Notícias do Mercado

-

23:52

Gold Price Forecast: XAU/USD struggles to cross $1,700, upside seems favored ahead of US NFP

- Gold price is facing less-confident hurdles around $1,700.00 after a vertical rally.

- Downbeat performance from US ISM Manufacturing data has weakened the DXY.

- Lower consensus for labor cost index data is becoming a concern for the DXY.

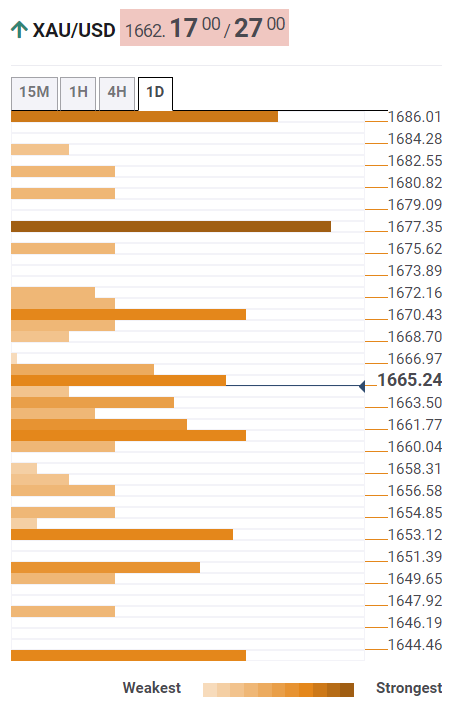

Gold price (XAU/USD) is hovering around the psychological resistance of $1,700.00 in the early Asian session. The precious metal displayed a juggernaut rally after delivering an upside break of the consolidation formed in a range of $1,660.00-1,675.70 in the past three trading sessions and is now facing pressure around $1,700.00. The yellow metal is expected to spend a little time around the critical resistance and will prepare for a further impulsive wave.

Meanwhile, the US dollar index (DXY) has printed a fresh weekly low at 111.47 and is looking to decline further on sluggish economic fundamentals. Weaker US ISM Manufacturing PMI data and lower consensus for US employment data are responsible for corrective action in the DXY. The US ISM Manufacturing PMI declined to 50.9 vs. the expectations of 52.2 and the prior release of 52.8.

This week, the release of the US NFP data will keep the DXY on the tenterhooks. The US NFP is seen lower at 250k vs. the prior release of 315k. While the Unemployment Rate is seen stabilizing at 3.7%. Apart from that, investors will keenly focus on the Average Hourly Earnings data. As price pressures have not shifted significantly to the lower side, the earnings data holds meaningful importance. The labor cost index is seen lower by 10 basis points (bps) to 5.1% on an annual basis.

Gold technical analysis

Gold prices have witnessed a juggernaut rally after an upside break of the Rising Channel chart pattern on an hourly scale. An upside break of the above-mentioned chart pattern plotted from Wednesday’s high at $1,662.80 and Thursday’s low at $1,641.59 displays the sheer confidence of bulls.

A formation of a golden cross, represented by the 50-and 200-period Exponential Moving Averages (EMAs) at $1,656.50 is indicating more upside ahead.

Also, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which advocates the continuation of upside momentum.

Gold hourly chart

-

23:26

USD/CHF Price Analysis: Double bottom in the hourly chart, targets 0.9970s

- The USD/CHF reclaims 0.9900, as a double bottom chart pattern, targets 0.9974.

- Short term, the USD/CHF is neutral-to-downward biased, but it could reach the double bottom target before retracing towards the 20-EMA at 0.9899.

The USD/CHF is slightly down as the Asian Pacific session begins, though in the week it is gaining some 0.49%, after hitting a weekly high in the mid-0.99-1.00 range, due to improvement in sentiment; however, it retraced some to the current spot prices. At the time of writing, the USD/CHF is trading at 0.9922, down 0.01%.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF remains upward biased, though it failed to break above the September monthly high of 0.9966. It should be noted that the major has printed a higher low, but to continue its uptrend, it would need to clear September’s high to open the door for a parity re-test.

Since September 28, the USD/CHF bottomed around the 0.9740 area, forming a double bottom chart pattern. During Monday’s session, the USD/CHF decisively cleared the September 29 daily high at 0.9855, validating the pattern, which targets a rally towards 0.9974.

Therefore, the USD/CHF first resistance would be the October 3 high at 0.9966. Once cleared, the next resistance would be the double bottom target, at 0.9974, followed by the parity.

USD/CHF Key Technical Levels

-

23:05

EUR/USD gyrates in a 0.9750-0.9850 range as focus shifts to US NFP data

- EUR/USD is going through a tad wider range bound moves in a 100-pips territory ahead of US NFP data.

- A downbeat US ISM Manufacturing PMI data has weakened the DXY.

- Eurozone bulls are awaiting the release of the German Retail Sales data.

The EUR/USD pair is witnessing topsy-turvy moves in a wider range of 0.9750-0.9850 from the past two trading sessions. The asset has turned sideways as investors are preparing for the release of the mega event of US Nonfarm Payrolls (NFP) data this week. The major is displaying a balanced auction profile and is expected to convert into an imbalanced bullish move sooner.

On Monday, the US dollar index (DXY) witnessed an intense sell-off as a pullback move to near 112.50 was capitalized by the market participants as a selling opportunity. The DXY printed a fresh weekly low at 111.47 after the release of downbeat US ISM Manufacturing data.

The economic PMI data declined to 50.9 vs. the expectations of 52.2 and the prior release of 52.8. As interest rates are escalating by the Federal Reserve (Fed), the extent of manufacturing activities is declining. Also, corporate have postponed their expansion plans too. Apart from that, weaker New Orders Index data has also plunged. The economic indicator that reflects forward demand for manufacturing activities slipped to 47.1 against the projections of 49.6 and the former figure of 51.3.

Going forward, the release of the US employment data will be of utmost importance. The US NFP is seen lower at 250k vs. the prior release of 315k. While the Unemployment Rate is seen stabilizing at 3.7%.

On the Eurozone front, the Eurozone Retail Sales data will be of utmost importance. The economic data is expected to decline by 1.7% against a decline of 0.9% reported earlier. In times, when the inflation rate is mounting firmly, a decline in Retail Sales is a cause of worry.

-

22:55

New Zealand NZIER Business Confidence (QoQ) increased to -42% in 3Q from previous -65%

-

22:30

Australia AiG Performance of Mfg Index increased to 50.2 in September from previous 49.3

-

22:28

AUD/USD bulls move in on a key resistance ahead of RBA

- AUD/USD bulls ta,e the lead ahead of the RBA today.

- The US dollar is soft on the back of lower US yields and poor US data.

AUD/USD rallied on Monday on the back of a softer US dollar and yields. The greenback fell within demand while the 10-year yield slipped to test critical support levels on the downside. AUD/USD is trading some 1.8% higher into early Asian markets following a rise from 0.6399 to 0.6522 the high and is recovering slightly from an over 2-year closing low ahead of the main domestic event for the week in the Reserve Bank of Australia interest meeting.

The RBA is expected to raise the cash rate by 50 basis points to combat inflation but the Aussie could come under pressure should there be any dovish hints given that policymakers said last time around that the central bank was looking for opportunities to slow the pace of rate hikes at some point. The latest inflation data showed that consumer prices in Australia eased to 6.8% in August from a record high of 7% in July on a year-to-date basis. The RBA has already hiked the cash rate by an aggregate of 225 basis points to a seven-year high of 2.35%.

Meanwhile, the US dollar was softer by 0.4% and stocks on Wall Street ended sharply higher on Monday. The Dow finished +2.7%, the S&P 500 closed +2.6% and the Nasdaq Composite ended +2.3%. The 10-year Treasury yield fell 14 basis points to 3.66% and at one point dropped by 20 basis points. The 2-year yield declined 9 basis points to 4.12%.

In economic data, ISM manufacturing index data, which provides a gauge for manufacturing activity in the US, came in lower than expected. The ISM reported a figure of 50.9 for September, lower than the forecasted 52.2.

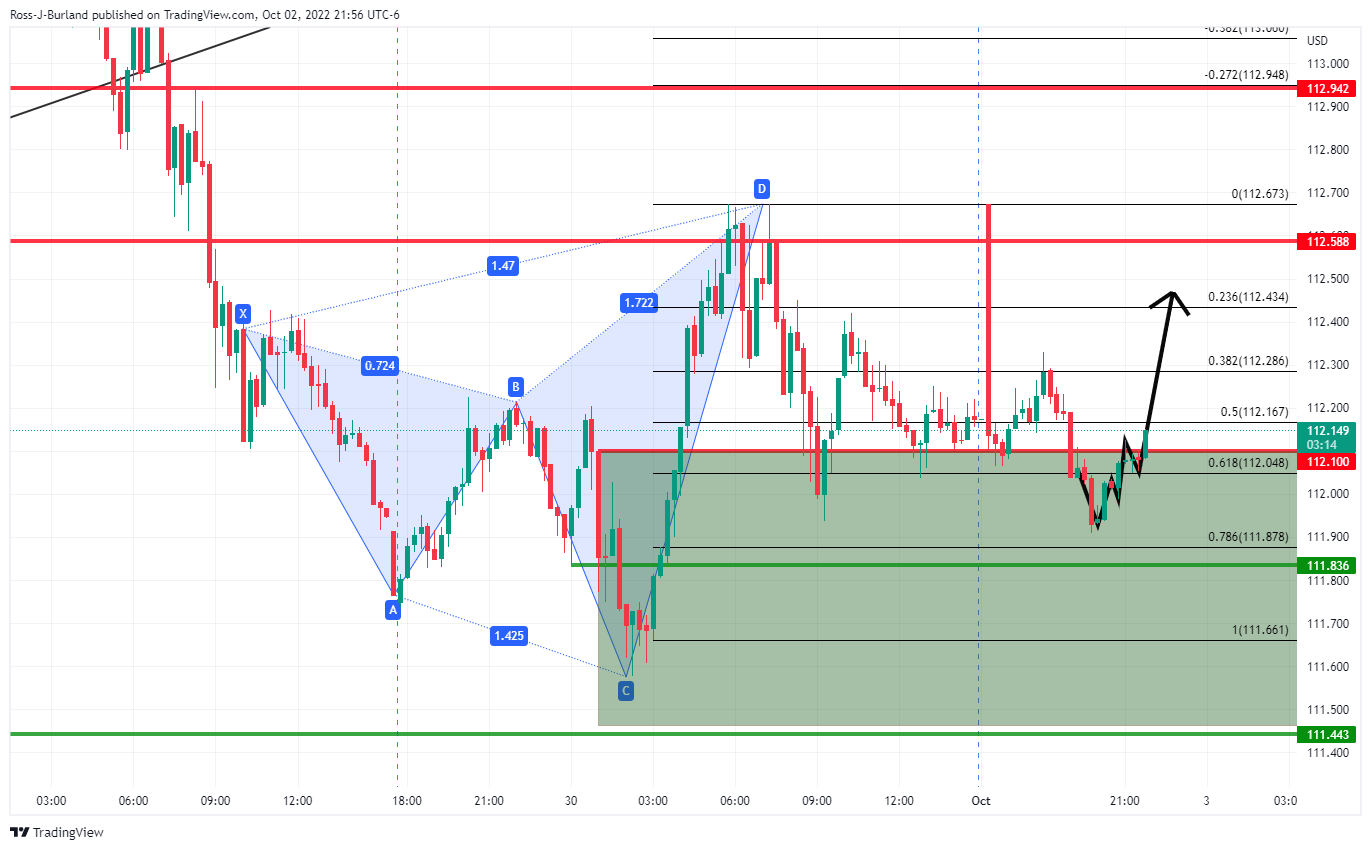

AUD/USD and DXY technical analysis

The dollar is offered to a key support level but the bullish harmonic shark pattern could see the price move in again on the 112 area imminently. This would be the basis for a bearish thesis on AUD/USD that is testing resistance currently:

However, should the bulls get above resistance, there will be a case for a bullish W-formation, as per the daily chart above.

The hourly chart's bullish scenario levels to watch are in red, and bearish in green.

-

22:06

Brazil Trade Balance registered at 3.99B, below expectations (4.75B) in September

-

21:48

NZD/USD reclaims 0.5700 after hitting a weekly low below 0.5600

- NZD/USD is gaining ground, up by more than 2% amid a soft US dollar.

- The US ISM Manufacturing PMI was weaker-than-expected, flashing signs that demand is slowing.

- NZD/USD traders are eyeing the NZIER Report, alongside US Durable Goods, JOLTs Openings, ahead of Friday’s US NFP.

The New Zealand dollar erases trims some of the last Friday’s losses, reclaiming the 0.6700 figure on a risk-on impulse. Measures of US economic activity in the US weakening, and some readings showing that inflation in the manufacturing sector is easing, is perceived by market players as a reason for the Fed to slow its pace of tightening. Hence, the NZD/USD is trading at 0.5720, above its opening price by 2.25%.

On Monday, the NZD/USD began trading around 0.5600 and climbed towards its daily high at 0.5731, late in the European session.

The Institute for Supply Management (ISM) revealed that Manufacturing PMI expanded at its slowest rhythm in two years, with September PMI decelerating to 50.9 from 52.8 in August. In the same report, new orders declined to 47.1 from 51, flashing that demand is softening, while prices retreated for the six-consecutive month.

Elsewhere, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, continued dropping as I type, is losing 0.45%, down at 111.671. Furthermore, US Treasury bond yields moved lower, following the release of weaker-than-expected ISM Manufacturing readings, alongside the U-turn in the UK’s 45% tax cuts budget.

Aside from this, the New Zealand calendar on Monday was absent. Still, it will report the NZIER Quarterly Survey of Business Opinion on Tuesday, which will be revealed at around 21:00 GMT.

What to watch

Nearby New Zealand, the Reserve Bank of Australia (RBA) is expected to hike rates by 50 bps late this Tuesday. On the United States front, the calendar will reveal Durable Good Orders alongside JOLTs Jobs Openings on Tuesday, ahead of September’s Nonfarm Payrolls report, announced on Friday.

NZD/USD Key Technical Levels

-

21:34

Fed's Williams: Fed still has a way to go, cites 4.6% median `23 dot

New York Fed President John C. Williams has been speaking on Monday at the 2022 U.S. Hispanic Chamber of Commerce National Conference.

He said in more recent trade that the Fed still has a way to go, cites 4.6% median `23 dot.

In earlier comments, Williams pointed to three layers of inflation, comparing it to an onion. "The outer layer consist of prices of globally traded commodities such as lumber, steel, grains, and oil."

Prices soared as demand rebounded from the pandemic. Russia's war in Ukraine also added to the pressure, he said.

Market update

Meanwhile, the US dollar was softer by 0.4% and stocks on Wall Street ended sharply higher on Monday. The Dow finished +2.7%, the S&P 500 closed +2.6% and the Nasdaq Composite ended +2.3%.

The 10-year Treasury yield fell 14 basis points to 3.66% and at one point dropped by 20 basis points. The 2-year yield declined 9 basis points to 4.12%.

ISM manufacturing index data, which provides a gauge for manufacturing activity in the US, came in lower than expected. The ISM reported a figure of 50.9 for September, lower than the forecasted 52.2.

-

20:38

Forex Today: Markets start the week with optimism

What you need to take care of on Tuesday, October 4:

The greenback resumed its decline at the beginning of the week, ending Monday with losses across the FX board. The EUR/USD pair was able to post a modest advance and settled around 0.9820, with the shared currency among the worst performers against the USD. Downwardly revised S&P Global Manufacturing PMIs weighed on the EUR.

Financial markets traded with optimism, despite persistent recession concerns. Political and financial turmoil in the United Kingdom keeps triggering volatile market reactions and leading the way. The UK government came up with a potential tax cut of a 45% rate on income, but British Finance Minister Kwasi Kwarteng later said they were dropping the idea. The announcement underpinned GBP/USD, which ended the day near an intraday high of 1.1333. Following UK news, European indexes reverted early losses and settled in the green.

The greenback tried to advance ahead of the US opening, but tepid local data put it back on the bearish path. The ISM Manufacturing PMI contracted to 50.9 in September, barely holding in expansion territory.

Wall Street picked up where European indexes left and posted a substantial advance, further undermining demand for the USD. US Treasury yields retreated, with the yield on the 10-year Treasury note down roughly 15 bps.

The AUD/USD pair regained the 0.6500 threshold ahead of the Reserve Bank of Australia monetary policy decision. USD/CAD settle near its intraday low at around 1.3630.

Finally, the dollar posted uneven advances against its safe-haven rivals, with USD/CHF now trading at 0.9930 and USD/JPY at 144.75.

Gold soared and flirts with $1,700 a troy ounce, while crude oil prices also advanced. WTI is currently trading at around $83.50 a barrel.

Government bond yields were sharply lower but moved off their intraday lows ahead of the close.

Dogecoin’s 4-month long consolidation set to drive investors away unless DOGE reclaims this level

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:34

GBP/USD Price Analysis: Bulls take out key longer term levels, but bears are lurking

- GBP/USD has rallied through critical daily and weekly resistance.

- Bears, however, could be lurking with a focus on 1.1200/60 which guards the risk of a significant cascade of offers below targeting 1.1100 and 1.1020.

GBP/USD is rallying and defying gravity as the US dollar runs into bears with the US yields softening at the start of the week. The following illustrates the current trajectory across the three mentioned assets and the potential for a downside correction in the coming sessions or days in cable.

DXY & US 10-year yields

The 10-year US treasury yield has slumped into a key area of support leaving a bullish harmonic shark pattern on the hourly time frame. The price has subsequently moved up to test an old support area that could act as resistance for the sessions ahead. However, if this area were to break, then that would be supportive of an otherwise softer US dollar and be expected to weigh on cable.

DXY H1:

GBP/USD technical analysis

The weekly and daily charts, above and below respectively, have seen a significant correction along the Fibonacci scales.

The price is attempting to come around in a full circle on the daily chart with the break of the 78.6% ratio. However, the structure on the hourly chart can be monitored in the case of a downside correction as follows:

GBP/USD H1 chart

1.1200/60 guards risk of a significant cascade of offers below targeting 1.1100 and 1.1020.

-

20:04

BoE Mann: UK inflation expectations are not de-anchored

Bank of England policymaker Catherine Mann is crossing the wires.

Key comments

UK inflation expectations are not de-anchored, has some concerns about medium-term upward drift.

More to come...

-

19:36

EUR/GBP extends its losses to four-straight days, below 0.8680

- EUR/GBP is registering weekly losses of more than 1% due to UK’s Chancellor Kwarteng U-Turn in the tax cut program.

- EU and UK’s S&P Global PMIs, paint a gloomy outlook for both economies.

- EUR/GBP is headed to the downside, as the pair extended its losses below last week’s low.

The EUR/GBP extends its losses for the fourth consecutive day, down by more than 1%, as UK’s new government, led by PM Liz Truss, backpedaled a 45% tax cut, improving investors’ sentiment around the globe. Therefore, the EUR/GBP is falling from around daily highs at 0.8830, below the 0.8700 threshold as the North American session progresses. At the time of writing, the EUR/GBP is trading at 0.8675.

Traders’ sentiment improved on Monday. Even though the EU’s energy crisis continues and geopolitical tensions between Russia/Ukraine escalate, was no reason to impede the British pound from appreciating vs. the single currency.

Data-wise, S&P Global PMIs revealed in the Euro area fell to a 27-month low of 48.4 in the previous month, from August’s 49.6, further reinforcing the thesis that the single-currency economy headed into a recession.

Chris Williamson, the chief business economist at S&P Global, said, “The ugly combination of a manufacturing sector in recession and rising inflationary pressures will add further to concerns about the outlook for the eurozone economy.” In a Reuters poll in September, analysts see a 60% chance of a recession in the bloc.

Meanwhile, the UK’s figure for manufacturing activity increased from 47.3 in August to 48.4 in September yet remained in contractionary territory.

Aside from this, UK turmoil abated some following the release of PM Liz Truss’s budget presented on September 23, which announced more than GBP 45 billion in tax cuts, which sent 30-year Gilts bond yield above 5%, spurring a crisis in the UK. Pension funds, unable to meet margin calls, were forced to sell assets to meet additional funding needs, while the Bank of England (BoE) intervened to stabilise the markets.

EUR/GBP Technical Analysis

During the day, the EUR/GBP tumbled below the 20-day EMA, which at 0.8756 opposed less to no resistance, as demand for GBP augmented as the UK’s Finance Minister, Kwasi Kwarteng, reversed the 45% tax cut. It should be noted that the RSI punched below the 50-midline, showing that sellers are gathering momentum. Intraday-wise, the EUR/GBP one-hour chart delineates the cross below the S2 daily pivot at 0.8695 and trading well below the EMAs. Therefore, a break below the September 22 cycle low at 0.8691 could open the door toward 0.8600.

-

19:18

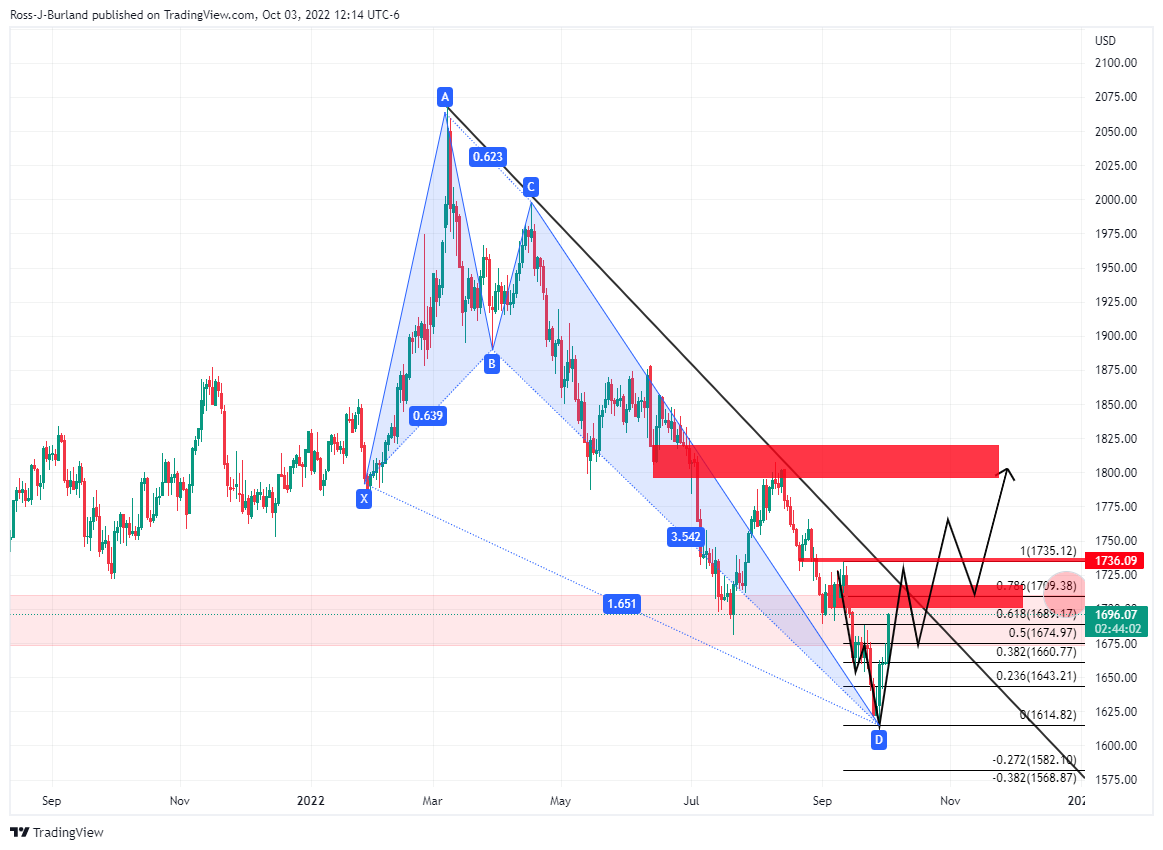

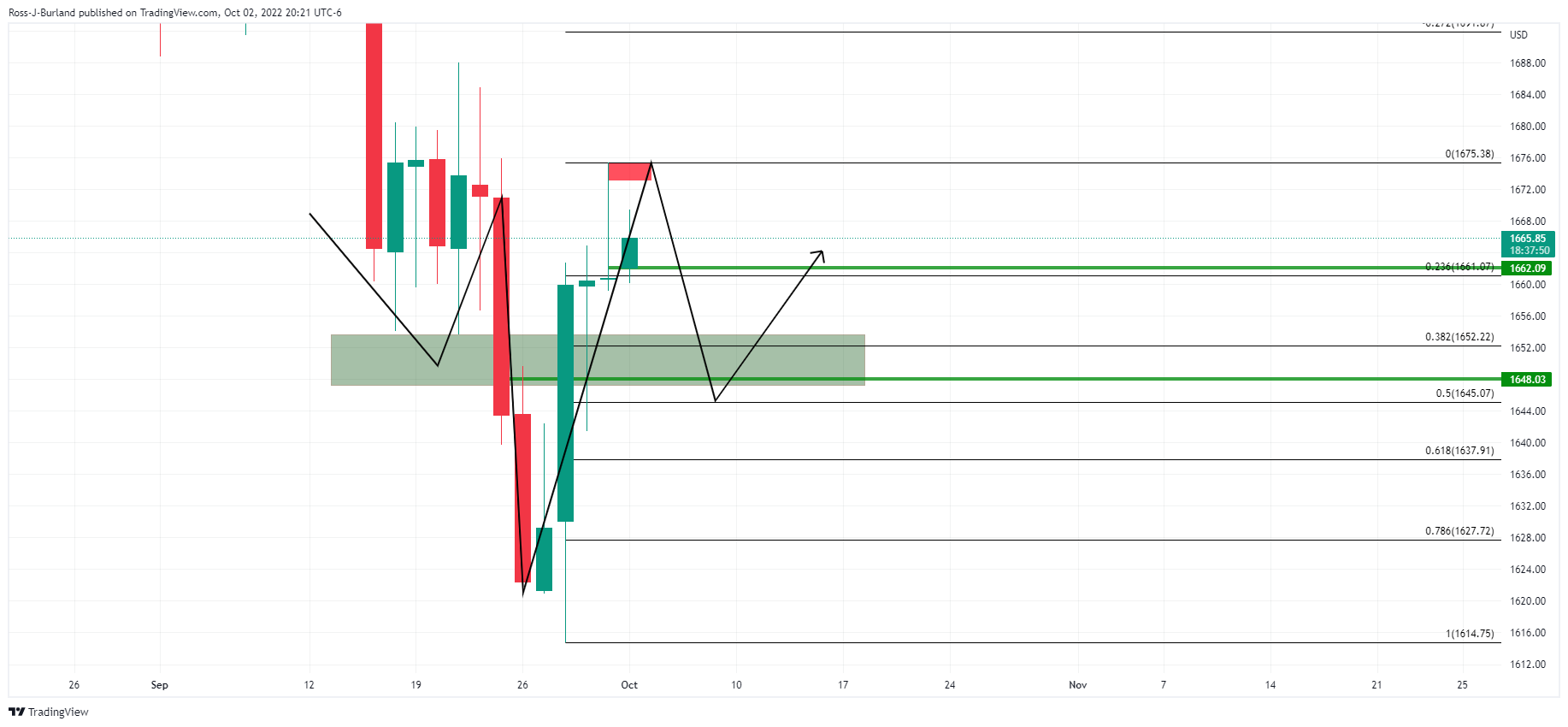

Gold Price Forecast: XAU/USD bulls coming up for air into critical daily structures

- Gold bulls move in on a critical technical area on the daily chart.

- US data sink the US dollar further in a weaker US yield environment.

The gold price exploded in the New York trade around the disappointment in the US data. Gold has travelled between a low of $1,696.26 and $1,697.13 and is higher by some 2.13% on the day. The price is homing in on a 78.6% Fibonacci retracement on the daily chart, as illustrated below having already breached the golden 61.8% ratio in trade today.

US data missed expectations despite a September beat in S&P Global Manufacturing PMI. The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) arrived at 50.9 vs 52.2 expected and the prior 52.5 which was the catalyst for the sell-off in the greenback that was already being weighed by softer US yields. Boosting safe-haven demand for metals, U.S. manufacturing activity grew at its slowest pace in nearly 2-1/2 years in September. In turn, gold shot through resistance triggering stops along the way no doubt, exuberating a move into 270 pips to the highs of the day.

The US dollar has eased, helping demand for the greenback-priced bullion among overseas buyers. DXY, an index that measures the greenback vs. a basket of currencies is now down some 0.2% after falling from a high of 112.543 to a low of 111.470. This softness in the safe-haven currency has afforded gold some respite that has staged a mini-recovery after dropping to its lowest since April 2020 on Sept. 28. The benchmark US 10-year Treasury yields have also fallen and are now making an advance on key support structure:

This is supporting the demand for zero-yield gold.

However, analysts at TD Securities argue that ''gold prices remain in a strengthening downtrend, despite the recent respite afforded by the slump in USD. The risk of capitulation remains prevalent for the yellow metal moving into October, with strong data continuing to point to a more aggressive Fed rate path ahead.''

Gold technical analysis

The daily charts above illustrate the price's trajectory below trendline resistance, on the way to the 78.6% Fibonacci retracement level near $1,710/oz. If resistance holds, then the price would be expected to continue with its southerly trajectory. On the other hand, should the bulls stay committed, then a break of resistance structure could lead to a significant upside continuation as per the bullish harmonic crab pattern:

-

18:25

USD/JPY Price Analysis: Retraces from daily highs around 145.30s, on fears of Japanese intervention

- USD/JPY slightly falls by 0.09% on Monday after hitting a daily high at 145.32.

- The Japanese Finance Minister expressed that Japan is ready to take action to stabilize the exchange rate,

- The short term is neutral-to-downward biased, and if it breaks below 144.00, it will pave the way for a fall to 143.90.G

The USD/JPY dropped after testing the YTD highs at around 145.32 during Monday’s overnight session, though retreated as US T-bond yields, namely the 10-year, collapsed more than 20 bps as sentiment improved. Therefore, the USD/JPY is trading at 144.57, below its opening price by 0.13%.

Given the vocal expression of the Japanese Finance Minister Suzuki saying that Japan is ready to take “decisive” steps in the Forex market aimed to stabilize the yen, put a lid on the major’s rally throughout the Asian-European sessions.

USD/JPY Price Analysis: Technical outlook

Therefore, the USD/JPY daily chart stills show the major advancing steadily, though with less conviction than previously witnessed, when price action rallied towards July’s high at 139.39 and when the pair’s edged up from around 130.00 to 144.99. Oscillators stabilized after the Bank of Japan’s intervention, with the Relative Strength Index (RSI) almost flat around 62.45 in positive territory, suggesting that the exchange rate might consolidate around current price levels

The USD/JPY one-hour scale dictates that the major Is neutral-to-downward biased in the near term. During the day, the USD/JPY tumbled below the 20, 50, and 100-EMAs, opening the door for further losses. Even Monday’s low was shy of clearing the 200-EMA at 144.12, which could have shifted the bias downwards.

Hence, the USD/JPY first support would be the S1 daily pivot at 144.34, which, once cleared, will expose the 200-EMA at 144.12. A breach of the latter will tumble the major towards the S2 daily pivot at 143.97, ahead of the September 28 daily low at 143.90.

USD/JPY Key Technical Levels

-

17:37

USD/CAD drops from 2-year highs toward 1.3650, trimming last Friday’s gains

- USD/CAD plummets more than 1.20% on Monday as sentiment improves.

- Manufacturing activity in the US slowed its pace but remained growing.

- Canada’s S&P Manufacturing PMI improved but stayed below 50, signs of an ongoing economic slowdown blamed on elevated interest rates.

The USD/CAD dropped from around two-year highs at around 1.3837, plunging 200 pips on Monday, as the US dollar weakened across the board, as sentiment shifted positively due to a U-turn of the UK’s budget. Rumors of a slash in global oil production spurred a jump in oil prices, bolstering the oil-linked loonie. At the time of writing, the USD/CAD is trading at 1.3649, down by 1.25%.

European and US equities continue to recover after diving toward the YTD lows. After Wall Street opened, the ISM Manufacturing PMI for September was revealed, showing that activity, even though slowed, remained in expansionary territory, a 50.9, below 52.8 from the previous month. Worth noting that the report showed that New Orders dropped, suggesting that spending is decelerating, while prices paid decreased to 51.7, the lowest reading since June 2020, from 52.5 in August.

On the Canadian side, the S&P Global Manufacturing PMI for September jumped to 49.8, improving compared to the August 48.7 reading. According to the report, new orders decelerated at a faster pace, impacting prices paid by producers. Additionally, high-interest rates and weak economic conditions led clients to refrain from placing orders.

Elsewhere, the US Dollar Index continues to weaken across the board, with the DXY losing 0.27%, at 111.869, a headwind for the USD/CAD. Also, traders need to be aware of crude oil prices, with WTI increasing by 3.13%, at $82.63 per barrel, a tailwind for the Canadian dollar.

What to watch

The Canadian docket will feature the Bank of Governor speech by Tiff Macklem on Thursday, alongside employment figures on Friday. In the United States, the calendar will reveal Durable Good Orders alongside JOLTs Jobs Openings on Tuesday, ahead of September’s Nonfarm Payrolls report, revealed on Friday.

USD/CAD Key Technical Levels

-

17:01

US ISM: Inventories hold the key to understanding what is happening – Wells Fargo

Data released on Monday showed the ISM Manufacturing Index dropped during September more than expected to the lowest level in two years. According to analysts at Wells Fargo, key measures point to slowing activity, but it is inventoried that hold the key to understanding what is happening in the sector today. They argue that “firms are tired of having input prices weigh on profits, but are also leery of procuring hard-to-get supplies. In an effort to mitigate both of these risks, they are making sure someone else is holding the inventories.”

Key Quotes:

“To understand what is happening in the manufacturing sector today it is helpful to consider everything in the context of inventories.”

“Employment dropped 5.5 points to fall back into contraction territory, though with respondent comments still focused on tight labor market conditions, we suspect this remains a supply problem rather than a demand one. Still this was the largest monthly component swing and could signal slower payroll growth or at least less of a boost from manufacturing jobs.”

“Tired of having input prices weigh on profits but also leery of procuring hard-to-get supplies, firms are now trying to mitigate both risks by making sure someone else in their supply chain is holding the inventories. This is clearly stated by a representative from the food & beverage industry said, "It seems no one wants to keep inventory on hand anymore.”

“We expect these supply and inventory dynamics to direct manufacturing activity for some time. To the extent supply issues continue to ease, production held up in September but only modestly so. At 50.6, the production index remained dangerously close to the 50-line distinguishing expansion from contraction. Continued production amid some supply easing has allowed producers to chip away at order backlog and is driving supplier devliery times lower.”

-

16:54

Fed's Barkin: Never count disinflationary forces out

"I don’t want to declare a long-term shift in the prevailing winds when we still don’t know exactly how the pandemic era will play out," Richmond Fed President Thomas Barkin said at an Atlanta Fed technology conference. "Never count disinflationary forces out."

"Over the last 10 years, our inflation and employment goals have not been in conflict while making policy," Barkin explained, as reported by Reuters. "We will need to be crystal clear that a growing economy and maximum employment require stable prices and that we will remain committed to addressing inflationary gusts."

Market reaction

These comments failed to help the greenback find demand and the US Dollar Index was last seen losing 0.42% on the day at 111.70.

-

16:53

EUR/USD rises to test last week's highs amid a weaker dollar

- Us dollar tumbles across the board amid risk appetite, lower US yields.

- US ISM Manufacturing Index below expectations in September.

- EUR/USD holds a bullish tone, in ranges.

The EUR/USD found support above 0.9750 and rose during the American session to 0.9844, hitting a fresh daily high. The pair finally received some impulse from a weak US dollar.

The DXY printed a new weekly low at 111.47 and it is hovering around 111.65. The greenback is falling across the board weakened by several factors, including a recovery in Treasuries. The US 10-year yield bottomed at 3.57%, moving further away from the 4% area it traded just a few days ago. European yields are also lower on Monday.

After a cautious opening, equity prices in Europe finally turned positive. With the DAX ending with a 0.77% gain and the CAC 40 up by 0.55%. In Wall Street, the Nasdaq rises by 1.39% and the Dow Jones climbs by more than 2%. Commodity prices are sharply higher on Monday.

US economic data came in below expectations with the ISM Manufacturing Index at 50.2 in September down from 52.8 in August and below the 52.2 of market consensus. It was the lowest reading in over two years.

The weaker dollar has been unable so far to boost EUR/USD above the 0.9850 area, a critical short-term resistance area. A firm break above would strengthen the recovery of the euro from the multi-year low it hit last week, targeting first 0.9870 and then the resistance area at 0.9910.

A slide below the 0.9750 zone (daily low and 20-Simple Moving Average in 4 hours chart) should weigh on the euro. Support levels are seen at 0.9730 followed by 0.9700 and 0.9670.

Technical levels

-

16:28

UK's Kwarteng: The plan we put forward caused a little turbulence

UK Finance Minister Kwasi Kwarteng acknowledged on Monday that the fiscal they have introduced caused "a little disturbance" in markets, as reported by Reuters.

Additional takeaways

"No more distractions."

"Our growth plan makes sure we focus relentlessly on growth."

"People should keep more of the money they earn."

"We will forge a new economic deal for Britain."

"We will focus relentlessly on economic growth."

"Now I want to focus on delivering the major parts of the growth plan."

"Economic deal will be backed by an iron-clad commitment to fiscal discipline."

Market reaction

GBP/USD preserves its bullish momentum after these comments and it was last seen rising 1.35% on the day at 1.1312.

-

16:19

Silver Price Forecast: XAG/USD climbs more than 1.30%, back above $20.30

- On Monday, silver is climbing solid, courtesy of falling US Treasury bond yields, meaning US bond real yields are down, a tailwind for precious metals.

- The US Dollar is also down by more than 0.50% after US manufacturing activity dropped but remained above recessionary territory.

- Traders are focused on Tuesday’s data ahead of Friday’s US Nonfarm Payrolls report.

Silver price rallies sharply as the fourth quarter begins, amidst a risk-on impulse in the financial markets, due to overnight news that the newest UK government has backpedaled with some tax cuts, easing traders’ fears. Demand for US Treasures jumped, so yields edged lower, meaning higher precious metals prices. At the time of writing, the XAG/USD is trading at $20.35 a troy ounce in the North American session.

US equities portray a positive sentiment across the board. The Institute for Supply Management (ISM) reported that manufacturing activity grew at the slowest pace in 2 and half years in September, dropping to 50.9, below August 52.8, but staying in expansionary territory, negating the “technical recession” in the US, as 2022 Q1 and Q2 GDP showed negative readings. In the same report, New Orders dropped to 47.1 from 51.3, while prices paid edged lower.

The US data began to flash the effects of the Fed’s tightening monetary conditions. Since Fed officials remained with their hawkish rhetoric throughout the last week, market players should expect additional rate hikes by November’s meeting, namely 75 bps.

Meanwhile, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, edges down by 0.57% down at 111.546, while the US 10-year Treasury bond yield collapses 25 bps to the 3.582% threshold, a headwind for the greenback.

Therefore, the fall in US 10-year TIPS yield, a proxy for real yields, is down at 1.45%, after reaching a YTD high at 1.70%, further explaining the appreciation of precious metals.

What to watch

On Tuesday, the US economic docket will feature Durable Goods Orders, alongside JOLTs Jobe Openings, ahead of September’s Nonfarm Payrolls report, revealed on Friday.

Silver (XAG/USD) Key Technical Levels

-

16:06

GBP/USD rises above 1.1300 amid renewed dollar weakness

- UK government's U-turn on tax cuts provided a boost to the British pound on Monday.

- The US Dollar Index turned negative on the day below 112.00.

- The dollar came under renewed selling pressure after ISM PMI data.

Following the sharp upsurge witnessed in the early European morning, the GBP/USD pair stayed in a consolidation phase near 1.1200 before gathering bullish momentum in the American session. The pair was last seen trading at its highest level in 10 days at 1.1310, rising 1.35% on a daily basis.

Reports suggesting that British Prime Minister Liz Truss and Finance Minister Kwasi Kwarteng would reverse a cut to the higher rate income tax caused UK gilt yields to fall sharply and provided a boost to the British pound at the beginning of the week. After Kwarteng confirmed the reports by saying "we are not proceeding with the abolition of the 45p tax rate. We get it, and we have listened," the pair held its ground despite the modest dollar strength.

In the second half of the day, the ISM Manufacturing PMI weighed on the dollar and opened the door for an extended rally in GBP/USD.

Although the headline PMI arrived above 50, the Employment Index fell to 48.7, revealing a contraction in manufacturing sector jobs ahead of the September Nonfarm Payrolls data on Friday. Additionally, the Prices Paid Index fell to 51.7 from 52.5 in August. Softening input inflation and declining employment in the sector caused investors to reassess the Fed's policy outlook with the CME Group FedWatch Tool's probability for a 75 basis points rate hike falling toward 50. Reflecting the broad-based dollar weakness, the US Dollar Index was last seen losing 0.4% on the day at 111.73.

Later in the session, Kansas Fed President Esther George and New York Fed President John Williams will be delivering speeches.

Technical levels to watch for

-

16:01

AUD/USD extends gains, hits fresh daily highs above 0.6500

- US Dollar weakens at the beginning of a busy week.

- AUD/USD rises above 0.6500, next resistance at 0.6530.

- RBA to announce monetary policy decision on Tuesday.

The AUD/USD opened the week under 0.6400 and recently printed fresh daily highs above 0.6500. The pair has been rising constantly since the Asian session and gained momentum on American hours amid a weaker dollar and risk appetite. It peaked at 0.6509 and is still moving with a bullish tone.

Dollar under pressure

The greenback weakened further across the board following the release of US data. The ISM Manufacturing Index dropped more than expected to 50.9 from 52.8. All details of the report showed numbers below market consensus.

US yields hit fresh lows after the ISM. The US 10-year yield that just a week ago was above 4%, is at 3.60%. In Wall Street, stocks are up significantly with the Dow Jones gaining more than 2%. Gold and silver are up sharply at weekly highs.

The combinations of risk appetite and lower yields are helping the AUD/USD but not the AUD/NZD that is falling, currently below 1.1380.

The next critical even for the aussie is the Reserve Bank of Australia (RBA) meeting on Tuesday. Market consensus expects a 50 basis points rate hike. The announcement and the tone of the statement will likely have a significant impact on AUD/USD.

-

15:57

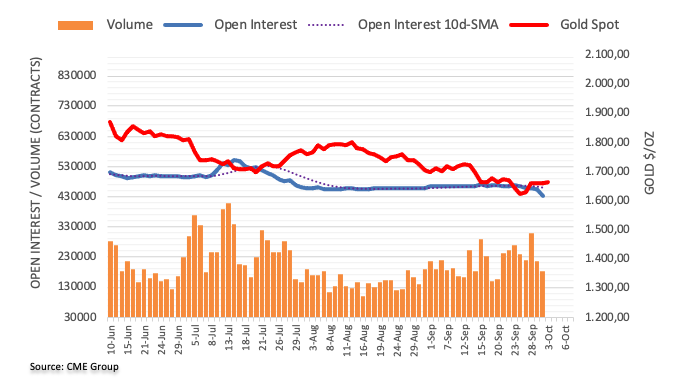

Gold Price Forecast: XAU/USD remains in a strengthening downtrend – TDS

Gold is defending gains amid a broadly weaker US dollar. However, strategists at TD Securities note that the yellow metal stays immersed in a strong downtrend.

The pain trade is still to the downside

“Gold prices remain in a strengthening downtrend, despite the recent respite afforded by the slump in USD.”

“The risk of capitulation remains prevalent for the yellow metal moving into October, with strong data continuing to point to a more aggressive Fed rate path ahead.”

“Considering the increase in inflation's persistence this cycle, a restrictive regime may last longer than historical precedents with the Fed likely to keep rates elevated for some time, even as recession risks rise, which argues for a prolonged period of pronounced weakness in precious metals.”

-

15:48

Gold extends rally to fresh multi-week highs, closes in on $1,700

- Gold rose to its highest level in over two weeks on Monday.

- Falling US T-bond yields, broad dollar weakness fuel XAU/USD's rally.

- ISM Manufacturing PMI's Priced Paid component continued to fall in September.

Gold gathered bullish momentum and climbed above $1,690 for the first time since mid-September. As of writing, XAU/USD was trading at $1,690, where it was up 1.7% on a daily basis.

The sharp decline witnessed in the US Treasury bond yields seems to be fueling gold's rally on the first trading day of the fourth quarter. The benchmark 10-year US T-bond yield was last seen losing 5.5% on the day at 3.6%. Reflecting the negative impact of falling yields' on the dollar's market valuation, the US Dollar Index is down 0.3% on the day below 112.00.

The data published by the ISM showed on Monday that the Manufacturing PMI declined to 50.9 in September from 52.8 in August. This pring fell short of analysts' estimate of 52.2. Additionally, the Prices Paid component of the PMI survey fell to 51.7 from 52.2, pointing to a further easing of input price pressures.

After this report, the probability of one more 75 basis points Fed rate hike in November declined toward 50%, revealing a shift in market positioning ahead of this week's highly-anticipated September jobs report.

Meanwhile, the improving market mood, as reflected by Wall Street's main indexes' impressive gains, is not allowing the dollar to stage a rebound.

Several FOMC policymakers will be delivering speeches later in the session but gold should manage to end the day with strong gains unless there is a decisive rebound in US T-bond yields.

Technical levels to watch for

-

15:43

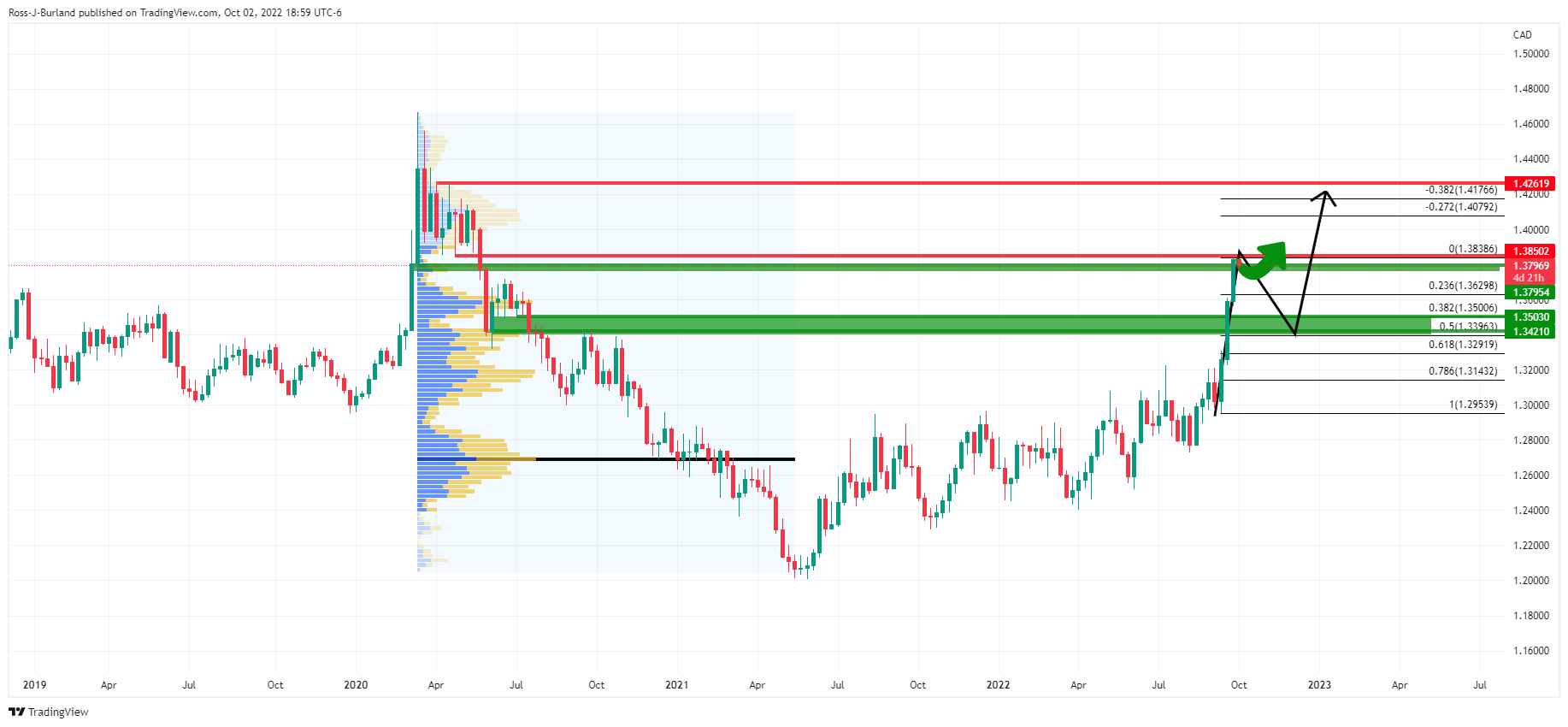

USD/CAD to advance nicely towards 1.4097 – Credit Suisse

USD/CAD’s rise has slowed, and the market has entered a consolidation. Nonetheless, the core uptrend remains intact, and analysts at Credit Suisse continue to look for a move to 1.4097.

Broader uptrend remains strong

“Whilst a minor bearish divergence in daily RSI warns of a potentially lengthier correction, the broader uptrend remains strong and with our bullish USD and bearish Brent Crude Oil views in mind, we continue to look for an eventual resumption of the recent upside.”

“Resistance is seen at the highs from last week at 1.3832/38, which we look to be broken to reassert strength and trigger a move to 1.4097 – the 78.6% retracement of the 2020/21 downtrend.”

“We look for support at the recent price lows at 1.3603/01 and then at the 13-day moving average at 1.3560 to try to hold any sharper move lower to prevent a lengthier downside correction.”

-

15:15

RBA Preview: Forecasts from eight major banks, another 50 bps hike

The Reserve Bank of Australia (RBA) will announce its monetary policy decision on Tuesday, October 4 at GMT 04:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of eight major banks regarding the upcoming central bank's decision.

The RBA is expected to hike rates by 50 basis points to 2.85%, making it the fourth consecutive rate hike of such a degree. Since updated macro forecasts were released at the August 2 meeting, we will not see the next update until the November 1 meeting.

ANZ

“We expect a 50 bps rate hike from the RBA, reflecting strength in recent domestic data, including solid household spending, ongoing inflation momentum and near-record job vacancies. We also expect the RBA to ‘soften’ its message by removing the reference to ‘over the months ahead’ in the context of further rate increases.”

Westpac

“We anticipate that the RBA will lift the cash rate by 50 bps – the fifth consecutive move of 50 bps. That will take the cash rate to 2.85%, a touch on the high side of ‘neutral’. Moves beyond this point are likely to be more measured. Globally and domestically, the inflation outlook is challenging, with risks that inflation expectations ratchet higher. In Australia, headline inflation is expected to climb to over 7% by year-end, the labour market is the tightest in 50 years, and wages growth is accelerating, albeit from modest levels. It is in this environment that the RBA is removing ultra-easy monetary conditions and will shift to a contractionary stance. We anticipate that the cash rate will peak at 3.60% in February 2023 – with further moves of 25 bps at each of the three meetings from November to February.”

Standard Chartered

“We expect the RBA to hike the cash rate by 50 bps to 2.85% from 2.35% previously. We expect the RBA to continue to front-load rate hikes and raise rates into restrictive territory above 3%; we expect the pace of hikes to ease, however, once the policy rate crosses the 3% level.”

ING

“Following some reasonable August labour market data, and stronger-than-expected retail sales figures, recent hints from the RBA that it may soon start to tighten rates at a slower pace are looking a bit less credible right now. With a strong and unified hawkish chorus from US Fed officials, the apparent ruling out by the US White House of a plaza-style currency agreement, and a further sliding of the Australian dollar, the odds are swinging back towards another 50 bps RBA move at the coming meeting.”

TDS

“In the RBA Sep minutes, the Board judged that it may be appropriate 'at some point' to scale back to 25 bps hikes, but we think it is too soon for that. Data on balance is still strong, which suggests the economy is holding up well. Thus, this affords room for the RBA to front-load hikes further as the Governor notes the current cash rate is ‘still probably on the low side’.”

SocGen

“We expect the RBA to increase the cash rate target from 2.35% to 2.85%, which would mark five consecutive 50 bps rate hikes since the initial one back in June. The policy statement will continue to say that the RBA is committed to returning inflation to the 2-3% target range over time while keeping the economy on an even keel and that the size and timing of future interest rate increases will be guided by the data and the outlook by policymakers on inflation and the labour market. The statement will also continue to skip the words ‘normalising monetary conditions’, which we think implies the intention of policymakers to adjust its policy stance to one of outright tightening.”

Citibank

“We do not expect any moderation in the pace of tightening from the RBA in October given the threat of wider rate differentials caused by expectations of a higher peak in global policy rates. Instead, we now expect 50 bps from the RBA this week to take the cash rate to 2.85%. Smaller rate hikes are likely to follow in November and December, when the RBA Board shifts to 25 bps rate hikes, leaving the cash rate target at 3.35% by year-end with a further 25 bps increase in Q1 2023, leaving the terminal rate next year at 3.6% where RBA policy will be firmly restrictive territory.”

Wells Fargo

“We expect the RBA to deliver a 25 bps hike, bringing the Cash Rate to 2.60%. More specifically, after a 25 bps hike at its October meeting, we expect two more 25 bps hikes in November and December, bringing the Cash Rate to 3.10%.”

-

15:13

GBP/USD points to the 1.14 zone so long as 1.12 holds – Scotiabank

Cable gains extended to near 1.13 earlier before losing close to a cent. So long as 1.12 holds, the pair could enjoy further gains to the 1.14 area, economists at Scotiabank report.

GBP does look very cheap from a long-run perspective

“Holding the 1.12 area would be a technical plus and point to further, corrective gains to the 1.14+ zone.”

“The sharp bounce from last week’s extreme low might indicate that the worst is over for the GBP but additional gains on a weekly basis are needed to instill more confidence in the still quite uncertain outlook. The GBP does look very cheap from a long-run perspective, however.”

-

15:04

US: ISM Manufacturing PMI declines to 50.9 in September vs. 52.2 expected

The US ISM Manufacturing PMI declined to 50.9 in September from 52.8 in August, pointing to a loss of momentum in the manufacturing sector's growth. This was the lowest reading in over two years and was weaker than the market expectation of 52.2.

Further details of the publication revealed that the Prices Paid Index declined to 51.7 from 52.5, the Employment Index fell to 48.7 from 54.2 and the New Orders Index slumped to 47.1 from 51.3.

Developing story...

Market reaction

The US Dollar Index came under modest bearish pressure and declined toward 112.00 with the initial reaction to this report.

-

15:01

United States ISM Manufacturing PMI came in at 50.9, below expectations (52.2) in September

-

15:00

United States ISM Manufacturing Prices Paid came in at 51.7, below expectations (51.9) in September

-

15:00

United States Construction Spending (MoM) registered at -0.7%, below expectations (-0.3%) in August

-

15:00

United States ISM Manufacturing Employment Index registered at 48.7, below expectations (52.1) in September

-

15:00

United States ISM Manufacturing New Orders Index registered at 47.1, below expectations (49.6) in September

-

14:54

Gold Price Forecast: XAU/USD hovers around one-week high, just below $1,675 level

- Gold gains some positive traction on Monday and inches back closer to a one-week high.

- A further pullback in the US bond yields turns out to be a key factor benefiting the metal.

- A modest USD strength, the risk-on impulse should keep a lid on any meaningful upside.

Gold attracts some dip-buying near the $1,660 area on Monday and is now looking to build on last week's goodish recovery from its lowest level since April 2020. The XAU/USD sticks to its intraday gains near the $1,670 area through the early North American session and is currently placed just below a one-week high touched on Friday.

The recent pullback in the US Treasury bond yields from a multi-year peak picks up the pace on the first day of a new week after the UK government announced that it will not go ahead with tax cut plans. This, in turn, is seen as a key factor offering some support to the non-yielding gold, though a modest US dollar strength could cap any meaningful upside.

Growing acceptance that the Fed will stick to its aggressive rate hiking cycle to curb stubbornly high inflation continues to act as a tailwind for the greenback. Apart from this, the risk-on impulse - as depicted by the early strong rally in the US equity markets - might further contribute to keeping a lid on the safe-haven precious metal, at least for now.

Investors also seem reluctant and might prefer to move on the sidelines ahead of important US economic data scheduled at the beginning of a new month. A rather busy week kicks off with the release of the ISM Manufacturing PMI on Monday. The focus, however, will remain on the closely-watched US monthly employment details, popularly known as NFP, due on Friday.

The key US labour market report will play a key role in influencing Fed rate hike expectations. This, in turn, will determine the near-term USD price dynamics and provide a fresh directional impetus to gold. In the meantime, traders are likely to take cues from the US bond yields, which, along with the broader risk sentiment, might provide some impetus to the XAU/USD.

Technical levels to watch

-

14:51

US: S&P Global Manufacturing PMI rises to 52 (final) in September vs. 51.8 expected

- US S&P Global Manufacturing PMI edged higher to 52 in September.

- US Dollar Index stays in daily range above 112.00 after the data.

The economic activity in the US manufacturing sector expanded at a slightly stronger pace in September than it did in August with the S&P Global Manufacturing PMI rising to 52.0 from 51.5. This reading came in better than the flash estimate and the market expectation of 51.8.

Commenting on the survey's findings, "with US manufacturers reporting a return to growth of order books for the first time in four months, as well as improved job gains, the September survey brings welcome news that business conditions are starting to improve again," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"However, even with the latest improvement, the weakness of the data in recent months still point to manufacturing acting as a drag on the economy in the third quarter," Williamson added. "Demand will need to revive further if any meaningful positive contribution to GDP is going to be seen in the rest of the year."

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen posting small daily gains at 112.25.

-

14:49

India: RBI raised rates further – UOB

UOB Group’s Head of Research Suan Teck Kin, CFA, reviews the latest interest rate decision by the RBI.

Key Takeaways

“The Reserve Bank of India (RBI) lifted its benchmark repo rate by 50 bps to 5.90% from 5.40% in its Sep monetary policy meeting in a 5-1 decision. The move was in line with majority of Bloomberg survey but exceeded our expectation of 25bps move as RBI focuses on keeping inflation within the target going forward, while supporting growth. This is the third straight 50-bps hike for the RBI, underlining its concerns over the inflation trajectory so far this year.”

“The Monetary Policy Committee (MPC) noted that despite a challenging global environment, domestic aggregate supply conditions are improving, while urban consumption is being lifted by discretionary spending ahead of the festival season and rural demand is gradually improving.”

“The MPC said elevated imported inflation pressures remain an upside risk for the future trajectory of inflation, amplified by the continuing appreciation of the USD. The outlook for crude oil prices is highly uncertain and tethered to geopolitical developments, with attendant concerns relating to both supply and demand. The MPC lowered its forecasts for average crude oil price (Indian basket) to US$100/barrel (from previous forecast of US$105), and kept its inflation forecast of 6.7% in 202223 (which was last raised from previous forecast of 5.7% at the Jun MPC), with 2Q at 7.1%; 3Q at 6.5%; and 4Q at 5.8%, and risks are evenly balanced. CPI inflation for 1Q FY2023-24 is projected at 5.0%.”

“Nevertheless, GDP growth forecast for 2022-23 is trimmed to 7.0% (in line with our projection), from 7.2% (after having downgraded it from 7.8% in Apr). RBI noted headwinds from global forces - protracted geopolitical tensions, rising global financial market volatility, tightening global financial conditions; and global recession risks. The MPC highlighted headwinds from geopolitical tensions, tightening global financial conditions and the slowing external demand pose downside risks to net exports and hence to India’s GDP outlook.”

“With the policy priority on containing inflationary pressures from second-round effects of supply side shocks and anchoring long term inflation expectations, there is still room for RBI’s rate hike cycle. After kicking off with the surprise unscheduled 40bps move on 4 May and the consecutive 50bps hikes in Jun, Aug and Sep MPC, we think that the RBI will hike further to rein in inflation while keeping a close watch on downside risks to growth. In the two remaining MPCs in FY2022-23, we anticipate the RBI raising the repo rate to 6.50% to match the level last seen in Jan 2019, just before RBI entered its accommodative phase.”

-

14:46

United States S&P Global Manufacturing PMI came in at 52, above forecasts (51.8) in September

-

14:43

NZD/USD to break below YTD low at 0.5563 as risk remains seen as lower – Credit Suisse

NZD/USD’s firm decline stalled last week. Nevertheless, economists at Credit Suisse continue to look for a break below the YTD low at 0.5563 to prompt a move to the 2020 low at 0.5468.

Pause seen as temporary

“Though the current pause may continue in the short-term, we continue to see the risk as lower whilst below the recent price highs at .5750/59 and thus, look for a break below the YTD low at 0.5563 to eventually occur. Below here should then reassert the recent weakness and expose the low from 2020 at 0.5468, a close below here would mark a major break lower and provide a platform for further decline to 0.5250.

“Meaningful near-term resistance stays seen at 0.5750/59 and then above at the 13-day exponential average at 0.5771, which ideally holds to avoid a lengthier recovery.”

-

14:43

USD/TRY advances to fresh all-time highs near 18.6000

- USD/TRY gathers extra upside traction near 18.60.

- Türkiye Manufacturing PMI eased to 46.90 during last month.

- Inflation rose to 24-year highs above 83% in September.

The Turkish lira accelerates its depreciation and lifts USD/TRY to a new all-time high past 18.57 on Monday.

USD/TRY stronger post-CPI, looks to USD rally

USD/TRY resumes the upside on Monday after another release of Turkish inflation figures saw the CPI run at the hottest pace since July 1998 at 83.45% YoY, while consumer prices rose 3.08% vs. the previous month. Also weighing on the sentiment, Producer Prices increased at an annualized 151.50% YoY and 4.78% MoM.

Furthermore, higher costs in transportation and food coupled with an important increase in housing prices were behind another uptick in the domestic CPI in September.

Additional releases noted the Manufacturing PMI ticked a tad lower to 46.90 in September (from 47.40).

Extra gains in the pair also come from the better tone in the greenback, which adds to Friday’s advance and keeps the mood in the risk complex subdued.

The lira, therefore, enters its 10th consecutive month with losses and already retreats more than 40% so far this year (vs. 44% in all 2021).

What to look for around TRY

USD/TRY keeps navigating the area of all-time tops near 18.60 amidst the combination of omnipresent lira weakness and the unabated rally in the dollar.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: CPI, Producer Prices, Manufacturing PMI (Monday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.59% at 18.5616 and faces the next hurdle at 18.5737 (all-time high October 3) followed by 19.00 (round level). On the downside, a break below 18.0801 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

14:38

EUR/USD to affirm a sustainable rebound once above 1.0050/1.0200 – SocGen

EUR/USD has tested the lower limit of the channel at 0.9500 resulting in a bounce. But the pair needs to surpass the 1.0050/1.0200 resistance zone to confirm a sustainable rebound, economists at Société Générale, report.

EUR/USD could test 0.9380 on a dip below 0.9500

“The pair has tested the lower limit of the channel at 0.9500 resulting in a bounce. However, it must establish itself beyond the 50-DMA and recent high of 1.0050/1.0200 to affirm a sustainable rebound.”

“In case the decline persists below 0.9500, EUR/USD could test next projections at 0.9380 and 0.9200/0.9150.”

-

14:35

Canada: S&P Global Manufacturing PMI recovers to 49.8 in September vs. 50.6 expected

- Canada S&P Global Manufacturing PMI rebounded modestly in September.

- USD/CAD trades deep in red near 1.3700 after the data.

The business activity in the Canadian manufacturing sector contracted at a modest pace in September with the S&P Global Manufacturing PMI coming in at 49.8. This print followed's August reading of 48.7 but came in lower than the market expectation of 50.6.

Commenting on the data, "the close of the third quarter yielded a mixed bag of results for Canada's manufacturing sector with a back-to-back deterioration in operating conditions recorded during September," said Shreeya Patel, Economist at S&P Global Market Intelligence."

"Output and new orders continued to fall with the sector still feeling the repercussions of material shortages and delivery delays," Patel added. "Demand was once again hit by client hesitancy in the wake of rising interest rates and weak macroeconomic conditions."

Market reaction

USD/CAD stays under bearish pressure after this data and was last seen losing nearly 1% on the day at 1.3695.

-

14:30

Canada S&P Global Manufacturing PMI registered at 49.8, below expectations (50.6) in September

-

14:16

GBP/USD to face stubborn resistance at the 1.1409/1.1500 zone – Credit Suisse

The rollercoaster ride for GBP/USD continues. Economists at Credit Suisse see scope for a deeper but still corrective recovery to 1.1405/09.

Initial support aligns at 1.1195

“Whilst our bias, for now, is to view this strength as a corrective rebound, with resistance from the 13-day exponential average cleared, we see scope for strength to extend further still.”

“Resistance is seen next at 1.1321, ahead of 1.1364 and then what we see as much tougher resistance from the lower end of the 2016/2022 range at 1.1409/1.1500. We look for this to then prove a major barrier and for the broader risk to turn lower again.”

“A close above the 1.1739 September high is needed to suggest we may have seen a more important low.”

“Support is seen at 1.1195 initially, then 1.1085 with a break below 1.1025 needed to ease the immediate upside bias for a fall to test support next at 1.0933/16.”

-

14:12

When is the September US ISM Manufacturing PMI and how could it affect EUR/USD?

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 14:00 GMT this Monday. The index is anticipated to have edged down to 52.2 in September from the 52.8 previous. Among the sub-components of the report, the focus will be on Prices Paid as it reflects business sentiment around future inflation. The index is expected to retreat from 52.5 in August to 51.9 during the reported month. Nevertheless, the data will provide a fresh update on the manufacturing sector activity amid rising borrowing costs and growing worries about a deeper economic downturn.

How could it affect EUR/USD?

Ahead of the key release, a modest US dollar strength keeps the EUR/USD pair depressed below the 0.9800 mark. A stronger headline print will be enough to reaffirm bets for another supersized 75 Fed rate hike move in November. This, in turn, should provide a fresh lift to the US Treasury bond yields and boost the greenback.

Conversely, a softer report will add to recession fears and offer some support to the safe-haven buck. This, along with the risk-off of a further escalation in the Russia-Ukraine conflict, suggests that the path of least resistance for the EUR/USD pair is to the downside and attempted recovery could still be seen as a selling opportunity.

The EUR/USD pair is down for a second consecutive day and overall bearish. The pair is developing below the 38.2% retracement of its latest daily decline at around 0.9790 while still below bearish moving averages in the daily chart. The 20 SMA approaches from above the 50% retracement of the same slide at 0.9865. Additionally, technical indicators remain within negative levels, with the Momentum still grinding higher, but the RSI is flat at around 41.”

Eren Sengezer, Editor at FXStreet, offers a brief technical overview of the EUR/USD pair and writes: “The Relative Strength Index (RSI) indicator on the four-hour chart holds comfortably above 50 on Monday. Additionally, the 20-period SMA crossed above the 50-period SMA, confirming the bullish bias in the near term.”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the upside, the Fibonacci 61.8% retracement of the latest downtrend forms initial resistance at 0.9850 ahead of 0.9875 (100-period SMA). With a four-hour close above the latter, the pair could target 0.9925 (200-period SMA) next.”

“0.9800 (psychological level, Fibonacci 50% retracement) aligns as first support before 0.9750 (Fibonacci 38.2% retracement, 50-period SMA) and 0.9700 (psychological level),” Eren adds further.

Key Notes

• EUR/USD Forecast: Risk-off flows hurting the EUR the most

• EUR/USD Forecast: Euro needs to clear 0.9850 to extend recovery

• EUR/USD remains in a downtrend with levels as low as 0.9200 possible – Credit Suisse

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

-

14:07

Brazil S&P Global Manufacturing PMI registered at 51.1, below expectations (53) in September

-

14:05

RBA expected to hike rates by 25 bps this week – UOB

Economist at UOB Group Lee Sue Ann suggests the RBA could raise the OCR by 25 bps at its meeting on October 4.

Key Quotes

“After having raised rates by 2.25ppts since May, the OCR is now approaching a neutral rate, allowing the RBA to return to smaller moves.”

“We have thus penciled in 25bps hikes for the remaining three meetings in 2022. Our call for shallower rate hikes is also largely due to a slowdown in the economy towards year-end, as the post-lockdown bounce in activity wanes.”

-

14:02

EUR/USD Price Analysis: Further weakness not ruled out near term

- EUR/USD extends the corrective downside to the mid-0.9500s.

- A deeper move could see the 2022 low at 0.9535 revisited.

EUR/USD faces extra selling pressure and breaks below the 0.9800 mark to drop to the 0.9750 region on Monday.

Odds for extra weakness in the European currency remain well in store so far, with the immediate target at the 2022 low at 0.9535 (September 28). The loss of the latter should pave the way for a visit to the round level at 0.9500 prior to the weekly low at 0.9411 (June 17 2002).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0645.

EUR/USD daily chart

-

14:00

Singapore Purchasing Managers Index: 49.9 (September) vs previous 50

-

14:00

S&P 500 Index to stage a sustained move lower towards 3235/3195 – Credit Suisse

S&P 500 has closed at a new low for the year. Analysts at Credit Suisse stay bearish for a conclusive break below the 200-week average for a fall to 3505/3494 and then 3235/3195.

Initial resistance seen at 3646

“With volume rising as the market falls we maintain our core negative outlook and we look for a clear and closing break below the 200-week average, currently at 3589, with support then seen next at the Q1 2020 pre-pandemic high and 50% retracement of the 2020/2021 uptrend at 3505/3494.”

“Our core objective remains the 3235/3195 support cluster, which includes the 38.2% retracement of the uptrend from the 2009 low.”

“Resistance is seen at 3646 initially, with 3671 ideally capping to keep the immediate risk lower. We shall though maintain an immediate tactical negative stance whilst below 3737/58.”

-

13:56

USD/IDR: Risks remain tilted to the upside – UOB

FX Strategist at UOB Group’s Global Economics & Markets Research Quek Ser Leang does not rule out further strength in USD/IDR in the near term.

Key Quotes

“Last Monday (26 Sep, spot at 15,120), we held the view that USD/IDR ‘appears to be on track for further gains’. We indicated, ‘The next resistance is at 15,150 followed by 15,200’. We underestimated USD/IDR strength as it surged to 15,273 last Thursday. Upward momentum remains strong and the risk for USD/IDR is still on the upside.”

“However, in view of the overbought conditions, any advance is unlikely to break clearly above 15,350. The rising trend-line support at 15,150 is a solid support level for this week.”

-

13:44

EUR/GBP drops to over one-week low, bears flirt with 0.8700 mark

- EUR/GBP turns lower for the fifth straight day and drops to over a one-week low on Monday.

- UK government withdraws tax cut plan, which boosts sterling and exerts pressure on the cross.

- Recession fears, modest USD strength weighs on the euro and contributes to the offered tone.

The EUR/GBP cross attracts fresh selling following an early uptick to the 0.8830 region and turns lower for the fifth successive day on Monday. Spot prices drop to over a one-week low during the mid-European session, with bears now awaiting sustained weakness below the 0.8700 round-figure mark.

UK Finance minister Kwasi Kwarteng takes a U-turn on Monday and confirms that his government will not go ahead with a plan to cut the top rate of income tax from 45%. This, in turn, is seen as a key factor behind the British pound's relative outperformance against its European counterpart and exerting downward pressure on the EUR/GBP cross.

The shared currency, on the other hand, is undermined by speculation of a potential recession in the region amid the risk of a further escalation in the Russia-Ukraine conflict. This, along with a modest US dollar strength, weighs on the euro and contributes to the offered tone surrounding the EUR/GBP cross, supporting prospects for further losses.

That said, a bleak outlook for the UK economy might hold back the GBP bulls from placing aggressive bets and lend some support to the EUR/GBP cross, at least for the time being. Nevertheless, spot prices have retreated over 500 pips from a two-year high, around the 0.9235 region touched in September and seem vulnerable to prolonging the descending trend.

Technical levels to watch

-

13:09

EUR/USD to remain glued into the lower half of September’s 0.95-1.02 range – SocGen

The US economy dictates EUR/USD prospects. Therefore, the EUR/USD is unlikely to race higher as the American economy continues to outperform the eurozone, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

It is hard to see the euro staging much of a rally

“The US has been outperforming the eurozone since mid-2021, and that outperformance has been accompanied by a rising dollar. It shows no signs of abating.”

“We’ll see what this afternoon’s US ISM data throws out (the consensus looks for a fall from 53.8 to 52.4), but if the US economy continues to outperform (in both manufacturing and services ISMs, and in the payroll report at the end of the week), then it’s hard to see the euro staging much of a rally.”

“Easier to see it mostly glued into the lower half of September’s EUR/USD 0.95-1.02 range.”

-

13:00

South Africa Total New Vehicle Sales dipped from previous 47420 to 47.786 in September

-

13:00

South Africa Total New Vehicle Sales declined to 48 in September from previous 47420

-

12:59

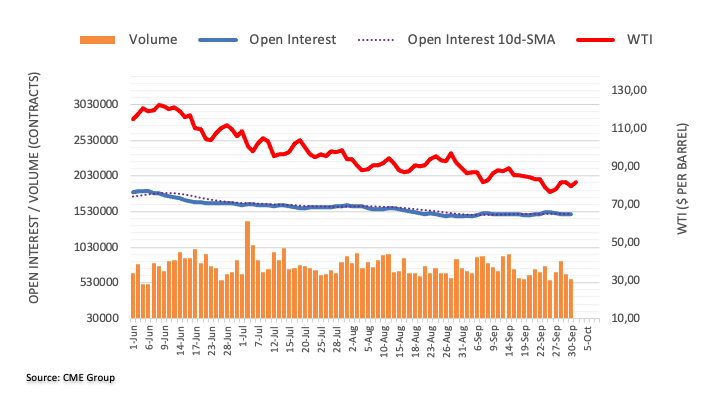

WTI rises to $83 as OPEC+ reportedly discusses in excess of 1 million bpd

Crude oil prices surged higher during the European trading hours on Monday and the barrel of West Texas Intermediate (WTI) was last seen gaining more than 4% on a daily basis at around $83.

Earlier in the day, Reuters reported that the OPEC+ group was discussing a potential output reduction of more than 1 million barrels per day (bpd).

One of the sources told Reuters that the supply cut could be "as significant as the April 2020 meeting," when the group stepped in to rebalance the pandemic-hit oil market.

OPEC+ meeting will take place on Wednesday, October 5.

-

12:43

GBP/USD to give up gains despite UK withdraws cut to higher rate tax – BBH

The GBP/USD pair has traded as high as 1.1280 at the start of a new week. But sterling gains from the reversal on the top tax rate are fleet, according to economists at BBH report.

The bulk of the fiscal plan remains intact

“The elimination of the top income tax rate was reversed but we see limited upside as the bulk of the fiscal plan remains intact.”

“With policymaking credibility in tatters, we look for an eventual test of last week’s new all-time low near 1.0350.”

-

12:31

Chile IMACEC registered at 0% above expectations (-1.2%) in August

-

12:25

US: Hiking into the second recession – Rabobank

With the Atlanta Fed’s GDPNow-cast for Q3 at 2.4% (as of September 30), the US economy may be coming out of the technical recession that started in Q1. But in the view of economists at Rabobank, the Fed’s Volcker-esque hiking cycle and the inverted yield curve point to an NBER-approved recession next year.

The probability of the second recession is 70%

“After the technical recession in the first half of this year, the Fed’s Volcker-esque hiking cycle and the inverted yield curve point to an official recession next year. Both recessions are linked to negative supply shocks, elevated inflation, and the Fed’s policy response.”

“The current inversion of the yield curve indicates that the probability of the second recession is 70%.”

-

12:22

USD Index Price Analysis: Initial support emerges around 111.50

- DXY adds to Friday’s recovery attempt and advances past 112.00.

- Bulls continue to target the 2022 peak near 114.80 near term.

DXY extends the ongoing bull run to the 112.50 zone at the beginning of the week.

The index retreated from recent extreme overbought levels and seems to have met some decent contention near 111.50 so far. If the recovery picks up extra pace the index could see the 2022 high at 114.77 (September 28) revisited in the short-term horizon.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 107.20.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.53.

DXY daily chart

-

12:15

USD/MYR could surpass the 4.6600 area near term – UOB

Further upside remains in the pipeline for USD/MYR, suggests FX Strategist at UOB Group’s Global Economics & Markets Research Quek Ser Leang.

Key Quotes

“We highlighted last Monday (26 Sep, spot at 4.5960) that USD ‘a break of 4.6000 would not be surprising’ and we indicated that ‘The next resistance is at 4.6200, followed by 4.6500’. USD/MYR subsequently soared to a high of 4.6450. While conditions are overbought, there is room for the advance in USD/MYR to extend to 4.6610 before a pullback is likely.”

“On the downside, a breach of the rising trend-line support at 4.6120 (minor support is at 4.6280) would indicate the current upward pressure has subsided.”

-

12:11

EUR/JPY Price Analysis: Next on the upside comes 144.00

- EUR/JPY adds to the recent rebound and surpasses 142.00.

- Further upside could see the 144.00 region revisited.

EUR/JPY maintains the bullish bias and reclaims the area beyond the 142.00 barrier at the beginning of the week.

The continuation of the rebound from last week’s lows remains well in place for the time being. That said, the cross could therefore extend the bullish attempt to the weekly top at 144.04 (September 20), which is deemed as the last defense for a move to the 2022 peak at 145.63 (September 12).

In the meantime, while above the key 200-day SMA at 135.90, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

11:58

Silver Price Analysis: XAG/USD retests descending trend-line hurdle, around mid-$19.00s

- Silver prolongs its upward trajectory and climbs to over a one-week high on Monday.

- Bulls still seem to struggle to make it through a multi-month-old descending trend line.

- Sustained break below the $18.35 area will expose the YTD low touched in September.

Silver builds on last week's bounce from sub-$18.00 levels and gains some follow-through traction for the second successive day on Monday. This also marks the fourth day of a positive move in the previous five and lifts the white metal to over a one-week high, around mid-$19.00s during the early part of the European session.

Bulls, however, still seem to struggle to make it through a downward sloping trend-line extending from May swing high. The said barrier, around the $19.50 region, should now act as a pivotal point, which if cleared decisively will set the stage for additional gains and allow the XAG/USD to aim to reclaim the $20.00 psychological mark.

The latter coincides with the 100-day SMA, above which the XAG/USD could accelerate the move towards the $20.50 intermediate resistance en route to the $21.00 round-figure mark. Some follow-through buying should pave the way for an extension of the momentum towards the next relevant hurdle near the $21.50-$21.55 horizontal zone.

On the flip side, the $19.00 mark could act as immediate support ahead of the $18.85-$18.80 zone and the $18.35 area. Failure to defend the said support levels will shift the bias in favour of bears and make the XAG/USD vulnerable to breaking below the $18.00 mark and test the YTD low, around the $17.55 region touched in September.

Silver daily chart

-638003905734497963.png)

Key levels to watch

-

11:45

GBP/USD: Bulls to dominate the action as long as 1.1130 stays intact

GBP/USD clings to modest daily gains near 1.1200. Bulls are expected to remain interested as long as 1.1130 holds, FXStreet’s Eren Sengezer reports.

Key near-term support aligns at 1.1130

“On the upside, the 100-period SMA forms immediate resistance at 1.1240 ahead of 1.1300 (Fibonacci 61.8% retracement of the latest downtrend). In case buyers managed to flip the latter into support, additional gains toward 1.1450 (200-period SMA) could be witnessed.”

“Supports are located at 1.1130 (Fibonacci 50% retracement), 1.1100 (psychological level) and 1.1000 (Fibonacci 38.2% retracement, 50-period SMA, psychological level).”

-

11:17

USD/BRL: Break above 5.62/66 to open up further gains – SocGen

USD/BRL has successfully defended the bullish gap near 5.01 recently, resulting in a steady bounce. 5.62/5.66 is expected to be an important resistance, economists at Société Générale report.

Risk of deeper pullback on a dip below 5.01

“The pair is now approaching the July high of 5.51 and more importantly heading towards the descending trend line drawn since 2020 at 5.62/5.66. This is expected to be an important resistance; cross above can result in next leg of uptrend.”

“Only if USD/BRL establishes itself below 5.01, there could be a risk of a deeper pullback.”

-

11:10

USD/CHF retakes 0.9900 mark amid modest pickup in USD demand, ahead of US ISM PMI

- USD/CHF turns positive for the second straight day and draws support from a combination of factors.

- Aggressive Fed rate hike bets continue to underpin the USD and remain supportive of the move up.

- A positive risk tone dents demand for the safe-haven CHF and provide an additional lift to the major.

The USD/CHF pair attracts fresh buying near the 0.9830 region on Monday and turns positive for the second successive day. The intraday move up picks up the pace and lifts spot prices back above the 0.9900 mark, or a three-day high during the first half of the European session.

Following an early dip, the US dollar catches fresh bids on the first day of a new week and allows the USD/CHF pair to capitalize on Friday's strong rally of nearly 150 pips from the 0.9730 area. Apart from this, a modest recovery in the global risk sentiment - as depicted by a positive tone around the US equity futures - undermines the safe-haven Swiss franc and provides an additional lift to the major.