Notícias do Mercado

-

20:00

S&P 500 2,075.67 -29.32 -1.39 %, NASDAQ 4,920.64 -87.15 -1.74 %, Dow 17,788.33 -317.44 -1.75 %

-

19:20

American focus: Dollar rises along with Greek-default fears

The U.S. dollar inched higher against its main rivals Friday, snapping three sessions of losses, as fears of a Greek default drove the dollar higher.

The Labor Department said Friday that core consumer prices rose 0.2% in March on the back of higher gas prices, matching expectations of economists polled by MarketWatch. Core prices increased by the same amount in February.

Aside from Friday's gauge of consumer-price inflation, U.S. economic data released since Monday has been weak, weighing on the dollar and suggesting that the Fed will wait longer before raising interest rates.

Greece's Kathimerini newspaper reported Friday that central banks of Southeastern European countries have told subsidiaries of Greek lenders operating in their countries to exit all exposure to Greek sovereign debt, which the market interpreted as a sign that a Greek default is imminent.

Sebastien Galy, director of FX strategy at Société Générale, said that Greek default fears were driving investors into the dollar.

Elsewhere, the Canadian dollar rallied against its U.S. counterpart after retail sales for February and the March consumer-price index came in above economists' expectations.

-

18:08

Wall Street. Major U.S. stock-indexes falls

Major U.S. indexes falling more than one percent on investor concerns over a clamp-down on margin trading in China and a lot of disappointing earnings results from U.S. corporations. Chinese authorities lifted restrictions on short-selling while also warning against excessive borrowing on margin, two developments that could pressure that market.

Almost all of the Dow stocks are trading in negative area (29 of 30). Top looser - American Express Company (AXP,-4.75%). Top gainer - General Electric Company (GE, +0.34%).

S&P index sectors are moving down. Top looser - Utilities (-0.6%).

At the moment:

Dow 18038.00 +16.00 +0.09%

S&P 500 2099.25 -0.50 -0.02%

Nasdaq 100 4413.00 -8.75 -0.20%

10-year yield 1.92% +0.02

Oil 56.08 -0.31 -0.55%

Gold 1196.80 -4.50 -0.37%

-

17:00

European stocks closed: FTSE 100 6,994.63 -65.82 -0.93 %, CAC 40 5,143.26 -81.23 -1.55 %, DAX 11,688.7 -310.16 -2.58 %

-

15:01

U.S.: Leading Indicators , March 0.2% (forecast 0.3%)

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, April 95.9 (forecast 93.8)

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0400 (E581M), $1.0450 (E478M), $1.0600 (E612M), $1.0800 (E575M)

EUR/GBP: Gbp0.7214 (E300M)

USD/CAD: C$1.2300 ($480M)

NZD/USD: $0.7580 (NZ$2.4B)

USD/JPY: Y120.00 ($1.8B), Y121.20 ($500M), Y121.40 ($401M)

-

14:33

U.S. Stocks open: Dow -0.71%, Nasdaq -0.91%, S&P -0.67%

-

14:28

Before the bell: S&P futures -0.67%, NASDAQ futures -0.85%

U.S. stock-index futures retreated as Chinese futures tumbled after regulators updated rules on margin trading and short selling in a market where equities have led global advances for the past year.

Reports from American Express (AXP), General Electric (GE) and Honeywell (HON) are in focus of the market.

Global markets:

Nikkei 19,652.88 -232.89 -1.17%

Hang Seng 27,653.12 -86.59 -0.31%

Shanghai Composite 4,288.35 +93.53 +2.23%

FTSE 6,984.2 -76.25 -1.08%

CAC 5,149.26 -75.23 -1.44%

DAX 11,766.76 -232.10 -1.93%

Crude oil $56.23 (-0.86%)

Gold $1203.10 (+0.43%)

-

14:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

HONEYWELL INTERNATIONAL INC.

HON

104.00

+0.08%

29.3K

General Electric Co

GE

27.48

+0.73%

394.4K

Barrick Gold Corporation, NYSE

ABX

12.75

+0.79%

14.7K

ALTRIA GROUP INC.

MO

52.05

0.00%

12.3K

FedEx Corporation, NYSE

FDX

169.15

-0.05%

0.1K

Apple Inc.

AAPL

125.99

-0.14%

236.4K

Ford Motor Co.

F

15.91

-0.19%

44.5K

Procter & Gamble Co

PG

83.32

-0.22%

0.8K

Walt Disney Co

DIS

107.85

-0.23%

3.6K

AT&T Inc

T

32.67

-0.24%

27.9K

Verizon Communications Inc

VZ

49.15

-0.24%

0.4K

Exxon Mobil Corp

XOM

87.49

-0.27%

3.1K

Johnson & Johnson

JNJ

99.50

-0.29%

4.8K

Wal-Mart Stores Inc

WMT

79.00

-0.30%

0.3K

Boeing Co

BA

151.50

-0.31%

0.1K

Starbucks Corporation, NASDAQ

SBUX

48.08

-0.34%

11.3K

McDonald's Corp

MCD

95.30

-0.35%

0.2K

ALCOA INC.

AA

13.40

-0.36%

38.8K

Home Depot Inc

HD

112.87

-0.44%

0.2K

The Coca-Cola Co

KO

40.42

-0.44%

0.1K

Merck & Co Inc

MRK

57.58

-0.45%

1.2K

Facebook, Inc.

FB

81.94

-0.45%

69.0K

UnitedHealth Group Inc

UNH

121.00

-0.49%

152.7K

Cisco Systems Inc

CSCO

28.45

-0.52%

11.0K

General Motors Company, NYSE

GM

36.88

-0.54%

13.3K

International Business Machines Co...

IBM

162.20

-0.57%

3.4K

Pfizer Inc

PFE

34.99

-0.57%

4.3K

Yahoo! Inc., NASDAQ

YHOO

45.50

-0.61%

66.3K

Chevron Corp

CVX

109.46

-0.64%

3.4K

Nike

NKE

99.25

-0.65%

2.3K

Intel Corp

INTC

32.65

-0.67%

9.4K

Citigroup Inc., NYSE

C

53.66

-0.67%

18.7K

JPMorgan Chase and Co

JPM

63.37

-0.69%

10.2K

Twitter, Inc., NYSE

TWTR

51.67

-0.69%

79.7K

3M Co

MMM

164.73

-0.70%

0.9K

Visa

V

65.19

-0.70%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

57.75

-0.70%

0.1K

Google Inc.

GOOG

529.88

-0.73%

0.4K

Microsoft Corp

MSFT

41.84

-0.76%

16.5K

Amazon.com Inc., NASDAQ

AMZN

383.10

-0.76%

2.5K

Hewlett-Packard Co.

HPQ

32.56

-0.76%

1.4K

Travelers Companies Inc

TRV

107.75

-0.85%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

204.72

-0.96%

12.6K

Caterpillar Inc

CAT

83.42

-1.09%

1.7K

Goldman Sachs

GS

198.00

-1.10%

5.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.55

-1.34%

3.9K

American Express Co

AXP

79.54

-1.69%

13.1K

Yandex N.V., NASDAQ

YNDX

20.35

-2.63%

10.8K

-

14:10

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Travelers Companies Inc (TRV) downgraded to Equal Weight from Overweight at Barclays

Goldman Sachs (GS) downgraded from Outperform to Mkt Perform at Keefe Bruyette, target raised from $195 to $210

Other:

UnitedHealth (UNH) initiated at Buy at Mizuho, target $146

Apple (AAPL) initiated at Outperform at FBR Capital, target $185

American Express (AXP) reiterated at Underperform at RBC Capital Mkts, target lowered from $74 to $69

UnitedHealth (UNH) reiterated at Outperform at Oppenheimer, target raised from $128 to $133

Walt Disney (DIS) reiterated at Buy at Jefferies, target raised from $105 to $120

-

13:51

Company News: Honeywell (HON) released mixed report

Company reports Q1 earnings of $1.41 per share versus $1.39 consensus. Revenues fell 4.8% year/year to $9.21 bln versus $9.50 bln consensus.

Company raises EPS guidance for FY15 to $6.00-6.15 from $5.95-6.15 versus $6.09 consensus and lowers guidance on revenues to $39.0-39.6 bln from $40.5-41.1 bln versus $40.52 bln consensus.

HON fell to $103.65 (-0.26%) on the premarket.

-

13:33

-

13:31

Canada: Foreign Securities Purchases, February 9.27B

-

13:30

U.S.: CPI, Y/Y, March -0.1% (forecast 0.1%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, y/y, March 2.4%

-

13:30

U.S.: CPI, m/m , March 0.2% (forecast 0.3%)

-

13:30

U.S.: CPI excluding food and energy, m/m, March 0.2% (forecast 0.2%)

-

13:30

Canada: Retail Sales, m/m, February +1.7%

-

13:30

Canada: Consumer price index, y/y, March 1.2%

-

13:30

U.S.: CPI excluding food and energy, Y/Y, March 1.8% (forecast 1.7%)

-

13:30

Canada: Retail Sales ex Autos, m/m, February 2.0%

-

13:30

Canada: Consumer Price Index m / m, March 0.6% (forecast 0.5%)

-

13:00

Orders

EUR/USD

Offers 1.0800 1.0820 1.0840 1.0865 1.0880 1.0900

Bids 1.0760 1.0740 1.0725 1.0700 1.0650-55 1.0620 1.0600

GBP/USD

Offers 1.4980-85 1.5000 1.5025-35 1.5050 1.5080 1.5100

Bids 1.4950 1.4930 1.4900 1.4885 1.4840 1.4800 1.4780 1.4750-55

EUR/JPY

Offers 128.30 128.60 129.00 129.50

Bids 127.80 127.50 127.00 126.85 126.50

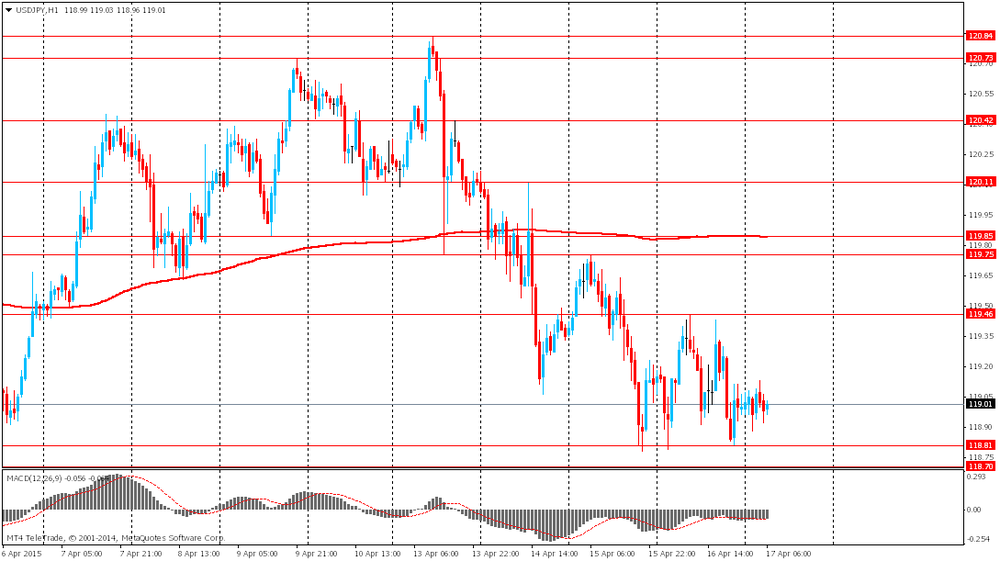

USD/JPY

Offers 119.15-25 119.55-60 119.75-80 120.00 120.20 120.50

Bids 118.70 118.50-55 118.25-30 118.00 117.85

EUR/GBP

Offers 0.7220-25 0.7250-55 0.7270 0.7285 0.7300 0.7320-25 0.7350

Bids 0.7175-80 0.7155-60 0.7135 0.7115 0.7100

AUD/USD

Offers 0.7825-30 0.7860 0.7880 0.7900

Bids 0.7800 0.7780-85 0.7750 0.7735 0.7700-05

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0400 (E581M), $1.0450 (E478M), $1.0600 (E612M), $1.0800 (E575M)

EUR/GBP: Gbp0.7214 (E300M)

USD/CAD: C$1.2300 ($480M)

NZD/USD: $0.7580 (NZ$2.4B)

USD/JPY: Y120.00 ($1.8B), Y121.20 ($500M), Y121.40 ($401M)

-

10:00

Eurozone: Harmonized CPI, Y/Y, March -0.1% (forecast -0.1%)

-

10:00

Eurozone: Harmonized CPI, March 1.1% (forecast 1.1%)

-

09:45

Asia Pasific Stocks: Japan’s Topix index fell

Japan's Topix index fell from a seven-year high, posting its first weekly loss this month, as the yen held five days of gains. Retailers led declines.

HANG SENG 27,597.68 -142.03 -0.51%

S&P/ASX 200 5,877.9 -69.57 -1.17%

TOPIX 1,588.69 -10.73 -0.67%

SHANGHAI COMP 4,288.35 +93.53 +2.23%

Sony Corp., a consumer electronics maker that gets more than 70 percent of sales outside Japan, lost 3.7 percent after Wikileaks published company documents.

Discount-store operator Don Quijote Holdings Co. slumped 7.6 percent.

JX Holdings Inc. advanced 2.2 percent as crude oil headed for the biggest weekly gain since 2011 and the Nikkei reported that the energy producer's profit will exceed analyst estimates.

-

09:31

United Kingdom: Claimant Count Rate, March 2.3%

-

09:30

United Kingdom: Claimant count , March -20.7K (forecast -28.5)

-

09:30

United Kingdom: ILO Unemployment Rate, March 5.6% (forecast 5.6%)

-

09:00

Eurozone: Current account, unadjusted, bln , February €13.8B

-

08:15

Switzerland: Retail Sales Y/Y, February -2.7% (forecast 0.7%)

-

07:19

Options levels on friday, April 17, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0885 (1038)

$1.0858 (601)

$1.0832 (69)

Price at time of writing this review: $1.0771

Support levels (open interest**, contracts):

$1.0728 (1293)

$1.0688 (1926)

$1.0635 (2321)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 56031 contracts, with the maximum number of contracts with strike price $1,1200 (6121);

- Overall open interest on the PUT options with the expiration date May, 8 is 71309 contracts, with the maximum number of contracts with strike price $1,0000 (9095);

- The ratio of PUT/CALL was 1.27 versus 1.31 from the previous trading day according to data from April, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.5208 (724)

$1.5111 (1659)

$1.5016 (2354)

Price at time of writing this review: $1.4942

Support levels (open interest**, contracts):

$1.4884 (1543)

$1.4788 (2344)

$1.4691 (2520)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 22962 contracts, with the maximum number of contracts with strike price $1,5000 (2354);

- Overall open interest on the PUT options with the expiration date May, 8 is 32796 contracts, with the maximum number of contracts with strike price $1,4400 (3719);

- The ratio of PUT/CALL was 1.43 versus 1.29 from the previous trading day according to data from April, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:18

Foreign exchange market. Asian session: The currencies of Australia and New Zealand dropped

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Japan Consumer Confidence March 40.7 41.4 41.7

The Dollar Spot Index, a gauge of the currency against 10 major counterparts, was little changed amid a weekly retreat of 1.5 percent, the most since the five days to March 20. Investors are poring over U.S. economic reports as they try to determine the Federal Reserve's likely path on interest rates. Officials from the U.S. central bank continued to provide conflicting signals Thursday, spurring fluctuations in Treasuries.

Fed Vice Chairman Stanley Fischer sent Treasuries tumbling last session after reminding investors that the central bank wants to boost key borrowing costs. Fed Bank of Atlanta President Dennis Lockhart then halted the selloff, saying he wanted to see both falling unemployment and quickening inflation prior to the first rate increase.

The currencies of Australia and New Zealand pared their advances this week as commodity prices dropped. Iron ore, the nation's biggest export earner, fell below $50 on Thursday.

EUR / USD: during the Asian session the pair traded in the range of $1.0750-85

GBP / USD: during the Asian session the pair traded in the range of $1.4920-45

USD / JPY: during the Asian session the pair traded in the range Y118.85-15

The next hurdle for the euro will come from eurozone CPI due later today at 0900 GMT.

-

06:05

Japan: Consumer Confidence, March 41.7 (forecast 41.4)

-

03:08

Nikkei 225 19,785.71 -100.06 -0.50%, Hang Seng 27,801.88 +62.17 +0.22%, Shanghai Composite 4,269.3 +74.48 +1.78%

-

00:01

Commodities. Daily history for Apr 16’2015:

(raw materials / closing price /% change)

Oil 56.71 +0.57%

Gold 1,197.80 -0.02%

-

00:01

Stocks. Daily history for Apr 16’2015:

(index / closing price / change items /% change)

Nikkei 225 19,885.77 +16.01 +0.1 %

Hang Seng 27,739.71 +120.89 +0.4 %

S&P/ASX 200 5,947.47 +39.06 +0.7 %

Shanghai Composite 4,194.65 +110.49 +2.7 %

FTSE 100 7,060.45 -36.33 -0.5 %

CAC 40 5,224.49 -29.86 -0.6 %

Xetra DAX 11,998.86 -232.48 -1.9 %

S&P 500 2,104.99 -1.64 -0.1 %

NASDAQ Composite 5,007.79 -3.23 -0.1 %

Dow Jones 18,105.77 -6.84 0.0%

-

00:00

Currencies. Daily history for Apr 16’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0763 +0,79%

GBP/USD $1,4933 +0,68%

USD/CHF Chf0,9559 -0,96%

USD/JPY Y119,00 -0,09%

EUR/JPY Y128,08 +0,69%

GBP/JPY Y177,69 +0,59%

AUD/USD $0,7793 +1,54%

NZD/USD $0,7662 +1,00%

USD/CAD C$1,2190 -0,85%

-