Notícias do Mercado

-

20:00

-

19:20

American focus: the Japanese yen has increased significantly

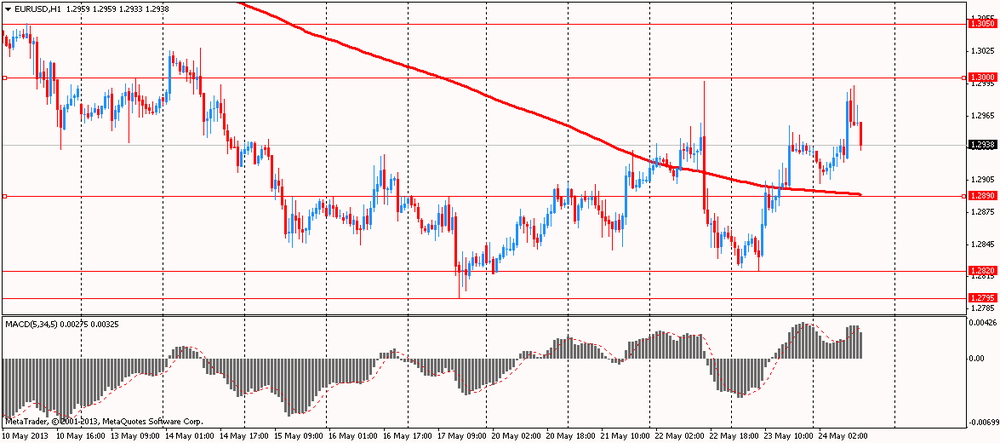

The euro exchange rate fell sharply against the dollar, while otsupiv of the maximum values, and returning to the opening level. Note that initially helped by strong growth in the euro data for Germany. Leading indicator of consumer confidence in Germany rose in June GfK fifth consecutive month, up 6.5 points from 6.2 points in May, exceeding the forecast of economists, who had expected that he would remain at 6.2 points. The June index value - the highest since September 2007. German GDP rose in the 1st quarter by 0.1% compared with the previous quarter, and this growth corresponds to the previously published estimates. The economy has become stronger thanks to private consumption, while exports and investment companies declined.

Report Ifo, presented on Friday, reveals that the confidence of German business confidence recovered in May after two consecutive months of decline, pointing out that the growth of Europe's largest economy is gathering pace. The index of business sentiment in Germany Ifo index for May rose to 105.7 from 104.4 in April, beating the forecasts of economists who had expected the index to improve to 104.6.

However, the situation changed dramatically after the publication of the American dannyh.V report stated that orders for durable goods rose 3.3% in April after falling by a revised 5.9% in March. Economists had expected orders to rise by 1.1% compared to the 5.7% drop that have been reported for the previous month. Total orders for durable goods in April, adjusted for seasonal variation was 222.6 billion dollars.

Spending increased in almost all categories, with the growth leader orders for military aircraft and parts, which increased by 53.3%, as well as orders for civilian aircraft, which increased by 18.1%. With the exception of volatile orders for transportation equipment, orders for durable goods rose 1.3% in April, compared with 1.7% ethyl drop in March. Orders for durable goods excluding defense value of goods in April rose by 2.1% compared with 4.7% ethyl drop in March.

The yen extended its biggest weekly gain against the dollar since June, after the seminar on the economic future of Asia, Bank of Japan Haruhiko Kuroda said that the stability of the "highly desirable" for the debt market in the country, adding that the central bank will work over flexible market operations and strengthening ties with the market to prevent volatility in bond yields. He also said the markets concerned about the situation with long-term government securities, through which the Bank of Japan has taken a direct part in the markets, and it is highly desirable for these tools steady motion. We will conduct our operations in the market in a flexible manner, while maintaining as much as possible, the volatility of long-term interest rates, which temporarily grown in recent years - he added. Kuroda also said that the Bank of Japan will continue to strengthen communication between the market and bonds. However, Kuroda refused to comment on the "daily motion" in the Japanese stock and bond markets and exchange rates. He added that the central bank is committed to a specific level of stock prices and the yen.

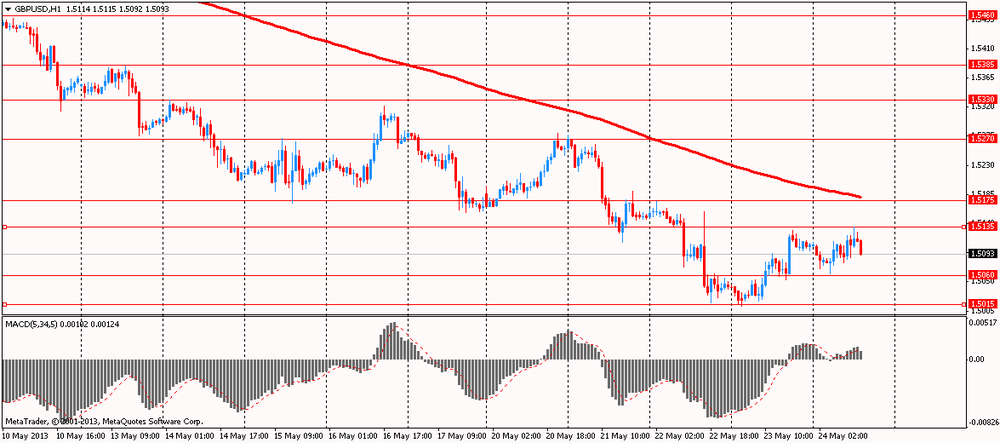

The pound rose against the dollar after the data of the British Bankers' Association (BBA), published on Friday, showed that UK companies and households in April continued to pay off debts, as confidence remains subdued, despite a number of government initiatives to stimulate lending. According to the BBA, the net payment of loans by non-financial companies in April was 2.0 billion pounds ($ 3 billion) from 0.8 billion pounds in March. Household as a whole is also made more payments on the mortgage loans than done. As a result, net repayment of loans in April totaled 241 million pounds against 348 million pounds in March. In April 2012, net mortgage lending increased by 350 million pounds.

The total mortgage lending, which measures mortgage loans without deducting repayments on loans in April was 7.8 billion pounds, unchanged compared with March. Meanwhile, the number of mortgage approvals in April rose only slightly, to 32,153 from 31,401 in March.

The only sector which saw an increase - is unsecured consumer credit, which includes credit card loans. The index rose by 0.5 billion pounds after net repayment in March of 0.6 billion pounds.

-

18:20

European stock close:

European stocks fell, posting their first weekly decline in more than a month, as speculation that central banks will reduce stimulus measures overshadowed a bigger-than-forecast increase in U.S. durable-goods orders.

The Stoxx Europe 600 Index slipped 0.2 percent to 303.35 at the close in London. The gauge lost 1.7 percent this week, the first weekly decline since April 19, as the Federal Reserve signaled it will scale back stimulus if the economy improves.

U.S. orders for durable goods climbed 3.3 percent in April after falling by the most in seven months in March, figures from the Commerce Department showed. Economists survey had estimated a 1.5 percent gain.

In Germany, business confidence increased for the first time in three months. The Ifo institute's business climate index, based on a survey of 7,000 executives, advanced to 105.7 in May from 104.4 in April. Economists in survey predicted sentiment to remain unchanged.

National benchmark indexes declined in 12 of the 18 western-European markets.

FTSE 100 6,654.34 -42.45 -0.6% CAC 40 3,956.79 -10.36 -0.3% DAX 8,305.32 -46.66 -0.6%

Raiffeisen Bank International lost 2.1 percent to 26.43 euros. Herbert Stepic offered to resign as the CEO of the Vienna-based lender, a day after officials began a probe into his investments through offshore accounts.

Next Plc (NXT) dropped 2.4 percent to 4,580 pence. Morgan Stanley cut the U.K. retailer to underweight, a recommendation similar to sell, saying the stock is expensive. Next jumped this week to its highest price since at least 1988 and has rallied 24 percent this year.

Telecom Italia SpA lost 3.4 percent to 62.9 euro cents as the company delayed a decision over a proposed spinoff of its fixed-line network. Its board of directors, after a meeting in Rome yesterday, will gather on May 30 to take a final call on the plan, Milan-based Telecom Italia said.

HSBC slid 2.1 percent to 726 pence, contributing the most to a decline in the Bloomberg European 500 Index. (BE500) The Telegraph reported, without citing anyone, that the lender's $1.9 billion settlement with the U.S. government in a money-laundering case may be rejected by a judge. HSBC said in a statement it is actively supporting steps taken by regulators.

Smiths Group Plc advanced 1.5 percent to 1,355 pence after saying it expects higher second-half sales compared with a year earlier, driven by an increase in orders. So-called underlying revenue increased in all of its divisions in the first nine months of the year, the maker of airport-security scanners said.

-

17:00

-

16:40

Oil: an overview of the market situation

Oil prices fell today, due to the low volume of trading in anticipation of the holiday in the U.S., the shaky outlook for demand in China, as well as ample stocks in the United States. Note that today's oil prices continued their four-day downward trend. This week, the price of WTI crude oil showed the biggest decline since mid-April. Experts note that the quotes Brent crude oil fell under the influence of clear cyclical factors, chief among them - a low growth of the world economy, the pace of which are able to drive oil prices below the $ 95 per barrel.

Note that the more positive economic data in the U.S. raised concerns that the Federal Reserve may soon collapse of bond purchases and curb the huge cash flow, which encourages financial investors to bet on oil.

The data showed that orders for durable goods rebounded in April, offering some good news for the manufacturing sector, which has recently slowed recovery of the U.S. economy. According to the report, orders for durable goods increased by 3.3% compared with the previous month to a seasonally adjusted 222.6 million. Economists had expected an increase of 1.3%. Expenses rose almost across the board, most of all in the defense sector by 53.3% and orders for civilian aircraft increased by 18.1%. Orders for durable goods without volatile sector rose by 1.3%. Durable goods are generally expensive products are designed for use within a few years. Businesses and consumers usually make such purchases when they are confident in the economy.

We also add that the pressure of the oil have concerns that China can not achieve its growth target of 7.5 percent this year.

The cost of the July futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to 93.48 dollars a barrel on the New York Mercantile Exchange.

July futures price for North Sea Brent crude oil mixture fell $ 0.56 to $ 102.09 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Note that, despite the current slight decline in gold prices, precious metal remains on track for the biggest weekly increase for the month, which is supported by the fall in the stock markets and comments from members of the Federal Reserve System.

It is also worth adding that gold was supported this week by the fall of the shares, and especially in Europe, which yesterday revealed its biggest one-day drop in nearly a year on Thursday. Meanwhile, speculation about the Fed is that the program of monetary stimulus may be completed, continues to put pressure on gold.

Experts point out that today's slight decline is likely due to the fact that investors are preparing for a longer weekend than usual due to the holiday in the U.S..

Also on the dynamics of trade have influenced the U.S. data, which showed that durable goods orders rose 3.3% in April after falling by a revised 5.9% in March. Economists had expected orders to rise by 1.1% compared to the 5.7% drop that have been reported for the previous month. Total orders for durable goods in April, adjusted for seasonal variation was 222.6 billion dollars. Spending increased in almost all categories, with the growth leader orders for military aircraft and parts, which increased by 53.3%, as well as orders for civilian aircraft, which increased by 18.1%. With the exception of volatile orders for transportation equipment, orders for durable goods rose 1.3% in April, compared with 1.7% ethyl drop in March. Orders for durable goods excluding defense value of goods in April rose by 2.1% compared with 4.7% ethyl drop in March.

Meanwhile, today it was announced that the gold reserves in the SPDR Gold Trust fell yesterday by 1.5 tonnes to 1,018.567 tons level, resulting in a total outflow for the week amounted to 19.8 tons.

The cost of the June gold futures on COMEX today dropped to 1386.50 dollars an ounce.

-

14:52

Option expiries for today's 1400GMT cut

EUR/USD $1.2750, $1.2785, $1.2825, $1.2830, $1.2865, $1.2900, $1.2925, $1.2935, $1.2970, $1.3000

USD/JPY Y101.00, Y101.50, Y101.60, Y102.00, Y102.25, Y104.00

EUR/JPY Y131.25

GBP/USD $1.5000, $1.5100, $1.5250

USD/CHF Chf0.9600, Chf0.9700

EUR/CHF Chf1.2375, Chf1.2400, Chf1.2450, Chf1.2550, Chf1.2705

AUD/USD $0.9605, $0.9650, $0.9850

-

14:35

-

14:29

Before the bell: S&P futures -0.42%, Nasdaq futures -0.43%

U.S. stock futures fell as investors weighed this week's Federal Reserve stimulus announcements and data showing a rise in durable goods orders.

Global Stocks:

Nikkei 14,612.45 +128.47 +0.89%

Hang Seng 22,618.67 -51.01 -0.23%

Shanghai Composite 2,288.53 +12.87 +0.57%

FTSE 6,662.26 -34.53 -0.52%

CAC 3,973.5 +6.35 +0.16%

DAX 8,313.43 -38.55 -0.46%

Crude oil $93.60 -0.69%

Gold $1389.60 -0.14%

-

14:15

U.S. durable goods orders rise more than expected in April

After reporting a sharp in new orders for manufactured durable goods in the previous month, the Commerce Department released a report on Friday showing that durable goods orders rebounded by more than anticipated in the month of April.

The report said durable goods orders surged up by 3.3 percent in April after tumbling by a revised 5.9 percent in March. Economists had expected orders to climb 1.1 percent compared to the 5.7 percent drop that had been reported for the previous month.

Excluding a rebound in orders for transportation equipment, durable goods orders rose by 1.3 percent in April compared to a 1.7 percent drop in March.

-

14:00

-

13:56

Upgrades and downgrades before the market open:

Upgrades:

Procter & Gamble (PG) upgraded to Buy from Neutral at UBS

Downgrades:

Other:

Johnson & Johnson (JNJ) price target raised to $94 from $88 at Leerink Swann

-

13:30

-

13:30

-

13:30

-

13:23

European session: the euro rose

06:00 Germany Gfk Consumer Confidence Survey June 6.2 6.2 6.5

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.1% +0.1% +0.1%

06:00 Germany GDP (YoY) (Finally) Quarter I -0.2% -0.2% -0.2%

07:15 United Kingdom MPC Member Fisher Speaks

08:00 Germany IFO - Business Climate May 104.4 104.6 105.7

08:00 Germany IFO - Current Assessment May 107.2 107.2 110.0

08:00 Germany IFO - Expectations May 101.6 101.6 101.6

08:30 United Kingdom BBA Mortgage Approvals April 31.2 32.7 32.2

10:00 Eurozone ECB's Jens Weidmann Speaks

The euro strengthened for a second day against the dollar after an industry report showed German business confidence unexpectedly increased in May, adding to optimism the region's biggest economy is improving.

The 17-nation currency extended its biggest weekly advance in seven weeks as a separate report forecast German consumer sentiment will improve in June.

The Ifo institute's German business climate index improved to 105.7 from 104.4 in April. Economists surveyed by Bloomberg News (GRIFPBUS) predicted it would remain unchanged. GfK AG said its consumer-sentiment index will increase to 6.5 next month from 6.2 in May. That would be the highest since September 2007.

While risks stemming from Europe's debt crisis persist, the German economy will gather pace in the current quarter, the Bundesbank said this week. Factory orders surged for a second month in March and exports increased.

The yen extended its biggest weekly gain versus the dollar since June after Bank of Japan Governor Haruhiko Kuroda said the central bank had announced sufficient monetary easing. The yen rose for a second day versus the dollar as Kuroda said the BOJ will implement flexible money-market operations and he wants to avoid increasing volatility in bond markets.

The pound rose against the dollar after the data of the British Bankers' Association (BBA), published on Friday, showed that UK companies and households in April continued to pay off debts, as confidence remains subdued, despite a number of government initiatives to stimulate lending. According to the BBA, the net payment of loans by non-financial companies in April was 2.0 billion pounds ($ 3 billion) from 0.8 billion pounds in March.

EUR / USD: during the European session, the pair rose to $ 1.2993 and retreated

GBP / USD: during the European session, the pair rose to $ 1.5135

USD / JPY: during the European session, the pair fell to Y101.17

At 12:30 GMT the United States will publish the change in orders for durable goods, including excluding transportation equipment in April.

-

13:04

Orders

EUR/USD

Offers $1.3050, $1.3000

Bids $1.2960550, $1.2905/00, $1.2880, $1.2850, $1.2820/00, $1.2790

GBP/USD

Offers $1.5220/25, $1.5200, $1.5150/60, $1.5120/30

Bids $1.5060/50, $1.5040, $1.5000, $1.4985/80

AUD/USD

Offers $0.9800, $0.9780, $0.9760, $0.9735/40, $0.9700/10

Bids $0.9650/45, $0.9620/00, $0.9550, $0.9500

EUR/GBP

Offers stg0.8650/60, stg0.8620, stg0.8600

Bids stg0.8445/40, stg0.8430/20, stg0.8400

EUR/JPY

Offers Y133.50, Y133.20, Y133.00, Y132.20

Bids Y131.40, Y131.25/20, Y131.00, Y130.55/50, Y130.35/30

USD/JPY

Offers Y103.00, Y102.75/80, Y102.40, Y101.95/00

Bids Y101.20, Y101.05/00, Y100.85/80, Y100.50, Y100.20

-

11:34

European stocks declined for a second day

European stocks declined for a second day, after the Stoxx Europe 600 Index yesterday dropped the most in 10 months.

In Germany, a report showed business confidence increased for the first time in three months. The Ifo institute's business climate index, based on a survey of 7,000 executives, climbed to 105.7 in May from 104.4 in April. Economists in a survey predicted sentiment to remain unchanged.

Raiffeisen Bank International lost 1.8 percent to 26.51 euros. Herbert Stepic offered to resign as CEO of the Vienna-based lender, a day after officials began a probe into his investments through offshore accounts.

Next Plc dropped 2.3 percent to 4,583 pence. Morgan Stanley cut the U.K. retailer to underweight, a recommendation similar to sell, saying the stock is expensive. Next this week jumped to its highest price since at least 1988 and has rallied 24 percent this year.

Novo Nordisk advanced 0.9 percent to 977.50 kroner. The Danish drugmaker said tests with its liraglutide treatment showed an eight percent weight-loss for overweight patients without diabetes, compared with a 2.6 percent weight loss for a placebo. Natixis raised the stock to buy from neutral. The company said in March that the drug helped patients with type 2 diabetes lose weight.

FTSE 100 6,656.79 -40.00 -0.60%

CAC 40 3,968.9 +1.75 +0.04%

DAX 8,295.96 -56.02 -0.67%

-

10:22

Option expiries for today's 1400GMT cut

EUR/USD $1.2750, $1.2785, $1.2825, $1.2830, $1.2865, $1.2900, $1.2925, $1.2935, $1.2970, $1.3000

USD/JPY Y101.00, Y101.50, Y101.60, Y102.00, Y102.25, Y104.00

EUR/JPY Y131.25

GBP/USD $1.5000, $1.5250

USD/CHF Chf0.9600, Chf0.9700

EUR/CHF Chf1.2375, Chf1.2400, Chf1.2450, Chf1.2550, Chf1.2705

AUD/USD $0.9605, $0.9650, $0.9850

-

10:04

Friday: Asia Pacific stocks close

Asia's benchmark regional stock index swung between gains and losses as Australian banks declined and the yen rose after Bank of Japan Governor Haruhiko Kuroda said the central bank had announced sufficient stimulus.

Nikkei 225 14,612.45 +128.47 +0.89%

S&P/ASX 200 4,983.5 -78.95 -1.56%

Shanghai Composite 2,288.53 +12.87 +0.57%

Commonwealth Bank of Australia, the country's largest lender, fell 1.6 percent, as Australian banks headed for the largest weekly drop in a year.

Lenovo Group Ltd. added 4.3 percent in Hong Kong after the second-biggest personal computer maker said it sees no limit to size of acquisitions to bolster its smartphone business.

Tokyo Electric Power Co. led Japanese utilities to the biggest advance on Japan's Topix Index, as the gauge rebounded from a plunge that yesterday wiped $314 billion from the values of the country's shares.

-

09:51

-

09:31

-

09:01

-

09:01

-

09:00

-

07:42

-

07:24

Asian session: The yen rose

02:55 Japan BOJ Governor Haruhiko Kuroda Speaks

The yen rose against all major peers as stocks reversed an earlier advance and Bank of Japan Governor Haruhiko Kuroda said the central bank had announced sufficient monetary easing. "Investors have bought both Japanese stocks and dollar-yen, so when the equities are sold, the pair is susceptible to a drop," said Hiroshi Yoshida, a senior portfolio manager in Tokyo at MassMutual Life Insurance Co. "Position adjustments are more likely before the three-day holiday."

The dollar strengthened versus most of its counterparts before U.S. data that economists say will show durable goods orders and consumer confidence rose, backing the case for the Federal Reserve to slow stimulus.

German business confidence was probably unchanged in May after two monthly declines amid doubts over the economic recovery.

The Ifo institute's business climate index, based on a survey of 7,000 executives, will remain at 104.4, according to the median of 44 forecasts in a Bloomberg News survey. Ifo releases the report at 10 a.m. in Munich today.

EUR / USD: during the Asian session the pair fell to $ 1.2900

GBP / USD: during the Asian session the pair fell to $ 1.5060

USD / JPY: during the Asian session the pair fell below Y101.50

There is a full calendar on Friday for markets to concentrate on, with a raft of early data from the eurozone. At 0600GMT, the latest German fiscal and economic report is due, along with the detailed first quarter GDP data. At 0610GMT, the June GFK consumer sentiment indicator will be released. French data is expected at 0645GMT, with the release of the May business climate indicator, along with the May manufacturing and service sentiment indicators. At 0700 GMT, the Spanish April PPI numbers will cross the wires. At 0730GMT, German Finance Minister Wolfgang Schaeuble takes part in a conference with finance ministers of Germany's regional states, while at 0800GMT, German Economics Minister Philipp Roesler and IEA executive director Maria van der Hoeven deliver a joint press conference. Possibly the main Euro area release of the day will be the German May IfO release at 0800GMT. Also at 0800GMT, the Italian May ISTAT consumer confidence survey is out.

-

07:03

-

07:01

-

07:01

-

07:00

-

06:43

Commodities. Daily history for May 23’2013:

Change % Change Last

GOLD 1,390.40 23.00 1.68%

OIL (WTI) 94.34 0.06 0.06%

-

06:43

Stocks. Daily history for May 23’2013:

Change % Change Last

Nikkei 225 14,483.98 -1,143.28 -7.32%

S&P/ASX 200 5,062.4 -102.97 -1.99%

Shanghai Composite 2,275.37 -27.03 -1.17%

FTSE 100 6,696.79 -143.48 -2.10%

CAC 40 3,967.15 -83.96 -2.07%

DAX 8,351.98 -178.91 -2.10%

Dow -12.05 15,295.12 -0.08%

Nasdaq -3.88 3,459.42 -0.11%

S&P -4.79 1,650.56 -0.29%

-

06:42

Currencies. Daily history for May 23'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2932 +0,62%

GBP/USD $1,5107 +0,42%

USD/CHF Chf0,9687 -1,06%

USD/JPY Y101,99 -1,11%

EUR/JPY Y131,89 -0,49%

GBP/JPY Y154,06 -0,68%

AUD/USD $0,9739 +0,51%

NZD/USD $0,8126 +0,86%

USD/CAD C$1,0301 -0,67%

-

06:01

Schedule for today, Friday, May 24’2013:

02:55 Japan BOJ Governor Haruhiko Kuroda Speaks

06:00 Germany Gfk Consumer Confidence Survey June 6.2 6.2

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.1% +0.1%

06:00 Germany GDP (wda) (YoY) (Finally) Quarter I -1.4% -1.4%

07:15 United Kingdom MPC Member Fisher Speaks

08:00 Germany IFO - Business Climate May 104.4 104.6

08:00 Germany IFO - Current Assessment May 107.2 107.2

08:00 Germany IFO - Expectations May 101.6 101.6

08:30 United Kingdom BBA Mortgage Approvals April 31.2 32.7

10:00 Eurozone ECB's Jens Weidmann Speaks

12:30 U.S. Durable Goods Orders April -5.7% +1.8%

12:30 U.S. Durable Goods Orders ex Transportation April -1.4% +0.6%

12:30 U.S. Durable goods orders ex defense April -4.7%

13:00 Belgium Business Climate May -14.7 -13.4

-