Notícias do Mercado

-

23:53

RTE TV: British, Irish PMs agree opportunity remains for negotiated Brexit resolution – Reuters

“British Prime Minister Liz Truss has agreed with her Irish counterpart Micheal Martin that an opportunity remains for a negotiated outcome to issues around the Northern Ireland protocol,” Reuters quotes Irish broadcaster RTE TV during the weekend.

The news also mentioned that an Irish government spokesperson declined to comment on what was discussed at the meeting between the two in London ahead of Queen Elizabeth's state funeral.

GBP/USD consolidates recent losses

The news seemed to have joined a lackluster start to the week and the UK’s holiday to help the GBP/USD pair pare its losses around the lowest levels since 1985, bouncing off a short-term support line to 1.1420 at the latest.

Also read: GBP/USD Price Analysis: Keeps bounce off four-month-old support above 1.1400

-

23:47

Goldman Sachs cuts 2023 US GDP forecasts to 1.1%

Goldman Sachs (GS) cut its forecast for 2023 US Gross Domestic Product (GDP) as it projects a more aggressive Federal Reserve tightening policy through the rest of this year, and sees that pushing the jobless rate higher than it previously projected, reported Reuters during the weekend.

The news also quotes GS’ note, released late Friday, stating that it now sees GDP growth of 1.1% next year, down from its prior call for 1.5% growth from the fourth quarter of 2022 to the end of 2023.

Key quotes

The influential financial firm now expects the Federal Reserve to hike policy rates by 75 basis points at its meeting next week, up from 50 basis points previously and sees 50 bp hikes in November and December, with the fed funds rate peaking at 4-4.25% by the end of the year.

This higher rates path combined with recent tightening in financial conditions implies a somewhat worse outlook for growth and employment next year.

GS sees the unemployment rate at 3.7% by year-end, up from 3.6%, and rising to 4.1% by the end of 2023, from 3.8% previously.

Also read: EUR/USD Weekly Forecast: Peak Fed hawkishness? Not so fast, determined message to send pair plunging

-

23:43

ECB’s Lange, Nagel signal higher rates, more pain ahead

“The European Central Bank (ECB) could raise interest rates into next year, causing pain for consumers as it tries to depress demand that is now increasingly adding to sky-high inflation,” ECB Chief Economist Philip Lane said on Saturday per Reuters. “At 0.75%, the ECB's deposit rate is still too low as it continues to stimulate the economy, so the ECB's job is not yet done,” ECB’s Lane added.

Additional quotes

Although Lane said rates could continue to go up at each remaining meeting this year and may rise early next year, too, the ECB is keeping an open mind about where to stop and will decide meeting by meeting.

Lane added that the eurozone economy is likely to flatline over the winter months and a recession could not be ruled out given high energy prices and a shortage of natural gas.

Elsewhere, said ECB Governing Council member and German central bank head Joachim Nagel stated that the ECB rates are far away from levels that are suitable for inflation. The policymaker also added that he doesn’t see a hard recession while mentioning that the ECB must be resolute on rates in October and beyond.

EUR/USD grinds higher

EUR/USD braces for this week’s Federal Open Market Committee (FOMC) meeting while grinding higher around 1.0015 by the press time of early Monday morning in Asia.

Also read: EUR/USD sees upside above 1.0050 despite soaring Fed bets

-

23:36

GBP/USD Price Analysis: Keeps bounce off four-month-old support above 1.1400

- GBP/USD licks its wounds near the lowest levels since 1985.

- Oversold RSI conditions, short-term support line restrict immediate downside amid the UK’s bank holiday.

- Recovery remains elusive below the 21-DMA nearly resistance, key FE levels may entertain bears below the stated support line.

- Bearish trend is likely to prevail but a short-term rebound can’t be ruled out.

GBP/USD stays defensive at around 1.1415-20 during the sluggish Asian session on Monday, after bouncing off the lowest levels since 1985 the previous day.

The Cable pair’s latest rebound could be linked to the oversold RSI (14), as well as the quote’s inability to break a downward sloping support line from mid-May.

It should, however, be noted that the recovery remains elusive until the quote stays below the 21-DMA resistance level near 1.1590.

Following that, the monthly high near 1.1740 and July’s bottom surrounding 1.1760 will be in focus.

Alternatively, GBP/USD bears may keep attacking the aforementioned support line, at 1.1330 before aiming for the 61.8% and 78.6% Fibonacci Expansion (FE) levels, respectively near 1.1285 and 1.1170.

In a case where the Cable bears keep reins past 1.1170, the 1.1000 psychological magnet and the year 1985 low near 1.0520 should gain the market’s attention.

Overall, GBP/USD is likely to remain bearish but hopes of a short-term rebound remain on the table.

GBP/USD: Daily chart

Trend: Corrective bounce expected

-

23:30

New Zealand Business NZ PSI climbed from previous 51.2 to 58.6 in August

-

23:27

NZD/USD advances towards 0.6000, focus shifts to Fed policy

- NZD/USD is aiming to recapture 0.6000 amid a decline in consensus for the US growth rate.

- Fed’s interest rates are expected to peak around 4-5% beyond 2023.

- A dovish PBOC’s monetary policy will support the antipodean.

The NZD/USD pair is marching towards the psychological resistance of 0.6000 after a break above the 0.5940-0.5985 range in the early Tokyo session. The asset has entered inside the prior balanced profile in a range of 0.5977-0.6026 after a rebound whose breakdown led to a decent fall. The major is likely to display significant gains ahead as the US dollar index (DXY) has turned lackluster ahead of the interest rate decision by the Federal Reserve (Fed).

The survey from the Financial Times conducted in partnership with the Initiative on Global Markets at the University of Chicago’s Booth School of Business sees Fed interest rates above 4% beyond 2023. The Fed is unlikely to shift its stance to a ‘neutral’ path before the conclusion of 2023 as price pressures will take sufficient time to return to the restoration level. Also, the interest rates will peak around 4-5% and will keep them until they find a slowdown in the inflation rate for several months.

Meanwhile, the DXY is expected to display a vulnerable performance as economists at Goldman Sachs have trimmed the growth forecasts for 2023. The US Gross Domestic Product (GDP) is expected to increase by 1.1% as Fed’s tightening path along with the current restrictive policy will prove less room for growth in the scale of economic activities.

On the NZ front, investors have shifted their focus toward the monetary policy meeting of the People’s Bank of China (PBOC). To spurt the inflation rate and economic activities, a dovish tone is expected from PBOC’s policymakers. A loose monetary policy will strengthen the antipodean a major trading partner of China.

Also, the Westpac Consumer Survey for the third quarter will be keenly watched, which is seen higher at 87.6 vs. the prior release of 78.7.

-

23:25

Gold Price Forecast: XAU/USD stays inside bearish channel below $1,700, Fed in focus

- Gold price floats above 29-month low flashed on Friday as the Fed week begins.

- US data favors traders to price-in 75 bps Fed rate hike.

- Yields dribble around multi-day top, stocks remain pressured but DXY stays on the bull’s radar.

- Off in Japan, the UK will join a light calendar at home to restrict intraday moves.

Gold price (XAU/USD) remains steady at around $1,675 as Asian traders begin the key week comprising the monetary policy meeting of the Fed.

The yellow metal refreshed the multi-month low the previous day amid broad US dollar strength, as well as increasingly hawkish calls of the US central bank’s next move, before bouncing off $1,654. The recovery moves, however, remain elusive amid a light calendar for the day and the market’s anxiety ahead of Wednesday’s Federal Open Market Committee (FOMC) meeting.

On Friday, the University of Michigan's preliminary readings of Consumer Sentiment for September came in at 59.5, up from 58.6 in the prior month while easing below 60.0 market forecasts. With the firmer US data, the odds of the Fed’s 75 basis points rate hike (bps) rose to nearly 80%, around 82% by the press time, while the market’s expectations of a full one percentage increase in the Fed rate rose to 18%.

It should be noted that a jump in China’s Treasury buying and the fears emanating from Beijing, as well as from Europe, also underpinned the US dollar’s safe-haven demand, which in turn weighed on the XAU/USD prices. That said, the US Dollar Index (DXY) dribbled around the 20-year high marked earlier in the month after the firmer data and geopolitical chatters.

Additionally, hawkish comments from the European Central Bank (ECB) policymakers could also be considered to favor the gold price. “The European Central Bank (ECB) could raise interest rates into next year, causing pain for consumers as it tries to depress demand that is now increasingly adding to sky-high inflation,” ECB Chief Economist Philip Lane said on Saturday per Reuters. On the same line was a ECB Governing Council member and German central bank head Joachim Nagel who said, “ECB rates are far away from levels that are suitable for inflation.”

Amid these plays, Wall Street benchmarks closed in the red while the US Treasury yields remained firmer, which in turn favored the market’s risk-off mood and exerted downside pressure on the metal prices.

Moving on, the XAU/USD traders will keenly await the Fed’s verdict and are likely to favor USD bulls amid hawkish hopes. However, the dot-plot, economic projections and Fed Chair Powell’s speech will be crucial for clear directions.

Technical analysis

Gold price defends the bounce off a six-week-old descending trend channel’s support line, as well as the 61.8% Fibonacci Expansion (FE) of April-August moves. In doing so, the XAU/USD also justifies the RSI (14) bounce off the oversold territory.

However, the bearish MACD signals and sustained trading beyond the previous support line from late July, now resistance around $1,694, keep gold sellers hopeful.

Even if the quote crosses the $1,694 hurdle, the 21-DMA and upper line of the stated channel, respectively around $1,711 and $1,718, could challenge the metal’s recovery moves. It should be noted that a downward sloping resistance line from June 13, close to $1,762, appears the last defense of the bears.

Alternatively, the 61.8% FE and the aforementioned channel’s bottom, respectively near $1,694 and $1,650, are likely to restrict the short-term XAU/USD downside.

Following that, the 78.6% FE level and a four-month-old descending trend line, close to $1,622 and $1,590 in that order.

Overall, gold is likely to remain bearish but the downside room appears limited, at least for intraday.

Gold: Daily chart

Trend: Limited downside expected

-

23:07

USD/JPY bears in charge but bulls eye 150.00s longer-term

- USD/JPY bulls are pressured still ahead of this week's central banks.

- The Fed and BoJ will be eyed for the week ahead.

USD/JPY fell from 143.69 at the end of the week to score a low of 142.83 as the greenback moved down slightly on Friday but registered a gain for the week as traders remain of the view that the US Federal Reserve will stick to an aggressive path when it hikes interest rates this week.

The US dollar found some support when consumer sentiment improved moderately in September. The University of Michigan's preliminary September reading on the overall index on consumer sentiment came in at 59.5, up from 58.6 in the prior month. Economists polled by Reuters had forecast a preliminary reading of 60.0 in September. The greenback's DXY's index that measured it against a basket of currencies fell 0.1% on the day to 109.68. It reached a two-decade high of 110.79 earlier this month. For the week, it was up 0.6%, and it is up about 15% for the year so far. The markets are in anticipation that the Fed will hike by 75-basis-points with there being some chance of a 100-bps increase.

Other than the Fed, the Bank of Japan is expected to maintain its accommodative stance at its meeting on Sept. 21-22 it has commonly communicated that it has no intention of raising rates or tweaking its dovish policy guidance to prop up the yen. Meanwhile, analysts at Rabobank have argued that USD/JPY 140 could be problematic for Japan, which imports a substantial proportion of its energy.

''However, it is often the pace and volatility around currency movements that prove more worrisome for policy makers rather than a certain level. Either way the dip back towards 142.00 this week will be welcomed by Japanese officials. That said, it is our view that USD strength will sustain for some months yet. It is also possible that the BoJ will maintain loose policy settings into next year. This suggests scope for USD/JPY to head higher in the coming months. A move to 150 can not be ruled out.''

-

22:58

EUR/USD sees upside above 1.0050 despite soaring Fed bets

- EUR/USD is expected to deliver an upside move above 1.0050.

- The doors of the Fed’s full percent rate hike are open amid soaring core CPI numbers.

- A decline in Eurozone Consumer Confidence could impact the shared currency bulls.

The EUR/USD pair attempted an upside break above the three-day consolidation formed in a narrow range of 0.9950-1.0020 in the last week. The asset is expected to generate gains as a break above 1.0040 will confirm the conclusion of the inventory accumulation process. The major is displaying signs of strength despite the rising odds of a bumper rate hike announcement by the Federal Reserve (Fed).

Considering the market consensus, Fed chair Jerome Powell will push the interest rates higher to 3.25-3.50% with a third consecutive rate hike by 75 basis points (bps). As price pressures have rebounded and are not responding well to the ongoing pace of interest rates, the extent of the rate hike is open to a full percent rate hike.

In the prior, US Consumer Price Index (CPI) release, the core inflation improved dramatically to 6.3%, higher than the expectations of 6.1% and the prior release of 5.9%. Also, the US Retail Sales landed at 0.3%, higher than the expectations of 0% and the prior release of -0.4%. This indicates that a revival in the demand prospects is not caring for the price rise index, which is supporting the Fed to go conservative unhesitatingly.

On the Eurozone front, investors are awaiting the release of Thursday’s Consumer Confidence data. The economic data is seen lower at -26 against the prior release of -24.9. Consumers are upset over the inflation chaos and signs of failure by the European Central Bank (ECB) in dealing with the same. A decline in consumer confidence indicates a loss of confidence in the economy. This is the outcome of bleak growth prospects, soaring inflation, and deepening energy prices.

-

21:35

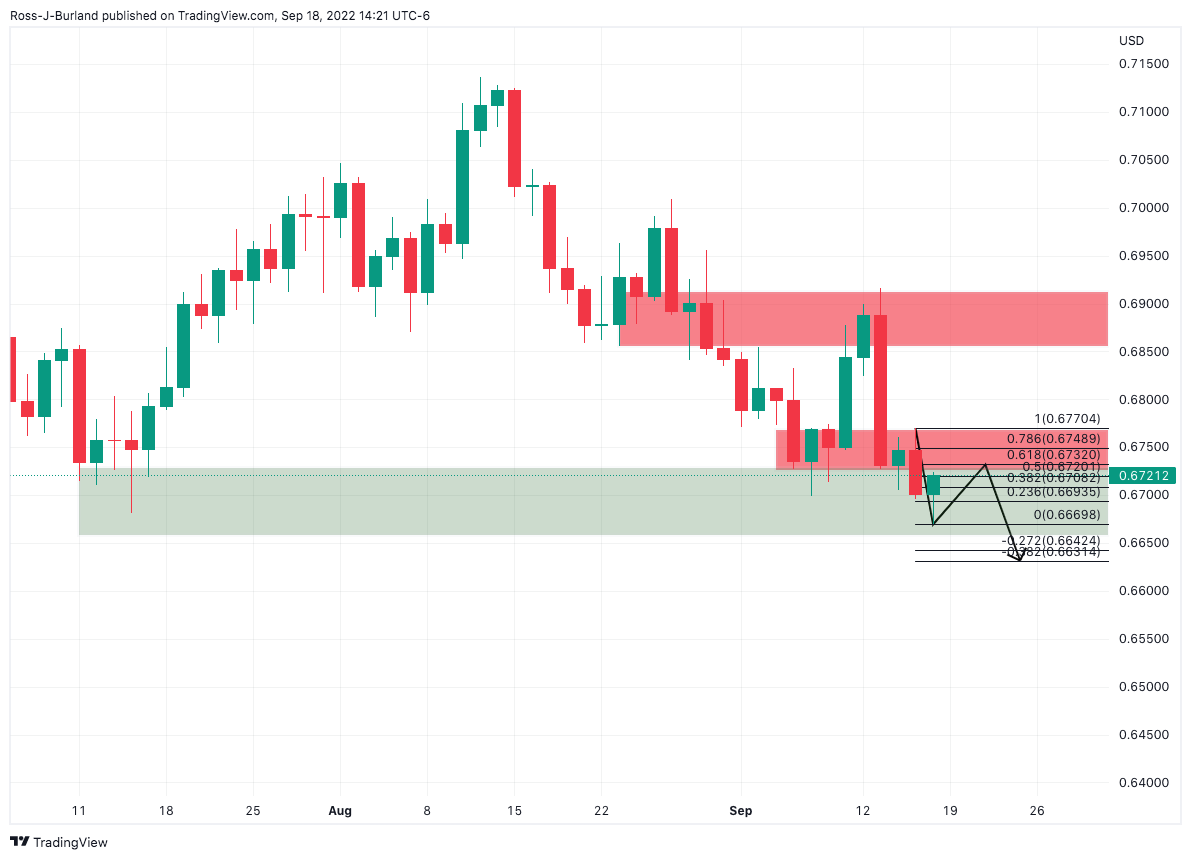

AUD/USD Price Analysis: Bulls look to 0.6750 but bears are lurking

- AUD/USD bulls eye 0.6750 for the opening sessions.

- The daily structure was broken last week, leaving bias to the downside longer-term.

As per the prior analysis, AUD/USD Price Analysis: Bearish bias persists as bears take control at key daily support, where it was stated that AUD/USD showed no sign of correcting on a longer-term time frame basis, threatening a break of key support in the following analysis:

the bears did indeed stay the course.

AUD/USD H1 chart, prior analysis

It was argued that the bears would be looking for an engulfing formation below the pin bar that had tapped the lower quarter of the 0.67 area that has pierced the 50% retracement of the latest bearish impulse on the hourly time frame. This was an area of confluence as per the wicks there and the bias is to the downside below 0.6750 tops:

AUD/USD updates, H1, daily chart

The price sank and has so far respected the resistance on the retests. However, a bullish structure is formed, to a bullish continuation can not be ruled out for the opening sessions:

On the other hand, the daily resistance could be as far as the bulls make it, near 0.6750:

-