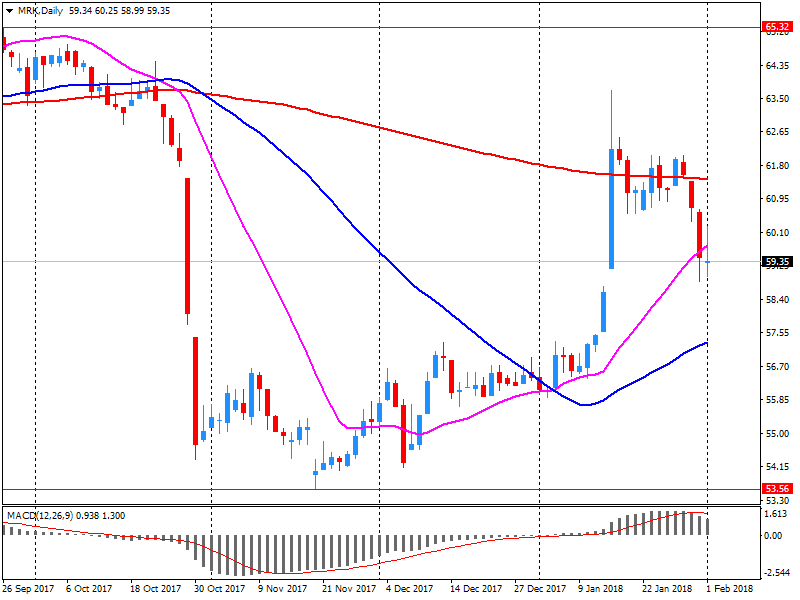

Company News: Merck (MRK) quarterly earnings beat analysts’ estimate

Merck (MRK) reported Q4 FY 2017 earnings of $0.98 per share (versus $0.89 in Q4 FY 2016), beating analysts' consensus estimate of $0.94.

The company's quarterly revenues amounted to $10.433 bln (+3.1% y/y), generally in-line with analysts' consensus estimate of $10.485 bln.

The company also issued guidance for FY 2018, projecting EPS of $4.08-4.23 (versus analysts' consensus estimate of $4.11) and revenues of $41.2-42.7 bln (versus analysts' consensus estimate of $41.1 bln).

MRK rose to $60.00 (+0.23%) in pre-market trading.

-

12:50

Company News: Apple (AAPL) quarterly earnings beat analysts’ estimate

Apple (AAPL) reported Q1 FY 2018 earnings of $3.89 per share (versus $3.36 in Q1 FY 2017), beating analysts' consensus estimate of $3.85.

The company's quarterly revenues amounted to $88.293 bln (+12.7% y/y), generally in-line with analysts' consensus estimate of $87.617 bln.

AAPL rose to $169.25 (+0.88%) in pre-market trading.

-

12:48

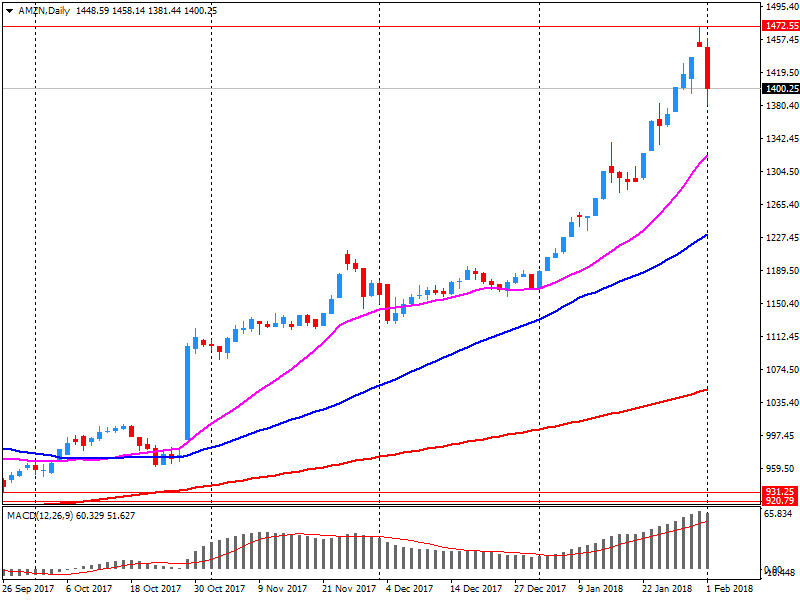

Company News: Amazon (AMZN) quarterly earnings beat analysts’ forecast

Amazon (AMZN) reported Q4 FY 2017 earnings of $2.19 per share (versus $1.54 in Q4 FY 2016), beating analysts' consensus estimate of $1.83.

The company's quarterly revenues amounted to $60.453 bln (+38.2% y/y), generally in-line with analysts' consensus estimate of $59.851 bln.

AMZN rose to $1472.40 (+5.93%) in pre-market trading.

-

12:46

Company News: Alphabet (GOOG) quarterly earnings miss analysts’ estimate

Alphabet (GOOG) reported Q4 FY 2017 earnings of $9.70 per share (versus $9.36 in Q4 FY 2016), missing analysts' consensus estimate of $10.07.

The company's quarterly revenues amounted to $32.323 bln (+24.0% y/y), beating analysts' consensus estimate of $31.879 bln.

GOOG fell to $1,131.00 (-3.14%) in pre-market trading.

-

12:46

Bitcoin extends fall, down 9 pct to two-month low of $7,586 on Bitstamp exchange , down more than 30 pct this week

-

12:43

UK PM May's spokesman says PM has been clear Britain will be leaving customs union, wants trade on a tariff free and frictionless basis with the EU

-

12:40

UK construction companies reported a subdued start to 2018 - Markit

UK construction companies reported a subdued start to 2018, with total industry activity barely rising. A return to contraction in residential building activity was accompanied by near-stagnant commercial and civil engineering activity.

New orders declined, linked by many companies to market uncertainty. On a more positive note, confidence towards future growth prospects improved, with many firms anticipating an increase in new project wins later in the year. Meanwhile, intense cost pressures continued across the UK construction sector.

The seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers' Index posted 50.2 in January, down from 52.2 in December. The figure was just above the neutral 50.0 no-change mark, thereby signalling a fractional rate of growth that was the weakest for four months.

-

12:39

Industrial producer prices rose by 0.2% in the euro area (EA19) and by 0.1% in the EU28

In December 2017, compared with November 2017, industrial producer prices rose by 0.2% in the euro area (EA19) and by 0.1% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In November 2017, prices increased by 0.6% in the euro area and by 0.7% in the EU28. In December 2017, compared with December 2016, industrial producer prices rose by 2.2% in the euro area and by 2.4% in the EU28. The average industrial producer prices for the year 2017, compared with 2016, increased by 3.1% in the euro area and by 3.4% in the EU28.

-

10:24

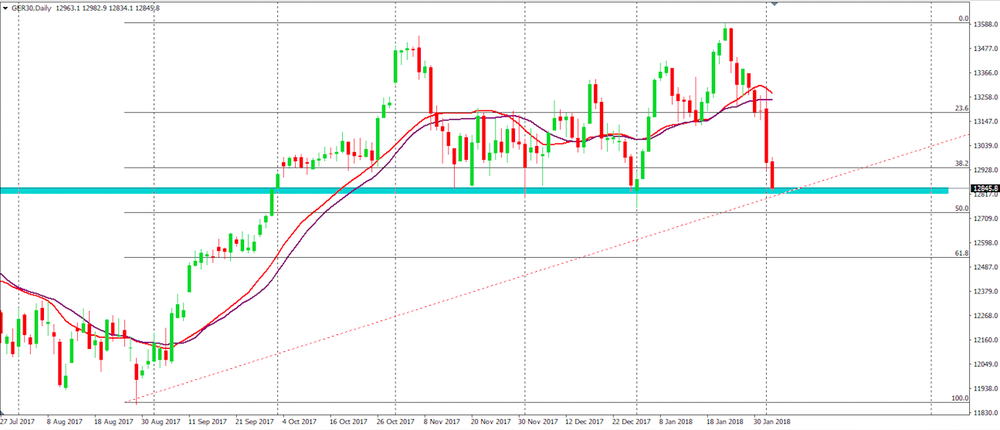

DAX Analysis

DAX has shown some indecision on the last few days.

On daily time frame chart, we can see that the price is stuck in a consolidation zone.

However, at this movement it is close to the bottom of the consolidation (which is a support level).

Therefore, if the price starts to reject more downside movements we can expect a further bullish movement soon.

-

10:00

Eurozone: Producer Price Index (YoY), December 2.2% (forecast 2.3%)

-

10:00

Eurozone: Producer Price Index, MoM , December 0.2% (forecast 0.3%)

-

09:30

United Kingdom: PMI Construction, January 50.2 (forecast 52.8)

-

08:33

The main stock markets in Europe started trading in the red zone: FTSE 7485.75 -4.64 -0.06%, DAX 12952.43 -51.47 -0.40%, CAC 5436.85 -17.70 -0.32%

-

07:37

Options levels on friday, February 2, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2607 (2000)

$1.2583 (2410)

$1.2546 (1654)

Price at time of writing this review: $1.2505

Support levels (open interest**, contracts):

$1.2454 (959)

$1.2422 (1231)

$1.2384 (1030)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 141559 contracts (according to data from February, 1) with the maximum number of contracts with strike price $1,1850 (7036);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4384 (954)

$1.4359 (262)

$1.4325 (748)

Price at time of writing this review: $1.4252

Support levels (open interest**, contracts):

$1.4203 (109)

$1.4147 (216)

$1.4112 (455)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 47199 contracts, with the maximum number of contracts with strike price $1,3600 (3462);

- Overall open interest on the PUT options with the expiration date February, 9 is 43865 contracts, with the maximum number of contracts with strike price $1,3400 (3038);

- The ratio of PUT/CALL was 0.93 versus 0.95 from the previous trading day according to data from February, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:26

Eurostoxx 50 futures up 0.20 pct, DAX futures up 0.03 pct, CAC 40 futures up 0.10 pct, FTSE futures up 0.10 pct

-

06:49

Japan financial regulator says wants cryptocurrency industry to step up self-regulation

-

06:48

10-year U.S. treasury yield at 2.789 percent vs U.S. close of 2.773 percent on thursday

-

06:45

Australian producer price index rose 0.6% in Q4

Final demand (excl. Exports):

Rose 0.6% in the december quarter 2017.

Mainly due to rises in the prices received for petroleum refining and petroleum fuel manufacturing (+11.9%), heavy and civil engineering construction (+0.7%) and building construction (+0.4%).

Partly offset by falls in the prices received for sugar and confectionery manufacturing (-3.9%), tobacco product manufacturing (-3.8%) and sheep, beef cattle and grain farming; and dairy cattle farming (-3.6%).

Rose 1.7% through the year to the december quarter 2017.

Intermediate demand:

Rose 1.2% in the december quarter 2017.

Mainly due to rises in the prices received for electricity, gas and water supply (+2.9%), petroleum refining and petroleum fuel manufacturing (+11.3%) and oil and gas extraction (+14.5%).

Partly offset by falls in the prices received for textile, leather, clothing and footwear manufacturing (-1.5%), motor vehicle and part manufacturing (-1.9%) and sugar and confectionery manufacturing (-7.6%).

Rose 3.1% through the year to the december quarter 2017.

-

06:38

The BoJ lifts purchases of 5 to 10-year JGBs to ¥450 Bln from ¥410 Bln in previous operation @SigmaSquawk

-

06:30

Global Stocks

European stock gauges finished with sizable losses Thursday as February kicked off, falling for a fourth session in a row as global bond yields extended their recent climb. The Stoxx Europe 600 index SXXP, -0.50% dropped 0.5% to end at 393.52, turning negative after a morning gain. It closed at a four-week low, cutting its 2018 gain to 1.1%.

U.S. stock indexes ended mostly lower on Thursday, switching between gains and losses as fears of a pick up in inflation and rising bond yields fostered emerging volatility on Wall Street.

Stock indexes in Japan and South Korea suffered earnings-related hits Friday, with Samsung Electronics falling 3.5% after rival Apple's latest quarterly financial results. Apple AAPL, +0.21% reported a slight drop in iPhone sales in the three months through December and gave a downbeat revenue forecast for the current quarter.

-

00:30

Australia: Producer price index, y/y, Quarter IV 1.7% (forecast 1.2%)

-

00:30

Australia: Producer price index, q / q, Quarter IV 0.6% (forecast 0.2%)

-