Notícias do Mercado

-

20:00

Dow -21.5 15,527.04 -0.14% Nasdaq -28.05 3,583.23 -0.78% S&P +0.45 1,689.82 +0.03%

-

19:20

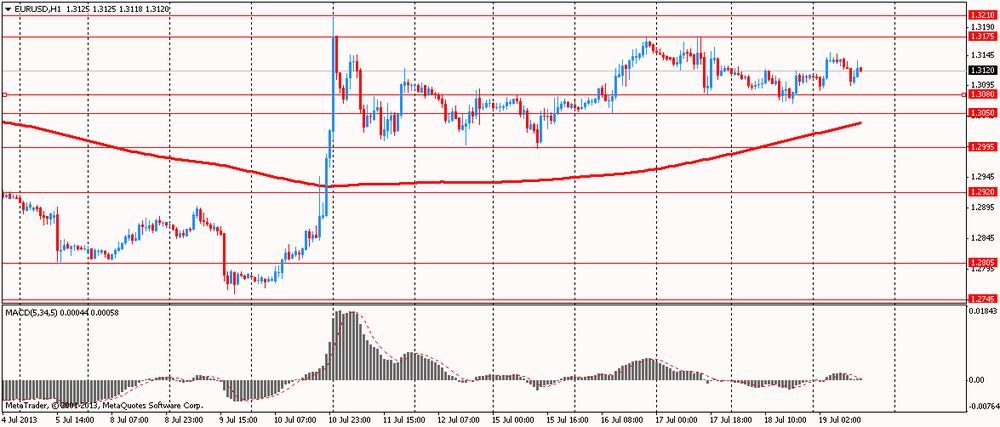

American focus: the euro rebounded from lows against the dollar

The euro rose against the dollar, recovering with a minimum values of the session in the absence of news in the United States. Note that a moderate impact on the bidding had data on producer prices in Germany. The Producer Price Index rose by 0.6 percent year on year in June after a 0.2 percent rise in May, the Federal Statistical Office. The growth rate in June was in line with economists' forecasts. Led the overall increase in the prices of consumer non-durable goods, which grew by 2.6 percent per year, while the price of capital goods rose by 0.8 percent. Expenditure on durable goods and energy prices were up 0.9 percent and 0.7 percent, respectively, compared to June 2012. On a monthly basis, producer prices were unchanged in June after a 0.3 percent decline the previous month. The index is forecast was reduced by 0.2 percent on a monthly basis.

We also note that the focus of the market is a 2-day summit of central bankers and finance ministers of the G-20. As the G20 draft communique published by the agency Reuters, the leaders gathered to declare their readiness to stimulate job growth through a series of structural reforms in the medium term. They stressed the need to stabilize the financial sector through the use of financial strategies, taking into account the particularities of each country.

Finance ministers and B20 have also said that they are determined to continue to progress, the changing balance of global demand, which requires a change in the balance within countries through structural reforms and exchange rate flexibility. In addition, they expressed their willingness to go to the exchange rate system more market-oriented and to refrain from devaluation, which aims to improve competitiveness. "

B20 also recalled that the Central Bank should carry out their mandates maintaining price stability and stimulate the economy. They stressed that the aggressive easing of monetary policy for an extended period may have negative effects.

The British Pound was higher against the U.S. dollar, which has been associated with the publication of a report by Britain. As it became known, in the UK public sector net borrowing excluding interventions fell to 8.5 billion pounds in June from 11.9 billion pounds a year earlier. This was reported by the Office for National Statistics. The budget deficit fell by 3.9 billion pounds of cash payments to the Fund's assets to the Government. If these transfers do not include government borrowings in June 2013 12.4 billion pounds.

In late June, the debt of the public sector, excluding the temporary effects of financial interventions was £ 1,202.8 billion, or 74.9% of GDP .. Published a report on the state of public finances in June, according to which, in June, net borrowing of the public sector, the preferred measure of the budget deficit amounted to 8.5 billion pounds against 11.9 billion pounds of debt in June of last year. However, the positive effect on the data for June has had a profit of the Bank of England in the amount of 3.9 billion pounds from operations to buy bonds.

The Canadian dollar strengthened against its U.S. counterpart, after the publication of the Canadian inflation data. The annual Canadian consumer price inflation accelerated in June to a four-month high due to higher cost of gasoline and cars. The value remains well below the 2% inflation target, without exerting any pressure on the central bank regarding the rate increase.

On a monthly measurement of consumer price index remained unchanged after the 0.2% rise in May, but compared to the previous year, the inflation rate accelerated to 1.2% from 0.7% reported Friday by Statistics Canada.

Consumer Price Index of the Bank of Canada, which excludes prices of energy and food, fell 0.2% on a monthly basis after the same growth the previous month. In annual terms, the core index rose 1.3% from 1.1%.

-

18:20

European stock close

European stocks were little changed and the Stoxx Europe 600 Index completed its fourth weekly gain as investors weighed worse-than-estimated earnings from Google Inc. (GOOG) and Microsoft Corp.

The Stoxx 600 added less than 0.1 percent to 299.87. The gauge gained 1.2 percent this week as Federal Reserve Chairman Ben S. Bernanke said the central bank remains flexible on the pace of asset purchases.

A gauge of European technology companies fell 0.7 percent as Google Inc., owner of the world’s most popular Internet search engine, yesterday reported second-quarter sales and profit that missed analysts’ estimates. Microsoft Corp., the largest software maker, posted fourth-quarter profit that trailed analysts’ forecasts by the biggest margin in at least a decade.

SAP, the biggest maker of business-management software, slid 2.4 percent to 55.69 euros. ARM Holdings, whose chip designs are used in phones that run on Google’s Android operating system, dropped 2.6 percent to 897 pence.

Tieto Oyj (TIE1V) dropped 3.1 percent to 15.01 euros as Finland’s biggest software producer reported second-quarter net income of 7.4 million euros ($9.7 million), less than half the 17.2 million euros estimated by analysts.

European shares briefly erased losses after the People’s Bank of China removed the floor on lending rates, effective tomorrow, giving freedom to banks to set borrowing costs. They were earlier allowed to lend at a maximum discount of 30 percent below the benchmark lending rate. China’s one-year rate has stayed at 6 percent since its last reduction in July 2012.

National benchmark indexes fell or were little changed in 13 of the 18 western European markets.

FTSE 100 6,630.67 -3.69 -0.06% CAC 40 3,925.32 -2.47 -0.06% DAX 8,331.57 -5.52 -0.07%

Royal Vopak NV tumbled 5 percent to 43.51 euros, its biggest drop since March 1, after the biggest chemical-and-oil storage company reduced its forecast for 2013 earnings before interest, taxes, depreciation and amortization to a range of 730 million euros to 780 million euros. It earlier predicted Ebitda to be between 760 million euros and 800 million euros.

Remy Cointreau SA slid 4.7 percent to 78.19 euros after JPMorgan Chase & Co. lowered its recommendation on the shares to underweight, a rating similar to sell, from neutral. The brokerage said a sales recovery may take longer than previously expected as the cognac maker yesterday reported a drop in first-quarter revenue. Separately, a shareholder sold as many as 1.06 million shares, or a 2.1 percent stake, in Remy at 78.50 euros to 79.50 euros each.

Scania AB dropped 4.3 percent to 141.60 kronor after the Swedish truckmaker reported second-quarter earnings of 1.72 kronor a share, missing the average analyst forecast of 2.17 kronor.

-

17:00

European stock close: FTSE 100 6,630.67 -3.69 -0.06% CAC 40 3,925.32 -2.47 -0.06% DAX 8,331.57 -5.52 -0.07%

-

16:34

Oil: an overview of the market situation

Prices for WTI crude oil rose to its highest level in 16 months, while the Brent price fell slightly, which was associated with the decision of the People's Bank of China deregulate interest rates and allow banks themselves set the rates on loans. As part of measures to normalize the flow of capital and the maintenance of slowing economic growth, China has adopted a decision on the liberalization of interest rates, and as an important first step declared his intention to remove the lower bound on the official rates of bank lending. The People's Bank also announced on its website that it will terminate the control of interest rates on discount bills. However, he will continue to monitor the deposit rate.

We also add that the impact on the bidding had a decision of the international rating agency Moody's changed the outlook on the U.S. sovereign credit rating from "negative" to "stable." We also add that he affirmed at AAA. The negative outlook on the rating of U.S. debt was assigned in August 2011.

The agency's analysts point out that the main factor for improving rating outlook became the administration's efforts of the United States to combat the budget deficit, experts also Moody's took into account the growth of the U.S. economy, which is ahead of other states, whose bonds were assigned the highest rating.

Special attention Moody's have been awarded the U.S. dollar as the main global reserve currency and debt obligations of the Federal Treasury, which remains one of the safest ways to invest money investors worldwide.

The main vulnerability to a "stable" outlook on U.S. debt to Moody's called the likely slowdown in GDP growth and a possible increase in social spending government in connection with health care reform.

We also add that WTI oil futures rise in price due to lower foreign exchange value of the U.S. dollar. On the eve of the dollar index peaked three days, surpassing the mark of 82.8 points, and today the indicator slipped below 82.6 points, providing a technically attractive terms for purchases of crude oil and other commodity asset prices are set in U.S. currency.

The cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to 108.29 dollars a barrel on the New York Mercantile Exchange.

August futures price for North Sea Brent crude oil mixture fell to $ 108.38 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose markedly today, adding to its market value of about 1%, which helped secure a second weekly gain, helped by the depreciation of the dollar. It should be noted that the weakening of the U.S. currency due to lower concerns about the fact that the U.S. Federal Reserve will withdraw the monetary stimulus in the near future. Earlier this week, Fed Chairman Ben Bernanke said that all future plans in respect of the Fed asset purchases will depend on the strength of the economy. Note that the ultrasoft monetary policy that maintains the pressure on long-term interest rates and fueling fears of inflation, was the main factor behind the increase in gold prices in recent years.

Data presented today also showed that the outflow of gold from the largest gold exchange-traded fund in the world of SPDR Gold Trust, slowed to 3.9 tons this week with 22.9 tons last week. We also add that on Thursday, stocks fell by almost 1 tonne to 935.17 tonnes - the lowest figure since 2009. Investors said earlier this week there was evidence of what is expected of a significant sales ETFs.

In addition, published by the Central Bank of Russia data showed that the volume of stocks remained unchanged in June, which happened for the first time in nine months, when prices fell by more than 10% - to the lowest in nearly three years. We also note that Russia was the largest buyer of gold in the formal sector in the last decade.

The cost of the August gold futures on COMEX today rose to a high of $ 1293.30 an ounce.

-

14:15

Canadian annual consumer prices accelerated in June

Canadian annual consumer prices accelerated in June to a four-month high driven by higher costs for gasoline and passenger vehicles, but remained well below the 2% inflation target, showing no pressure on the central bank to hike rates.

The monthly consumer price index was flat following a 0.2% rise in May, but the year-on-year rate quickened to 1.2% from 0.7%, Statistics Canada said Friday.

The core rate, which excludes some energy and food costs, dropped 0.2% on a monthly basis following a rise of that magnitude previously, and was up 1.3% year-on-year from 1.1%. -

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, June +1.3% (forecast +1.3%)

-

13:31

Canada: Bank of Canada Consumer Price Index Core, m/m, June -0.2% (forecast -0.3%)

-

13:30

Canada: Consumer Price Index m / m, June 0.0% (forecast +0.2%)

-

13:30

Canada: Consumer price index, y/y, June +1.2% (forecast +1.3%)

-

13:19

European session: commodity currencies rose after the decision of the People's Bank of China

06:00 Germany Producer Price Index (MoM) June -0.3% -0.2% 0.0%

06:00 Germany Producer Price Index (YoY) June +0.2% +0.6% +0.6%

08:30 United Kingdom PSNB, bln June 12.7 Revised From 10.5 9.4 10.2

Commodity currencies rose against the decision of the People's Bank of China deregulate interest rates and allow banks themselves set the rates on loans. As part of measures to normalize the flow of capital and the maintenance of slowing economic growth, China has adopted a decision on the liberalization of interest rates, and as an important first step declared his intention to remove the lower bound on the official rates of bank lending. The People's Bank also announced on its website that it will terminate the control of interest rates on discount bills. However, he will continue to monitor the deposit rate.

The British рound was higher against the U.S. dollar. Published a report on the state of public finances in June, according to which, in June, net borrowing of the public sector, the preferred measure of the budget deficit amounted to 8.5 billion pounds against 11.9 billion pounds of debt in June of last year. However, the positive effect on the data for June has had a profit of the Bank of England in the amount of 3.9 billion pounds from operations to buy bonds.

The euro fell against the dollar on data on producer prices in Germany. The Producer Price Index rose by 0.6 percent year on year in June after a 0.2 percent rise in May, the Federal Statistical Office. The growth rate in June was in line with economists' forecasts. Led the overall increase in the prices of consumer non-durable goods, which grew by 2.6 percent per year, while the price of capital goods rose by 0.8 percent. Expenditure on durable goods and energy prices were up 0.9 percent and 0.7 percent, respectively, compared to June 2012. On a monthly basis, producer prices were unchanged in June after a 0.3 percent decline the previous month. The index is forecast was reduced by 0.2 percent on a monthly basis.

Today in Moscow launched a 2-day summit of central bankers and finance ministers of the G-20. As expected, the focus will be to discuss the current situation in the global economy, labor market issues and reform of financial regulation. In addition, an important issue on the agenda may be the policy of central banks. Thus, the debate over the possible aggressive easing implemented by the Bank of Japan and the Federal Reserve's plans to curtail QE. However, according to the published communiqué, such measures are unlikely to be subjected to official criticism. Representatives of the G-20 will continue negotiations on the key issue - the financing of investment, "which are essential for economic growth and an important factor in stimulating job growth."

EUR / USD: during the European session, the pair fell to $ 1.3096

GBP / USD: during the European session, the pair rose to $ 1.5281

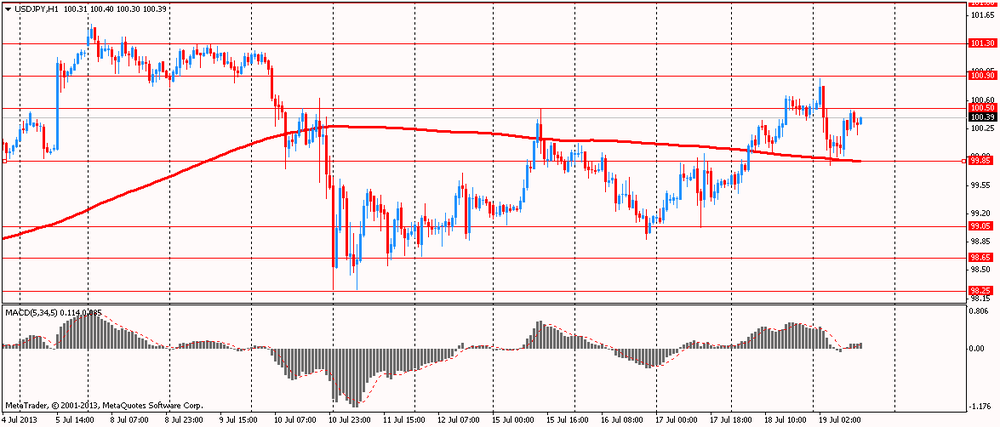

USD / JPY: during the European session, the pair rose to Y100.48

At 12:30 GMT Canada will release the consumer price index, core consumer price index from the Bank of Canada in June. On Friday and Saturday will be a meeting G20.

-

13:00

Orders

EUR/USD

Offers $1.3250/60, $1.3225/30, $1.3210, $1.3170-90

Bids $1.3080, $1.3065, $1.3060/50, $1.3020

GBP/USD

Offers $1.5340/50, $1.5295/305, $1.5280/85

Bids $1.5185/80, $1.5160/50, $1.5145/40, $1.5130/20, $1.5100, $1.5080, $1.5060/45

AUD/USD

Offers $0.9300, $0.9240/50, $0.9215/20, $0.9195/00

Bids $0.9140, $0.9120, $0.9110/00, $0.9050

EUR/GBP

Offers stg0.8740/45, stg0.8700, stg0.8675/80, stg0.8665, stg0.8645/55

Bids stg0.8590, stg0.8575/65

EUR/JPY

ОOffers Y133.00, Y132.50, Y132.20, Y132.05/10

Bids Y131.00, Y130.80, Y130.55/50, Y130.10/00

USD/JPY

Offers Y102.00, Y101.50, Y101.00, Y100.85/90

Bids Y99.85/80, Y99.55/50, Y99.25/20, Y99.00, Y98.80

-

11:31

European stocks fell

European stocks fell, with the Stoxx Europe 600 Index paring its fourth weekly gain, as investors weighed worse-than-estimated earnings from Google Inc. and Microsoft Corp.

A gauge of European technology companies fell 1 percent as Google, owner of the world’s most popular Internet search engine, yesterday reported second-quarter sales and profit that missed analysts’ estimates. Microsoft, the world’s largest software maker, posted fourth-quarter profit that trailed analysts’ forecasts by the biggest margin in at least a decade.

SAP, the biggest maker of business-management software, slid 2 percent to 55.88 euros. ARM Holdings, whose chip designs are used in phones that run on Google’s Android operating system, dropped 2.4 percent to 898.5 pence.

Tieto Oyj dropped 4.2 percent to 14.84 euros, its largest slump in eight weeks, as Finland’s biggest software producer reported second-quarter net income of 7.4 million euros ($9.7 million), less than half the 17.2 million euros estimated by analysts in a Bloomberg survey.

Group of 20 finance ministers and central bank governors begin a two-day meeting in Moscow today. Treasury Secretary Jacob J. Lew said yesterday he will urge his European counterparts to spur growth, citing the U.S. economy as an example of successful recovery.

Royal Vopak NV tumbled 5.6 percent to 43.26 euros, its biggest drop since March 1, after the biggest chemical-and-oil storage company reduced its forecast for 2013 earnings before interest, taxes, depreciation and amortization to a range of 730 million euros to 780 million euros. It earlier predicted Ebitda to be between 760 million euros and 800 million euros.

Remy Cointreau SA slid 4.2 percent to 78.64 euros after JPMorgan Chase & Co. lowered its recommendation on the shares to underweight, a rating similar to sell, from neutral. The brokerage said a sales recovery may take longer than previously expected as the cognac maker yesterday reported a drop in first-quarter revenue.

Separately, a shareholder sold as many as 1.06 million shares, or a 2.1 percent stake, in Remy at 78.50 euros to 79.50 euros each.

FTSE 100 6,610.98 -23.38 -0.35%

CAC 40 3,917.43 -10.36 -0.26%

DAX 8,309.68 -27.41 -0.33%

-

11:16

Japan all industry activity growth accelerates in May

Japan's all industry activity growth accelerated in May on robust recovery across sub-sectors, data from the Ministry of Economy, Trade and Industry showed Friday.

The corresponding index rose 1.1 percent month-on-month, after climbing 0.1 percent in April. But it remained marginally below the 1.2 percent expected increase.

Construction activity surged 5.2 percent, offsetting last month's 0.1 percent fall. At the same time, industrial production growth surged to 1.9 percent from 0.9 percent.

Tertiary industry activity climbed 1.2 percent from a month ago, when it fell 0.5 percent. The index of government services gained 0.3 percent compared to a 0.1 percent drop in April.

On a yearly basis, all industry activity growth more than doubled to 1.2 percent from 0.4 percent in May.

-

11:00

U.K. June budget deficit narrows

The U.K. public sector net borrowing excluding interventions declined to GBP 8.5 billion in June from GBP 11.9 billion last year, data from the Office for National Statistics showed Friday.

The ONS said PSNB has been reduced by GBP 3.9 billion of cash transfers from the Asset Purchase Facility Fund to government. If these transfers are excluded then public sector net borrowing in June 2013 was GBP 12.4 billion, data showed.

At the end of June, the public sector net debt excluding the temporary effects of financial interventions was GBP 1,202.8 billion or 74.9 percent of GDP.

-

10:44

Germany June output price inflation rises as expected

Germany's producer price inflation accelerated in June, and the figure matched economists' expectations, latest data showed Friday.

The producer price index increased 0.6 percent on an annual basis in June, following a 0.2 percent gain in May, the Federal Statistical Office said. The growth rate for June was in line with economists' forecast.

Driving the overall growth, prices of non-durable consumer goods increased by 2.6 percent annually, and capital goods prices moved up 0.8 percent. Costs of durable consumer goods and energy products were higher by 0.9 percent and 0.7 percent respectively than in June 2012.

On a monthly basis, producer prices stayed unchanged in June, after recording a 0.3 percent decrease in the previous month. The index was forecast to drop 0.1 percent month-on-month.

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.3000, $1.3050, $1.3100, $1.3160, $1.3200, $1.3300

USD/JPY Y99.00, Y99.50, Y100.50, Y100.65, Y101.50

GBP/USD $1.5000, $1.5100, $1.5250, $1.5260, $1.5300

EUR/GBP stg0.8610, stg0.8800

AUD/USD $0.9130, $0.9200, $0.9235, $0.9305, $0.9330

NZD/USD $0.7910

USD/CAD C$1.0400, C$1.0500

-

10:00

Asia Pacific stocks close

Asian stocks fell, with the regional benchmark index set to decline for a third day, as Advantest Corp. and Taiwan Semiconductor Manufacturing Co. led technology stocks lower.

Nikkei 225 14,589.91 -218.59 -1.48%

Hang Seng 21,324.99 -20.23 -0.09%

S&P/ASX 200 4,972.1 -21.32 -0.43%

Shanghai Composite 1,992.65 -30.75 -1.52%

Advantest, the world’s biggest maker of chip-manufacturing equipment, sank 7 percent in Tokyo after Nomura Holdings Inc. lowered its rating on the stock.

TSMC, as the No. 1 contract manufacturer of chips is known, dropped 6.9 percent in Taipei after forecasting sales that trailed estimates.

Orica Ltd., the largest maker of industrial explosives, slumped 13 percent in Sydney after cutting its profit forecast.

-

09:02

FTSE 100 6,617.3 -17.06 -0.26%, CAC 40 3,914.76 -13.03 -0.33%, Xetra DAX 8,294.04 -43.05 -0.52%

-

07:42

European bourses are initially seen trading lower Friday: the FTSE down 18, the DAX down 24 and the CAC down 14.

-

07:25

Asian session: The yen strengthened

04:30 Japan All Industry Activity Index, m/m May +0.4% +1.3% +1.1%

The yen strengthened against all 16 of its major peers as Asian stocks declined, boosting the allure of haven currencies, before upper-house elections of Japan’s parliament on July 21. Abe’s Liberal Democratic Party and its coalition partner New Komeito are on track to win more than 65 of the 121 upper house seats being contested, according to a poll published in the Nikkei newspaper on July 17.

The yen erased its decline as Japanese stocks dropped after Koichi Hamada, an adviser to the prime minister, said the nation’s consumption tax must be raised “at some point” because Japan’s finances aren’t solid when viewed from an extremely long-term perspective.

The Australian dollar is set to complete its first weekly gain since mid-June before an inflation report next week that is likely to influence the Reserve Bank’s interest-rate decision in August. Australia’s consumer price index probably gained 0.5 percent in the second quarter from a 0.4 percent pace in the previous three-month period, economists forecast in a Bloomberg News survey before the July 24 data. The trimmed mean gauge of core prices climbed 0.5 percent compared with 0.3 percent in the previous quarter, the poll showed.

The kiwi strengthened today after a statistics department report showed permanent net migration to the nation climbed to a four-year high in June. Permanent arrivals exceeded departures by 2,330 in June, the most since May 2009, the data showed. Credit card spending rose 2.6 percent in June, the biggest increase in four months, according to separate data released today.

EUR / USD: during the Asian session the pair rose to $ 1.3150

GBP / USD: during the Asian session the pair rose to $ 1.5250

USD / JPY: during the Asian session the pair fell to Y99.80

UK data will be released at 0830GMT, when the June public sector finance data crosses the wires. Aside from the Treasury commentary, all the focus on the public finances is on underlying borrowing measures - which exclude a raft of distorting factors. The Office for Budget Responsibility said at the time of the March Budget that stripping out special factors "the decline in cash borrowing now appears to have stalled. We expect PSNB to be broadly flat ... (in 2013-14) resuming its fall in 2014-15." Measured against this forecast, the tentative signs of an improvement in underlying borrowing this year would mark a better than expected outturn. PSNB is seen at stg 9.5 bn versus stg 10.5 bn previously.

-

07:01

Germany: Producer Price Index (MoM), June 0.0% (forecast -0.2%)

-

07:00

Germany: Producer Price Index (YoY), June +0.6% (forecast +0.6%)

-

06:26

Commodities. Daily history for Jul 18’2013:

Change % Change Last

GOLD 1,283.30 5.80 0.45%

OIL (WTI) 108.09 1.61 1.51%

-

06:25

Stocks. Daily history for Jul 18’2013:

Nikkei 225 14,808.5 193,46 1,32%

Hang Seng 21,345.42 -26,45 -0,12%

S & P / ASX 200 4,993.42 11,74 0,24%

Shanghai Composite -1,05 -21,53 2,023.4%

FTSE 100 6,634.36 +62.43 +0.95%

CAC 40 3,927.79 +55.77 +1.44%

DAX 8,337.09 +82.37 +1.00%

Dow +78.33 15,548.85 +0.51%

Nasdaq +1.28 3,611.28 +0.04%

S&P +8.47 1,689.38 +0.50%

-

06:25

Currencies. Daily history for Jul 18'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3112 -0,08%

GBP/USD $1,5228 +0,09%

USD/CHF Chf0,9441 +0,32%

USD/JPY Y100,52 +0,93%

EUR/JPY Y131,79 +0,85%

GBP/JPY Y153,05 +1,03%

AUD/USD $0,9169 -0,72%

NZD/USD $0,7904 -0,01%

USD/CAD C$1,0375 -0,29%

-

06:02

Schedule for today, Friday July 19’2013:

04:30 Japan All Industry Activity Index, m/m May +0.4% +1.3%

06:00 Germany Producer Price Index (MoM) June -0.3% -0.2%

06:00 Germany Producer Price Index (YoY) June +0.2% +0.6%

08:30 United Kingdom PSNB, bln June 10.5 9.4

09:00 G20 G20 Meetings

12:30 Canada Consumer Price Index m / m June +0.2% +0.2%

12:30 Canada Consumer price index, y/y June +0.7% +1.3%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June +0.2% -0.3%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June +1.1% +1.3%

-

05:33

Japan: All Industry Activity Index, m/m, May +1.1% (forecast +1.3%)

-