Notícias do Mercado

-

23:54

NZD/USD attempts a break above 0.5700 as Jinping’s impact fades, US GDP buzz

- NZD/USD is playing around 0.5700, eyeing a break above 0.5700 amid a risk-on mood.

- China’s Jinping impact that dragged the kiwi bulls has started fading away.

- The US economy is expected to deliver a positive growth rate for the third quarter of CY2022.

The NZD/USD pair has given an upside break of the consolidation formed in a narrow range of 0.5662-0.5696 in the early Tokyo session. The asset is playing near the round-level resistance of 0.5700 and is working on further advancement.

The positive risk profile is gaining more traction as S&P500 futures have made a positive start after a cheerful Monday. Meanwhile, the US dollar index (DXY) is oscillating around 112.00 as investors have shifted to the sidelines ahead of the US Gross Domestic Product (GDP) data. The 10-year US Treasury yields have jumped to 4.25% after dropping to 4.15%.

On Monday, the antipodean witnessed a steep fall despite a cheerful market mood. An unprecedented third term for China’s XI Jinping dented the sentiment of investors that invests in Chinese equities and other related assets. The kiwi dollar was punished for being a leading trading partner of China, as Jinping’s ideology-drive approaches are not healthy for China’s economic prospects. The zero-Covid policy is expected to continue further.

Also, China’s flat import data impacted the antipodean. China’s imports data remained flat at 0.3%, much lower than the estimates of 1%. A lower-than-projected Chinese imports data brought volatility in the kiwi counter.

Going forward, the US Gross Domestic Product (GDP) data will hog the limelight. As per the projections, the annualized GDP will improve significantly to 2.4% vs. a decline of 0.6% reported earlier. This could impact the kiwi bulls ahead.

-

23:47

USD/CHF Price Analysis: Rising wedge teases bears, 0.9985 is the key

- USD/CHF remains pressured inside a bearish chart pattern.

- Sustained trading below 50-HMA, downside break of weekly support line also favor sellers.

- Buyers need validation from 1.0075 to refresh multi-month high.

USD/CHF holds lower grounds near the parity levels, fading the week-start bounce off 0.9944 inside a rising wedge bearish formation during Tuesday’s Asian session.

In doing so, the Swiss currency pair also extends the previous day’s pullback from the 50-HMA hurdle while keeping Friday’s downside break of a one-week-old ascending support line, now resistance around 1.0085.

Additionally favoring the USD/CHF sellers is the receding bullish bias of the MACD line, as well as the recent lower-high formation.

It should, however, be noted that a clear downside break of the 0.9985 support appears necessary to confirm the rising wedge pattern.

Following that, the recent swing low of around 0.9945 and the previous weekly bottom near 0.9920 could test the USD/CHF bears during the theoretical fall towards 0.9890.

Alternatively, the 50-HMA level surrounding 1.0025 acts as an immediate hurdle to watch during the pair’s fresh recovery, a break of which should question the bearish wedge’s resistance line, close to 1.0040 at the latest.

In a case where USD/CHF rises past 1.0040, the bearish formation gets defied.

However, a broad horizontal area comprising multiple levels marked since October 13, between 1.0066 and 1.0075 will precede the support-turned-resistance line, near 1.0085, to challenge the USD/CHF bulls afterward.

USD/CHF: Hourly chart

Trend: Further weakness expected

-

23:46

AUD/JPY Price Analysis: Oscillates around 94.00, amid a buoyant JPY

- The AUD/JPY ended Monday’s session negatively on suspected intervention in the FX markets.

- A risk-on mood capped the AUD/JPY losses to just 0.21%.

- Short term, the AUD/JPY is range-bound, trapped within the 91.00/95.74 range.

The AUD/JPY seesaws in a volatile 100-pip trading range as speculation that the Bank of Japan (BoJ) intervened in the FX markets pile, as the USD/JPY tanked 300 pips early in the New York session. Nevertheless, the Australian Dollar (AUD) trimmed some of its earlier losses and finished Monday’s session down by 0.21%. As Tuesday’s Asian session begins, the AUD/JPY is trading at 94.06.

AUD/JPY Price Forecast: Technical outlook

Since October 17, the AUD/JPY tumbled below the 20-day Exponential Moving Average (EMA), which acts as dynamic support, holds the fort for AUD buyers, which leaned to it, to open fresh longs positions, as shown by the price action in the daily chart. Nevertheless, on the upside, the 100 and 50-day EMAs capped the previous rallies, around 94.18/94.58, respectively, while the Relative Strength Index (RSI) at bullish territory, trendless, suggests the pair remains range-bound.

Short term, the AUD/JPY is range-bound, on the downside, capped by the 91.00 figure, and on the upside, the October 21 daily high at 95.74. Despite the Relative Strength Index (RSI) being in bullish territory, is almost trendless, while the confluence of the 50 and 100-EMAs, around 94.22, and 94.17, respectively, would be difficult resistance to hurdle.

On the upside, the AUD/JPY first resistance would be the previously mentioned EMAs. A breach of the latter will expose the 95.00 figure, followed by the R1 daily pivot level at 95.30. On the flip side, the AUD/JPY first support would be the October 24 daily low at 93.58, followed by the 200-EMA at 93.54, and then the S1 daily pivot at 92.79.

AUD/JPY Key Technical Levels

-

23:27

GBP/USD retreats towards 1.1250 as UK’s political optimism fades, economic woes unearth

- GBP/USD pulls back from one-week high amid fears surrounding the UK’s recession.

- UK PMIs, BOE’s Ramsden raised fears of British economic slowdown.

- Optimism surrounding Rishi Sunak’s leadership cools down amid long way to success.

- US Q3 GDP will be crucial ahead of next week’s FOMC.

GBP/USD dribbles around 1.1280 as fears surrounding the UK’s economic conditions probe the pair buyers after a two-week uptrend. That said, the Cable pair retreats from a one-week top during Tuesday’s Asian session.

The quote managed to extend the previous gains on Monday amid hopes of sound economic policies from ex-Chancellor Rishi Sunak as he will be the next British Prime Minister after Liz Truss’ shortest serving time. The Tory member turned down the need for general elections and saved the nation from another time-consuming method and increased optimism in the beginning.

However, the fears that Sunak’s leadership isn’t the only cure for the British economy amid downbeat numbers and fears of the Bank of England’s (BOE) restrain to act seemed to have weighed on the GBP/USD prices.

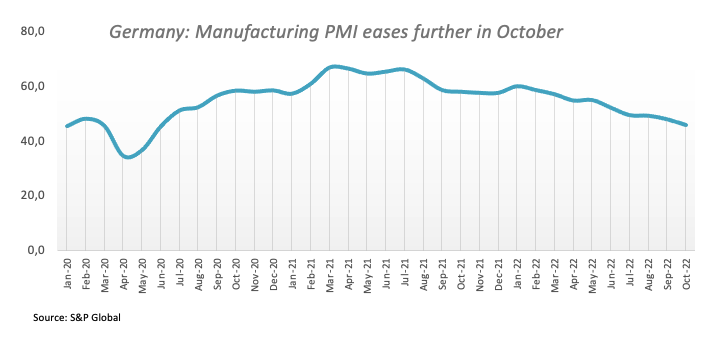

As per the first readings of the UK S&P Global PMIs for October, the Manufacturing activities’ gauge dropped to 45.8 versus 48.0 expected and 48.4 prior while its services counterpart slid to 47.5 from 50.0 previous reading and 49.0 market forecasts. With this, the Composite PMI for the said month declined to 47.2 compared to 48.1 anticipated and 49.1 prior.

On the other hand, the US S&P Global PMIs for October suggests that the Manufacturing activities’ gauge dropped to 49.9 versus 51.2 expected and 52.0 prior while its services counterpart slid to 46.6 from 49.3 previous reading and 49.2 market forecasts. With this, the Composite PMI for the said month declined to 47.3 compared to 49.1 anticipated and 49.5 prior.

It should be noted that the mixed feeling in the markets amid an absence of Fed speakers and geopolitical concerns surrounding China and Russia also weigh on the GBP/USD prices.

Amid these plays, Wall Street closed with gains while the US Treasury yields also ended the day on the positive side after a downbeat start.

Moving on, a light calendar on Tuesday may allow GBP/USD bulls to pare some of their recent gains. Also, recently increasing hawkish Fed bets also could weigh on the prices ahead of the key US Gross Domestic Product for the third quarter (Q3).

Technical analysis

GBP/USD pair’s failure to provide a daily closing beyond a six-week-old resistance line, near 1.1285 by the press time, as well as the 50-DMA hurdle surrounding 1.1400, keeps sellers hopeful of revisiting the monthly support line near 1.1085.

-

23:19

Gold Price Forecast: XAU/USD behaves lackluster around $1,650 ahead of US GDP data

- Gold price has turned sideways around $1,650.00 after a corrective move as yields rebound.

- Weaker PMI data weighed pressure on the DXY.

- The release of the GDP data will be a major trigger this week.

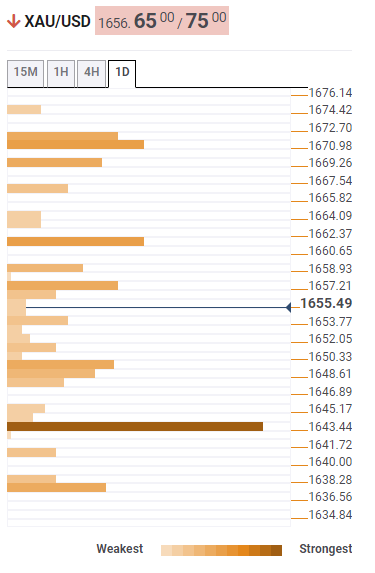

Gold price (XAU/USD) is displaying back-and-forth moves around $1,650.00 in the early Asian session. The precious metal is following the footprints of the US dollar index (DXY) and is performing lackluster. The DXY is oscillating around 112.00 after dropping from 112.50 on Monday. The release of the downbeat US S&P PMI data terminated DXY’s attempts of shifting into a positive trajectory.

The Manufacturing PMI landed lower at 49.9 vs. the projections of 51.2. Also, the Services PMI reported a weak performance as dropped to 46.6 against the expectations of 49.2. A vulnerable PMI data restricted the upside in the DXY.

The gold prices were underperforming despite the upbeat market mood. The catalyst that weighed pressure on the gold prices was the sheer recovery in the returns from US government bonds. The 10-year US Treasury yields recovered sharply after dropping to near 4.15% and settled Monday with gains of 0.82% at 4.25%.

Going forward, the release of the US Gross Domestic Product (GDP) data will be keenly watched. The annualized GDP is expected to improve significantly to 2.4% vs. a decline of 0.6% reported earlier. A firmer increment in the US growth rate could bring volatility in gold prices.

Gold technical analysis

On an hourly scale, gold prices have dropped after facing barricades of around $1,670.00. The precious metal has declined to near the horizontal support placed from Thursday’s high at $1,645.67. The yellow metal is hovering around the 200-period Exponential Moving Average (EMA) at $1,650.46.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates the unavailability of a potential trigger for a decisive move.

Gold hourly chart

-

22:42

AUD/USD turns sideways above 0.6300, Australian CPI grabs focus

- AUD/USD is oscillating above 0.6300 as investors await the Australian CPI release for a decisive movement.

- Positive market sentiment failed to support the commodity-linked currency.

- Weaker employment data and higher inflation projections are complicating things for the RBA.

The AUD/USD pair has developed a cushion around 0.6300 in early Tokyo after dropping from Monday’s high at 0.6411. Earlier, the asset displayed a breakout of a tad longer consolidation formed in a range of 0.6170-0.6355 but has come back inside the woods. The antipodean faced severe pressure despite an upbeat market sentiment.

S&P500 extended their gains on Monday after a cheerful Friday. The US dollar index (DXY) faced selling pressure while attempting to overstep the critical hurdle of 112.50. However, the 10-year US Treasury yields gained some confidence despite the positive risk profile, recovered their Monday morning losses, and settled comfortably near 4.25%. The commodity-liked currencies are diverging with positive market sentiment due to the confirmation of China’s XI Jinping's third term of leadership.

Investors share concerns over the continuation of China Jinping’s leadership citing his ideology-driven approaches to operating the economy even at the cost of economic growth. This has dampened sentiment for Chinese markets and its trading members.

On Wednesday, investors will keep an eye on Australian Consumer Price Index (CPI) data. The headline inflation may accelerate to 7.0% vs. the prior release of 6.1% on an annual basis. On a quarterly basis, the plain-vanilla CPI could decline to 1.5% against the prior print of 1.8%.

A release of a higher-than-projected CPI may force the Reserve Bank of Australia (RBA) to return to its previous pace of hiking interest rates. A less-hawkish approach to policy rate is far from over. The job of combating inflation for RBA policymakers has become more difficult as the labor market is also not supportive.

-

22:11

USD/JPY accelerates towards 149.00 after suspected BoJ’s intervention

- USD/JPY soared back above 149.00, following a suspect intervention when the USD/JPY dived towards its daily low below 146.00.

- The US economy is decelerating faster than estimated, will the Fed pivot?

- Speculations of another Bank of Japan (BoJ) intervention lurk after diving more than 400 pips during the day.

The USD/JPY rises as the North American session winds down and reclaims the 149.00 figure due to high US Treasury yields, alongside broad US Dollar strength, across the board, amidst a risk-on impulse. At the time of typing, the USD/JPY is trading at 149.06. up by almost 1%.

Risk-on impulse boosted the US Dollar, despite bad economic data

Wall Street finished the day with solid gains, despite worse-than-expected US economic data. Since Federal Reserve officials entered the blackout period last Saturday, a tranche of US data in the docket would shed some light on the US economy.

On Monday, S&P Global revealed that the Composite PMI for the country shrank at a faster pace than estimated, coming at 47.3, below estimates of 49.3, trailing September’s 49.5. According to Chris Williamson, the S&P Global Chief Economist, the risks of contraction in the fourth quarter increased at the time “that inflationary pressures remain stubbornly high,” via Bloomberg.

Aside from this, speculations of Japanese authorities propelling the Japanese Yen arose as the USD/JPY tumbled toward its daily low at 145.61 at around 07:45 ET time. Nevertheless, the dip was short-lived, as the USD/JPY bounced back towards 148.00, meandering since then, at around the 148.00-149.24 area.

The Japanese economic docket will feature some tier 1 data, like Service PPI, the Consumer Price Index (CPI) for October, and employment data, ahead of the Bank of Japan’s (BoJ) monetary policy meeting.

On the US front, the calendar will reveal additional Regional Fed indices, the CB Consumer Confidence, Durable Good Orders, Jobless Claims, and the Fed’s favorite gauge for inflation, the PCE.

USD/JPY Key Technical Levels

-

22:00

South Korea Consumer Sentiment Index came in at 88.8, below expectations (89.9) in October

-

21:52

EUR/USd Price Analysis: Bulls and bears battle it out at key structure

- EUR/USD bulls eye up a key resistance structure.

- The bears need to get back below 0.9850.

EUR/USD's daily chart is indeed bearish while below the trendline resistance. The price is on the verge of a break of structure as per the triangle coil as it moves in on the resistance in a creeping bullish short-term trend.

EUR/USD daily chart

A move below 0.9700 opens the risk of a test of 0.9535 for the foreseeable future. A break of the resistance, however, puts 1.0000 back in focus and 1.0200 thereafter.

EUR/USD H1 chart

The hourly chart shows that the price is stalling within the W-formation but should bulls commit at 0.9850, we could see the makings of a breakout structure to cement the bullish case going forward.

DXY technical analysis

The US dollar is leaning on a key area of support within the bullish flag on a daily time frame. The rising support could see the greenback bust back to life and hinder the prospects of a stronger correction in the gold price.

-

21:14

Forex Today: Tensions mount ahead of first-tier events

What you need to take care of on Tuesday, October 26:

The American Dollar started the week losing ground, extending its Friday's decline at the opening, but slowly grinding higher as the day developed. It ended with modest gains against most major rivals as investors await first-tier events scheduled for later in the week.

European and American indexes managed to close Monday with gains, despite growth-related figures were generally discouraging, as most S&P Global PMIs missed expectations. The October flash PMIs indicated a steeper contraction in the Union and the United States at the beginning of Q4. The EUR/USD pair ended the day little changed, around 0.9870.

Rishi Sunak became the new United Kingdom Prime Minister after Liz Truss's failed 44-day government. GBP/USD ended the day in the red, around 1.1280.

Chinese data published at the beginning of the day was mostly upbeat. The Q3 Gross Domestic Product beat expectations, up by 3.9% QoQ. The September Trade Balance posted a surplus of $84.74 billion, better than anticipated, while Industrial Production rose by 6.3% YoY. Finally, Retail Sales increased by 2.5% YoY, up, although below the market's forecast of 3.3%. Also, the country announced it would raise fuel prices on Tuesday, weighing on local equities.

USD/JPY remained volatile, ending the day roughly 450 pips up after bottoming at 145.37. Japan's Prime Minister Fumio Kishida anticipated an upcoming stimulus package to be announced by the end of October as planned. Meanwhile, the Bank of Japan suspected intervention last week was estimated at 5.5 trillion yen.

Tensions between Germany and Russia continue. The German Chancellor Olaf Scholz said they want Ukraine to become an EU member state. On the other hand, Moscow has asked UN Secretariat for data on Ukrainian grain and its destinations and end consumers, and Russian Foreign Minister Lavrov hinted at "corrections" to the Black Sea grain deal.

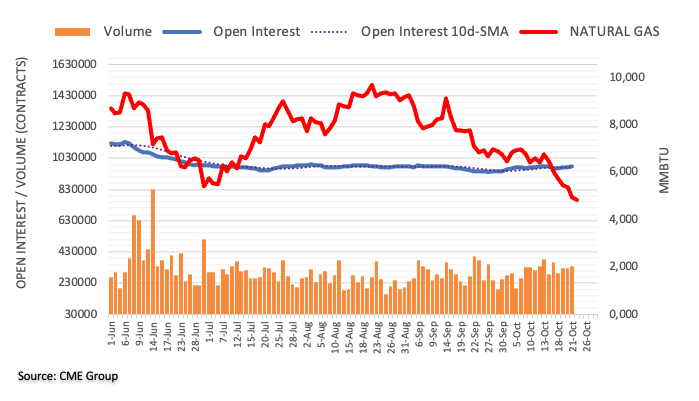

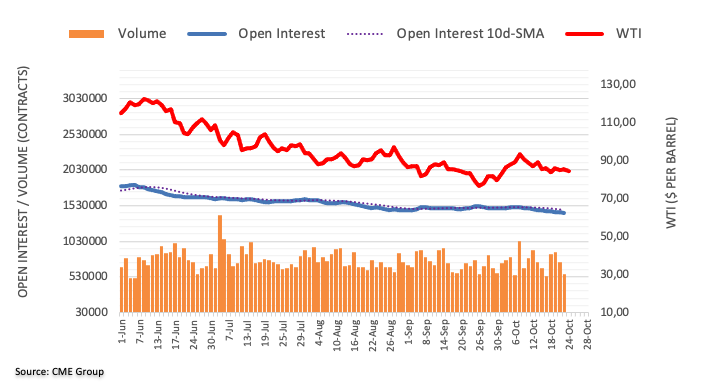

Gold trades at around $1,650 a troy ounce, marginally lower on a daily basis, while crude oil prices were little changed. WTI settled at $84.70 a barrel.

In the upcoming days, several central banks will announce their monetary policy decisions. The Bank of Canada, the Bank of England and the European Central Bank will make their announcements these days, while the Reserve Bank of Australia and the US Federal Reserve will unveil their decisions next week. In the middle, the US will publish the preliminary estimate of its Q3 Gross Domestic Product, foreseen reverting the negative trend of the first two quarters of the year.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:04

GBP/USD dips below 1.1300 as the Sunak effect fades

- The pound retreats below 1.1300 after failure at the 1.1400 area.

- Investors welcome Risi Sunak's victory.

- GBP/USD is aiming to 1.11/1.12 if 1.1400 resistance holds – Scotiabank.

The pound is depreciating moderately on Monday, despite the initial positive reaction to the news about the election of Rishi Sunak as the next Prime Minister.

The pair was rejected at the 1.1400 area and has been losing ground through the day to consolidate below 1.13 during the afternoon US trading session..

The market welcomes Sunak's victory

News that former PM Boris Jonson retired from the Tory race to Downing Street, leaving the doors open for the market candidate, Rishi Sunak, triggered an immediate bullish reaction on the GBP and pushed gilts higher in early trading.

The positive reaction, however, was short-lived and the pound lost traction as soon as the market came to terms with the challenges ahead for the UK economy. The soaring inflation coupled with the gloomy growth forecasts are likely to maintain GBP longs on check for some time.

GBP/USD: aiming for 1.12 or 1.11 if 1.1400 resistance holds – Scotiabank

Failure to breach 1.14 will pull the pair to the 1.12/1.11 area, according to FX analysts at Scotiabank: “A break above the 1.1395/1.1400 area could change short-term dynamics and put the pound on course for a 1.15/1.17 test (…)If the 1.1395/1.1400 resistance holds, GBP/USD may slip back to 1.11/1.12.”

Technical levels to watch

-

20:29

USD/CHF consolidating around 1.0000 after pulling back from 1.0145

- US dollar's decline from 1.0145 finds support at 0.9965.

- The greenback consolidates in a calm market session.

- US macroeconomic figures are mixed on Monday.

The US dollar has been trading sideways against the Swissie on Monday. The pair has remained moving roughly between 0.6965 and 1.0030, consolidating losses after Friday’s reversal from the 1.0145 high.

The USD treads water on a cautious session

Investors seem to have entered the week in a vigilant mood, ahead of key monetary policy decisions later this week. The Bank of Canada and The European Central Bank are expected to approve hefty interest rate hikes, aiming to tame the soaring inflationary pressures.

In China, the confirmation of Xi Jinping’s unprecedented third term this weekend has contributed to dampening investor sentiment. Market concerns that Jinping's zero-COVID policy might trigger a new set of lockdowns and hurt economic growth have put a lid on risk appetite.

On the macroeconomic front, the upbeat Chinese data has failed to improve the market mood. Chinese GDP expanded beyond expectations in the third quarter and the trade surplus increased due to a significant increase in exports.

In the US, however, data have been mixed. The Chicago Fed National Activity Index increased 0.1% against expectations of a 0.4% decline, while the S&P PMI showed that both, services and manufacturing sectors’ activity contracted beyond expectations in October.

Technical levels to watch

-

20:26

Gold Price Forecast: XAU/USD bulls seeking a move to key daily resistance

- Gold bulls could be on the verge of a move higher to test daily resistance.

- The US dollar, however, is also at a critical level of support.

Gold is under pressure on Monday as it pulls back from the highs reached at the start of the day around $1,670, 0.5% higher than the current spot price of $1,650. The US dollar has firmed for its safe haven qualities but is teetering with key trendline support that is illustrated below, a break of which could help to boost the yellow metal.

The US dollar index, DXY, was last seen up 0.10 points to 111.98, making gold more expensive for international buyers. The yield on the US 10-year note was last seen down 0.3 basis points to 4.234%, near the 14-year high of 4.325% reached at the end of last week which is pushing up the carrying cost of owning gold.

''We've seen this movie before,'' analysts at TD Securities said. ''The 'peak central bank hawkishness' narrative once again orchestrated an attempted squeeze on bloated money manager shorts in precious metals, but failed to gather steam.''

'''After all,'' the analyst say, ''while rates markets are increasingly pricing in a fair outlook for the Fed funds rate, precious metals have yet to discount the implications of a prolonged period of restrictive rates. In reality, the resiliency in gold prices while facing the most hawkish central bank regime since the 1980s highlights a growing battle between retail and institutional flows.''

''Massive purchases of physical precious metals from retail buyers have clashed with institutional investor outflows in past months.''

US data softer, bad news is good news?

Meanwhile, the preliminary October US PMI data were disappointing today, with the numbers indicating that both the manufacturing (49.9 vs 52.0) and service sectors (46.6 vs 49.3) are now in a contractionary territory (50 being par). This leaves prospects of a less hawkish Fed back o the table, so bad news is good news for the gold price. In full, the data showed that 47.3, the composite PMI registered its fourth consecutive print below 50.0. The drop in the composite measure was led by a 4.1% drop in the backlog of orders to 46.6, a 2.2% drop in new orders to 49.0 and a 2.5% drop in employment to 49.8. Output prices fell 0.8 to 58.3. This leaves a dark cloud over US exports and signals that the strength of the US dollar could be impacting negatively.

The next big piece of the puzzle for the US economy will come in the form of Gross Domestic Product. ''We look for US output to have rebounded firmly after registering two consecutive quarterly declines in 22H1. We expect Q3 GDP growth to be supported, in particular, by a large, positive swing in net exports. Domestic demand, however, likely advanced at a below-trend pace,'' analysts at TD Securities said.

Gold technical analysis

From the daily, above, and hourly, below, we can see that the price is bounded by last week's range and below a key dynamic resistance. However, the path of least resistance could well be to the upside as the bulls move in at hourly and daily supports. The break of the micro trendline could be a key feature for the days ahead and lead to a break towards the longer-term trendline in a move derived from the neckline of the W-formation:

The US dollar, meanwhile, is up against a key area of support within the bullish flag on a daily time frame. The rising support could see the greenback bust back to life and hinder the prospects of a stronger correction in the gold price.

-

19:47

EUR/JPY Price Analysis: Back above 147.00 with the positive bias intact

- EUR/JPY retraces Friday's losses and returns above 148.00.

- Above 148.40 the pair will aim to 2014 high at 149.80.

- On the downside, a breach of 144.00 support would negate the bullish bias.

The euro has taken back on Monday most of the ground lost on Friday's suspected intervention by the Japanese authorities. The pair appreciated about 1% so far today, returning above 147.00 from the 143.70 lows

The four-hour chart shows the upward trending support from late September lows intact, and the pair on a steady upward trend hitting higher tops and bottoms.

The positive price action is likely to push the pair towards Friday’s high, at 148.40. A confirmation above here would set the focus at the 2014 high at 149.80 ahead of the 150.00 psychological level.

On the downside, the 50-period SMA has been holding downside attempts over the latest sessions with another important support area at 144.00 (Trendline support and 100-period SMA). Below here, the pair would negate the near-term bullish bias, aiming probably at the 141.00 area (October 10,11 lows).

EUR/JPY 4-hour chart

Technical levels to watch

-

19:40

EUR/GBP Price Analysis: Unable to crack the 20-DMA, retraces towards 0.8740s

- EUR/GBP rebounded at the 50-day Exponential Moving Average (EMA), as buyers eye 0.8800.

- UK’s upbeat political news briefly underpinned the British Pound, though it retraced its gains as euphoria waned.

- Near term, the EUR/GBP might correct towards 0.8700 before resuming its uptrend.

The EUR/GBP reclaims the 50-day EMA and advances steadily toward 0.8750, though it faced resistance in the 20-day EMA at around 0.8751, as it aims towards 0.8800, amidst some UK’s political stability. News that Rishi Sunak is the new head of the Conservative Party, and consequently the new Prime Minister, calmed the markets though the Pound Sterling weakened. At the time of writing, the EUR/GBP sits at around 0.8746, above its opening price, by a decent 0.27% margin.

EUR/GBP Price Forecast: Technical outlook

From a daily chart perspective, the EUR/GBP remains neutral-biased. However, once it clears the 20-day EMA, it could send the pair towards 0.8800, ahead of the next supply zone, the October 12 high at 0.8866, followed by the 0.8900 figure. Notably is that the Relative Strength Index (RSI) slope shifted upwards, meaning buyers are gathering momentum, preparing to attack 0.8800.

In the short term, the EUR/GBP hourly chart depicts the pair gapped down on positive news from the UK, opening at around 0.8660. Later, the Euro recovered from its earlier losses and reclaimed the 0.8700 mark, as the EUR/GBP was headed toward the daily high at 0.8763 before the pair retraced to current exchange rates in sympathy with the Relative Strength Index (RSI), which aimed downwards.

Given the backdrop, the EUR/GBP first support would be the confluence of the 50 and 100-EMAs at around 0.8719/13. Break below will expose the 20-EMA at 0.8703, followed by the 200-EMA at 0.8697, ahead of the S1 daily pivot at 0.8693.

EUR/GBP Key Technical Levels

-

19:11

NZD/USD’s reversal from 0.5790 extends to levels sub-0.5700

- The kiwi gives away gains on Monday and returns below 0.5700.

- Concerns about China's zero-COVID policy hurt the NZD.

- The US dollar pares losses after Friday's reversal.

The New Zealand dollar has opened the week on the back foot, retreating from two-week highs at 0.5790, reaching session lows at the 0.5655 area, with the US dollar regaining lost ground as risk appetite ebbed.

Negative reaction to Jinping’s third term

The confirmation that Xi Jinping’s secured an unprecedented third term at the Chinese presidency has hurt investors’ mood on concerns about the consequences of his zero-COVID policy. Fears that a new set of lockdowns may hurt economic growth have hammered the kiwi due to New Zealand's status as one of China’s major providers.

In the macroeconomic docket, better-than-expected Chinese Trade Balance data, which has shown a $84.74B surplus in September, beating the market consensus of $81.0B has offered a brief impulse to the Kiwi earlier today.

On the other end, the US dollar is trading moderately higher on Monday, shrugging off Friday’s weakness, in spite of the mixed US data.

The Chicago Fed National Activity Index has edged up 0.1%, against the 0.4% decline forecasted by the analysts, while the S&P PMI showed that economic activity in both, services and manufacturing sectors contracted beyond expectations in October.

Technical levels to watch

-

19:07

GBP/JPY is trapped between last week's range, but bulls are moving in

- GBP/JPY is trapped between last week's range but bulls are in favour.

- UK politics and central bank divergences are in play.

GBP/JPY has had a turbulent start to the week with pressures from both sides of the world. In the UK, economic data and politics are in play while from Japan, the Ministry of Finance hand was likely formed again to intervene in the forex markets causing huge volatility ahead of the Tokyo open. At the time of writing, GBP/JPY is trading at 168.00 and has travelled between 169.78 and 165.41, up by some 0.82%.

Rishi Sunak will become Britain's youngest prime minister and will lead the Conservative Party and will be the UK's third prime minister in less than two months.

He replaces Liz Truss, who only lasted 44 days before she resigned. He told his lawmakers in parliament on Monday that they faced an "existential crisis" and must "unite or die". He told the country it faced a "profound economic challenge".

"We now need stability and unity, and I will make it my utmost priority to bring our party and our country together," he said.

The multi-millionaire former hedge fund boss will be expected to launch spending cuts to try to rebuild Britain's fiscal reputation, just as the country slides into one of the toughest downturns in decades, hit by the surging cost of energy and food.

The UK’s poor fundamental outlook will potentially keep the pound at bay, however, despite the relief of the new PM. Retail Sales were dismal and the latest data in this morning’s UK preliminary October PMI underpins the risk that the UK may already be in recession. Analysts at Rabobank argue that both business and consumer confidence in the UK has been weak for some time, but explained ''the spike in market interest rates on the back of the Truss agenda will have severely worsened confidence and the UK economic outlook.''

Eyes on BoE and BoJ

This brings us to the central banks. ''While the BoE is expected to announce a hefty rate hike on November 3, this may do little to support cable given expectations of further aggressive rate hikes from the Fed,'' the analysts at Rabobank said.

With respect to the Bank of Japan, ''There has been no indication from the BoJ that it is willing to step away from its very accommodative monetary policy settings. The BoJ essentially wants to nurture inflation until there are more widespread signs of wage inflation,'' the analysts said.

''The market is aware that interest rate differentials continue to act as an upward drag on USD/JPY. This means that the best the MoF can be expected to do with FX intervention is to slow the move higher until the Fed is content that it is in control of inflation expectations in the US,'' the analysts argued. ''A tweak to the BoJ’s YCC policy would give FX intervention more teeth. That said, a continued display by the BoJ at this week’s policy meeting that it favours current settings suggests USD/JPY remains a buy on dips''

GBP/JPY technical analysis

The price is trapped between last week's range and the M-formation is holding up the bear's progress in an attempt to break below the horizontal support around 166.50. The trendline support will keep the bulls in favour who eye a break of 170.00.

-

18:55

Silver Price Forecast: XAG/USD struggles at the 100-DMA and trips down toward $19.20

- Despite a risk-on impulse, silver price edges lower amidst US Dollar strength.

- US S&P Global PMIs flash contraction as traders eye GDP and PCE figures ahead of the Fed’s next monetary policy meeting.

- Silver Price Forecast (XAG/USD): To extend its losses once it clears $19.20.

Silver price collides with solid resistance at the 100-day Exponential Moving Average (EMA) at $19.64, and retraces below $19.30, as the US Dollar (USD) got boosted by risk-aversion in the FX markets, while US bond yields ease from last week’s highs. Factors like weaker US economic data, alongside US Dollar strength, weighed on the white metal. At the time of writing, XAG/USD is trading at $19.20 a troy ounce, below its opening price.

Business activity in the US declined, bolstered the greenback

S&P Global reported that United States (US) business activity deteriorated sharply in October. The Manufacturing and Services Indices remained in contractionary territory, each at 49.9 and 46.6, consequently impacting the compound figure. The S&P Composite PMI dropped to 47.3, less than estimates, and trailed September’s 49.5, which at contractionary territory, was contained.

Following the report, the greenback aimed lower, as delineated by the US Dollar Index (DXY). However, the DXY recovered some ground and edged towards 112.022. In the meantime, the US 10-year Treasury bond yield is almost flat at 4.219%, a headwind for the silver price.

The blackout period for Fed officials started last Saturday. Friday’s comments by San Francisco Fed President Mary Daly and St. Louis James Bullard said that 75 bps for November are “almost” a done deal but acknowledged that the pace might slow down as rates move higher.

Aside from this, the US economic docket during the week will be busy. Tier 1 info includes Tuesday’s Conference Board (CB) Consumer Confidence. On Thursday, the US Bureau of Economics will release the Advanced GDP reading ahead of Friday’s unveiling of the Fed’s favorite gauge of inflation, the PCE.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD remains neutral-to-downward biased, further cemented by the failure to crack the 100-day EMA, which was a difficult supply zone to hurdle; hence XAG/USD fell. However, XAG/USD buyers leaned on the 20-day EMA at around $19.30, though the price slipped at the time of typing, so further downward action is expected. Therefore, the XAG/USD first support would be the 50-day EMA at $19.10, followed by the $19.00 figure and the October 20 daily low at $18.23.

-

18:21

WTI bounces up from $82.55, return to the $84.70 area

- Oil prices trim losses after bouncing up from $82.55.

- Concerns about the Chinese zero-COVID policy are hurting crude oil.

- The lower US oil reserves have avoided a further decline in prices.

WTI futures have picked up following a negative market opening on Monday. The West Texas intermediate retreated to $82.55 lows on the Asian and early European sessions to pare losses during the US session and return to the $84.70 area.

Concerns about China’s Zero-COVID policy

The confirmation of Chinese President Xi Jinping for an unprecedented third time over the weekend has hit crude prices. Investors are wary that his commitment to the Zero-COVID policy may lead to new lockdowns in the country that will, ultimately, depress demand for oil from the world’s major importer.

In this scenario, the upbeat Chinese GDP, which has shown a 3.9% yearly growth in the third quarter, beating market expectations of a 3.4% increase, has been practically unnoticed,

On the other hand, a European ban on Russian crude oil, expected to come into effect in December, as part of a new set of sanctions, for the Ukrainian war, is providing some support, as the eurozone leaders struggle to find alternative providers ahead of the winter.

Furthermore, official data revealed last week that the US Strategic Petroleum reserves have dropped to their lowest level since 1984 in the week of October 14th, while the EIA reported a 1.725M decline in crude oil inventories in the same week. These figures have avoided a sharper decline in crude prices.

Technical levels to watch

-

17:43

AUD/USD, capped below 0.6325 after dropping from 0.6410

- The aussie's recovery attempts from 0.6275 remains capped below 0.6325.

- Concerns about China's zero-COVID policy are hurting the AUD.

- The RBA pointed out to a slower monetary tightening path.

The Australian dollar has given away on Monday most of the ground taken last Friday. The pair’s retreat from the 0.6410 high found support at 0.6275 although the ensuing recovery attempts remain limited below 0.6325 so far.

Concerns about China hit the aussie

The confirmation of Chinese President Xi Jinping’s third term in power has hit risk appetite, sending the offshore yuan and Asian markets lower on Monday, with investors concerned that his commitment to the zero-COVID policy may damage economic growth.

The upbeat Chinese data, with the third quarter GDP expanding beyond expectations, has failed to lift spirits.

Beyond that, the dovish message send by the Reserve Bank of Australia last month, suggesting that they might slow their monetary tightening path is acting as a headwind for the Aussie, which has depreciated about 1.25% so far today day.

In the US, macroeconomic data has also been mixed. The Chicago Fed National Activity Index ticked up 0.1% against the 0.4% decline forecasted by the analysts, while the S&P PMI showed that economic activity in both, services and manufacturing sectors contracted beyond expectations in October.

Technical levels to watch

-

17:27

USD/CAD climbs back above 1.3700 despite poor US data

- USD/CAD trims some of last Friday’s losses, up 0.46% on Monday.

- Worse-than-expected US economic data and a risk-off impulse in the FX complex bolstered the US Dollar (USD).

- Wednesday’s Bank of Canada (BoC) meeting to cap the Canadian Dollar (CAD) losses.

The USD/CAD marches firmly amid a risk-off impulse in the FX space due to S&P Global PMIs hinting that global economies might hit a recession, while the greenback recovered some losses, trading positive as delineated by the US Dollar Index (DXY), up 0.08%, at 111.961. At the time of writing, the USD/CAD is trading at 1.3705, gaining 0.44%.

US S&P Global PMIs underpinned the USD, amid a risk aversion in the FX markets

S&P Global reported that on their final readings, US October’s Flash PMIs confirmed that the economy is contracted for the fourth consecutive month. The Manufacturing and Services components of the Composite index missed estimations and trailed September’s figures. Consequently, the S&P Flash Composite Index fell to 47.3, from 49.5 in September, and less than estimates of 49.3, as the economic downturn gathered momentum, “while confidence deteriorated sharply,” as S&P Global Chief Business Economist Chris Williamson said.

Albeit the data was negative for the US Dollar (USD), the USD/CAD dipped below 1.3700 before resuming its previous uptrend and reclaiming the figure, reaching a daily high of 1.3774.

Aside from this, the Canadian docket is pretty light, ahead of Wednesday’s Bank of Canada’s (BoC) monetary policy meeting, with most economists expecting a 50 bps lift, though last week’s Consumer Price Index (CPI) rise to 6.9% YoY, less than the previous month’s reading, above estimates, shifted previous forecasts.

TD Securities analysts commented that consensus points to a 50 bps lift to 3.75%, “but there is a heavy skew towards 75 bps from those who submitted forecasts post-CPI, and markets are pricing ~67bps of tightening.” TDS expects that the BoC would likely maintain a hawkish tone in its statement while acknowledging slower economic growth and revising lower inflation estimates for 2022.

Given that Fed officials reiterated that the US central bank would continue to tighten, though it opened the door for a rhythm of slower rate hikes, therefore, the USD/CAD might consolidate in the 1.3600-13750 range, ahead of the BoC and the Federal Reserve’s monetary policy meeting. The BoC’s decision will be featured on October 26, while the Fed on November 2.

USD/CAD Key Technical Levels

-

17:07

USD/JPY drops below 149.00 on a volatile day

- US S&P Global October preliminary numbers below expectations.

- Japanese yen remains calms during American session following BoJ intervention.

- USD/JPY steadies around 148.80 after sharp moves.

The USD/JPY is hovering around 148.80, up more than a hundred pips for the day on another session of extreme volatility. Earlier it bottomed at 145.36, the lowest since October 10 and then rebound, being unable to regain the 149.50 area.

Japanese authorities seem to be behind the sharp moves seen in the USD/JPY earlier on Monday. More recently, the US dollar lost momentum particularly during the American session following the release of US economic data. The preliminary S&P Global Manufacturing PMI decline to 49.9 from 52 in September, the lowest level in 28 months.

Volatility is set to remain at extreme levels with the upside in USD/JPY still being supported by the divergence between the ultra-accommodative Bank of Japan and the aggressive tightening of the Federal Reserve. The Bank of Japan Monetary Policy Committee will meet this week (decision on Friday) and the Federal Reserve will have the FOMC meeting next week (decision on Wednesday).

“Despite the lack of urgency to tighten policy from a real wages and output gap perspective, the rapid weakening of the JPY and broadening inflation pressures in Japan cannot be ignored. We don't expect the BOJ to act at the October meeting, but there is a risk of more aggressive signaling. There is a stronger case for a shift in YCC once Governor Kuroda's term ends on April 8, 2023, and after the spring wage negotiations”, explained analysts at TD Securities. They expect continued FX intervention if USD/JPY rallies. “We are neutral, as the pair is fairly valued relative to spreads.”

Technical levels

-

16:55

BoE's Ramsden: Will take necessary steps to get inflation back to target

Bank of England (BoE) Deputy Governor Dave Ramsden said on Monday that the concern that inflation becoming more domestically generated has been a driver of the BoE's bigger-than-usual rate hikes, as reported by Reuters.

Additional takeaways

"We will take necessary steps to get inflation back to target."

"We are acutely aware of the impact of rate rises so far."

"Today's PMIs are consistent with the UK economy being in recession."

"We have to take account of the fall in the value of the pound."

"Sterling has been relatively stable of late."

"Temporary expanded collateral repo facility will hopefully have a role, not called on yet."

"I was reluctant to go down the bond purchase route."

Market reaction

These comments failed to help the British pound find demand and GBP/USD was last seen posting small daily losses at 1.1290.

-

16:55

Gold Price Forecast: XAU/USD is pushing against $1,1645 support area

- Gold retreats from a $1,670 high on Friday to the $1,645 area so far.

- The US dollar regains lost ground on a cautious market.

- XAU/USD is testing support at $1,640.

Gold futures have opened the week on a moderately bearish tone, giving away some of the ground taken on the sharp recovery witnessed last Friday. The yellow metal has pulled back from a 10-day high at $1,670 and is now testing the support area at $1,640.

Gold loses strength as the US dollar picks up

Investors remain cautious in the week opening, awaiting the monetary policy decisions by some of the world’s major central banks, while stock markets are mixed. In the US, the Dow Jones and the S&P Indexes appreciate 0.8% and 0.6%, while the Nasdaq Index eases 0.1%.

The market seems to have digested a news report published by the Wall Street Journal on Friday, suggesting that the Federal Reserve would be open to moderate its tightening cycle in December. The US dollar, as a result, has shrugged off Friday's weakness to appreciate moderately higher which is weighing on gold prices.

XAU/USD: Support area at $1645 is holding bears

On the downside, the support area at $1,645 Is protecting the XAU/USD from further decline, which might push the yellow metal to retest $1,615 (September 28, October 21 lows) ahead of April 2020 lows at $1,575.

On the upside, the pair should appreciate past Friday’s top at $1,670 and the 50-day SMA at $1,695 to regain bullish momentum and set its target at the $1,730/35 area (September 13, October 4 highs).

Technical levels to watch

-

16:34

UK: A crisis, at least, looks to have been averted – ABN Amro

Bill Diviney, Economist at ABN Amro points out that despite the political chaos of late, the news flow has been largely positive from a policy point of view. He affirms the outlook for the economy is still bleak but considers a crisis at least looks to have been averted.

Key Quotes:

“In the near-term we expect the MPC to hike rates aggressively, with a 75bp hike expected on 3 November, and Bank Rate to peak at 4% in early 2023. However, the risks to this view – previously to the upside – have become markedly more balanced.”

“The silver lining to the political chaos is that the worst of the crisis in financial markets – and therefore the risks to the economy – now looks to be behind us. The new government is likely to be as focused on fiscal discipline as the present Chancellor Jeremy Hunt, if not more so.”

“The new government will have tough choices to make over tax and spend plans given the higher risk premium on UK government bonds – which has put a large hole in UK government finances.”

“We estimate that, after accounting for the policy U-turns of the past few weeks, the government needs to find another GBP20bn in tax rises or spending cuts. We think this will take the form of a temporary link of working age benefits to wage growth rather than inflation – meaning a real-terms cut to benefits – alongside a curtailment in public investment.”

-

16:33

US Treasury Sec. Yellen: No difficulty in executing trades in Treasury market

US Treasury Secretary Janet Yellen acknowledged on Monday that they have observed some decline in the Treasury market liquidity but noted that this situation was not unexpected given the increased volatility.

Yellen further noted that Treasury market traders are not having difficulty in executing trades and reiterated that the US economy is healthy with a resilient financial system.

Market reaction

There was no immediate reaction to these comments and the benchmark 10-year US Treasury bond yield was last seen rising 0.3% on the day at 4.24%.

-

16:15

GBP/USD steady hovering around 1.1300, Sunak to become PM on Tuesday

- GBP/USD remains steady but pound pulls back versus other rivals.

- UK: Rishi Sunak will become UK Primer Minister.

- US S&P Global drops more than expected in October.

The GBP/USD is hovering around 1.1300 since the beginning of the American session, unable to benefit from a modestly weaker US dollar. Economic data from the US came in below expectations while Sunak was confirmed as the next UK PM.

Cable peaked after the weekly opening at 1.1410 and then pulled back to as low as 1.1271. During the last hours is has been moving between 1.1340 and 1.1275.

New PM in the UK, weak data in the US

Rishi Sunak will become UK Primer Minister after Penny Mordaunt dropped out of the Tory race on Monday. The transition from Liz Truss to Sunak could take place on Tuesday. The government announced that is up to Sunak to decide whether to announce a fiscal plan on October 31. Speaking to Tory MPs, Sunak said there will be no early election.

The confirmation of Sunak was no surprise for markets as it was already priced after Boris Johnson pulled out of the race on Sunday. After a spike higher at the beginning of the week, the pound has been pulling back. EUR/GBP is back above the level it closed on Friday, above 0.8735.

The US dollar lost momentum during the American session weakened by the US S&P Global PMI preliminary October report. The Manufacturing Index dropped more than expected to the lowest level in 28 months and below the 50 level. US yields remain higher for the day despite the economic report. The 10-year yield stands at 4.25% and the 2-year at 4.51%.

Technical levels

-

16:14

EUR/USD climbs towards 0.9900 on weaker US PMIs

- EUR/USD advances steadily following the release of weaker US data.

- The Eurozone is headed toward a recession as the S&P Global PMIs contracted.

- EUR/USD Price Analysis: Once it clears 0.9900, a test of parity is on the cards; otherwise, it could tumble to 0.9700.

The EUR/USD makes a U-turn, pairing some of its earlier losses, amidst a critical week for the Euro, with the European Central Bank (ECB) monetary policy meeting on Thursday. The shared currency recovery is due to some US data reporting S&P Global PMIs, which showed the US economy continues to deteriorate. At the time of writing, the EUR/USD is trading at 0.9886.

US PMIs disappointed, weakening the US Dollar

The US S&P Global Flash Composite for October showed that business activity in the country shrank by the fourth-consecutive month, with the Composite PMI hitting 47.3 less than estimates. The Manufacturing and Services PMI dropped, each at 49.9, less than September’s 52.0, while Services tumbled to 46.6, against 49.3 in the previous month’s reading.

Across the pond, the Eurozone also reported PMIs for France, Germany, and the whole bloc, further cementing that the Euro area economy is headed toward a recession. The S&P Global PMI Composite fell to 47.1 from 48.1 in September, below economists’ estimates of 47.5.

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains neutral-to-downward biased, capped by the top-trendline of a descending channel drawn from February, a resistance level sought by sellers. Worth noting that the 50-day Exponential Moving Average (EMA), meanders around 0.9897, confluence with the top-trendline, shy of 0.9900, which will be strong resistance to overcome by buyers.

If the EUR/USD clears the 50-day EMA, the next resistance would be 0.9900. The break above will expose 0.9994, followed by parity. On the flip side, the EUR/USD first support would be the 0.9800 figure. Once cleared, the EUR/USD is the 20-day EMA at 0.9787.

-

15:59

Russia-Ukraine War: It still makes sense to position for negative market implications – TDS

Strategists at TD Securities assess the market response to possible developments in Russia's invasion of Ukraine. Their analysis sets us unambiguously in the negative market implication camp.

Investors should err on the side of caution

“We see a 67% probability that the conflict escalates. This implies a 61% probability of a neutral-to-positive market response. However, once we scale the outcomes for their likely intensity, the strong negative reactions in the lower probability scenarios outweigh the slightly positive reactions in the more likely positive market scenarios, including full NATO disengagement.”

“There remains a non-negligible 39% chance that events will lead to negative market reactions. Within this cluster, we embed our worst-case scenarios that may lead to a panic reaction and, in extreme circumstances, to complete market disruption. Overall, there is a 5% chance of an extremely negative outcome.”

-

15:45

S&P 500 Index: On track to test of key resistance at 3797/3810 – Credit Suisse

A bullish “outside day” to end last week for the S&P 500. The index is on course for a test of key near-term resistance at 3797/3810, but a break above here is needed to see a base established, analysts at Credit Suisse report.

Initial support aligns at 3736/31

“We look for a test of a cluster of key resistances at 3797/3810 – the current October high, 38.2% retracement of the August/October fall and downtrend from August.”

“With daily and weekly RSI momentum divergences in place and with sentiment and breadth measures still pointing to an oversold condition we continue to look for a more protracted consolidation/recovery phase to emerge but with a break above 3810 needed to mark a near-term base though and a more concerted recovery for a test of the 63-day average, currently at 3931.”

“Support is seen at 3736/31 initially ahead of the 13-day exponential average at 3697 which we now look to try and hold on a closing basis. A break can see a retest of 3647/39.”

-

15:32

BoE's Ramsden: Gilt market shows credibility is being recovered

"You could argue we are quite close to a round-trip for gilt yields after mini-budget," Bank of England (BoE) Deputy Governor Dave Ramsden said on Monday, as reported by Reuters.

Ramsden further argued that the gilt market shows that credibility is being restored and added that the fiscal plan scheduled to be unveiled on October 31 will be very important to sustain that credibility.

Market reaction

THere was no immediate market reaction to these remarks. As of writing, the GBP/USD pair was trading at 1.1297, where it was virtually unchanged on a daily basis.

-

15:21

GBP/USD: Break above 1.1395/1.1400 to clear the way towards 1.15/1.17 – Scotiabank

GBP/USD is trading on a relatively firm basis. However, the pair is still struggling to break above resistance in the 1.1395/00 area. A break above here is needed to propel cable towards the 1.15/15 region, economists at Scotiabank report.

GBP/USD to drop back towards 1.11/12 if 1.1395/1.1400 resistance holds

“A break above the 1.1395/1.1400 area could change short-term dynamics an put the pound on course for a 1.15/1.17 test.”

“If the 1.1395/1.1400 resistance holds, GBP/USD may slip back to 1.11/1.12.”

See – GBP/USD: Resistance at 1.1480 /1.1500 to cap the recovery – Credit Suisse

-

15:02

USD/JPY: Close below 147.82 needed to reinforce the case for a peak – Credit Suisse

USD/JPY extended its push on Friday before posting an aggressive fall following another currency intervention. Economists at Credit Suisse look for a potentially important top – which will be confirmed on a close below 13-Day Moving Average (DMA) at 147.82

Initial resistance aligns at 149.69

“A close below support from the 13-DMA at 147.82 is needed to mark a further easing in upside pressure, with support then seen next at Friday’s low of 146.20, then 145.50/42. Beneath this latter area should see support next at the October low and 38.2% retracement of the August/October rally at 143.72/53, with better support expected here at first.”

“Resistance is seen at 149.69 initially, then 151.13/19, with 151.92/153.01 expected to cap.”

-

14:59

USD/TRY finally surpasses 18.60 to print new all-time highs

- USD/TRY trespasses the 18.6000 level and rose to new tops.

- The firmer dollar remains behind the upside bias in the pair.

- The lira stays under pressure after the CBRT rate cut.

The Turkish lira depreciates to fresh all-time lows vs. the dollar and lifts USD/TRY to the area beyond the 18.6000 region.

USD/TRY: Next target at 19.00

USD/TRY extends its glacial-pace upside momentum to the 18.6000 region at the beginning of the week on the back of the strong rebound in the greenback and the generalized risk-off tone in the global markets.

In addition, the lira faces persistent headwinds as investors continue to digest the larger-than-expected interest rate cut by the Turkish central bank (CBRT) on October 20, which reduced the One-Week Repo Rate to 10.50%. In its statement, the central bank also left the door open to further rate cuts in the next gatherings.

On the latter, it is worth recalling that President Erdogan advocated for further reduction of the interest rates in several occasions, emphasizing at the same time the need of single-digits rates by year end.

What to look for around TRY

USD/TRY finally leaves behind the key barrier at the 18.6000 zone on Monday.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth via transforming the current account deficit into surplus, always following a lower-interest-rate recipe.

Key events in Türkiye this week: Capacity Utilization, Manufacturing Confidence (Tuesday) – Economic Confidence Index, Trade Balance, Tourism Revenues (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.34% at 18.6012 and faces the next hurdle at 18.6280 (all-time high October 24) followed by 19.00 (round level). On the downside, a break below 18.2810 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

14:52

US: S&P Manufacturing PMI drops to 49.9 vs. 51.2 expected

- US S&P Manufacturing PMI dropped into contraction territory in early October.

- US Dollar Index fell below 112.00 on disappointing PMI surveys.

Business activity in the US manufacturing sector contracted slightly in early October with the preliminary S&P Global Manufacturing PMI declining to 49.9 from 52 in September. This reading came in weaker than the market expectation of 51.2.

Further details of the publication revealed that the Services PMI slumped to 46.6 from 49.3 and the Composite PMI fell to 47.3 from 49.5. Both of these prints fell short of anaylsts' projections.

Commenting on the data, "the US economic downturn gathered significant momentum in October, while confidence in the outlook also deteriorated sharply," noted Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"The decline was led by a downward lurch in services activity, fuelled by the rising cost of living and tightening financial conditions," Williamson added. "While output in manufacturing remains more resilient for now, October saw a steep drop in demand for goods, meaning current output is only being maintained by firms eating into backlogs of previously placed orders."

Market reaction

The greenback lost interest after the data with the US Dollar Index declining below 112.00.

-

14:47

GBP/USD: UK’s poor fundamental backdrop will to continue to act as a downward drag – Rabobank

For months, economists at Rabobank have labelled the pound a vulnerable currency. And the GBP/USD pair is set to remain under downward pressure for the time being.

Rishi Sunak to become the next PM

“It is possible that in a few hours, former Chancellor Sunak will become PM. If Sunak is confirmed as PM, GBP may rally a little further. That said, in our view the UK’s poor fundamental backdrop suggests that the pound is likely to continue to struggle vs. the USD in the coming months.”

“While the BoE is expected to announce a hefty rate hike on November 3, this may do little to support cable given expectations of further aggressive rate hikes from the Fed.”

“We retain a three-month forecast for GBP/USD at 1.06.”

-

14:46

United States S&P Global Composite PMI below expectations (49.1) in October: Actual (47.3)

-

14:46

United States S&P Global Manufacturing PMI registered at 49.9, below expectations (51.2) in October

-

14:46

United States S&P Global Services PMI came in at 46.6 below forecasts (49.2) in October

-

14:45

USD/JPY Price Analysis: Intraday rally stalls near 61.8% Fibo./100-hour SMA confluence

- USD/JPY rebounds swiftly from a nearly two-week low touched earlier this Monday.

- Resurgent USD demand and the Fed-BoJ policy divergence provide a strong boost.

- Bulls now await sustained strength beyond the 149.55-149.60 confluence hurdle.

The USD/JPY pair attracts aggressive buying near the 145.45 region on Monday and rallied over 400 pips from a nearly two-week low touched earlier this Monday. The pair maintains its bid tone through the early North American session and is currently placed around the 149.15-149.20 region.

The initial market reaction to a suspected intervention by the Bank of Japan (BoJ) fades rather quickly amid resurgent US dollar demand. Furthermore, the risk-on impulse - as depicted by a generally positive tone around the equity markets - undermines the safe-haven JPY and offers support to the USD/JPY pair. Meanwhile, retreating US Treasury bond yields keeps a lid on any further gains, though a big divergence in the policy stance adopted by the BoJ and other major central banks favours bullish traders.

From a technical perspective, the strong intraday rally stalls ahead of the 149.50-149.55 confluence hurdle. The said area comprises the 100-hour SMA and 61.8% Fibonacci retracement level of the USD/JPY pair's sharp pullback from the 152.00 neighbourhood, or the highest-level August 1990 touched last Friday. This should now act as a pivotal point, which if cleared decisively should lift spot prices to the 150.00 psychological mark en route to the next relevant hurdle near the 150.55-150.60 area.

On the flip side, weakness back below the 149.00 mark now seems to find decent support near the 50% Fibo. level, around the 148.70 region. Any subsequent downfall could attract fresh buyers near the 148.30-148.25 region, which should help limit the downside near the 38.2% Fibo. level, around the 148.00 mark. A convincing break below the latter will negate any near-term positive bias and make the USD/JPY pair vulnerable to slide back towards retesting the 147.00 mark, or the 23.6% Fibo. level.

USD/JPY 1-hour chart

-638022158358535867.png)

Key levels to watch

-

14:35

EUR/USD could suffer a renewed dip under the 0.98 mark – Scotiabank

EUR/USD fades from 0.99. In the view of analysts at Scotiabank, the world’s most popular currency pair could slip below the 0.98 level.

Gains to the 0.99 area could not muster additional momentum

“Intraday gains to the 0.99 area could not muster additional momentum to test key trend resistance, drawn off the Feb high, at 0.9940.”

“The 40-day MA (0.9866) is still curbing EUR gains in effect and that may prompt a renewed dip under the figure to test support in the mid-0.97s ahead of key, short-term support at 0.9700/10.”

-

14:19

GBP/USD: Resistance at 1.1480 /1.1500 to cap the recovery – Credit Suisse

GBP/USD has struggled to find acceptance above 1.1400 on Monday. Resistance at 1.1480/1.1500 is set to cap cable, analysts at Credit Suisse report.

Support seen at 1.1215/11, then 1.1080/61

“GBP/USD extends its consolidation for a test of its short term downtrend from the beginning of October at 1.1405/11. We would not rule out further strength to the 55-day average at 1.1480 but with the October high just above at 1.1496, we continue to look for this to prove the extent of the recovery. Above 1.1496/1.1500 though would mark the completion of a small bullish continuation pattern to clear way for a deeper recovery.”

“Support is seen at 1.1244 initially, with a break below 1.1215/11 needed to ease the immediate upside bias with short-term trend/range support and low from Friday at 1.1080/61. Below here can see a retest of 1.0933/16.”

-

14:12

UK: Rishi Sunak to become next UK PM after winning leaderchip contest

Sir Graham Brady, chair of the 1922 Committee, announced on Monday that Rishi Sunak is elected as leader of the Conservative Party and new prime minister following Penny Mordaunt's decision to drop out of the contest.

Sunak will reportedly deliver a private speech to Tory MPs at 1430 GMT.

Market reaction

This development doesn't seem to be having a significant impact on the British pound's performance against its major rivals. As of writing, GBP/USD was trading virtually unchanged on the day at 1.1298. Meanwhile, the UK's FTSE 100 Ubdex gained traction on this headline and was last seen rising 0.7% on the day.

-

13:54

When are the S&P Global's flash US PMIs and how could the data affect EUR/USD?

US PMI Overview

S&P Global will release the flash version of the US Manufacturing and Services PMIs at 13:45 GMT this Monday. The gauge for manufacturing is expected to decline to 51.2 in October from 52.0 in the previous month. The Services PMI, meanwhile, is anticipated to remain in the contraction territory for the fourth successive month and come in at 49.2 for the current month. Moreover, the composite PMI is also expected to show a contraction in the overall business activity and edge down to 49.1 from 49.5 in September.

How Could it Affect EUR/USD?

Ahead of the key release, the US dollar regains strong positive traction on the first day of a new week and exerts some downward pressure on the EUR/USD pair. A stronger US PMI print will reaffirm market bets that the Federal Reserve will stick to its policy-tightening path and provide an additional lift to the buck. Conversely, weaker US macro data will add to worries about a deeper global economic downturn and continue to benefit the greenback's relative safe-haven status.

The fundamental backdrop suggests that the path of least resistance for the EUR/USD pair is to the downside. That said, any immediate market reaction is more likely to remain limited amid expectations that the European Central Bank will deliver another supersized 75 bps rate hike at its upcoming policy meeting on Thursday. This, in turn, warrants some caution for aggressive traders and before positioning for a firm near-term direction.

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical outlook for the EUR/USD pair and writes: “The Relative Strength Index (RSI) indicator on the four-hour chart holds above 50 despite the latest decline, suggesting that sellers remain hesitant for the time being. On the downside, 0.9800 (Fibonacci 38.2% retracement of the latest downtrend, 20-period SMA, 50-period SMA, 100-period SMA) aligns as key support. With a four-hour close below that level, the pair could come under technical bearish pressure and decline toward 0.9750 (Fibonacci 23.6% retracement) and 0.9700 (psychological level, static level).”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the upside, the 0.9840/50 area, where the Fibonacci 50% retracement and the 200-period SMA are located, forms stiff resistance. If buyers manage to flip that level into support, 0.9900 (daily high, psychological level) and 0.9930 (static level) could be targeted.”

Key Notes

• EUR/USD Forecast: Euro closes in on key support area

• EUR/USD Price Analysis: Decent contention appears around 0.9700

• EUR/USD: Unlikely to push ahead, 0.9950 is significant resistance – ING

About the US Manufacturing PMI

The Manufacturing Purchasing Managers Index (PMI) released by the Markit Economics captures business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of total GDP, the manufacturing PMI is an important indicator of business conditions and the overall economic condition in the United States. Readings above 50 imply the economy is expanding, making investors understood it as a bullish for the USD, whereas a result below 50 points for an economic contraction, and weighs negatively on the currency.

About the US ISM Services PMI

The Services Purchasing Managers Index (PMI) released by Markit Economics captures business conditions in the services sector. As the services sector dominates a large part of total GDP, the services PMI is an important indicator of the overall economic condition in US. A result above 50 signals is bullish for the USD, whereas a result below 50 is seen as bearish.

-

13:39

US: Chicago Fed National Activity Index stays unchanged at 0.1 in September

- Chicago Fed's National Activity Index stayed unchanged in September.

- US Dollar Index stays in positive territory above 112.00.

The Federal Reserve Bank of Chicago's National Activity Index (CFNAI) stayed unchanged at 0.1 in September. This reading came in slightly better than the market expectation of -0.04.

"The CFNAI Diffusion Index, which is also a three-month moving average, increased to +0.35 in September from +0.16 in August," the publication read.

According to the Chicago Fed, a zero value for the CFNAI is associated with the national economy expanding at its historical trend (average) rate of growth.

Market reaction

This report doesn't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.4% on the day at 112.30.

-

13:33

EUR/USD Price Analysis: Decent contention appears around 0.9700

- EUR/USD triggers a knee-jerk after failing to surpass 0.9900.

- There is initial support around the 0.9700 region so far.

EUR/USD corrects lower and approaches 0.9800 after two consecutive daily advances at the beginning of the week.

In case losses accelerate, the pair should face the initial contention at last week’s lows near the 0.9700 yardstick (October 21). If cleared, then the October low at 0.9631 (October 13) could emerge on the horizon.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0529.

EUR/USD daily chart

-

13:31

Brazil Current Account below forecasts ($-4.2B) in August: Actual ($-5.678B)

-

13:30

United States Chicago Fed National Activity Index came in at 0.1, above forecasts (-0.04) in September

-

13:19

GBP/JPY could move above the 170.00 level in the short-term – Rabobank

Both the Japanese yen and the British pound have been under a lot of pressure recently. GBP/JPY remains firm around 168.50 and economists at Rabobank believe that the pair could rise above the 170 mark.

A key week for GBP and JPY

“Although UK fundamentals remain sour, it is possible that the risk of further panic selling of the pound may now be contained. That said, the week ahead will be another crucial one in terms of the outlook for GBP.”

“The outlook for the JPY is essentially a mix of two drivers. On one hand the BoJ’s accommodative monetary policy settings are undermining the JPY in an environment in which most other central banks are hiking interest rates. On the other hand, FX intervention from the MoF is designed to make speculators think twice about shorting the JPY.”

“We see risk of GBP/JPY moving above the 170.00 level in the short-term, though we expect that these levels could be difficult to sustain, and forecast that GBP/JPY is likely to be lower on a three-month view on the back of a weak pound.”

-

12:47

The last stage of the dollar market will see more big moves than direction – SocGen

The last stage of the dollar’s rally is no fun for chess players. This is the time when the poker players thrive, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

Constant diet of rising US yields needed to drive USD/JPY higher and higher

“The dollar is supported a strong economy hawkish central bank, and favourable terms of trade. But the market is short treasuries, long dollars.”

“The yen’s bounce suggests that the market needs a constant diet of rising US yields to drive USD/JPY higher and higher. The China-sensitive currency universe though, seems vulnerable until the Chinese economic outlook changes.”

“The European data are holding up better than they might thanks to energy support, but not well, and anyway, the tail risk confuses things. Spot European natural gas prices suggest storage tanks are full, three-month ahead prices suggest that if cold weather created a bit of space, the spot price would bounce.”

“We’re closer to peak US yields and peak dollar, but if you want to know how to time the turn with confidence, you need to understand market psychology. All I know is that the last stage of the dollar market will see more big moves than direction.”

-

12:18

USD Index Price Analysis: Another visit to 114.00 looks on the table

- DXY gathers traction and reverses two daily drops in a row.

- The ongoing rebound should target the 114.00 region near term.

DXY reclaims the area beyond 112.00 the figure on Monday after two straight sessions with losses.

The continuation of the recovery should refocus on recent tops near 114.00. The surpass of this level should put a visit to the 2022 top at 114.78 (September 28) back on the radar in the short-term horizon.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 8-month support line near 108.20, an area coincident with the 100-day SMA.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 103.78.

DXY daily chart

-

12:05

Any messaging that the BoC can explore ‘fine-tuning’ rate hikes will hurt the CAD – Scotiabank

The Canadian dollar is choppy ahead of key Bank of Canada’s (BoC) decision. Any messaging that the Bank can start to consider ‘fine-tuning’ rate hikes will hurt the loonie, economists at Scotiabank report.

Solid US growth data will cheer USD and stocks

“In Canada, the primary focus will fall on Wednesday’s BoC policy decision, Monetary Policy Report and Governor Macklem’s press conference afterwards. A 75 bps hike is more or less fully priced. This will take the Overnight Target rate to 4.00%. Any messaging that the Bank can start to consider ‘fine-tuning’ rate hikes will hurt the CAD. Whether the Bank’s outlook and still elevated inflation allows the Governor to make that concession at this stage remains to be seen.”

“ It’s a busy week for data release in the US. Thursday’s advance Q3 GDP report is likely to be the highlight of the week. GDP tracking suggests a fairly solid quarter for the US economy after negative prints in Q1 and Q2. The consensus estimate calls for 2.1% (SAAR). The Atlanta Fed’s GDP Now forecast is tacking 2.8/2.9%. Solid growth will be positive for the USD and rates and may weigh on stocks (hurting the CAD).”

-

12:04

AUD/USD keeps the red below 0.6300 mark, seems vulnerable amid resurgent USD demand

- AUD/USD meets with aggressive supply on Monday amid a strong pickup in demand for the USD.

- Hawkish Fed expectations remain supportive of elevated US bond yields and underpin the buck.

- A positive risk tone also does little to benefit the risk-sensitive aussie or lend support to the pair.

The AUD/USD pair comes under fresh selling pressure and retreats over 100 pips from levels just above the 0.6400 mark, or a two-week high touched earlier this Monday. The downward trajectory drags spot prices below the 0.6300 round figure during the first half of the European session and is sponsored by a strong pickup in demand for the US dollar.

Despite reports that some Fed officials are signalling greater unease with oversized rate hikes, the markets seem convinced that the US central bank will stick to its faster policy tightening path. This, in turn, remains supportive of elevated US Treasury bond yields and assists the USD to regain strong positive traction on the first day of a new week.

The Australian dollar, on the other hand, is pressured by worries about the economic headwind stemming from China's zero-COVID policy, which overshadows upbeat Chinese third-quarter GDP, which showed that the world's second-largest economy expanded by 3.9% YoY. Adding to this, China's Industrial Output rose 6.3% YoY in September against 4.5% estimates.