Notícias do Mercado

-

21:58

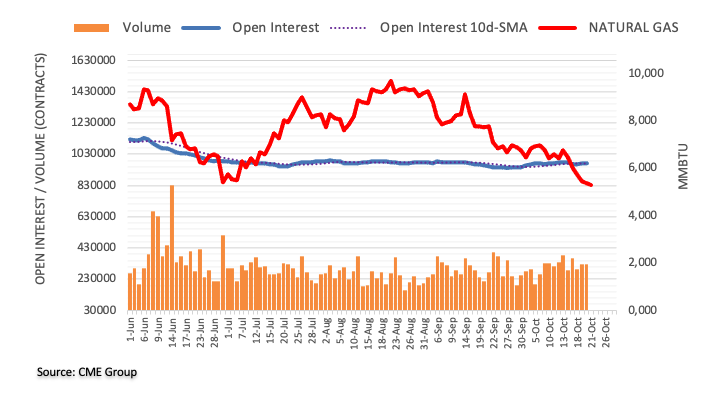

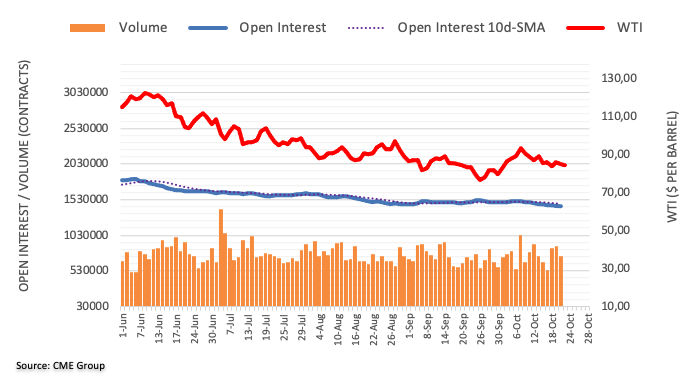

WTI turns positive, hovering around $85.00 a barrel as the US Dollar tumbles

- Western Texas Intermediate (WTI) s set to finish the week with losses of 0.55%.

- China’s demand and a soft US Dollar underpinned oil prices.

- WTI buyers unable to crack the 50-day EMA keeps the commodity downward biased.

WTI is about to finish Friday’s trading session almost flat, as Wall Street ended the day with hefty gains amidst hopes of a Fed pivot, as wires mentioned Fed officials debating to slow the pace of rate increases following November’s meeting. At the time of writing, WTI is trading at $85.17 a barrel, up by a minimal 0.19%.

WTI trimmed earlier losses courtesy of a soft US Dollar and China’s demand

Given that the Fed would diminish its aggression, the greenback fell, a tailwind for the US Dollar denominated commodity. US Treasury yields retraced their earlier gains, undermining the buck, which, as shown by its US Dollar Index, fell 0.88%, down at 111.865, after hitting a YTD high of 113.942.

Aside from this, oil prices increased in choppy trading on the likelihood of China’s more robust demand. News that the country might ease quarantine restrictions for visitors abroad from 10 to 7 days spurred a jump in oil prices.

The Organization of Petroleum Exporters Countries (OPEC) and its allies decided to cut oil production amidst the weakened global economic outlook, threatening to tip the largest economies into a recession. OPEC+ drew 2 million barrels daily, in a widely criticized decision by the White House, which reacted negatively to the decision.

WTI Price Forecast

Western Texas Intermediate (WTI) recovered some ground during the day and is clinging to the 20-day Exponential Moving Average (EMA) at $85.13 PB as volume dry. In the week, the US crude oil benchmark could not trade above its 50-day EMA at $86.80, meaning that risks remain skewed to the downside.

Therefore, WTI’s first support would be the October 18 daily low at $82.10, followed by the September 30 swing low at $79,16, and then a re-test of the YTD low at $76.28.

-

21:02

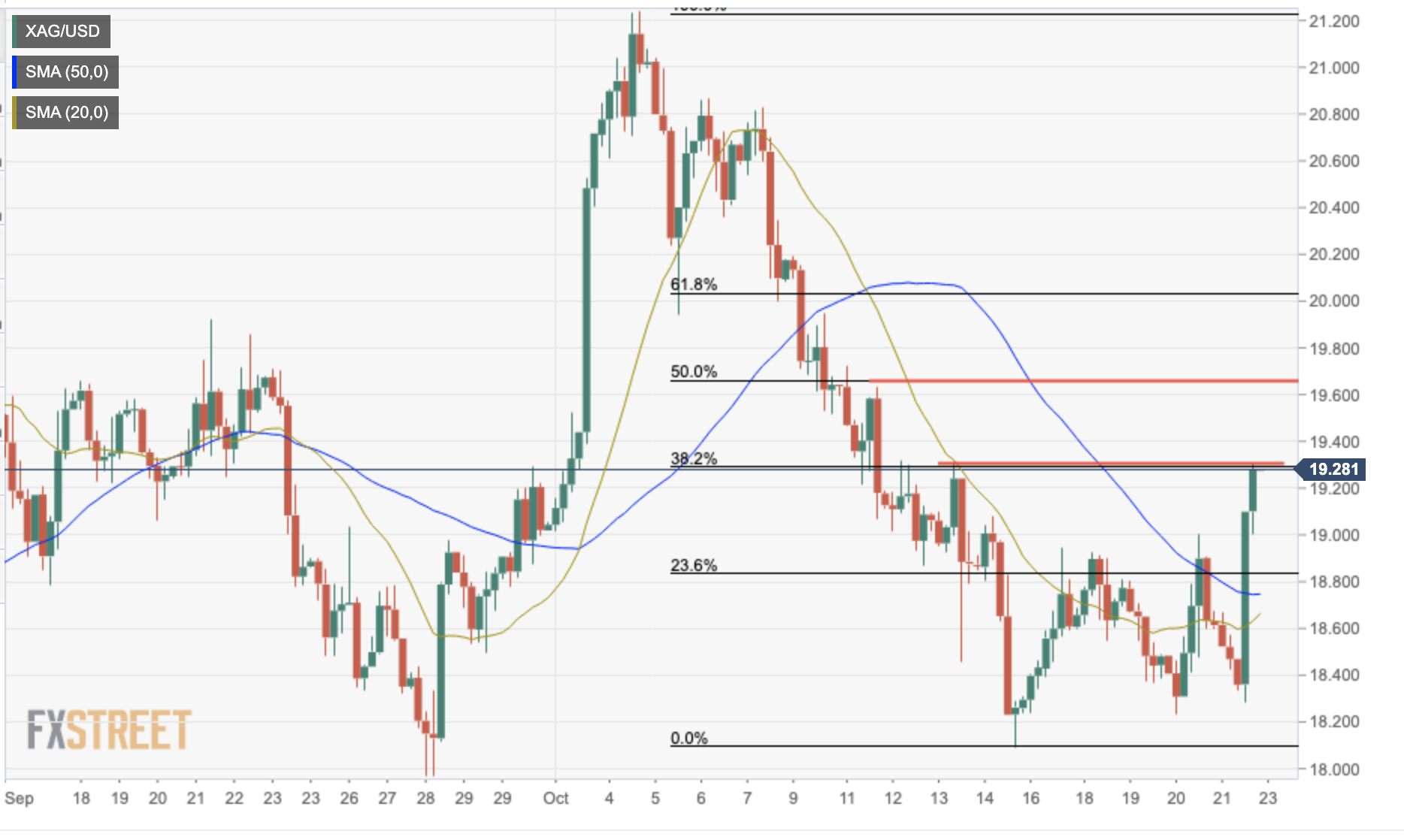

Silver Price Analysis: XAG/USD strengthens and rallies past $19.00

- Silver prices extend recovery to reach levels beyond $19.00.

- The US dollar dives on Fed easing speculation.

- XAG/USD is now at a key resistance area of $19.30.

Silver prices have extended Thursday’s rebound from $18.30 lows on Friday, breaking beyond $19.00 and reaching one-week highs at $19.30 so far. The precious metal appreciates more than 3% on the day, retracing half of the ground lost on the previous week’s sell-off.

Precious metals appreciate against a softer USD

A news report by the Wall Street Journal has suggested Federal Reserve officials are open to debate on how to signal a smaller rate hike in December. This has offset the positive impact of the bank’s representative’s hawkish rhetoric and sent the US dollar tumbling across the board.

Furthermore, an alleged intervention by the Bank of Japan and the Japanese Finance Ministry has sent the yen surging across the board. The USD/JPY plunged more than 2.5%, as a consequence, and weighed the US dollar across the board.

XAG/USD pushing against key resistance at $19.30

From a technical perspective, the pair is now testing the resistance area at $19.30 (Oct. 13 high and the 38.7% Fib. Retracement of the October 4-10 decline). Above here, the next potential targets are $19.65 (50% retracement and Oct. 11 high) and the $20.00 level.

On the downside, below the $19.00 previous resistance area, the next potential targets could be the 20-period SMA in the 4-hour chart, now at $18.60, and October 14 low at $18.08.

XAG/USD 4-hour chart

Technical levels to watch

-

21:00

European Monetary Union CFTC EUR NC Net Positions increased to €48.1K from previous €37.5K

-

21:00

United Kingdom CFTC GBP NC Net Positions: £-51.2K vs previous £-39.2K

-

21:00

United States CFTC Gold NC Net Positions: $77K vs previous $94.4K

-

21:00

Australia CFTC AUD NC Net Positions declined to $-35.4K from previous $-31.3K

-

21:00

United States CFTC S&P 500 NC Net Positions down to $-223.2K from previous $-164.1K

-

21:00

United States CFTC Oil NC Net Positions declined to 251.5K from previous 259.2K

-

21:00

Japan CFTC JPY NC Net Positions: ¥-94.3K vs previous ¥-77.4K

-

20:18

NZD/USD rushes up to the 0.5750 area as the US dollar loses ground

- The kiwi bounces up at 0.5610 and rallies to 0.5755.

- The US dollar drops amid Fed easing speculation.

- NZD/USD is unlikely to consolidate above 0.5750 – UOB.

The New Zealand dollar bounced up strongly at 0.5610 on Friday’s early US session to hit fresh two-week highs at 0.5765, favored by a broad-based US dollar weakness.

Fed easing speculation hits the US dollar

A news report by the Wall Street Journal published earlier on Friday has suggested that Fed officials would be open to debating the size of future hikes, pointing out to a step back on the tightening cycle in December has hammered the US Dollar.

The WSJ report offsets the positive impact of recent hawkish comments by Fed officials. Only on Thursday, Patrick Harker, The Philadelphia Fed President affirmed that the bank will "keep raising rates for a while."

Furthermore, a suspected intervention by the Japanese authorities has sent the yen surging across the board. The USD/JPY, as a result, has plunged more than 2.5% in a matter of minutes, which has reverberated on all USD crosses.

NZD/USD: More consolidation ahead– UOB

Analysts at UOB expect the pair to remain trading sideways over the next weeks, with upside attempts capped below 0.5755: “We highlighted yesterday that NZD ‘could rise above 0.5725 but a sustained advance above this level still appears unlikely’(…) “Our update from two days ago (18 Oct, spot at 0.5675) still stands. As highlighted, NZD appears to have moved into a consolidation phase and is likely to trade between 0.5570 and 0.5755 for the time being.”

Technical levels to watch

-

19:33

USD/CHF Price Analysis: Seesawed in a 200-pip range, hovers around parity amid a soft US Dollar

- USD/CHF is set to finish the week with losses of 0.45%.

- Failure to reclaim 1.0027 would confirm the USD/CHF rising wedge break, which would target the 200-day EMA at 0.9567.

USD/CHF retraces from daily highs reached in the North American session around 1.0147 but trimmed its gains, plunging below 1.0000 towards its daily low at 0.9961, as the Japanese government and the Bank of Japan (BoJ) recognized intervening in the FX markets, propelling the yen a headwind for the USD/CHF. At the time of writing, the USD/CHF is trading at 1.0003, clinging to parity.

USD/CHF Price Forecast

The USD/CHF daily chart illustrates the pair broke above the top-trendline of a bearish rising wedge, though retraced within, on the BoJ intervention. As the BoJ hit the greenback, the USD/CHF tumbled below the bottom-trendline of the rising wedge, opening the door for further losses. Albeit the USD/CHF trimmed some of its losses, the major remains below the previously-mentioned trendline. So further downward action is warranted.

Therefore, the USD/CHF first support would be the parity. Break below will immediately expose the October 21 daily low at 0.9961, followed by the 20-day Exponential Moving Average (EMA) at 0.9928, ahead of 0.9900.

On the other hand, if the USD/CHF reclaims 1.0027, it would exacerbate a re-test of 1.0100, as buyers target the YTD high at 1.0147.

USD/CHF Key Technical Levels

-

19:33

AUD/USD’s rally from 0.6210 stalls below 0.6380

- The aussie bounces up from 0.6210 and erases the previous two days' losses.

- Fed speculation and BoJ intervention hit the USD.

- AUD/USD is expected to remain capped below 0.6390.

The Australian dollar has featured a strong recovery on Friday’s US trading session. The pair bounced up from session lows at 0.6210, rallying all the way to levels right below 0.6380 and retracing the last two day’s decline.

The USD dives on Fed speculation and BoJ intervention

A news report by the Wall Street Journal suggested earlier on Friday that Federal Reserve officials are open to discussing how to signal a smaller rate hike in December which has hurt demand on the USD across the board.

The report has offset the impact of the hawkish rhetoric of Fed members. Just on Thursday, the Philadelphia Fed President Patrick Harker assured that the bank will "keep raising rates for a while."

Furthermore, an alleged intervention by the Bank of Japan and the Japanese Finance Ministry has pushed the yen higher across the board. The USD has tumbled more than 2.5% in a matter of minutes, which has hit all US dollar crosses.

AUD/USD unlikely to appreciate past 0.6390 in the near term – UOB

From a longer-term perspective, FX analysts at UOB remain skeptical about the possibility of a sustained uptrend: “Our latest narrative from Tuesday (18 Oct, spot at 0.6295) still stands. As highlighted, AUD is likely to consolidate and trade between 0.6190 and 0.6390 for the time being.”

Technical levels to watch

-

19:04

GBP/USD's reversal from 1.1300 finds support at 1.1200

- The pound remains steady above1.1220.

- Weak UK data and political uncertainty are weighing on the GBP.

- GBP/USD, approaching the tip of a triangle pattern.

The pound failed on its assault to 1.1300 earlier on Friday, although the ensuing reversal has found support at 1.1220 and the pair picked up again to the 1.1250 area. The GBP/USD remains moderately positive on the day in track to regain the previous two day’s losses.

UK's weak economic prospects are hurting the pound

Retail consumption contracted by 1.4% in September, well above market expectations of a 0.5% decline, and was 6.9% lower from the same month last year, according to data reported by National Statistics released earlier on Friday.

The impact of these figures, which have confirmed fears of an upcoming recession in the UK and have been coupled with political uncertainty, as the Tory party hustles to find a replacement for Liz Truss, which has increased negative pressure on the pair.

GBP/USD approaching the tip of a triangle formation

From a technical point of view, the daily chart shows the pair approaching the tip of a symmetrical triangle pattern with trendline resistance at 1.1325, and the next potential resistance levels at 1.1430 (50-day SMA) ahead of October 4 and 5 highs at 1.1510.

On the downside, the base of the triangle lies now at 1.1080. Below here, bears might increase confidence and send the pair to 1.0920 (October 12 low) and then probably to 1.0540 (September 28 low)

GBP/USD daily chart

Technical levels to watch

-

18:59

United States Baker Hughes US Oil Rig Count climbed from previous 610 to 612

-

18:42

AUDJPY Price Analysis: Plunges from monthly highs, struggles to reclaim the 100-DMA

- AUD/JPY retraces from weekly highs, set to end the week with minimal losses of 0.07%.

- Japanese authorities intervened in the FX market to bolster the Japanese yen.

- AUD/JPY Price Forecast: From the daily, the pair is neutral-to-upwards, but short term, is range-bound, so caution is warranted.

The AUD/JPY seesawed in a wide range following Japanese authorities’ intervention in the FX markets. The risk-perceived cross pair hit a daily high at around 95.73 before plunging toward its daily low at 93.08. At the time of writing, the AUD/JPY is trading at 93.80, below its opening price by 0.49%.

AUD/JPY Price Forecast

Friday’s session was volatile, and the AUD/JPY shifted its bias from neutral upwards to neutral, as flashed by the daily chart. When the pair fell from daily highs, it hurdled the 50 and 100-day Exponential Moving Averages (EMAs), each at 94.57 and 94.20, exposing the 20-day EMA. Worth noting that the AUD/JPY pierced the latter around 93.22 but rebounded towards current exchange rates, keeping the pair range-bound.

Due to market participants bracing for the weekend, the lack of catalyst might keep the AUD/JPSD trading within the boundaries imposed by the daily EMAs. Therefore, key resistance lies at the 100 and 50-EMAs at 94.20 and 94.57, ahead of the 95.00 figure. On the flip side, the AUD/JPY first support would be the 20-day EMA at 93.22, ahead of the weekly low at 93.08.

AUD/JPY Daily Chart

Short term, the AUD/JPY hourly chart, lacks direction, so traders better be on the sidelines until the dust settles. For the restless ones, the AUD/JPY first resistance is the daily pivot point at 94.27, followed by the 95.00 figure, ahead of the R2 pivot level at 95.16. On the flip side, the AUD/JPY key support levels would be the 94.00 figure, followed by the S1 daily pivot at 93.86, ahead of the 200-EMA at 93.18.

AUD/JPY Hourly Chart

AUD/JPY Key Technical Levels

-

18:11

USD/CAD tumbles below 1.3700 as the US Dollar gets battered

- USD/CAD drops as Japanese authorities confirmed an intervention, selling US Dollars.

- San Francisco Fed Mary Daly said further tightening is needed while laying the ground for lower rate hikes.

- Canada’s Retail Sales in August exceeded estimates, contrarily for September, with expectations at -0.5%.

The USD/CAD tumbled from around daily highs of 1.3850 towards the 1.3660s area as US Treasury bond yields dropped on news that Fed officials are looking to slow the pace of interest-rate increases at December’s meeting. Additionally, speculation of Japanese authorities intervening mounted as the USD/JPY tumbled from 151.60 to its daily low of 147.16. At the time of writing, the USD/CAD is trading at 1.3662.

US equities are trading in the green as a Fed pivot lurks. An article in the WSJ commented that Fed officials are assessing the size of December’s rate hike, as a 75 bps in November is most likely. Echoing those comments, San Francisco Fed President Mary Daly said that more tightening is needed while adding that “we (Fed) don’t just keep going up at 75 bps increments” on Friday. She noted that slowing rates should be considered “at this point.”

On Thursday, Philadelphia Fed President Patrick Harker and Fed’s newest board member Lisa Cook said the Fed would need to keep hiking interest rates. He added that he is “disappointed with the lack of progress curtailing inflation” and expects rates to be above 4% in 2023.

The absence of Us economic data left traders adrift in Thursday’s releases. US economic data, namely, unemployment claims, rose less than estimates, flashing the tightness of the labor market. Additionally, the Philadelphie Fed Manufacturing Index improved in October but was below estimates, hovering below zero for 5 consecutive months.

On the Canadian side, the calendar featured Retail Sales, which increased by 0.7% in August, above 0.2% estimates, while estimates for September are down 0.5%. Also underpinning the Canadian dollar was oil prices, with WTI up 0.09% at $85.25 a barrel, on higher demand by China and OPEC and its allies cuts.

USD/CAD Key Technical Levels

-

18:03

GBP/JPY plunges from 169.50 area to session lows below 165.00

- The pound retreats to levels below 165.00 on an alleged BoJ intervention.

- The Japanese authorities have declined any comment.

- FX analysts are skeptical about the effectiveness of monetary interventions.

The British pound has depreciated more than 2.5% in a few minutes during Friday's US trading session in what seems like an intervention by the Japanese authorities to protect the yen.

The GBP/JPY was trading at 169.50, at a short distance to a six-year high of 170.25 before plummeting to session lows at 164.70. The pound’s bearish reversal has lacked any fundamental catalyst, and all signs point out to an alleged action by the Bank of Japan and the Ministry of Finance.

The Japanese Ministry of Finance has declined to comment on the issue.

Earlier during the week, however, BoJ officials and Japanese authorities reiterated their commitment to step in to curb yen volatility. On Friday, Finance minister Suzuki affirmed that Japanese authorities were dealing with currency speculators “strictly”.

On Thursday, Masato Kanda, Japan’s vice minister of finance for international affairs assured that the Japanese Government is ready to take action “as excessive volatility becomes increasingly unacceptable.”

Currency analysts are doubtful about the effectiveness of such actions while the fundamental reasons are adverse. The monetary policy differential between a hawkish Federal Reserve and the ultra-accommodative Bank of Japan is clearly favorable to the US dollar.

Technical levels to watch

-

17:32

ECB: We have significantly increased our rate expectations through 2023Q1 – Rabobank

A key event next week is the European Central Bank meeting. According to analysts from Rabobank, a 75 basis points interest rate hike is a done deal. They see the deposit rate reaching 3% by March next year.

Key Quotes:

“The inflation outlook continues to deteriorate, with a strong acceleration in underlying price pressures. This cements a 75bp hike this month. Moreover, it is difficult to see how core inflation could come in below 3% in 2024.”

“President Lagarde will have to acknowledge additional inflationary risks, but we expect her to stick to the narrative that the ECB is merely ‘frontloading’ normalisation.”

“A 75bp rate hike in October seems like a done deal. We have also upgraded our expectations for the next few meetings, and now see the deposit rate reach 3% by March.”

“With a 75bp increase next week and the prospect of another jumbo hike in December, it is debatable whether the ECB’s tightening cycle can still be considered as ‘frontloading’, or whether this catchphrase will suffer the same fate as ‘transitory’ did earlier this year. We would argue the latter, but with the ECB sticking to its meeting-by-meeting approach, we don’t expect President Lagarde to discontinue ‘frontloading’ as descriptor of next week’s hike.”

-

17:28

EUR/JPY plunges below 145.00 on an alleged BoJ intervention

- The euro plunges from a seven-year high of 148.25 to 144.75.

- All signs point out to a BoJ intervention.

- Volatility levels soar in all yen crosses.

The euro plummeted about 2.5% in a matter of minutes during Friday’s North American trading session on suspected intervention by the Japanese economic authorities. The pair retreated from seven-year highs at 148.25 to 144.75 area at the time of writing

In the absence of any relevant fundamental element to justify the move, all signs point out to a market intervention By the Bank of Japan and the Ministry of Finance to protect the Japanese currency.

Different officials of the Bank of Japan had been reiterating the Japanese authorities’ commitment to step in as the yen declined to fresh multi-year lows against its main peers. On Thursday Masato Kanda, a top currency diplomat assured that the Japanese Government is ready to take action “as excessive volatility becomes increasingly unacceptable.”

Currency analysts, however, remain skeptical about the effectiveness of currency interventions while the fundamental reasons keep underpinning dollar demand, especially with the monetary policy differential between the Federal Reserve and the Bank of Japan.

Technical levels to watch

-

16:50

US: Economy likely rebounded in Q3, still seen a mild recession next year – Wells Fargo

Next week, on Thursday the first estimate of US Q3 GDP growth data will be released. Analysts at Wells Fargo forecast the economy expected at an annualized rate of 2.8%, after two negative quarters. They still see a recession next year.

Key Quotes:

“After two consecutive quarters of negative growth, we forecast the U.S. economy expanded at an annualized rate of 2.8% in the third quarter.”

“We anticipate underlying demand measures remained solid, and we have bumped up our forecast for real personal consumption expenditures (PCE) on the recent retail sales data for September. We now look for real PCE to rise at a 0.8% annualized pace in Q3 (+0.6% previously). Higher consumption suggests modestly more import growth as well, though net exports still look to provide a considerable boost of over three percentage points to the headline GDP figure as import growth still broadly reversed during the quarter.”

“We still anticipate a mild recession to take place next year. But as we detail in our latest monthly report, recent momentum makes the start of recession by the beginning of the year less likely. We now see a downturn happening a bit later, beginning in the second quarter rather than the first.”

-

16:43

EUR/USD's recovery extends beyond 0.9800 as the US dollar loses momentum

- The euro picks up and returns to levels above 0.9800.

- Speculation about a shorter Fed hike in December has hit the USD.

- EUR/USD seen declining to 0.9300 in Q1 2023 – Nordea.

The euro has shrugged off the previous sessions' weakness during Friday’s US trading. The pair has regained lost ground after bouncing at 0.9705 lows earlier today and is struggling to consolidate above 0.9800 at the moment of writing.

The US dollar dives with all eyes on the Fed

A news report by the Wall Street Journal pointed out on Friday that Federal Reserve officials are likely to open a debate on how to signal a smaller rate hike in December. The US dollar has reacted with a sharp reversal from session highs.

The US Dollar index, which measures the value of the US dollar against a basket of the world’s most traded currencies, has plummeted more than 1%, from three-week highs near 114.00, to the mid-range of 112.00.

WSJ’s report has offset the positive impact on the US dollar generated by the hawkish tone of the Fed officials' recent comments. Philadelphia Fed President Patrick Harker reiterated on Thursday that the bank will "keep raising rates for a while."

Beyond that, initial jobless claims increased below expectations last week, according to data released on Thursday, confirming the tight labor market conditions and paving the path for the Fed to maintain its aggressive tightening cycle.

EUR/USD, seen bottoming at 0.9300 during Q1 2023 – Nordea

Currency analysts at Nordea expect the euro to continue depreciating to hit 0.9300 in 2023: “We believe the USD will continue to do well in the months to come due to the hawkish Fed conducting the fastest rate hikes in decades, a resilient US economy, and USD’s safe haven in these troubling times. This will bring EUR/USD to 0.93 during Q1.”

Technical levels to watch

-

16:36

Canada: Retail sales above forecasts in August, but trend is still failrly sluggish – CIBC

Data released on Friday showed a higher-than-expected increase in August retail sales. Analysts at CIBC, point out that while headline figures came in above consensus expectations, there were hints within the detail suggesting that while Canadian consumers are surviving, they are no longer thriving.

Key Quotes:

“Retail sales posted a rebound of 0.7% (consensus +0.2%) after declining by 2.2% in the prior month. In volume terms, sales were up by an even healthier 1.1%, although that reversed only about half of the decline seen in the previous month. The big driver of higher sales in August was food & beverage stores, which could signal that consumers are once again eating at home more often than eating out.”

“Released alongside the retail sales figures today, the advance estimate for wholesale sales in September suggested a modest decline of 0.2%.”

“Retail sales were somewhat stronger than expected in August, although the trend is still fairly sluggish. The higher than expected print, combined with an upside surprise for August wholesale sales released last week, puts some upward pressure on forecasts for monthly GDP next week (flash estimate was 0.0%) and by extension Q3 as a whole.”

-

16:15

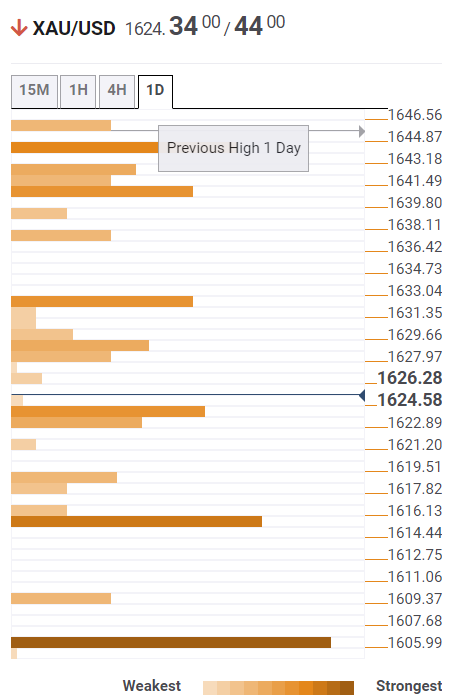

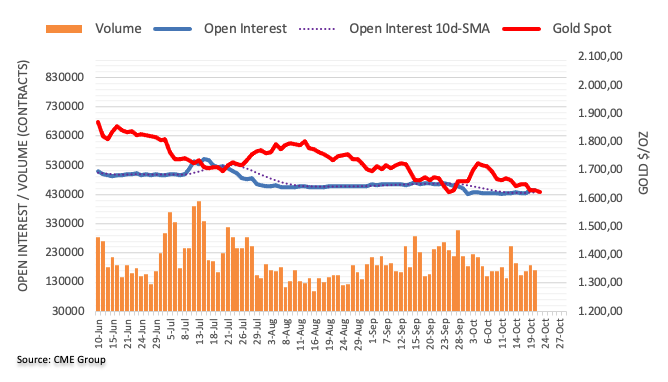

Gold Price Forecast: XAU/USD rises on speculation a Fed pivot lurks, US bond yields fall

- Gold price advances almost 1% as the market speculates on a Fed pivot, spurred by a WSJ article.

- US T-bond yields dropped, underpinning the gold price, which bounced off the month’s lows.

- Gold Price Forecast: The downtrend remains intact, though a break above $1650 would send gold to $1665.

Gold price rebounds from monthly lows around $1617, advancing steadily towards the $1640s region as US Treasury yields drop on an article published by the Wall Street Journal (WSJ), which mentioned that Fed officials are split about December’s rate hike, as November increase to the Fed funds rate (FFR) 75 bps, is utmost certain.

Gold advances as Fed officials debate December’s rate hike

Additionally, the WSJ article noted that policymakers are weighing whether to hike rates at a slower pace in December, namely 50 bps, though fears of being perceived as a “Fed pivot” could trigger a rally in equities, which according to the article, is not the case. Instead, Fed officials are adjusting the pace of rate increases as they try to cool down inflation. Once the article was published, US equities rallied, and US bond yields retraced, a tailwind for the gold price, as it printed a fresh monthly low early in the session.

The US 10-year T-bond yield is gaining two bps, up at 4.250%, well below the YTD high of 4.338%, a level last seen before the global financial crisis in 2007. Also, US real yields retreated from 1.838% to 1.706% as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) bond yield, giving a respite to the yellow metal holders.

Fed officials reiterated the need to further action, as inflation remains high

Friday’s absence of US economic data to be reported left market participants leaning to further Fed commentary. On Thursday, a slew of Fed speakers, namely, the Philadelphia Fed President Patrick Harker and Fed board member Lisa Cook commented that the Fed would need to keep increasing rates. Harker commented that he is “disappointed of the lack of progress curtailing inflation,” while he added that he expects rates to be above 4% in 2023.

The US Dollar Index is dropping like a stone, from around 113.94 to 112.90, as speculations of an intervention in the USD/JPY increase, due to the broad trading range depicted by the hourly chart.

Gold Price Forecast

The daily chart shows that the XAU/USD is still downward biased, though it remains close to the YTD lows of $1614.92. The daily Exponential Moving Averages (EMAs) keep their bearish slope, trading well above the spot price, while the Relative Strength Index (RSI) at 39.86, although it’s aiming higher, remains in bearish territory. Hence, sellers remain in charge, though getting a respite, as the yellow metal prepares to prolong its losses for back-to-back weeks. If XAU/USD breaks $1650, a test of the 20-day EMA is on the cards; otherwise, it will remain exposed to re-test the YTD lows.

-

15:58

USD/JPY collapses below 150.00, intervention?

- Japanese yen soars suddenly across the board on potential intervention.

- Volatility at extreme levels in JPY crosses.

- USD/JPY falls 300 pips from the top, find support so far around 149.00.

The USD/JPY lost three hundred pips during the last minutes rising suspicion of an intervention from Japanese authorities. The pair rose to as high as 151.92 earlier on Friday, the highest level since August 1990 and it has recently dropped below 149.50.

The Bank of Japan and the Finance Minister could be behind the dramatic decline. The pair is now negative for the day and it could post the first decline in more than two weeks.

Analysts doubt about how successful could be an intervention while fundamental conditions remain the same with and ultra-accommodative Bank of Japan and the Federal Reserve rising aggressively interest rates.

Volatility at current times is at extreme level in USD/JPY, with the pair moving more than 30 pips by the minute.

USD/JPY technical levels

-

15:49

AUD/USD rebounds above 0.6300 as USD slides

- Dollar loses momentum late on Friday after WSJ report.

- AUD/USD rises from multi-day lows to 0.6330.

The AUD/USD turned positive for the day after rebounding more than a hundred pips from four-day lows. The pair rose from near 0.6200 to 0.6333, hitting a fresh daily high on the back of a weaker dollar.

The greenback pulled back across the board following a report from WSJ mentioning a debate at the upcoming FOMC meeting on how to continue rising interest rates. The DXY moved off highs and trimmed daily gains. The report also boosted equity prices in Wall Street, also helping commodity prices.

Despite the sharp moves in AUD/USD, it continues to move in ranges between 0.6340 and 0.6200. A firm break above 0.6350 should open the doors to more gains in the very short term.

AUD/USD 4-hour chart

-

15:34

United States Monthly Budget Statement fell from previous $-220B to $-430B in September

-

15:05

FX intervention could lead to an even strong dollar down the road – Nordea

Is global intervention on the cards to weaken the US Dollar? Economists at Nordea do not think so and see an even stronger USD ahead.

Uncoordinated FX intervention will not stop the USD rally

“The FX intervention whereby countries are actively intervening to prop up their currencies against the USD may dampen the strengthening of the USD in the short to medium-term. But countries do not have an endless amount of USD at disposal to sell, meaning that the FX intervention will fail when their USD coffers run dry.”

“FX intervention involves selling of US Treasuries, which adds upwards pressure on US rates and leads to a stronger USD in isolation. This FX intervention USD doom-loop could lead to dollar overshooting – especially when several central banks are enforcing the loop.”

-

15:01

European Monetary Union Consumer Confidence registered at -27.6 above expectations (-30) in October

-

14:46

USD/JPY retreats after hitting fresh 32-year peak. Still well bid around mid-151.00s

- USD/JPY builds on the breakout rally beyond 150.00 and surges to a new 32-year high.

- The Fed-BoJ policy divergence, widening US-Japan rate differential weighs on the JPY.

- Hawkish Fed expectations, elevated US bond yields lift the USD and remain supportive.

The USD/JPY pair adds to its strong intraday gains and continues scaling higher through the early North American session. The momentum, however, stalls ahead of the 152.00 round-figure mark and spot prices quickly retreat to mid-151.00s in the last hour.

The Japanese yen has been the worst-performing G10 currency and has depreciated over 30% against the US dollar since the beginning of this year. A big divergence in the monetary policy stance adopted by the Bank of Japan and the Federal Reserve turns out to be a key factor behind the USD/JPY pair's bullish move.

In fact, the BoJ remains committed to continuing with its monetary easing and so far, has shown no inclination to hike interest rates from ultra-low levels. Furthermore, the Japanese central bank announced emergency bond-buying worth $667 million to keep the yields on the Japanese Government Bonds below 0.25%.

In contrast, the yield on the benchmark 10-year US Treasury note hits its highest level since the 2008 financial crisis amid expectations for a more aggressive policy tightening by the Fed. This results in the widening of the US-Japan rate differential, which, along with resurgent US dollar demand, boosts the USD/JPY pair.

Apart from this, Friday's strong rally could also be attributed to some technical buying following the overnight breakout through the 150.00 psychological mark. That said, reports that the Fed could debate on whether and how to signal plans to approve a smaller increase in December prompts some USD selling and caps the USD/JPY pair.

Moreover, extremely overstretched technical indicators on short-term charts warrant some caution and might hold back bullish traders from placing fresh bets. Nevertheless, the USD/JPY pair remains on track to register its 10th straight weekly advance as the focus now shifts to the BoJ monetary policy meeting on October 28.

Technical levels to watch

-

14:41

GBP/USD gearing towards a retest of last week’s low at 1.0925 – Scotiabank

GBP/USD has declined to weekly lows. In the view of economists, the pair is set to retest last week’s low at 1.0925.

Closing above 1.11 will be positive

“GBP/USD has been flirting with minor trend support (1.1260, now resistance) over the past couple of sessions and weakness below that trend now is yielding some significant declines in the short-term chart.”

“Holding above 1.11 on the close will be positive – but, after a couple of failures in the upper 1.14s, the main risk for the pound appears to a gearing towards a retest of last week’s low at 1.0925.”

-

14:24

EUR/USD eyes next support at 0.9720 amid renewed weakness – Scotiabank

The euro cannot resist the dollar’s advance. Economists at Scotiabank highlight the key technical levels to watch.

Technical pattern of trade has been consistent in the past few months

“Since the middle of the year, EUR rebounds have been limited to the 40-Day Moving Average – or levels close to that – ahead of renewed weakness and new cycle lows. So far this week, that pattern is holding, with the EUR capped in the upper 0.98s (40-DMA at 0.9878 today) and turning soft subsequently. New cycle lows remain some way off, however (below 0.95).

“In the short-run, we see support at 0.9720 and 0.9675/80 below there.”

“Resistance intraday is 0.9800/10.”

-

14:17

EUR/USD Price Analysis: Another visit to the October low appears likely

- EUR/USD comes under pressure and puts 0.9700 to the test.

- Further south emerges the October low near 0.9630.

EUR/USD accelerates losses and flirts with the key 0.9700 neighbourhood at the end of the week.

In case losses accelerate and the pair breaches 0.9700, then the next significant support is expected to appear at the October low at 0.9631 (October 13). Once cleared, there are no contention levels of note until the 2022 low at 0.9535 (September 28).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0536.

EUR/USD daily chart

-

14:16

Fed to debate on whether and how to signal plans for a smaller increase in December - WSJ

Federal Reserve officials are barreling toward another interest-rate rise of 75 bps at their meeting in November and are likely to debate then whether and how to signal plans to approve a smaller increase in December, writes Nick Timiraos - chief economics correspondent at The Wall Street Journal.

Timiraos highlights a divide in the Fed, with few officials signalling greater unease with big rate rises to fight inflation. Some Policymakers also want to stop raising rates early next year to see how their moves this year are slowing the economy and to reduce the risk of causing an unnecessarily sharp slowdown.

The markets react positively to the article, which is evident from a goodish recovery in the equity markets, forcing the safe-haven US dollar to trim a part of its intraday gains.

-

13:41

GBP/USD dives to fresh weekly low, eyes 1.0500 amid broad-based USD strength

- A combination of factors prompts aggressive selling around GBP/USD on the last day of the week.

- The dismal UK macro data weigh on sterling and exert pressure amid resurgent USD demand.

- Aggressive Fed rate hike bets continue to push the US bond yields higher and underpin the buck.

- Diminishing odds for a full 100 bps BoE rate hike in November support prospects for further losses.

The GBP/USD pair continues losing ground through the early North American session and dives to a fresh weekly low, around the 1.1060-1.1065 region in the last hour.

The sentiment surrounding the British pound remains bearish amid growing worries about a deeper economic downturn and the cost-of-living crisis. The fears were further fueled by Friday’s disappointing release of the UK Retail Sales figures, which suggests that consumers are feeling the pinch of high inflation.

Apart from this, the relentless US dollar buying exerts additional downward pressure on the GBP/USD pair and contributes to the ongoing depreciating move. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, rallies back closer to the monthly high and is supported by a combination of factors.

The continuous rise in the US Treasury bond yields, bolstered by hawkish Fed expectations, turns out to be a key factor pushing the greenback higher. The overnight hawkish remarks by Philadelphia Fed President Patrick Harker reaffirmed bets for another supersized rate hike in November. This, in turn, lifts the yield on the benchmark 10-year US government bond to its highest level since the 2008 financial crisis.

This, along with a weaker risk tone, underpins the safe-haven buck. This, in turn, suggests that the path of least resistance for the GBP/USD pair is to the downside amid diminishing odds for a full 100 bps rate increase by the Bank of England in November. Hence, a subsequent decline, back towards the 1.1000 psychological mark, remains a distinct possibility.

Technical levels to watch

-

13:41

USD Index Price Analysis: The dollar wants more and targets the 2022 high

- DXY resumes the upside and approaches the 114.00 zone.

- The 2022 high near 114.80 now emerges on the horizon.

DXY quickly leaves behind Thursday’s small drop and advances to the proximity of the 114.00 yardstick on Friday, or 3-week peaks.

If the index breaks below the 114.00 region, then it could dispute the YTD high at 114.78 (September 28) prior to the round level at 115.00.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 8-month support line near 108.20. The proximity of the 100-day SMA also reinforces this region.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 103.70.

DXY daily chart

-

13:33

Canada: Retail Sales rose 0.7% in August vs. 0.4% expected

- Retail Sales in Canada rose more than expected in August.

- USD/CAD sticks to strong intraday gains after the release.

The data published by Statistics Canada revealed on Friday that Retail Sales grew by 0.7% on a monthly basis in August following June's sharp contraction of 2.2%. This reading came in better than consensus estimates pointing to a modest rise of 0.4%.

Additional details of the report showed that core sales, which exclude gasoline stations and motor vehicle and parts dealers, recorded a stronger-than-expected growth of 0.7% during the reported month.

Market reaction

The USD/CAD pair, meanwhile, moves little following the data and maintains its strong bid tone just below mid-1.3800s amid a strong pickup in the US dollar demand. Apart from this, softer crude oil prices undermine the commodity-linked loonie and support prospects for a further intraday appreciating move.

-

13:31

Canada New Housing Price Index (YoY): 6.3% (September) vs previous 6.9%

-

13:30

Canada Retail Sales (MoM) came in at 0.7%, above forecasts (0.2%) in August

-

13:30

Canada Retail Sales ex Autos (MoM) above forecasts (0.4%) in August: Actual (0.7%)

-

13:30

Canada New Housing Price Index (MoM) declined to -0.1% in September from previous 0.1%

-

13:19

Gold Price Forecast: No recovery potential for XAU/USD amid aggressive rate hikes – Commerzbank

Gold has dropped to $1,620. Growing rate hike expectations are set to continue weighing on the yellow metal, economists at Commerzbank report.

Gold demand is disappointing

“The ongoing outflows from the gold ETFs – September was already the fifth month in a row to register ETF outflows – point to weak investment demand.”

“No reversal of sentiment can be expected on the gold market for as long as there is no end in sight to the aggressive rate hikes.”

See – Gold Price Forecast: XAU/USD to remain under pressure as yields and dollar keep rallying – ANZ

-

12:31

India Bank Loan Growth climbed from previous 16.4% to 17.9% in October 7

-

12:29

USD/BRL: Break below 5.01 to open up further losses – SocGen

USD/BRL recently defended the bullish gap near 5.01 resulting in a steady bounce. Only a dip below here would risk a deeper pullback, economists at Société Générale report.

USD/BRL to target 5.51 if 5.42 gives way

“USD/BRL is evolving within two converging trend lines forming a symmetrical triangle. The pattern denotes a clear direction is lacking. This is also highlighted by crisscross moves around the 200-Day Moving Average.”

“If the pair breaks above the upper limit at 5.42, a move towards July high of 5.51 and the descending trend line drawn since 2020 at 5.62/5.66 is expected. This is an important resistance zone.”

“Only if the pair breaks below 5.01 would there be a risk of a deeper pullback.”

-

12:19

UK’s Wallace: I would lean towards Boris Johnson at the moment

When asked who he will back to be the new Prime Minister, the UK Defence Minister Ben Wallace said, “I would lean towards Boris Johnson at the moment.”

Additional quotes

I will not stand to be Prime Minister.

Keen to see what Sunak says on security and defence.

Conservative party needs to settle down and get on with delivering 2019 mandate.

Unity is important, will look at how candidates will bring party together.

Hope Jeremy hunt stays as finance minister.

Market reaction

Amidst the UK political turmoil and downbeat consumer spending data, GBP/USD is licking its wounds at around 1.1130, down 0.91% on the day.

-

12:18

GBP will likely continue to be under pressure in the time to come – Nordea

In the UK, rates have continued their fall on a policy U-turn. Still, economists at Nordea see more pain ahead for the British pound.

The policy U-turn will lessen the GBP blow, but it is not enough

“The proposal of the UK government – lower taxes and higher spending financed by more debt – broke havoc in the gilt markets while sending the pound in a free fall. Since then UK markets have stabilised. But it takes a long time to build up trust which can be easily lost in a moment.”

“Investors are unlikely to have strong renewed confidence in UK’s governance no matter who take over the helm – trust takes years to build, seconds to break and forever to repair.”

“The poor economic fundamentals in the UK, sky-high inflation, financial imbalances and pension funds under strain will continue to weigh upon the pound.”

-

12:02

EUR/JPY Price Analysis: Room for extra upside near term

- EUR/JPY adds to Thursday’s gains and prints new highs.

- Further upside could target the 149.80 region in the short term.

EUR/JPY extends the optimism seen in the second half of the week and advances to new cycle highs around 147.60 on Friday.

Considering the current price action in the cross, the door still looks open to extra upside. That said, the immediate target now emerges at the December 2014 high at 149.78 (December 8).

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 136.85, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

12:00

Mexico Retail Sales (MoM) below forecasts (0.3%) in August: Actual (-0.4%)

-

12:00

Mexico Retail Sales (YoY) came in at 4.7% below forecasts (6.1%) in August

-

12:00

UK PM Truss Spokesman: Working in preparation for a medium-term fiscal plan on October 31

UK PM Liz Truss's spokesman said in a statement on Friday, “we are working in preparation for a medium-term fiscal plan on October 31.”

He added that “the new PM will decide whether it will be delivered then.”

Market reaction

GBP/USD found some support on the above headlines, as it moved away from weekly lows at 1.1100, currently trading at 1.1130, still down 0.91% so far.

-

11:57

EUR/USD set to bottom at 0.93 during Q1 2023 – Nordea

The stage is set for continued dollar strength. In the view of economists at Nordea, EUR/USD will continue lower and bottom at 0.93 around the start of 2023.

USD will continue to do well in the months to come due

“We have long been in the USD strengthening camp and see no reason to change our view yet. We believe the USD will continue to do well in the months to come due to the hawkish Fed conducting the fastest rate hikes in decades, a resilient US economy, and USD’s safe haven in these troubling times. This will bring EUR/USD to 0.93 during Q1.”

“Our take is that the current dollar strength will not stop until the Fed accomplishes bringing inflation down so it can relax its aggressive policy tightening or we see a clear improvement in the global growth outlook.”

-

11:52

USD/CAD sticks to gains near multi-day top, above 1.3800 ahead of Canadian Retail Sales

- A combination of supporting factors pushes USD/CAD to a multi-day high on Friday.

- Softer oil prices weigh on the loonie and offer support amid resurgent USD demand.

- Investors now look to Canadian Retail Sales data for short-term trading opportunities.

The USD/CAD pair builds on the overnight late rebound from the 1.3650 area, or a two-week low and gains strong follow-through traction on Friday. The intraday buying remains unabated through the first half of the European session and lifts spot prices to a four-day peak, around the 1.3830 region.

A fresh leg down in crude oil prices undermines the commodity-linked loonie and turns out to be a key factor acting as a tailwind for the USD/CAD pair. In fact, the black liquid remains well within the striking distance of the weekly low amid concerns that a deeper global economic downturn will hurt fuel demand.

Apart from this, a goodish pickup in the US dollar demand provides an additional lift to the USD/CAD pair and supports prospects for additional gains. The overnight hawkish remarks by Philadelphia Fed President Patrick Harker bets for another supersized rate hike in November and lifts the USD to over a one-week high.

Harker warned that the US central bank is actively trying to slow the economy to combat inflation and added fuel to the recent rally in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond rallies to its highest level since 2008, which, in turn, is seen lending support to the buck.

Investors also seem worried that rapidly rising borrowing costs will eventually trigger a recession in the world’s largest economy. Adding to this, the protracted Russia-Ukraine war and China's strict zero-COVID policy take a toll on the global risk sentiment and further benefits the greenback's relative safe-haven status.

There isn't any major market-moving macro data due for release from the US, leaving the greenback at the mercy of the US bond yields and the broader risk sentiment. The Canadian economic docket features monthly Retail Sales figures. This, along with oil price dynamics, should provide some impetus to the USD/CAD pair.

Technical levels to watch

-

11:36

Gold Price Forecast: XAU/USD eyes $1,615 and $1,607 amid a down week – Confluence Detector

- Gold price is on track for the second straight weekly loss amid surging Treasury yields.

- The US dollar jumps back into the game on risk-aversion and aggressive Fed rate hike bets.

- XAU/USD’s path of least resistance remains to the downside, with eyes on $1,607.

Gold price is testing bullish commitments near 2022 lows on its way to the $1,600 threshold heading into a new week. The Fed entered the blackout period ahead of its November 2 rate hike decision. Therefore, the recent speeches from Fed policymakers and a surprise drop in the US Jobless Claims data had a significant impact on the aggressive Fed rate hike expectations. The US Treasury yields shot through the roof, thereafter, driving the dollar northward alongside, throwing the metal under the bus. The parabolic rise in the USD/JPY pair on policy divergence is also benefiting dollar bulls. The bullion is headed for the second consecutive weekly decline, as higher borrowing costs continue denting the yieldless metal. All eyes now turn towards a fresh batch of top-tier US economic data due for release in the week ahead.

Also read: Gold Price Forecast: XAU/USD eyes a sustained break below $1,615 as yields keep rallying

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is likely to find footing below the previous day’s low of $1,623, despite the renewed uptick.

The pivot point one-day S1 at $1,618 could come to the rescue of buyers before they look to attack the previous month’s low of $1,615.

A sustained break below the latter will open up downside towards the critical cap at the pivot point one-month S1 at $1,607. Ahead of that, the pivot point one-day S2 at $1,609 could offer temporary support.

Alternatively, gold price needs to find acceptance above the confluence of the Fibonacci 23.6% one-day and SMA5 four-hour at $1,628 on its recovery. The next powerful barrier is seen at the Fibonacci 38.2% one-day at $1,632.

Further up, the Fibonacci 61.8% one-day at $1,637 would be a tough nut to crack for XAU buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

-

11:27

GBP/USD: Levels well below 1.1000 are achievable – MUFG

Sterling’s rally yesterday has fully reversed as investors conclude the resignation of Liz Truss as Prime Minister does not necessarily mean political uncertainty will be removed. Economists at MUFG believe that GBP/USD could return to sub-1.10 levels.

Potential for GBP underperformance also versus EUR

“The pound remains vulnerable to the downside and we still see levels well below 1.1000 as achievable. The conviction of the view comes more from the US dollar side but we also see potential for GBP underperformance versus EUR.”

“The political mess in the UK is unlikely to go away. If the right of the party (the Johnson/Truss/hard Brexit supporting faction) loses power the divisions will remain and getting tax rises/spending cuts through parliament could remain a challenge.”

-

11:07

AUD/USD flirts with daily low amid stronger USD, seems vulnerable near mid-0.6200s

- AUD/USD meets with a fresh supply on Friday amid a goodish pickup in the USD demand.

- Aggressive Fed rate hike bets and the continuous rise in the US bond yields boost the buck.

- Recession fears and a softer risk tone further drive flows away from the risk-sensitive aussie.

The AUD/USD pair comes under some selling pressure on Friday and retreats further from a nearly two-week high, around the 0.6355 region touched the previous day. The pair maintains its offered tone through the first half of the European session and is currently flirting with the daily low, just below mid-0.6200s.

The US dollar regains positive traction and climbs to over a one-week high, which, in turn, is seen as a key factor exerting pressure on the AUD/USD pair. The overnight hawkish remarks by Philadelphia Fed President Patrick Harker reinforced expectations for another supersized rate hike in November. Harker warned that the US central bank is actively trying to slow the economy to combat inflation.

His comments added fuel to the recent rally in the US Treasury bond yields. In fact, the rate on the benchmark 10-year US government bond jumps to its highest level since the 2008 financial crisis, which continues to act as a tailwind for the greenback. Apart from this, a softer risk tone further benefits the safe-haven buck and contributes to driving flows away from the risk-sensitive aussie.

Apart from this, the Reserve Bank of Australia's (RBA) decision to slow the pace of policy tightening earlier this month suggests that the path of least resistance for the AUD/USD pair is to the downside. Hence, a subsequent slide back towards the 0.6200 mark, en route to the YTD low, around the 0.6170 area, remains a distinct possibility amid the absent market-moving US macro releases.

Technical levels to watch

-

10:58

USD Index eyes next resistance at 113.70 – OCBC

US Dollar Index (DXY) extends its gains further north of the 113.00 hurdle. Economists at OCBC Bank expect the index to remain on a solid foot.

Slight risk to the upside

“Mild bearish momentum on the daily chart shows tentative signs of fading while RSI is rising. Slight risk to the upside.”

“Resistance here at 113.70.”

“Support at 112.40 (50% fibo retracement of Sep high top Oct low, 21 Day Moving Average), 111.85 levels (38.2% fibo), 111.20 (23.6% fibo).”

See: USD Index to return to the late-September 114/115 highs over the coming weeks – ING

-

10:54

German parliament votes to approve €200 billion emergency rescue package

German Parliament, as reported by Reuters, prepares to vote for the approval of a €200 billion emergency rescue package to tackle the energy crisis.

Market reaction:

The news pushes 10-year German bund yield to its highest since 2011. The shared currency, meanwhile, continues to lose ground and slides below mid-0.9700s, back closer to the weekly low amid the emergence of fresh US dollar buying.

-

10:47

Indonesia: BI delivers another 50 bps rate hike – UOB

UOB Group’s Economist Enrico Tanuwidjaja reviews the latest interest rate decision by the Bank Indonesia (BI).

Key Takeaways

“Bank Indonesia (BI) delivered a back-to-back 50bps rate hike in Oct MPC meeting, in line with market expectation, to 4.75%.”

“BI said that the decision is a front-loaded, pre-emptive, and forward-looking step to anticipate and mitigate the risk of rising inflation and anchor inflation expectations to remain within the 2-4% range in 1H23.”

“Going forward, we revised and brought forward our BI rate forecast to 5.25% (previously 5.00%) by the end of 2022 and revised higher the terminal rate to 5.75% (before 5.50%) that is likely to occur in 1Q23. This will give a reasonably comfortable yet historically tighter spread of circa 100bps with the expected terminal rate of the Fed funds rate of 4.75% by 1Q23.”

-

10:44

New cyclical highs for US Treasury bond yields mean new highs for USD/JPY – MUFG

USD/JPY is nearing the 151 level. Economists at MUFG expect the pair to continue grinding higher.

A break of 150 remains orderly

“The lack of action by the MoF certainly will likely encourage a pick-up in yen selling over the coming weeks. The risk of action will persist of course but Japan’s efforts to highlight that no particular level is being protected means there is scope for this relatively orderly grind higher in USD/JPY to continue.”

“We can’t see intervention working until we at least get to the point when market participants can be confident of a shift from the Fed.”

“New cyclical highs for US Treasury bond yields mean new highs for USD/JPY.”

-

10:32

GBP/USD: Two-way trades in 1.1060-1.1360 range for now – OCBC

The GBP/USD pair drops to over a one-week low on Friday. In the near-term, two-way trade is likely, in the opinion of economists at OCBC Bank.

Two-way trades

“Bullish momentum on the daily chart shows tentative signs of waning while RSI fell. Risks are skewed to the downside.”

“Support at 1.1130 (21-Day Moving Average), 1.1060 levels. Resistance at 1.1360, 1.1420 (50 DMA).”

“We look for two-way trades in the 1.1060-1.1360 range for now.”

See: There are too many reasons pointing towards weaker sterling – Commerzbank

-

10:25

USD Index to return to the late-September 114/115 highs over the coming weeks – ING

Strong Treasury yields and rate increases expected by the Federal Reserve are set to underpin the US dollar. Economists at ING expect USD Index (DXY) to retest 114/115.

Strong dollar drivers intact

“Yesterday’s small correction in the dollar proved very short-lived. This is not surprising, as most drivers of dollar strength have indeed remained intact.”

“Markets have pushed their peak Fed rate expectations to the 5.0% mark, and UST 2-year yields are inching closer to 4.60%. This rate environment continues to shed doubts about the sustainability of any rally in equities, and chances that the dollar will receive more safe-haven flows are elevated.”

“For the moment, we see no reasons to change our call for a return of DXY to the late-September 114/115 highs over the coming weeks.”

-

10:20

USD/JPY surges to 151.00 neighbourhood, fresh 32-year top amid rising US bond yields

- USD/JPY continues scaling higher on Friday and rallies to its highest level since August 1990.

- The Fed-BoJ policy divergence continues to weigh on the JPY and offers support to the pair.

- The continuous rise in the US bond yields underpins the USD and provides an additional lift.

The USD/JPY pair is prolonging its well-established bullish trend and gaining strong follow-through traction on the last day of the week. The buying interest picks up pace during the mid-European session and lifts spot prices to the 151.00 neighbourhood, or a new 32-year peak.

The selling bias around the Japanese yen remains unabated amid a big divergence in the monetary policy stance adopted by the Bank of Japan and other major central banks. This helps offset threats of an intervention by the Japanese government and continues to push the USD/JPY pair higher.

The US dollar, on the other hand, climbs to a fresh weekly high and remains well supported by hawkish Fed expectations. In fact, Philadelphia Fed President Patrick Harker warned on Thursday that the US central bank is actively trying to slow the economy to combat stubbornly high inflation.

Meanwhile, firming expectations for a more aggressive policy tightening by the Fed pushes the yield on the benchmark 10-year US government bond to its highest levels since the 2008 financial crisis. This results in a further widening of the US-Japan rate differential and weighs on the JPY.

Apart from this, the latest leg of a sharp move-up witnessed over the past hour or so could further be attributed to some technical buying above the 150.50 area. It will now be interesting to see if the momentum marks a fresh breakout or turns out to be a stop-run amid extremely overbought conditions.

There isn't any major market-moving economic data due for release from the US on Friday. Hence, the US bond yields will continue to influence the USD price dynamics and provide some impetus to the USD/JPY pair. Nevertheless, spot prices remain on track to register gains for the tenth straight week.

Technical levels to watch

-

10:05

WTI: Buyers defend $83 amid mixed oil headlines and USD strength

Saudi Energy Minister Abdulaziz bin Salman Al Saud said on Friday that OPEC+ is doing the right job for a stable energy market.

Meanwhile, an Iranian official said urged the US to “lift sanctions on Iran, if you want to reduce the price of oil.”

He added that “you cannot solve the problem by threatening one country.”

Separately, industry players and a US official told Reuters that Russia could skirt the new G7 price cap on its oil exports, Moscow has access to enough tankers to ship most of its oil to make the price cap ineffective.

Market reaction

WTI is licking its wounds near $83.35, at the time of writing, having hit a daily low at $82.96 earlier on. The US oil suffers from broad risk aversion and notable US dollar demand, as Treasury yields keep their relentless rise intact. Mixed oil headlines fail to have any impact on the black gold so far this Friday.

-

09:58

There are too many reasons pointing towards weaker sterling – Commerzbank

It is unlikely that UK politicians are going to regain market confidence any time soon. Therefore, the British pound is set to remain under pressure, economists at Commerzbank report.

UK political developments to keep investors on tenterhooks

“All the issues like high inflation, the looming recession and the effects of Brexit, which were in place prior to the government crisis and constitute a considerable challenge for the politicians are likely to ensure that markets remain cautious.”

“Against the background of a struggling economy, the BoE is likely to fight high inflation levels comparatively cautiously so that monetary policy will continue to put pressure on sterling. The fact that the BoE has intervened on the markets with bond purchases, thus threatening its credibility, is not likely to be forgotten easily by the markets either.”

-

09:43

Gold Price Forecast: XAU/USD to remain under pressure as yields and dollar keep rallying – ANZ

Gold price trades close to three-week lows near $1,620. The hawkish tone of the central banks is set to continue pressuring the yellow metal, economists at ANZ Bank report.

US real yields and the US dollar on a strong footing

“Increased prospects of aggressive rate hikes are keeping Treasury yields and the US dollar on a strong footing, leaving more room for downside.”

“While recession fears grow due to rising rates and sticky inflation, we should see some haven flows but not enough to reverse the bearish trend anytime soon.”

“We expect gold to remain under pressure.”

-

09:40

EUR/USD treads water around 0.9770, dollar remains bid

- EUR/USD meets resistance in the 0.9800 region on Friday.

- The dollar advances markedly above the 113.00 mark tracked by the DXY.

- The EMU flash Consumer Confidence will be on tap later.

The single currency comes under pressure and drags EUR/USD to the 0.9760 region at the end of the week.

EUR/USD weaker on USD-buying, high yields

EUR/USD now seems to stabilize in the lower end of the recent range in the 0.9770/60 band against the backdrop of further buying interest surrounding the greenback. The move higher in the buck, in the meantime, appears propped up by the unabated climb in US yields.

In the same line, but in the German money market, the 10-year bund yields climb to the vicinity of the 2.50% region for the first time since July 2011.

In the domestic calendar, the advanced Consumer Confidence gauge tracked by the European Commission will be the sole release later in the evening. In the US calendar, NY Fed J.Williams is due to speak ahead of the publication of the Monthly Budget Statement.

What to look for around EUR

EUR/USD now seems to have embarked on some consolidation in the sub-0.9800 area amidst the persistent advance in the dollar.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Following latest results from key economic indicators, the latter is expected to extend further amidst the ongoing resilience of the US economy.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: European Council Meeting, EMU Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.05% at 0.9776 and the breakdown of 0.9631 (monthly low October 13) would target 0.9535 (2022 low September 28) en route to 0.9411 (weekly low June 17 2002). On the flip side, the next up barrier comes at 0.9875 (weekly high October 18) followed by 0.9999 (monthly high October 4) and finally 1.0050 (weekly high September 20).

-

09:38

Japan aims to get cabinet approval for stimulus spending plan on October 28 – Kyodo

Kyodo News Agency reports, citing sources, Japan aims to get cabinet approval for an economic stimulus package spending plan on October 28.

The Japanese government and ruling coalition are considering state outlays of more than JPY20 trillion to fund the economic stimulus package, Kyodo reported.

Market reaction

Amidst the latest Japanese fiscal headlines and renewed US dollar strength, USD/JPY is seeing a fresh leg towards 151.00, fresh 32-year highs. The pair was last seen trading at 150.85, adding 0.48% on the day.

-

09:33

Hong Kong SAR Consumer Price Index came in at 4.4%, above expectations (1.9%) in September

-

09:23

USD/CNH: A breakout of 7.3000 remains on the cards – UOB

Further upside could see USD/CNH challenging the 7.3000 region in the near term, comment Markets Strategist Quek Ser Leang and Economist Lee Sue Ann at UOB Group.

Key Quotes

24-hour view: “We did not expect the sharp pullback in USD to 7.2210 and the subsequent strong bounce from the low. While the rebound has not gained much momentum, the bias for today is on the upside. That said, a clear break of 7.2800 is unlikely (next resistance is at 7.3000). Support is at 7.2440, followed by 7.2240.”

Next 1-3 weeks: “We continue to hold the same view as yesterday (20 Oct, spot at 7.2650). As highlighted, the upside risk remains intact and there is a good chance for USD to break 7.3000. Only a break of 7.2150 (no change in ‘strong support’ level from yesterday) would indicate that the USD strength that started one week ago has ended.’

-

09:18

GBP/USD could return to 1.05 by year-end after failure at 1.15 – ING

GBP/USD is trading close to weekly lows below 1.1200. Economists at ING believe that the pair could be back at 1.05 by year-end.

EUR/GBP may struggle to break much lower than 0.8600

“Our view that: a) UK politicians will struggle to quickly reclaim all of the lost fiscal credibility and b) US real interest rates look set to push even higher this year meaning that GBP/USD will likely struggle to break above the 1.15 area over coming weeks.”

“Into year-end, we favour broader dollar strength as US real rates push to 2.00%, meaning that GBP/USD could be back at 1.05.”

“0.8600 may well prove the lower end of the EUR/GBP trading range over coming weeks and maybe months too any policy misstep could easily push the pair back to 0.90.”

-

09:16

USD Index regains the smile and the 113.00 barrier

- The index rose to 4-day highs near 113.15 on Friday.

- There is no respite for the rally in US yields across the curve.

- Fedspeak, Monthly Budget Statement next in the calendar.

The USD Index (DXY), which gauges the greenback vs. a basket of its main competitors, manages to regain upside traction and surpasses the 113.00 mark at the end of the week.

USD Index supported by yields

The index maintains the recovery from weekly lows near 111.80 (October 18) well in place and looks to extend the upside momentum further north of the 113.00 hurdle on Friday.

The bounce in the dollar comes in tandem with the continuation of the rally in US yields, which navigate in multi-year peaks across the curve and always underpinned by expectations of a tighter-for-longer stance from the Federal Reserve.

In the US docket, NY Fed J.Williams (permanent voter, centrist) will speak later in the NA session followed by the release of the Monthly Budget Statement.

What to look for around USD

The dollar probes once again the area above the 113.00 mark at the end of the week.

In the meantime, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Monthly Budget Statement (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.18% at 113.05 and faces the next up barrier at 113.88 (monthly high October 13) followed by 114.76 (2022 high September 28) and then 115.32 (May 2002 high). On the other hand, the breakdown of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

09:04

USD/JPY: Extra gains now look at 151.00 – UOB

Further upside momentum in USD/JPY could see 151.00 revisited in the next few weeks, note Markets Strategist Quek Ser Leang and Economist Lee Sue Ann at UOB Group.

Key Quotes

24-hour view: “Yesterday, we highlighted that ‘a break of 150.00 would not be surprising but USD is unlikely to be able to maintain a foothold above this level’. The anticipated USD strength was more resilient than expected as USD rose to 150.28 and closed at 150.14 (+0.17%). Further USD strength is not ruled out but overbought conditions suggest that a sustained rise above 150.60 is unlikely (next resistance is at 151.00). On the downside, a break of 149.70 (minor support is at 149.95) would indicate that the deeply overbought advance is ready to take a breather.”

Next 1-3 weeks: “We highlighted yesterday that ‘A break of 150.00 is likely to lead to further USD strength but it might take a while before the next resistance at 150.60 comes into view’. USD subsequently took out 150.00 and rose to a high of 150.28. We continue to expect USD strength, albeit at a slower pace and any gains could be relatively limited. The next resistance above 150.60 is at 151.00. Overall, only a breach of 149.00 (‘strong support’ level was at 148.50 yesterday) would indicate that the USD strength that started more than a week ago has run its course.”

-

09:01

Greece Current Account (YoY) fell from previous €1.104B to €0.449B in August

-

08:57

Brent Crude Oil: Retest of $103/05 is not ruled out – SocGen

Brent defended the lower limit of a multi-month descending channel at $83 resulting in an impressive rebound. Strategists at Société Générale believe that the black gold could challenge the important $103/05 resistance zone.

Recent pullback formed a higher trough as compared to $83.00

“Recent pullback has formed a higher trough as compared to $83.00. Daily MACD is above its trigger and is about to enter positive territory denoting regain of upside momentum.”

“Holding above $87.20, the 76.4% retracement of the bounce, Brent is likely to head higher towards $99 and perhaps even towards the descending trend line since March at $103/105. This could be an important resistance zone.”

-

08:44

FX option expiries for Oct 21 NY cut

FX option expiries for Oct 21 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 0.9600 2.2b

- 0.9700 1.8b

- 0.9725 1.2b

- 0.9745-50 1.1b

- 0.9775 514m

- 0.9800 1.3b

- 0.9840 1.7b

- 1.0000 485m

- GBP/USD: GBP amounts

- 1.1325 330m

- USD/JPY: USD amounts

- 147.00 490m

- 147.50 1b

- 150.50 630m

- AUD/USD: AUD amounts

- 0.6500 526m

- USD/CAD: USD amounts

- 1.3500 876m

- 1.3600 687m

- 1.3650 400m

- 1.3700 455m

- 1.3750 725m

- 1.3850 405m

- NZD/USD: NZD amounts

- 0.5600 439m

-

08:26

EUR/USD: 0.98 to continue working as an anchor – ING

EUR/USD is under pressure below 0.9800. It looks like this level is working as an anchor from the pair at the moment, in the view of economists at ING.

Still no benefits from falling gas prices

“Falling consumer confidence is hardly surprising, but the fact that the euro is drawing very little benefits from the recent drop in gas prices is likely a testament to how markets are clearly looking well beyond short-term dynamics and may actually be growing increasingly concerned about Europe’s energy supply for next year, not just this winter.”

“It looks like 0.9800 is working as an anchor from EUR/USD at the moment, and this could continue to be the case today unless we receive some truly exciting news from the ongoing EU summit, which has so far only displayed lingering divergence in EU members’ views on energy price caps.”

“We retain a bearish bias on EUR/USD and expect a drop below 0.9500 by year-end.”

-

08:11

Euro Stoxx 50 to extend its downtrend on a move below 3250 – SocGen

Euro Stoxx 50 recently formed a double bottom near 3250 resulting in a short-term bounce. Failure to hold 3250 would reinforce the downtrend, economists at Société Générale report.

Euro Stoxx 50 to see an extended bounce on a break past 3530

“If the index overcomes 3530, an extended bounce could materialize towards the target of the formation at 3700/3720 which is also the 200-Day Moving Average (DMA). This is an important resistance.”

“Failure to hold 3250 would mean persistence in the downtrend that started last year.”

-

08:01

Gold Price Forecast: XAU/USD renews monthly low near $1,620 as yields propel DXY

- Gold price prints second weekly loss as bears approach the lowest level in 2022.

- Market sentiment remains dicey but hawkish Fed bets, inflation woes propel yields to multi-year high.

- Risk-aversion could weigh on XAU/USD amid light calendar, Fedspeak eyed.

Gold price (XAU/USD) takes offers to renew intraday low near $1,620 amid the initial hour of Friday’s European session. In doing so, the bullion price remains inside a bearish chart formation while approaching the yearly low marked in September.

That said, the multi-year high Treasury yields appear to be the biggest challenge for the metal prices of late. It should be observed that the US 10-year Treasury bond yields refreshed a 14-year high of 4.27% before a few minutes while the two-year counterpart rose to the highest levels since 2007 around 4.64%. Both the key bond coupons are near 4.25% and 4.60% respectively by the press time.

The jump in the latest hawkish Fed bets, comments suggesting further rate hikes from the US Federal Reserve (Fed) officials and mostly upbeat US data seemed to have underpinned the bond rout of late. Also weighing on the market sentiment, and weighing on the XAU/USD prices, is the political crisis in Britain, fresh covid woes from China and the Russia-Ukraine tussles.

Given the firmer yields, the US Dollar Index (DXY) pares the first weekly loss in three around 113.15 by the pres time while the stock futures and equities in the Asia-Pacific, as well as in Europe, print mild losses.

Moving on, the last dose of the Fed speakers’ comments before the blackout period preceding November’s Federal Open Market Committee (FOMC) meeting appears crucial for the metal traders to watch for fresh impulse while keeping the bearish bias intact.

Technical analysis

Gold price remains inside a short-term bearish channel while extending late Thursday’s pullback from the 100-HMA, around $1,643 by the press time. Bearish MACD signals add strength to the downside bias.

The metal’s further weakness, however, appears to have a bumpy road as the lower line of the stated channel joins the yearly bottom, as well as the nearly oversold RSI, to challenge the bears.

That said, the $1,600 threshold adds to the downside filters past the $1,615 immediate support convergence.

On the flip side, 100-HMA guards the short-term XAU/USD upside near $1,643 before challenging the bearish channel by poking the pattern’s resistance line near $1,645.

Even if the quote rises past $1,645, the bullion buyers remain off the table unless the quote renews the monthly top, around $1,730.

Gold: Hourly chart

Trend: Limited downside expected

-

08:01

Turkey Consumer Confidence: 76.2 (October) vs 72.4

-

08:00

GBP to remain stable until the new Prime Minister is announced – ANZ

UK financial markets have responded well to the resignation of Liz Truss as Prime Minister. Economists at ANZ Bank expect the pound to remain stable until the announcement of the new PM.

All eyes on Bank of England

“We expect the GBP to remain stable until the new Prime Minister is announced, after which the focus will be on the fiscal statement on 31 October, and the Bank of England meeting on 3 November.”