Notícias do Mercado

-

20:00

Dow +70.9 17,789.90 +0.40% Nasdaq +8.03 4,709.90 +0.17% S&P +7.61 2,060.36 +0.37%

-

17:07

European stocks close: stocks closed higher, supported by comments by the European Central Bank (ECB) President Mario Draghi and the People's Bank of China’s interest rate cut

Stock indices closed higher, supported by comments by the European Central Bank (ECB) President Mario Draghi and the People's Bank of China's interest rate cut.

The European Central Bank (ECB) President Mario Draghi reiterated that the ECB is prepared to add further stimulus measures if needed. Investors speculate that the central bank is moving closer to launch the quantitative easing programme.

Draghi also said that inflation expectations were declining.

The People's Bank of China lowered unexpectedly its interest rate on Friday. China's central bank cut its one year deposit rate to 2.75% from 3.0%. That was the first cut since 2012. It is a try to revive the economy.

The one-year lending rate will also be lowered from 6% to 5.6%.

The changes come into effect on Saturday.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,750.76 +71.86 +1.08%

DAX 9,732.55 +248.58 +2.62%

CAC 40 4,347.23 +113.02 +2.67%

-

17:00

European stocks close: FTSE 100 6,750.76 +71.86 +1.08% CAC 40 4,347.23 +113.02 +2.67% DAX 9,732.55 +248.58 +2.62%

-

16:44

Oil: an overview of the market situation

Oil prices, while demonstrating its second-session rise in a row, which is associated with reduced rates of China, as well as speculation about production cuts by OPEC.

China's central bank said that the lowering of interest rates, carried out for the first time in more than two years, there was no change in the "prudent monetary policy" and the need for more aggressive measures not. The People's Bank of China said that the economy is experiencing a downward pressure, which is an additional burden for small businesses. However, economic growth is still relatively high, and inflation is still low, the bank noted.

Regarding the situation in OPEC production, on the eve of Venezuelan Foreign Minister Rafael Ramirez has promised that the country will reduce oil production if OPEC quota reduction treaty at a meeting on November 27. Venezuela, Libya and Ecuador earlier urged fellow cartel to agree on reducing production to stop the fall in prices.

"In the last day there was a lot of rumors about what the solution might take at the forthcoming meeting of OPEC", - said the managing director of IHS Victor Shum, adding that these rumors have caused a rise in prices, but OPEC countries will be difficult to agree on reducing production.

It is worth emphasizing that the concern over the weakening global demand and the likelihood that OPEC producers do not reduce the volume of production, puts considerable pressure on oil prices in recent months.

Support prices have also yesterday's US data. Recall Philadelphia Fed manufacturing index increased to 40.8 this month from 20.7 in October. Analysts had expected the index to decline to 18.9. Another report showed that home sales in the secondary market in the US rose in October to a 13-month high, reaching 5.26 million. Units.

Cost January futures on US light crude oil WTI (Light Sweet Crude Oil) rose to 76.23 dollars a barrel on the New York Mercantile Exchange.

January futures price for North Sea petroleum mix of mark Brent rose $ 0.21 to $ 79.97 a barrel on the London exchange ICE Futures Europe.

-

16:41

Oil: an overview of the market situation

Oil prices, while demonstrating its second-session rise in a row, which is associated with reduced rates of China, as well as speculation about production cuts by OPEC.

China's central bank said that the lowering of interest rates, carried out for the first time in more than two years, there was no change in the "prudent monetary policy" and the need for more aggressive measures not. The People's Bank of China said that the economy is experiencing a downward pressure, which is an additional burden for small businesses. However, economic growth is still relatively high, and inflation is still low, the bank noted.

Regarding the situation in OPEC production, on the eve of Venezuelan Foreign Minister Rafael Ramirez has promised that the country will reduce oil production if OPEC quota reduction treaty at a meeting on November 27. Venezuela, Libya and Ecuador earlier urged fellow cartel to agree on reducing production to stop the fall in prices.

"In the last day there was a lot of rumors about what the solution might take at the forthcoming meeting of OPEC", - said the managing director of IHS Victor Shum, adding that these rumors have caused a rise in prices, but OPEC countries will be difficult to agree on reducing production.

It is worth emphasizing that the concern over the weakening global demand and the likelihood that OPEC producers do not reduce the volume of production, puts considerable pressure on oil prices in recent months.

Support prices have also yesterday's US data. Recall Philadelphia Fed manufacturing index increased to 40.8 this month from 20.7 in October. Analysts had expected the index to decline to 18.9. Another report showed that home sales in the secondary market in the US rose in October to a 13-month high, reaching 5.26 million. Units.

Cost January futures on US light crude oil WTI (Light Sweet Crude Oil) rose to 76.23 dollars a barrel on the New York Mercantile Exchange.

January futures price for North Sea petroleum mix of mark Brent rose $ 0.21 to $ 79.97 a barrel on the London exchange ICE Futures Europe.

-

16:35

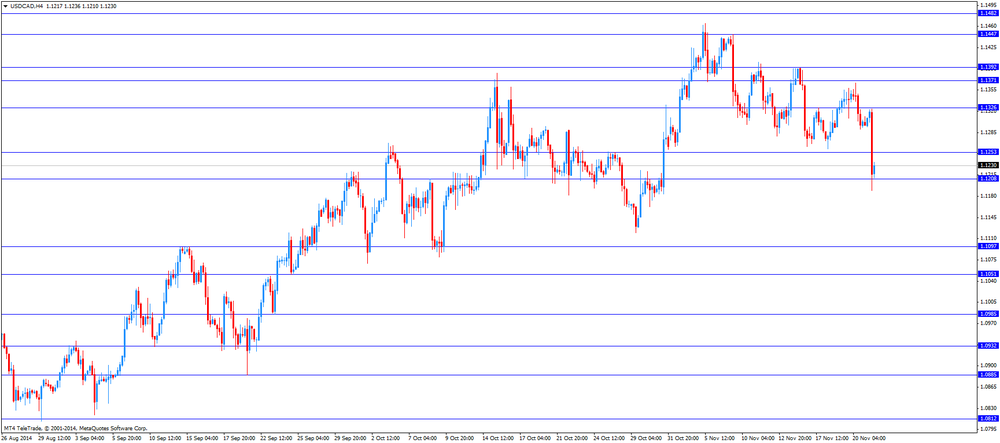

Foreign exchange market. American session: the Canadian dollar surged against the U.S. dollar after the better-than-expected Canadian consumer price inflation

The U.S. dollar mixed against the most major currencies ahead of the U.S. economic data. The greenback was supported by yesterday's better-than-expected U.S. economic data. The Philadelphia Federal Reserve Bank' manufacturing index surged to 40.8 in November from 20.7 in October. That was the highest level since December 1993.

Sales of existing homes in the U.S. climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013.

There were released no major economic reports in the U.S. on Friday.

The euro traded lower against the U.S. dollar. In the morning trading session, the euro dropped against the greenback after comments by the European Central Bank (ECB) President Mario Draghi. He reiterated that the ECB is prepared to add further stimulus measures if needed. Investors speculate that the central bank is moving closer to launch the quantitative easing programme.

Draghi also said that inflation expectations were declining.

The British pound traded higher against the U.S. dollar. The public sector net borrowing in the U.K. declined to £7.1 billion in October from £10.6 billion in September, but missing expectations for a fall to £6.9 billion. September's figure was revised up from £11.1 billion

The Canadian dollar surged against the U.S. dollar after the better-than-expected Canadian consumer price inflation. Canadian consumer price inflation increased 0.1% in October, beating expectations for a 0.3% decline, after a 0.1% gain in September.

On a yearly basis, the consumer price index rose to 2.4% October from 2.0% in September. Analysts had expected the index to remain unchanged at 2.0%.

The consumer price index was driven by higher prices in all categories. Shelter and food costs rose 2.8% in October.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.3% in October, exceeding expectations for a 0.2% rise, after a 0.2% increase in September.

On a yearly basis, core consumer price index in Canada climbed to 2.3% in October from 2.1% in September, beating forecasts of a rise to 2.2%.

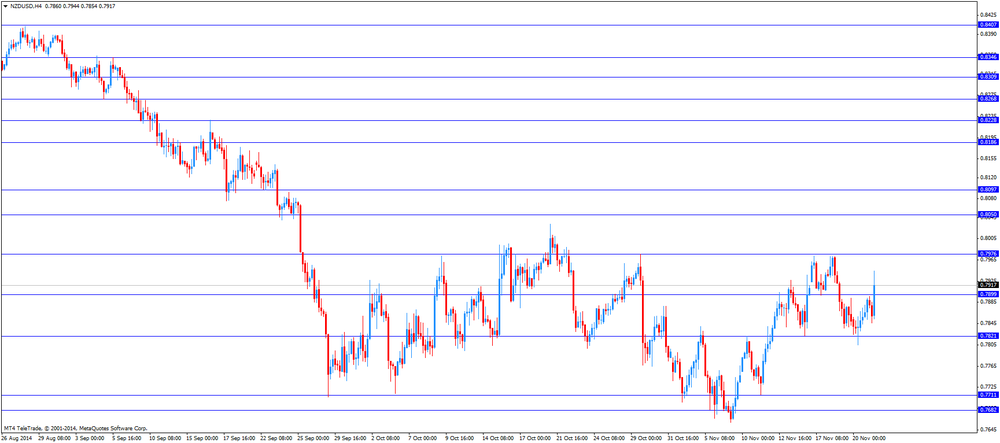

The New Zealand dollar traded higher against the U.S. dollar as the People's Bank of China lowered unexpectedly its interest rate on Friday. China's central bank cut its one year deposit rate to 2.75% from 3.0%. That was the first cut since 2012. It is a try to revive the economy.

The one-year lending rate will also be lowered from 6% to 5.6%.

The changes come into effect on Saturday.

Credit card spending in New Zealand rose 6.7% in October, after a 4.5% gain in September. September's was revised up from a 4.4% increase.

The Australian dollar climbed against the U.S. dollar as the People's Bank of China lowered unexpectedly its interest rate on Friday. There were released no major economic reports in Australia.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen increased against the greenback as Japanese Finance Minister Taro Aso said on Friday that the yen declined too rapid over the past week. That was one of the strongest warnings against a weak yen since Japan's central bank started its stimulus measures in 2012.

-

16:20

Gold: an overview of the market situation

Gold prices rose markedly today, breaking the level of $ 1,200 per ounce, and reaching the highest value in the last three weeks. The catalyst of this movement was the sudden decision of China to lower their rates, which increased the likelihood of increased demand from the world's biggest consumer of the metal.

It is worth emphasizing that the People's Bank of China for the first time since June 2012 announced reduction in base interest rates to support the economy. Thus, the rate of annual credit will be reduced by 0.4 percentage points - from 6% to 6.31%, the interest rate on deposits for the year decreased by 0.25 percentage points - from 3% to 2.75%. The Chinese central bank clarified that the changes will take effect from 22 November.

Recall that the economy of the PRC for the III quarter of 2014 added 7.3% compared with the same period last year, slightly above the average forecast of analysts. The rate of increase in China's GDP for the period were minimal over the past 5 years and below the official forecast of 7.5%, which allowed for the current year, the Chinese authorities. In II quarter change in GDP was 7.5%.

A further increase in gold prices constrains the strengthening of the US currency, the demand for which is maintained after the publication of minutes of the last Fed meeting, showing that officials believe that the economic recovery is happening confident enough to withstand external threats to growth. Because the protocol is not further clarified regarding the possible timing recovery rates, markets continue to be placed on the fact that the US central bank will raise rates in about September 2015. Expectations of growth rates on loans are putting pressure on gold as a precious metal hardly competes with the yield of interest-earning assets at higher rates.

The course of trading also influenced today's announcement ECB President Draghi who said that inflation expectations declined to very low levels, according to this, there is a possibility of further measures easing monetary policy.

Traders were also analyzed news on the sale and purchase of gold by central banks. According to the IMF, Ukraine in October reduced the gold reserves of more than a third, and Russia increased their seventh consecutive month. In addition, it was reported that India in October increased its imports of gold (in the form of bullion, jewelery and semi-finished products) by 24% compared to October last year - to $ 620 million. The import of gold jewelry rose by almost 2-fold, to $ 40, 44 million, gold bullion - by 22%, to $ 574,370,000. The import of semi-finished products for gold jewelry (jewelery accessories, frames, molding) decreased by 10%, to $ 5.18 million. since the beginning of 2014 India imported gold approximately $ 4.8 billion, which is 18% less than in January-October 2013. The import of bullion fell by 20%, to $ 4.2 billion, imports of jewelry remained at $ 0.5 billion. Imports of semi-finished products grew by 36% to $ 56 million. The export of gold from India in October 2014 increased by 39% yoy and exceeded $ 1.02 billion, this amount is almost completely accounted for by exports of gold jewelry (supply of gold coins and medallions totaled only $ 0.59 million). During 10 months of 2014, gold exports from India declined by 12% compared with January-October 2013, to about $ 7.8 billion. Exports of gold jewelry rose 11% to $ 7.3 billion. The export of gold coins and medallions fell by 76%, to less than $ 0.6 billion.

The cost of December gold futures on the COMEX today rose to 1205.00 dollars per ounce.

-

15:43

Japan’s Finance Minister Taro Aso: the yen declined too rapid over the past week

Japanese Finance Minister Taro Aso said on Friday that the yen declined too rapid over the past week.

That was one of the strongest warnings against a weak yen since Japan's central bank started its stimulus measures in 2012.

-

15:11

-

15:08

Canadian consumer price inflation climbed to 2.4% in October

Statistics Canada released consumer price inflation data today. Canadian consumer price inflation increased 0.1% in October, beating expectations for a 0.3% decline, after a 0.1% gain in September.

On a yearly basis, the consumer price index rose to 2.4% October from 2.0% in September. Analysts had expected the index to remain unchanged at 2.0%.

The consumer price index was driven by higher prices in all categories. Shelter and food costs rose 2.8% in October.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.3% in October, exceeding expectations for a 0.2% rise, after a 0.2% increase in September.

On a yearly basis, core consumer price index in Canada climbed to 2.3% in October from 2.1% in September, beating forecasts of a rise to 2.2%.

The Bank of Canada's inflation target is 2.0%.

These figures are adding to speculation that the Bank of Canada won't cut its interest rates.

-

14:36

U.S. Stocks open: Dow 17,800.08 +81.08 +0.46%, Nasdaq 4,751.32 +49.45 +1.05%, S&P 2,061.09 +8.34 +0.41%

-

14:13

DOW components before the bell

(company / ticker / price / change, % / volume)

Microsoft Corp

MSFT

48.80

+0.21%

80.6K

AT&T Inc

T

35.41

+0.37%

48.0K

3M Co

MMM

160.20

+0.53%

0.4K

The Coca-Cola Co

KO

44.50

+0.56%

4.6K

McDonald's Corp

MCD

97.21

+0.59%

0.8K

Cisco Systems Inc

CSCO

26.97

+0.60%

37.3K

International Business Machines Co...

IBM

161.70

+0.66%

5.1K

UnitedHealth Group Inc

UNH

97.50

+0.67%

0.1K

Wal-Mart Stores Inc

WMT

85.15

+0.67%

2.0K

Walt Disney Co

DIS

89.50

+0.67%

6.2K

Merck & Co Inc

MRK

59.79

+0.69%

5.6K

Home Depot Inc

HD

98.25

+0.70%

0.8K

General Electric Co

GE

27.04

+0.71%

43.7K

Procter & Gamble Co

PG

89.12

+0.73%

1K

Boeing Co

BA

132.70

+0.76%

0.9K

Travelers Companies Inc

TRV

104.28

+0.79%

0.7K

E. I. du Pont de Nemours and Co

DD

72.00

+0.80%

1K

Verizon Communications Inc

VZ

50.60

+0.82%

7.3K

Pfizer Inc

PFE

30.72

+0.92%

4.3K

Johnson & Johnson

JNJ

108.50

+0.95%

8.4K

American Express Co

AXP

91.49

+0.96%

1.5K

Goldman Sachs

GS

191.60

+0.97%

1.6K

Visa

V

254.20

+1.01%

1.1K

Nike

NKE

98.30

+1.03%

2.6K

United Technologies Corp

UTX

109.98

+1.07%

0.3K

JPMorgan Chase and Co

JPM

60.78

+1.10%

4.4K

Exxon Mobil Corp

XOM

96.90

+1.13%

14.3K

Chevron Corp

CVX

118.80

+1.27%

4.0K

Caterpillar Inc

CAT

103.95

+1.82%

8.3K

Intel Corp

INTC

35.90

-0.14%

166.0K

-

14:07

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intel (INTC) downgraded to Sell from Underperform at Credit Agricole

Other:

Caterpillar Inc (CAT) initiated with a Buy at Stifel, target $122

Amazon.com (AMZN) initiated with a Buy Nomura

Intel (INTC) target raised from $36 to $39 at Stifel, from $35 to $35 at RBC Capital Mkts, from $36 to $40 at FBR Capital, from $34 to $36 at Cowen.

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2500(E1.1bn), $1.2550(E851mn), $1.2580(E1.3bn), $1.2615/20(E716mn), $1.2650(E2.2bn)

USD/JPY: Y117.50($821mnn), Y118.25($400mn), Y118.50($710mn)

AUD/USD: $0.8600(A$230mn)

USD/CAD: Cad1.1400($310mn), Cad1.1500($921mn)

USD/CHF: Chf0.9675($1.1bn), Chf0.9700($600mn)

EUR/GBP: stg0.7825(E1.1bn), stg0.7850, stg0.7925(E302mn)

-

13:30

Canada: Consumer price index, y/y, October +2.4% (forecast +2.0%)

-

13:30

Canada: Consumer Price Index m / m, October +0.1% (forecast -0.3%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, m/m, October +0.3% (forecast +0.2%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, y/y, October +2.3% (forecast +2.2%)

-

13:25

-

13:21

People's Bank of China cut unexpectedly its interest rate on Friday

The People's Bank of China lowered unexpectedly its interest rate on Friday. China's central bank cut its one year deposit rate to 2.75% from 3.0%. That was the first cut since 2012. It is a try to revive the economy.

The one-year lending rate will also be lowered from 6% to 5.6%.

The changes come into effect on Saturday.

The interest rate cut came after the recent weak economic data from China. China's HSBC preliminary manufacturing purchasing managers' index released on Thursday dropped 50.0 in November from 50.4 in October. A reading below 50.0 indicates contraction.

China's economic growth fell to a five-year low of 7.3% in the third quarter.

-

13:04

Foreign exchange market. European session: the euro dropped against the U.S. dollar after comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 New Zealand Credit Card Spending October +4.4% +6.7%

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October 10.6 6.9 7.1

The U.S. dollar mixed against the most major currencies ahead of the U.S. economic data. The greenback was supported by yesterday's better-than-expected U.S. economic data. The Philadelphia Federal Reserve Bank' manufacturing index surged to 40.8 in November from 20.7 in October. That was the highest level since December 1993.

Sales of existing homes in the U.S. climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013.

There will be released no major economic reports in the U.S. on Friday.

The euro dropped against the U.S. dollar after comments by the European Central Bank (ECB) President Mario Draghi. He reiterated that the ECB is prepared to add further stimulus measures if needed. Investors speculate that the central bank is moving closer to launch the quantitative easing programme.

Draghi also said that inflation expectations were declining.

The British pound traded lower against the U.S. dollar after the weaker-than-expected public sector net borrowing figures from the U.K. The public sector net borrowing in the U.K. declined to £7.1 billion in October from £10.6 billion in September, but missing expectations for a fall to £6.9 billion. September's figure was revised up from £11.1 billion

The Canadian dollar rose against the U.S. dollar ahead of the Canadian consumer price inflation. The consumer price index in Canada is expected to remain unchanged at an annual rate of 2.0% in October.

The core consumer price index in Canada is expected to rise to an annual rate of 2.2% in October from 2.1% in September.

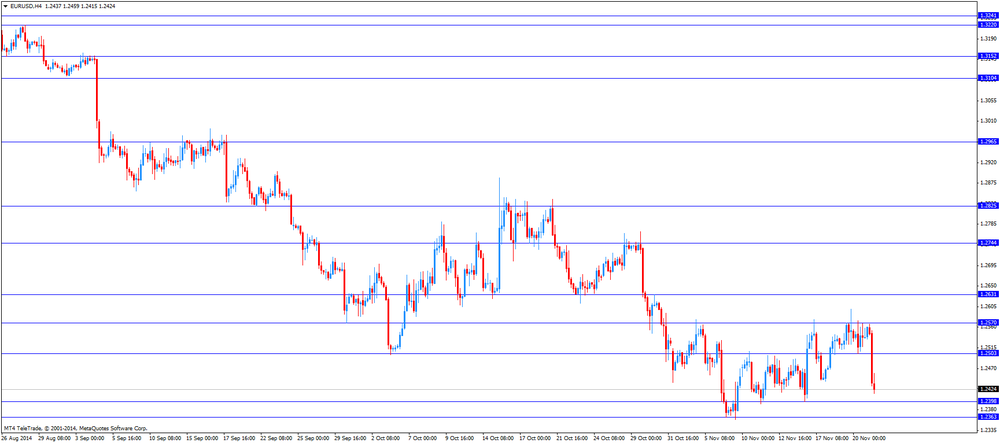

EUR/USD: the currency pair dropped to $1.2415

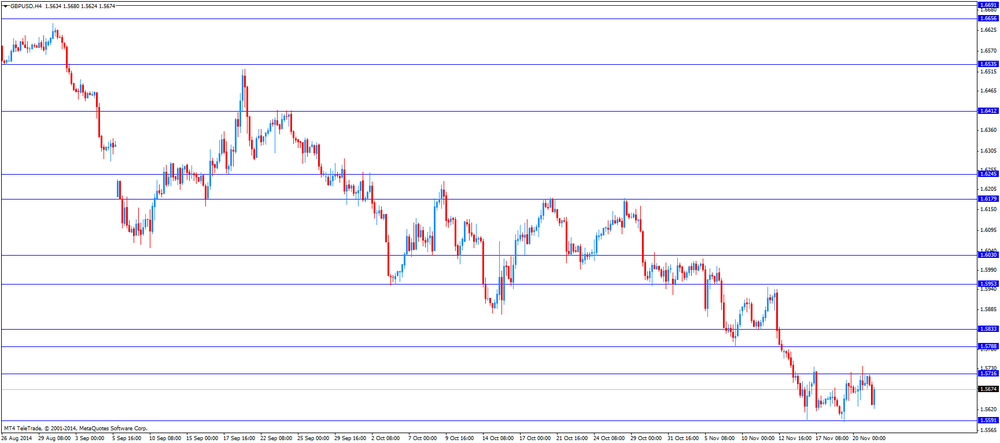

GBP/USD: the currency pair fell to $1.5624

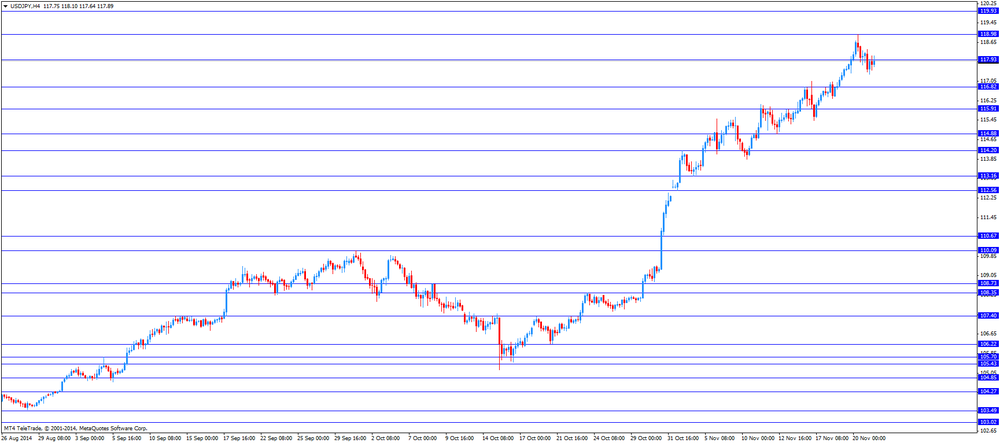

USD/JPY: the currency pair rose to Y118.11

The most important news that are expected (GMT0):

13:30 Canada Consumer price index, y/y October +2.0% +2.0%

13:30 Canada Consumer Price Index m / m October +0.1% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m October +0.2% +0.2%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October +2.1% +2.2%

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580, $1.2520, $1.2475/80

Bids $1.2400, $1.2380, $1.2350

GBP/USD

Offers $1.5800, $1.5780/85, $1.5745/50

Bids $1.5620/00, $1.5580, $1.5550, $1.5525/20, $1.5500

AUD/USD

Offers $0.8800, $0.8750

Bids $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y148.50, Y148.00, Y147.50, Y147.00

Bids Y146.00, Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.60/80

Bids Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980

Bids stg0.7910/00, stg0.7885/75, stg0.7860/50

-

11:55

European stock markets mid-session: European stocks gain after signals from Mario Draghi

European stocks rose after a good start in early trading fuelled by ECB president Mario Draghi's hints at the European banking congress that more monetary easing could help European economy's recovery and that policy makers have to bring inflation back to target as fast as possible. Size, pace and composition of the economic stimulus can be adjusted. At the moment there are no indications that economic growth will increase significantly in the months to come, he further stated. The FTSE 100 index is currently trading +0.69% at 6,725.27 points, Germany's DAX 30 gained +1.59% trading at 9,634.79 points and France's CAC 40 is up +1.46% currently quoted at 4,295.87 points leaving them on course for weekly gains.

-

11:20

Oil: Prices rise on good U.S. data

Oil prices rose in today's session with Brent Crude trading +1.18% at USD80.27 a barrel and WTI Crude gaining +0.95% currently quoted at USD76.57 supported by good U.S. economic data published yesterday.

Investors try to assess the potential outcome of the OPEC meeting, which will take place next week in Vienna. Experts note that the main producers of OPEC do not want to reduce production quotas, and other members of the cartel, including Venezuela, Iran, Ecuador, Nigeria and Algeria called for measures to stabilize oil prices. Morgan Stanley analysts pointed out that the probability that the leadership of OPEC still decide to cut production, has recently increased.

Increasingly weak oil prices which have fallen by almost a third in five months add further pressure on the leading OPEC members Saudi Arabia and Kuwait that still seem resisting calls from other members to cut output as they fear losing market shares to U.S. shale drillers. The OPEC with its 12 member countries responsible for 40% of world's oil production is scheduled to meet in Vienna on November 27 to discuss 2015 production target and whether to adjust the current volume of production at 30 million. B / d at the beginning of 2015.

-

11:00

Gold recovers from losses after Draghi’s speech trading below USD1,200

Gold, currently trading below the key-level of USD1200.00 a troy ounce recovered from earlier trading losses. ECB presidents Mario Draghi's speech sent the euro toward five-year lows weighing on the precious metal. The strong greenback supported by strong U.S. data and the Federal Reserve's most recent meeting minutes puts pressure on gold as it makes the metal more expensive for buyers not using the U.S. dollar.

Holdings in gold-backed exchange-traded products fell 2.1 tons to 1,614.7 tons yesterday, remaining at the lowest in more than five years, data compiled by Bloomberg show.

GOLD currently trading below USD1,200.00

-

10:26

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2500(E1.1bn), $1.2550(E851mn), $1.2580(E1.3bn), $1.2615/20(E716mn), $1.2650(E2.2bn)

USD/JPY: Y117.50($821mnn), Y118.25($400mn), Y118.50($710mn)

AUD/USD: $0.8600(A$230mn)

USD/CAD: Cad1.1400($310mn), Cad1.1500($921mn)

USD/CHF: Chf0.9675($1.1bn), Chf0.9700($600mn)

EUR/GBP: stg0.7825(E1.1bn), stg0.7850, stg0.7925(E302mn)

-

10:25

Japans Prime Minister Shinzo Abe: sales tax hike wont be postponed any longer than 18 months

After having announced snap elections and postponing a sales tax hike until October 2015, Japans Prime Minister Shinzo Abe said today that he won't postpone it any further than that regardless of Japan's economic condition.

-

09:35

Press Review: SNB Can Take Further Steps to Defend Cap, Zurbruegg Says

BLOOMBERG

Confused OPEC Watchers Are More Divided Than Ever

To understand just how contentious next week's OPEC meeting will be, take a look at the confusion it's created among professionals paid to predict the outcome.

The 20 analysts surveyed this week by Bloomberg are perfectly divided, with half forecasting the Organization of Petroleum Exporting Countries will cut supply on Nov. 27 in Vienna to stem a plunge in prices while the other half expect no change. In the seven years since the surveys began, it's the first time participants were evenly split. The only episode that created a similar debate was the OPEC meeting in late 2007, when crude was soaring to a record.

Source: http://www.bloomberg.com/news/2014-11-21/confused-opec-watchers-are-more-divided-than-ever.html

BLOOMBERG

SNB Can Take Further Steps to Defend Cap, Zurbruegg Says

The Swiss National Bank will defend its cap of 1.20 per euro on the franc and won't hesitate to enact supplementary measures, Governing Board Member Fritz Zurbruegg said.

"The SNB will continue to enforce the minimum exchange rate with the utmost determination," Zurbruegg said in a speech yesterday in Geneva, reiterating the stance taken by the central bank at its most recent policy decision. "To this end, it is prepared to purchase foreign exchange in unlimited quantities and to take further measures immediately if required."

REUTERS

Iran says will double oil exports in two months if sanctions end

Iran will double its oil exports within two months if sanctions against it end, Oil Minister Bijan Zanganeh told official news agency IRNA.

Zanganeh said he will talk with top oil exporter Saudi Arabia about market share when OPEC meets next week, IRNA said on Thursday.

Source: http://www.reuters.com/article/2014/11/20/us-opec-iran-saudi-idUSKCN0J424120141120

-

09:30

United Kingdom: PSNB, bln, October 7.1 (forecast 6.9)

-

09:10

ECB president Mario Draghi: growth outlook for the Eurozone remains weak

ECB president Mario Draghi just finished his speech at the European banking congress at Frankfurt. At the moment Bundesbank President Jens Weidmann is speaking. Mario Draghi stated that interest rates have reached a low but the ECB will do what is necessary to meet inflation targets if low inflation persists. Size, pace and composition of the economic stimulus can be adjusted. He said that growth outlook for the Eurozone remains weak in the months to come.

-

09:00

European Stocks. First hour: European stocks trading higher

European stocks are trading higher in early trading after yesterday's disappointing preliminary data on manufacturing and service sector activity in France and Germany and the Eurozone fuelled expectations for further easing measures by the European Central Bank. Markets are awaiting the speeches of ECB president Mario Draghi who just finished and Bundesbank President Jens Weidmann at the European banking congress at Frankfurt starting at 08:00 GMT. Draghi stated that interest rates have reached a low but the ECB will do what is necessary to meet inflation targets. Size, pace and composition of the economic stimulus can be adjusted. At the moment there are no indications that economic growth will increase significantly.

The FTSE 100 index is currently trading higher at +0.40% at 6,705.86 points, Germany's DAX 30 is up +0.76% trading at 9,556.51 points and France's CAC 40 gained +0.62% currently quoted at 4,260.30 points. Markets found support in strong U.S. data published yesterday and rising Asian indices.

-

08:00

Global Stocks: Dow Jones and S&P500 rise to new highs on upbeat U.S. data

The DOW Jones and S&P 500 were trading higher in Thursday's trading session after better-than-expected data on the U.S. economy and despite weaker growth in China and the Eurozone. The DOW Jones closed at 17,719 at new record highs, a plus of +0.19% while the S&P500 edged up by +0.20% closing at 2,052.75 points and erasing early losses.

Hong Kong's Hang Seng trading +0.47% at 23,459.38 and China's Shanghai Composite closing at 2,487.11 points, a gain of 1.40%, edged up as speculations about the PBOC is going to inject money into the markets to prevent from a cash crunch. Yesterday's data showed a loss of momentum in China's economy as the preliminary HSBC Manufacturing PMI dropped to 50, a stall.

Japan's Nikkei closed with a gain of +0.33% at 17,357.51 points after Prime Minister Shinzo Abe dissolved parliament's lower house in order to hold snap elections in December.

-

07:25

Foreign exchange market. Asian session: U.S. dollar trading mixed after U.S. data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 New Zealand Credit Card Spending October +4.4% +6.7%

The U.S. dollar traded mixed against its peers during Asian Trade despite the mostly better-than-expected U.S. economic data but profit taking took away some gains. The Philadelphia Federal Reserve Bank' manufacturing index surged to 40.8 in November from 20.7 in October to the highest level since December 1993. Beating forecasts that expected the index to decline to 18.9.Sales of existing homes in the U.S. climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013. September's figure was revised up from 5.17 million units. Analysts had expected an increase to 5.16 million units. The U.S. consumer price inflation was flat in October, beating expectations for a 0.1% decrease, after a 0.1% increase in September.

The Australian dollar recouped some of its losses as China's preliminary PMI stalled and falling iron ore prices weighed on the currency earlier in the week.

The New Zealand dollar could recover losses against the U.S. dollar as lower milk prices pushed down in- and output producer prices in New Zealand and disappointing Chinese PMI data earlier in the week. China is New Zealand's second biggest export partner. Credit Card spending in October went up +6.7% compared to a +4.4% in September.

The Japanese yen strengthened against the U.S. dollar ahead of a three-day weekend as markets are closed on Monday for a public holiday after Japan's Finance Minister Taro Aso stated that the yen has depreciated too fast. Early in yesterday's session the yen traded at a new seven-year low at USD118.98.

EUR/USD: the euro traded mixed against the greenback

USD/JPY: the U.S. dollar traded weaker against the Japanese yen after new seven-year highs

GPB/USD: The British pound traded slightly weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October 11.1 6.9

13:30 Canada Consumer price index, y/y October +2.0% +2.0%

13:30 Canada Consumer Price Index m / m October +0.1% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m October +0.2% +0.2%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October +2.1% +2.2%

-

06:22

Options levels on friday, November 21, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2696 (4227)

$1.2639 (2223)

$1.2600 (1262)

Price at time of writing this review: $ 1.2544

Support levels (open interest**, contracts):

$1.2506 (2568)

$1.2463 (3163)

$1.2402 (4439)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 103115 contracts, with the maximum number of contracts with strike pric $1,3000 (5322);

- Overall open interest on the PUT options with the expiration date December, 5 is 105831 contracts, with the maximum number of contracts with strike price $1,2500 (6685);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from November, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (730)

$1.5804 (635)

$1.5708 (1144)

Price at time of writing this review: $1.5679

Support levels (open interest**, contracts):

$1.5595 (1448)

$1.5497 (844)

$1.5399 (1032)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 39981 contracts, with the maximum number of contracts with strike price $1,6000 (1947);

- Overall open interest on the PUT options with the expiration date December, 5 is 40118 contracts, with the maximum number of contracts with strike price $1,5900 (2304);

- The ratio of PUT/CALL was 1.00 versus 1.01 from the previous trading day according to data from November, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:29

Nikkei 225 17,134.6 -166.26 -0.96%, Hang Seng 23,347.03 -2.61 -0.01%, S&P/ASX 200 5,305.7 -10.54 -0.20%, Shanghai Composite 2,450.88 -1.78 -0.07%

-

02:01

New Zealand: Credit Card Spending, October +6.7%

-