Notícias do Mercado

-

20:00

Dow 16,907.89 -77.72 -0.46%, Nasdaq 4,397.86 -21.17 -0.48%, S&P 1,964.40 -8.43 -0.43%

-

17:26

Oil: an overview of the market situation

Crude oil fell as supply concerns eased in Iraq and Libya. Futures dropped for a 10th day, poised for the longest retreat since the contracts began trading in 1983. Libya's production rose as output from the western Sharara field climbed, National Oil Corp. said. The fighting in Iraq hasn't spread to the south, home to more than three-quarters of its crude output.

WTI for August delivery dropped to $102.18 a barrel (-0.09%) on the New York Mercantile Exchange.

Brent for August settlement fell to $107.98 a barrel (-0.30%) on the London-based ICE Futures Europe exchange.

-

17:00

-

17:00

European stocks close: stocks traded lower due to losses in the banking sector

Stock indices decreased traded lower due to losses in the banking sector. There are growing concerns over the financial health of Porugal's Espirito Santo Financial Group. Espirito Santo Financial Group is the largest lender in Portugal.

In the early trading session, stock markets were driven by the weaker-than-expected data from France. French industrial production declined 1.7% in May, missing expectations for a 0.5% rise, after a 0.3% gain in April.

On a yearly basis, French industrial production fell 3.7% in May, after a 2.0% drop in April.

French consumer price index remained flat in June, missing expectations for a 0.2% rise. On a yearly basis, French consumer price index increased 0.6% in June, after a 0.7% gain in May.

Gerresheimer AG shares jumped 3.6% after reporting better-than-expected quarterly earnings.

DNB ASA shares declined 5.0% after the company's second quarter net income missed analysts' forecasts.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,672.37 -45.67 -0.68%

DAX 9,659.13 -149.07 -1.52%

CAC 40 4,301.26 -58.58 -1.34%

-

16:44

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the better-than-expected number of initial jobless claims in the U.S.

The U.S. dollar traded higher against the most major currencies after the better-than-expected number of initial jobless claims in the U.S. The number of initial jobless claims in the U.S. in the week ending July 5 fell by 11,000 to a 304,000 from the previous week's number of 315,000 claims. Analysts had expected jobless claims to increase to 316,000.

The U.S. wholesale inventories rose 0.5% in May, after a 1.0% increase in April. April's figure was revised from a 1.1% rise. Analysts had expected a 0.6% gain.

The euro dropped against the U.S. dollar due to the weaker-than-expected data from France. French industrial production declined 1.7% in May, missing expectations for a 0.5% rise, after a 0.3% gain in April.

On a yearly basis, French industrial production fell 3.7% in May, after a 2.0% drop in April.

French consumer price index remained flat in June, missing expectations for a 0.2% rise. On a yearly basis, French consumer price index increased 0.6% in June, after a 0.7% gain in May.

The British pound fell against the U.S. dollar after the Bank of England's interest decision and the weaker-than-expected trade data from the U.K. The Bank of England kept unchanged its interest rate at 0.5%. The volume of the BoE's asset purchase program remained unchanged at £375 billion. This decision was expected by the analysts.

The U.K. trade deficit climbed to £9.2 billion in May from a deficit of £8.81 billion in April. April's figure was revised up from a deficit of £8.92 billion. Analysts had expected a deficit of £9.00 billion.

The Canadian dollar traded mixed against the U.S. dollar after the weaker-than-expected Canadian new housing price index. The index increased 0.1% in May, missing expectations for a 0.3% rise, after a 0.2% gain in April.

The New Zealand dollar traded lower against the U.S dollar. The kiwi was supported by the better-than-expected Business NZ purchasing managers' index for New Zealand. The index climbed to 53.3 in June from a reading of 52.6 in May. May's figure was revised down from 52.7.

The weaker-than-expected Chinese trade balance data put the kiwi under pressure. China's trade surplus declined to $31.6 billion in June from a surplus of $35.9 billion in May, missing expectations for an increase to a surplus of $37.3 billion.

The Australian dollar dropped against the U.S. dollar after mixed economic data from Australia, but later recovered a part of its losses. The number of employed people in Australia jumped by 15,900 in June, exceeding expectations for a rise of 12,300, after a 5,100 drop in May. May's figure was revised down from a 4,800 decrease.

Australia's unemployment rate surged to 6.0% in June from 5.9% in May. May's figure was revised up from 5.8%. Analysts had expected the rate to remain unchanged at 5.9%.

The consumer inflation expectations in Australia fell to 3.8% in June from 4.0% in May.

The Japanese yen traded higher against the U.S. dollar. The core machinery orders in Japan dropped 19.5% in May, missing expectations for a 0.9% gain, after a 9.1% fall in April.

On a yearly basis, the core machinery orders in Japan declined 14.3% in May, missing expectations for a 9.5% rise, after a 17.6% increase in April.

Japan's tertiary industry index rose 0.9% in May, missing forecasts of a 1.9% increase, after a 5.4% drop in April.

-

15:00

U.S.: Wholesale Inventories, May +0.5% (forecast +0.6%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3560-70, $1.3575-80, $1.3600-05, $1.3615, $1.3620-30, $1.3650

USD/JPY Y101.35-45, Y101.65-75, Y101.85, Y102.00, Y102.30-35

GBP/USD $1.7000, $1.7070, $1.7110

EUR/GBP stg0.8000

EUR/CHF Chf1.2205

AUD/USD $0.9300, $0.9330, $0.9375-85, $0.9400, $0.9440

NZD/USD $0.8760

-

14:34

U.S. Stocks open: Dow 16,885.11 -100.50 -0.59%, Nasdaq 4,353.77 -65.26 -1.48%, S&P 1,955.23 -17.60 -0.89%

-

14:27

Before the bell: S&P futures -0.97%, Nasdaq futures -0.99%

U.S. stock-index futures fell sharply as the Federal Reserve unveiled its plan for winding down its asset-buying program and the parent of a Portuguese bank delayed payments on some short-term debt.

Global markets:

Nikkei 15,216.47 -86.18 -0.56%

Hang Seng 23,238.99 +62.92 +0.27%

Shanghai Composite 2,038.34 -0.27 -0.01%

FTSE 6,654.4 -63.64 -0.95%

CAC 4,284.09 -75.75 -1.74%

DAX 9,634.53 -173.67 -1.77%

Crude oil $102.02 (-0.26%)

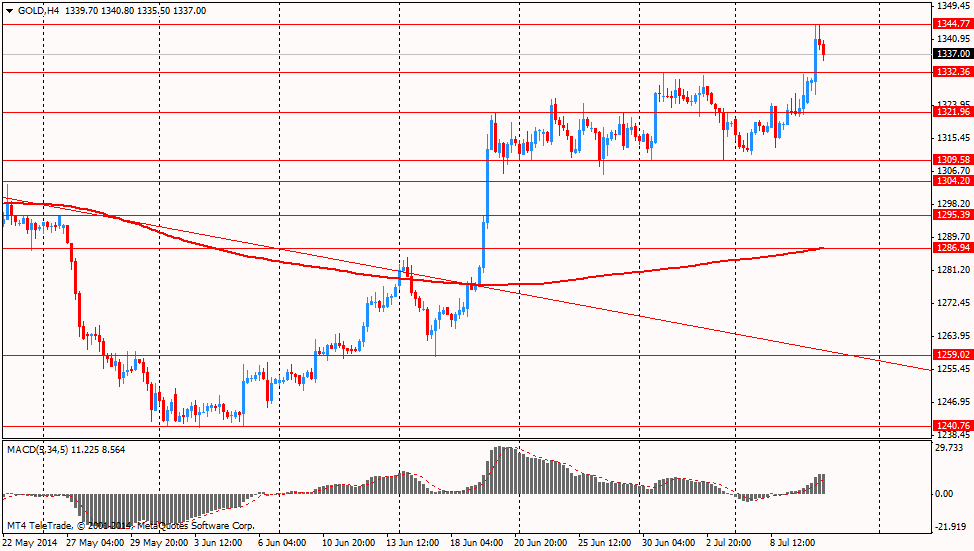

Gold $1343.20 (+1.43%)

-

14:06

DOW components before the bell

(company / ticker / price / change, % / volume)

Verizon Communications Inc

VZ

48.62

-0.57%

14.8K

AT&T Inc

T

35.44

-0.59%

9.4K

Wal-Mart Stores Inc

WMT

76.74

-0.61%

0.6K

Microsoft Corp

MSFT

41.41

-0.62%

5.4K

Intel Corp

INTC

30.68

-0.68%

44.8K

3M Co

MMM

143.66

-0.71%

0.2K

E. I. du Pont de Nemours and Co

DD

64.57

-0.72%

4.1K

Johnson & Johnson

JNJ

105.27

-0.73%

1.8K

Pfizer Inc

PFE

29.83

-0.73%

4.8K

Walt Disney Co

DIS

86.58

-0.73%

3.7K

McDonald's Corp

MCD

100.32

-0.74%

0.9K

Procter & Gamble Co

PG

81.06

-0.75%

3.4K

International Business Machines Co...

IBM

186.90

-0.81%

2.5K

Exxon Mobil Corp

XOM

102.70

-0.82%

2.7K

Merck & Co Inc

MRK

58.07

-0.82%

0.4K

Chevron Corp

CVX

130.27

-0.85%

1.0K

Cisco Systems Inc

CSCO

25.20

-0.94%

32.4K

General Electric Co

GE

26.03

-1.10%

56.2K

Boeing Co

BA

125.38

-1.11%

8.6K

Nike

NKE

77.67

-1.30%

1.8K

American Express Co

AXP

93.50

-1.31%

1.4K

JPMorgan Chase and Co

JPM

55.23

-1.41%

17.5K

Goldman Sachs

GS

162.31

-1.43%

0.5K

Caterpillar Inc

CAT

108.57

-1.43%

4.6K

UnitedHealth Group Inc

UNH

81.55

-1.44%

3.0K

Home Depot Inc

HD

79.18

-1.92%

4.2K

-

14:00

Upgrades and downgrades before the market open

Upgrades:

Alcoa (AA) upgrade from Equal-Weight to Overweight at Morgan Stanley

Downgrades:

UnitedHealth (UNH) downgraded from Buy to Hold at Jefferies

Other:

FedEx (FDX) target raised to $169 from $162 at Argus

-

13:30

U.S.: Initial Jobless Claims, July 304 (forecast 316)

-

13:30

Canada: New Housing Price Index , May +0.1% (forecast +0.3%)

-

13:27

Bank of England kept unchanged its interest rate and asset purchase program

The Bank of England kept unchanged its interest rate at 0.5%. The volume of the BoE's asset purchase program remained unchanged at £375 billion. This decision was expected by the analysts.

Markets participants are awaiting any hints on when the Bank of England could start to raise its interest rate. Some investors speculate that the BoE will hike its interest rate sooner than expected due to the strong economic data.

The UK gross domestic product rose 0.8% in the first quarter of the year. That was the fifth straight quarter of growth.

The unemployment rate in the UK declined to 6.6% in the three months to May.

But the inflation rate was at 1.5% in May, below the central bank's 2% inflation target.

-

13:07

Foreign exchange market. European session: the euro dropped against the U.S. dollar due to the weaker-than-expected data from France

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

22:30 New Zealand Business NZ PMI June 52.7 53.3

23:01 United Kingdom RICS House Price Balance June 57% 55% 53%

23:50 Japan Core Machinery Orders May -9.1% +0.9% -19.5%

23:50 Japan Core Machinery Orders, y/y May +17.6% +9.5% -14.3%

23:50 Japan Tertiary Industry Index May -5.4% +1.9% +0.9%

01:00 Australia Consumer Inflation Expectation July +4.0% +3.8%

01:30 Australia Changing the number of employed June -4.8 +12.3 +15.9

01:30 Australia Unemployment rate June 5.8% 5.9% 6.0%

02:00 China Trade Balance, bln June 35.9 37.3 31.6

05:00 Japan Consumer Confidence June 39.3 40.7 41.1

06:45 France CPI, m/m June 0.0% +0.2% 0.0%

06:45 France CPI, y/y June +0.7% +0.6%

06:45 France Industrial Production, m/m May +0.3% +0.5% -1.7%

06:45 France Industrial Production, y/y May -2.0% -3.7%

08:00 Eurozone ECB Monthly Report July

08:30 United Kingdom Trade in goods May -8.9 -9.0 -9.2

13:00 United Kingdom Asset Purchase Facility 375 375 375

13:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

13:00 United Kingdom MPC Rate Statement

The U.S. dollar traded higher against the most major currencies due to yesterday's Fed's monetary policy meeting minutes. Markets participants were disappointed because there was no information on when the Fed could start to raise its interest rate. The Fed could keep interest rate at low level for a longer period.

Fed policymakers agreed to end the Fed's bond-buying programme in October.

The Fed said that the economy is continuing to improve. But there are different views over the outlook for inflation.

The central bank added that U.S. consumer prices should increase and the labour market tighten before it will start to raise its interest rate.

The euro dropped against the U.S. dollar due to the weaker-than-expected data from France. French industrial production declined 1.7% in May, missing expectations for a 0.5% rise, after a 0.3% gain in April.

On a yearly basis, French industrial production fell 3.7% in May, after a 2.0% drop in April.

French consumer price index remained flat in June, missing expectations for a 0.2% rise. On a yearly basis, French consumer price index increased 0.6% in June, after a 0.7% gain in May.

The British pound declined against the U.S. dollar after the Bank of England's interest decision and the weaker-than-expected trade data from the U.K. The Bank of England kept unchanged its interest rate at 0.5%. The volume of the BoE's asset purchase program remained unchanged at £375 billion. This decision was expected by the analysts.

The U.K. trade deficit climbed to £9.2 billion in May from a deficit of £8.81 billion in April. April's figure was revised up from a deficit of £8.92 billion. Analysts had expected a deficit of £9.00 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian new housing price index. The index should increase 0.3% in May, after a 0.2% gain in April.

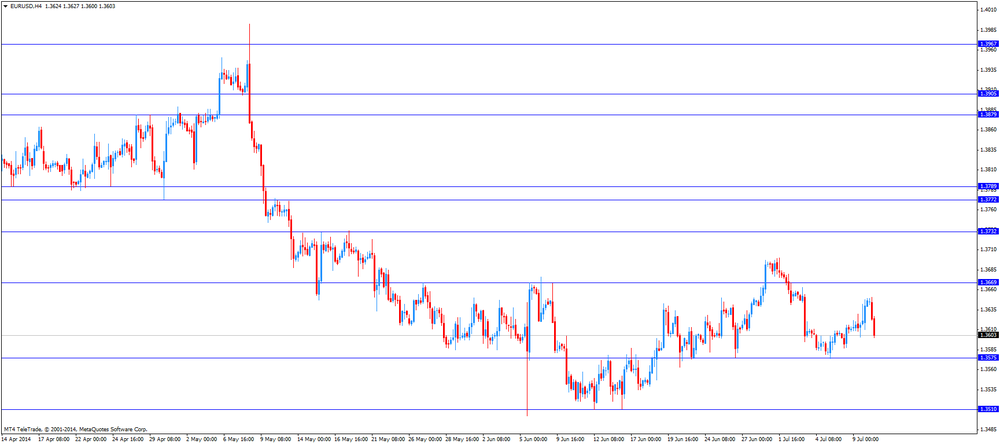

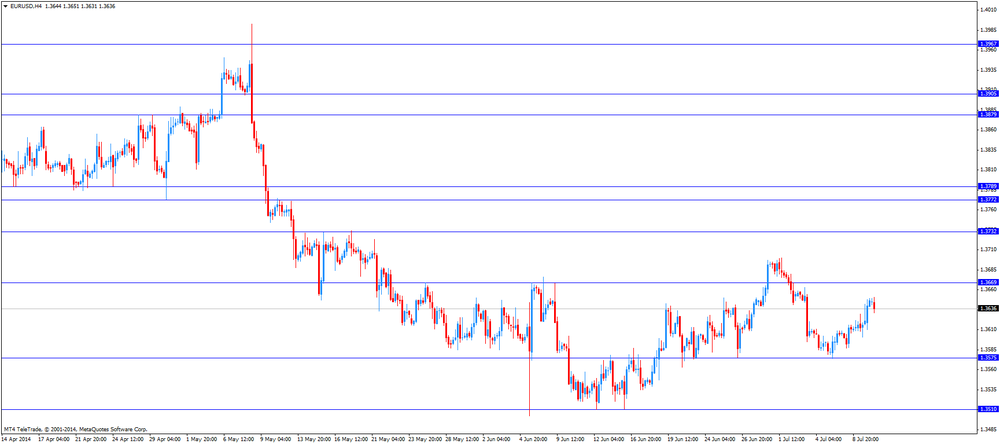

EUR/USD: the currency pair declined to $1.3600

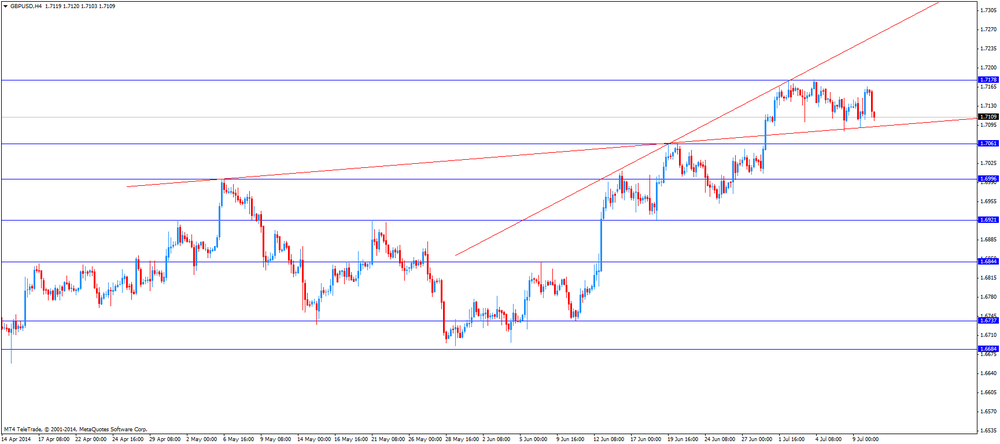

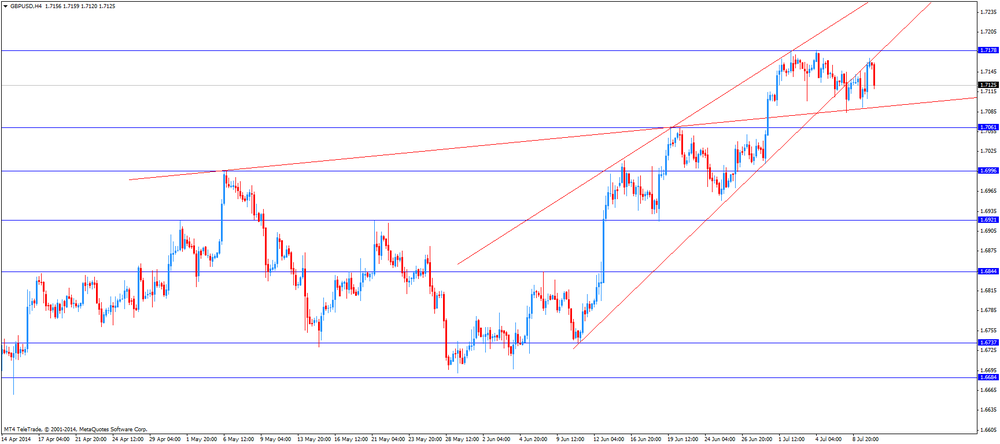

GBP/USD: the currency pair decreased to $1.7103

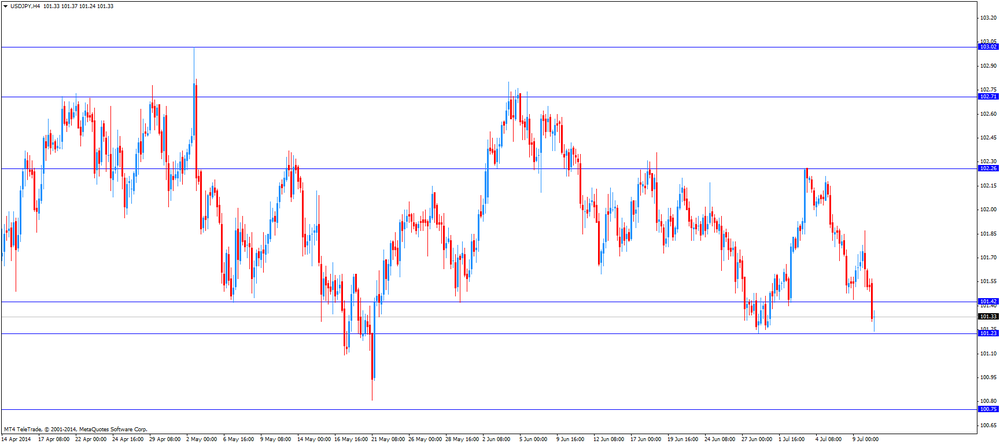

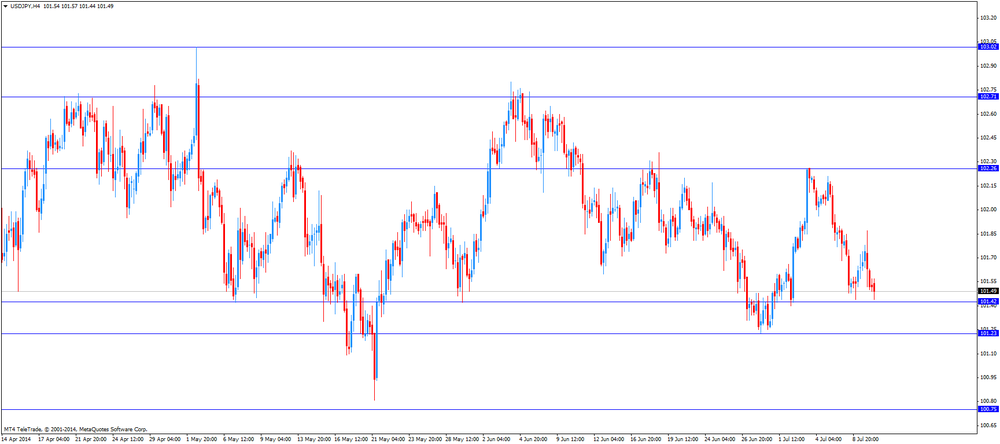

USD/JPY: the currency pair fell to Y101.24

The most important news that are expected (GMT0):

14:30 Canada New Housing Price Index May +0.2% +0.3%

14:30 U.S. Initial Jobless Claims July 315 316

16:00 U.S. Wholesale Inventories May +1.1% +0.6%

-

13:00

Orders

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660

Bids $1.3605, $1.3585, $1.3565, $1.3550/40, $1.3500

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9450

Bids $0.9360, $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.00, Y139.50, Y139.30, Y139.00, Y138.80

Bids Y138.00, Y137.90, Y137.70

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30, Y101.90/00

Bids Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970

Bids stg0.7925, stg0.7905-890, stg0.7800

-

12:02

European stock markets mid session: stocks decreased after the weaker-than-expected data from France

Stock indices decreased after the weaker-than-expected data from France. French industrial production declined 1.7% in May, missing expectations for a 0.5% rise, after a 0.3% gain in April.

On a yearly basis, French industrial production fell 3.7% in May, after a 2.0% drop in April.

French consumer price index remained flat in June, missing expectations for a 0.2% rise. On a yearly basis, French consumer price index increased 0.6% in June, after a 0.7% gain in May.

Stock markets were also driven by yesterday's Fed's monetary policy meeting minutes. Markets participants were disappointed because there was no information on when the Fed could start to raise its interest rate. The Fed could keep interest rate at low level for a longer period.

Fed policymakers agreed to end the Fed's bond-buying programme in October.

The Fed said that the economy is continuing to improve. But there are different views over the outlook for inflation.

The central bank added that U.S. consumer prices should increase and the labour market tighten before it will start to raise its interest rate.

Gerresheimer AG shares jumped 5.8% after reporting better-than-expected quarterly earnings.

DNB ASA shares declined 4.5% after the company's second quarter net income missed analysts' forecasts.

Current figures:

Name Price Change Change %

FTSE 100 6,660.5 -57.54 -0.86%

DAX 9,653.77 -154.43 -1.57%

CAC 40 4,289.01 -70.83 -1.62%

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

11:37

Fed's monetary policy meeting minutes: Fed ends its bond-buying programme in October

The Federal Reserve released its June monetary policy meeting minutes on Wednesday:

- Fed policymakers agreed to end the Fed's bond-buying programme in October;

- The economy is continuing to improve;

- There are different views over the outlook for inflation;

- U.S. consumer prices should increase and the labour market tighten before the Fed will start to raise its interest rate.

- Fed policymakers agreed to end the Fed's bond-buying programme in October;

-

10:47

Asian Stocks close: most stocks declined due to the weaker-than-expected trade data from China

Most Asian stock indices declined due to the weaker-than-expected trade data from China. China's trade surplus declined to $31.6 billion in June from a surplus of $35.9 billion in May, missing expectations for an increase to a surplus of $37.3 billion.

Chinese exports in June rose 7.2% from a year earlier. Imports increased 5.5%.

The core machinery orders in Japan dropped 19.5% in May, missing expectations for a 0.9% gain, after a 9.1% fall in April.

On a yearly basis, the core machinery orders in Japan declined 14.3% in May, missing expectations for a 9.5% rise, after a 17.6% increase in April.

Japan's tertiary industry index rose 0.9% in May, missing forecasts of a 1.9% increase, after a 5.4% drop in April.

Indexes on the close:

Nikkei 225 15,216.47 -86.18 -0.56%

Hang Seng 23,238.99 +62.92 +0.27%

Shanghai Composite 2,038.34 -0.27 -0.01%

-

10:28

Option expiries for today's 1400GMT cut

EUR/USD $1.3550, $1.3560-70, $1.3575-80, $1.3600-05, $1.3615, $1.3620-30, $1.3650

USD/JPY Y101.35-45, Y101.65-75, Y101.85, Y102.00, Y102.30-35

GBP/USD $1.7000, $1.7070, $1.7110

EUR/GBP stg0.8000

EUR/CHF Chf1.2205

AUD/USD $0.9300, $0.9330, $0.9375-85, $0.9400, $0.9440

NZD/USD $0.8760

-

10:15

Foreign exchange market. Asian session: the Australian dollar dropped against the U.S. dollar after mixed economic data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

22:30 New Zealand Business NZ PMI June 52.7 53.3

23:01 United Kingdom RICS House Price Balance June 57% 55% 53%

23:50 Japan Core Machinery Orders May -9.1% +0.9% -19.5%

23:50 Japan Core Machinery Orders, y/y May +17.6% +9.5% -14.3%

23:50 Japan Tertiary Industry Index May -5.4% +1.9% +0.9%

01:00 Australia Consumer Inflation Expectation July +4.0% +3.8%

01:30 Australia Changing the number of employed June -4.8 +12.3 +15.9

01:30 Australia Unemployment rate June 5.8% 5.9% 6.0%

02:00 China Trade Balance, bln June 35.9 37.3 31.6

05:00 Japan Consumer Confidence June 39.3 40.7 41.1

06:45 France CPI, m/m June 0.0% +0.2% 0.0%

06:45 France CPI, y/y June +0.7% +0.6%

06:45 France Industrial Production, m/m May +0.3% +0.5% -1.7%

06:45 France Industrial Production, y/y May -2.0% -3.7%

08:00 Eurozone ECB Monthly Report July

08:30 United Kingdom Trade in goods May -8.9 -9.0 -9.2

The U.S. dollar traded mixed against the most major currencies due to yesterday's Fed's monetary policy meeting minutes. There was no new information on when the Fed could start to raise its interest rate. Fed policymakers agreed to end the Fed's bond-buying programme in October.

The Fed said that the economy is continuing to improve. But there are different views over the outlook for inflation.

The central bank added that U.S. consumer prices should increase and the labour market tighten before it will start to raise its interest rate.

The New Zealand dollar traded mixed near 3-year highs against the U.S dollar. The kiwi was supported by the better-than-expected Business NZ purchasing managers' index for New Zealand. The index climbed to 53.3 in June from a reading of 52.6 in May. May's figure was revised down from 52.7.

The weaker-than-expected Chinese trade balance data put the kiwi under pressure. China's trade surplus declined to $31.6 billion in June from a surplus of $35.9 billion in May, missing expectations for an increase to a surplus of $37.3 billion.

The Australian dollar dropped against the U.S. dollar after mixed economic data from Australia. The number of employed people in Australia jumped by 15,900 in June, exceeding expectations for a rise of 12,300, after a 5,100 drop in May. May's figure was revised down from a 4,800 decrease.

Australia's unemployment rate surged to 6.0% in June from 5.9% in May. May's figure was revised up from 5.8%. Analysts had expected the rate to remain unchanged at 5.9%.

The consumer inflation expectations in Australia fell to 3.8% in June from 4.0% in May.

The Japanese yen traded higher against the U.S. dollar after the weaker-than- expected economic data from Japan. The core machinery orders in Japan dropped 19.5% in May, missing expectations for a 0.9% gain, after a 9.1% fall in April.

On a yearly basis, the core machinery orders in Japan declined 14.3% in May, missing expectations for a 9.5% rise, after a 17.6% increase in April.

Japan's tertiary industry index rose 0.9% in May, missing forecasts of a 1.9% increase, after a 5.4% drop in April.

EUR/USD: the currency pair increased to $1.3650

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair decreased to Y101.50

The most important news that are expected (GMT0):

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

12:30 Canada New Housing Price Index May +0.2% +0.3%

12:30 U.S. Initial Jobless Claims July 315 316

14:00 U.S. Wholesale Inventories May +1.1% +0.6%

-

08:47

DAX 9,792.82 -15.38 -0.16%, CAC 40 4,351.41 -8.43 -0.19%, EUROFIRST 300 1,361.48 -1.98 -0.15%, FTSE 100 6,714.26 -3.78 -0.06%

-

07:47

France: CPI, y/y, June +0.6%

-

07:46

France: CPI, m/m, June 0.0% (forecast +0.2%)

-

07:01

European bourses are seen a touch higher in early trade: the FTSE is seen up 0.1%, the DAX up 0.2% and the CAC up 0.1%.

-

06:27

Options levels on thursday, July 10, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3721 (2849)

$1.3700 (2581)

$1.3674 (282)

Price at time of writing this review: $ 1.3645

Support levels (open interest**, contracts):

$1.3619 (151)

$1.3602 (364)

$1.3579 (1875)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 22903 contracts, with the maximum number of contracts with strike price $1,3800 (3450);

- Overall open interest on the PUT options with the expiration date August, 8 is 30615 contracts, with the maximum number of contracts with strike price $1,3500 (7331);

- The ratio of PUT/CALL was 1.34 versus 1.33 from the previous trading day according to data from July, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (1010)

$1.7304 (1493)

$1.7207 (1358)

Price at time of writing this review: $1.7154

Support levels (open interest**, contracts):

$1.7093 (1891)

$1.6996 (1636)

$1.6898 (1871)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15430 contracts, with the maximum number of contracts with strike price $1,7250 (2094);

- Overall open interest on the PUT options with the expiration date August, 8 is 19233 contracts, with the maximum number of contracts with strike price $1,7100 (1891);

- The ratio of PUT/CALL was 1.25 versus 1.25 from the previous trading day according to data from Jule, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:23

Currencies. Daily history for Jule 9'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3640 +0,21%

GBP/USD $1,7155 +0,15%

USD/CHF Chf0,8909 -0,21%

USD/JPY Y101,63 +0,09%

EUR/JPY Y138,62 +0,30%

GBP/JPY Y173,34 -0,33%

AUD/USD $0,9406 +0,10%

NZD/USD $0,8818 +0,37%

USD/CAD C$1,0652 -0,23%

-

05:23

Stocks. Daily history for Jule 9’2014:

(index / closing price / change items /% change)

S&P/ASX 200 5,452.48 -58.46 -1.06%

TOPIX 1,270.82 -4.88 -0.38%

SHANGHAI COMP 2,038.61 -25.41 -1.23%

HANG SENG 23,176.07 -365.31 -1.55%

FTSE 100 6,718.04 -20.41 -0.30%

CAC 40 4,359.84 +17.31 +0.40%

Xetra DAX 9,808.2 +35.53 +0.36%

S&P 500 1,972.83 +9.12 +0.46%

NASDAQ 4,419.03 +27.57 +0.63%

Dow Jones 16,985.61 +78.99 +0.47%

-

05:03

Schedule for today, Thursday, Jule 10’2014:

(time / country / index / period / previous value / forecast)

01:30 New Zealand Business NZ PMI June 52.7

02:01 United Kingdom RICS House Price Balance June 57% 55%

02:50 Japan Core Machinery Orders May -9.1% +0.9%

02:50 Japan Core Machinery Orders, y/y May +17.6% +9.5%

02:50 Japan Tertiary Industry Index May -5.4% +1.9%

04:00 Australia Consumer Inflation Expectation July +4.0%

04:30 Australia Changing the number of employed June -4.8 +12.3

04:30 Australia Unemployment rate June 5.8% 5.9%

05:00 China Trade Balance, bln June 35.9 37.3

08:00 Japan Consumer Confidence June 39.3 40.7

09:45 France CPI, m/m June 0.0% +0.2%

09:45 France CPI, y/y June +0.7%

09:45 France Industrial Production, m/m May +0.3% +0.5%

09:45 France Industrial Production, y/y May -2.0%

11:00 China New Loans June 871 950

11:00 Eurozone ECB Monthly Report July

11:30 United Kingdom Trade in goods May -8.9 -9.0

14:00 United Kingdom Asset Purchase Facility 375 375

14:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

14:00 United Kingdom MPC Rate Statement

15:30 Canada New Housing Price Index May +0.2% +0.3%

15:30 U.S. Initial Jobless Claims July 315 316

17:00 U.S. Wholesale Inventories May +1.1% +0.6%

-