Notícias do Mercado

-

23:53

EUR/JPY Price Analysis: Prints YTD high, retreats as evening star pattern emerges

- EUR/JPY is still upward biased, but failure at 147.00 exacerbated a pullback towards 146.80s.

- Downside risks for the EUR/JPY remain at 146.60 as sellers will eye the 20-DMA.

- A bullish resumption will occur if EUR/JPY reclaims 147.00.

The EUR/JPY hit a YTD high at 147.45 but retreated and lost 0.11% in Monday’s trading session. However, as the Asian session begins, the EUR/JPY starts to trend higher, exchanging hands at 146.93, above 0.06%.

EUR/JPY Price Action

Monday’s price action formed an inverted hammer that could be a prelude of an evening star, a three-candlestick bearish pattern that could pave the way for further downside. Nevertheless, to confirm its validity, the EUR/JPY must break below the April 17 daily low of 146.66, followed by 146.50, before testing the April 14 low at 146.24.

The Relative Strength Index (RSI) shifted flat but remained bullish. Contrarily, the Rate of Change (RoC), shows that buying pressure is waning as it heads to neutral territory.

For a bearish continuation, if EUR/JPY cracks 146.24, it needs to break below 146.00. Once done, the pair might dive toward the December 20 daily high at 145.83 before retreating toward the 20-day Exponential Moving Average (EMA) at 144.87.

On the flip side, for a bullish continuation, the EUR/JPY must reclaim 147.00, which would open the door to test the YTD high at 147.45, followed by the 148.00 figure.

EUR/JPY Daily Chart

EUR/JPY Technical Levels

-

23:48

Silver Price Analysis: Further XAG/USD downside hinges on $24.85 break

- Silver price remains pressured after breaking one-month-old support line, down for the third consecutive day.

- Looming bear cross on MACD adds strength to downside bias.

- Previous resistance line from early January challenges XAG/USD sellers before the 21-DMA support.

Silver price (XAG/USD) remains pressured at the $25.00 threshold, down for the third consecutive day during early Tuesday in Asia.

In doing so, the bright metal justifies the previous day’s downside break of a one-month-old ascending support line, now immediate resistance, while extending the pullback from a one-year high marked in the last week.

Apart from the trend line breakdown, an impending bear cross on the MACD indicator also keeps the XAG/USD sellers hopeful.

However, a resistance-turned-support line from early January, close to $24.85 by the press time, challenges the Silver bears at the latest.

Following that, tops marked in February and January, around $24.65 and $24.55 respectively, could challenge the XAG/USD bears before directing them to the 21-DMA support of around $24.15.

In a case where the Silver price remains bearish past $24.15, the odds of witnessing a slump toward March’s high of nearly $23.50 can’t be ruled out.

On the flip side, Silver price recovery needs validation from the previous support line from mid-March, close to $25.25 at the latest.

Should the commodity manages to remain firmer past $25.25, the late 2021 high near $25.40 and the latest peak of near $26.10 can act as extra checks for the XAG/USD bulls to cross before eyeing the April 2022 high of $26.22 and the last years high of $26.95.

Silver Price: Four-hour chart

Trend: Further downside expected

-

23:38

EUR/USD sees more downside to near 1.0900 as ECB to slow down policy-tightening pace

- EUR/USD is expected to witness more downside to near 1.0900 as the Fed to remain hawkish in May.

- Eurozone is prone to a credit crunch after the collapse of several US regional banks and takeover of Credit Suisse.

- The ECB is highly expected to raise rates by 25bps in its May policy meeting.

The EUR/USD pair is continuously declining for the past two trading sessions after failing to sustain above the critical resistance of 1.1050. The major currency pair is expected to extend its downside to near 1.0900 as investors are supporting the US Dollar Index (DXY) on expectations of one more rate hike announcement from the Federal Reserve (Fed).

The USD Index has shown a minor correction after printing a fresh three-day high of 102.22 as Fedfunds market is conveying that one more rate hike cannot be ruled out despite easing labor market conditions and softening United States inflation. President and CEO of the Federal Reserve Bank of Richmond Thomas Barkin said that he wants to see more evidence of inflation settling back to target.

Meanwhile, S&P500 futures have turned subdued in the Asian session after settling Monday’s session on a positive note. Market sentiment is still positive but a stock-specific action is highly observed amid the quarterly result season.

The Euro witnessed extreme selling pressure as investors are divided about the pace of hiking interest rates by the European Central Bank (ECB). Also, ECB policymaker Martins Kazaks said on Monday, the central bank has the option of 25 basis points (bps) or 50 bps move in May.

However, Bloomberg looks confident after a survey from economists, showing that a majority of them expect the European Central Bank (ECB) to hike rates by 25 basis points (bps) at its May, June, and July policy meetings before pausing its tightening cycle. “That would take the deposit rate to 3.75%, where it would stay through the rest of the year.”

Another report from Bloomberg showed that the Eurozone economy is facing the danger of a lending squeeze following the recent banking turmoil, according to the continent’s largest pension services provider.

Thijs Knaap, a chief economist at Netherlands-based APG Asset Management, said, “The risk of a credit crunch is there and it certainly increased” after the collapse of several US regional banks and the emergency takeover of Credit Suisse Group AG, reported Bloomberg.

The comments are markedly less optimistic than statements from some European Central Bank officials, who are hopeful that the 20-nation eurozone can emerge from the financial sector turbulence with little damage and continue raising interest rates.

-

23:25

USD/CAD rebounds prods 1.3400 amid firmer USD, downbeat Oil price, Canada inflation, BoC’s Macklem eyed

- USD/CAD grinds higher after two-day rebound from the lowest levels since mid-February.

- US Dollar cheers hawkish Fed bets, upbeat yields to extend previous week’s recovery.

- Firmer greenback, fears of economic recovery and anxiety ahead of key China data weigh the Oil price.

- Canada CPI, BoC Governor Macklem’s speech eyed for clear directions.

USD/CAD bulls take a breather around the 1.3400 round figure as they await the key Canada inflation data and a speech from Bank of Canada (BoC) Governor Tiff Macklem. That said, the Loonie pair rose in the last two consecutive days while bouncing off the lowest levels since mid-February.

While tracing the clues, the US Dollar’s broad recovery on the back of firmer US Treasury bond yield and hawkish Fed bets joins the fall in the WTI crude Oil price, Canada’s main export item, could be lined as the key catalysts.

On Monday, the NY Empire State Manufacturing Index jumped to 10.8 for April while snapping the four-month downtrend, as well marking the highest level since July last year. Further, the US National Association of Home Builders (NAHB) housing market index also rose for the fourth consecutive month in April to 45, versus 44 expected and prior reading.

Further, Richmond Fed President Thomas Barkin said on Monday that he wants to see more evidence of inflation settling back to target. The policymaker also added that he feels reassured by what he is seeing in the banking sector.

US Dollar Index (DXY) stretched Friday’s rebound from a one-year low as upbeat US data and hawkish Fed talks joined the increasing odds of another Fed rate hike in May, as well as a reduction in the market’s bets suggesting a rate cut in later 2023. The same could be true for the US Treasury bond yields as the US 10-year and two-year bod coupons printed three-day uptrend to 3.60% and 4.20% respectively.

On the other hand, WTI Crude Oil dropped around 2.0% to the lowest levels in a week, pressured near $80.85 by the press time, as hawkish Fed bets and a firmer US Dollar challenges energy demand. Also exerting downside pressure on the black gold could be the latest doubt on China’s economic recovery.

Also read: WTI falls over 2% on fears of Fed’s tightening plan, broad US Dollar strength

Looking forward, Canada’s Consumer Price Index (CPI) for March and BoC CPI for the said month will be important to watch for clear directions as BoC Governor Tiff Macklem showed readiness to renew rate hike trajectory if needed. That said, BoC Governor Macklem is also up for a speech later in the day and will be eyed closely for fresh impetus. Additionally, the US Housing Starts and Building Permits for March will also be important to watch.

Technical analysis

200-DMA and a one-month-old descending resistance line, respectively near 1.3405 and 1.3415, restricts short-term USD/CAD upside. However, recently firmer oscillators favor the Loonie pair bulls.

-

23:03

GBP/USD Price Analysis: Bears attack 21-DMA below 1.2400 as UK Employment data looms

- GBP/USD remains pressured around one-week low after declining in the last two consecutive days.

- Clear break of three-week-old ascending support line bearish MACD signals favor Cable sellers.

- Likely increase in UK Claimant Count Change for April may also weigh on GBP/USD price.

- Buyers need validation from 1.2435; convergence of 100, 50 DMA appears a tough nut to crack for bears.

GBP/USD holds lower grounds near 1.2375 as bears flirt with seven-day bottom ahead of the key UK employment report on Tuesday. That said, the Cable pair dropped in the last two consecutive days.

Also read: GBP/USD falls on US Dollar strength amid Fed rate hike speculations

It should be noted that the quote’s clear downside break of an upward-sloping support line from March 24, now immediate resistance near 1.2435, joins bearish MACD signals to lure the GBP/USD bears ahead of the key UK statistics. However, the 21-DMA challenges the pair sellers around 1.2375 of late.

With this, the Cable pair is likely to break the immediate DMA support and can drop further toward the 1.2300 round figure. Though, a convergence of the 100-DMA and the 50-DMA, close to 1.2190 can challenge the pair sellers afterward.

It’s worth observing that February’s high of around 1.2270 can act as an intermediate halt between the 21-DMA and the aforementioned DMA convergence.

On the flip side, the GBP/USD pair’s clear recovery beyond 1.2435 support-turned-resistance will need validation from January’s high of around 1.2450.

Even so, a three-month-old upward-sloping resistance line, near 1.2545 can restrict the quote’s further upside.

GBP/USD: Daily chart

Trend: Further downside expected

-

23:02

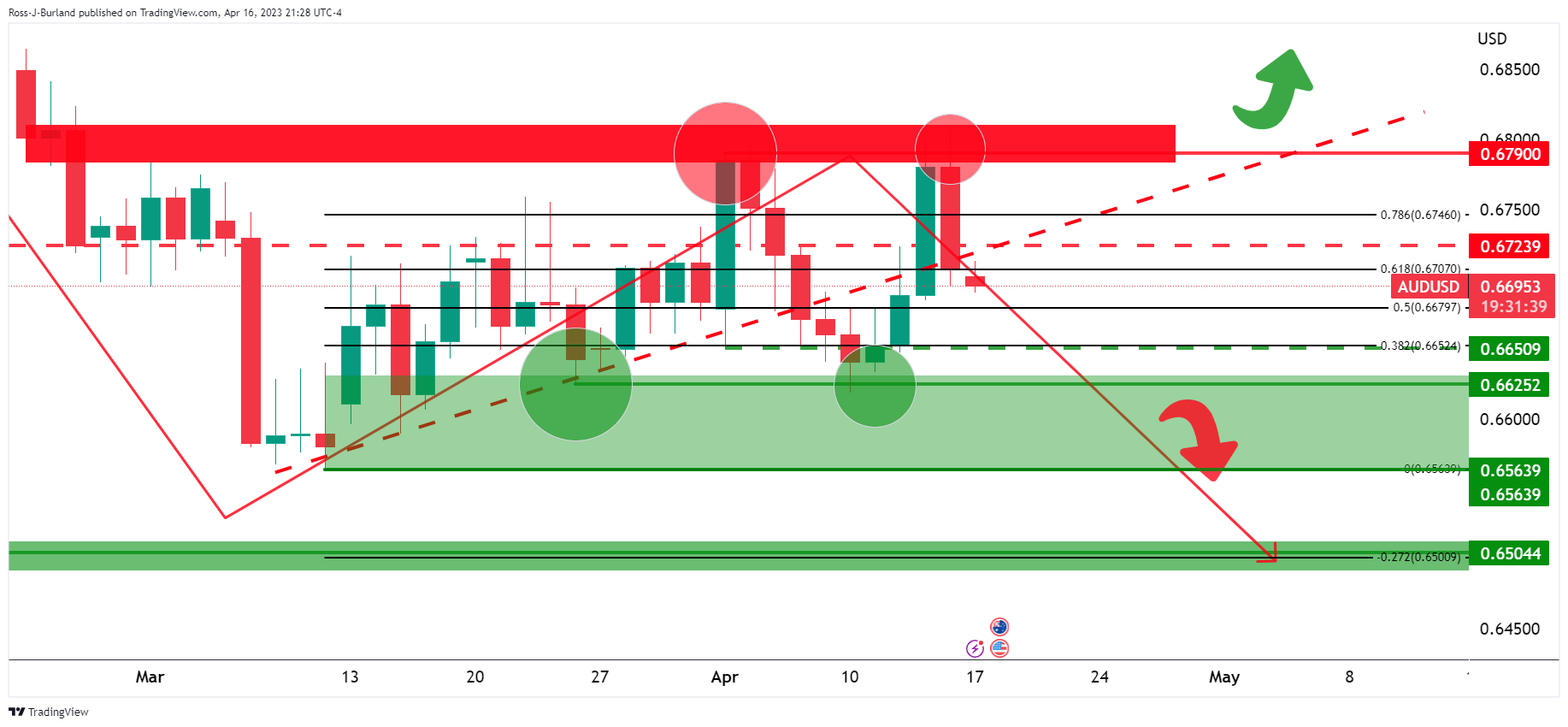

AUD/USD remains sideways around 0.6700 ahead of RBA minutes and China’s GDP

- AUD/USD has continued its sideways performance around 0.6700 as investors await RBA minutes.

- The demand for US government bonds dented significantly as investors are eyeing one more rate hike from the Fed.

- The RBA could sound hawkish in coming sessions as Australian job market data remained resilient in March.

The AUD/USD pair has continued its sideways auction in the early Asian session around 0.6700. The Aussie asset remained lackluster on Monday despite a decent upside in the US Dollar Index (DXY). A back-and-forth action might continue in the Aussie asset ahead of the release of the Reserve Bank of Australia (RBA) minutes and Chinese Gross Domestic Product (GDP) data.

S&P500 ended Monday’s session on a positive note led by a recovery in banking stocks. A stock-specific action has been witnessed in US equities amid the quarterly result season. The US Dollar Index (DXY) extended its upside journey to near 102.20 in hopes of more rate hikes from the Federal Reserve (Fed) despite the sheer softening of United States inflation.

The demand for US government bonds dented significantly as chances of one more rate hike are above 86%, according to the CME Fedwatch tool. Therefore, the yields offered on 10-year US Treasury bonds rose firmly above 3.60%.

A power-pack action is expected from the Australian Dollar amid the release of the RBA minutes, which will provide a detailed explanation behind keeping interest rates unchanged.

RBA Governor Philip Lowe could sound hawkish in coming sessions as Australian Employment (March) data showed higher than anticipated additions of fresh talent last week. Also, the Unemployment Rate dropped to 3.5%. This could force the RBA to reconsider its unchanged policy stance.

On Tuesday, investors will also focus on China’s Gross Domestic Product (GDP) (Q1) data. According to the estimates, the Chinese economy has expanded by 2.2% vs. a stagnant performance shown in the last quarter of CY2022. On an annual basis, the economy is expanded by 4.0% against a 2.9% growth rate recorded earlier. It is worth noting that Australia is the leading trading partner of China and higher Chinese GDP data would support the Australian Dollar.

-

22:56

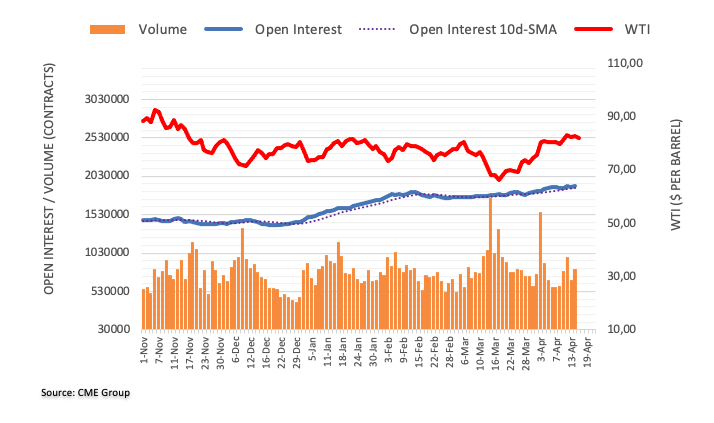

WTI falls over 2% on fears of Fed’s tightening plan, broad US Dollar strength

- Waller’s comments on monetary policy tightening send shockwaves through T-bond, Dollar, Gold, and WTI markets.

- China’s Q1 GDP, Industrial Production, and Retail Sales release to test the reality of the global economic outlook.

- WTI Price Analysis: Remains in consolidation mode, with traders watching for potential breakouts above $82.09 or below $80.00.

Western Texas Intermediate (WTI) slid almost $2.00 on Monday as traders brace for additional tightening by the US Federal Reserve (Fed). Therefore, the greenback advanced against most commodities, and in the FX space, against most G10 currencies. At the time of writing, WTI is trading at $80.92 a barrel, down more than 2%.

Fed official’s comments boost the US Dollar as oil traders wait for China’s data

Sentiment shifted sour on expectations that the Fed will hike rates at the May 3 decision. Hence, the greenback advanced, as shown by the US Dollar Index, up 0.51% at 102.101. After reaching a YTD high of $83.46, WTI lost 3% after the Organization of Petroleum Exporting Countries (OPEC) announced the cuts of crude oil output.

The prospects for additional interest rate increases of the Fed had arisen and hurt WTI’s price. During the week, Federal Reserve officials in the names of New York Fed President John Williams, Governors Michelle Bowman, Lisa Cook, and Christopher Waller would be the latest policymakers to cross newswires before Fed officials enter the blackout period.

Waller’s comments last Friday spurred a jump in US T-bond yields, the US Dollar, and tumbled Gold and WTI prices. Waller commented that we “haven’t made much progress,” adding, “Monetary policy needs to be tightened further.”

Meanwhile, although the global economic outlook looks bright regarding China’s reopening, it would have a test of reality with the release of China’s Q1 Gross Domestic Product (GDP), March’s Industrial Production, and Retail Sales.

WTI Technical Analysis

After gapping up six dollars during the last week, WTI remains trading sideways, though it encountered solid support at $80.00 per barrel. However, downside risks remain below the latter, with the 200-day Exponential Moving Average (EMA) lying above the current price at $82.09 PB, a zone protected by sellers. But a break below $80.00 could expose the confluence of several EMAs, at the $78.20-90 area, before dropping towards the 50-day EMA At 76.93.

-

22:51

NZD/USD Price Analysis: Bulls and bears engaged at critical dialy support

- NZD/USD bears are in the market testing key support.

- A break lower will open the risk of a sell-off towards 0.6150.

NZD/USD has been in the hands of the bears this week as the US Dollar firms on hawkish Federal Reserve sentiment. The bulls will be in the clear, at least momentarily, if they can get back above 0.6220, but the pressure is on as follows:

NZD/USD daily chart

NZD/USD is rested at a key support area with a break of 0.6180 eyed for the day ahead as the following four-hour chart illustrates:

NZD/USD H4 chart

The bears are in the market and eye a break to the downside given the broken structure with 0.6150 eyed.

-

22:20

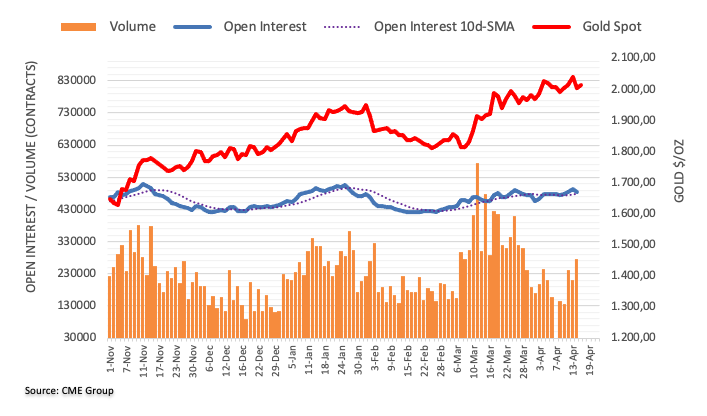

Gold Price Forecast: XAU/USD bulls are guarding a key daily support area

- Gold price is testing critical support near $1,980.

- The US Dollar is bouncing back and pressuring the yellow metal.

Gold price has fallen from a high of $2,015.07 to a low of $1,981.19 on the day amid the rebound in the US Dollar as the hawks move back in over the sentiment surrounding the Federal Reserve again.

Federal Reserve´s Governor Christopher Waller said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up. We also had consumer spending for the past quarter, and the April survey of business activity in New York state rising for the first time in five months, the US Dollar gained 0.6%. This is making greenback-bullion less attractive for overseas buyers, while benchmark Treasury yields climbed to a more than two-week high.

On Monday, President and CEO of the Federal Reserve Bank of Richmond Thomas Barkin explained that he wants to see more evidence of inflation settling back to target. Barkin also said he feels reassured by what he is seeing in the banking sector. Meanwhile, Fed funds futures are showing that the expectations that the Fed will start cutting rates later this year have been pushed back to November from September, with a smaller cut now expected also.

Gold positioning analysis

´´While the gold price previously held the most competitive risk-return characteristics on our screen, we now see elevated risks of a tactical retreat.,´´ analysts at TD Securities explained. ´´After all,´´ they say, ´´the substantial inflows tied to notable CTA long acquisitions and discretionary short covering are now grinding to a halt. CTA positioning has nearly effectively reached 'max long', and our estimates of discretionary flows still suggest that this cohort has yet to buy into the rally, suggesting that one of the main engines of the recent rally is now sputtering.´´

The analysts went on to talk of China´s holdings and developments there:

´´Evidence of notable accumulation of gold in Shanghai is reassuring for the bulls, but Shanghai positioning is now nearing local highs. That leaves physical markets in control once more, where lackluster demand in India and only modest improvements in wholesale demand in China suggest the risk of a tactical retreat in precious metals continues to grow. Still, CTA outflows are only expected below the $1960/oz range, suggesting that a catalyst may be required before more substantial outflows ensue.´´

Gold technical analysis

Gold price is back into the barroom brawl and the bulls are defending the key support area near $1,980.

-

21:44

Forex Today: US Dollar strengthens further, RBA minutes and China’s GDP next

Tuesday will be a busy day in terms of economic data in an overall light week. Early, the Reserve Bank of Australia will release the minutes of its latest meeting and then China will report Q1 growth numbers. Will the US Dollar extend its recovery?

Here is what you need to know on Tuesday, April 18:

The US Dollar Index rose for the second day in a row on Monday amid increasing odds of another rate hike from the Federal Reserve (Fed) at the May meeting and as bets for rate cuts later in 2023 diminished. Data from the US surpassed expectations, with the Empire Manufacturing Index at 10.8 in April, showing a significant improvement. On Tuesday, the US reports Housing Starts and Building Permits.

A late rally in Wall Street pushed equity indexes to positive ground. The Dow Jones gained a hundred points or 0.30%, the Nasdaq rose by 0.28% and the S&P 500 rose 0.33%. US yields jumped, posting the highest close in weeks across the curve and boosting USD/JPY, which rose to 134.50, the highest in over a month.

EUR/USD dropped for the second straight day but stayed above 1.0900. The Euro lagged on Monday, with EUR/GBP ending a four-day positive streak. The German ZEW Survey is due on Tuesday.

GBP/USD broke below 1.2400, reaching weekly lows, and settled around the 20-day Simple Moving Average (SMA) at 1.2375. On Tuesday, the UK will release employment numbers.

USD/CAD peaked at 1.3420, surpassing the 200-day SMA momentarily and then pulled back to 1.3390. In Canada, critical March Consumer Price Index (CPI) data is due on Tuesday, with a decline expected in the annualized rate from 5.2% to 4.3%.

NZD/USD found support at the 200-day SMA at 0.6156 and bounced modestly to the upside. The pair is moving with a bearish bias, but losses seem limited while above 0.6150.

AUD/USD slid further, reaching levels under 0.6700 and is back into a familiar range. The Reserve Bank of Australia (RBA) will release the minutes of its latest meeting when it decided to pause its tightening cycle.

Gold tumbled on Monday amid higher US yields and a stronger US Dollar and bottomed at $1,980, reaching a weekly low. Silver lost 1.50%, falling below $25.00. Crude oil prices shed around 2%, with WTI falling to six-day lows near $80.00.

Bitcoin suffered the worst decline in a week, falling to $29,150, the lowest level in six days. Ethereum lost 1.75% and it was trading at $2,085.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:34

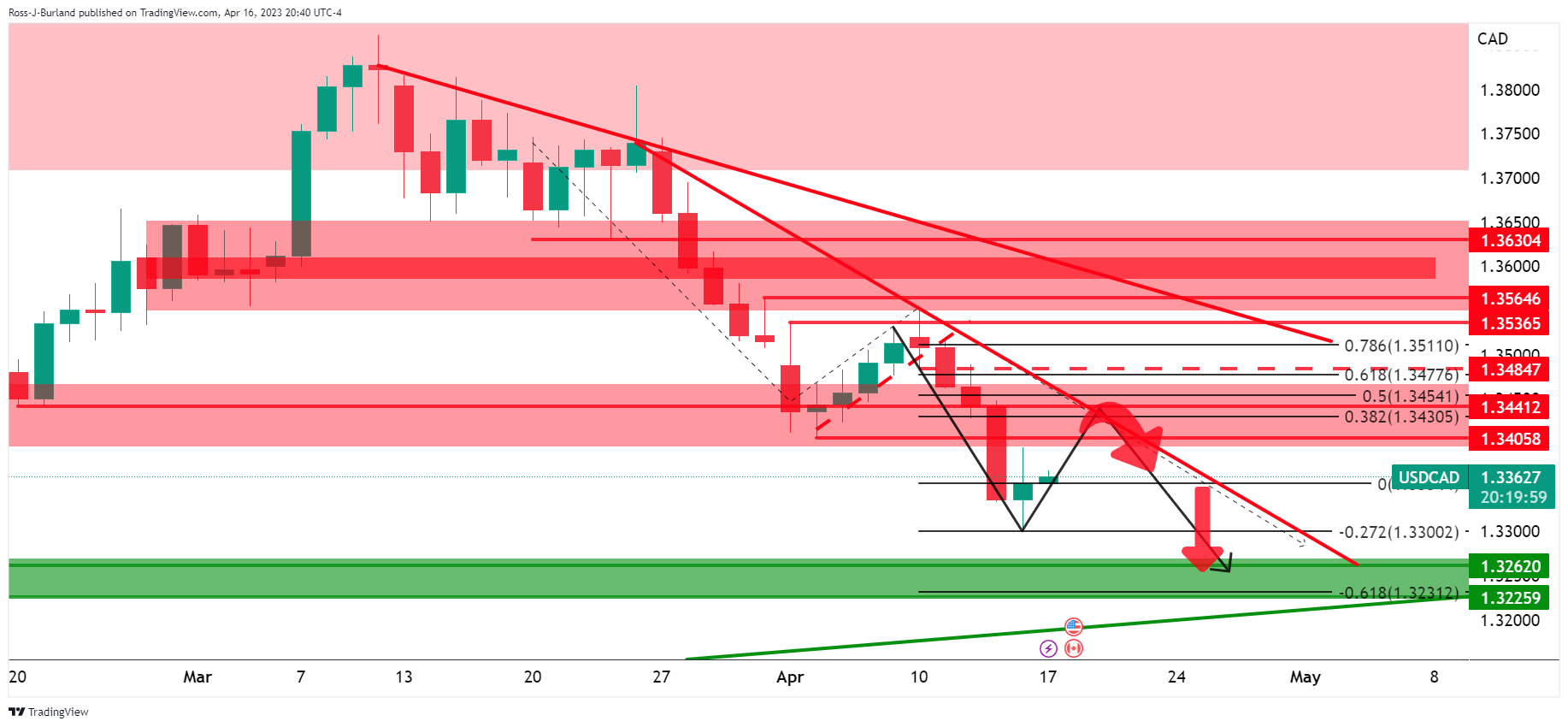

USD/CAD Price Analysis: Shows signs of recovery, trades above the 200-DMA

- USD/CAD rises above the 200-day EMA but struggles to crack 1.3400.

- Upside risks for the USD/CAD lie above 1.3400, which can trigger a rally toward 1.3500.

- USD/CAD failure to crack 1.3400 could pave the way for further losses.

The USD/CAD advances after bottoming last Friday at around 1.3300; the pair bounces off and hovers nearby the 1.3400 figure after reaching a high of 1.3420. At the time of writing, the USD/CAD is trading at 1.3395 and is gaining 0.31%.

The USD/CAD dove to new 8-week lows at 1.3300, spurring an increase in the greenback’s demand, even though the Bank of Canada (BoC), in its latest monetary policy, announced the BoC Governing Council discussed raising rates. Nevertheless, current expectations for additional Fed tightening bolstered the US Dollar.

USD/CAD Price Action

Given the backdrop, the USD/CAD is still neutral to downward biased, but it’s testing the upper boundaries of the 200-day Exponential Moving Average (EMA) at 1.3377. In addition, a daily close of the USD/CAD pair above the latter could exacerbate another leg-up in the pair, initially towards a downslope resistance trendline drawn from November 2022 highs that pass around the 1.3430-50 area. But firstly, the USD/CAD buyers need to reclaim 1.3400.

If USD/CAD cracks the 1.3400 figure, the next resistance would be the trendline mentioned above at 1.3430-50. Once cleared, the USD/CAD could threaten the confluence of the 20 and 100-day EMAs, around 1.3497-1.3504, before rallying towards the 50-day EMA At 1.3534.

Conversely, if USD/CAD stays below 1.3400, that could open the door for further downside. That said, the first support would be the 200-day EMA at 1.3377, followed by the April 17 low at 1.3342, before aiming toward the 1.3300 figure.

USD/CAD Daily Chart

USD/CAD Technical Levels

-

21:00

United States Total Net TIC Flows below forecasts ($197.6B) in February: Actual ($28B)

-

21:00

United States Net Long-Term TIC Flows below expectations ($101.9B) in February: Actual ($71B)

-

20:46

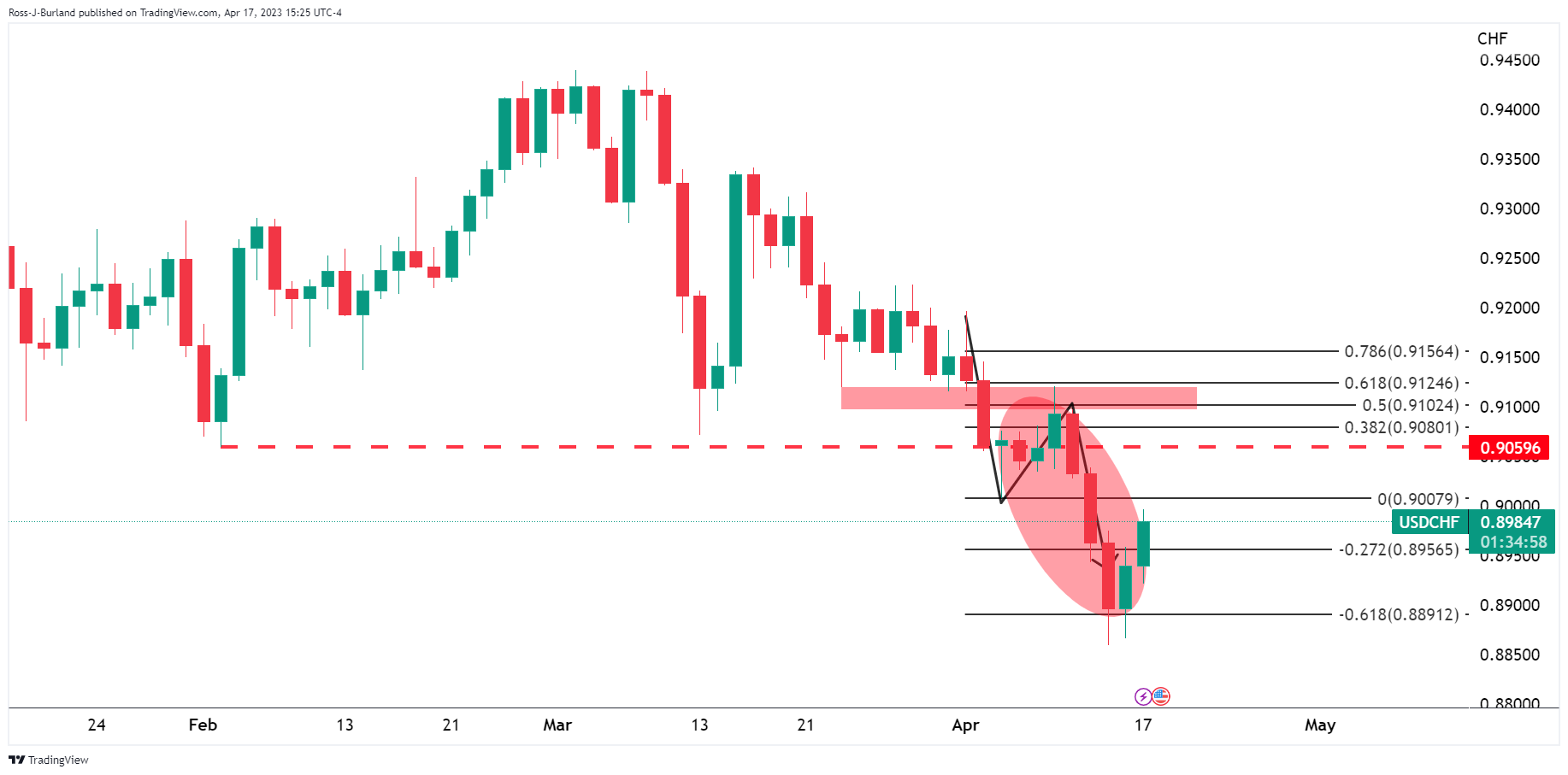

USD/CHF Price Analysis: Bears prowl below trendline resistance

- USD/CHF bulls and bears battle it out below trendline resistance.

- From a 4-hour perspective, 0.9020, 0.9060 and 0.9120 are key milestones.

As per the prior analysis, USD/CHF Price Analysis: Bullish correction eyed, but bears to commit below 0.9150, the bears moved into the market following the correction and the following will illustrate that a downside bias still remains.

USD/CHF prior analysis

Meanwhile, the daily chart showed that the bears had broken structure as follows:

The bears were meeting prior support of 0.9060 and had pierced the level to 0.9055. It was argued that a correction could be due but explained that once the bears committed below 0.9150, the likelihood would be for a downside continuation as per the weekly support area.

USD/CHF update

As illustrated, the price has continued lower as forecasted, and given that it remains on the front side of the downtrend, the bais stays bearish for the foreseeable future:

USD/CHF live daily chart

With that being said, there is still room for the upside into the trendline resistance.

USD/CHF H4 chart

From a 4-hour perspective, 0.9020, 0.9060 and 0.9120 are key milestones.

-

19:49

USD/MXN soars above 18.0000 as Fed hints more hikes; rate cut expectations pushed back

- Risk-off impulse triggered outflows from the emerging market Mexican Peso, boosting the US Dollar.

- The NY Fed Manufacturing Index climbed as business conditions improved.

- USD/MXN Price Analysis: Downward biased, but it could aim towards 18.7000 if it clears 18.2000.

The USD/MXN advances as the Mexican Peso (MXN) weakens, courtesy of hawkish commentary by Federal Reserve (Fed) officials. Increasing woes that the Fed would keep tightening monetary conditions, alongside investors pushing back the first rate cut to November 2023, augmented US Dollar demand. At the time of writing, the USD/MXN is trading at 18.0755 after hitting a low of 17.9142.

Investors favor US Dollar with a potential Fed rate hike and Banxico’s easing

Investors’ sentiment deteriorated as the US Dollar (USD) advanced. Traders seeking safety bought the US Dollar, as shown by its US Dollar Index (DXY). The DXY, which tracks the American Dollar value against a basket of six currencies, extends its gains, up 0.56%, at 102.140.

Expectations for the upcoming May meeting of the US Federal Reserve, the CME FedWatch Tool, foresees an 88.7% chance for a 25 bps rate hike to the 5.00% - 5.25% range.

Earlier, a report by the New York Fed revealed that manufacturing activity in the region unexpectedly expanded in April due to a jump in new orders and shipments. The Empire State Manufacturing Index advanced 10.8, above estimates for a -18 plunge. The poll highlighted that factories were more optimistic about general business conditions.

On the Mexican front, a light economic calendar keeps traders leaning on the latest monetary policy decision by the Bank of Mexico (Banxico), which raised rates by “only” 25 bps to 11.25% after a series of 50 and 75 bps rate hikes to the TIIE. Banxico’s moderated the pace of interest-rate increases as the institution is near to end of its tightening cycle.

The latest inflation data in Mexico witnessed a deceleration from 7.62% in February to 6.85% in March. However, the core reading remained above 8%, at 8.09%, from the prior’s month 8.29%, proving to be stickier than foreseen.

What to watch?

The Mexican economic docket is empty. On the other hand, the US calendar would feature housing data alongside additional Fed speakers crossing newswires.

USD/MXN Technical Analysis

From a technical analysis perspective, the USD/MXN is still downward biased. However, the recent leg-up could put up a test to the 20-day Exponential Moving Average (EMA) at 18.1929, which, once cleared, could exacerbate a rally, initially to the 50-day EMA at 18.4035. A breach of the latter and the USD/MXN pair will continue higher towards the 100-day EMA at 18.7272. On the contrary, a fall below 18.0000 can open the door for a re-test of the YTD low at 17.8968.

-

19:22

Silver bulls are lining up as the US Dollar hits a 61.8% Fibo area

- Silver is holding up in support but within a firmer US Dollar environment.

- Bulls are lurking in support as US Dollar takes on a 61.8% Fibo.

Spot silver XAG/USD fell to $24.8090 per ounce on Monday but has since recovered some ground to $24.9816 currently but remains well below the highs of the day of $25.6080. The drop comes amid a revival of the US Dollar bulls and hawkish sentiment surrounding the Federal Reserve again.

While investors looked for cues on whether the market will see a 'one and done' rate hike by the U.S. Federal Reserve in May, on Friday, to the contrary, Federal Reserve´s Governor Christopher Waller said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up. With a combination of firm consumer spending for the past quarter, and the April survey of business activity in New York state rising for the first time in five months, the US Dollar gained 0.6%. This is making greenback-priced precious metals less attractive for overseas buyers, while benchmark Treasury yields climbed to a more than two-week high.

Moreover, Fed funds futures are showing that the expectations that the Fed will start cutting rates later this year have been pushed back to November from September, with a smaller cut now anticipated also.

With a relatively light calendar for the rest of the week, investors will focus on US flash PMIs for April and any further comments from Fed officials before they enter into a blackout period from April 22 ahead of the Fed's May 2-3 meeting. In this regard, analysts at TD Securities said the S&P PMIs for early April will offer a first comprehensive look at the state of the US economy post-banking turmoil. ´´Note that the March data was not clearly impacted by banking jitters, but perhaps it was too soon to be reflected: both the mfg and services PMIs registered their third consecutive increase then, with the latter advancing further into expansion territory.´´

As for Fed speakers, we have heard from President and CEO of the Federal Reserve Bank of Richmond Thomas Barkin so far who has stated that he wants to see more evidence of inflation settling back to target. Barkin also said he feels reassured by what he is seeing in the banking sector.

Silver technical analysis

Silver has broken below the trendline support and could close on a daily candle in the support area. $24.5664 is the first import structure level that may otherwise give way to sell-off as illustrated below. However, there could be some consolidation and price discovery to follow over the coming days in and around the recent highs and lows.

US Dollar takes on a 61.8% Fibo:

If the DXY stalls, Silver bulls will be in play.

-

18:52

USD/JPY Price Analysis: Gains momentum on rising US Treasury bond yields

- USD/JPY reached fresh five-week highs at 134.57, with bulls eyeing 135.00.

- Oscillators at bullish areas favor further upside in the USD/JPY.

- Downside risks lie below 134.00, which could drive the USD/JPY towards 133.00.

The USD/JPY moved higher as US Treasury bond yields resumed their uptrend, following the last week’s hawkish commentary by Federal Reserve (Fed) officials. Fed Board Governor Christopher Waller’s comments that more tightening is needed, triggered the latest jump in the 10-year US T-bond yield. Therefore, the USD/JPY rallied and is trading at 134.47, up 0.52%.

USD/JPY Price Action

The USD/JPY extended its gains past the last week’s high of 134.04, and it’s aiming to challenge a break above January 6 high at 134.77. On its way up, the USD/JPY climbed above several solid resistance areas, like the 200-day Exponential Moving Average (EMA) EMA at 133.70, followed by the 100-day Exponential Moving Average (EMA) at 134.00. Once the pair cleared those levels, a challenge to 135.00 is on the cards.

The Relative Strength Index (RSI) cements the upward case in bullish territory, while the Rate of Change (RoC) indicates that buying pressure is increasing.

If USD/JPY rallies above 135.00, the next resistance would be 136.00, followed by the psychological 137.00 level before testing the YTD high at 137.91. Conversely, if the USD/JPY retraces, the first support would be 100-day EMA at 134.00. A breach of the latter will immediately expose the 200-day EMA at 133.70, followed by the 50-day EMA At 133.14, before sliding to 133.00.

USD/JPY Daily Chart

USD/JPY Technical Levels

-

18:13

GBP/USD falls on US Dollar strength amid Fed rate hike speculations

- Greenback stages a comeback, boosted by higher US Treasury bond Yields

- Empire State Index surprises with 10.8 point jump in March’s report.

- GBP/USD Price Analysis: Double top emerges, but the pair must fall below 1.2344 to confirm the pattern.

GBP/USD dropped after forming a double top in recent price action during the last nine days and falls amidst speculations that the US Federal Reserve (Fed) would raise rates in May. That, alongside Fed Fund’s swaps, pushing the first rate cut by November of 2023, increased appetite for the greenback. Therefore, the GBP/USD is trading at 1.2355 after hitting a high of 1.2438.

Bets for May’s rate hike by the Fed underpins the US Dollar

US equities have turned read, while the greenback, as shown by the US Dollar Index (DXY), stages a comeback. The DXY sits at 102.214, gains 0.62%, and is one of the reasons for the GBP/USD pullback. Underpinned by traders bracing for additional tightening by the Fed, US Treasury bond yields are heading north, consequently bolstering the USD.

According to the CME FedWatch Tool, the probability of a 25 bps rate hike by the Fed stands at 84.7%, indicating an increase from last Friday’s 78%.

Earlier, a report by the New York Fed revealed that manufacturing activity in the region jumped, as shown by the Empire State Index, for March, advanced 10.8, above estimates of a -18 plunge. A rise in orders and shipments underpinned the data.

Given the backdrop, the GBP/USD retreated from daily highs at 1.2438 and extended its losses towards the S1 daily pivot at 1.2359, shy of last week’s low of 1.2344.

On the United Kingdom (UK) docket, Bank of England (BoE) Deputy Governor Jon Cunliffe crossed newswires. Cunliffe focused on digital currencies and said, “Systemic stablecoins will need to be backed with high quality and liquid assets,” and added that it would not be possible to protect stablecoin deposits in the case of failure.;

What to watch?

The UK calendar will feature the important jobs report, with Employment Change, expected at 50K and the Unemployment Rate unchanged at 3.7%. On the US front, the docket will feature Building Permits, Housing Starts, and Federal Reserve Governor Michell Bowman speaking.

GBP/USD Technical Analysis

A double-top chart pattern is beginning to emerge in the GBP/USD daily chart. Nevertheless, a break below April’s 10 cycle low at 1.2344 is needed to validate the pattern. An initial price target would be 1.2144, but the GBP/USD must hurdle some demand areas toward the latter. First, the April 3 daily low at 1.2274, followed by the 1.2200 figure, ahead of February’s 28 high, turned support at 1.2144.

-

18:09

Fed´s Barkin: Wants to see more evidence inflation settling back to target

President and CEO of the Federal Reserve Bank of Richmond Thomas Barkin has crossed the wires and said that he wants to see more evidence of inflation settling back to target.

Barkin said he feels reassured by what he is seeing in the banking sector.

US Dollar update

The US Dollar, as per the DXY index, is making its way up into resistance as per the micro trendline as illustrated on the daily charts above and in a 61.8% Fibonacci correction. DXY has traveled from a low of 101.531 to a high of 102.231 so far.

-

17:05

Gold Price Forecast: XAU/USD extends slide to $1,980 amid dollar strength

- Gold price resumed downside on Monday, fall to the $1,980$ area.

- Us Dollar rises across the board, boosted by higher US yields.

Gold price resumed the downside on Monday, breaking under $1,990. XAU/USD bottomed at $1,980 reaching the lowest level in a week.

As of writing it is hovering near $1,980 almost $60 from last week’s top. The reversal in gold gained momentum amid a rally of the US Dollar and higher US yields.

Expectations that the Federal Reserve will raise interest rates again in May pushed yields to the upside. The US 10-year yield rose to 3.60%, the highest level since late March. The US Dollar Index is advancing for the second day in a row, and is above 102.20.

Data released on Monday in the US showed a sharp rebound in the Empire Manufacturing Index in April to 10.8 from -24.60, surpassing expectations of -18.0. The numbers contribute to the expectations of one more rate hike from the Fed.

On the daily chart, XAU/USD is trading around the 20-period Simple Moving Average at the $1,990 area. If the yellow metal consolidates clearly below, the outlook would point to an extension of the correction. On the contrary, if gold manages to remain above and retakes $2,005 bulls may return. The next resistance is seen around $2,025.

XAU/USD daily chart

-

16:42

EUR/USD stumbles on Fed rate hike speculations, slides below 1.1000

- EUR/USD falls for the second straight day, as sellers are eyeing 1.0800.

- US New York Empire State Manufacturing Index climbed for the first time in five months.

- EUR/USD Price Analysis: Could register a pullback in the near term before resuming upwards.

EUR/USD losses traction on technical reasons and on a stronger US Dollar (USD, as speculations that the US Federal Reserve (Fed) would hike rates in May, gains adepts. US Treasury bond yields rose; consequently, bonds dropped, a tailwind for the buck. At the time of writing, the EUR/USD is trading at 1.0911 after hitting a YTD high at 1.1075.

Growing adepts for a US central bank 25 bps rate hike boosted the USD

Wall Street trades with a risk-off-tilted mood. The economic docket in the United States (US) and the Eurozone (EU) is light, with the main driver of EUR/USD’s price action being the US 2-year Treasury bond yield. The US 2-year bond yield is gaining almost 10 bps, sitting at 4.194%, while the CME FedWatch Tool shows odds for a 25 bps rate hike by the Fed, at 84.7%, higher than last Friday’s 78%.

The US Dollar Index (DXY) continues to advance and tests the 20-day EMA around 102.321. A break above it could expose the 103.000 mark.

Data-wise, the New York Factory Empire State Manufacturing Index unexpectedly jumped in April, from -24.5 to 10.8, exceeding forecasts for a -18 plunge. Orders and shipments rising were the reasons behind the expansion, while a measure of prices paid fell 9 points.

On the Eurozone front, inflation in Italy rose by 7.6%, beneath the consensus and below February’s 9.1%. In the meantime, the European Central Bank (ECB) President, Christine Lagarde, is crossing newswires, but she’s not commenting about monetary policy.

What to watch?

Ahead of the week, the EU will reveal the Zew Economic Sentiment Index for the bloc and Germany, alongside the EU’s Balance of Trade. On the US front, Housing data, and Fed Bowman, will cross newswires.

EUR/USD Technical Analysis

The EUR/USD is still upward biased, though after hitting a new YTD high at 1.1075, it has retreated below 1.1000. Additionally, oscillators like the Relative Strength Index (RSI) aiming downward, the same as the Rate of Change (RoC), suggest that buyers are losing momentum. Therefore, the EUR/USD path of least resistance is downwards in the near term.

The EUR/USD first support would be 1.0900, followed by the 20-day Exponential Moving Average (EMA) at 1.0881. A decisive break would tumble the pair towards the 50-day EMA At 1.0800.

-

15:03

NZD/USD drops further below 0.6200, to four-week lows

- US Dollar remains strong, DXY gains 0.45%.

- US Empire Manufacturing jumps in March.

- NZD/USD breaks previous lows, looks at the 200-day SMA.

The NZD/USD is falling for the second day in a row and printed fresh lows after the release of US data, hitting at 0.6175, the lowest in four weeks. The US Dollar gained momentum across the board and resumed the upside.

Dollar adds to gains after US data

Data released on Monday showed an unexpected rebound from -24.60 to 10.8, against expectations of -18.0. The numbers boosted further the US Dollar while the Kiwi is lagging again.

Earlier on Monday, data from New Zealand showed a 0.8% increase in the Food Price Index during March and a modest decline in the Business NZ PSI in March to 54.4 from 55.8. The key report this week in New Zealand will be Q1 inflation early on Thursday.

NZD/USD is trading at 0.6175, at the lowest level since March 22. The pair is holding below previous April lows, looking vulnerable, near the 200-day Simple Moving Average that stands at 0.6160.

Technical levels

-

15:00

United States NAHB Housing Market Index came in at 45, above expectations (44) in April

-

14:50

Week Ahead: Canada Macro Market Movers – TDS

Strategists at TD Securities (TDS) offer a brief preview of a rather busy week in terms of important Canadian macro data, starting with the release of the latest consumer inflation figures on Tuesday.

Key quotes:

“We will receive CPI on Tuesday where we expect a sharp deceleration in the y/y measure to 4.3% (prior: 5.2% y/y) reflecting base effects. Housing Starts (out Wednesday) are expected to edge lower from 244k to 235k with declines in both single-family and multi-unit starts. Lastly, we will receive Retail Sales on Friday where we look for a 0.5% contraction (flash estimate: -0.6%).”

-

14:41

USD Index trades remains bid and flirts with 102.00

- The index adds to Friday’s rebound and retargets 102.00.

- US yields keep the march north and bolster the dollar.

- The NY Empire State index surprised to the upside in April.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main competitors, extends Friday’s bounce to the boundaries of 102.00 the figure at the beginning of the week.

USD Index supported by yields, rates hike bets

The index now trades on a firmer foot and pokes with the key barrier at the 102.00 region on the back of the continuation of the selling bias in the risk-associated universe, while further upside in US yields across the curve also collaborates with the daily uptick.

In the meantime, bets on a 25 bps rate hike by the Federal Reserve at the May 3 event remain on the rise and look propped up by hawkish Fedspeak, while the still elevated inflation also seems to maintain the prudent stance among investors.

In the US docket, the NY Empire State Manufacturing Index improved to 10.8 for the current month. Later in the session, the NAHB Housing Market Index and TIC Flows are both due.

What to look for around USD

The dollar’s corrective upside remains en route to challenge the key barrier at 102.00 on Monday.

In the meantime, the marked retracement in the buck since March has been underpinned by the pick-up in the perception that the Federal Reserve could make a pause in its current tightening cycle just after the May meeting.

In favour of a pivot in the Fed’s normalization process, however, still emerges the persevering disinflation, nascent weakness in some key fundamentals and somewhat persistent concerns surrounding the banking sector.

Key events in the US this week: NAHB Housing Market Index, TIC Flows (Monday) – Building Permits, Housing Starts (Tuesday) – MBA Mortgage Applications, Fed’s Beige Book (Wednesday) – Initial Claims, Philly Fed Index, CB Leading Index, Existing Home Sales (Thursday) - Flash Manufacturing/Services PMIs (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is advancing 0.31% at 101.89 and the next resistance level emerges at 103.05 (monthly high April 3) seconded by 103.53 (100-day SMA) and then 105.11 (weekly high March 15). On the flip side, the breach of 100.78 (2023 low April 14) would open the door to 100.00 (psychological level) and finally 99.81 (weekly low April 21 2022).

-

14:27

Singapore: MAS ends its hiking cycle – UOB

UOB Group’s Senior Economist Alvin Liew and Senior FX Strategist Peter Chia review the latest MAS decision on its monetary policy conditions.

Key Takeaways

“MAS Apr 2023 MPS – The Monetary Authority of Singapore (MAS), in its scheduled monetary policy statement (MPS) release on Fri (14 Apr), announced it was maintaining the prevailing rate of appreciation of the S$NEER policy band, with no change to the width of the policy band and the level at which the policy mid-point is centred. This is the first time MAS has kept policy unchanged after five preceding rounds of policy tightening since Oct 2021.”

“MAS Inflation & Growth Assessment – The MAS provided a downbeat assessment for growth as it noted “Singapore’s GDP growth is projected to moderate significantly this year, in line with the global goods and investment cycle downturn.” The MAS projects Singapore’s GDP to ease below trend growth to 0.5%-2.5% (from 3.6% in 2022) and the output gap to turn slightly negative in 2023 with risks to global and Singapore’s growth tilted to the downside. The MAS kept its inflation forecasts (that were first made in the 14 Oct 2022 MPS) unchanged in today’s Apr statement. The two notable differences this time is that the MAS explicitly stated “MAS Core Inflation is projected to reach around 2.5% y-o-y by the end of 2023” and it sees both upside and downside risks to inflation.”

“MAS Outlook – Tightening Cycle Is Over, Status Quo For Oct: Overall, the MAS took the prudent approach and kept policy unchanged in Apr. We now expect the current tightening cycle to have ended and the MAS to maintain this pause in the next Oct meeting. If there is another off-cycle announcement before Oct, we think it will likely be due to a sudden worsening in external conditions leading to a sharp downgrade in growth outlook, so the MAS will likely shift to a more accommodative policy rather than further tightening in its next move, but that is not our base case to expect an off-cycle policy announcement for now.”

-

14:24

USD/CAD challenges 200-day SMA, around 1.3400 mark amid softer Oil prices/USD strength

- USD/CAD scales higher for the second straight day and draws support from a combination of factors.

- A modest downtick in Oil prices undermines the Loonie and acts as a tailwind amid a stronger USD.

- Bets for an imminent Fed rate-hike pause might hold back bulls from placing fresh bets and cap gains.

The USD/CAD pair attracts fresh buying following an intraday dip to the 1.3340 area and turns positive for the second straight day on Monday. Spot prices climb back closer to the 1.3400 mark during the early North American session, with bulls now awaiting a move beyond the 200-day Simple Moving Average (SMA) before positioning for an extension of Friday's bounce from a two-month low.

Crude Oil prices kick off the new week on a weaker note amid worries that a deeper global economic downturn will dent fuel demand, which, in turn, undermines the commodity-linked Loonie. The US Dollar (USD), on the other hand, recovers further from a one-year low touched on Friday amid speculations that the Federal Reserve (Fed) might continue raising interest rates. This is seen as another factor that acts as a tailwind for the USD/CAD pair and remains supportive of the intraday positive move.

In fact, the markets are currently pricing in a greater chance of another 25 bps lift-off at the next FOMC meeting in May. The bets were lifted by the University of Michigan's preliminary report, which showed a rise in short-term inflation expectations during April. Furthermore, Fed Governor Christopher Waller on Friday called for further rate hikes and said that the job was still not done as inflation remains far too high. This continues to push the US Treasury bond yields higher and lifts the USD for the second straight day.

Investors, however, still seem convinced that the US central bank will pause its rate-hiking cycle, sooner rather than later, amid signs of easing inflationary pressures. In fact, the US CPI and the PPI report released last week indicated that disinflation is progressing smoothly. This, along with a positive risk tone, might cap the safe-haven USD and any meaningful upside for the USD/CAD pair.

Technical levels to watch

-

14:13

EUR/USD Price Analysis: A deeper drop could retest 1.0830

- EUR/USD adds to Friday’s corrective decline well below 1.1000.

- The weekly low near 1.0830 emerges as the next support of note.

EUR/USD retreats to 3-day lows in the mid-1.0900s following a failed attempt to retake the key barrier at 1.1000 the figure on Monday.

Further weakness appears on the cards in the very near term for the pair. Against that, there is an initial support at the weekly low at 1.0831 (April 10) prior to April low at 1.0788 (April 3).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0373.

EUR/USD daily chart

-

13:51

USD/IDR faces extra side-lined trading – UOB

According to Markets Strategist Quek Ser Leang at UOB Group, USD/IDR is seen navigating within the 14,610-14,960 range in the short term.

Key Quotes

“We highlighted last Monday (10 Apr, spot at 14,905) that ‘weakness in USD/IDR has yet to stabilize’ and held the view that USD/IDR ‘could weaken further but February’s low of 14,830 is likely out of reach’. The anticipated weakness exceeded our expectations as USD/IDR plummeted to 14,640 on Friday.”

“Severely oversold conditions suggest that USD/IDR is unlikely to weaken much further. This week, USD/IDR is more likely to trade in a range, expected to be in a range of 14,610/14,960.”

-

13:47

The US Dollar is finally getting some traction – BBH

Economists at BBH said in their latest note that the recent relentless US Dollar (USD) selling was interrupted by a strong rebound on Friday that followed the release of the retail sales data and hawkish Fed comments.

Additional quotes:

“DXY is up for the second straight day and trading near 101.714. A break above 102.036 Is needed to set up a test of the April 10 high near 102.807.”

“Fed tightening expectations have picked up a bit. WIRP suggests nearly 90% odds of a 25 bp hike at the May 2-3 meeting, up from 70% at the start of last week and 50% at the start of the week before that. Small odds of another 25 bp hike in June has crept back into the market. After that, only one cut is priced in by year-end vs. two at the start of last week. In that regard, Powell has said that Fed officials “just don’t see” any rate cuts this year. If a second hike gets more priced in while a rate cut gets more priced out, this should help the dollar get more traction.”

-

13:38

EUR/SEK: Scope for a move to 10.80 on a 6-month view – Rabobank

The EUR/SEK pair is falling on Monday for the fifth consecutive day, trading at 11.30, the lowest level in a week. Analysts at Rabobank, see the Swedish Krona as vulnerable in the short term but they see it improve over the medium term. They forecast EUR/SEK at 10.80 on a six-month perspective.

Key quotes:

“Reflecting the weakness of the economy, the SEK was the weakest performing G10 currency in 2022. Sweden’s proximity to Russia was also likely a factor weighing on the SEK in early 2022. In the year to date, it has pulled back a little ground vs the EUR but has remained on the back foot vs. the EUR, reflecting the hawkishness of the ECB.”

“The weakness of the SEK has recently sparked market talk regarding FX intervention risks, though we view this as unlikely at this stage.”

“EUR/SEK has recently tested its 2020 high in the 11.42 region. The 2009 high stands around EUR/SEK11.79. In the near-term the SEK remain vulnerable. However, expectations that growth will be supported in 2024 by a still robust labour market and a recovery in the housing market suggests an improved outlook for the SEK into year end. We see scope for a move to EUR/SEK10.80 on a 6-month view.”

-

13:30

United States NY Empire State Manufacturing Index above forecasts (-18) in April: Actual (10.8)

-

13:30

Canada Wholesale Sales (MoM) came in at -1.7% below forecasts (-1.6%) in February

-

13:30

Canada Foreign Portfolio Investment in Canadian Securities climbed from previous $4.21B to $4.62B in February

-

13:30

Canada Canadian Portfolio Investment in Foreign Securities rose from previous $-16.18B to $-1.61B in February

-

13:25

Silver Price Analysis: XAG/USD sticks to gains around $25.40 area, bullish potential intact

- Silver regains positive traction and reverses a part of Friday’s retracement slide from the YTD peak.

- The technical setup still favours bullish traders and supports prospects for further near-term gains.

- A convincing break below the $25.00 mark should pave the way for a meaningful corrective decline.

Silver attracts fresh buying on the first day of a new week and reverses a part of Friday's retracement slide from levels just above the $26.00 mark, or a fresh one-year high. The white metal sticks to its modest intraday gains around the $25.45 region heading into the North American session and seem poised to prolong its recent appreciating move witnessed over the past month or so.

The recent breakout through the $24.30-$24.40 strong horizontal barrier and a subsequent move beyond the $25.00 psychological mark add credence to the near-term positive outlook for the XAG/USD. That said, the slightly overbought Relative Strength Index (RSI) on the daily chart might hold back traders from placing aggressive bets and keep a lid on any meaningful upside, at least for the time being.

In the meantime, any intraday slide might continue to attract fresh buyers and remain limited near the $25.00 mark. The latter should act as a pivotal point, which if broken decisively might prompt some technical selling and drag the XAG/USD towards the $24.30-$24.40 resistance-turned-support en route to the $24.00 mark. A convincing break below the latter might shift the bias in favour of bearish traders.

On the flip side, bulls might now wait for some follow-through buying beyond the YTD peak, around the $26.10 area touched on Friday, before placing fresh bets and positioning for a further appreciating move. The XAG/USD might then climb towards the next relevant hurdle near the $26.40-$26.50 zone before eventually aiming to test the 2022 peak, just ahead of the $27.00 round-figure mark.

Silver daily chart

Key levels to watch

-

13:14

USD Index Price Analysis: The loss of 100.80 exposes a drop to 100.00

- DXY adds to Friday’s recovery and approaches the 102.00 barrier.

- There are still chances of a breakdown of the 2023 peak near 100.80.

DXY extends further Friday’s optimism and looks to retake the 102.00 neighbourhood at the beginning of the week.

Despite the ongoing rebound, the index is expected to remain under pressure for the time being. Against that, the loss of the 2023 low at 100.78 (April 14) should open the door to a deeper decline to, initially, the psychological 100.00 mark.

South from here aligns the late-March 2022 lows near 97.70.

Looking at the broader picture, while below the 200-day SMA, today at 106.33, the outlook for the index is expected to remain negative.

DXY daily chart

-

13:07

USD/MYR: Upside should meet a tough resistance at 4.4450 – UOB

The continuation of the upside momentum in USD/MYR is expected to face a solid barrier around 4.4450, notes Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

“We noted last week that ‘further range trading appears likely’ and expected USD/MYR to trade in a range between 4.3930 and 4.4350. Our view of range-trading was not wrong even though USD/MYR traded in a narrower range than expected (4.3790/4.4200). Despite the relatively quiet price actions, upward momentum appears to be building, albeit tentatively.”

“This week, we expect USD/MYR to edge higher but any advance is expected to face solid resistance at 4.4450. Support is at 4.4050; a break below 4.3950 would indicate that the current mild upward pressure has eased.”

-

12:53

Net USD long positions moved lower last week – Rabobank

Analysts at Rabobank assess the latest CFTC Commitment of Traders Report:

"Net USD long positions moved lower last week. That said, there has been little net change in USD longs since late March. While the recovery in sentiment after the recent bank jitters has weighed on the safe-haven USD, the greenback is again finding support from expectations about further policy tightening from the Fed."

"Net EUR long positions surged last week to their highest levels since mid-February as the market reacted to hawkish commentary from ECB officials."

"Net short GBP speculators’ positions dropped to their lowest level since March 2022 reflecting an improvement in sentiment linked to a slew of less bad UK economic data. The May BoE policy meeting is in view. The market is fully priced for another 25-bps rate hike and sees risk of additional tightening in the coming months."

"JPY net short positions saw little change having increased the previous week. They remain well above the levels held earlier in the year as speculators have lost faith in the view that the BoJ may soon announce a less accommodative monetary policy.

"CHF net shorts remain choppy, dropping back last week. Last month the issues surrounding Credit Suisse and the treatment of AT1 paper complicated the CHF’s safe-haven status."

"Speculators’ net short CAD positions edged a little lower having increased notably in late March, oil prices and the signalled pause in policy from the BoC are in view. Net AUD short positions moved higher again last week. That said, talk of another RBA rate hike could see a reversal of this direction in the next set of data."

-

12:49

AUD/USD trades with modest gains around 0.6700, upside seems capped amid stronger USD

- AUD/USD catches some bids on the first day of a new week, though lacks follow-through.

- Bets for another 25 bps Fed rate hike underpin the USD and act as a headwind for the pair.

- A positive risk tone caps the safe-haven buck and lends support to the risk-sensitive Aussie.

The AUD/USD pair attracts some buying on the first day of a new week and stalls Friday's rejection slide from the 0.6800 mark, or the 100-day Simple Moving Average (SMA). Spot prices stick to a mildly positive tone through the mid-European session, albeit seem to struggle to capitalize on the move and lack bullish conviction.

The US Dollar(USD) gains some positive traction for the second successive day and moves further away from a one-year low touched on Friday, which, in turn, acts as a headwind for the AUD/USD pair. Federal Reserve (Fed) Governor Christopher Waller on Friday called for further rate hikes and said that the job was still not done as inflation remains far too high. Adding to this, the University of Michigan's preliminary report showed that one-year inflation expectations rose to 4.6% from 3.6% in March and lifted bets for another 25 bps lift-off at the next FOMC policy meeting in May. This remains supportive of elevated US Treasury bond yields and continues to underpin the Greenback.

Market participants, however, still seem convinced that the Fed will pause its rate-hiking cycle, sooner rather than later. This, along with a generally positive tone around the equity markets, holds back traders from placing aggressive bullish bets around the safe-haven buck and lends support to the risk-sensitive Aussie. The mixed fundamental backdrop makes it prudent to wait for strong follow-through movement in either direction before positioning for a firm intraday direction. Investors also seem reluctant ahead of the release of the minutes of the latest Reserve Bank of Australia (RBA) meeting and Chinese data dump on Tuesday amid signs that the recovery in the world's second-largest economy is losing steam.

In the meantime, the US economic docket, featuring the release of the Empire State Manufacturing Index, will be looked upon for short-term trading impetus around the AUD/USD pair. Apart from this, the US bond yields, along with the broader market risk sentiment, might influence the USD price dynamics and contribute to producing short-term opportunities.

Technical levels to watch

-

12:48

RBA likely to keep its policy rate unchanged again in May – TDS

Analysts at TD Securities say that they don't expect the minutes of the Reserve Bank of Australia's (RBA) April policy meeting to offer any surprises.

RBA likely keep its policy rate unchanged again in May

"In their recent speeches, Governor Lowe and Deputy Governor Bullock made it clear that the RBA wanted to pause to assess the impact of the rapid rate hikes and the economic outlook. Thus, we expect the Apr Minutes to follow closely to the content of their speeches and don't expect any surprises. Again, the Minutes will emphasise the "long and variable lags" of monetary policy and the uncertainty from the upcoming mortgage roll off."

"We doubt the Board will place much focus on the Q1 CPI print in their discussion but rather steer their discussion on the importance of the aggregate data flow. We still think the Bank is likely to keep its policy rate unchanged again in May as a single month is unlikely enough time for the RBA's assessment. A hike after pausing potentially adds more confusion to the RBA's message."

-

12:24

EUR/JPY Price Analysis: Strong momentum could target the 2022 peak

- EUR/JPY extends the strong rally past the 147.00 region.

- Further up aligns the 2022 high north of the 148.00 barrier.

EUR/JPY extends the needle-like uptrend and surpasses the key 147.00 hurdle fort het first time since late October 2022.

Considering the ongoing price action, further gains in the cross remain in store for the time being. That said, the continuation of the upside momentum could extend further and challenge the 2022 peak at 148.40 (October 21) sooner rather than later.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.07.

EUR/JPY daily chart

-

12:19

USD/THB: Room for extra upside near term – UOB

Markets Strategist Quek Ser Leang at UOB Group suggests further strength in USD/THB remains on the cards for the time being.

Key Quotes

“We expected USD/THB to edge higher last week but we were of the view that ‘a sustained rise above 34.55 appears unlikely’. Our expectations did not materialize and USD/THB traded in a relatively quiet manner between 3.97 and 34.41 before settling slightly higher for the week (Friday’s close of 34.27, +0.20%).”

Upward momentums has improved somewhat and this week USD/THB is likely to trade with an upward bias. However, USD/THB is still unlikely to rise above 34.75 in a sustained manner (the next resistance level is at 34.75). Support is at 34.20, followed by 34.05.”

-

11:43

Gold Price Forecast: XAU/USD sticks to modest gains above $2,000, lacks follow-through

- Gold price regains positive traction on Monday, though the uptick lacks bullish conviction.

- Looming recession fears turn out to be a key factor benefitting the safe-haven commodity.

- A modest US Dollar strength holds back bulls from placing fresh bets and caps the upside.

Gold price attracts fresh buying near the $1,995 area on the first day of a new week and maintains its bid tone through the first half of the European session. The XAU/USD is currently placed around the $2,010-$2,011 region, up over 0.40% for the day, and for now, seems to have stalled Friday's retracement slide from the vicinity of over a one-year peak.

Looming recession fears benefit the safe-haven Gold price

Growing worries about a deeper global economic downturn turns out to be a key factor lending some support to the safe-haven Gold price amid expectations for an imminent pause in the rate-hiking cycle by the Federal Reserve (Fed). That said, impressive bank earnings seem to have eased fears about a banking crisis that unfolded in March. Adding to this, the Retail Sales report released from the United States (US) on Friday suggested that the economy is not so bad and remained supportive of a generally positive tone around the equity markets. This, along with a modest US Dollar (USD) strength, is holding back bulls traders from placing aggressive bets around the XAU/USD and capping the upside, at least for the time being.

Modest US Dollar strength keeps a lid on Gold price

Despite the softer US consumer inflation and the Producer Price Index released last week, Fed Governor Christopher Waller on Friday called for further rate hikes and said that the job was still not done as inflation remains far too high. The markets were quick to react and are now pricing in a greater chance of another 25 basis point (bps) lift-off at the next Federal Open Market Committee (FOMC) policy meeting in May. This remains supportive of elevated US Treasury bond yields, which, in turn, assists the USD to build on Friday's goodish rebound from a one-year low and gain follow-through traction for the second successive day. A stronger Greenback tends to undermine demand for the US Dollar-denominated Gold price.

Traders now look to US macro data for short-term impetus

The aforementioned mixed fundamental backdrop warrants some caution before positioning for any further appreciating move for the XAU/USD. Nevertheless, Gold price manages to hold above the $2,000 psychological mark as traders now look to the US economic docket, featuring the release of the Empire State Manufacturing Index for a fresh impetus later during the early North American session. Apart from this, the US bond yields will influence the USD price dynamics, which, along with the broader risk sentiment, should contribute to producing short-term opportunities around the XAU/USD.

Gold price technical outlook

From a technical perspective, the emergence of fresh buying on Monday favours bullish traders and support prospects for an extension of the recent strong upward trajectory witnessed over the past month or so. That said, sustained weakness below the $1,995-$1,990 region, will negate the positive outlook and prompt some technical selling. The Gold price might then accelerate the corrective decline towards the $1,965-$1,960 intermediate support en route to the $1,950 horizontal zone.

On the flip side, bulls might now wait for some follow-through buying beyond the $2,020 area before placing fresh bets. The Gold price might then climb to the YTD peak, around the $2,047-$2,049 region touched last Thursday. The subsequent move up has the potential to lift the XAU/USD back towards retesting the all-time high, around the $2,070-$2,075 region touched in August 2020.

Key levels to watch

-

11:00

US Dollar recovers as markets expect Fed rate hike in May

- US Dollar gathers strength to start the week following Friday’s decisive rebound.

- Markets expect the Federal Reserve to raise its policy rate again in May.

- EUR/USD needs to hold above 1.0900 to keep buyers interested.

The US Dollar (USD) started the new week on a bullish note after having registered strong gains against its major rivals ahead of the weekend. The latest macroeconomic data releases from the United States (US) and hawkish comments from Federal Reserve (Fed) officials help the USD keep its footing.

The US Dollar Index, which tracks the USD performance against a basket of six major currencies, extends its recovery toward 102.00 following a more-than-0.5% increase seen on Friday.

Daily digest market movers: US Dollar rises on hawkish Fed bets

- The data published by the US Census Bureau revealed on Friday that Retail Sales declined by 1% on a monthly basis in March. On a positive note, March’s reading of -0.4% got revised higher to -0.2%.

- The University of Michigan’s (UoM) Consumer Confidence Index improved modestly to 63.5 in April’s flash estimate from 62 in March.

- The one-year consumer inflation expectation component of the UoM’s survey climbed to 4.6% from 3.6% in March, providing a boost to the USD.

- "Monetary policy will need to remain tight for a substantial period and longer than markets anticipate,” Federal Reserve Governor Christopher Waller said on Friday. Waller further argued that the recent data show that the Fed hasn't made much progress on its inflation goal.

- In an interview with Reuters, Atlanta Fed President Raphael Bostic noted that recent developments in the US economy were consistent with one more rate hike.

- According to the CME Group’s FedWatch Tool, markets are currently pricing in a more-than-80% probability of a 25 basis points (bps) Fed rate hike in May.

- On Wednesday, the Fed will release the Beige Book. Existing Home Sales and Initial Jobless Claims data will be featured in the US economic docket on Thursday ahead of S&P Global’s Manufacturing and Services PMI surveys on Friday.

- Previewing the Fed’s publication, “since the March 21-22 meeting, the data suggest that activity is slowing, the labor market is softening, and price pressures are easing,” said analysts at BBH. “Notably, supply chains continue to improve. We believe the Beige Book will highlight these trends that support a pause after what is widely expected to be another 25 bp hike whilst leaving the door open for further tightening if needed.”

Technical analysis: US Dollar could stay resilient against Euro

On the daily chart the Relative Strength Index (RSI) indicator declined toward 60 early Monday, suggesting that the pair is staging a technical correction. On the downside, 1.0900 (20-day Simple Moving Average (SMA) aligns as first technical support ahead of 1.0760 (50-day SMA) and 1.0700 (100-day SMA).

In case EUR/USD manages to stabilize above 1.1000 (psychological level, static level), sellers could be discouraged. In that scenario, 1.1100 (psychological level, static level) could be seen as the bullish target before 1.1160 (static level from April 2022) and 1.1200 (psychological level).

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

-

10:35

USD/CNH clings to the consolidative theme so far – UOB

In the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, USD/CNH is expected to stick to the current range bound theme between 6.8500 and 6.9200 for the time being.

Key Quotes

24-hour view: “We expected USD to trade with a downward bias last Friday but we held the view that ‘a clear break below 6.8500 is unlikely’. We did not expect the volatile price actions as USD plunged to 6.8303 and snapped back up to end the day little changed at 6.8696 (-0.01%). USD traded on a firm note in early Asian trade and upward momentum is building. That said, any advance is expected to face solid resistance at 6.9000. Support is at 6.8700, followed by 6.8600.”

Next 1-3 weeks: “Last Friday (14 Apr, spot at 6.8700), we noted that ‘downward momentum is showing tentative signs of building’. However, we indicated that USD ‘has to break clearly below 6.8500 before a sustained decline is likely’. While USD took out 6.8500 and plunged to 6.8303, the decline was short-lived as it soared to a high of 6.8760 in NY trade before extending its gains in Asian trade. The price actions suggest there is no clear USD direction and for the time being, it could trade in a relatively broad range of 6.8500/6.9250.”

-

10:32

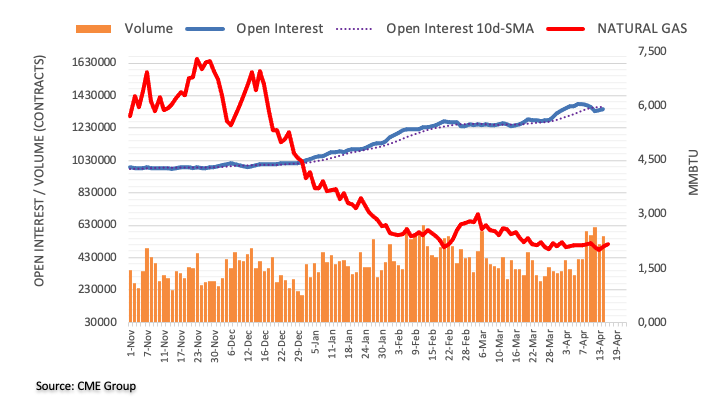

Natural Gas Futures: Scope for a near-term bounce

Considering advanced figures from CME Group for natural gas futures markets, open interest went up for the second session in a row on Friday, now by around 4.7K contracts. In the same line, volume partially reversed the previous decline and rose by around 48.7K contracts.

Natural Gas faces an interim hurdle at the 55-day SMA

Friday’s uptick in prices of the natural gas was amidst increasing open interest and volume. That said, the continuation of the upward bias appears likely in the very near term and could face a temporary hurdle at the 55-day SMA, today at $2.387 per MMBtu.

-

10:26

USD/JPY: Next on the upside comes 134.80 – UOB

Further upside could prompt USD/JPY to revisit the 134.80 region in the next weeks, note Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Last Friday, we held the view that USD ‘has scope to test 132.00 again before a sustained recovery is likely’. USD dropped to 132.15 in Asian trade and then bounced strongly to 133.84 in NY session. Upward momentum is strong and USD is likely to strengthen further. In view of the overbought conditions, the major resistance level at 134.80 could be out of reach today. On the downside, a break of 133.25 (minor support is at 133.50) would indicate that USD is not strengthening further.”

Next 1-3 weeks: “We highlighted last Friday (14 Apr, spot at 132.60) that USD ‘appears to have moved into a consolidation phase and is likely to trade between 131.20 and 133.70 for now’. We did not expect the sharp and rapid bounce as USD soared to 133.84 in NY trade. While it is too early to expect the start of a sustained advance in USD, it is likely to trade with an upward bias to 134.80. Looking ahead, it has to break clearly above this level before further gains can be expected. Overall, only a breach of 132.70 (‘strong support’ level) would suggest that USD is not advancing to 134.80.”

-

10:26

BoJ to consider CPI projection for FY2025 between 1.6%-1.9% – Jiji

Citing sources familiar with the Bank of Japan’s (BoJ) thinking, the Japanese media agency – Jiji, reported on Monday that the central bank is looking to consider the Consumer Price Index (CPI) projection for FY2025 between 1.6%-1.9%.

The BoJ meets next week for its monetary policy review and it will be the first one under the new Governor Kazuo Ueda. Ueda’s comments last week emphasized that accommodative monetary policy in Japan is here to stay.

At the time of writing, USD/JPY is trading at 134.05, up 0.20% on the day. The pair is underpinned by increased Fed rate hike expectations.

-

10:26

USD/CAD holds steady around 1.3365-70 area amid modest USD strength, remains below 200 DMA

- USD/CAD attracts some dip-buying on the first day of a new week, though lacks follow-through.

- Softer Crude Oil prices undermine the Loonie and lend some support amid a modest USD uptick.

- Expectations for an imminent Fed rate hike pause act as a headwind for the USD and cap gains.

The USD/CAD pair reverses an intraday dip to the 1.3340 area on Monday and climbs to the top end of its daily trading range during the first half of the European session. The pair, however, remains confined well within Friday's broader trading range, below a technically significant 200-day Simple Moving Average (SMA) and is currently placed around the 1.3365-1.3370 region.

The US Dollar (USD) edges higher for the second successive day and moves away from a one-year low touched on Friday. Apart from this, a modest downtick in Crude Oil prices is seen undermining the commodity-linked Loonie and acting as a tailwind for the USD/CAD pair. The University of Michigan's preliminary report showed that one-year inflation expectations rose to 4.6% in April from 3.6% previous and fueled speculations that the Federal Reserve (Fed) might continue raising interest rates.

Adding to this, hawkish comments by Fed officials reaffirmed market expectations for another 25 bps lift-off at the next FOMC meeting in May. This, in turn, remains supportive of elevated US Treasury bond yields and continues to lend some support to the Greenback. That said, growing acceptance that the Fed will pause its rate-hiking cycle, sooner rather than later, amid signs of easing inflationary pressures, holds back the USD bulls from placing aggressive bets and seems to cap the USD/CAD pair.