Notícias do Mercado

-

23:43

Commodities. Daily history for Jule Aug 19'2014:

(raw materials / closing price /% change)

Light Crude 94.57 +0.10%

Gold 1,296.20 -0.04%

-

23:30

Stocks. Daily history for Jule Aug 19'2014:

(index / closing price / change items /% change)

Nikkei 225 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

Shanghai Composite 2,245.33 +5.86 +0.26%

FTSE 100 6,779.31 +38.06 +0.56%

CAC 40 4,254.45 +23.80 +0.56%

Xetra DAX 9,334.28 +88.95 +0.96%

S&P 500 1,981.6 +9.86 +0.50%

NASDAQ 4,527.51 +19.20 +0.43%

Dow Jones 16,919.59 +80.85 +0.48%

-

23:22

Currencies. Daily history for Aug 19'2014:

(pare/closed(GMT +2)/change, %)

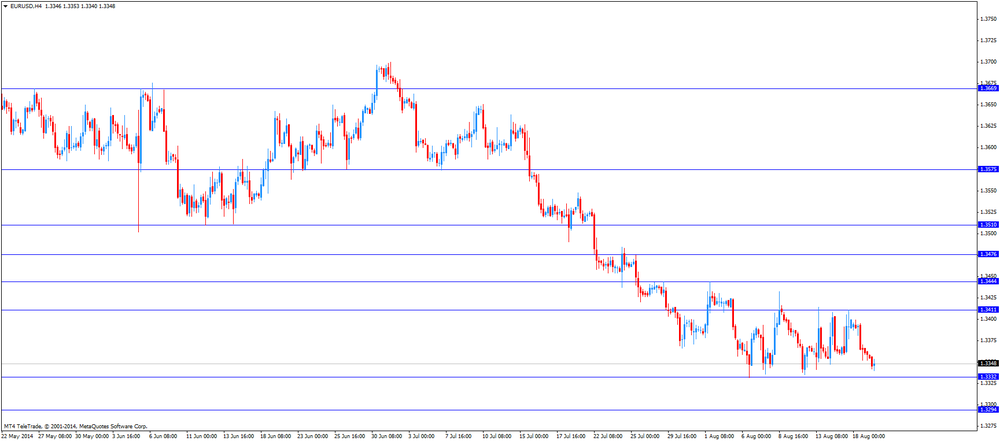

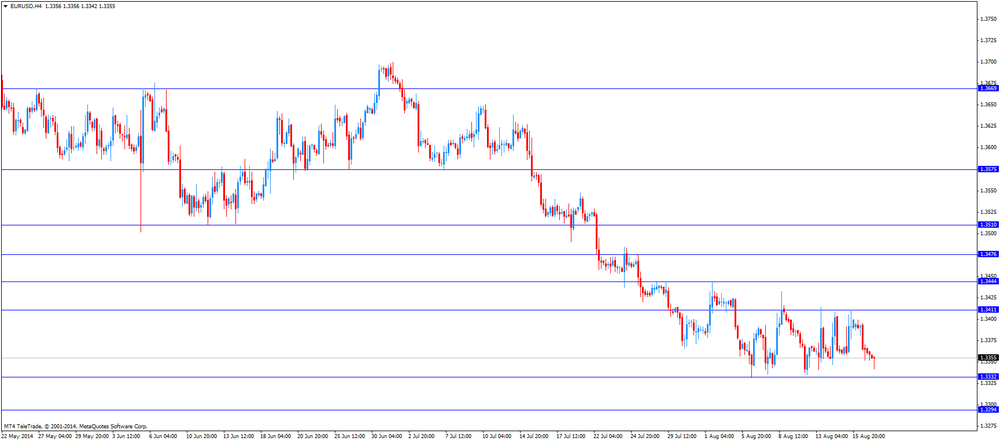

EUR/USD $1,3317 -0,33%

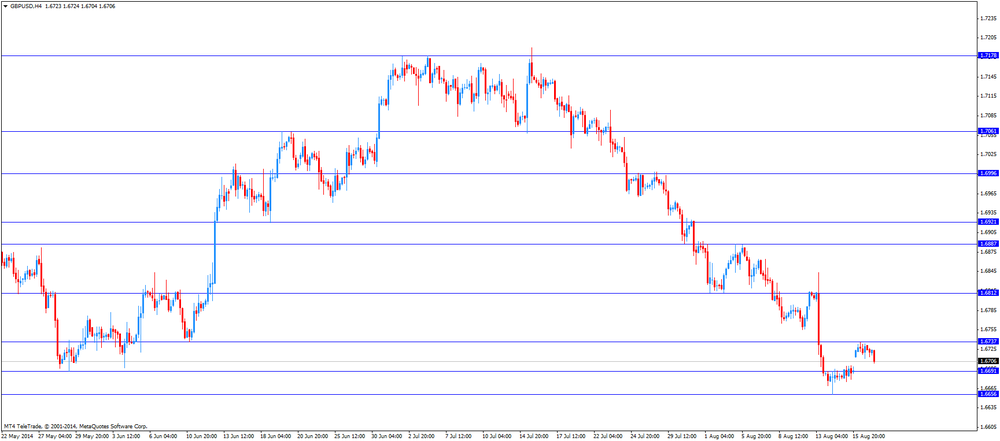

GBP/USD $1,6614 -0,67%

USD/CHF Chf0,9092 +0,31%

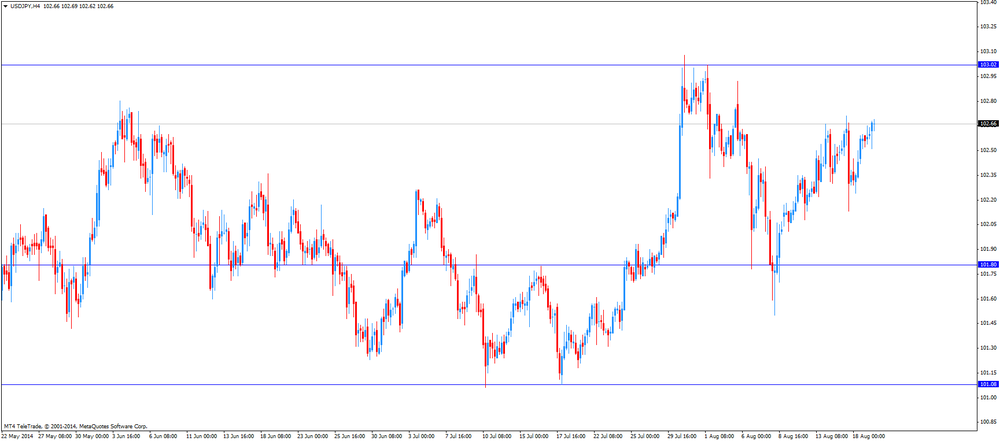

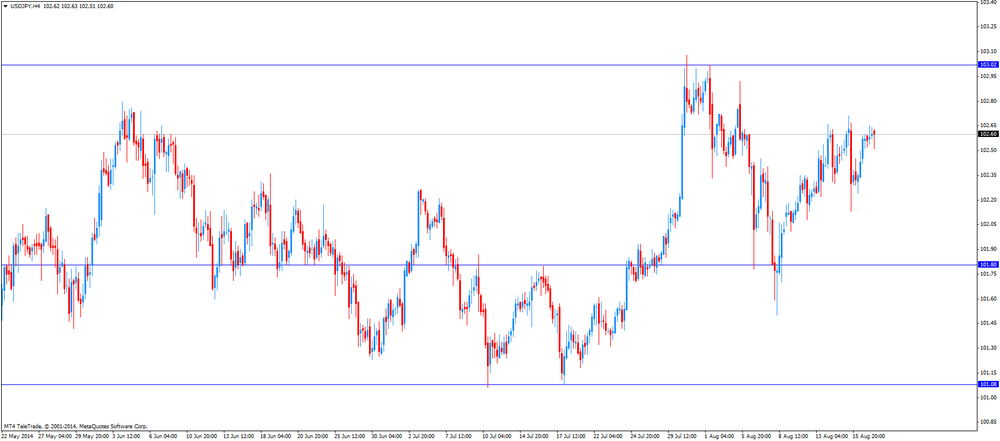

USD/JPY Y102,92 +0,35%

EUR/JPY Y137,06 +0,02%

GBP/JPY Y170,98 -0,32%

AUD/USD $0,9296 -0,28%

NZD/USD $0,8421 -0,67%

USD/CAD C$1,0940 +0,49%

-

23:00

Schedule for today, Wednesday, Aug 20’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index June +0.1%

04:30 Japan All Industry Activity Index, m/m June +0.6% -0.2%

06:00 Germany Producer Price Index (MoM) July 0.0% +0.1%

06:00 Germany Producer Price Index (YoY) July -0.7%

08:30 United Kingdom Bank of England Minutes

10:00 United Kingdom CBI industrial order books balance August 2 4

12:30 Canada Wholesale Sales, m/m June +2.2% +1.3%

14:30 U.S. Crude Oil Inventories August 1.4

18:00 U.S. FOMC meeting minutes

22:45 New Zealand Visitor Arrivals July -0.3%

-

17:02

European Stocks close: FTSE 6,779.31 +38.06 +0.56%, CAC 4,254.45 +23.80 +0.56%, DAX 9,334.28 +88.95 +0.96%

-

17:01

European stocks close: stocks closed higher due to the better-than-forecasted corporate earnings and as tensions over Ukraine eased

Stock indices closed higher due to the better-than-forecasted corporate earnings and as tensions over Ukraine eased. A.P. Moeller-Maersk A/S shares increased 4.9% after the company upgraded its full-year profit forecast.

Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

BHP Billiton Ltd. shares slid 4.9% after reporting the weaker-than-forecasted annual profit.

Sixt SE shares rose 3.2% after reporting the better-than-forecasted second-quarter earnings.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,779.31 +38.06 +0.56%

DAX 9,334.28 +88.95 +0.96%

CAC 40 4,254.45 +23.80 +0.56%

-

16:30

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the better-than-expected U.S. housing market data

The U.S. dollar traded higher against the most major currencies after the better-than-expected U.S. housing market data. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November. June's figure was revised up from 893,000 units. Analysts had expected a rise to 970,000 units.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June. June's figure was revised up from 963,000 units. Analysts had expected 1.0 million units.

The U.S. consumer price index increased 0.1% in July, in line with expectations, after a 0.3% rise in June.

On a yearly basis, consumer prices in the U.S. rose 2.0% in July, after a 2.1% gain in June.

Consumer prices, excluding food and energy, climbed 0.1% in July, missing expectations for a 0.2% increase, after a 0.1% rise in June.

On a yearly basis, consumer prices, excluding food and energy, increased 1.9% in July, after a 1.9% rise in June.

The euro fell against the U.S. the better-than-expected U.S. housing market data.

Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

The British pound declined against the U.S. dollar after the weaker-than-expected economic data from the UK and the better-than-expected U.S. housing market data.

Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Producer price index input in the UK fell 1.6% in July, missing forecasts of a 0.8% decline, after a 0.9% decrease in June. June's figure was revised down from a 0.8% drop.

Producer price index output in the UK decreased 0.1% in July, missing forecasts of a 0.1% increase, after a 0.1% fall in June. June's figure was revised up from a 0.2% decline.

The New Zealand dollar traded mixed against the U.S dollar. In the overnight trading session, the New Zealand dollar dropped against the U.S dollar after the weaker-than-expected economic data from New Zealand. Producer price index input in New Zealand fell by 1.0% in the second quarter, missing expectations for a 0.7% rise, after a 1.0% gain in the first quarter.

Producer price index output in New Zealand declined by 0.5% in the second quarter, missing expectations for a 0.8% increase, after a 0.9% rise in the first quarter.

New Zealand's annual inflation expectations for the next two years decreased to 2.2% in the second quarter from 2.4% in the first quarter.

Growth forecast cut by New Zealand's government also weighed on the kiwi. The government lowered growth forecast in the year to next March to 3.8% from 4% earlier.

The Australian dollar declined against the U.S. dollar after the better-than-expected U.S. housing market data.

The Reserve Bank of Australia released its policy meeting minutes. The RBA said that its interest rate will remain on hold for some time. There were no comments on the currency.

The Japanese yen traded lower against the U.S. dollar the better-than-expected U.S. housing market data. No major economic reports were released in Japan.

-

15:12

US housing starts jumped 15.7% in July

The U.S. Commerce Department released the U.S. housing data today. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November. June's figure was revised up from 893,000 units. Analysts had expected a rise to 970,000 units.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June. June's figure was revised up from 963,000 units. Analysts had expected 1.0 million units.

-

14:50

Option expiries for today's 1400GMT cut

EUR/USD $1.3350(E886mn), $1.3365-75(E204mn), $1.3390(E324mn)

USD/JPY Y102.50($220mn), Y102.60($375mn), Y103.00($250mn)

GBP/USD $1.6600(stg260mn), $1.6685(stg396mn), $1.6795(stg201mn)

EUR/CHF Chf1.2100(E100mn)

AUD/USD $0.9290(A$163mn), $0.9340(A$100mn)

NZD/USD $0.8425(NZ$140mn), $0.8450(NZ$104mn)

USD/CAD C$1.0850-55($170mn), C$1.0950($242mn)

-

14:34

U.S. Stocks open: Dow 16,870.21 +31.47 +0.19%, Nasdaq 4,515.52 +7.21 +0.16%, S&P 1,975.37 +3.63 +0.18%

-

14:33

US consumer prices rose 0.1% in July

The Labor Department in the U.S. released consumer price index. The U.S. consumer price index increased 0.1% in July, in line with expectations, after a 0.3% rise in June.

On a yearly basis, consumer prices in the U.S. rose 2.0% in July, after a 2.1% gain in June.

Gasoline prices declined 0.3% in July, while food prices rose 0.4% in July.

Consumer prices, excluding food and energy, climbed 0.1% in July, missing expectations for a 0.2% increase, after a 0.1% rise in June.

On a yearly basis, consumer prices, excluding food and energy, increased 1.9% in July, after a 1.9% rise in June.

The figures could mean that the Fed will keep its interest rate low for a while.

The Fed's inflation target is 2% at annual rate. The Fed prefers to use the index for personal consumption. The index for personal consumption was 1.6% at annual rate in June.

-

14:29

Before the bell: S&P futures +1.01%, Nasdaq futures +0.97%

U.S. stock futures advanced as housing starts jumped to the highest level in eight months and an inflation gauge showed price pressures remain limited.

Shares of Home Depot Inc. (HD) gained more than 4% after earnings topped analysts' estimates and the company raised its forecast.

Global markets:

Nikkei 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

Shanghai Composite 2,245.33 +5.86 +0.26%

FTSE 6,774.18 +32.93 +0.49%

CAC 4,248.44 +17.79 +0.42%

DAX 9,340.58 +95.25 +1.03%

Crude oil $96.85 (-0.51%)

Gold $1301.30 (-1.00%)

-

14:09

DOW components before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

78.57

+0.03%

0.4K

Chevron Corp

CVX

126.40

+0.08%

0.1K

Intel Corp

INTC

34.44

+0.09%

1.7K

The Coca-Cola Co

KO

41.39

+0.10%

0.1K

Caterpillar Inc

CAT

107.10

+0.11%

3.2K

Exxon Mobil Corp

XOM

99.63

+0.11%

0.5K

Cisco Systems Inc

CSCO

24.66

+0.12%

0.8K

AT&T Inc

T

34.70

+0.14%

3.1K

Johnson & Johnson

JNJ

102.85

+0.15%

2.6K

Microsoft Corp

MSFT

44.90

+0.16%

1.4K

Procter & Gamble Co

PG

82.57

+0.16%

0.1K

E. I. du Pont de Nemours and Co

DD

66.00

+0.20%

0.1K

Verizon Communications Inc

VZ

48.88

+0.21%

17.7K

General Electric Co

GE

26.13

+0.23%

2.3K

Goldman Sachs

GS

175.00

+0.26%

2.0K

Wal-Mart Stores Inc

WMT

74.70

+0.28%

3.4K

JPMorgan Chase and Co

JPM

57.40

+0.30%

3.2K

McDonald's Corp

MCD

94.55

+0.32%

0.1K

Pfizer Inc

PFE

28.95

+0.38%

0.4K

American Express Co

AXP

87.75

+0.68%

2.9K

International Business Machines Co...

IBM

189.36

0.00%

0.2K

Walt Disney Co

DIS

89.75

-0.24%

5.7K

-

13:31

U.S.: CPI, Y/Y, July +2.0%

-

13:31

U.S.: CPI excluding food and energy, Y/Y, July +1.9%

-

13:30

U.S.: CPI, m/m , July +0.1% (forecast +0.1%)

-

13:30

U.S.: CPI excluding food and energy, m/m, July +0.1% (forecast +0.2%)

-

13:30

U.S.: Building Permits, mln, July 1.05 (forecast 1.000)

-

13:30

U.S.: Housing Starts, mln, July 1.09 (forecast 0.970)

-

13:01

Foreign exchange market. European session: the British pound dropped against the U.S. dollar after the weaker-than-expected economic data from the UK

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III +2.4% +2.2%

08:00 Eurozone Current account, adjusted, bln June 19.8 Revised From 19.5 21.3 13.1

08:30 United Kingdom Retail Price Index, m/m July +0.2% -0.1%

08:30 United Kingdom Retail prices, Y/Y July +2.6% +2.6% +2.5%

08:30 United Kingdom RPI-X, Y/Y July +2.7% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) July -0.9% -0.8% -1.6%

08:30 United Kingdom Producer Price Index - Input (YoY) July -4.5% -7.3%

08:30 United Kingdom Producer Price Index - Output (MoM) July -0.1% +0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July +0.3% -0.1%

08:30 United Kingdom HICP, m/m July +0.2% -0.3%

08:30 United Kingdom HICP, Y/Y July +1.9% +1.8% +1.6%

08:30 United Kingdom HICP ex EFAT, Y/Y July +2.0% +1.9% +1.8%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. housing data and consumer price index. The consumer price index is expected to increase 0.1% in July, after a 0.3% rise in June.

The consumer price index, excluding food and energy, is expected to rise 0.2% in July, after a 0.1% gain in June.

The euro traded mixed against the U.S. dollar after the weaker-than-expected current account data from the Eurozone. Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

The British pound dropped against the U.S. dollar after the weaker-than-expected economic data from the UK. Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Producer price index input in the UK fell 1.6% in July, missing forecasts of a 0.8% decline, after a 0.9% decrease in June. June's figure was revised down from a 0.8% drop.

Producer price index output in the UK decreased 0.1% in July, missing forecasts of a 0.1% increase, after a 0.1% fall in June. June's figure was revised up from a 0.2% decline.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6632

USD/JPY: the currency pair rose to Y102.69

The most important news that are expected (GMT0):

12:30 U.S. Building Permits, mln July 0.963 1.000

12:30 U.S. Housing Starts, mln July 0.893 0.970

12:30 U.S. CPI, m/m July +0.3% +0.1%

12:30 U.S. CPI, Y/Y July +2.1%

12:30 U.S. CPI excluding food and energy, m/m July +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July +1.9%

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Adjusted Merchandise Trade Balance, bln July -1080.8 -770.0

-

13:00

Orders

EUR/USD

Offers $1.3485, $1.3445, $1.3415, $1.3400, $1.3375/80

Bids $1.3330, $1.3300-3295, $1.3230

GBP/USD

Offers $1.6845, $1.6800/10, $1.6750

Bids $1.6620, $1.6600, $1.6550

AUD/USD

Offers $0.9400, $0.9370, $0.9350

Bids $0.9285/80, $0.9240, $0.9220/00

EUR/JPY

Offers Y138.20, Y138.00, Y137.60

Bids Y136.75, Y136.50, Y136.25/20

USD/JPY

Offers Y103.50, Y103.00, Y102.80/85, Y102.70

Bids Y102.30, Y102.15, Y102.00, Y101.80, Y101.50

EUR/GBP

Offers stg0.8100, stg0.8035, stg0.8000

Bids stg0.7980, stg0.7950/40, stg0.7900

-

12:37

UK consumer price inflation weaker than expected in July

The Office for National Statistics (ONS) released consumer price inflation today. Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

Food prices declined by 0.6% in July, while clothing prices fell 0.2% in July.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Retail price index increased at an annual rate of 2.5% in July, missing expectations for a 2.6% gain, after a 2.6% rise in June.

-

12:11

European stock markets mid session: stocks traded higher due to the better-than-forecasted corporate earnings

Stock indices traded higher due to the better-than-forecasted corporate earnings. A.P. Moeller-Maersk A/S shares increased 4% after the company upgraded its full-year profit forecast.

Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Sixt SE shares rose 4.5% after reporting the better-than-forecasted second-quarter earnings.

Current figures:

Name Price Change Change %

FTSE 100 6,767.93 +26.68 +0.40%

DAX 9,318.01 +72.68 +0.79%

CAC 40 4,244.38 +13.73 +0.32%

-

10:44

Asian Stocks close: stocks closed higher, following gains on U.S. markets

Asian stock indices closed higher, following gains on U.S. markets as geopolitical tensions eased and due to yesterday's better-than-expected U.S. housing data.

Foreign ministers from Russia, Ukraine, Germany, and France met in Berlin over the weekend. Investors have seen signs of progress in the talks to bring about a ceasefire in Ukraine.

The Red Cross is close to working out details of a safe-passage plan for a Russian humanitarian convoy.

The NAHB housing market index climbed to 55.0 in August from 53.0 in July. Analysts had expected the index to remain unchanged at 53.0.

Indexes on the close:

Nikkei 225 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

Shanghai Composite 2,245.33 +5.86 +0.26%

-

10:20

Option expiries for today's 1400GMT cut

EUR/USD $1.3350(E886mn), $1.3365-75(E204mn), $1.3390(E324mn)

USD/JPY Y102.50($220mn), Y102.60($375mn), Y103.00($250mn)

GBP/USD $1.6600(stg260mn), $1.6685(stg396mn), $1.6795(stg201mn)

EUR/CHF Chf1.2100(E100mn)

AUD/USD $0.9290(A$163mn), $0.9340(A$100mn)

NZD/USD $0.8425(NZ$140mn), $0.8450(NZ$104mn)

USD/CAD C$1.0850-55($170mn), C$1.0950($242mn)

-

09:55

Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S dollar after the weaker-than-expected economic data from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III +2.4% +2.2%

08:00 Eurozone Current account, adjusted, bln June 19.8 Revised From 19.5 21.3 13.1

08:30 United Kingdom Retail Price Index, m/m July +0.2% -0.1%

08:30 United Kingdom Retail prices, Y/Y July +2.6% +2.6% +2.5%

08:30 United Kingdom RPI-X, Y/Y July +2.7% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) July -0.8% -0.8% -1.6%

08:30 United Kingdom Producer Price Index - Input (YoY) July -4.4% -7.3%

08:30 United Kingdom Producer Price Index - Output (MoM) July -0.2% +0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July +0.2% -0.1%

08:30 United Kingdom HICP, m/m July +0.2% -0.3%

08:30 United Kingdom HICP, Y/Y July +1.9% +1.8% +1.6%

08:30 United Kingdom HICP ex EFAT, Y/Y July +2.0% +1.9% +1.8%

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by yesterday's NAHB housing market index. The NAHB housing market index climbed to 55.0 in August from 53.0 in July. Analysts had expected the index to remain unchanged at 53.0.

The New Zealand dollar dropped against the U.S dollar after the weaker-than-expected economic data from New Zealand. Producer price index input in New Zealand fell by 1.0% in the second quarter, missing expectations for a 0.7% rise, after a 1.0% gain in the first quarter.

Producer price index output in New Zealand declined by 0.5% in the second quarter, missing expectations for a 0.8% increase, after a 0.9% rise in the first quarter.

New Zealand's annual inflation expectations for the next two years decreased to 2.2% in the second quarter from 2.4% in the first quarter.

Growth forecast cut by New Zealand's government also weighed on the kiwi. The government lowered growth forecast in the year to next March to 3.8% from 4% earlier.

The Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia's policy meeting minutes. The RBA said that its interest rate will remain on hold for some time. There were no comments on the currency.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Building Permits, mln July 0.963 1.000

12:30 U.S. Housing Starts, mln July 0.893 0.970

12:30 U.S. CPI, m/m July +0.3% +0.1%

12:30 U.S. CPI, Y/Y July +2.1%

12:30 U.S. CPI excluding food and energy, m/m July +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July +1.9%

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Adjusted Merchandise Trade Balance, bln July -1080.8 -770.0

-

09:52

Asian stocks closed

Asian stocks rose after confidence in the U.S. housing industry climbed to the highest level in seven months and tensions eased over global political conflicts. Hong Kong shares climbed to a six-year high.

The MSCI Asia Pacific Index gained 0.7 percent to 148.99 as of 4:03 p.m. in Hong Kong, with all 10 of its industry groups rising. The gauge jumped 2.7 percent last week, the most in four months, as concern eased over global conflicts from Ukraine to Gaza and Iraq. A measure of U.S. homebuilder sentiment yesterday showed confidence rose in August, indicating the industry is making more headway as the Federal Reserve watches economic data to help gauge adjustments to monetary stimulus.

Amcor advanced 4.6 percent to A$10.75 in Sydney after reporting net income of A$564.8 million ($527.4 million), topping the A$560 million average forecast of analysts.

Terumo climbed 3.5 percent to 2,596 yen in Tokyo. Credit Suisse upgraded the shares to outperform from neutral, citing an expected improvement in profit margins at its hospital business as costs are cut.

Don Quijote slipped 3.7 percent to 5,510 yen after projecting operating profit of 34.8 billion yen for the current fiscal year. That's less than than the 37.7 billion estimate of 10 analysts surveyed by Bloomberg.

Nikkei 225 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

S&P/ASX 200 5,623.78 +36.68 +0.66%

Shanghai Composite 2,245.33 +5.86 +0.26%

-

09:35

United Kingdom: RPI-X, Y/Y, July +2.3%

-

09:32

United Kingdom: Producer Price Index - Input (YoY) , July -7.3%

-

09:32

United Kingdom: Producer Price Index - Output (MoM), July -0.1% (forecast +0.1%)

-

09:32

United Kingdom: Producer Price Index - Output (YoY) , July -0.1%

-

09:31

United Kingdom: HICP ex EFAT, Y/Y, July +1.8% (forecast +1.9%)

-

09:31

United Kingdom: Retail Price Index, m/m, July -0.1%

-

09:31

United Kingdom: Retail prices, Y/Y, July +2.5% (forecast +2.6%)

-

09:31

United Kingdom: Producer Price Index - Input (MoM), July -1.6% (forecast -0.8%)

-

09:30

United Kingdom: HICP, m/m, July -0.3%

-

09:30

United Kingdom: HICP, Y/Y, July +1.6% (forecast +1.8%)

-

09:00

Eurozone: Current account, adjusted, bln , June 13.1 (forecast 21.3)

-

08:40

European stocks start: FTSE 100 6,773.25 +32.00 +0.47%, CAC 40 4,249.07 +18.42 +0.44%, DAX 9,333.85 +88.52 +0.96%

-

06:40

Major European bourses are initially seen trading higher Tuesday, extending gains seen in the previous session. Spreadbetters are calling the FTSE up 17, the CAC up 9 and the DAX up 45.

-

06:25

Options levels on tuesday, August 19, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3441 (6169)

$1.3415 (1234)

$1.3396 (677)

Price at time of writing this review: $ 1.3357

Support levels (open interest**, contracts):

$1.3339 (1789)

$1.3322 (5110)

$1.3298 (4507)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 54616 contracts, with the maximum number of contracts with strike price $1,3400 (6169);

- Overall open interest on the PUT options with the expiration date September, 5 is 59930 contracts, with the maximum number of contracts with strike price $1,3100 (6603);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from August, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2650)

$1.6901 (2433)

$1.6804 (1695)

Price at time of writing this review: $1.6718

Support levels (open interest**, contracts):

$1.6694 (3098)

$1.6597 (1990)

$1.6499 (1848)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 27506 contracts, with the maximum number of contracts with strike price $1,7000 (2650);

- Overall open interest on the PUT options with the expiration date September, 5 is 29531 contracts, with the maximum number of contracts with strike price $1,6800 (4032);

- The ratio of PUT/CALL was 1.07 versus 1.09 from the previous trading day according to data from August, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:02

New Zealand: Expected Annual Inflation 2y from now, Quarter III +2.2%

-

03:00

Nikkei 225 15,471.15 +148.55 +0.97%, Hang Seng 25,008.95 +53.49 +0.21%, Shanghai Composite 2,242.34 +2.87 +0.13%

-