Notícias do Mercado

-

20:00

Dow 16,446.23 -16.51 -0.10%, Nasdaq 4,152.41 -13.20 -0.32%, S&P 500 1,836.34 -1.15 -0.06%

-

19:20

American focus : the euro fell on Draghi comments

Euro fell against the U.S. dollar on a background of ECB President Mario Draghi . Earlier it was reported that the ECB kept its benchmark interest rate at a record low of 0.25%. Deposit rate was also kept at zero.

Head of the European Central Bank Mario Draghi has once again confirmed the promise controller to keep rates at the minimum values in the near future . " The Governing Council strongly emphasizes that he intends to keep stimulating monetary policy as long as it is necessary " - Draghi said in a speech at a press conference in Frankfurt.

According to him , inflation in the eurozone will remain low for at least two years. ECB President believes that it is too early to talk about the victory over the crisis as " the eurozone 's economic recovery is weak, moderate and unstable ." Expansionary policy will lead to a revitalization of domestic demand in the euro zone in 2014-2015 . Believes Draghi .

Earlier, the euro rose against the dollar significantly after the data for the euro area , which showed that economic sentiment in the euro zone rose to more than two-year high in December , which is a sign that the economic recovery is starting to gain momentum after a long decline .

Data published by the European Commission , supported by a growing list of statistics, which indicates improvement in business confidence and spending .

The report showed that the index of sentiment in the economy rose in December to a level of 100 points, compared to 98.4 points in November , while reaching its highest level since July 2011 .

Rise was broad-based and in all sectors . It is noteworthy that the trust between providers of the service sector was in the "plus" for the first time since August 2011 , while industrial companies were the second level of confidence.

Furthermore, it became known that the index of German economic sentiment was one of the most positive in December - at the level of 106.0 points. In Spain , the figure rose to 100.0 , while Italy he rose to 96.2 from November's 93.9 .

Pound traded slightly higher against the dollar on the fact that the Bank of England left unchanged interest rate and bond-buying program to support the UK economy. The Bank of England left its key interest rate unchanged at 0.5% and the size of its bond purchase program untouched for 375 billion pounds .

As usual, when there is no change in policy , Monetary Committee is not making a statement explaining its decision . Minutes of committee meetings will be published on January 22.

Economists expect GDP growth in 2014 is 2.5% , the highest since 2007. But despite this growth , some economists expect the central bank to start raising the UK refuses to borrowing costs in the near future .

Bank of England officials headed by Mark Carney pledged to keep its benchmark interest rate at a record low level in order to support the growing recovery in Britain as long as inflation remains subdued .

-

18:20

European stocks close

European stocks declined as President Mario Draghi reiterated the European Central Bank’s pledge to keep interest rates low as he warned that it’s too soon to say the euro region is out of danger.

The ECB’s Governing Council, convening in Frankfurt today for the first policy-setting meeting of 2014, left the main refinancing rate at 0.25 percent, a decision predicted by all 51 economists in a Bloomberg survey. Officials held the deposit rate at zero and the "> “The Governing Council strongly emphasizes that it will maintain an accommodative stance of monetary policy for as long as necessary,” Draghi told reporters in Frankfurt today after the announcement.

He refused to say the fight against Europe’s debt crisis is won, even as stocks and bonds rally and countries such as Ireland and Portugal return to the debt market.

The Bank of England also kept its benchmark rate at a record-low 0.5 percent today, while its bond-purchase target stayed at 375 billion pounds ($618 billion).

National benchmark indexes slipped in 10 of the 18 western European markets. The U.K.’s FTSE 100 lost 0.5 percent, France’s CAC 40 fell 0.8 percent and Germany’s DAX declined 0.8 percent.

Arkema slipped 3.1 percent to 79.50 euros after lowering its forecast for 2013 earnings before interest, taxes, depreciation and amortization to around 900 million euros ($1.22 billion) from a previous estimate of 920 million euros.

TGS soared 17 percent to 172.50 kroner after Norway’s biggest surveyor of underwater oil and gas fields forecast 2013 revenue of about $882 million, compared with previous guidance of $810 million to $870 million.

AstraZeneca added 0.7 percent to 3,572.5 pence. The Food and Drug Administration said in a statement yesterday it approved dapagliflozin, a treatment for Type 2 diabetes. The pill by AstraZeneca and Bristol-Myers Squibb is the second in a new class of medicines for the disease, with Johnson & Johnson gaining clearance for its treatment in March.

Genel Energy added 3.5 percent to 1,117 pence as HSBC Holdings Plc upgraded its rating on the shares to overweight, similar to a buy, from neutral. HSBC said in a note that many exploration and production companies are now trading below core-asset value.

-

17:00

European stocks closed in minus: FTSE 100 6,691.34 -30.44 -0.45%, CAC 40 4,225.14 -35.82 -0.84%, DAX 9,421.61 -76.23 -0.80%

-

16:41

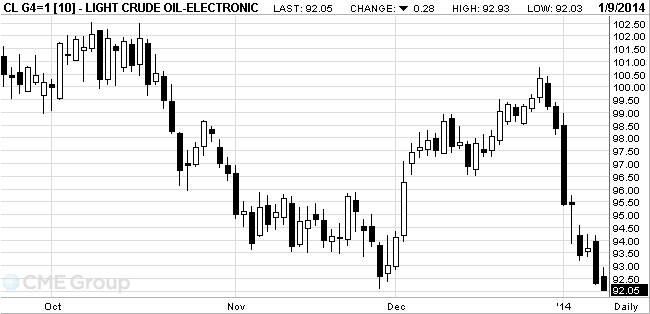

Oil fell

West Texas Intermediate crude tumbled to the lowest level in more than six weeks, erasing an earlier advance of 0.7 percent.

Pressure on oil futures continue to provide data to the government report , pointed out the restrained demand for petroleum products .

According to data released on Wednesday the U.S. Department of Energy , the oil reserves in the country last week fell by 2.7 million barrels, while they expected a decline of 600,000 barrels. Reducing oil reserves observed the sixth consecutive week . However , news about the growth of stocks of petroleum products have overshadowed reports of the high demand for oil .

According to the Ministry of Energy , gasoline inventories in the week December 27 - January 3, increased by 6.2 million barrels, while expected to rise by 2 million barrels. Distillate stocks , which include diesel and heating oil, rose by 5.8 million barrels, while the projected growth of 1.5 million barrels .

Futures on crude oil prices continued to decline after the December meeting of the protocols of the Federal Reserve , according to which most of the leaders of the central bank supported the folding of bond-buying program . The program supported oil prices, weakening the dollar, which , in turn, makes oil more attractive to foreign investors.

WTI for February delivery slid 32 cents, or 0.3 percent, to $92.01 a barrel at 10:12 a.m. on the New York Mercantile Exchange. Earlier, it touched $91.94, the lowest intraday price since Nov. 27. The volume of all futures traded was 8.9 percent below the 100-day average. Prices have fallen 5.9 percent since the start of the year.

Brent for February settlement increased 1 cent to $107.16 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude was at a premium of $15.15 to WTI, compared with $14.82 at yesterday’s close.

-

16:20

Gold stabilized

Gold prices consolidated after declining in the previous two sessions . On the eve of gold fell after the publication of minutes of the last meeting of the U.S. Federal Reserve , during which it was decided to start to minimize the program to stimulate the economy .

Many investors in recent years to invest in gold, considering it as a hedge against inflation risks , which could be the result of the Fed's ongoing program to stimulate the economy . However, despite the trillions of dollars poured in by the central bank in the financial system by buying bonds , U.S. inflation remained muted .

According to analysts, now , when the Fed begins to reduce the monthly purchase of assets, inflation risks seem more restrained , which reduces the attractiveness of gold in the eyes of investors. In 2013, gold futures fell 28% , while investors expect the Fed will eventually announce the beginning of collapse of asset purchases , which happened in December and passed on rapidly rising stock markets .

Decline in gold prices was observed after eve was better than expected report on the U.S. labor market . These data have raised expectations about what the Fed will continue its program of folding to stimulate the economy this year.

According to published data ADP, the number of jobs in the private sector in the U.S. in December rose more sharply than economists expected. In addition, data released on Tuesday , reporting the more serious than expected , reducing the trade deficit the U.S. in November .

Today we have published data on the number of initial applications for unemployment benefits , which also came out better than expected. Gold traders closely monitor data on the U.S. labor market in search of signals about how far can the Fed in its rolling program to stimulate the economy .

Cost February gold futures on the COMEX today rose to $ 1230.90 per ounce.

-

14:35

u.s. stocks open: Dow 16,511.80 +49.06 +0.30%, Nasdaq 4,178.72 +13.11 +0.31%, S&P 1,841.33 +3.84 +0.21%

-

14:25

before the bell: S&P futures +0.17% NASDAQ futures +0.15%

U.S. stock futures climbed, as Macy’s Inc. and J.C. Penney Co. rallied and jobless claims fell to the lowest level in a month.

Global markets:

Nikkei 15,880.33 -241.12 -1.50%

Hang Seng 22,787.33 -209.26 -0.91%

Shanghai Composite 2,027.62 -16.72 -0.82%

FTSE 6,721.15 -0.63 -0.01%

CAC 4,252.3 -8.66 -0.20%

DAX 9,508.29 +10.45 +0.11%

Crude oil $92.65 (+0.35%)

Gold $1226.20 (+0.06%).

-

13:46

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3585, $1.3590, $1.3600, $1.3700

USD/JPY Y103.75-85, Y104.00, Y104.50, Y104.95, Y105.00, Y105.40, Y105.50, Y106.00, Y106.05-10

EUR/JPY Y142.00

EUR/GBP stg0.8325

USD/CHF Chf0.9000, Chf0.9050, Chf0.9080

EUR/CHF Chf1.2300, Chf1.2350

AUD/USD $0.8800, $0.8850, $0.8950, $0.9000

EUR/AUD A$1.5250

AUD/JPY Y93.40

NZD/USD $0.8200

-

13:30

U.S.: Initial Jobless Claims, January 330 (forecast 337)

-

13:30

Canada: New Housing Price Index , November 0.0% (forecast +0.2%)

-

13:30

Canada: Building Permits (MoM) , November -6.7% (forecast -2.3%)

-

13:15

Canada: Housing Starts, December 190 (forecast 196)

-

13:10

European session: the euro has grown significantly against the U.S. dollar

Data

00:30 Australia Building Permits m / m in November -1.6% Revised to -1.8% -0.9 % -1.5 %

00:30 Australia Building Permits y / y in November +23.1 % +20.1 % +22.2 %

00:30 Australia Retail Sales m / m +0.5 % in November 0.5% 0.7%

00:30 Australia Retail Sales y / y +3.6 % in November

1:30 China Producer Price Index y / y in December -1.4 % -1.2 % -1.4 %

1:30 China Consumer Price Index y / y in December +3.0 % +2.7 % +2.5 %

7:45 France Trade Balance , Revised -4.8 billion in November from -4.7 -4.6 -5.6

09:30 UK Trade balance -9.7 -9.5 -9.4 November

10:00 Eurozone business sentiment in December 0.18 0.2 0.27

10:00 Eurozone Economic Sentiment 98.5 99.0 100.0 December

10:00 Eurozone business optimism in the industry -3.9 -3.3 -3.4 December

11:00 Germany Industrial Production ( m / m) in November -1.2 % +1.6% +1.9%

11:00 Germany Industrial Production y / y November +1.0% +3.4% +3.9%

12:00 UK BoE decision on interest rate 0.50% 0.50 % 0.50%

12:00 UK BoE decision in terms of the program of asset purchases 375 375 375

12:00 UK BoE statement Cover

12:45 Eurozone Interest Rate Decision ECB 0.25% 0.25 % 0.25%

The euro exchange rate against the dollar has grown significantly , due to the expectations of the press conference, ECB head Draghi . It is expected that Mario Draghi will use a balanced tone after the announcement of the decision on the rate , which has remained unchanged - at the level of 0.25 %. Experts say that most likely will not be announced any additional measures to stimulate the economy.

Moreover, the impact on the bidding had data for the euro area , which showed that economic sentiment in the euro zone rose to more than two-year high in December , which is a sign that the economic recovery is starting to gain momentum after a long decline .

Data published by the European Commission , supported by a growing list of statistics, which indicates improvement in business confidence and spending .

The report showed that the index of sentiment in the economy rose in December to a level of 100 points, compared to 98.4 points in November , while reaching its highest level since July 2011 .

Rise was broad-based and in all sectors . It is noteworthy that the trust between providers of the service sector was in the "plus" for the first time since August 2011 , while industrial companies were the second level of confidence.

Furthermore, it became known that the index of German economic sentiment was one of the most positive in December - at the level of 106.0 points. In Spain , the figure rose to 100.0 , while Italy he rose to 96.2 from November's 93.9 .

Pound with a slight rise against the dollar, given the fact that the Bank of England left unchanged interest rate and bond-buying program to support the UK economy. The Bank of England left its key interest rate unchanged at 0.5% and the size of its bond purchase program untouched for 375 billion pounds .

As usual, when there is no change in policy , Monetary Committee is not making a statement explaining its decision . Minutes of committee meetings will be published on January 22.

Economists expect GDP growth in 2014 is 2.5% , the highest since 2007. But despite this growth , some economists expect the central bank to start raising the UK refuses to borrowing costs in the near future .

Bank of England officials headed by Mark Carney pledged to keep its benchmark interest rate at a record low level in order to support the growing recovery in Britain as long as inflation remains subdued .

EUR / USD: during the European session, the pair rose to $ 1.3623

GBP / USD: during the European session, the pair rose to $ 1.6479 , then dropped to $ 1.6450

USD / JPY: during the European session, the pair rose to Y105.06

At 13:30 GMT will be held monthly press conference of the ECB. Also this time, Canada announces the change of volume of building permits issued , and will release the house price index in the primary market in November.

-

12:45

Eurozone: ECB Interest Rate Decision, 0.25% (forecast 0.25%)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:30

European stock rose

European stocks advanced as investors awaited the European Central Bank’s interest-rate decision. U.S. stock futures were little changed, while Asian shares fell.

The Stoxx Europe 600 Index gained 0.3 percent to 330.72 at 9:21 a.m. in London. The benchmark gauge rose 0.9 percent in the past two sessions to the highest level since May 2008. The Stoxx 600 rallied 17 percent last year as central banks around the world kept interest rates low.

ECB President Mario Draghi today convenes the first rate-setting meeting of 2014 in Frankfurt. The central bank will maintain its key interest rate at a record low of 0.25 percent, according to the median forecast of economists.

The Bank of England announces its interest-rate decision at noon in London. Policy makers will hold the key rate at 0.5 percent and maintain the asset-purchase target at 375 billion pounds ($617 billion), economists predicted.

In the U.S., minutes from the Federal Reserve’s December meeting showed officials saw declining economic gains from its monthly bond-buying program. The Fed decided at the meeting to start reducing the size of its asset purchases by $10 billion to $75 billion starting this month.

Participants were also concerned “about the ">TGS soared 13 percent to 166.40 kroner after Norway’s biggest surveyor of underwater oil and gas fields forecast 2013 revenue of about $882 million, compared with a previous guidance in the range of $810 million to $870 million.

AstraZeneca Plc added 1.6 percent to 3,607 pence. The Food and Drug Administration said in a statement yesterday it approved dapagliflozin, a treatment for Type 2 diabetes. The pill by AstraZeneca and Bristol-Myers Squibb Co. is the second in a new class of medicines for the disease, with Johnson & Johnson gaining clearance for its treatment in March.

Tesco declined 2.5 percent to 320.2 pence after saying comparable sales, excluding fuel and value added taxes, fell 2.4 percent in the six weeks to Jan. 4. That missed analysts’ predictions of a 2.2 percent drop. A gauge of retail stocks posted the second-worst decline of the 19 industry groups on the Stoxx 600.

Arkema fell 3.2 percent to 79.46 euros after lowering its forecast for 2013 earnings before interest, taxes, depreciation and amortization to around 900 million euros ($1.22 billion) from a previous estimate of 920 million euros.

FTSE 100 6,739.63 +17.85 +0.27%

CAC 40 4,269.32 +8.36 +0.20%

DAX 9,530.57 +32.73 +0.34%

-

11:00

Germany: Industrial Production s.a. (MoM), November +1.9% (forecast +1.6%)

-

11:00

Germany: Industrial Production (YoY), November +3.5% (forecast +3.4%)

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3585, $1.3590, $1.3600, $1.3700

USD/JPY Y103.75-85, Y104.00, Y104.50, Y104.95, Y105.00, Y105.40, Y105.50, Y106.00, Y106.05-10

EUR/JPY Y142.00

EUR/GBP stg0.8325

USD/CHF Chf0.9000, Chf0.9050, Chf0.9080

EUR/CHF Chf1.2300, Chf1.2350

AUD/USD $0.8800, $0.8850, $0.8950, $0.9000

EUR/AUD A$1.5250

AUD/JPY Y93.40

NZD/USD $0.8200

-

10:01

Eurozone: Industrial confidence, December -3.4 (forecast -3.3)

-

10:00

Eurozone: Economic sentiment index , December 100.0 (forecast 99.0)

-

10:00

Eurozone: Business climate indicator , December 0.27 (forecast 0.2)

-

09:41

Asia Pacific stocks close

Asian stocks fell as China’s factory-gate prices extended the longest streak of declines since the Asian financial crisis and Federal Reserve minutes showed officials saw diminishing benefits from bond buying.

Nikkei 225 15,880.33 -241.12 -1.50%

Hang Seng 22,787.33 -209.26 -0.91%

S&P/ASX 200 5,324.41 +8.36 +0.16%

Shanghai Composite 2,027.62 -16.72 -0.82%

Canon Inc. lost 2 percent in Tokyo on a report operating profit at the world’s biggest camera maker probably missed its own forecast.

Belle International Holdings Ltd., China’s No. 1 seller of footwear, fell 3.4 percent in Hong Kong after surging 13 percent yesterday.

Daiei Inc. slumped 7.3 percent in Tokyo as the supermarket operator cut its operating-profit forecast.

-

09:30

United Kingdom: Trade in goods , November -9.4 (forecast -9.5)

-

08:41

FTSE 100 6,725.41 +3.63 +0.05%, CAC 40 4,260.22 -0.74 -0.02%, Xetra DAX 9,489.43 -8.41 -0.09%

-

07:45

France: Trade Balance, bln, November -5.6 (forecast -4.6)

-

07:26

European bourses are initially seen mixed Thursday: the FTSE up 4, the DAX down 7 and the CAC up 3.

-

07:10

Asian session: The dollar remained higher

00:30 Australia Building Permits, m/m November -1.8% -0.9% -1.5%

00:30 Australia Building Permits, y/y November +23.1% +20.1% +22.2%

00:30 Australia Retail sales (MoM) November +0.5% +0.5% +0.7%

00:30 Australia Retail Sales Y/Y November +3.6%

01:30 China PPI y/y December -1.4% -1.2% -1.4%

01:30 China CPI y/y December +3.0% +2.7% +2.5%

The dollar remained higher versus most major peers before government data today forecast show initial claims for unemployment benefits fell. Initial jobless claims in the U.S. probably fell to 335,000 in the week through Jan. 4 from 339,000 in the previous period, according to the median estimate of economists surveyed by Bloomberg News before today’s Labor Department report. A report tomorrow may say U.S. employers continued to add positions and the jobless rate remained at a five-year low. Data tomorrow may show employers in the world’s biggest economy added 195,000 jobs last month after boosting positions by 203,000 in November, according to a separate poll. The unemployment rate probably held at 7 percent, the least since November 2008.

The pound traded near its strongest in a year against the euro before policy decisions by the European Central Bank and the Bank of England today. ECB officials meeting today will probably keep the benchmark at a record-low 0.25 percent, according to all 51 economists and analysts surveyed by Bloomberg. Policy makers at the BOE are likely to refrain from changing its 0.5 percent key rate, a separate poll showed.

Australia’s currency weakened along with Asian stocks. Government reports showed retail sales in the nation rose in November by more than economists predicted, while building approvals declined.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3565-85

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6440-60

USD / JPY: on Asian session the pair traded in the range of Y104.75-00

UK trade data will be released at 0930GMT. Business surveys have suggested UK export growth should accelerate, but the official data have painted a picture of exporters struggling in the face of weak Eurozone demand. In October goods exports to EU countries fell by stg0.5 billion on the month to stg12.1 billion and the EU goods trade balance widened to a record stg6.5 billion. The UK's total trade gap is expected to remain unchanged at stg2.6 billion in November, with a slight improvement in the goods trade gap. The January BOE Monetary Policy Decision will be released at 1200GMT and will likely see the MPC treading water. All the external debate is about what the MPC will do as the jobless rate, currently at 7.4%, nears the 7.0% policy threshold. Even if this were to happen as early as the end of Q1, the March jobless rate data will not be published until May, so the MPC does have a little time on its hand to debate its next step. -

06:26

Commodities. Daily history for Jan 8’2014:

Gold $1,226.20 +0.70 +0.06%

Oil $92.50 +0.17 +0.18%

-

06:26

Stocks. Daily history for Jan 8’2014:

Nikkei 225 16,121.45 +307.08 +1.94%

Hang Seng 23,003.22 +290.44 +1.28%

S&P/ASX 200 5,316.05 -0.94 -0.02%

Shanghai Composite 2,044.34 -2.98 -0.15%

FTSE 100 6,721.78 -33.67 -0.50%

CAC 40 4,260.96 -1.72 -0.04%

DAX 9,497.84 -8.36 -0.09%

Dow 16,461.45 -69.49 -0.42%

Nasdaq 4,165.61 +12.43 +0.30%

S&P 500 1,837.47 -0.41 -0.02%

-

06:25

Currencies. Daily history for Jan 8'2014

(00:00 GMT +02:00)/change, %)

EUR/USD $1,3574 -0,29%

GBP/USD $1,6446 +0,28%

USD/CHF Chf0,9111 +0,24%

USD/JPY Y104,84 +0,24%

EUR/JPY Y142,33 -0,05%

GBP/JPY Y172,44 +0,54%

AUD/USD $0,8899 -0,29%

NZD/USD $0,8264 -0,21%

USD/CAD C$1,0819 +0,51%

-

06:01

Schedule for today, Thursday, Jan 9’2013:

00:30 Australia Building Permits, m/m November -1.8% -0.9%

00:30 Australia Building Permits, y/y November +23.1% +20.1%

00:30 Australia Retail sales (MoM) November +0.5% +0.5%

00:30 Australia Retail Sales Y/Y November +3.6%

01:30 China PPI y/y December -1.4% -1.2%

01:30 China CPI y/y December +3.0% +2.7%

07:45 France Trade Balance, bln November -4.7 -4.6

09:30 United Kingdom Trade in goods November -9.7 -9.5

10:00 Eurozone Business climate indicator December 0.18 0.2

10:00 Eurozone Economic sentiment index December 98.5 99.0

10:00 Eurozone Industrial confidence December -3.9 -3.3

11:00 Germany Industrial Production s.a. (MoM) November -1.2% +1.6%

11:00 Germany Industrial Production (YoY) November +1.0% +3.4%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.25% 0.25%

13:15 Canada Housing Starts December 192 196

13:30 Eurozone ECB Press Conference

13:30 Canada Building Permits (MoM) November +7.4% -2.3%

13:30 Canada New Housing Price Index November +0.1% +0.2%

13:30 U.S. Initial Jobless Claims January 339 337

-