Notícias do Mercado

-

23:52

Japan: Adjusted Merchandise Trade Balance, bln, October -977.53 (forecast -1020.00)

-

23:37

Commodities. Daily history for Nov 19’2014:

(raw materials / closing price /% change)

Light Crude 74.26 -0.43%

Gold 1,181.60 -1.03%

-

23:35

Stocks. Daily history for Nov 18’2014:

(index / closing price / change items /% change)

Nikkei 225 17,288.75 -55.31 -0.32%

Shanghai Composite 2,450.99 -5.38 -0.22%

Topix 1,396.54 +1.66 +0.12%

FTSE 100 6,696.6 -12.53 -0.19%

CAC 40 4,266.19 +3.81 +0.09%

Xetra DAX 9,472.8 +16.27 +0.17%

S&P 500 2,048.72 -3.08 -0.15%

NASDAQ Composite 4,675.71 -26.73 -0.57%

Dow Jones 17,685.73 -2.09 -0.01%

-

23:28

Currencies. Daily history for Nov 19’2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2553 +0,14%

GBP/USD $1,5681 +0,31%

USD/CHF Chf0,9568 -0,14%

USD/JPY Y117,96 +0,94%

EUR/JPY Y148,07 +1,08%

GBP/JPY Y184,95 +1,25%

AUD/USD $0,8616 -1,18%

NZD/USD $0,7851 -0,89%

USD/CAD C$1,1339 +0,41%

-

23:00

Schedule for today, Thursday, Nov 20’2014:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) November 52.4 52.7

01:45 China HSBC Manufacturing PMI (Preliminary) November 50.4 50.2

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (MoM) October 0.0% -0.2%

07:00 Germany Producer Price Index (YoY) October -1.0% -0.9%

07:00 Switzerland Trade Balance October 2.45 2.57

07:58 France Manufacturing PMI (Preliminary) November 48.5 48.9

07:58 France Services PMI (Preliminary) November 48.3 48.6

08:28 Germany Manufacturing PMI (Preliminary) November 51.4 51.5

08:28 Germany Services PMI (Preliminary) November 54.4 54.5

08:58 Eurozone Services PMI (Preliminary) November 52.3 52.3

08:58 Eurozone Manufacturing PMI (Preliminary) November 50.6 50.9

09:30 United Kingdom Retail Sales (MoM) October -0.3% +0.3%

09:30 United Kingdom Retail Sales (YoY) October +2.7% +3.8%

11:00 United Kingdom CBI industrial order books balance November -6 -3

12:45 U.S. FOMC Member Tarullo Speaks

13:30 Canada Wholesale Sales, m/m September +0.2% +0.7%

13:30 U.S. Initial Jobless Claims November 290 286

13:30 U.S. CPI, m/m October +0.1% -0.1%

13:30 U.S. CPI, Y/Y October +1.7% +1.6%

13:30 U.S. CPI excluding food and energy, m/m October +0.1% +0.2%

13:30 U.S. CPI excluding food and energy, Y/Y October +1.7% +1.8%

14:45 U.S. Manufacturing PMI (Preliminary) November 55.9 56.2

15:00 Eurozone Consumer Confidence November -11 -11

15:00 U.S. Leading Indicators October +0.8% +0.6%

15:00 U.S. Philadelphia Fed Manufacturing Survey October 20.7 18.9

15:00 U.S. Existing Home Sales October 5.17 5.16

17:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks

18:30 U.S. FOMC Member Mester Speaks

-

20:00

Dow -22.27 17,665.55 -0.13% Nasdaq -23.45 4,678.99 -0.50% S&P -4.9 2,046.90 -0.24%

-

17:20

BoJ kept its monetary policy unchanged, BoJ Governor Kuroda said the last month’s decision to boost stimulus measures wasn’t a “mistake”

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen.

The BOJ board member Takahide Kiuchi said that it was appropriate to revert to the BoJ's monetary policy before the October 31 decision. The central bank decided on October 31 to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion.

The BoJ Governor Haruhiko Kuroda said at the press conference that the last month's decision to boost stimulus measures wasn't a "mistake". He added that the decision was based on assumption the government will implement the sales-tax increase.

Kuroda pointed out that the government is responsible for fiscal discipline, and not the central bank.

The BoJ governor noted that consumer price inflation could fall below 1%.

Japan's Prime Minister Shinzo Abe announced a delay in the sales-tax increase for 18 months on Tuesday, and called a snap election to take place next month. This decision was driven by recent GDP (gross domestic product) figures. Japan's economic fell back into recession. The country's gross domestic product dropped by an annual rate of 1.6% in the third quarter, after a 7.3% fall in the previous quarter.

-

17:04

European stocks close: most stocks closed higher ahead of FOMC minutes

Most stock indices closed higher ahead of FOMC minutes. Minutes from the last Federal Reserve policy meeting will be released later in the day.

Eurozone's adjusted current account surplus climbed to €30.0 billion in September from €22.8 billion in August. August's figure was revised up from a surplus of €18.9 billion. Analysts had expected a surplus of €21.3 billion.

The Bank of England (BoE) released its last meeting minutes. The BoE kept its monetary policy unchanged. Two members, Ian McCafferty and Martin Weale, voted for the fourth consecutive month to raise interest rates to 0.75% from 0.5%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,696.6 -12.53 -0.19%

DAX 9,472.8 +16.27 +0.17%

CAC 40 4,266.19 +3.81 +0.09%

-

17:00

European stocks close: FTSE 100 6,696.6 -12.53 -0.19% CAC 40 4,266.19 +3.81 +0.09% DAX 9,472.8 +16.27 +0.17%

-

16:40

Oil: A review of the market situation

The price of oil rose moderately, closer to $ 79 (Brent) and $ 75 (WTI) amid speculation that OPEC may take measures to stabilize prices, which have fallen by almost a third in five months.

It is worth emphasizing that the oil ministers of Saudi Arabia and Kuwait are opposed to the reduction of production, while Libya, Venezuela and Ecuador are insisting on the adoption of measures to prevent further price declines. OPEC oil ministers scheduled a meeting in Vienna on November 27, during which intend to consider whether to adjust the current volume of production at 30 million. B / d at the beginning of 2015.

"Agreed to reduce production will be difficult. I think that the market does not believe in it, and even if OPEC said it was ready to cut production, I think many would react skeptical, "- said a senior strategist at CMC Markets in Sydney, Michael McCarty.

Meanwhile, today the head of the Energy Information Agency of the Ministry of Energy of the United States allowed the fall of Adam Seminsky world oil prices to $ 50 per barrel. He also said that according to forecasts of most analysts, WTI crude oil falls to $ 62 per barrel by mid-2015. With oil prices at $ 60 per barrel increase in the production of shale oil in the US may stop Seminsky added. However, to accurately predict the cost of oil Seminsky not. Predict the price of oil prevented the geopolitical problems and conflicts in Libya, Iraq and other countries.

The course of trade also affected the data on oil reserves in the United States. The Department of Energy reported that commercial oil reserves in the vaults of the United States during the week of 8-14 November rose by 2.6 million barrels to 381.1 million barrels, while the average forecast assumed their fall by 1 million barrels. Stocks rose to a maximum of 4 July. Oil reserves in Cushing terminal rose to 23.2 million barrels, the highest level since May 9. Gasoline inventories rose by 1 million barrels to 204.6 million barrels. Analysts expected gasoline supplies to increase by 600,000 barrels. Distillate stocks fell by 2.1 million barrels to 114.8 million barrels, the lowest level since May 9, while analysts had expected a decrease of 1.4 million barrels.

Utilization rate of refining capacity rose to 91.2%. Earlier, analysts expected an increase in the index by 0.3 percentage points.

We also recall that yesterday after markets closed the American Petroleum Institute reported that US crude stocks rose 3.7 million barrels for the week ended November 14th. The report also showed that gasoline inventories rose by 519,000 barrels, while distillate inventories decreased by 3.3 million. Barrels.

Cost of January futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 74.70 dollars per barrel on the New York Mercantile Exchange.

January futures price for North Sea petroleum mix of Brent rose $ 0.36 to $ 78.76 a barrel on the London Stock Exchange ICE Futures Europe.

-

16:39

Foreign exchange market. American session: the U.S. dollar mixed against the most major currencies ahead of FOMC meeting minutes

The U.S. dollar mixed against the most major currencies ahead of FOMC meeting minutes.

Housing starts in the U.S. declined 2.8% to 1.009 million annualized rate in October from a 1.038 million pace in September, missing expectations for a decrease to 1.025 million. September's figure was revised up from 1.017 million units.

Building permits in the U.S. increased 4.8% to 1.008 million annualized rate in October from a 1.031 million pace in September, exceeding expectations for a rise to 1.040 million units. September's figure was revised up from 1.018 million units.

The euro traded mixed against the U.S. dollar. The euro remained supported by yesterday's better-than-expected ZEW economic sentiment index from the Eurozone.

Eurozone's adjusted current account surplus climbed to €30.0 billion in September from €22.8 billion in August. August's figure was revised up from a surplus of €18.9 billion. Analysts had expected a surplus of €21.3 billion.

The British pound traded mixed against the U.S. dollar. Earlier, the Bank of England (BoE) released its last meeting minutes. The BoE kept its monetary policy unchanged. Two members, Ian McCafferty and Martin Weale, voted for the fourth consecutive month to raise interest rates to 0.75% from 0.5%.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. The Westpac/Melbourne Institute (MI) leading index for Australia was flat in October, after a 0.1% fall in September.

The Japanese yen fell against the U.S. dollar. The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen.

The BOJ board member Takahide Kiuchi said that it was appropriate to revert to the BoJ's monetary policy before the October 31 decision. The central bank decided on October 31 to increase its monetary base target to an annual increase of ¥80 trillion, up from ¥60-70 trillion, and to boost exchange-traded fund purchases to ¥3 trillion.

Yesterday's decision by Japan's Prime Minister Shinzo Abe still weighed on yen. He announced a delay in the sales-tax increase for 18 months on Tuesday, and called a snap election to take place next month.

-

16:20

Gold: a review of the market situation

Gold prices fell markedly, while losing about 1.5 percent, due to the expectations of the Fed's publication of the protocol, as well as the approach of the Swiss referendum on gold, which is scheduled for next week.

Experts point out that if the protocols are not will signal to strengthen the tendency to tighten policy, and inflation will decline, gold is likely to continue to strengthen.

But in the short term, gold prices are likely to remain vulnerable amid signs that the strengthening US recovery could force the Fed to start raising interest rates earlier and more sharply than expected. Expectations of growth rates on loans put pressure on gold as a precious metal with difficulty competing with the yield of interest-earning assets at higher rates.

Had little effect as today's data on the US housing market. It is learned that the establishment of new homes fell 2.8% in October compared with a month earlier and to a seasonally adjusted annual rate reached 1,009,000 units. The fall was due to a decrease in construction mnogkvartirnyh homes - a category that provides a smaller contribution to economic growth, rather than single-family homes. Building permits (an indicator of future construction) increased by 4.8% last month - to the level of 1.08 million units. Economists had expected the establishment of new homes will rise by 0.8% last month, while building permits increase by 0.6%. September bookmark new homes revised up to an annual rate of 1.038 million, showing an increase of 7.8% from August. The initial reading is intended to increase by 6.3%. September building permits have not been revised and made 1.031 million units.

The value of the precious metal is also affected by the change in the US currency. Add the dollar to a basket of six major currencies rose due to falling yen to seven-year low. "It looks like it was another short covering, as the price does not hold above $ 1,200. The dollar remains the main factor affecting the price "- say experts.

The cost of the December gold futures on the COMEX today fell $ 17.7 to 1180.10 dollars per ounce.

-

15:30

U.S.: Crude Oil Inventories, November +2.6

-

15:15

U.S. housing market data was mixed in October

The U.S. Commerce Department released the housing market data today. Housing starts in the U.S. declined 2.8% to 1.009 million annualized rate in October from a 1.038 million pace in September, missing expectations for a decrease to 1.025 million. September's figure was revised up from 1.017 million units.

Building permits in the U.S. increased 4.8% to 1.008 million annualized rate in October from a 1.031 million pace in September, exceeding expectations for a rise to 1.040 million units. September's figure was revised up from 1.018 million units.

The construction of single-family homes rose 4.2% in October. Building permits for single-family homes increased 4.8% in October.

Construction of multifamily buildings dropped 15.4% in October. Permits for multi-family housing climbed 10%.

-

14:34

U.S. Stocks open: Dow 17,663.80 -24.02 -0.14%, Nasdaq 4,695.39 -7.05 -0.15%, S&P 2,049.33 -2.47 -0.12%

-

14:26

Before the bell: S&P futures -0.10%, Nasdaq futures -0.04%

U.S. stock-index futures fluctuated as data showed housing starts fell in October before the Federal Reserve releases minutes from its policy meeting.

Global markets:

Nikkei 17,288.75 -55.31 -0.32%

Hang Seng 23,373.31 -155.86 -0.66%

Shanghai Composite 2,451.17 -5.20 -0.21%

FTSE 6,700.88 -8.25 -0.12%

CAC 4,279.8 +17.42 +0.41%

DAX 9,504.35 +47.82 +0.51%

Crude oil $74.91 (+0.40%)

Gold $1197.50 (+0.03%)

-

14:09

DOW components before the bell

(company / ticker / price / change, % / volume)

3M Co

MMM

159.30

+0.00%

2.7K

Visa

V

249.75

+0.01%

1.2K

Johnson & Johnson

JNJ

108.85

+0.02%

2.7K

AT&T Inc

T

35.75

+0.08%

0.7K

United Technologies Corp

UTX

109.00

+0.18%

0.1K

International Business Machines Co...

IBM

162.20

+0.19%

2.1K

Exxon Mobil Corp

XOM

95.11

+0.25%

0.9K

Home Depot Inc

HD

96.39

+0.43%

1.7K

JPMorgan Chase and Co

JPM

60.79

+0.43%

0.9K

Chevron Corp

CVX

115.98

+0.44%

0.1K

American Express Co

AXP

90.58

0.00%

0.1K

UnitedHealth Group Inc

UNH

98.19

0.00%

0.4K

Merck & Co Inc

MRK

59.89

0.00%

0.1K

Goldman Sachs

GS

189.60

-0.02%

0.1K

Nike

NKE

96.45

-0.02%

2.0K

Wal-Mart Stores Inc

WMT

83.75

-0.05%

7.2K

Microsoft Corp

MSFT

48.71

-0.06%

11.3K

The Coca-Cola Co

KO

43.50

-0.07%

36.2K

Procter & Gamble Co

PG

87.88

-0.08%

0.7K

Verizon Communications Inc

VZ

51.18

-0.08%

0.3K

Cisco Systems Inc

CSCO

26.56

-0.13%

0.7K

Pfizer Inc

PFE

30.54

-0.16%

6.0K

Intel Corp

INTC

34.64

-0.20%

0.1K

General Electric Co

GE

26.94

-0.26%

5.8K

Walt Disney Co

DIS

89.93

-0.39%

0.5K

Boeing Co

BA

130.12

-0.41%

1.7K

-

14:01

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Home Depot (HD) target raised from $105 to $108 at RBC Capital Mkts

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450(E323mn), $1.2485(E324mn), $1.2500(E694mn), $1.2520-30(E1bn), $1.2590/00(E1bn)

USD/JPY: Y115.50($1bn), Y116.00($300mn), Y116.50($416mn), Y117.00($500mn), Y117.50($1bn)

AUD/USD: $0.8650

GBP/USD: $1.5600, $1.5700(stg263mn)

NZD/USD: $0.7900-10(NZ$400mn)

-

13:30

U.S.: Housing Starts, mln, October 1.009 (forecast 1.025)

-

13:30

U.S.: Building Permits, mln, October 1.080 (forecast 1.040)

-

13:06

Orders

EUR/USD

Offers $1.2650, $1.2600/05, $1.2580, $1.2550

Bids $1.2505/00, $1.2450, $1.2400

GBP/USD

Offers $1.5800, $1.5780/85, $1.5745/50

Bids $1.5650, $1.5620/00, $1.5580, $1.5550

AUD/USD

Offers $0.8800, $0.8760/80, $0.8750, $0.8700, $0.8675/80

Bids $0.8620/00, $0.8550, $0.8500

EUR/JPY

Offers Y149.00, Y148.50, Y148.00, Y147.80

Bids Y147.20/00, Y146.55/50, Y146.20/00, Y145.50

USD/JPY

Offers Y119.00, Y118.50, Y118.00, Y117.80

Bids Y117.20/00, Y116.85/80, Y116.50, Y116.10/00, Y115.85/80

EUR/GBP

Offers stg0.8120, stg0.8100, stg0.8066

Bids stg0.7950, stg0.7905/00, stg0.7885/75

-

13:01

Foreign exchange market. European session: the British pound rose against the U.S. dollar after the Bank of England’s minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.1% +1.2% +1.0%

06:30 Japan BOJ Press Conference

09:00 Eurozone Current account, adjusted, bln September 22.8 21.3 30.0

09:30 United Kingdom Bank of England Minutes

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November -30.7 -7.6

The U.S. dollar mixed against the most major currencies ahead of the U.S. housing market data and FOMC meeting minutes.

Housing starts in the U.S. are expected to rise to 1.025 million units in October from 1.017 million units in September.

The number of building permits is expected to increase to 1.040 million units in October from1.018 million in September.

The euro traded higher against the U.S. dollar. The euro remained supported by yesterday's better-than-expected ZEW economic sentiment index from the Eurozone.

Eurozone's adjusted current account surplus climbed to €30.0 billion in September from €22.8 billion in August. August's figure was revised up from a surplus of €18.9 billion. Analysts had expected a surplus of €21.3 billion.

The British pound rose against the U.S. dollar after the Bank of England's (BoE) minutes. The BoE kept its monetary policy unchanged. Two members, Ian McCafferty and Martin Weale, voted for the fourth consecutive month to raise interest rates to 0.75% from 0.5%.

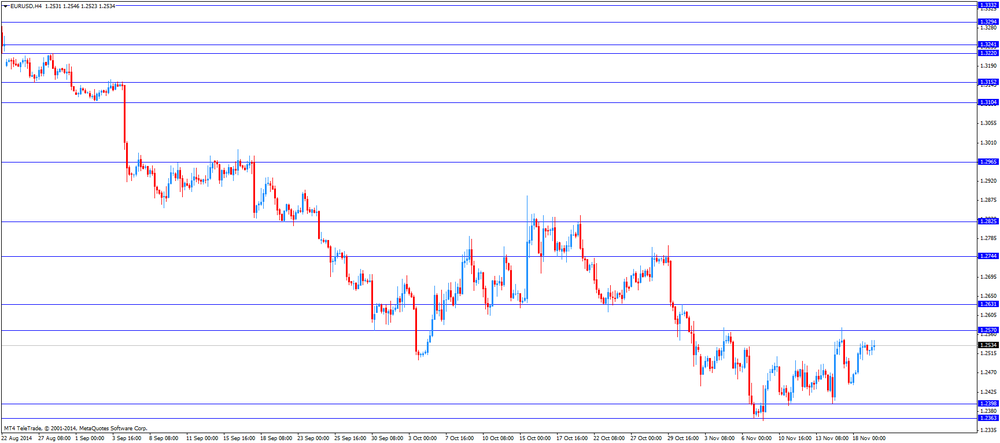

EUR/USD: the currency pair rose to $1.2547

GBP/USD: the currency pair climbed to $1.5661

USD/JPY: the currency pair increased to Y117.64

The most important news that are expected (GMT0):

13:30 U.S. Building Permits, mln October 1.018 1.040

13:30 U.S. Housing Starts, mln October 1.017 1.025

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter III -1.0% +0.3%

21:45 New Zealand PPI Output (QoQ) Quarter III -0.5% +0.2%

23:50 Japan Adjusted Merchandise Trade Balance, bln October -1070.14 -1020.00

-

12:00

European stock markets mid-session: Indices little changed after yesterday’s German sentiment boost

European stock indices are trading little changed as investors await the Federal Reserve policy meeting minutes published later in the day at 19:00 GMT. Indices were boosted yesterday after ZEW data showed growing investor confidence and Mario Draghi's comments that the ECB's stimulus program might include government bonds. The FTSE 100 is trading slightly negative after the Bank of England minutes were published and the banks policy makers voted 7-2 to leave interest rates at a record low of 0.5%.

The FTSE 100 index is currently trading -0.09% at 6,702.81 points, Germany's DAX 30 is up +0.31% trading at 9,485.88 points and France's CAC 40 gained +0.14% currently quoted at 4,268.48 points.

-

11:20

Oil: Brent Crude up – WTI down

Oil prices are mixed in today's session with Brent Crude trading +0.29% at USD78.70 a barrel and West Texas Intermediate Crude losing -0.20% currently quoted at USD74.46. Brent Crude rose after a car bomb exploded in Iraq, OPEC's second largest oil producer. Oil prices are still under pressure amid weakening global demand and the OPEC resisting calls to cut output. The OPEC with its 12 member countries responsible for 40% of world's oil production is scheduled to meet in Vienna on November 27 to discuss 2015 production target.

-

11:00

Gold steadies below two-week high at USD1,200

Gold, currently trading around the key-level of USD1200.00 a troy ounce steadied in today's session as market participants are awaiting FOMC meeting minutes for October due later in the day at 19:00 GMT for an indication on when the FED is going to increase interest rates. Gold will remain under pressure as the world's largest economy's is recovering and a stronger U.S. dollar weighs on gold.

GOLD currently trading around USD1,200.00

-

10:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2450(E323mn), $1.2485(E324mn), $1.2500(E694mn), $1.2520-30(E1bn), $1.2590/00(E1bn)

USD/JPY: Y115.50($1bn), Y116.00($300mn), Y116.50($416mn), Y117.00($500mn), Y117.50($1bn)

AUD/USD: $0.8650

GBP/USD: $1.5600, $1.5700(stg263mn)

NZD/USD: $0.7900-10(NZ$400mn)

-

10:00

Switzerland: Credit Suisse ZEW Survey (Expectations), November -7.6

-

09:50

Bank of England minutes: interest rates stay at 0.5%

The minutes released today show that the comitte voted 7-2 to keep interest rates at a record low of 0.5% and the QE program unchanged. Martin Weale and Ian McCafferty voted for a 0.25% increase in the rate to 0.75%.

-

09:20

Press Review: SNB Seen Delaying Cap Exit as Draghi Bond Purchases Loom

BLOOMBERG

SNB Seen Delaying Cap Exit as Draghi Bond Purchases Loom

Switzerland's central bank will keep its cap on the franc into 2017 to ward off the effects of the European Central Bank's unconventional measures, according to Bloomberg News's monthly survey of economists.

More than half of respondents say the SNB won't remove its ceiling on the franc of 1.20 per euro until that year or later. Just 3 of 18 expect an exit next year.

BLOOMBERG

Iraq's Biggest Oil Plant to Reopen After Militants Moved

Iraq's biggest oil refinery at Baiji is set to restart processing in about three months after government troops forced Islamic State armed militants away from the facility.

Iraqi troops will expel the militants from areas near a pipeline supplying the refinery 130 miles (209 kilometers) north of Baghdad, Colonel Khalaf al-Jabouri, a member of Iraq's anti-terror forces, said by phone. It will take about three months to restart the plant because workers have fled to other provinces, refinery units need maintenance and militants still control part of the pipeline network, according to Saad al-Azzawi, an engineer at Baiji.

REUTERS

Dollar firm as Fed minutes likely to highlight policy divergence with peers

The dollar hit a fresh seven-year high against the yen on Wednesday, and held near a 14-month peak versus sterling, as investors added favorable bets ahead of Federal Reserve minutes that could highlight policy divergence with its peers. The yen was on the defensive, falling to a six-year trough against the euro, after Japanese Prime Minister Shinzo Abe's decision to postpone a sales tax rise was seen as supportive for stock markets and negative for the yen.

Source: http://www.reuters.com/article/2014/11/19/us-markets-forex-idUSKCN0J22N820141119

-

09:01

Eurozone: Current account, adjusted, bln , September 30.0 (forecast 21.3)

-

09:00

European Stocks. First hour: European stocks trading lower after yesterday’s gains

European stocks are trading lower after yesterday's gains fuelled by good ZEW economic sentiment data. Weaker Asian Indices and mining stocks are weighing on the markets. The FTSE 100 index is currently trading lower at -0.27% at 6,690.92 points, Germany's DAX 30 is down by only -0.04% trading at 9,453.22 points and France's CAC 40 lost -0.19% currently quoted at 4,254.33 points. Markets are awaiting the release of minutes from the Bank of England scheduled for 09:30 GMT, the FED will release its minutes at 19:00 GMT.

-

08:00

Global Stocks: Dow Jones and S&P500 climbed to new record highs

The DOW Jones and S&P 500 were trading positive in Tuesday's trading session. The DOW Jones closed at 17,687.82, a plus of 0.23% and the S&P500 closed higher with a plus of +0.51% at 2,051.80 points - both indices reaching new highs on upbeat European economic sentiment and positive U.S. data.

Hong Kong's Hang Seng lost -0.69%, China's Shanghai Composite was down -0.21% closing at 2,451.17 points. Both indices lost after Monday being the first day of a new stock-exchange link between Shanghai and Hong Kong and investors continued to book profits.

Japan's Nikkei closed with a loss of -0.32% at 17,288.75 points reversing gains from early trading as investors took profits after Prime Minister Abe delayed the sales tax hike by 18 months and announced snap elections.

-

07:30

Foreign exchange market. Asian session: U.S. dollar trading weaker against euro and at new highs against Japanese yen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% .10%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.1% +1.2% +1.0%

06:30 Japan BOJ Press Conference

The U.S. dollar traded mixed against its peers during Asian Trade losing against the euro after the ZEW centre for economic research reported a much stronger-than-expected economic sentiment for Germany and the Eurozone and further comments from Mario Draghi on future economic stimulus.

The Australian dollar declined as prices for iron ore fell. Australia is a major exporter of iron ore.

The New Zealand dollar dropped against the U.S. dollar after the Fonterra Cooperative Group Global Dairy Trade auction as the price for milk powder continued to fall and yesterday's comments of New Zealand's central bank Governor Glenn Stevens that there is a risk that the currency will decline.

The Japanese yen is currently trading at USD117.35 close to a new seven-year low triggered earlier in the session against the greenback after Prime Minister Shinzo Abe called snap elections and postponed the sales tax hike. The BoJ will keep its monetary policy unchanged and will continue to increase its purchases of Japanese government bonds at an annual pace of about JPY80 trillion.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded stronger against the Japanese yen at new seven-year highs

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

09:00 Eurozone Current account, adjusted, bln September 18.9 21.3

09:30 United Kingdom Bank of England Minutes

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November -30.7

13:30 U.S. Building Permits, mln October 1.018 1.040

13:30 U.S. Housing Starts, mln October 1.017 1.025

15:30 U.S. Crude Oil Inventories November -1.7

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter III -1.0% +0.3%

21:45 New Zealand PPI Output (QoQ) Quarter III -0.5% +0.2%

23:50 Japan Adjusted Merchandise Trade Balance, bln October -1070.14 -1020.00

-

06:26

Options levels on wednesday, November 19, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2663 (4952)

$1.2613 (3586)

$1.2580 (638)

Price at time of writing this review: $ 1.2523

Support levels (open interest**, contracts):

$1.2474 (3660)

$1.2424 (6513)

$1.2357 (5383)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 100461 contracts, with the maximum number of contracts with strike pric $1,3000 (5322);

- Overall open interest on the PUT options with the expiration date December, 5 is 103738 contracts, with the maximum number of contracts with strike price $1,2500 (6513);

- The ratio of PUT/CALL was 1.03 versus 1.04 from the previous trading day according to data from November, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (646)

$1.5803 (584)

$1.5707 (824)

Price at time of writing this review: $1.5615

Support levels (open interest**, contracts):

$1.5592 (1414)

$1.5495 (880)

$1.5397 (864)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 38725 contracts, with the maximum number of contracts with strike price $1,6000 (2007);

- Overall open interest on the PUT options with the expiration date December, 5 is 39154 contracts, with the maximum number of contracts with strike price $1,5900 (2304);

- The ratio of PUT/CALL was 1.01 versus 1.06 from the previous trading day according to data from November, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:51

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

03:50

Japan: Bank of Japan Monetary Base Target, 275 (forecast 275)

-

02:01

Nikkei 225 17,400.77 +56.71 +0.33%, Hang Seng 23,479.39 -49.78 -0.21%, S&P/ASX 200 5,390.6 -9.09 -0.17%, Shanghai Composite 2,451.41 -4.95 -0.20%

-