Notícias do Mercado

-

20:00

Dow +102.37 16,360.31 +0.63% Nasdaq +65.88 4,179.19 +1.60% S&P +18.26 1,837.46 +1.00%

-

19:20

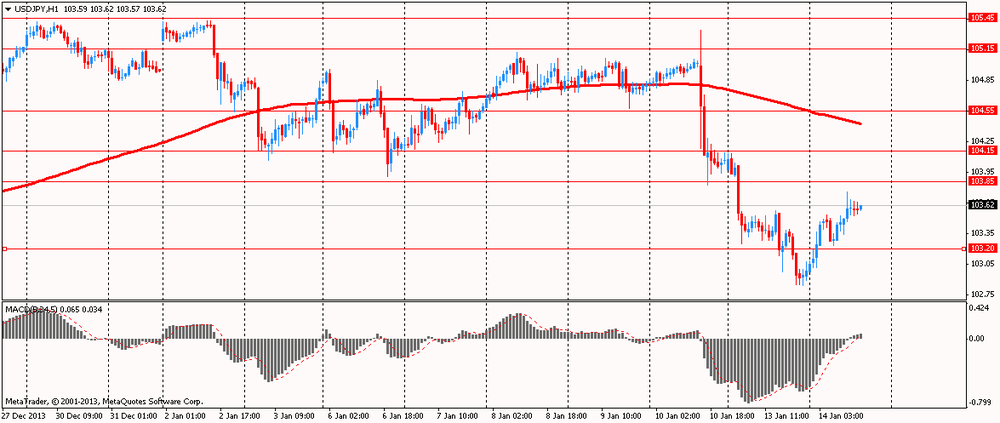

American focus: the yen has fallen markedly against the U.S. dollar

The euro exchange rate fell slightly against the dollar, losing previously won positions . Little impact on the bidding had U.S. data on retail sales and inventories , which confirmed the experts' predictions . Statements were important members of the Federal Open Market Plosser and Fisher . President of the Federal Reserve Bank of Philadelphia Charles Plosser said that the weak employment report for December will force the central bank to refrain from exercising its plans to curtail purchases of bonds . Plosser gave a reassuring speech on the prospects of the economy. According to him, there's no reason that the Fed could abandon the collapse of asset purchases .

During his speech, the representative of the Fed Fisher expressed commitment that the Fed started to cut bond purchases , but still said that the first cut should have been larger. Meanwhile , Fisher added that the Fed is facing enormous difficulties trying to manage liquidity .

Fisher also said that the market correction is not necessarily undermine the economic recovery . In his speech, he also said that he would not mind the correction in the stock market if the economic indicators are good .

Fisher also said that the Fed provided the markets too much liquidity , and liquidity the Fed clouded perception of investors. An important point of his speech were the words that the Fed is important to go ahead and complete the purchase of bonds

Pound rose against the U.S. dollar, after data indicated the slowdown in inflation in Britain. As it became known , inflation fell unexpectedly in December and reached the target level of 2 per cent of the Bank of England for the first time since 2009. Consumer prices rose by 2 percent year on year , after rising 2.1 percent in November. According to forecasts , inflation was to remain stable at 2.1 per cent . But on a monthly basis , consumer prices rose by 0.4 percent , which is faster than the growth of 0.1 percent posted in the previous month .

Excluding energy , food, alcoholic beverages and tobacco products , core inflation declined ">In a separate statement, the ONS said inflation producer prices accelerated to 1 percent in December from 0.8 percent a month earlier. Compared to November , prices for products remained unchanged .

Purchase prices , at the same time , decreased the second consecutive month in December. Prices fell by 1.2 per cent per annum, after easing to 1 percent in November . On a monthly basis the purchase prices increased by 0.1 percent.

The yen fell against the U.S. dollar , which primarily was due to the publication of a report on the current account deficit in Japan . In November, this figure increased to a record , as imports grew . This again highlights the problems for Prime Minister Shinzo Abe, who is trying to achieve sustainable economic growth. Index reached 592.8 billion yen ( $ 5.7 billion ) , the Finance Ministry said today in Tokyo. According to the median estimate of the deficit had to make 368.9 billion yen . The weakness of the yen and the additional demand for energy due to the closure of nuclear facilities have the most direct impact on Japan's imports . Sustained deficit is a major problem for the country because it could undermine investor confidence in the Japanese government debt.

Furthermore, the pressure on the currency was the U.S. data , which showed that retail sales rose 0.2 % last month , in line with expectations . Car sales fell 1.8 % , pulling down the broader indicators . For the automotive industry, this was a record year , and the slowdown in December is considered more a reflection of poor weather conditions and calendar amendments than the beginning of a new trend. Excluding autos, retail sales rose by December confident 0.7%. Value of retail sales for previous months were revised down to an increase of 0.5 % in October and in November, rising by 0.4%. Total retail sales for 2013 increased by 4.2 % compared with the previous year , slowing the pace of 2012 to 5.4% and 7.5% growth in 2011 .

-

18:20

European stock close

European stocks erased their decline in the final half an hour of trading as RWE AG rallied, leading utility shares higher.

The Stoxx Europe 600 Index added 0.1 percent to 331.11 at 4:30 p.m. in London. The gauge declined as much as 1 percent today as investors weighed equity valuations after closing yesterday at its highest level since May 2008.

National benchmarks fell in 12 of the 18 western-European market.

FTSE 100 6,766.86 +9.71 +0.14% CAC 40 4,274.2 +10.93 +0.26% DAX 9,540.51 +30.34 +0.32%

RWE jumped 5 percent to 26.81 euros after Germany’s Federal Administrative Court ruled that the forced shutdown of the company’s Biblis nuclear power plant in the aftermath of the 2011 Fukushima disaster was unlawful.

Celesio dropped 5.3 percent to 22.89 euros. McKesson, the largest U.S. drug distributor, said in a statement that its increased offer of 23.50 euros a share failed to pass the threshold needed for the deal to go through. McKesson may now seek a joint venture with the European wholesaler, John H. Hammergren, chairman and chief executive officer, said yesterday at a conference in San Francisco.

Jeronimo Martins, which owns supermarkets in Portugal and Poland, slid 2.8 percent to 13.62 euros. Comparable sales rose 2.5 percent in Poland in the fourth quarter, less than the 4 percent rate for the previous three-month period, according to a statement late yesterday. The Polish business, Biedronka, accounted for 66 percent of total sales in the three months through December. JPMorgan Chase & Co. downgraded the stock to neutral from overweight, meaning that investors should no longer buy the shares.

Ashmore Group Plc slumped 12 percent to 358 pence, its biggest drop since February 2009. The fund manager’s assets under management slipped 4.1 percent to $75.3 billion in the three months that ended Dec. 31, according to a statement.

Volkswagen AG decreased 2.4 percent to 197.80 euros as UBS AG lowered its rating on Europe’s largest carmaker to sell from neutral. The brokerage said the company’s high level of re-investment may cut into earnings growth.

Aeroports de Paris retreated 1.4 percent to 81.64 euros, while Fraport AG declined 0.8 percent to 54.66 euros after Barclays Plc lowered its ratings on the airport operators. The brokerage said AdP’s stock trades near fair value. Barclays added that passenger spending in Frankfurt airport’s shops has fallen below its estimates and the investment needed to build a third terminal may prevent Fraport from increasing its dividend.

-

17:00

European stock close: FTSE 100 6,766.86 +9.71 +0.14% CAC 40 4,274.2 +10.93 +0.26% DAX 9,540.51 +30.34 +0.32%

-

16:40

Oil: an overview of the market situation

Prices for WTI crude oil rose today , offsetting losses the previous session, while Brent oil price fell , which was associated with an additional increase in Libyan oil supplies and expectations that Iranian oil will return to the market.

It should be noted that caution bidders reinforce expectations data on wholesale inventories of oil in the United States. According to analysts , the oil reserves in the country for the week ending January 10 fell by 1.15 million barrels. Stocks of distillates , including fuel oil and diesel , last week could grow by 1.38 million barrels, while gasoline stocks could increase by 2.2 million barrels . Recall that later today its assessment of reserves present American Petroleum Institute (API).

On the dynamics of trade also affected the U.S. data , which showed that U.S. retail sales rose slightly in December , despite a large decline in car sales . This is a sign that consumers were willing to spend a bit more on other goods during the end of the Christmas season sales. Overall retail sales rose 0.2 % last month . Economists predicted a similar increase . Car sales fell 1.8 % , pulling down the broader indicators . For the automotive industry, this was a record year , and the slowdown in December is considered more a reflection of poor weather conditions and calendar amendments than the beginning of a new trend. Excluding autos, retail sales of December rose by 0.7%. Value of retail sales for previous months were revised down to an increase of 0.5 % in October and in November, rising by 0.4%.

Prices also affects the information that the Federal Reserve is ready to take the preliminary steps to limit banks' operations with raw materials on the background of attention of Congress.

The Federal Reserve plans to issue a notice seeking information on ways containment property and trade in certain goods banks as Central Bank is trying to reduce the risk of deposit banks , said the people , who requested anonymity . Regulators and legislators argue that commodity assets can lead to catastrophic losses , collapses and rescue by the state.

February futures price of U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 92.11 per barrel.

February futures price for North Sea Brent crude oil mixture fell 6 cents to $ 106.38 a barrel on the London exchange ICE Futures Europe.

-

16:21

Gold: an overview of the market situation

Gold prices rose today , while reaching its highest level in a month , which was due to the depreciation of stocks and uncertainty about growth prospects after a disappointing U.S. employment data , voiced last week. Markets believe that Friday's employment report may prompt the Fed to proceed with caution against narrowing its program of monetary stimulus , which will be a fall stock prices and cheaper dollar.

"The weak dollar and the employment report helped gold rise. In the near future , at least , these rates continue, because they also provide support for the purchase of in China before the New Year by the lunar calendar" - said the managing director GoldSilver Central Pte Ltd in Singapore , Brian Lang .

In addition, the course of today's trades affected data from the Association of Gold China, which showed that in January-November 2013 , China increased its gold production compared with the same period in 2012 to 7.01 % - up to 392.141 tons. Including gold production amounted to 321.115 tons, which is 4.08 % more than in 2012 . In November issue amounted to 44.487 tons of the precious metal . To

China is the largest gold producer in the world - the release of the precious metal in 2012 in the country , according to CGA, amounted to 403.05 tons. Last year, China also took second place for the consumption of gold ( after India ) - 768 tons. During the first 9 months of 2013 , according to the World Gold Council, China's consumption of the precious metal was 797.8 tons , surpassing the same period in India. In addition, previously reported that , perhaps on the basis of China in 2013 overtook Italy and France on gold reserves in foreign exchange reserves , taking third place on this indicator after the U.S. and Germany.

Meanwhile, adding that today the sale of 99.99 fine gold on the Shanghai Gold Exchange rose to 15.73 tons 14.63 tons on Monday, and ">Cost February gold futures on the COMEX today rose to $ 1252.20 per ounce.

-

15:00

U.S.: Business inventories , November +0.4% (forecast +0.4%)

-

14:34

U.S. Stocks open: Dow 16,302.70 +44.76 +0.28%, Nasdaq 4,132.99 +19.68 +0.48%, S&P 1,826.05 +6.85 +0.38%

-

14:26

Before the bell: S&P futures +0.23%, Nasdaq futures +0.26%

U.S. stock-index futures rose, as retail sales advanced more than forecast in December and investors weighed earnings from major banks.

Global markets:

Nikkei 15,422.4 -489.66 -3.08%

Hang Seng 22,791.28 -97.48 -0.43%

Shanghai Composite 2,026.84 +17.28 +0.86%

FTSE 6,760.26 +3.11 +0.05%

CAC 4,258.51 -4.76 -0.11%

DAX 9,494.76 -15.41 -0.16%

Crude oil $91.18 (+0.41%)

Gold $1249.80 (-0.10%).

-

13:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3550

USD/JPY Y103.30, Y103.50, Y104.00, Y104.70, Y104.75, Y105.00, Y106.00, Y106.50

GBP/USD $1.6425

GBP/JPY Y168.40

AUD/USD $0.8900, $0.8950, $0.9050

NZD/USD $0.8275

USD/CAD C$1.0800, C$1.0900

-

13:30

U.S.: Retail sales, December +0.2% (forecast +0.2%)

-

13:30

U.S.: Retail sales excluding auto, December +0.7% (forecast +0.4%)

-

13:30

U.S.: Import Price Index, December 0.0% (forecast +0.3%)

-

13:15

European session: the euro rose

07:45 France CPI, m/m December 0.0% +0.4% +0.3%

07:45 France CPI, y/y December +0.7% +0.8% +0.7%

09:30 United Kingdom Retail Price Index, m/m December +0.1% +0.5% +0.5%

09:30 United Kingdom Retail prices, Y/Y December +2.6% +2.7% +2.7%

09:30 United Kingdom RPI-X, Y/Y December +2.7% +2.8%

09:30 United Kingdom Producer Price Index - Input (MoM) December -0.7% -0.2% +0.1%

09:30 United Kingdom Producer Price Index - Input (YoY) December -1.0% -1.1% -1.2%

09:30 United Kingdom Producer Price Index - Output (MoM) December -0.2% +0.2% +0.1%

09:30 United Kingdom Producer Price Index - Output (YoY) December +0.8% +1.1% +1.0%

09:30 United Kingdom HICP, m/m December +0.1% +0.6% +0.4%

09:30 United Kingdom HICP, Y/Y December +2.1% +2.1% +2.0%

09:30 United Kingdom HICP ex EFAT, Y/Y December +1.8% +1.8% +1.7%

10:00 Eurozone Industrial production, (MoM) November -0.8% Revised From -1.1% +1.6% +1.8%

10:00 Eurozone Industrial Production (YoY) November +0.5% Revised From +0.2% +0.8% +3.0%

The euro rose against the U.S. dollar after strong data on industrial production in the euro area . Eurozone industrial production in November rose at the highest rate in three and a half years , indicating that the currency bloc 's GDP at the end of 2013 , probably increased the third consecutive quarter .

Unexpectedly strong growth in manufacturing eurozone reduces doubts about the sustainability of economic recovery . Although the results of the poll in the business world in the last quarter of 2013 were positive , the official data were weak industrial production , production in construction and retail sales fell in October .

Statistical Office of the European Union reported that industrial production in November rose by 1.8% compared to October , and by 3% compared with the same period last year. These data were better than forecast.

October data were revised upward . In Eurostat reported that industrial production in October fell by 0.8 %, whereas the previously reported 1.1% decline .

Growth in industrial production in November compared with the previous month was the highest since May 2010 , when it rose by 2%. Annualised growth was the highest since August 2011 , when industrial production grew by 5.5%.

The British pound rose against the U.S. dollar on data on slowing inflation in Britain. Inflation in the UK fell unexpectedly in December and reached the target level of 2 per cent of the Bank of England for the first time since 2009, the Office for National Statistics reported .

Consumer prices rose by 2 percent year on year , after rising 2.1 percent in November. According to forecasts , inflation was to remain stable at 2.1 per cent .

But on a monthly basis , consumer prices rose by 0.4 percent , which is faster than the growth of 0.1 percent posted in the previous month .

Excluding energy , food, alcoholic beverages and tobacco products , core inflation declined ">In a separate statement, the ONS said inflation producer prices accelerated to 1 percent in December from 0.8 percent a month earlier. Compared to November , prices for products remained unchanged .

Purchase prices , at the same time , decreased the second consecutive month in December. Prices fell by 1.2 per cent per annum, after easing to 1 percent in November . On a monthly basis the purchase prices increased by 0.1 percent.

EUR / USD: during the European session, the pair rose to $ 1.3699

GBP / USD: during the European session, the pair rose to $ 1.6448

USD / JPY: during the European session, the pair rose to Y103.75

In the U.S. at 13:30 GMT will change in the volume of retail trade , the change in retail sales excluding auto sales , the change in volume of retail trade turnover , excluding sales of cars and fuel, the import price index for December at 15:00 GMT - change in stocks in commercial warehouses for November. At 23:30 GMT Australia will release the consumer confidence index from Westpac in January , the index of leading indicators of economic activity from the Westpac-MI in December.

-

11:30

European stocks dropped

European stocks dropped from their highest level since May 2008, tracking global indexes lower amid concern over equity valuations. U.S. index futures fluctuated, while Asian shares retreated.

The Stoxx Europe 600 Index declined 0.8 percent to 328.04 at 8:29 a.m. in London, its biggest retreat since Jan. 2. Standard & Poor’s 500 Index futures added less than 0.1 percent, after the equity benchmark yesterday dropped the most in two months. The MSCI Asia Pacific Index sank 1.4 percent for its largest loss since September as Japanese equities tumbled.

Celesio dropped 5.4 percent to 22.85 euros. McKesson, the largest U.S. drug distributor, said in a statement that its increased offer of 23.50 euros a share failed to obtain the backing of 75 percent of Celesio’s shares needed for the deal to go through. McKesson may seek a joint venture with the European wholesaler, John H. Hammergren, chairman and chief executive officer, said yesterday at a conference in San Francisco.

Jeronimo Martins, which owns supermarkets in Portugal and Poland, lost 3.4 percent to 13.53 euros as JPMorgan downgraded the stock to neutral from overweight, meaning that investors should no longer buy the shares. Comparable sales rose 2.5 percent in Poland in the fourth quarter, less than the 4 percent rate for the previous three-month period, according to a statement late yesterday. The Polish business, Biedronka, accounted for 66 percent of total sales in the three months through December.

Volkswagen slipped 2.7 percent to 197.05 euros as UBS lowered its rating on Europe’s largest carmaker to sell from neutral, saying the company’s high level of re-investment may cut into earnings growth.

FTSE 100 6,749.56 -7.59 -0.11%

CAC 40 4,247.99 -15.28 -0.36%

DAX 9,462.99 -47.18 -0.50%

-

10:31

Option expiries for today's 1400GMT cut

EUR/USD $1.3550

USD/JPY Y103.30, Y103.50, Y104.00, Y104.70, Y104.75, Y105.00, Y106.00, Y106.50

GBP/USD $1.6425

GBP/JPY Y168.40

AUD/USD $0.8900, $0.8950, $0.9050

NZD/USD $0.8275

USD/CAD C$1.0800, C$1.0900

-

10:15

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index poised to drop for a fourth day, as a report showed U.S. service industries expanded less than expected and raw-material shares led declines.

Nikkei 225 15,814.37 -94.51 -0.59%

S&P/ASX 200 5,316.99 -7.89 -0.15%

Shanghai Composite 2,044.44 -1.27 -0.06%

Sinopec Shanghai Petrochemical Co., an oil processor, slumped 5.9 percent, leading material shares lower.

Oversea-Chinese Banking Corp., Southeast Asia’s second-biggest lender, fell 0.8 percent in Singapore amid concern it may pay too much to take over Hong Kong’s Wing Hang Bank Ltd.

Li & Fung Ltd., the world’s largest supplier of clothes and toys to retailers, gained 8.5 percent in Hong Kong as the company called its 2013 performance “solid.”

-

10:00

Eurozone: Industrial production, (MoM), November +1.8% (forecast +1.6%)

-

10:00

Eurozone: Industrial Production (YoY), November +3.0% (forecast +0.8%)

-

09:32

United Kingdom: Retail Price Index, m/m, December +0.5% (forecast +0.5%)

-

09:32

United Kingdom: Retail prices, Y/Y, December +2.7% (forecast +2.7%)

-

09:31

United Kingdom: Producer Price Index - Input (MoM), December +0.1% (forecast -0.2%)

-

09:31

United Kingdom: Producer Price Index - Input (YoY) , December -1.2% (forecast -1.1%)

-

09:31

United Kingdom: Producer Price Index - Output (MoM), December +0.1% (forecast +0.2%)

-

09:31

United Kingdom: Producer Price Index - Output (YoY) , December +1.0% (forecast +1.1%)

-

09:30

United Kingdom: HICP, m/m, December +0.4% (forecast +0.6%)

-

09:30

United Kingdom: HICP, Y/Y, December +2.0% (forecast +2.1%)

-

09:30

United Kingdom: HICP ex EFAT, Y/Y, December +1.7% (forecast +1.8%)

-

08:46

FTSE 100 6,714.76 -42.39 -0.63%, CAC 40 4,228.65 -34.62 -0.81%, Xetra DAX 9,413.14 -97.03 -1.02%

-

07:45

France: CPI, m/m, December +0.4% (forecast +0.4%)

-

07:45

France: CPI, y/y, December +0.8% (forecast +0.8%)

-

07:27

European bourses are initially seen trading lower: the FTSE down 33, the DAX down 53 and the CAC down 23.

-

07:07

Asian session: The yen dropped

05:00 Japan Eco Watchers Survey: Current December 53.5 54.2 55.7

05:00 Japan Eco Watchers Survey: Outlook December 54.8 54.3 54.7

The yen dropped against all of its 16 major peers after data showed Japan’s current-account deficit widened to a record in November. Japan posted a record 592.8 billion yen ($5.73 billion) shortfall in its current account in November, the broadest measure of international trade, according to a Ministry of Finance report released in Tokyo today. The yen tends to strengthen during a period of financial turmoil because the nation had an annual current-account surplus since at least 1985, making it less reliant on foreign capital.

Government data showed today investors in the Asian nation increased holdings of dollar bonds for a fifth month, as economists forecast the Bank of Japan will boost asset purchases this year that hold domestic yields at the lowest globally.

The yen fell against the dollar after Osaka-based Suntory Holdings Ltd. agreed to buy Beam Inc. in the U.S. for $16 billion.

The Bloomberg Dollar Spot Index snapped a three-day decline before Charles Plosser from the Federal Reserve Bank of Philadelphia and Richard Fisher from the Dallas Fed speak today. Plosser, an opponent of bond purchases by the Fed, said earlier this month policy makers shouldn’t try to make up for a permanent loss in potential growth caused by the financial crisis. Fisher argued for a $20 billion reduction in the central bank’s monthly bond purchasing pace instead of the $10 billion announced last month. The regional Fed chiefs and other voting members of the Federal Open Market Committee next meet on Jan. 28-29.

The New Zealand dollar extended a gain from yesterday versus its Australian peer after reports showed business confidence surged to an almost 20-year high in the smaller nation.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3655-70

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6375-00

USD / JPY: during the Asian session, the pair rose to Y103.55

Tuesday sees a full calendar on both sides of the Atlantic, with a list of data releases and central bank speakers. The European calendar kicks off at 0700GMT, with the release of the December wholesale prices index. French data due at 0700GMT sees the release of the November current account and the December HICP data. HICP is expected to rise 0.4% on month, up 0.9% on year. At 0800GMT, ECB Governing Council member Ewald Nowotny speaks at the Euromoney Central and Eastern European Forum 2014, in Vienna. Italian December final HICP will be released at 0900GMT and is seen up 0.6% on year. At 1000GMT, the EMU November industrial output numbers will be released and is seen up a seasonally adjusted 1.4%. At 1800GMT, Bundesbank Vice-President Sabine Lautenschlaeger will speak on "European bank union: status quo and outlook." Then, at 1830GMT, Spanish Prime Minister Mariano Rajoy will deliver a speech in Washington. UK inflation data due at 0930GMT and will be in focus, most see the y/y number to remain unchanged at 2.1% though others comment that last year's increase in energy prices could feed through to raise that to 2.2%. -

06:25

Commodities. Daily history for Jan 13’2013:

Gold $1,252.50 +5.60$ +0.45%

Oil $91.60 -1.12$ -1.21%

-

06:24

Stocks. Daily history for Jan 13’2013:

Nikkei 225 Closed

Hang Seng 22,884.98 +38.73 +0.17%

S&P/ASX 200 5,292.08 -20.31 -0.38%

Shanghai Composite 2,009.56 -3.73 -0.19%

FTSE 100 6,757.15 +17.21 +0.26%

CAC 40 4,263.27 +12.67 +0.30%

DAX 9,510.17 +36.93 +0.39%

Dow -177.44 16,259.61 -1.08%

Nasdaq -61.36 4,113.31 -1.47%

S&P -23.22 1,819.15 -1.26%

-

06:24

Currencies. Daily history for Jan 13'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3672 +0,06%

GBP/USD $1,6382 -0,61%

USD/CHF Chf0,8988 -0,40%

USD/JPY Y102,98 -1,05%

EUR/JPY Y140,78 -1,00%

GBP/JPY Y168,59 -1,73%

AUD/USD $0,9052 +0,64%

NZD/USD $0,8374 +0,91%

USD/CAD C$1,0859 -0,37%

-

06:03

Schedule for today, Tuesday, Jan 14’2013:

02:00 China New Loans December 625 589

05:00 Japan Eco Watchers Survey: Current December 53.5 54.2

05:00 Japan Eco Watchers Survey: Outlook December 54.8 54.3

07:45 France CPI, m/m December 0.0% +0.4%

07:45 France CPI, y/y December +0.7% +0.8%

09:30 United Kingdom Retail Price Index, m/m December +0.1% +0.5%

09:30 United Kingdom Retail prices, Y/Y December +2.6% +2.7%

09:30 United Kingdom RPI-X, Y/Y December +2.7%

09:30 United Kingdom Producer Price Index - Input (MoM) December -0.7% -0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) December -1.0% -1.1%

09:30 United Kingdom Producer Price Index - Output (MoM) December -0.2% +0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) December +0.8% +1.1%

09:30 United Kingdom HICP, m/m December +0.1% +0.6%

09:30 United Kingdom HICP, Y/Y December +2.1% +2.1%

09:30 United Kingdom HICP ex EFAT, Y/Y December +1.8% +1.8%

10:00 Eurozone Industrial production, (MoM) November -1.1% +1.6%

10:00 Eurozone Industrial Production (YoY) November +0.2% +0.8%

13:30 U.S. Retail sales December +0.7% +0.2%

13:30 U.S. Retail sales excluding auto December +0.4% +0.4%

13:30 U.S. Import Price Index December -0.6% +0.3%

15:00 U.S. Business inventories November +0.7% +0.4%

17:45 U.S. FOMC Member Charles Plosser Speaks

18:20 U.S. FOMC Member Richard Fisher Speaks

21:30 U.S. API Crude Oil Inventories January -7.3

21:45 New Zealand Food Prices Index, m/m December -0.2%

21:45 New Zealand Food Prices Index, y/y December +1.4%

22:45 New Zealand REINZ Housing Price Index, m/m December +1.2%

23:30 Australia Westpac Consumer Confidence January -4.8%

-

05:00

Japan: Eco Watchers Survey: Current , December 55.7 (forecast 54.2)

-