Notícias do Mercado

-

20:00

Dow -12.18 16,894.44 -0.07% Nasdaq -10.08 4,352.76 -0.23% S&P -0.53 1,956.45 -0.03%

-

17:00

European stock close: FTSE 100 6,808.11 +29.55 +0.44% CAC 40 4,563.04 +32.67 +0.72% DAX 10,004 +73.67 +0.74%

-

17:00

European stocks close: stocks traded higher supported by the Fed’s interest rate decision

Stock indices traded higher supported by the Fed's interest rate decision. The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent. Market participants had expected this decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance increased to 11% in June from 0% in May, exceeding expectations for a climb to 3%.

Rolls-Royce Holdings Plc surged 8.1% after announcing a 1 billion pounds share buyback.

Peugeot SA increased 5.2%.

Electricite de France SA dropped 7.6% after the French energy minister said the government will cancel a 5% rise to electricity prices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,808.11 +29.55 +0.44%

DAX 10,004.00 +73.67 +0.74%

CAC 40 4,563.04 +32.67 +0.72%

-

16:41

Oil: an overview of the market situation

The cost of Brent crude rose today, while reaching a nine-month high around $ 115 per barrel, due to the growing tensions in Iraq.

Experts point out that fears of potential supply disruptions in connection with the fighting in Iraq persist, as the conflict between Sunni Islamist militants and the Iraqi army continued on Thursday. According to local residents, Iraqi forces regained control of the oil refinery in Baiji, after he was captured by Sunni militants on Wednesday. Recall that in Iraq, producing about 3.5 million barrels of oil a day last month, making it the second largest oil producer in OPEC after Saudi Arabia.

"Iraq - one of the world's largest oil producers and exporters, the second largest OPEC, he overtook Iran. Even a small reduction in production will have a huge impact on oil prices, and some analysts are already talking about the future of 125 and even $ 150 a barrel, "- says the expert of the German Commerzbank Eugen Weinberg. Among economists there is a perception that every extra 10 dollars a barrel of oil cost rob global GDP growth of 0.2%. At the same time, and without the Iraqi crisis, the IMF and other international organizations worsen forecasts for this year.

Meanwhile, adding that oil prices were supported after the Federal Reserve gave a positive assessment of the U.S. economy and has remained committed to accommodative monetary policy.

Slight pressure continues to provide data from the U.S. Energy Information Administration, which showed that domestic crude oil inventories fell by 579,000 barrels in the week ended June 13, which was much less than the decrease of 5.7 million barrels, which have been reported in American Petroleum Institute (API). Analysts predicted that stocks decrease by 700,000 barrels. We also add that oil at Cushing, Oklahoma, rose by 247,000 barrels, recording the first increase in the past nine weeks.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 106.07 per barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture rose $ 0.71 to $ 115.00 a barrel on the London exchange ICE Futures Europe.

-

16:39

Foreign exchange market. American session: the U.S. dollar traded slightly higher against the most major currencies after the better-than-expected U.S. economic data

The U.S. dollar traded slightly higher against the most major currencies after the better-than-expected U.S. economic data. The number of initial jobless claims in the week ending June 14 decreased by 6,000 to 312,000 from 318,000 in the previous week. The previous week's figure was revised down from 317,000. Analysts had expected a decline by 4,000 to 314,000.

The Philadelphia Fed Manufacturing index rose to 17.8 in June from 15.4 in May. Analysts had expected a fall to 14.3.

The U.S. currency remained under pressure due to Fed's comments that interest rates in the U.S. will remain unchanged for a considerable time after the Fed's asset purchase program ends.

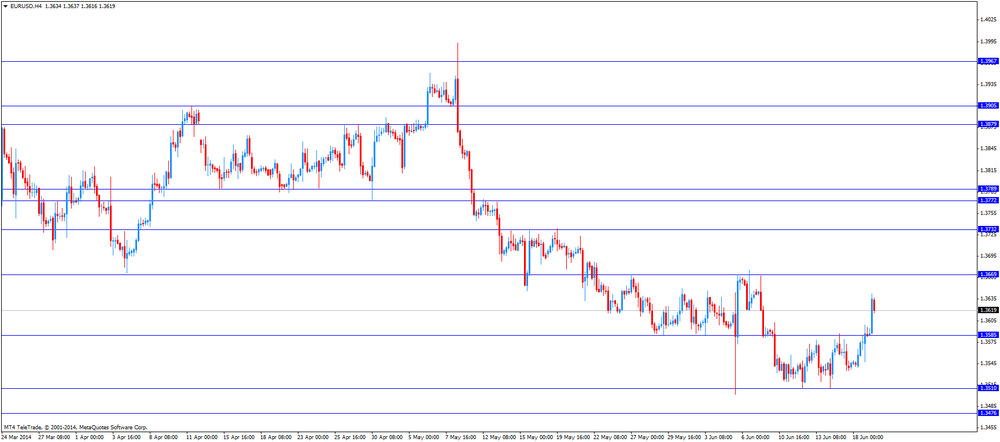

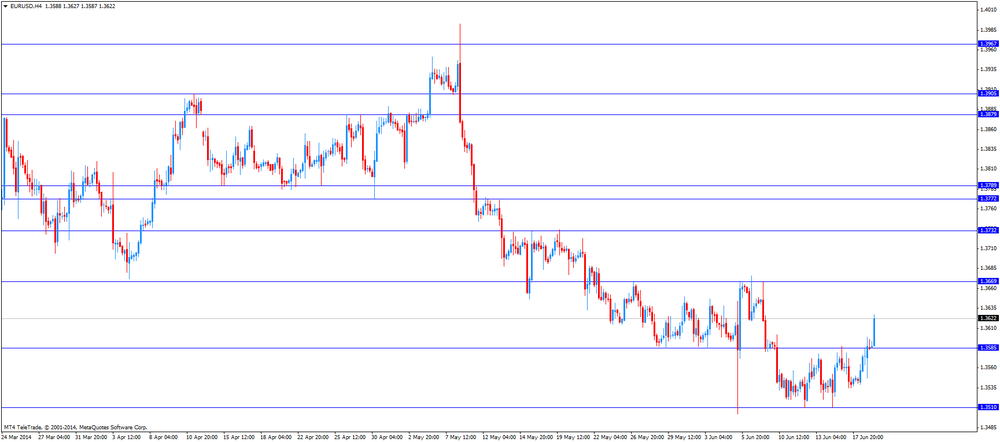

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

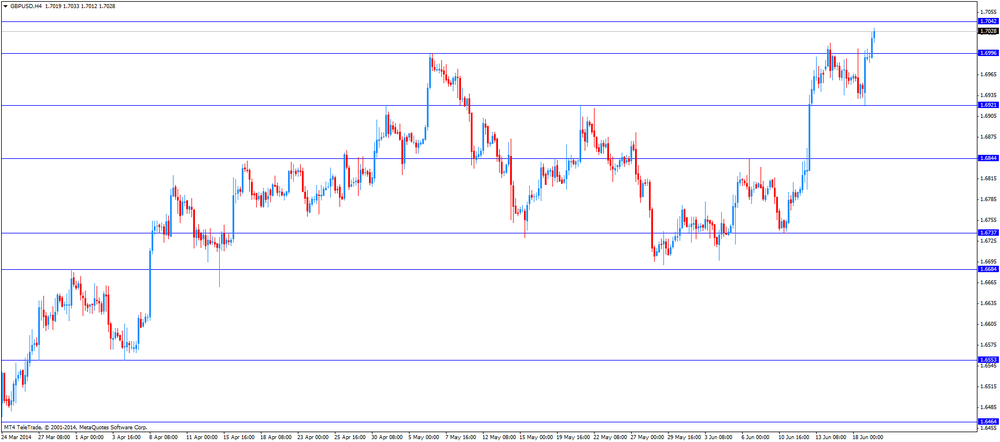

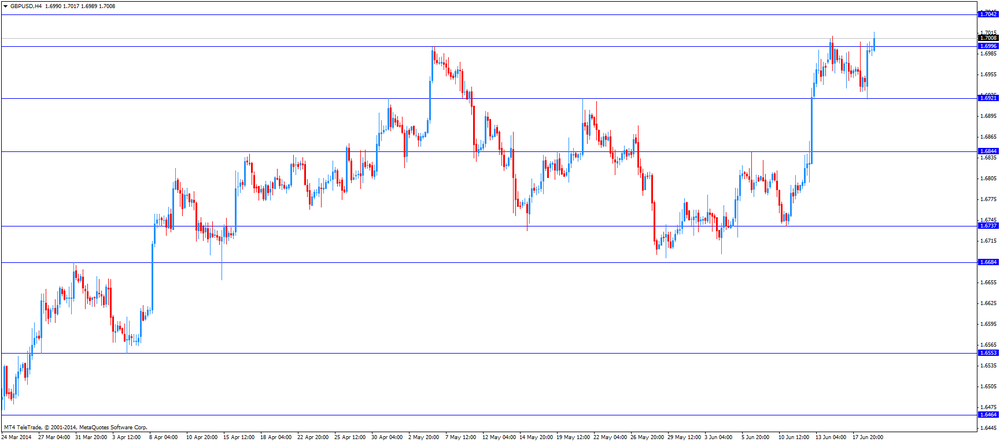

The British pound traded higher against the U.S. dollar after the U.K. economic data. The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance increased to 11% in June from 0% in May, exceeding expectations for a climb to 3%.

The Swiss franc traded mixed against the U.S. dollar. The SNB kept unchanged its interest rate close to zero and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro as expected by analysts. The SNB said the central bank will monitor the impact of the ECB's interest rate cut on Switzerland and the SNB will take the necessary measures if required.

The New Zealand dollar traded mixed against the U.S dollar. New Zealand's gross domestic product increased 1.0% in the first quarter, missing expectations for a 1.2% gain, after a 1.0% rise in the fourth quarter of 2013. The fourth quarter of 2013 figure was revised up from a 0.9% increase.

On a yearly basis, gross domestic product in New Zealand rose 3.8% in the first quarter, exceeding expectations for a 3.7% increase, after a 3.1% gain in the fourth quarter of 2013.

The Australian dollar traded lower against the U.S. dollar. Japanese life insurance firms and retail funds and Fed's interest rate decision supported the demand for the Australian dollar due to higher yields.

The Reserve Bank of Australia (RBA) released its June bulletin. The RBA said foreign property demand may have pushed up houses and the supply of dwellings in Australia. The RBA also said the growth in infrastructure investment in China could remain strong for some time, which will have a positive impact on Australian commodity exporters.

The RBA pointed out that the lower retail sales from May to mid June was driven by "the "significant downturn in consumer confidence".

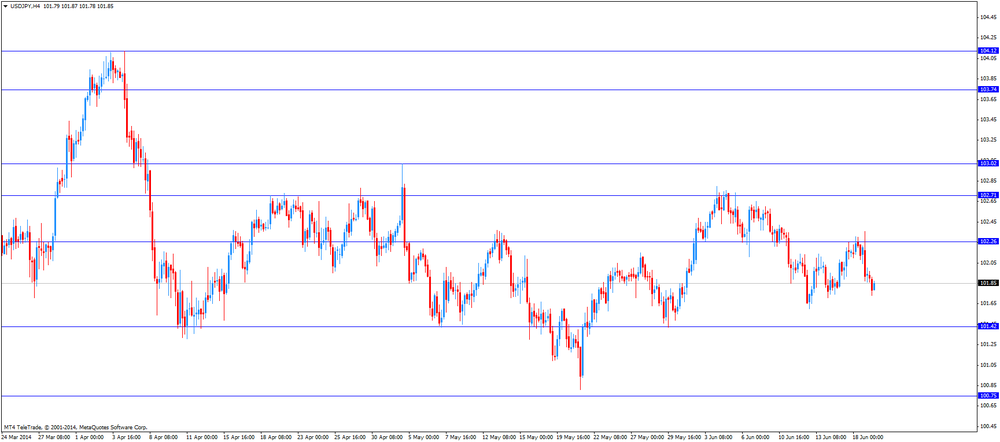

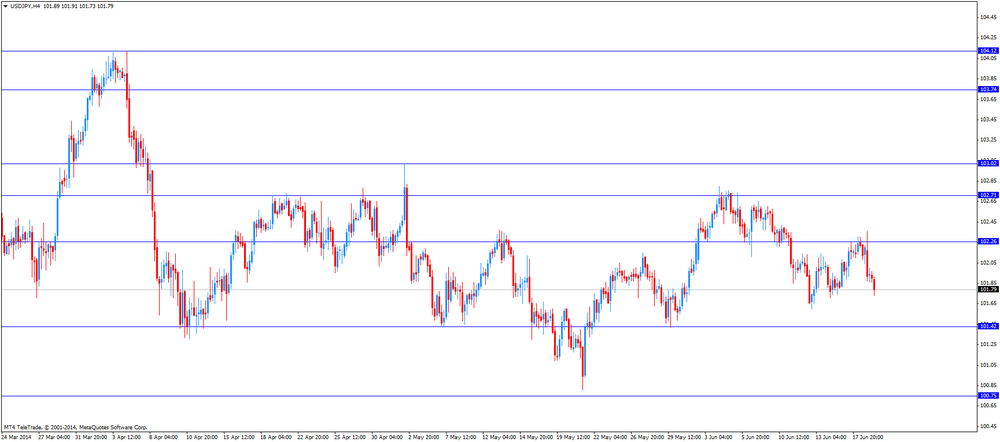

The Japanese yen traded slightly lower against the U.S. dollar. Japan's all industry activity index declined 4.3% in April, after a 1.5% increase in March. Analysts had expected the index to fall 3.7%.

-

16:20

Gold: an overview of the market situation

Gold prices rose sharply today, reaching in this four-week high, which was due to the weakening of the dollar and the Federal Reserve's statements that the policy remains committed to adaptive measures and low interest rates.

Recall that the U.S. central bank yesterday reduced the amount of QE to $ 10 billion - $ 35 billion, but kept the benchmark interest rate at a record low of 0-0.25% per annum. The Fed also changed the outlook on the dynamics of the interest rate on the 2015-2016 years. Regulator expects that by the end of 2015 it will be 1.25% (previous forecast by - 1%), and by the end of 2016 will grow to about 2.5% instead of 2.25% previously expected. The Fed also worsened outlook for economic growth in the country in 2014 to 2.1-2.3% from the expected 2.8-3% in March, according to a press release from the regulator. Inflation at 1.5-1.7% (from the March forecast - 1.5-1.6%), the unemployment rate will be within 6-6,1% instead of the previously expected 6.1-6.3%. Forecast for 2015 U.S. GDP growth remained at 3-3.2%, inflation - at the level of 1.5-2%, and the forecast for unemployment lowered to 5.4-5.7% from the previous 5.6 - 5.9%. In the long term, the Fed predicts growth of world's largest economy by 2.1-2.3%, the unemployment rate in the range 5.2-5.5%, inflation at around 2%.

As for today's events, the data had little impact on the U.S. labor market, which showed that the number of initial claims for unemployment benefits fell by 6,000 and amounted to a seasonally adjusted 312,000 in the week ended June 14. Economists had expected the number of applications will be reduced to only 316,000 to 318,000. Moving average for four weeks, which smooths weekly volatility, fell by 3,750 to 311,750. The report also showed that the number of workers continuing to receive unemployment benefits amounted to a seasonally adjusted fluctuations 2,560,000, a decrease of 54,000 in the week ended June 7.

Market participants also continue to monitor the developments in Iraq and Ukraine. "A weaker dollar and geopolitical tensions support gold prices, but the lack of strong physical demand and outflow of funds from exchange-traded funds can weaken Rally" - said precious metals trader in Hong Kong.

Due to low demand in the physical market, ">Stocks of the world's largest gold exchange-traded fund secured SPDR Gold Trust declined two consecutive session until Wednesday, approaching the five-month minimum.

The cost of the August gold futures on the COMEX today rose to $ 1298.0 per ounce.

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, June 17.8 (forecast 14.3)

-

15:00

U.S.: Leading Indicators , May +0.5% (forecast +0.6%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3400, $1.3450, $1.3500, $1.3550, $1.3564/65, $1.3600, $1.3650

USD/JPY Y101.20/25, Y101.40, Y101.50, Y102.00, Y102.15, Y102.25, Y102.50, Y103.00

AUD/USD $0.9250, $0.9285, $0.9340/50, $0.9360

EUR/GBP stg0.7960, stg0.8010

USD/CHF Chf0.9000

NZD/USD $0.8625

-

14:37

U.S. Stocks open: Dow 16,895.38 -11.24 -0.07%, Nasdaq 4,368.30 +5.46 +0.13%, S&P 1,957.26 +0.28 +0.01%

-

14:30

Before the bell: S&P futures +0.05%, Nasdaq futures +0.07%

U.S. stock futures were little changed as the Federal Reserve promised to keep interest rates low amid signs of an economic recovery.

Global markets:

Nikkei 15,361.16 +245.36 +1.62%

Hang Seng 23,167.73 -13.99 -0.06%

Shanghai Composite 2,023.73 -31.78 -1.55%

FTSE 6,827.86 +49.30 +0.73%

CAC 4,575.92 +45.55 +1.01%

DAX 10,015.48 +85.15 +0.86%

Crude oil $105.89 (-0.09%)

Gold $1286.50 (+1.08%)

-

14:18

DOW components before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

132.50

+0.02%

0.5K

Exxon Mobil Corp

XOM

102.75

+0.02%

0.6K

Microsoft Corp

MSFT

41.66

+0.02%

1.1K

Verizon Communications Inc

VZ

49.43

+0.02%

3.8K

AT&T Inc

T

35.22

+0.06%

5.6K

Visa

V

211.49

+0.11%

1.4K

Caterpillar Inc

CAT

107.62

+0.13%

0.1K

JPMorgan Chase and Co

JPM

57.86

+0.14%

0.1K

Walt Disney Co

DIS

83.75

+0.20%

1.4K

Intel Corp

INTC

30.00

+0.23%

1.6K

Nike

NKE

76.47

+0.34%

0.3K

Chevron Corp

CVX

130.28

0.00%

1.8K

Procter & Gamble Co

PG

79.79

0.00%

0.1K

General Electric Co

GE

26.65

-0.07%

18.6K

Johnson & Johnson

JNJ

102.74

-0.07%

1.1K

Cisco Systems Inc

CSCO

24.60

-0.12%

1K

The Coca-Cola Co

KO

41.51

-0.12%

2.4K

Pfizer Inc

PFE

29.67

-0.13%

1.8K

McDonald's Corp

MCD

101.16

-0.19%

0.1K

3M Co

MMM

144.00

-0.23%

0.1K

International Business Machines Co...

IBM

183.10

-0.27%

0.2K

-

14:09

Upgrades and downgrades before the market open

Upgrades:

Starbucks (SBUX) upgraded to Buy from Neutral at UBS

FedEx (FDX) upgraded to Sector Perform at RBC Capital Mkts, target raised to $155 from $125

Downgrades:

Other:

FedEx (FDX) target raised to $155 from $136 at Cowen

FedEx (FDX) target raised to $161 from $157 at Oppenheimer

-

13:30

U.S.: Initial Jobless Claims, June 312 (forecast 316)

-

13:04

Foreign exchange market. European session: the British pound climbed against the U.S. dollar after the U.K. economic data

Economic calendar (GMT0):

01:30 Australia RBA Bulletin Quarter II

04:30 Japan All Industry Activity Index, m/m April +1.5% -3.7% -4,3%

04:30 Switzerland SNB Financial Stability Report 2014

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:30 United Kingdom Retail Sales (MoM) May +1.3% -0.5% -0.5%

08:30 United Kingdom Retail Sales (YoY) May +6.9% +4.2% +3.9%

09:00 Eurozone Eurogroup Meetings

10:00 United Kingdom CBI industrial order books balance June 0 3 11

The U.S. dollar traded lower against the most major currencies. The Fed's interest decision on Wednesday still weighed on the U.S. currency. The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent. Market participants had expected this decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

Investors had awaited Fed Chair Janet Yellen gave some hints when the Fed will start to rise its interest rate, but it didn't happen. Investors were disappointed. The U.S. currency suffered due to this disappointment by investors.

The number of initial jobless claims and the Philadelphia Fed Manufacturing index will be released later in the day. The number of initial jobless claims should decline by 1,000 to 316,000. The Philadelphia Fed Manufacturing index should decline to 14.3 in June from 15.4 in May.

The euro traded higher against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound climbed against the U.S. dollar after the U.K. economic data. The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance increased to 11% in June from 0% in May, exceeding expectations for a climb to 3%.

The Swiss franc increased against the U.S. dollar. The SNB kept unchanged its interest rate close to zero and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro as expected by analysts. The SNB said the central bank will monitor the impact of the ECB's interest rate cut on Switzerland and the SNB will take the necessary measures if required.

EUR/USD: the currency pair increased to $1.3643

GBP/USD: the currency pair rose to $1.7033

USD/JPY: the currency pair fell to Y101.73

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims June 317 316

14:00 U.S. Leading Indicators May +0.4% +0.6%

14:00 U.S. Philadelphia Fed Manufacturing Survey June 15.4 14.3

-

13:00

Orders

EUR/USD

Offers $1.3695/00, $1.3670/80, $1.3650

Bids $1.3600, $1.3550, $1.3535, $1.3515/10, $1.3500

GBP/USD

Offers $1.7110/20, $1.7080/85, $1.7040/50

Bids $1.7000, $1.6950, $1.6910/00, $1.6885/80

AUD/USD

Offers $0.9550, $0.9500, $0.9450

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.20, Y138.00

USD/JPY

Offers Y102.50, Y102.00

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8120, stg0.8100, stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

-

12:01

European stock markets mid session: stocks increased as the Fed kept unchanged its interest rate

Stock indices increased as the Fed kept unchanged its interest rate. The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent. Market participants had expected this decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

Rolls-Royce Holdings Plc surged 5.7% after announcing a 1 billion pounds share buyback.

Current figures:

FTSE 100 6,833.23 +54.67 +0.81%

DAX 10,009.34 +79.01 +0.80%

CAC 40 4,569.89 +39.52 +0.87%

-

11:49

Swiss National Bank’s interest decision: the SNB kept unchanged its interest rate close to zero

The Swiss National Bank (SNB) released its interest decision on Thursday:

- The SNB kept unchanged its interest rate close to zero and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro as expected by analysts;

- The SNB said the he Swiss franc is still high;

- The SNB will continue to enforce the minimum exchange rate with the utmost determination;

- The SNB could purchase foreign currency in unlimited quantities and could add further measures if required.

The Swiss National Bank president Thomas Jordan said on Thursday:

- The Swiss economy is facing an "extremely challenging" climate with weak growth in the euro area and a hesitant global recovery;

- The SNB expect the moderate recovery in Switzerland;

- The SNB will monitor the impact of the ECB's interest rate cut on Switzerland and the SNB will take the necessary measures if required.

- The SNB kept unchanged its interest rate close to zero and reaffirmed its commitment to the minimum exchange rate of CHF1.20 per euro as expected by analysts;

-

11:28

U.K. retail sales declined 0.5% in May

The Office for National Statistics (ONS) released the retail sales. The U.K. retail sales dropped 0.5% in May, in line with forecasts, after a 1.3% gain in April. That was the first drop since January.

On a yearly basis, retail sales in the U.K. climbed 3.9% in May, missing expectations for a 4.2% increase, after a 6.9% gain in April.

The ONS pointed out the decline would have been even bigger had it not been for strong sales in sports stores driven by football shirt sales ahead of the World Cup.

A drop in prices in stores could not help to increase the retail sales volume.

-

11:00

United Kingdom: CBI industrial order books balance, June 11 (forecast 3)

-

10:44

Federal Reserve’s decision: interest rate remained unchanged

The Federal Reserve released its interest decision in Wednesday:

- The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent;

- The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends;

- The Fed lowered its forecast for economic growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously;

- The Fed expect its interest rate to reach 1.2% by the end of 2015 and 2.5% by the end of 2016.

Fed Chair Janet Yellen said at the press conference on Wednesday:

- The U.S. economy will continue to expand at a moderate pace;

- The U.S. economy is continuing to make progress towards the Fed's targets of full employment and 2% inflation.

- The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent;

-

10:33

Asian Stocks close: stocks traded mixed after the Fed’s interest decision

Asian stock traded mixed after the Fed’s interest decision. The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent. Market participants had expected this decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed’s asset purchase program ends.

Shares in China and Hong Kong traded lower due to concerns over the health of China’s economy. Chinese Premier Li Keqiang promised during a speech in London yesterday that the Chinese economy would continue to expand moderately and avoid a hard landing.

Indexes on the close:

Nikkei 225 15,361.16 +245.36 +1.62%

Hang Seng 23,167.73 -13.99 -0.06%

Shanghai Composite 2,023.73 -31.78 -1.55%

Nippon Sheet Glass Co. shares rose 17.0% after Nomura Holdings Inc. raised its rating on the company.

-

10:28

Option expiries for today's 1400GMT cut

EUR/USD $1.3400, $1.3450, $1.3500, $1.3550, $1.3600

AUD/USD $0.9250, $0.9285, $0.9340/50, $0.9360

-

10:09

Foreign exchange market. Asian session: the U.S. dollar dropped against the most major currencies after the Fed’s interest decision on Wednesday

Economic calendar (GMT0):

01:30 Australia RBA Bulletin Quarter II

04:30 Japan All Industry Activity Index, m/m April +1.5% -3.7% -4,3%

04:30 Switzerland SNB Financial Stability Report 2014

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:30 United Kingdom Retail Sales (MoM) May +1.3% -0.5% -0.5%

08:30 United Kingdom Retail Sales (YoY) May +6.9% +4.2% +3.9%

09:00 Eurozone Eurogroup Meetings

The U.S. dollar dropped against the most major currencies after the Fed’s interest decision on Wednesday. The Fed cut its monthly asset purchases by another $10 billion to $35 billion and kept the Federal Funds Target Rate between zero and 0.25 percent. Market participants had expected this decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed’s asset purchase program ends.

Investors had awaited Fed Chair Janet Yellen gave some hints when the Fed will start to rise its interest rate, but it didn’t happen. Investors were disappointed. The U.S. currency suffered due to this disappointment by investors.

The Fed lowered its forecast for economic growth this year to a range of 2.1% to 2.3% from 2.8 to 3.0% previously.

The Fed expect its interest rate to reach 1.2% by the end of 2015 and 2.5% by the end of 2016.

The New Zealand dollar traded lower against the U.S dollar due to the slower than expected economic growth in New Zealand. New Zealand’s gross domestic product increased 1.0% in the first quarter, missing expectations for a 1.2% gain, after a 1.0% rise in the fourth quarter of 2013. The fourth quarter of 2013 figure was revised up from a 0.9% increase.

On a yearly basis, gross domestic product in New Zealand rose 3.8% in the first quarter, exceeding expectations for a 3.7% increase, after a 3.1% gain in the fourth quarter of 2013.

The Australian dollar climbed against the U.S. dollar after the Fed’s interest decision. Japanese life insurance firms and retail funds also supported the demand for the Australian dollar due to higher yields.

The Reserve Bank of Australia (RBA) released its June bulletin. The RBA said foreign property demand may have pushed up houses and the supply of dwellings in Australia. The RBA also said the growth in infrastructure investment in China could remain strong for some time, which will have a positive impact on Australian commodity exporters.

The RBA pointed out that the lower retail sales from May to mid June was driven by “the “significant downturn in consumer confidence”.

The Japanese yen climbed against the U.S. dollar after the Fed’s interest decision. Japan’s all industry activity index declined 4.3% in April, after a 1.5% increase in March. Analysts had expected the index to fall 3.7%.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

10:00 United Kingdom CBI industrial order books balance June 0 3

12:30 U.S. Initial Jobless Claims June 317 316

14:00 U.S. Leading Indicators May +0.4% +0.6%

14:00 U.S. Philadelphia Fed Manufacturing Survey June 15.4 14.3

-

09:31

United Kingdom: Retail Sales (MoM), May -0.5% (forecast -0.5%)

-

09:31

United Kingdom: Retail Sales (YoY) , May +3.9% (forecast +4.2%)

-

08:41

FTSE 100 6,824.21 +45.65 +0.67%, CAC 40 4,566.14 +35.77 +0.79%, Xetra DAX 10,011.89 +81.56 +0.82%

-

06:40

European bourses are seen higher Thursday, helped by higher US stocks, boosted in the wake of the Fed: the FTSE is seen up 0.4%, the DAX up 0.5% and the CAC up 0.4%.

-

06:23

Options levels on thursday, June 19, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3677 (2191)

$1.3645 (3496)

$1.3620 (1819)

Price at time of writing this review: $ 1.3591

Support levels (open interest**, contracts):

$1.3559 (1774)

$1.3536 (1008)

$1.3493 (5033)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 29935 contracts, with the maximum number of contracts with strike price $1,3700 (3728);

- Overall open interest on the PUT options with the expiration date July, 3 is 42215 contracts, with the maximum number of contracts with strike price $1,3550 (5033);

- The ratio of PUT/CALL was 1.41 versus 1.43 from the previous trading day according to data from June, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.7201 (1762)

$1.7102 (1852)

$1.7005 (2184)

Price at time of writing this review: $1.6991

Support levels (open interest**, contracts):

$1.6895 (1232)

$1.6798 (1707)

$1.6699 (2081)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 18623 contracts, with the maximum number of contracts with strike price $1,7000 (2184);

- Overall open interest on the PUT options with the expiration date July, 3 is 22336 contracts, with the maximum number of contracts with strike price $1,6750 (2293);

- The ratio of PUT/CALL was 1.20 versus 1.22 from the previous trading day according to data from June, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:32

Japan: All Industry Activity Index, m/m, April -4,3% (forecast -3.7%)

-

00:30

Commodities. Daily history for June 18’2014:

(raw materials / closing price /% change)Gold $1,272.40 +3.40 +0.27%

ICE Brent Crude Oil $114.26 +0.81 +0.71%

NYMEX Crude Oil $106.26 -0.19 -0.18%

-

00:25

Stocks. Daily history for June 18’2014:

(index / closing price / change items /% change)Nikkei 15,115.8 +139.83 +0.93%

Hang Seng 23,181.72 -21.87 -0.09%

Shanghai Composite 2,055.52 -11.18 -0.54%

S&P 1,956.98 +14.99 +0.77%

NASDAQ 4,362.84 +25.60 +0.59%

Dow 16,906.62 +98.13 +0.58%

FTSE 1,387.44 -0.31 -0.02%

CAC 4,530.37 -5.70 -0.13%

DAX 9,930.33 +10.01 +0.10%

-

00:20

Currencies. Daily history for June 18'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3587 +0,30%

GBP/USD $1,6990 +0,17%

USD/CHF Chf0,8961 -0,35%

USD/JPY Y101,92 -0,24%

EUR/JPY Y138,49 +0,08%

GBP/JPY Y173,16 -0,05%

AUD/USD $0,9396 +0,66%

NZD/USD $0,8727 +0,85%

USD/CAD C$1,0837 -0,18%

-

00:00

Schedule for today, Thursday, June 19’2014:

(time / country / index / period / previous value / forecast)01:30 Australia RBA Bulletin Quarter II

04:30 Japan All Industry Activity Index, m/m April +1.5% -3.7%

04:30 Switzerland SNB Financial Stability Report 2014

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:30 United Kingdom Retail Sales (MoM) May +1.3% -0.5%

08:30 United Kingdom Retail Sales (YoY) May +6.9% +4.2%

09:00 Eurozone Eurogroup Meetings

10:00 United Kingdom CBI industrial order books balance June 0 3

12:30 U.S. Initial Jobless Claims June 317 316

14:00 U.S. Leading Indicators May +0.4% +0.6%

14:00 U.S. Philadelphia Fed Manufacturing Survey June 15.4 14.3

-