Notícias do Mercado

-

23:51

Japan: Monetary Base, y/y, December +38.2% (forecast +34.3%)

-

23:35

Commodities. Daily history for Jan 5’2015:

(raw materials / closing price /% change)

Light Crude 50.02 -0.04%

Gold 1,203.50 -0.04%

-

23:32

Stocks. Daily history for Jan 5’2015:

(index / closing price / change items /% change)

TOPIX 1,401.09 -6.42 -0.46%

SHANGHAI COMP 3,351.35 +116.68 +3.61%

HANG SENG 23,767.46 -90.36 -0.38%

FTSE 100 6,417.16 -130.64 -2.00%

CAC 40 4,111.36 -140.93 -3.31%

Xetra DAX 9,473.16 -291.57 -2.99%

S&P 500 2,020.58 -37.62 -1.83%

NASDAQ Composite 4,652.57 -74.24 -1.57%

Dow Jones 17,501.65 -331.34 -1.86%

-

23:29

Currencies. Daily history for Jan 5’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,1932 -0,60%

GBP/USD $1,5245 -0,57%

USD/CHF Chf1,0067 +0,56%

USD/JPY Y119,62 -0,71%

EUR/JPY Y142,74 -1,30%

GBP/JPY Y182,4 -1,26%

AUD/USD $0,8081 -0,19%

NZD/USD $0,7684 -0,14%

USD/CAD C$1,1761 0,00%

-

23:00

Schedule for today, Tuesday, Jan 6’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Trade Balance November -1.32 -1.59

01:45 China HSBC Services PMI December 53.0

08:00 United Kingdom Halifax house price index December +0.4% +0.3%

08:00 United Kingdom Halifax house price index 3m Y/Y December +8.2%

08:48 France Services PMI (Finally) December 49.8 49.8

08:53 Germany Services PMI (Finally) December 51.4 51.4

08:58 Eurozone Services PMI (Finally) December 51.9 51.9

09:30 United Kingdom Purchasing Manager Index Services December 58.6 58.9

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

13:30 Canada Industrial Product Prices, m/m November -0.5% -0.5%

13:30 Canada Raw Material Price Index November -4.3% -4.6%

14:45 U.S. Services PMI (Finally) December 53.6 53.8

15:00 U.S. ISM Non-Manufacturing December 59.3 58.2

15:00 U.S. Factory Orders November -0.7% -0.3%

21:30 U.S. API Crude Oil Inventories December +0.8

23:30 Australia AIG Services Index December 43.8

-

20:00

Dow 17,494.81 -338.18 -1.90%, Nasdaq 4,647.19 -79.62 -1.68%, S&P 500 2,018.53 -39.67 -1.93%

-

17:14

European Central Bank’s purchases of covered bonds and asset backed securities declined slightly in the week to January 2

The European Central Bank's (ECB) purchases of covered bonds and asset backed securities (ABS) declined slightly in the week to January 2. The ECB spokesman said that it was due to assets maturing and accounting issues.

Since mid-October, the ECB has purchased 29.632 billion euros of covered bonds and 1.744 billion euros of asset backed securities.

-

17:03

European stocks close: stocks closed lower on falling oil prices and political uncertainty in Greece

Stock indices closed lower on falling oil prices and political uncertainty in Greece. There is speculation that Greece could leave the Eurozone. Greeks will elect new parliament later this month.

German inflation data also weighed on markets. German preliminary consumer price index remained flat in December, missing expectations for a 0.1% gain.

On a yearly basis, German preliminary consumer price index decreased to 0.2% in December from 0.6% in November, missing forecasts for a decline to 0.4%. That was the lowest level since October 2009.

These figures has added to concerns that the Eurozone could slip into deflation.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,417.16 -130.64 -2.00%

DAX 9,473.16 -291.57 -2.99%

CAC 40 4,111.36 -140.93 -3.31%

-

17:01

European stocks closed: FTSE 100 6,417.16 -130.64 -2.00%, CAC 40 4,111.36 -140.93 -3.31%, DAX 9,473.16 -291.57 -2.99%

-

16:42

Foreign exchange market. American session: the euro traded lower against the U.S. dollar after the weaker-than-expected German consumer inflation data

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by expectation that the Fed will start to hike its interest rate this year.

There will be released no major economic reports in the U.S. today.

The euro traded lower against the U.S. dollar after the weaker-than-expected German consumer inflation data. German preliminary consumer price index remained flat in December, missing expectations for a 0.1% gain.

On a yearly basis, German preliminary consumer price index decreased to 0.2% in December from 0.6% in November, missing forecasts for a decline to 0.4%. That was the lowest level since October 2009.

These figures has added to concerns that the Eurozone could slip into deflation.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

Speculation on quantitative easing measures by the European Central Bank and political uncertainty in Greece also weighed on the euro. There is speculation that Greece could leave the Eurozone. Greeks will elect new parliament later this month.

The Sentix investor confidence index for the Eurozone increased to 0.9 in January from -2.5 in December. Analysts had expected the index to climb to -0.9.

The British pound traded lower against the U.S. dollar due to the weaker-than-expected construction data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 57.6 in December from 59.4 in November, missing expectations for a decline to 59.2. The U.K. construction sector expanded at the slowest pace in 17 months.

The Swiss franc traded lower against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland rose to 54.0 in December from 52.1 in November, exceeding expectations for a rise to 52.9.

The New Zealand dollar rose against the U.S. dollar. In the overnight trading session, the kiwi decreased against the greenback in the absence of any major reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback in the absence of any major reports from Australia.

The Japanese yen rose against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback. Japan's final manufacturing purchasing managers' index (PMI) fell to 52.0 in December from 52.1 in November.

-

16:41

Оil fell

Brent oil fell below $55 a barrel for the first time since May 2009 as surging supply from Russia and Iraq bolstered speculation the global glut that drove crude into a bear market will persist.

Futures slid as much as 5.1 percent in London and 4.3 percent in New York. Russia's output rose to a post-Soviet high in December, preliminary Energy Ministry data showed. Iraq, the second-largest producer in the Organization of Petroleum Exporting Countries, plans to boost crude exports to a record this month, the Oil Ministry said.

"This bearish market is being fed by a combination of surging supply and shaky demand," John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone. "We now have Russian production at a post-Soviet high and the Iraqis planning to add even more supply to the market. This just adds to negative market sentiment."

Brent slumped 48 percent last year, the most since the 2008 financial crisis, as OPEC resisted calls to cut output amid a battle with U.S. shale producers for market share. The 12-member group pumped above its target for a seventh straight month in December, according to a Bloomberg survey.

Brent for February settlement declined $2.83, or 5 percent, to $53.59 a barrel on the London-based ICE Futures Europe exchange at 10:46 a.m. New York time. The contract touched $53.53, the lowest since May 4, 2009. The volume of all futures traded was 42 percent higher than the 100-day average for the time of day.

West Texas Intermediate for February delivery dropped $2.14, or 4.1 percent, to $50.55 a barrel on the New York Mercantile Exchange. It slipped to $50.42, the lowest level since April 30, 2009. Volume for all futures traded was 4.8 percent above the 100-day average. The U.S. benchmark grade traded at a $3.04 discount to Brent.

Iraq plans to expand crude exports to 3.3 million barrels a day this month, Asim Jihad, a spokesman at the Oil Ministry in Baghdad, said by phone yesterday. The country exported 2.94 million a day in December, the most since the 1980s, he said.

Russian oil production rose 0.3 percent in December to a post-Soviet record of 10.667 million barrels a day, according to preliminary data published Jan. 2 by CDU-TEK, part of the Energy Ministry.

-

16:20

Gold rоse

Gold prices rise, as investors try to hide from the sharp losses in the oil market amid lingering concerns over a slowdown in the global economy.

Oil prices continue to decline, falling to a more than five-year lows as investors switched to short positions in anticipation of lower prices amid lingering concerns about the growing supply.

Significantly limits the rise of the dollar got stronger. Index USD, which measures the dynamics of the US currency against a basket of six major currencies, rose 0.21% to a nine-year peak of 91.67.

The euro fell to nine-year low against the dollar amid high expectations that at the beginning of this year, the European Central Bank will resort to measures of quantitative easing in an attempt to strengthen the flagging economy of the region.

This week, investors will be focused on Friday's data on US non-farm payrolls to gain additional insight into the strength of the recovery in the labor market. On Wednesday, as the long-awaited report will be published next Fed meeting.

In 2014, gold fell nearly 2% amid signs that the strengthening of the US economic recovery will force the Fed to start raising interest rates sooner and faster than expected.

Expectations of an increase of interest on loans have a negative impact on the dynamics of gold, as the precious metal are struggling to compete with earning assets during periods of high interest rates.

The cost of the February gold futures on the COMEX today rose to 1202.90 dollars per ounce.

-

15:57

Ford Motor reported on Monday that its U.S. sales rose 1.2% to 220,671 vehicles in December, its best sales in December since 2005

-

15:34

Boston Fed President Rosengren said the Fed can be “patient” in tightening its monetary policy

The Boston Fed President Eric Rosengren said in a speech at the American Economic Association in Boston over the weekend that the Fed can be "patient" in tightening its monetary policy due to very low core inflation and wage growth.

"I believe the continued very low core inflation and wage growth numbers provide ample justification for patience," Rosengren said.

He expects that inflation will reach the Fed's 2% target "over the next several years".

Rosegren noted that interest rate "rates may not normalize at the same level they were prior to the financial crisis".

-

15:04

General Motors reported on Monday that its U.S. sales increased 19% to 274,483 vehicles in December

-

14:35

U.S. Stocks open: Dow 17,773.26 -59.73 -0.33%, Nasdaq 4,701.12 -25.69 -0.54%, S&P 2,050.46 -7.74 -0.38%

-

14:27

Before the bell: S&P futures -0.42%, Nasdaq futures -0.32%

U.S. stock-index futures fell as energy shares slid with oil extending its lowest price since 2009.

Global markets:

Nikkei 17,408.71 -42.06 -0.24%

Hang Seng 23,721.32 -136.50 -0.57%

Shanghai Composite 3,351.35 +116.68 +3.61%

FTSE 6,482.09 -65.71 -1.00%

CAC 4,185.11 -67.18 -1.58%

DAX 9,624.44 -140.29 -1.44%

Crude oil $50.97 (-3.28%)

Gold $1196.50 (+0.84%)

-

14:06

DOW components before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

36.37

+0.03%

9.9K

Verizon Communications Inc

VZ

47.00

+0.09%

2.2K

Pfizer Inc

PFE

31.36

+0.10%

0.7K

Travelers Companies Inc

TRV

105.60

+0.15%

1.9K

AT&T Inc

T

34.00

+0.38%

0.4K

The Coca-Cola Co

KO

42.56

+1.00%

29.0K

Merck & Co Inc

MRK

57.78

+1.03%

5.4K

UnitedHealth Group Inc

UNH

100.78

0.00%

5.3K

Boeing Co

BA

129.86

-0.07%

0.2K

General Electric Co

GE

25.04

-0.08%

48.6K

Procter & Gamble Co

PG

90.30

-0.15%

0.9K

McDonald's Corp

MCD

93.10

-0.17%

1.9K

Walt Disney Co

DIS

93.40

-0.37%

2.6K

International Business Machines Co...

IBM

161.25

-0.50%

0.3K

Microsoft Corp

MSFT

46.48

-0.60%

14.6K

Exxon Mobil Corp

XOM

91.56

-1.37%

15.6K

Chevron Corp

CVX

110.69

-1.68%

5.5K

Caterpillar Inc

CAT

90.24

-1.78%

8.0K

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2000(E720mn), $1.2100(E719mn)

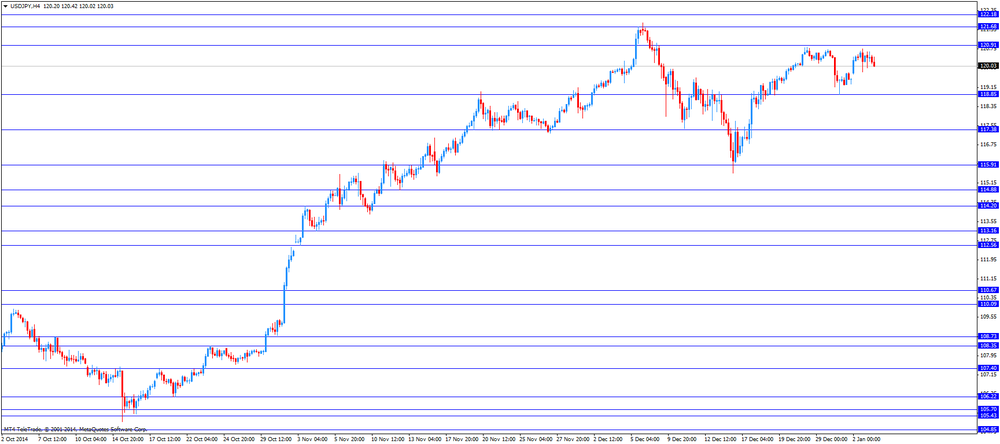

USD/JPY: Y120.00($2.2bn), Y120.50($1.9bn), Y121.20($400mn), Y121.50(695mn)

GBP/USD: $1.5400(stg220mn)

AUD/USD: $0.8200(A$558mn)

-

13:49

Upgrades and downgrades before the market open

Upgrades:

Coca-Cola (KO) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Wells Fargo (WFC) downgraded to Neutral from Outperform at Robert W. Baird

Ford Motor (F) downgraded to Neutral from Buy at Citigroup

Starbucks (SBUX) downgraded to Neutral from Buy at Janney

Other:

Goldman Sachs (GS) target raised to $225 from $220, maintain Outperform at Credit Suisse

-

13:39

German consumer price inflation hits its lowest level since October 2009

The German Federal Statistics Bureau released its consumer price index on Monday. German preliminary consumer price index remained flat in December, missing expectations for a 0.1% gain.

On a yearly basis, German preliminary consumer price index decreased to 0.2% in December from 0.6% in November, missing forecasts for a decline to 0.4%. That was the lowest level since October 2009.

These figures has added to concerns that the Eurozone could slip into deflation.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

-

13:09

Foreign exchange market. European session: the British pound fell against the U.S. dollar after the weaker-than-expected construction data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Finally) December 52.1 52.0

08:30 Switzerland Manufacturing PMI December 52.1 52.9 54.0

09:30 Eurozone Sentix Investor Confidence January -2.5 -0.9 0.9

09:30 United Kingdom PMI Construction December 59.4 59.2 57.6

13:00 Germany CPI, m/m (Preliminary) December 0.0% +0.1% 0.0%

13:00 Germany CPI, y/y (Preliminary) December +0.6% +0.4% 0.2%

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by expectation that the Fed will start to hike its interest rate this year.

There will be released no major economic reports in the U.S. today.

The euro declined against the U.S. dollar due to speculation on quantitative easing measures by the European Central Bank and political uncertainty in Greece. There is speculation that Greece could leave the Eurozone. Greeks will elect new parliament later this month.

German preliminary consumer price index remained flat in December, missing expectations for a 0.1% gain.

On a yearly basis, German preliminary consumer price index decreased to 0.2% in December from 0.6% in November, missing forecasts for a decline to 0.4%.

The Sentix investor confidence index for the Eurozone increased to 0.9 in January from -2.5 in December. Analysts had expected the index to climb to -0.9.

The British pound fell against the U.S. dollar after the weaker-than-expected construction data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 57.6 in December from 59.4 in November, missing expectations for a decline to 59.2. The U.K. construction sector expanded at the slowest pace in 17 months.

The Swiss franc traded lower against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland rose to 54.0 in December from 52.1 in November, exceeding expectations for a rise to 52.9.

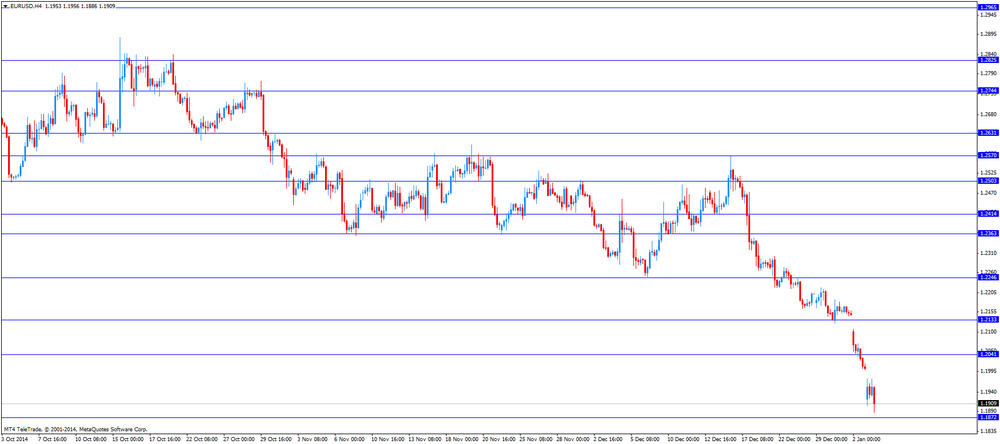

EUR/USD: the currency pair dropped to $1.1886

GBP/USD: the currency pair fell to $1.5203

USD/JPY: the currency pair rose to Y120.02

The most important news that are expected (GMT0):

19:30 U.S. Total Vehicle Sales, mln December 17.2 16.9

23:50 Japan Monetary Base, y/y December +36.7% +34.3%

-

13:00

Germany: CPI, m/m, December 0.0% (forecast +0.1%)

-

13:00

Germany: CPI, y/y , December +0.2% (forecast +0.4%)

-

12:45

Orders

EUR/USD

Offers $1.2200, $1.2150, $1.2125/20, $1.2100

Bids $1.1900, $1.1865, $1.1800

GBP/USD

Offers $1.5620, $1.5545, $1.5485, $1.5430

Bids $1.5200/05, $1.5185, $1.5100

AUD/USD

Offers $0.8250, $0.8200, $0.8100

Bids $0.8035, $0.8000, $0.7950

EUR/JPY

Offers Y146.00/05, Y145.50, Y145.30

Bids Y143.15, Y143.00, Y142.90

USD/JPY

Offers Y121.85, Y121.50, Y121.20, Y120.90/00

Bids Y120.00, Y119.80, Y119.20, Y118.85

EUR/GBP

Offers stg0.7900, stg0.7880/85, stg0.7860-70

Bids stg0.7755/50, stg0.7745, stg0.7720, stg0.7700, stg0.7680

-

12:19

U.K. construction sector expanded at the slowest pace in 17 months

Markit and the Chartered Institute of Purchasing & Supply released their construction purchasing managers' index (PMI) for the U.K. on Monday. The index fell to 57.6 in December from 59.4 in November, missing expectations for a decline to 59.2. The U.K. construction sector expanded at the slowest pace in 17 months.

A reading above 50 indicates growth in the sector.

Civil engineering showed a decline in output. That was the first decline since May 2013.

-

12:00

European stock markets mid-session: European indices decline as oil and Greece weigh on markets

European indices declined as slumping oil-prices and worries over Greece's future in currency-union after the elections on January 25th weigh on markets and outweigh speculation of further stimulus by the ECB. The German Spiegel magazine reported that Chancellor Merkel is ready to accept a Greek euro exit as elections will take place in three weeks. After a decline in U.K.'s PMI Construction from previously 59.4 to 57.6, not meeting forecast of a slight decrease to 59.2, markets are looking forward to German CPI due 13:00 GMT.

In today's session the FTSE 100 index declined by -0.59% quoted at 6,509.42. France's CAC 40 lost -0.58% trading at 4,227.62. Germany's DAX 30 is currently trading -0.34% at 9,731.58 points.

-

11:20

Oil: Extending declines from lows

Brent crude and West Texas Intermediate fell for a third day, extending the slump hitting new 5 ½ year lows as the global glut continues in 2015 and a low global demand weighs amid record output from Iraq and Russia.

Both major brands lost more than 50% of their value since mid-2014 but the OPEC, responsible for 40% of worldwide oil-production, decided to leave output-rates unchanged around 30 million barrels a day. Disappointing data from the United States on Friday further fuelled fears about a sowing global economy and a decline in demand. The weak euro, making the dollar-nominated commodity more expensive for holders of other currencies, put further pressure on oil.

Brent Crude lost -2.04%, currently trading at USD55.27 a barrel. West Texas Intermediate declined by -2.11% currently quoted at USD51.58.

-

11:00

Gold recovers but is still under the USD1,200 threshold

Gold prices rose in today's session for a second consecutive day re-approaching the USD1200 threshold once again after Friday's losses as investors demand for a haven is spurred by the political crisis in Greece. At the end of last week the precious metal was quoted intraday at a one-month low at USD1,167.30 before gaining ground.

The course of trading also influenced statements of the ECB Draghi, who acknowledged the high risk that the ECB will not be able to fulfill its mandate. As he pointed out, to fulfill the mandate under which the ECB should be the guarantor of price stability, it has become more difficult than six months ago, while reaffirming its commitment to action at the beginning of this year, if circumstances so require.

The precious metal continues to be under pressure with a strengthening greenback as the U.S. economy recovers and the FED is moving closer to raise interest rates. Falling oil prices make an inflation-hedge via gold less attractive. Volumes are back at normal levels after the holiday-shortened sessions.

The precious metal is currently quoted at USD1,192.00, +0,35% a troy ounce.

GOLD currently trading at USD1,192.00

-

10:32

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2000(E720mn), $1.2100(E719mn)

USD/JPY: Y120.00($2.2bn), Y120.50($1.9bn), Y121.20($400mn), Y121.50(695mn)

GBP/USD: $1.5400(stg220mn)

AUD/USD: $0.8200(A$558mn)

-

09:30

United Kingdom: PMI Construction, December 57.6 (forecast 59.2)

-

09:30

Eurozone: Sentix Investor Confidence, January 0.9 (forecast -0.9)

-

09:00

European Stocks. First hour: Indices climb on bets on additional easing by ECB

European indices edge higher in early trading despite energy stocks were under pressure as oil prices decline to multi-year lows and the political turmoil in Greece where the anti-austerity party Syriza could come to power after the elections of January 25th. Growing concerns over a potential Greek exit from the euro zone weighs but the prospect of for additional easing measures by the ECB supported the markets.

Markets are looking ahead to the publication of the Eurozone's Sentix Investor Confidence due 09:30 GMT and German CPI at 13:00 GMT.

The FTSE 100 index is currently trading +0.43% quoted at 6,576.03 points, Germany's DAX 30 added +0.22% trading at 9,785.87. France's CAC 40 rose by +0.47%, currently trading at 4,272.27 points.

-

08:30

Switzerland: Manufacturing PMI, December 54.0 (forecast 52.9)

-

08:00

Global Stocks: U.S. stocks mixed, Nikkei declines, Shanghai rallies

U.S. markets closed mixed on Friday. At the close the DOW JONES added +0.06% to 17,832.99 points. The S&P 500 lost -0.03% with a final quote of 2,058.20. Disappointing data on the ISM Manufacturing Index and Construction Spending were published on Friday weighing on the markets.

Hong Kong's Hang Seng declined by -0.16% to 23,818.93 points. China's Shanghai Composite closed at 3,351.35 points, rallying as much as +3.61% diverging from mainland and Hong Kong.

Japan's Nikkei declined on the first trading day of 2015 by -0.24% closing at 17,408.71 giving up earlier gains. A stronger yen weighed on exporters and falling oil prices put pressure on energy shares.

-

07:30

Foreign exchange market. Asian session: U.S. dollar rallies against major peers – only yen gains

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual01:35 Japan Manufacturing PMI (Finally) December 52.1 52.0

The greenback traded broadly stronger against its major peers only losing versus the Japanese yen despite a disappointing ISM Manufacturing Index and Construction Spending published on Friday. The U.S. dollar continued to rally against the euro who fell to its weakest in almost 9 years before regaining some ground. The Eurozone single currency traded as low as USD1.1867, the weakest level since March 2006, in today's session amid speculations that the ECB will large start bond purchases and upcoming elections in Greece where the anti-austerity party Syriza is going to win on January 25th according to polls. In an interview published on Friday ECB President Mario Draghi said the risk of the central bank not fulfilling its mandate of preserving price stability was higher now than half a year ago. A strong sign that the ECB is ready to start Quantitative Easing.

The Australian dollar further slumped to its lowest since 2009 currently trading at USD0.8048 with other commodity-currencies also declining.

New Zealand's dollar lost against the greenback again trading close to its lows hit on December 2014 continuing a slump started last Friday.

The Japanese yen traded stronger during the Asian against the greenback being currently quoted around USD120 despite a Japanese Manufacturing PMI that declined for the month of December to 52.0 from a previous reading of 52.1. Investors look ahead to Japan's Monetary Base due 23:50 GMT. The Japanese currency was supported by investors looking for a haven as Asian stocks declined.

EUR/USD: the euro slumped against the greenback

USD/JPY: the U.S. dollar slightly weaker against the yen

GPB/USD: The British pound lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 Switzerland Manufacturing PMI December 52.1 52.9

09:30 Eurozone Sentix Investor Confidence January -2.5 -0.9

09:30 United Kingdom PMI Construction December 59.4 59.2

13:00 Germany CPI, m/m (Preliminary) December 0.0% +0.1%

13:00 Germany CPI, y/y (Preliminary) December +0.6% +0.4%

19:30 U.S. Total Vehicle Sales, mln December 17.2 16.9

23:50 Japan Monetary Base, y/y December +36.7% +34.3%

-

06:07

Options levels on monday, January 5, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2211 (2407)

$1.2132 (1372)

$1.2074 (897)

Price at time of writing this review: $ 1.1932

Support levels (open interest**, contracts):

$1.1874 (5572)

$1.1834 (2343)

$1.1791 (1949)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 61886 contracts, with the maximum number of contracts with strike price $1,2500 (6650);

- Overall open interest on the PUT options with the expiration date January, 9 is 65258 contracts, with the maximum number of contracts with strike price $1,2000 (7655);

- The ratio of PUT/CALL was 1.05 versus 1.08 from the previous trading day according to data from January, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5600 (1456)

$1.5501 (962)

$1.5404 (846)

Price at time of writing this review: $1.5282

Support levels (open interest**, contracts):

$1.5294 (1792)

$1.5197 (2045)

$1.5099 (473)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 27606 contracts, with the maximum number of contracts with strike price $1,5850 (4020);

- Overall open interest on the PUT options with the expiration date January, 9 is 23846 contracts, with the maximum number of contracts with strike price $1,5500 (2697);

- The ratio of PUT/CALL was 0.86 versus 0.79 from the previous trading day according to data from January, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:02

Nikkei 225 17,297.52 -153.25 -0.88%, Hang Seng 23,713.76 -144.06 -0.60%, Shanghai Composite 3,259.81 +25.13 +0.78%

-

01:36

Japan: Manufacturing PMI, December 52.0

-