Notícias do Mercado

-

20:00

Dow +42.21 16,003.91 +0.26% Nasdaq -13.48 3,972.49 -0.34% S&P -1.46 1,796.72 -0.08%

-

19:20

American focus : dollar regained some ground against the euro

Rate of the euro retreated from session highs against the dollar, but in spite of this, still continues to trade at a slight increase . Note that support for the U.S. currency was president of the Fed's comments , New York, who has expressed more optimistic about the economic prospects for the U.S., though declined to comment on how they may impact on monetary policy.

" We see not only the improvement of data , but also a significant weakening of the fiscal brakes that held back the growth of the economy, which is likely to continue over the next few years , along with the improvement of basic economics . With the accelerating pace of growth, I expect to see a significant improvement in labor market conditions and a gradual rise in inflation to the target level of the Fed , "- said Dudley .

However, he expressed some caution due to the fact that in recent years, the dynamics of the economy was worse than expected.

Many economists expect that because of ambiguous data and continuing uncertainty that emerged as a result of the suspension of the government in October , the Fed will continue bond-buying program and will begin to fold it in 2014.

However , stronger -than-expected labor market data led some economists believe that the Fed may begin to curtail the incentive program before. According to them , it can happen at the December meeting of the Federal Reserve.

With regard to the data presented, it is to provide a report on the United States. The National Association of Home Builders that its indicator of the state of the housing market was 54 in November , being in line with the revised index down in October.

The results were below expectations. Economists expected the index to rise to 56 compared with 55 , which was originally reported in October.

NAHB reported that people are showing interest in buying a new home , but the current housing affordability conditions hamper their intentions . Builders are also faced with problems related to the cost of construction and low scores .

The Canadian dollar continued to strengthen against the U.S. dollar after a small correction . Note that the dynamics of trade affected by comments of Deputy Governor of the Bank of Canada Tiff Maklema , who said that the financial reforms of Great Twenty countries after the economic crisis , have helped reduce the risk of future collapse in the world and has led to the fact that the risk is less affected by monetary policy Canada.

"Considerable progress has been made in the financial reform members of the G- 20, which has made the world a safer financial system . This reduces the risk that the financial collapse anywhere in the world affects the world and the Canadian economy, " - said the ILCA to the report. He did not touch the economic forecast of the Bank or the prospects of monetary policy, but said that risk management is an important element of monetary policy

He identified as a set of general principles aimed at reforming the global financial system has helped alleviate major shocks in many countries , they have faced during the last economic crisis of 2008-2009 These principles, which include higher standards on capital requirements for financial institutions together well developed in terms of the requirements of leverage and liquidity levels , helped to manage risk and ensure the stability of the financial system.

ILCA added that the risk of a financial crisis is now less influence on decision of the Bank of Canada 's Monetary Policy , which he considers one of the hallmarks of a successful implementation of the principles .

-

18:20

European stock close

European shares rose to their highest level in more than five years before a publication of Federal Open Market Committee minutes later this week.

The Stoxx Europe 600 Index increased 0.5 percent to 324.70 at 4:37 p.m. in London. The benchmark gauge rose for six straight weeks as signs emerged the Federal Reserve won’t rush to reduce the pace of its stimulus, outweighing data that showed the euro-area economic recovery is faltering.

The FOMC will release minutes from its Oct. 29-30 meeting on Nov. 20. The minutes will probably reveal more details on the debate behind the decision to press on with the record $85 billion in monthly bond purchases. Economists estimate that policy makers will wait until a March 18-19 meeting to begin tapering monthly buying to $70 billion.

In Europe, a report on Nov. 21 may show that a composite index of euro-area services and manufacturing rose to 52 this month from 51.9 in October.

National benchmark indexes advanced in 15 of the 18 western-European markets today.

FTSE 100 6,722.71 +29.27 +0.44% CAC 40 4,322.75 +30.52 +0.71% DAX 9,234.98 +66.29 +0.72%

Aberdeen gained 15 percent to 489.7 pence. Lloyds, Britain’s biggest mortgage lender, agreed to sell its Scottish Widows Investment division to Aberdeen for 560 million pounds ($903 million). The lender will receive a 9.9 percent stake in Scotland’s largest money manager, the companies said in a statement today. Aberdeen may pay a further 100 million pounds in cash over five years depending on the performance of partnership under which the fund manager will manage assets on behalf of the bank. Lloyds climbed 0.9 percent to 76 pence.

Sonova (SOON) advanced 5.4 percent to 124.70 Swiss francs after predicting that annual earnings before interest, taxes and amortization would grow as much as 14 percent, compared with a previous forecast of 9 percent to 13 percent. Sales will increase 8 percent to 10 percent, up from an earlier projection of 6 percent to 8 percent.

Medica SA (MDCA) jumped 4.8 percent to 21 euros. Korian agreed to buy Medica for 1.1 billion euros ($1.5 billion) in a deal that will create the largest French operator of nursing homes. Medica holders will receive Korian (KORI) stock valued at about 23.01 euros a share, the companies said in a statement today. That’s 15 percent above Medica’s closing price on Nov. 15. Korian declined 2.8 percent to 24.61 euros.

RWE AG (RWE) jumped 5.9 percent to 27.78 euros after Exane BNP Paribas raised Germany’s second-biggest utility to outperform from neutral, meaning investors should buy the stock, saying power prices in Germany have troughed and the group should benefit from a favorable outcome to German nuclear litigation.

Petrofac sank 17 percent to 1,200 pence, the biggest drop in the Stoxx 600, after the company predicted its profit growth will be “flat to modest” in 2014.

-

17:00

European stock close: FTSE 100 6,698.01 -25.45 -0.38% CAC 40 4,272.29 -48.39 -1.12% DAX 9,193.29 -32.14 -0.35%

-

16:41

Oil: an overview of the market situation

Gold prices fluctuate today , as the reform plan presented by China showed that the country can achieve more sustainable growth , while Saudi Arabia reported that exported the largest volume of oil in eight years.

Note that the state-run news agency Xinhua published a document detailing the decision taken at a meeting behind closed doors. The document lists 60 objectives, and states that the decisive results to be achieved by 2020. The tasks cover a wide range of issues. They include the contribution of 30 % of the profits of state enterprises in the state in order to enable it to finance social welfare programs to the public. In addition, the one-child policy will be significantly weakened. The transition to the family planning policy in force since 1980 , and will allow families in which one of the parents was an only child , to have a second child. The party also said it would give up the system of labor camps.

The changes will affect the judicial system : the courts and prosecutors will be under the control of the vertical control system , rather than subordination to local authorities. In relation to the management of budgets and the interaction of the central and local authorities , responsibilities, Beijing's spending should be expanded.

Meanwhile, today it was announced that in September of this year, Saudi Arabia took first place in the volume of oil exports , increasing it to the maximum since November 2005 . Middle Eastern country holds the primacy of the second month in a row. In September, Saudi Arabia was producing 10.12 million barrels a day - to 70,000 barrels less than in August 2013 , but exported 7.84 million barrels per day. In September , OPEC countries , including Iraq , Kuwait , Venezuela, Qatar , Nigeria and Angola, reduced oil exports . Algeria and Ecuador increased the supply of raw materials on the world market.

Add that to the cost of oil is also influenced by the fact that investors are waiting for speech of the Chairman of the Federal Reserve Ben Bernanke and the publication of the minutes of October meeting of the U.S. central bank to try to figure out when the regulator plans to begin reducing the program to buy up assets.

The cost of the December futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 94.14 a barrel on the New York Mercantile Exchange.

January futures price for North Sea Brent crude oil mixture fell 15 cents to $ 108.36 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices declined moderately today , because the correction in the stock market and lackluster physical demand has prompted traders to fix their profits. Those , however, expectations about the fact that U.S. monetary policy will be "soft" gold is kept on an even greater fall. Recall that last week, Janet Yellen , who will replace Ben Bernanke as head of the Fed , said that he would support a "soft" monetary policy .

Note that experts Barclays, expect that in the near future the prices seem to be in the range . The bank is believed that on the eve of the New Year likely increase in purchases of metal in China, and this may provide some support to prices . In this case, the likely timing of stimulus measures to curtail the Fed believed the market receded even further.

But , nevertheless, these factors are not sufficient to ensure that prices have soared. Based on technical indicators , analysts predict that gold prices remain susceptible to sharp sales.

In addition , the published data show that the largest reserves of gold in gold ETFs - SPDR Gold, fell to 2.7 tons last week after locking his first weekly inflow since late August in the previous week - 2.1 tons.

Add that to the beginning of the year , gold prices have fallen by 23 per cent on expectations of a speedy completion of the ultra-soft monetary policy that pushed gold in recent years.

The cost of the December gold futures on COMEX today rose to $ 1279.80 per ounce.

-

15:00

U.S.: NAHB Housing Market Index, November 54 (forecast 56)

-

14:35

-

14:27

Before the bell: S&P futures +0.22%, Nasdaq futures +0.08%

U.S. stock-index futures advanced, as global equities rallied after China pledged to expand economic freedoms.

Global markets:

Nikkei 15,164.3 -1.62 -0.01%

Hang Seng 23,660.06 +627.91 +2.73%

Shanghai Composite 2,197.22 +61.39 +2.87%

FTSE 6,730.04 +36.60 +0.55%

CAC 4,331.69 +39.46 +0.92%

DAX 9,247.05 +78.36 +0.85%

Crude oil $93.80 (-0.04%).

Gold $1280.30 (-0.55%).

-

14:00

U.S.: Net Long-term TIC Flows , September 25.5 (forecast 21.3)

-

14:00

U.S.: Total Net TIC Flows, September -106.8

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y98.70, Y99.50, Y99.75, Y100.00, Y100.30, Y100.45, Y100.50

EUR/USD $1.3400, $1.3420, $1.3450, $1.3495, $1.3500, $1.3525

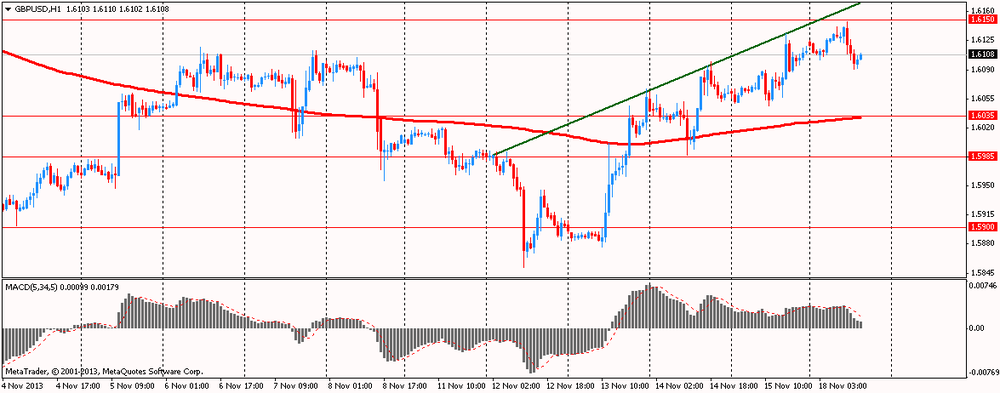

GBP/USD $1.5920, $1.5925, $1.6000, $1.6050, $1.6100

EUR/GBP stg0.8435

AUD/USD Y93.25, Y93.50, $0.9370, $0.9400, $0.9470, $0.9600

USD/CAD C$1.0430, C$1.0465, C$1.0500

-

13:30

Canada: Foreign Securities Purchases, September 8.36 (forecast 6.71)

-

13:15

European session: the euro rose

09:00 Eurozone Current account, adjusted, bln September 17.9 Revised From 17.4 18.3 13.7

10:00 Eurozone Trade Balance s.a. September 12.3 14.3 14.3

The euro rose against the dollar on payments data and the trade balance of the euro area. In the euro area 's current account surplus fell to a seasonally adjusted 13.7 billion in September from 17.9 billion euros in August , said Monday the European Central Bank . The data showed that the trade surplus fell to 13.7 billion euros from 14.7 billion euros in August. In addition, the services account surplus fell to 7.6 billion euros in September from 8.2 billion euros in August.

Trade area in goods with the rest of the world has led to a positive balance of € 13.1 billion in September , compared with EUR 6.9 billion surplus in August. A year earlier , the surplus amounted to 8.6 billion euros. In September, exports increased by 1 percent compared to the previous month, adjusted for seasonal variations. Imports fell by 0.3 percent. On an unadjusted basis exports rose 3 percent in September compared with a year earlier. While imports remained unchanged on an annual basis.

The U.S. dollar remains under slight pressure , continuing to remain under the influence of comments Janet Yellen , voiced last week. Yellen dovish statement and its responses to the Committee's questions regarding the role of the Federal Reserve have convinced markets that the Bank will continue to conduct ultra accommodative policy. The future head of the Federal Reserve noted that in her opinion , the Fed should continue to support economic recovery. A cautious approach to any issue related with folding Fed program of 85 billion dollars , supports risk by stimulating the stock markets and putting pressure on the dollar.

Today is expected to address the Fed Plosser ( Philadelphia Fed ) and Dudley ( Federal Reserve Bank of Chicago ) .

EUR / USD: during the European session, the pair rose to $ 1.3517

GBP / USD: during the European session, the pair has set high at $ 1.6150 and then retreated to lows on $ 1.6091

USD / JPY: during the European session, the pair fell to Y99.77 and stepped

-

13:00

Orders

EUR/USD

Offers $1.3615/20, $1.3600, $1.3565/70, $1.3550, $1.3530

Bids $1.3475/70, $1.3450

GBP/USD

Offers $1.6250/60, $1.6200/10,$1.6160/65, $1.6150

Bids $1.6105/095, $1.6085, $1.6070, $1.6050/45, $1.6030

AUD/USD

Offers $0.9550, $0.9500, $0.9480, $0.9450, $0.9420

Bids $0.9380, $0.9350, $0.9300

EUR/GBP

Offers stg0.8430, stg0.8415/20, stg0.8390/400

Bids stg0.8340, stg0.8325/20, stg0.8300

EUR/JPY

Offers Y137.00, Y136.50, Y136.00, Y135.50

Bids Y134.20/00, Y133.50

USD/JPY

Offers Y101.00, Y100.80, Y100.50

Bids Y99.50/40, Y99.20, Y99.00

-

12:45

UK house prices fall in November

Average asking prices of a property in the U.K. declined in November in line with the usual pre-Christmas trend, a monthly survey by Rightmove revealed Monday.

Prices fell 2.4 percent on a month-on-month basis, following a 2.8 percent surge in October. However, compared with an average November fall over the last three years, this year's drop was slightly more muted. "The excitement about Help-to-Buy's early launch failed to buck the seasonal trend of a fall in new sellers' average asking prices," Rightmove director Miles Shipside said.

Rightmove said that with increase in property demand and reduction in the number of property available in the market, there are indications that momentum is building for 2014. The online real estate firm expects 4 percent annual growth in prices next year, the highest seen since November 2007.

Rightmove traffic since September's Help to Buy announcement is up 30 percent compared to the same period in 2012.

Year-on-year, prices increased 4 percent in November following a 3.8 percent rise in October.

-

11:32

European shares rose

European shares rose, following the longest streak of weekly gains in 15 months, as investors awaited a Nov. 20 publication of Federal Open Market Committee minutes. U.S. stock-index futures were little changed, and Asian shares advanced.

The FOMC releases minutes from its Oct. 29-30 meeting on Nov. 20. The minutes will probably reveal more details on the debate behind the decision to press on with $85 billion in monthly bond purchases. Economists in a Bloomberg survey estimate that policy makers will wait until a March 18-19 meeting to begin tapering monthly buying to $70 billion.

In Europe, a report on Nov. 21 may show that a composite index of euro-area services and manufacturing rose to 52 this month, from 51.9 in October.

Aberdeen Asset Management Plc jumped 13 percent after Lloyds Banking Group Plc agreed to sell its Scottish Widows Investment Partnership division to the money manager.

Sonova Holding AG advanced 7 percent as the world’s largest hearing-aid maker raised its full-year forecast and said first-half revenue beat analyst estimates.

Petrofac Ltd. plunged 15 percent, the most in almost five years.

FTSE 100 6,718.36 +24.92 +0.37 %

CAC 40 4,310.1 +17.87 +0.42 %

DAX 9,221.21 +52.52 +0.57 %

-

11:15

Eurozone's trade surplus increases in September

Eurozone's foreign trade surplus increased markedly in September, the latest data from the statistical office Eurostat showed Monday.

The region's trade in goods with the rest of the world resulted in a surplus of EUR 13.1 billion in September, up from EUR 6.9 billion surplus in August. A year earlier, the surplus amounted to 8.6 billion.

In September, exports rose 1 percent month-on-month after adjusting to seasonal variations. Imports were down 0.3 percent. Exports rose 3 percent in September from a year earlier on an unadjusted basis. Imports remained unchanged on an annual basis.

Meanwhile, foreign trade by EU28 resulted in a surplus of EUR 0.6 billion compared with a deficit of EUR 2.4 billion in August and deficit of EUR 14.5 billion in September last year.

-

11:00

Eurozone current account surplus declines in September

The euro area current account surplus declined to a seasonally adjusted EUR 13.7 billion in September from EUR 17.9 billion in August, the European Central Bank reported Monday.

Data showed that the surplus on goods trade decreased to EUR 13.7 billion from EUR 14.7 billion in August. Likewise, the surplus on services fell to EUR 7.6 billion in September from EUR 8.2 billion.

Further, income declined to EUR 2.5 billion from EUR 4.8 billion in August. Partially offsetting the surplus, the shortfall on current transfers widened to EUR 10.1 billion from EUR 9.7 billion in the prior month.

However, on an unadjusted basis, the current account surplus increased to EUR 14 billion from EUR 12.4 billion in August.

In the financial account, combined direct and portfolio investment recorded net outflows of EUR 12 billion in September, as a result of net outflows for both direct investment and portfolio investment, the ECB said.

-

10:46

China house prices rise in October

House prices in all Chinese cities except Wenzhou increased in October as the government abstained from initiating new property curbs.

House prices rose in 69 out of 70 cities tracked by the government, data published by the National Bureau of Statistics showed Monday.

On a yearly basis, prices surged 20.2 percent in Shenzhen and 17.8 percent in Shanghai. And it gained 16.4 percent in Beijing.

Month-on-month, house prices increased in 65 cities in October. Prices remained unchanged in three cities and declined in two.

-

10:29

Option expiries for today's 1400GMT cut

USD/JPY Y98.70, Y99.50, Y99.75, Y100.00, Y100.30, Y100.45, Y100.50

EUR/USD $1.3400, $1.3420, $1.3450, $1.3495, $1.3500, $1.3525

GBP/USD $1.5920, $1.5925, $1.6000, $1.6050, $1.6500

EUR/GBP stg0.8435

AUD/USD Y93.25, Y93.50, $0.9370, $0.9400, $0.9470, $0.9600

USD/CAD C$1.0465, C$1.0500

-

10:12

Asia Pacific stocks close

Asian stocks rose for a third day, with the benchmark index extending a two-week high, after China vowed to carry out the broadest expansion of economic freedoms since at least the 1990s.

Nikkei 225 15,164.3 -1.62 -0.01%

S&P/ASX 200 5,384.66 -17.01 -0.31%

Shanghai Composite 2,197.22 +61.39 +2.87%

China Mengniu Dairy Co., a maker of milk products, jumped 5.1 percent after policy makers pledged to relax the nation’s one-child policy.

Citic Securities Co. surged 13 percent in Hong Kong, leading gains among Chinese brokerages as the government flagged policy changes that portend the end of a ban on mainland initial public offerings.

Dwango Co. soared 17 percent in Tokyo after jumping by the daily limit on Nov. 15, when the provider of content through mobile phones said Nintendo Co. bought a stake in the company.

-

10:00

Eurozone: Trade Balance s.a., September 14.3 (forecast 14.3)

-

09:19

FTSE 100 6,686.33 -7.11 -0.11%, CAC 40 4,285.82 -6.41 -0.15%, Xetra DAX 9,155.48 -13.21 -0.14%

-

09:01

Eurozone: Current account, adjusted, bln , September 13.7 (forecast 18.3)

-

07:23

Asian session: The U.S. Dollar Index headed for its lowest close

00:01 United Kingdom Rightmove House Price Index (MoM) November +2.8% -2.4%

00:01 United Kingdom Rightmove House Price Index (YoY) November +3.8% +4.0%

01:30 China Property Prices, y/y October +9.1% +9.6%

The U.S. Dollar Index headed for its lowest close in more than a week amid bets some Federal Reserve speakers will echo Chairman-nominee Janet Yellen in reiterating the need for monetary stimulus. Yellen at her Nov. 14 congressional hearing indicated she’ll press on with the central bank’s unprecedented monetary stimulus until she sees a robust recovery, downplaying risks the policy is inflating asset bubbles. The dollar held declines from last week versus most major peers. New York Fed President William C. Dudley, a permanent voter on monetary policy, is scheduled to speak today, as are Eric Rosengren, Charles Plosser and Narayana Kocherlakota. Dudley said Oct. 15 that the Fed is missing “by much more” on the employment side of its mandate than on the inflation side.

The yen traded near a two-month low against the greenback and slid versus most of its major counterparts before Bank of Japan policy makers meet this week. BOJ Governor Haruhiko Kuroda and his board will gather for a two-day meeting starting Nov. 20. Almost three-quarters of economists in a Bloomberg News survey expect the central bank will bolster stimulus in the first six months of 2014.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3475-95

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6100-25

USD / JPY: during the Asian session the pair fell to the level of Y100.00

-

07:03

European bourses are initially seen flat to very modestly lower Monday: the FTSE down 5, the DAX down 3 and the CAC unchanged.

-

06:01

Schedule for today, Monday, Nov 18’2013:

00:01 United Kingdom Rightmove House Price Index (MoM) November +2.8% -2.4%

00:01 United Kingdom Rightmove House Price Index (YoY) November +3.8% +4.0%

01:30 China Property Prices, y/y October +9.1% +9.6%

06:00 U.S. FOMC Member Rosengren Speaks

09:00 Eurozone Current account, adjusted, bln September 17.4 18.3

09:00 Eurozone Bank of Spain bad loans data September 12.1%

10:00 Eurozone Trade Balance s.a. September 12.3 14.3

13:30 Canada Foreign Securities Purchases September 2.08 6.71

14:00 U.S. Net Long-term TIC Flows September -8.9 21.3

14:00 U.S. Total Net TIC Flows September -2.9

15:00 U.S. NAHB Housing Market Index November 55 56

16:00 Canada Gov Council Member Macklem Speaks

17:15 U.S. FOMC Member Dudley Speak

23:00 Australia Conference Board Australia Leading Index September -0.2%

-