Notícias do Mercado

-

23:59

EUR/USD rallies hard as markets bet on tariff pivot

- EUR/USD rose 1.4% on Tuesday, cracking the 1.0600 level.

- Data was of little consequence on Tuesday as markets focus on tariffs.

- ECB rate call in the pipe for Thursday, US NFP jobs data due on Friday.

EUR/USD pinned the gas pedal on Tuesday, surging 1.4% and climbing 140 pips in a single session as markets sell off the US Dollar and bet that US President Donald Trump will find a reason to walk back his own tariff threats. Key data on both the European and US side are due later this week, but trade war rhetoric is ruling the roost for the midweek.

Tariffs, no tariffs

Staying true to form, US President Donald Trump is already seeding a pivot on his own tariff threats. A stiff tariff package of 25% on imported goods from Canada and Mexico went into effect at midnight EST. However, despite a brief spat of risk aversion early in the US session, currency markets quickly recovered their feet and bet big on another tariff policy reversal or delay from the Trump administration. Key personnel in the Trump team, specifically Commerce Secretary Howard Lutnick, admitted to Fox News viewers that a pivot on this week’s tariffs may already be in the works, to be announced by President Trump on Wednesday.

Economic data on the European side is a lean offering during the midweek market session as Fiber traders knuckle down for the one-two punch of the European Central Bank’s (ECB) March rate call on Thursday, as well as the latest iteration of US Nonfarm Payrolls (NFP) jobs figures, slated for Friday. This week’s NFP print will likely draw even more attention than usual as investors start to keep an eye out for any signs of economic weakness as consumers and businesses begin to crack under the weight of continued threats of a global trade war by President Trump.

Wednesday brings US ADP Employment change figures, as well as an ISM Services Purchasing Managers Index (PMI) survey results update. ADP jobs counts are expected to ease slightly to 140K from 183K, while the ISM Services PMI is forecast to tick down slightly to 52.6 from 52.8.

The ECB is broadly expected to trim interest rates by another quarter of a percent on Thursday, bringing the main reference rate down to 2.65% from 2.9%, and the Deposit Facility Rate is forecast to fall by a matching amount to 2.5% from 2.75% as the ECB tries to get out ahead of growing recession risks and tries to bolster the EU’s wide and varied domestic economy.

EUR/USD price forecast

The Euro put in its best single-day performance in over two years on Tuesday, climbing nearly 1.4% and bringing its two-day bull run to an impressive 2.4% bottom-to-top. EUR/USD broke through the 1.0600 handle for the first time since last December, and is on pace to reach new five-month highs as long as Fiber bulls are able to keep hitting the buy button.

However, significant technical resistance is beginning to mount. The 200-day Exponential Moving Average (EMA) lies in wait near 1.0635, and has a habit of making a mess of what would otherwise be smooth trends.

Technical oscillators are also caught in overbought territory, implying buyers could run out of gas quickly and spark a fresh round of bearish bidding.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

-

23:23

USD/CAD tumbles to near 1.4400 amid trade tensions

- USD/CAD attracts some sellers to around 1.4400 in Tuesday’s late American session, down 0.50% on the day.

- Lutnick said Trump may roll back Canada and Mexico tariffs on Wednesday.

- The BoC is expected to cut its interest rate further next week.

The USD/CAD pair extends the decline to near 1.4400 during the late American session on Tuesday. The US Dollar (USD) fell against the Canadian Dollar (CAD) amid concerns about slowing growth and the impact of tariffs on the US economy outweighed any potential boost from new levies on Canada, China and Mexico.

President Donald Trump's 25% tariffs on goods from Canada and Mexico took effect Tuesday, along with a doubling of duties on Chinese goods to 20%. However, US Commerce Secretary Howard Lutnick hinted that Trump may be preparing to pivot on his own tariffs less than 48 hours after imposing them. Investors will closely monitor the developments surrounding further tariff policies, which might trigger the volatility in the major pair.

The rising bets on further interest rate cuts from the Bank of Canada (BoC) might drag the Loonie lower and act as a tailwind for the pair. Investors have priced in roughly 80% odds that the BoC will cut interest rates further next week, according to Reuters. "We now look for the quarter-point pace to continue in each of the next four meetings until July, taking the rate to 2.0 per cent,” said BMO chief economist Douglas Porter.

Meanwhile, a decline in crude oil prices on reports that OPEC+ will proceed with a planned oil output increase in April might weigh on the commodity-linked Loonie. It’s worth noting that Canada is the largest oil exporter to the United States (US), and lower crude oil prices tend to have a negative impact on the CAD value.Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

23:06

NZD/JPY Price Forecast: Bounces off 7-month low, but downtrend remains

- NZD/JPY must break above 85.03 (Tenkan-Sen) to extend recovery.

- Key resistance levels lie at 85.40 (Senkou Span A) and 85.66 (Kijun-Sen).

- Failure to hold above 84.00 could reopen the path toward YTD low of 83.15.

The NZD/JPY recovered some ground on Tuesday after dropping to a seven-month low of 83.15. The pair finished the session near 84.90 for gains of over 1%. At the time of writing, the cross-pair trades near 85.00, virtually unchanged as the Wednesday Asian session begins.

NZD/JPY Price Forecast: Technical outlook

Despite posting a bullish candle, the NZD/JPY remains biased downward, with the exchange rate hovering near the Tenkan-Sen at 85.03. A breach of the latter will expose the Senkou Span A at 85.4, immediately followed by the Kijun-Sen at 85.66. The next stop would be Senkou Span B at 86.43 on further strength.

Conversely, if NZD/JPY drops below 84.00, the next support would be the year-to-date (YTD) low of 83.15, followed by the August 5 low of 83.05, before diving to 83.00. A breach of the latter will send the cross sliding to a two-year low near April 27, 2023, a low of 81.63.

NZD/JPY Price Chart – Daily

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

-

23:00

South Korea Gross Domestic Product Growth (YoY) meets forecasts (1.2%) in 4Q

-

23:00

South Korea Gross Domestic Product Growth (QoQ) in line with expectations (0.1%) in 4Q

-

22:46

RBA's Hauser: Measures of global trade uncertainty are at 50-year highs

Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser said early Tuesday that the measures of global trade uncertainty are at 50-year highs. Hauser added that the ambiguity from US President Donald Trump's tariffs could see companies and households "batten down the hatches" and postpone planning and investment, leading to a hit to the economy.

Key quotes

Measures of global trade uncertainty are at 50-year highs.

Risk for Australia would be if US tariffs triggered a global trade war.

Markets realising that trade uncertainty could see firms and households batten down the hatches.

Such ‘watchful waiting’ could prove economically damaging in aggregate.

Possibility of such an effect played a part in the RBA's February rate cut.

February rate cut reduced the risks of inflation undershooting the 2.5% target.

The board does not currently share market confidence that a sequence of further rate cuts will be required.

Progress on inflation has been good, but it is too soon to declare victory.

Judge that labour market conditions will remain relatively tight over the forecast period.

Recognise risk we have overestimated tightness of labour market.Market reaction

At the time of writing, AUD/USD is holding higher ground near 0.6265, adding 0.27% on the day.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

-

22:09

USD/JPY Price Forecast: Rebounds but struggles at 150.00 amid bearish pressure

- USD/JPY must clear 149.70 and 150.00 to regain bullish momentum.

- Key resistance lies at 151.99-152.32, confluence of Kijun-Sen and 200-day SMA.

- Failure to hold above 148.57 could open the door for a drop to 141.64.

The USD/JPY advances some 0.17% late during the North American session, yet it remains shy of the 150.00 figure after slumping to a new year-to-date (YTD) low of 148.09. At the time of writing, the pair trades at 149.73.

USD/JPY Price Forecast: Technical outlook

The pair is downwardly biased despite recovering some ground. USD/JPY buyers must clear the Tenkan-Sen at 149.70, which paves the way for further upside. The next resistance is 150.00, and a daily close above the latter could cement the chance to challenge the confluence of the Kijun-Sen and the 200-day Simple Moving Average (SMA) around 151.99-152.32.

Nevertheless, the path of least resistance is for a bearish continuation as depicted by the Relative Strength Index (RSI), but USD/JPY needs to surpass below the February 25 swing low of 148.57, which could drive the pair towards the September 30 through at 141.64.

USD/JPY Price Chart – Daily

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

-

22:02

Australia Judo Bank Services PMI below expectations (51.4) in February: Actual (50.8)

-

22:02

Australia Judo Bank Composite PMI down to 50.6 in February from previous 51.2

-

21:45

Australia Gross Domestic Product set to show a modest uptick in the last quarter of 2024

- Australian Gross Domestic Product is foreseen at 0.5% in the last quarter of 2024.

- The Reserve Bank of Australia hinted at a cautious approach to interest rate cuts.

- The Australian Dollar could run towards 0.6300 vs the USD on an upbeat GDP report.

The Australian Gross Domestic Product (GDP) will be out early on Wednesday. The fourth quarter (Q4) figures released by the Australian Bureau of Statistics (ABS) are expected to show that the economy made modest progress in the last three months of 2024. The quarter-on-quarter (QoQ) GDP is foreseen at 0.5%, improving from the 0.3% posted in the previous quarter, while the annualised reading is foreseen at 1.2% after posting 0.8% in Q3.

Slow progress in Australia is partially due to the Reserve Bank of Australia (RBA), as the central bank decided to maintain interest rates on hold at multi-decade highs throughout 2024 to fight stubbornly high inflation.

What to expect from the Q4 GDP report

As said, the Australian economy is expected to have posted a modest 1.2% annualised growth in the last quarter of 2024. GDP data tends to impact significantly the local currency, in this case, the Australian Dollar (AUD).

However, financial markets may take the figures with a pinch of salt. Indeed, record interest rates have weighed on economic developments, yet the RBA finally delivered an interest rate cut in its early February meeting. The Official Cash Rate (OCR) now stands at 4.1%, down 25 basis points (bps) from 4.35%, which means the impact of higher interest rates should start to recede. It will be a long process, but at least the Board took a first step, boosting investors’ hopes.

With time, rate reductions should help stabilise growth around long-term trends while keeping inflation within target. It is worth noting that real GDP per capita fell for seven consecutive quarters as of Q3 2024, driven by restricted household spending amid higher rates.

Meanwhile, it is also worth remembering that the RBA has had a cautious approach to interest rate cuts. The recently released Minutes showed the Board “was not yet assured” inflation could be returned to the target range with a lower OCR. “As a result, members expressed caution about the prospect of further policy easing, which could also be seen in the forecast for inflation based on the market path,” the document reads.

Ahead of the announcement, analysts from the Westpac Banking Corporations noted: “We have upgraded our forecast of economic growth following the latest batch of partial activity indicators in the run-up to Q4 GDP, due tomorrow. We now expect the economy grew by 0.7% in Q4, up from our initial estimate of 0.4% in our preview last week. The upside surprise on business inventories was met with a lower-than-anticipated growth in imports, albeit with some of the latter pointing to slightly softer domestic demand.”

At the same time, the National Australian Bank (NAB) expects a GDP print of 0.5% QoQ and 1.2% YoY. “We continue to expect GDP growth to strengthen over 2025 making H2 2024 the low point in growth for the cycle.”

How can the GDP report affect the Australian Dollar?

The GDP report will be released on Wednesday at 00:30 GMT. Ahead of the release, the Australian Dollar (AUD) struggles to advance against its American rival. The US Dollar (USD) is under selling pressure amid fresh fears of a United States (US) economic slowdown following US President Donald Trump’s decision to go on with tariffs on Canada, Mexico and China. At the same time, a risk-averse environment weighs on the Aussie, leaving the AUD/USD pair within familiar levels.

Generally speaking, upbeat figures should boost the AUD, while a slide should be expected if numbers miss expectations.

Valeria Bednarik, Chief Analyst at FXStreet, notes: “The AUD/USD pair trades just above the 0.6200 mark ahead of the announcement, trapped between USD broad weakness and risk aversion. The daily chart suggests bears retain control, albeit slides towards the 0.6200 figure are attracting buyers. The intraday low following Trump’s levies was set at 0.6201. The latter could give up on a discouraging GDP outcome and result in a slide towards the 0.6100-0.6130 region, as the dismal mood will add to the bearish case.”

Bednarik adds: “Stronger-than-anticipated Australian growth could help AUD/USD run past 0.6253, the weekly high, and reach the 0.6300 threshold. Beyond the latter, resistance comes at 0.6330 and 0.6370.”

Economic Indicator

Gross Domestic Product (YoY)

The Gross Domestic Product (GDP), released by the Australian Bureau of Statistics on a quarterly basis, is a measure of the total value of all goods and services produced in Australia during a given period. The GDP is considered as the main measure of Australian economic activity. The YoY reading compares economic activity in the reference quarter compared with the same quarter a year earlier. Generally, a rise in this indicator is bullish for the Australian Dollar (AUD), while a low reading is seen as bearish.

Read more.Next release: Wed Mar 05, 2025 00:30

Frequency: Quarterly

Consensus: 1.2%

Previous: 0.8%

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) releases the Gross Domestic Product (GDP) on a quarterly basis. It is published about 65 days after the quarter ends. The indicator is closely watched, as it paints an important picture for the economy. A strong labor market, rising wages and rising private capital expenditure data are critical for the country’s improved economic performance, which in turn impacts the Reserve Bank of Australia’s (RBA) monetary policy decision and the Australian dollar. Actual figures beating estimates is considered AUD bullish, as it could prompt the RBA to tighten its monetary policy.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

-

21:41

US Treasury Secretary Lutnick: Trump may roll back Canada and Mexico tariffs tomorrow

US Commerce Secretary Howard Lutnick, during a televised interview on Fox News, hinted that US President Donald Trump may be preparing to pivot on his own tariffs less than 48 hours after imposing them.

Key highlights

If USMCA rules followed, Trump is considering relief.

We will see tariff changes on April 2nd with Canada and Mexico.

The administration will balance the us budget.

Trump is to move with Canada and Mexico, but not all the way.

The tariffs compromise announcement is likely tomorrow.

Trump is considering relief for USMCA-compliant goods.

Trump may roll back Canada and Mexico tariffs tomorrow.

-

21:33

United States API Weekly Crude Oil Stock below expectations (-0.3M) in February 28: Actual (-1.455M)

-

21:00

Canadian Dollar roils on Tuesday as US tariffs begin

- The Canadian Dollar is churning on Tuesday and volatility is increasing.

- US President Trump’s 25% tariffs on Canadian goods kicked off on Tuesday.

- USD/CAD remains pinned near 1.4500 as another NFP Friday looms ahead.

The Canadian Dollar churn on the charts on Tuesday, roiling inside of its technical cage, but stuck close to the 1.4500 handle against the Greenback. Traders are hunkering down to see potential economic fallout from US President Donald Trump’s 25% tariffs on all US imports of Canadian goods, as well as a reduced 10% tariff on Canadian-sourced energy products.

Canada has already responded with its own targeted tranches of economic penalties on US goods, sparking further ire from President Trump, who has already vowed to increase his planned ‘reciprocal tariffs’ by a commensurate amount.

Daily digest market movers: Trump’s 25% tariffs against Canada come into effect

- A 25% tariff on all Canadian goods and 10% on Canadian energy products has kicked off on Tuesday.

- Markets are bracing for economic fallout as tit-for-tat trade retaliations heats up quickly.

- Canadian Prime Minister Justin Trudeau has green-lit his own 25% retaliatory tariff on US goods bound for Canada, due to take effect in 21 days.

- US President Donald Trump has vowed to increase his planned ‘reciprocal tariffs’ in retaliation to Canada’s retaliatory tariffs.

- Another Nonfarm Payrolls (NFP) print looms ahead this Friday, as well as Canadian employment figures. Key economic data will take on a renewed focus as markets look out for signs of recession caused by tariffs.

Canadian Dollar price forecast

The Canadian Dollar continues to churn within near-term technical levels against the US Dollar, keeping USD/CAD trapped near the 1.4500 handle. Geopolitics has kicked volatility higher, but Loonie traders are apprehensive about pushing USD/CAD into new territory for the time being.

The Canadian Dollar is posted near multi-year lows against the US Dollar, keeping USD/CAD bid into the high end, but momentum remains limited for now as markets jostle for position and await political developments.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

20:59

AUD/JPY Price Analysis: Sellers hit a wall after fresh multi-month lows

- AUD/JPY extended its decline ahead of the Asian session, trading near the 92.00 zone after a sharp drop.

- The pair fell to its lowest level since August 2024 but rebounded as sellers struggled to push further.

- Immediate resistance aligns near 92.60, while support remains at the recent low; indicators suggest possible consolidation.

AUD/JPY experienced a sharp drop on Tuesday, reaching its lowest level since August 2024 before bouncing back. The pair came under renewed selling pressure ahead of the Asian session but found strong support near the 92.00 region, leading to a mild recovery. Despite the brief bounce, bearish sentiment persists, with technical indicators still favoring downside risks.

The Relative Strength Index (RSI) continues to decline sharply within oversold territory, suggesting that sellers have dominated recent price action. Meanwhile, the Moving Average Convergence Divergence (MACD) prints decreasing red bars, signaling that selling momentum may be losing intensity. The latest price reaction hints at a possible consolidation phase, as sellers struggle to push lower.

Looking at support and resistance levels, immediate resistance stands near 92.60, followed by the 93.00 zone, which aligns with previous daily highs. On the downside, the recent low near 92.00 remains key support; a decisive break below this level could open the door for further losses. However, if consolidation takes hold, the pair may trade within a narrow range before its next directional move.

AUD/JPY daily chart

-

20:41

Gold price rises on US tariffs and recession fears, fueling haven demand

- XAU/USD climbs to $2,918 as weak US data weighs on the US Dollar.

- US imposes 25% tariffs on Mexico and Canada, 10% on China, boosting Gold’s appeal.

- Atlanta Fed GDP Now model slashes Q1 2025 forecast to -2.8%, stoking recession fears.

- Traders eye ISM Services PMI, Initial Jobless Claims and Nonfarm Payrolls for further cues.

Gold price climbs amid a soft US Dollar (USD) as the trade war between the United States (US), Canada, Mexico and China escalates with new tariffs taking effect on Tuesday. Therefore, the plunge of the USD underpins the precious metal. The XAU/USD is trading at $2,918, gaining 0.62%.

Market sentiment remains downbeat after 25% tariffs on Canada and Mexico and an additional 10% duties in China took effect around midnight. Consequently, traders seeking safety pushed Bullion prices higher on increased demand, while the Greenback dropped across the board.

Meanwhile, recently revealed US data sparked recessionary fears. The Atlanta Fed GDP Now Model projects the Gross Domestic Product (GDP) for Q1 2025 at -2.8%, down from 1.6% estimated on Monday.

On Monday, the February ISM and S&P Global Manufacturing PMI readings were mixed. The former slowed towards the expansion/contraction 50 thresholds, while the latter expanded solidly. US Treasury bond yields slumped on the data as traders began to price in the Federal Reserve's (Fed) interest rate cuts.

Therefore, traders seeking safety bought Bullion pushing prices on the way towards $2,900.

Gold traders' focus shifts toward the release of the ISM Services PMI, Initial Jobless Claims data and February’s Nonfarm Payrolls.

Daily digest market movers: Gold price surges amid pessimistic US economic outlook

- The US 10-year Treasury note climbs six basis points (bps) to 4.221%.

- US real yields, as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) yield, are rising six bps up to 1.858%.

- St. Louis Fed President Alberto Musalem said the economic outlook is for continued solid economic growth, but recent data pose some downside risks.

- Data from Prime Market Terminal revealed that money markets had priced in the Federal Reserve (Fed) easing policy by 74 basis points (bps), up from 70 bps last week.

XAU/USD technical outlook: Gold price surges above $2,900

After bottoming out at around $2,830, Gold buyers seem to have regained control and are poised to drive XAU/USD to retest the all-time high of $2,954. Although momentum is bullish, as depicted by the Relative Strength Index (RSI), buyers must reclaim $2,950 first. If the latter and the record high are hurdled, the next resistance would be the $3,000 mark.

On the other hand, Bullion sliding beneath $2,900 could pave the way for further downside. The first support would be the February 14 low of $2,877, followed by the February 12 swing low of $2,864.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

19:47

Fed's Williams: We're beginning to factor in tariff impact on prices

Federal Reserve (Fed) Bank of New York President John Williams spoke at the Bloomberg Invest Forum in New York on Tuesday, highlighting that although inflation pressures have eased and the US labor market appears strong, the Fed will have to take a close look at the fallout from the US tariff actions.

Key highlights

Details of tariffs are key to understand.

There's still a lot of uncertainty how tariffs will play out.

We will see some impact on inflation from tariffs.

Tariffs can also impact sentiment and weigh on growth.

We're beginning to factor in tariff impact on prices.

I have somewhat higher prices in outlook.

The US economy is in a good place, and the labor market has stabilized.

Infaltion has been gradually easing.

Monetary policy is in good position and we can adjust as needed.

I don't see need to change rate policy right now.

I expect growth to slow from last year's pace.

I'm watching inflation expectations very closely.

Worth watching University of Michigan inflation expectations data.

NY Fed data thus far has shown more stable inflation expectations.

Talk of tariffs impacting how people are thinking about near term inflation.

It's hard to have an economic outlook base case; it's more about scenarios.

It's really hard to know what Fed will do with rates this year.

Fed balance sheet strategy has not changed.

-

19:39

Australian Dollar trades lower above 0.6200 as Trump imposes additional tariffs on China

- The Aussie pair sees mild losses on Tuesday, trading in the 0.6200 zone during the American session.

- Selling pressure looms as President Trump announces an extra 10% tariff on China, compounding February’s similar levy.

- The pair records a fresh losing streak amid a negative outlook despite the US Dollar’s current weakness failing to lift the Aussie.

The AUD/USD pair is down around 0.1% near 0.6220 on Tuesday. This comes even as the US Dollar extends its downside, revisiting multi-week lows near 106.15 on the US Dollar Index (DXY).

President Donald Trump’s newly added 10% tariff on China clouds the Aussie’s prospects despite an anticipated rise in Australian Retail Sales data. Meanwhile, investors’ dovish Federal Reserve (Fed) bets, spurred by a decline in United States Personal Spending, fail to provide the Aussie with a solid footing.

Daily digest market movers: Tariffs weigh on the Aussie as traders eye Fed dovish stance

- President Trump’s decision to impose an additional 10% tariff on China intensifies concerns over global growth, especially as China is Australia’s leading export market. The extra levies follow the 10% duty introduced in February, heightening fear that Beijing may retaliate.

- Trump also threatening North American partners contributes to a cautious risk backdrop. Concerns linger that further US tariffs or retaliation from China could undermine global demand and put pressure on export-driven currencies like the AUD.

- Australian Retail Sales are expected to show a moderate increase, offering some cushion for the Aussie.

- Nonetheless, the Australian Dollar’s upside remains capped by slow growth prospects and uncertainty surrounding the next RBA move.

- Mounting market bets on a June Fed rate cut reflect a softer US Personal Spending figure, which stokes recession worries. The US Dollar, however, has seen renewed downside despite risk aversion, leaving the Aussie unable to capitalize on the Greenback’s overall fragility.

Technical analysis: Pair’s decline stalls, negative outlook stays

The AUD/USD pair declined by about 0.38% to a lower region around 0.6200 during Tuesday’s American session with selling pressure abating only slightly once the US Dollar lost steam. Notably, the pair has suffered a new losing streak, keeping the outlook negative from last week.

The Relative Strength Index (RSI) currently lies in a lower band, declining near the 30s, an indication of ongoing bearish momentum. The Moving Average Convergence Divergence (MACD) prints flat red bars, suggesting sellers remain dominant for now.

Having slipped under its 20-day Simple Moving Average (SMA), the Aussie remains vulnerable unless it reclaims that threshold. Immediate support stands near 0.6150, whereas any rebound would likely face resistance near the recent swing high within 0.6250–0.6270.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

19:15

Forex Today: Investors now look at the US labour market

The US Dollar extended its intense sell-off on Tuesday, retreating to levels last seen in early December as investors remained concerned over the health of the US economy ahead of key data releases in the US labour market.

Here is what you need to know on Wednesday, March 5:

The US Dollar Index (DXY) broke below the 106.00 support to hit new three-month lows in response to rising worries over the US economy, while the extra decline in US also added to the sour sentiment. The ADP Employment Change takes centre stage seconded by the final S&P Global Services PMI, the ISMM Services PMI, Factory Orders, the Fed Beige Book and the EIA’s weekly report on US crude oil stockpiles.

EUR/USD extended its march north, reaching new yearly peaks around 1.0550 on the back of the persistent offered bias in the US Dollar. Next on tap in the region will be the Unemployment Rate in the bloc, followed by the final HCOB Services PMIs in Germany and the euro area, as well as Producer Prices in the euro zone.

GBP/USD added to Monday’s uptick beyond 1.2700 the figure and hit new three-month peaks in the 1.2745-1.2750 band. The final S&P Global Services PMI is due followed by speeches by the BoE’s Bailey and Pill.

USD/JPY plummeted to five-month lows on Tuesday, challenging the key contention zone around 148.00. All the attention will be on Japan’s Unemployment Rate along with Capital Spending figures and the Consumer Confidence print.

AUD/USD failed to maintain its initial bull run to the proximity of 0.6250, although it managed well to keep the trade above the 0.6200 mark and chart humble gains for the day. Markets’ attention will be on the publication of the Ai Group Industry Index, seconded by the final S&P Global Services PMI, and key Q4 GDP Growth Rate.

The combination of geopolitical concerns, the OPEC+ plans to hike production in April and US tariffs sent prices of the barrel of WTI to new yearly lows near the $67.00 mark.

Gold prices added to Monday’s optimism and extended further its surpass of the key $2,900 mark per troy ounce on the back of steady safe haven demand. Silver prices advanced further and flirted with multi-day highs near the 432.00 mark per ounce.

-

18:36

US President Donald Trump vows to increase reciprocal tariffs on Canada

United States (US) President Donald Trump has hit the ground running on his latest tariffs, vowing to impose additional "reciprocal tariffs" on Canada in response to Canada's retaliatory trade actions against Trump's 25% tariff on all Canadian goods crossing the border into the US.

Tit-for-tat trade wars that accomplish little but cost consumers in both countries was a hallmark of President Trump's first term in office, and Donald Trump appears keen to set new records as he risks sparking recessions both at home and abroad barely six weeks into his second term.

Key highlights

Please explain to Governor (sic) Trudeau, of Canada, that when he puts on a Retaliatory Tariff on the US, our Reciprocal Tariff will immediately increase by a like amount!

US reciprocal tariff will increase to retaliatory level.

-

18:25

Dow Jones Industrial Average sinks 550 points as tariffs kick off

- The Dow Jones lost 550 points on Tuesday, falling to 42,600.

- Trump’s new and improved trade war kicked off with new tariffs on Canada and Mexico.

- US data remains limited through the midweek as politics and policy headlines dominate.

The Dow Jones Industrial Average (DJIA) tumbled 700 points at its lowest on Tuesday as investor sentiment hits the floorboards. After the initial sticker shock on new import taxes, markets recovered some footing, but the Dow Jones remains down around 550 points.

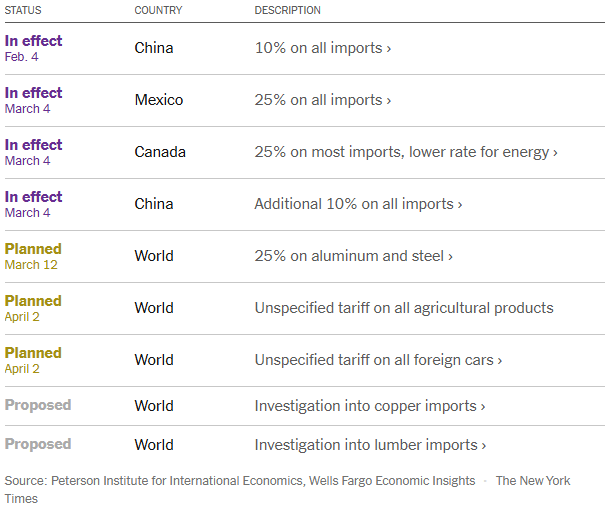

United States (US) President Donald Trump has kicked off his second, bigger global trade war by imposing a stiff 25% tariff on all imported goods from Canada and Mexico, as well as adding on an additional 10% import tax on China, bringing China’s tariff total to 20%. Further tariff packages are still in the oven, with the Trump administration planning to target aluminum, steel, agriculture goods, foreign cars, copper, and lumber.

Rate markets are now pricing in around 100 bps of interest rate cuts through the end of the year, with the first quarter-point rate trim expected in June. ADP Employment Change figures are due on Wednesday and will serve as a preview of this Friday’s upcoming Nonfarm Payrolls (NFP) jobs report. Markets will be watching economic figures with renewed anxiety as investors hunker down for negative impacts from President Trump’s sweeping tariff packages.

Dow Jones news

The overwhelming majority of securities listed on the Dow Jones are in the red on Tuesday, with slim recovery gains in UnitedHealth (UNH) and Nvidia (NVDA), which gained around 1.8% and 1.1%, respectively. UNH is trading back above $475 per share, while Nvidia is grappling with $115.

Boeing (BA) tumbled 5.5% to $160 per share, with American Express (AXP) and 3M (MMM) falling around 4.5% apiece, to $281 and $146 per share, respectively. Entire industry sectors are falling back in their own reactions to tariffs, with key losses concentrated in financials.

Dow Jones price forecast

Tuesday’s backslide puts the Dow Jones Industrial Average on pace to make contact with the 200-day Exponential Moving Average (EMA) near 42,060 for the first time since November of 2023. The Dow Jones has fallen nearly 1,700 points in two days top-to-bottom, shedding 3.8% in the process.

Momentum is fully in the bears’ control in the near-term, but the 42,000 price handle could prove to be a major challenge to further downside unless market fundamentals continue to roil. Technical oscillators remain in oversold territory, and could signal a prime opportunity for a bullish recovery if bidders gather themselves in time.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

-

18:09

President Trump’s Capitol address: The agenda takes shape

US President Donald Trump will address Congress from the US Capitol at around 02:00 GMT Wednesday, marking his first appearance before lawmakers since retaking the White House. He’s expected to outline his vision for a wide range of domestic and foreign policy initiatives.

In his second term, President Trump has wasted no time getting started. He’s signed a series of executive orders in just a few weeks, and he promises even more are on the way. During his inaugural speech, he declared that “the golden age of America” had arrived, identifying immigration, trade, and national security as top priorities.

On the international front, the President recently held a turbulent Oval Office meeting with Ukrainian President Volodymyr Zelensky. Following that meeting, he announced a pause on military aid to Ukraine.

Turning to trade, another round of tariffs went into effect on March 4. Tariffs on Chinese imports have doubled to 20%, while imports from Canada and Mexico now face a 25% tariff (with a lower 10% rate for Canadian energy). President Trump also revealed plans to impose tariffs on “external” agricultural products starting April 2, along with automobile tariffs and country-by-country reciprocal tariffs set to begin the same day.

-

17:47

US Dollar slides further as tariff tensions escalate

- DXY extends Monday’s losses, dropping below 106.00 amid trade tensions.

- Canada and China retaliate against US tariffs, increasing economic uncertainty.

- Technical indicators suggest a bearish crossover is forming, which may push the Greenback lower.

The US Dollar Index (DXY), which measures the Greenback's value against six major currencies, suffers another leg lower on Tuesday, adding to Monday’s losses and losing the key support of 106.00. Investors dumped the US Dollar after the US confirmed new tariffs on Canada, Mexico, and China with no last-minute extensions granted. As Canada and China announced countermeasures, further stoking market volatility.

Daily digest market movers: US Dollar tumbles amid tariff battle

- Canada retaliates with 25% tariffs on US goods worth C$30 billion with more to come in three weeks. In line, China pushes back on US tariffs, adding to global trade tensions.

- US Treasury Secretary Scott Bessent reassures that rates will come down and expects Chinese manufacturers to absorb tariffs.

- Locally, after a set of mixed data, concerns rise over stagflation as slowing growth and persistent inflation threaten the US economy.

- Regarding the Federal Reserve’s next steps, the CME FedWatch Tool indicates an increasing probability of a Fed rate cut later this year with investors growing confident of a cut in June.

- Equities trade mixed with uncertainty over tariffs weighing on market sentiment.

DXY technical outlook: Bearish crossover looms as downside pressure builds

The US Dollar Index continues to decline, slipping below both the 20-day and 100-day Simple Moving Averages (SMA), which are on the verge of forming a bearish crossover near 107.00. This pattern could signal further downside momentum for the US Dollar as Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators confirm growing selling pressure.

If the bearish crossover completes, it could open the door for further losses toward the 105.50-105.00 range in the short term. A recovery above 107.00 would be required to shift the near-term outlook back to neutral.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

-

17:09

Mexican Peso sinks as Trump’s tariffs send Peso to four-week low

- The Mexican Peso plunges 1.79% as trade tensions escalate, nearing the 21.00 mark

- Trump enacts 25% tariffs on Mexico, citing fentanyl and immigration concerns.

- President Sheinbaum condemns the move and vows retaliatory tariff and non-tariff measures.

- Mexico’s economy slows as S&P Global Manufacturing PMI contracts to 47.6.

The Mexican Peso (MXN) plunged sharply against the US Dollar (USD) on Tuesday as the 25% tariffs imposed on Mexico by the President of the United States (US), Donald Trump, commenced. This sent the Peso sliding into a four-week low of 20.99, a whisker of clearing the 21.00 handle. At the time of writing, the USD/MXN is trading at 20.89, gaining over 1.79%.

According to Trump, Mexico failed to do enough to stop fentanyl traffic and illegal immigration. Meanwhile, his counterpart, President Claudia Sheinbaum, condemned Trump's decision, saying it was unjustified. Sheinbaum promised to respond with tariff and non-tariff measures and added she would reveal details of the response at an event on Sunday.

As tariffs began, the USD/MXN pair soared sharply to 20.70 during the overnight session before rallying sharply to 20.99 early in the North American session.

Mexico’s economic docket remains absent, yet Monday’s data underscored that the economy is slowing sharply as businesses take measures against US tariffs. The S&P Global Manufacturing PMI for the last month contracted from 49.1 to 47.6. Business Confidence revealed by INEGI deteriorated further, yet it remained above the 50 threshold in February.

Daily digest market movers: Mexican Peso heavy as tariffs on Mexico begin

- Banco de México's (Banxico) private economists' survey indicated that economic growth is expected to remain below 1%, while inflation expectations remained unchanged.

- The poll showed that GDP growth for 2025 is now projected at 0.81%, down from 1%. Headline inflation is forecast to end at 3.71%, slightly lower than the previous 3.83%, while core CPI is expected to finish at 3.75%, unchanged from the prior estimate.

- Economists now predict the USD/MXN exchange rate to close in 2025 at 20.85, slightly lower than the 20.90 projection in the previous survey. However, for 2026, they anticipate a sharper depreciation of the Peso, well beyond the 21.30 level expected in January’s poll.

- Business activity in the US remains mixed, as the ISM shows the economy slowed, while the S&P Global Manufacturing PMI jumped. Nevertheless, the Atlanta Fed GDP Now model foresees the Gross Domestic Product (GDP) for Q1 2025 to slow sharply, by -2.8%.

- Hence, money market traders had priced in 81 basis points of easing in 2025, up from last week’s 70 bps via data from the Chicago Board of Trade (CBOT).

- Trade disputes between the US and Mexico remain front and center. If countries could come to an agreement, this could pave the way for a recovery of the Mexican currency. Otherwise, further USD/MXN upside is seen, as US tariffs could trigger a recession in Mexico.

USD/MXN technical outlook: Mexican Peso tanks as USD/MXN hovers near 21.00

The uptrend remains in place, though the USD/MXN pair has retraced the early move shy of 21.00, which if cleared, could’ve exposed the year-to-date (YTD) peak of 21.28. Nevertheless, buyers are in charge, as they surpassed the 20.50 figure, and they are gathering momentum as depicted in the Relative Strength Index (RSI).

With that said, USD/MXN first resistance would be today’s peak at 20.99. On further strength, the YTD high is up next at 21.28, followed by last year’s high of 21.46.

For a bearish continuation, USD/MXN must clear the 20.50 figure, ahead of the 50-day Simple Moving Average (SMA) at 20.48. If cleared, up next is the 100-day SMA at 20.32, followed by the 20.00 figure.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

-

16:21

EUR/USD Price Analysis: Bulls extend gains above key resistance levels

- EUR/USD climbed higher after the European session, trading near the 1.0520 zone as bullish momentum strengthened.

- The pair pushed further above the 100-day SMA, adding nearly 1.40% at the start of the week with indicators improving.

- Resistance emerges near 1.0560, while support is seen at 1.0480; a failure to hold above key levels may invite selling pressure.

EUR/USD extended its advance on Tuesday, holding steady above a key resistance area after gaining traction earlier in the session. The pair saw a notable push following the European session, building on its strong start to the week and continuing the bullish momentum. A fresh green bar on the Moving Average Convergence Divergence (MACD) and a mild rise in the Relative Strength Index (RSI), now in positive territory, indicate improving conditions for buyers.

Bulls managed to bring the pair above the 100-day Simple Moving Average (SMA), solidifying gains of nearly 1.40% since the beginning of the week. The RSI remains in positive territory, suggesting that buying interest is still intact, though not yet at overbought levels. Meanwhile, the MACD printing fresh green bars further supports the case for continued upside, though further confirmation is needed.

Looking at technical levels, immediate resistance stands around the 1.0560 area, where sellers could step in to cap further gains. If buyers manage to clear this level, a move toward the 1.0600 psychological handle could be in play. On the downside, the first relevant support lies at 1.0480, with a drop below this threshold possibly triggering a pullback toward the 20-day SMA near 1.0450.

EUR/USD daily chart

-

15:15

Mexico President Sheinbaum: We are responding with tariff, non-tariff measures

Mexican President Claudia Sheinbaum said on Tuesday that they will respond to the US' tariffs with tariff and non-tariff measures, as reported by Reuters.

Key takeaways

"Mexico took measurable steps to fight fentanyl trafficking and crime."

"There is no reason or justification for US tariff decision."

"US government also needs to take responsibility for opioid crisis."

"Cooperation between both countries is necessary to fight opioid crisis, crime."

"Not our plan to start a trade confrontation."

"No one wins with this decision."

"Will announce retaliatory measures on Sunday."

Market reaction

Safe-haven flows dominate the action in financial markets following these comments. At the time of press, the S&P 500 Index was down 1.6% on the day.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

-

15:06

United States RealClearMarkets/TIPP Economic Optimism (MoM) registered at 49.8, below expectations (53.1) in March

-

15:06

GBP/USD holds gain amid soft US Dollar on tariff fallout

- US tariffs on Mexico, Canada, and China weigh on risk sentiment, dragging USD lower.

- US Dollar Index (DXY) hits three-month low at 105.87 before recovering slightly.

- UK inflation risks rise as minimum wage hike adds pressure ahead of BoE rate cuts.

The Pound Sterling clings to early gains, extending its advance to two days versus the US Dollar as tariffs enacted by US President Donald Trump against Mexico, Canada, and China come into effect. Although the market is risk averse, traders punish the Greenback as the economic outlook darkens. The GBP/USD trades at 1.2708, up 0.08%

Sterling rises to 1.2708 as Greenback struggles on economic concerns

The economic calendar is light in the US, except for speeches by Federal Reserve officials. Tariffs of 25% on imports from Mexico and Canada and an additional 10% on Chinese products shifted investors' moods. Despite these measures being seen as inflation-prone, US Treasury bond yields are edging lower, with the 10-year T-note down seven basis points in the week at 4.132%.

Consequently, the US Dollar Index (DXY), which tracks the buck's behavior against a basket of six currencies, has fallen to a three-month low of 105.87. However, it has pared some of its losses, yet the DXY is down 0.33% at 106.20.

Across the pond, the British Retail Consortium (BRC) shop price index in February dropped -0.7 % YoY overnight. Nevertheless, prices rose 0.4% MoM due to a rise in food prices. BRC Chief Executive Helen Dickinson said that shop prices will likely increase further as retailers face a surge in annual costs this year due to a nearly 7% rise in the minimum wage on April 1.

This measure could put upward pressure on inflation at a time when the Bank of England (BoE) is embarking on an easing cycle. In January, the Consumer Price Index (CPI) rose by 3%, hitting a 10-month high. Ahead in the docket, BoE Governor Andrew Bailey would cross the wires on Wednesday.

In the US, market participants will be watching President Donald Trump address the US Congress at 01:00 GMT.

GBP/USD Price Forecast: Technical outlook

Despite reaching a new year-to-date (YTD) high of 1.2753, the GBP/USD retreated somewhat as market players digested US tariffs. Buyers lacked the strength to test the 200-day Simple Moving Average (SMA) at 1.2785, which could’ve sent the pair towards 1.2800 if cleared. On the other hand, if GBP/USD slumps beneath 1.2700, sellers would be poised to push prices toward the 100-day SMA at 1.2627, ahead of 1.2600.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

-

14:57

USD/JPY to trade at 145 in the end of the year – Rabobank

US President Trump is clearly far too busy to be an avid BoJ watcher. His comments that Japan and China are putting the US at an unfair disadvantage when they weaken their currencies suggests he may have missed the fact that the rounds of intervention implemented by the MoF since 2022 have been aimed at strengthening the JPY, Rabobank's FX analyst Jane Foley notes.

Downside risk to persist to the end of the year