Notícias do Mercado

-

23:50

USD/CHF displays signs of exhaustion above 0.9950, US Durable Goods Orders data eyed

-

USD/CHF is expected to witness more losses below 0.9920 as momentum loss kicks in.

-

A steep rise in core CPI data already indicated a subdued demand for US Durable Goods.

-

This week, the release of the ZEW Survey- Expectations will be of utmost importance.

The USD/CHF pair has slipped to near 0.9928 after failing to sustain above the critical hurdle of 0.9950 in the late New York session. The asset is auctioning in a minor inventory adjustment process and is expected to extend its correction further, however, the upside remains favored amid broader strength in the US dollar index (DXY).

On Monday, the asset witnessed a juggernaut rally after delivering an upside break of the consolidation formed in a tad wider range of 0.9757-0.9850. Investors shielded themselves behind the safe-haven asset as the risk profile turned vulnerable. Russia-linked negative sentiment has renewed fears of terrorism and chances of a nuclear attack.

Going forward, the DXY will dance to the tunes of the US Durable Goods Orders data. Considering the market consensus, the economic data will decline by 1.1% vs. The prior decline of 0.1%. Soaring prices for durable products have trimmed advance orders for the economic data.

One could understand from the fact that the core Consumer Price Index (CPI) remained upbeat for August. The core inflation rate reading was 6.3%, higher than the estimates of 6.1% and the prior release of 5.9%. Therefore, higher prices for durable goods have postponed their purchases.

Also, escalating interest rates from the Federal Reserve (Fed) are resulting in higher credit obligations to households, which have also forced them to ditch current purchases for durable goods.

Meanwhile, the Swiss franc investors are awaiting the release of the ZEW Survey- Expectations, which indicates the business conditions, employment conditions, and day-to-day business activities. The sentiment data is expected to improve to -48.5 vs. The prior release of -56.3. An occurrence of the same will support the Swiss franc.

-

-

23:46

GBP/USD retreats towards 1.0600 as bears again eye record low on BOE’s hesitance

- GBP/USD resumes downside towards the all-time low after a corrective bounce.

- BOE refrains from early intervention, UK government rules out scope for canceling mini-budget.

- Pessimism in the UK contrasts with the hawkish Fedspeak, firmer yields to favor US dollar.

- Bears can keep reins and can dig deeper, US Durable Goods Orders, CB Consumer Confidence eyed.

GBP/USD fades bounce off the all-time low marked on Monday, easing to 1.0670 during the early Asian session on Tuesday, as pessimism surrounding the UK remains intact. Also exerting downside pressure on the Cable pair is the hawkish Fedspeak ahead of the week’s key US data.

Be it the newly formed British government or the Bank of England (BOE), both disappointed the GBP/USD traders the previous day by turning down the hopes of meddling to defend the British Pound (GBP).

When asked whether the government is planning to change the measures set out in the mini-budget, British Prime Minister Lis Truss' spokesman responded by simply saying "no," as reported by Reuters. The diplomat also mentioned that it is important that BOE independence remains while adding that we don’t comment on interest rates.

On the other hand, the BOE stated that they are monitoring developments in financial markets very closely in light of the significant repricing of the financial assets. The BoE further noted that they welcome the government’s commitment to sustainable economic growth and the role of the Office for Budget Responsibility.

Elsewhere, The UK Times stated that Labour has surged to its largest poll lead over the Conservatives in more than two decades, with voters turning against (UK Chancellor) Kwasi Kwarteng’s tax-cutting budget. A YouGov poll for The Times today puts Labour 17 points clear of the Tories — a level of support not seen since Tony Blair won his landslide victory in 2001.

On the other hand, Chicago Fed National Activity Index weakened to 0.0 in August versus 0.09 market expectations and an upwardly revised prior reading of 0.29. Even so, Boston Fed President Susan Collins said, per Reuters, “Getting inflation down will require slower employment growth, somewhat higher unemployment rate”. Following that, Cleveland Fed President Loretta Mester said on Monday that if there is an error to be made, better that the Fed do too much than to do too little.

Amid these plays, the yields rally as the traders sought premium to hold riskier assets while the equities dropped, which in turn helped the US dollar to remain firmer.

Moving on, headlines from the UK will be crucial for the short-term direction of the GBP/USD pair. However, major attention could be given to the US CB Consumer Confidence for September and Durable Goods Orders for August will be crucial to watch for intraday guidance. That said, the bears are likely to keep the reins and may dominate further if the scheduled US data offers a positive surprise.

Also read: US Consumer Confidence Preview: Near-term relief or more risk aversion?

Technical analysis

Unless crossing a previous support line from May, around 1.1270-80 by the press time, GBP/USD remains vulnerable to dropping towards the record low.

-

23:31

NZD/USD plunges to two and half-year lows around 0.5620s on sour sentiment

- On Monday, the NZD/USD plunged to levels last seen on March 2020.

- Risk aversion is the game’s name, due to increased recession jitters, alongside UK’s tax cuts, adding to inflationary pressures.

- NZD/USD traders eye Durable Good Orders, New Home Sales, Consumer Confidence, and Fed Chief Jerome Powell.

On Monday, the NZD/USD plunged more than 1% or 107 pips, as risk aversion hit the markets, with global equities trading in the red, amidst growing concerns of a worldwide recession, following a week of 500 bps of tightening by central banks. Additionally, tax cuts in the UK added to the country’s inflationary pressures, despite the ongoing tightening cycle by the Bank of England (BoE). As the Asian Pacific session begins, the NZD/USD is trading at 0.5635, slightly down by 0.01%.

NZD/USD fell towards the 0.5420s on risk-off impulse

The lack of economic data kept investors leaning towards market sentiment and US dollar dynamics. Last week’s 75 bps by the Fed, and expectations of the Federal funds rate (FFR) to finish at around 4-4.4% levels, augmented appetite for the safe-haven US dollar. Consequently, US Treasury bond yields rose, with the short-end of the curve, namely 2s and 5s, breaching the 4% threshold, while the US 10-year T-bond yield climbed towards 3.93%.

In the meantime, the US Dollar Index refreshed two-decade highs at around 114.53, a headwind for the NZD/USD, which began trading on Monday at 0.5740 and reached a daily high of 0.5754 before plummeting toward the daily low at 0.5625.

Elsewhere, Fed officials crossed newswires on Monday. The Boston Fed President Susan Collins expressed that further tightening is needed to temper inflation and emphasized that the unemployment rate should rise to achieve the Fed goal. Echoing her comments was Cleveland’s Fed President Loretta Mester, alongside Atlanta’s Fed President Raphael Bostic

What to watch

On Tuesday, the US economic docket will feature Durable Goods Orders, Consumer Confidence, New Home Sales, and further Fed speaking, led by Chair Jerome Powell.

The New Zealand calendar is empty, leaving traders adrift to US dollar dynamics.

NZD/USD Key Technical Levels

-

23:10

AUD/USD bears take a breather at two-year low near 0.6450, risk-aversion, US data eyed

- AUD/USD pauses two-day downtrend at 28-month low, paring losses of late.

- Risk-off mood joined firmer yields to weigh on the pair.

- Panic selling of the GBPUSD, calls for central bank intervention contributed to the sour sentiment.

- Bears are likely to keep reins amid light calendar, corrective bounce can’t be ruled out.

AUD/USD justified its risk-barometer status as markets panicked on Monday before traders lick their wounds near 0.6460 during Tuesday’s early Asian session. The quote’s latest weakness could be linked to the broad pessimism amid the GBP/USD pair’s plunge that raised concerns over multiple central bank interventions.

GBP/USD slumped to an all-time low on Monday amid the market’s scathing rejection to the new tax-cut measures, fearing more burden on the monetary policymakers and fiscal budget. The same triggered speculations that the Bank of England (BOE) needs to intervene to defend the domestic currency, allowing the cable to pare some losses. However, the British central bank refrained from any immediate moves and renewed the selling of the Cable.

At home, the People’s Bank of China’s (PBOC) updates surrounding the increase in the Forex reserves tried to defend the AUD/USD buyers recently but failed amid the risk-off mood.

The sour sentiment pushed market players to demand a premium and pushed the Treasury yields towards the north, which in turn joined the hawkish Fedspeak to propel the US dollar and weigh on the AUD/USD prices. Also portraying the risk-aversion was the downbeat performance of the global equities, tracked by Wall Street.

On Monday, Chicago Fed National Activity Index weakened to 0.0 in August versus 0.09 market expectations and an upwardly revised prior reading of 0.29. Even so, Boston Fed President Susan Collins said, per Reuters, “Getting inflation down will require slower employment growth, somewhat higher unemployment rate”. Following that, Cleveland Fed President Loretta Mester said on Monday that if there is an error to be made, better that the Fed do too much than to do too little.

That said, AUD/USD traders are likely to witness hardship in extending the latest rebound amid economic fears. With that in mind, today’s US CB Consumer Confidence for September and Durable Goods Orders for August will be crucial to watch for immediate directions.

Also read: US Consumer Confidence Preview: Near-term relief or more risk aversion?

Technical analysis

Despite the latest pause in the downside, a clear break of the four-month-old bearish channel’s support line, now resistance around 0.6500, keeps AUD/USD bears hopeful of visiting the 78.6% Fibonacci Expansion (FE) of April-August moves, near 0.6360.

-

23:10

EUR/USD oscillates above 0.9600 as investors await US Durable Goods Orders data

-

EUR/USD has turned sideways around 0.9610 as the focus shifts to US Durable Goods Orders data.

-

Costly durable goods and accelerating interest rates have trimmed consensus for US economic data.

-

ECB Lagarde’s speech will provide cues for likely monetary policy action ahead.

The EUR/USD pair is displaying back-and-forth moves in a narrow range of 0.9600-0.9627 in the early Tokyo session. The asset has turned sideways as investors are awaiting the release of the US Durable Goods Orders data. Earlier, the asset displayed a responsive buying action after dropping to near 0.9550 on Monday. The asset witnessed a steep fall on negative market sentiment, which forced the market participants to dump risk-perceived currencies further.

As per the preliminary estimates, the US Durable Goods Orders are expected to decline by 1.1% against the prior decline of 0.1%. As the price rise index for core products is scaling higher, households have ditched their purchases and are spending in seldom on essentials. Inflation-adjusted payouts and subdued earnings have forced them to alter their expenditure pattern.

Apart from them, accelerating interest rates are compelling households to postpone their spending on durable goods. Payment for durable goods on credit is attracting extremely higher interest obligations. Therefore, the economic data seems grim ahead.

On the Eurozone front, investors are awaiting cues on likely monetary policy action will be provided from the European Central Bank (ECB) President Christine Lagarde’s speech. The situation of the inflation rate is vulnerable in the Eurozone, therefore ‘hawkish’ guidance is highly expected.

On Monday, ECB Governing Council member and German central bank head Joachim Nagel said that decisive rate hikes are needed amid rising risks of inflation expectations getting de-anchored. Nagel favored a decisive action to bring down the inflation rate to 2%.

-

-

22:21

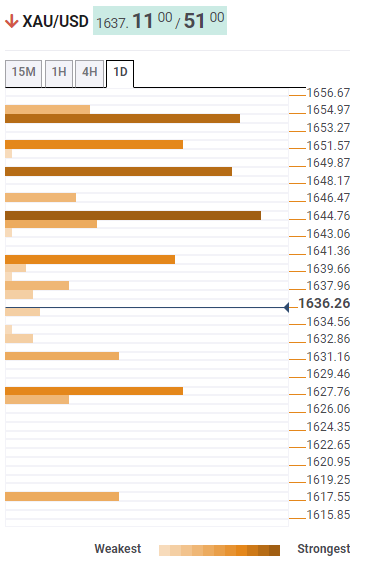

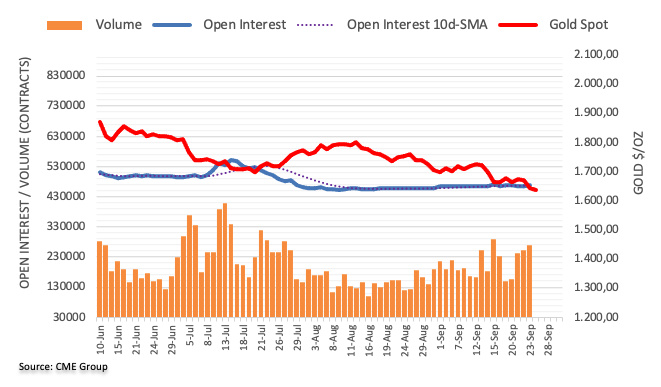

Gold Price Forecast: XAU/USD bears eye a test of $1,600

- Gold continues to bleed out with a focus on a break below $1,600.

- The US dollar is pulling in the flows as markets move strongly risk averse.

Gold is sliding into fresh lows after being held back by the bears below $1,650 on corrections on Monday. The yellow metal dropped to the lowest in more than two years while the US dollar extends its bull cycle on recession fears and rising interest rates. US bond yields have also moved up and are reaching their highest in more than a decade.

The ICE dollar index has touched 114.53, the highest since 2002 while the yields on the US 10-year note have rallied to their highest since 2008 at around 3.93%. The rise comes following the Federal Reserve's 75 basis point hike in interest rates and the promise of further increases as the central bank looks to quell inflation. This has been a weight for gold since it offers no interest to investors in the search for yield.

''An added concern for the US Treasury market is that should a round of coordinated FX market intervention to weaken the USD occur, it would probably involve sales of US Treasuries by foreign central banks,'' analysts at ANZ Bank said.

Meanwhile, Wall Street fell deeper into a bear market at the start of this week with the S&P 500 and Dow closing lower as investors fretted that the Federal Reserve's aggressive campaign against inflation. With the Fed signaling last Wednesday that high-interest rates could last through 2023, the S&P 500 has relinquished the last of its gains made in a summer rally. The Dow is now down 20.5% from its record high close on Jan. 4.

''We see the potential for continued outflows from money managers and ETF holdings to weigh on prices moving forward, which ultimately raises the probability of a pending capitulation from the small number of family offices and proprietary trading shops that hold complacent length in gold,'' analysts at TD Securities said.

''In this context, while prices are certainly weak, precious metals' price action could still have further to fall as the restrictive rates regime is set to last for longer. Given that the momentum in underlying inflation trends is persistently inconsistent with the Fed's target, we have changed our terminal rate forecast from 4.25-4.50% to 4.75-5.00%, with not only a 75bp hike in November and 50bp in December but also 25bp rate increases in February and March.''

Gold technical analysis

As per the start of the week's pre-open analysis, Gold, Chart of the Week: XAU/USD thrown to the bears at the edge of the abyss, the price has continued to bleed out having broken key structures. $1,600 is calling with a focus on $1,575.

-

22:14

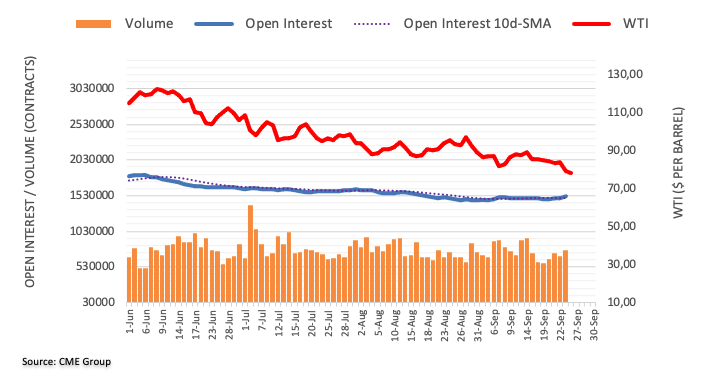

WTI drops to fresh eight-month-lows below $74.50 per barrel on buoyant US dollar

- WTI is falling close to 4% on Monday on recession fears.

- Fed policymakers emphasized the need for further rate increases as inflation remains stickier.

- The US Dollar Index extended its gains and recorded a fresh 20-year high at 114.53, a headwind for oil prices.

On Monday, the US crude oil benchmark, also known as WTI (Western Texas Intermediate), drops for the second straight day after sliding from above the $80 per barrel figure to the mid $70-$80s range. At the time of writing, WTI is exchanging hands at $76.31 per barrel, down by 3.63%.

Oil prices fell on emerging recession fears

Worries about a global economic slowdown are mounting, as energy prices have shown. Last week’s 75 bps rate hike by the Fed, alongside another 425 bps of worldwide central banks, fueled worries of a recession. Therefore, WTI remains defensive, as lower demand implies lower prices.

Sources cited by Reuters said, “With more and more central banks being forced to take extraordinary measures no matter the cost to the economy, demand is going to take a hit which could help rebalance the oil market.”

Another factor weighing US crude oil prices is the rapid rise of the greenback. The US Dollar Index, a gauge of the buck’s value vs. a basket of six currencies, edges up 0.98% at 114.128, a headwind for oil and US dollar-denominated commodities.

Elsewhere, Fed officials crossed newswires on Monday. The Boston Fed President Susan Collins expressed that further tightening is needed to temper inflation and emphasized that the unemployment rate should rise to achieve the Fed goal. Echoing her comments was Cleveland’s Fed President Loretta Mester, alongside Atlanta’s Fed President Raphael Bostic.

Oil traders’ attention turns to further US economic to be released ahead of the Organization of the Petroleum Exporting Countries (OPEC) and allies reunion, to be hosted on October 5. The US calendar will feature durable good orders, consumer confidence, and further Fed speaking, led by Fed Chair Jerome Powell, on Tuesday.

WTI Daily Chart

WTI Key Technical Levels

-

22:00

South Korea Consumer Sentiment Index came in at 91.4, above expectations (87.2) in September

-

21:24

GBP/JPY Price Analysis: Shifted bearish after plunging below the 200-EMA

- In the overnight session, the GBP/JPY tumbled near 4.50% on concerns over the UK budget.

- The GBP/JPY pierced the 20 and 50-Week EMAs, hoovering around the 100-Week EMA.

- GBP/JPY Price Analysis: Shifted bearish biased, as it broke below the 200-EMA, eyeing a re-test of the YTD low around 148.00.

The GBP/JPY drops as the New York session is about to finish, though recovered after printing a fresh one-year low at around 148.63, on Increasing concerns that the UK’s new budget would likely add to the country’s inflationary pressures amidst the Bank of England’s tightening cycle to quell inflation from double-digit levels. At the time of writing, the GBP/JPY is trading at 154.56, still below its opening price.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY weekly chart portrays the cross tumbled below the 20, 50, and 100-Week EMAs, though the pair trimmed some of its losses and is back above the 154.80 mark. Oscillators, mainly the Relative Strength Index (RSI), shifted negatively, showing the Japanese FX intervention’s impact alongside the UK’s slowing economic outlook. If the GBP/JPY registers a decisive break below the 100-WEMA at 153.52, that could pave the way for further losses. Otherwise, expect the cross-currency to stay range-bound in the 153.50-158.56 range.

From a daily chart perspective, the GBP/JPY shifted bearish biased once sellers hurdled the 200-day EMA, which, at the time of typing, stands at 160.27, opening the door for further losses. GBP/JPY traders should be aware that the Relative Strength Index (RSI) plunged to oversold levels at 24, which could impede sellers from taking action. Indeed, once the RSI exits from those levels, traders should expect a resumption of the downtrend, targeting the fresh YTD low at 148.53, which could extend towards the September 2020 cycle high of 142.70.

GBP/JPY Key Technical Levels

-

21:16

Fed's Mester: With inflation high, better to act “aggressively”

Cleveland Fed President Loretta Mester said on Monday that if there is an error to be made, better that the Fed do too much than to do too little.

"When there is uncertainty, it can be better for policymakers to act more aggressively because aggressive and pre-emptive action can prevent the worst-case outcomes from actually coming about," Mester said in remarks prepared for delivery to the Massachusetts Institute of Technology.

Key notes

Mester said she would be "very cautious" about assessing inflation, and would need to see several months of declines in month-to-month readings to be convinced it had peaked.

Mester said she will "guard against being complacent" on long-term inflation expectations that have recently dropped a bit but may not, she said, be as well-anchored as hoped and could rise again.Policymakers faced with uncertainty over inflation expectations should risk setting policy too tight rather than too loose, she said.

"Research indicates that erroneously assuming that longer-term inflation expectations are well anchored at the level consistent with price stability when, in fact, they are not is a more costly error for the economy than assuming they are not well-anchored when they actually are," Mester said.

"Further increases in our policy rate will be needed," Mester said.

"In order to put inflation on a sustained downward trajectory to 2%, monetary policy will need to be in a restrictive stance, with real interest rates moving into positive territory and remaining there for some time."

-

21:12

SNB's Maechler: Ready to buy foreign currencies if franc too strong

Swiss National Bank's Ms Andréa M Maechler has crossed the wires saying that raising interest rates was intended to send a clear signal that the SNB is determined to bring down inflation.

Key comments

- We see a weakening in the swiss economy but no recession.

- Declines comment on possible further interest rate moves.

- Potential losses by central bank do not influence monetary policy.

- Recent rise in swiss franc has helped dampen inflation.

- Now is not the time to reduce central bank's balance sheet.

- Central bank ready to buy foreign currencies if franc too strong, buy francs if currency is too weak.

- A set level for franc exchange rate is not important, it is the impact the exchange rate has on inflation.

Meanwhile, USD/CHF is higher by some 1.25% as the US dollar extends its bullish cycle to fresh highs on Monday in the DXY to 114.58.

-

21:05

Forex Today: Panic took over financial markets

What you need to take care of on Tuesday, September 27:

The dollar maintained its bullish momentum and soared at the beginning of the week, pushing major pairs into fresh multi-year lows. A scarce macroeconomic calendar exacerbated risk-related trading as worldwide central bankers insisted on battling inflation at any cost.

The GBP/USD pair sunk to a record low of 1.0317 and now trades around 1.0690, still down on the day. The Bank of England was expected to step in, helping the pair recover, although it did not. In fact, Governor Andrew Bailey repeated they would not hesitate to alter interest rates as necessary to return inflation to the 2% target sustainably in the medium term, adding they are “closely monitoring” financial markets developments. Nevertheless, he added that the latest developments would be fully assessed at their next scheduled meeting.

EUR/USD trades near a fresh two-decade low of 0.9549 as the EU sees no light at the end of the tunnel. European Central Bank President Christine Lagarde offered a speech and said that they may need to take additional measures to deal with inflation.

Commodity-linked currencies were also under strong selling pressure. AUD/USD bottomed at 0.6437 while USD/CAD surged to 1.3807. The USD/CHF pair was also up, reaching 0.9965. The USD/JPY finished the day up at 144.55.

Spot gold plunged at trades around $1,625 a troy ounce, while crude oil prices were also sharply down, with WTI now trading at $76.60 a barrel, nearing this year low at $74.25.

Global stocks closed in the red amid panic selling. The FTSE was the exception, helped by the plummeting Sterling. It added measly 2 points.

US Durable Goods Orders and CB Consumer Confidence are taking center stage on Tuesday.

Bitcoin Price Prediction: Investors need to prepare for volatile breakout

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:26

GBP/USD comes under renewed pressure, testing 1.0680s

- GBP/USD bulls attempting to recover from massive losses.

- US dollar has hit a new 20-year top of 114.58 amid heavy volatility.

GBP/USD is down by over 1.5% on the day, but trading at 1.0698, it is well away from the lows of 1.0356 that were scored earlier in the session and rests between there and the day's high of 1.0931. We have seen a record low in the pair on the back of a renewed selloff in British gilts and concerns about high-interest rates that have continued to put pressure on the global financial system.

In particular, markets took fright at British finance minister Kwasi Kwarteng announcing the scrapping of the top rate of income tax and canceling a planned rise in corporate taxes. The reaction to the proposed plan is a real concern and adds uncertainty to the economy. Additionally, US dollar strength is weighing heavily on the FX space with the dollar index, which tracks the greenback against six peers - hitting a new 20-year top of 114.58 in early trade.

The drop in the pound is also leading to speculation the Bank of England will have to hold an emergency meeting to raise rates. The Bank of England said on Monday it would not hesitate to change interest rates and was monitoring markets "very closely".

"The Bank is monitoring developments in financial markets very closely in light of the significant repricing of financial assets," Bank of England Governor Andrew Bailey said. "The MPC will not hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term, in line with its remit." The Treasury and central bank statements came towards the end of a day of turmoil for Britain's currency and debt with the British 10-year government bond prices now on track for their biggest slump in any calendar month since at least 1957.

-

19:57

RNZ's Orr: NZ tightening cycle ‘is very mature’

The Reserve Bank of New Zealand's governor Adrian Orr has crossed the wires saying New Zealand's tightening cycle is very mature and has stated that there is still a little bit more to do in terms of tightening.

More to come

-

19:28

USD/CAD ducks back below fresh cycle highs in the 1.3800s

- USD/CAD holds in bullish territory with the US dollar spiking to fresh bull cycle highs.

- Market volatility has dented the high beta CAD in the face of weaker oil prices.

At 1.3770. USD/CAD is up over 1.3% on the day as the pair tries to hold on to near the highs of the day at 1.3808 following a surge from the day's low of 1.3559. It has been a strong day for US bond yields with sky-high volatility in global currency markets that has seen the US dollar extending its gains to 114.52 as per the DXY index.

Investors continued to fret about the Federal Reserve's aggressive policy tightening and its impact on the US economy which has seen a sell-off across financial markets and a bid into the greenback. This also added an extra layer of volatility to markets worried about a global recession amid soaring prices. The CBOE Volatility index, hovered near three-month highs while the US 10-year Treasury yield is rising again on Monday, hitting 3.9020%, which is a fresh high back to April 2010.

''CAD is not immune to this deterioration in conditions,'' analysts at TD Securities said. ''We were bearish the CAD for fundamental reasons as the debt servicing problem should start to manifest and create a data domino over the balance of the year, while worsening global growth meant that the currency would also be on the defensive.''

''With oil prices in retreat as global demand wanes, CAD will continue to struggle. If you did not like the CAD a week ago, there is more reason to despise it further. We are now entering the FOMO stage of USD/CAD.''

The price of oil, one of Canada's major exports, clawed back some recent losses as market participants awaited for details on new sanctions on Russia. However, oil had fallen to new eight-month lows as recession worries continue to dominate trading while the US dollar continues to strengthen. West Texas Intermediate crude is still down by over 3.4% on the day to $76.63.

In domestic data, wholesale trade rose 0.8% in August from July, largely driven by higher sales in the food, beverage and tobacco subsector, a preliminary estimate from Statistics Canada showed. Meanwhile, more than a third of customers in the Canadian province of Nova Scotia were without power on Monday, two days after powerful storm Fiona battered the east coast of the country.

-

19:28

Silver Price Forecast: XAG/USD plunges to fresh three-week lows as US T-bond yields skyrocket

- Silver price plummets more than 2.50% due to overall US dollar strength.

- US Treasury bond yields rise, a headwind for the white metal.

- Silver Price Analysis: Once it falls below $18.00, a test of the YTD lows at $17.56 is on the cards.

Silver price slides to fresh three-week lows below $19.00, as US Treasury bond yields are rising sharply, with the US 10-year T-note rate hitting 3.90%, for the first time since April 2010, when the benchmark note fell from the 4% threshold. At the time of writing, XAG/USD exchanges hands at $18.35, below its opening price by 2.51%.

Risk aversion keeps global equities in the red, courtesy of the past week’s 500 bps of central bank interest rate increases as recession fears grow. Global bond yields are rising as the bond sell-off continues. US Treasury yields in the short end of the curve rose above 4%, while the US 10-year benchmark rate hit a daily high of around 3.90%.

XAG/USD plunges on high US T-bond yields

Money market futures are discounting a 75 bps rate hike at the Fed’s November meeting, a headwind for the white metal. In the meantime, Fed officials led by Atlanta’s Fed President Bostic and Boston Susan Collins crossed news wires.

On Sunday, Raphael Bostic commented that he believes the Fed can temper inflation without triggering substantial job market losses. He reassured that inflation is “too high,” emphasizing the need to control it.

During the last hour, Bostic crossed wires, acknowledging that events in the UK might put additional stress on Europe and the US in the already tense financial markets. In the meantime, the newest President of the Boston Fed, Susan Collins, commented that the unemployment rate needs to increase so that the US central bank can achieve its inflation goal. She added that she would like “clear and convincing signs” that inflation is cooling and that achieving a soft landing “while challenging, is achievable.”

Even though, Collins said, “a significant economic or geopolitical event could push our economy into a recession as policy tightens further.”

Elsewhere, the US Dollar Index, a measure of the buck’s performance vs. six rivals, edges higher by almost 1%, at 114.159, weighing on the US dollar-denominated silver.

From a technical perspective, it’s worth noting that XAG/USD tumbled below the 20-day EMA of $18.83, exacerbating a fall towards the $18.30s area. Furthermore, the Relative Strength Index (RSI). Shifted negatively, signaling that sellers are gathering momentum. Therefore, if XAG/USD breaks below the $18.00 figure, we could expect a re-test of the YTD lows at around $17.56 in the near- term.

Silver Daily Chart

Silver Key Technical Levels

-

18:28

USD/JPY Price Analysis: Back above 144.50, as a break of 145.00 could spur another FX intervention

- The USD/JPY bounces off the 143.00 regions and is back above 144.50 after last week’s BoJ FX intervention.

- Following the Japanese intervention in the FX space, the USD/JPY recovered some 3%.

- Near term, the USD/JPY might re-test the 145.00 area, despite increasing concerns of being the BoJ’s line in the sand, opening the door for another FX intervention,

The USD/JPY is recovering some ground after last week’s BoJ FX intervention that bolstered the Japanese yen from trading at around 145.00 price levels towards the 140.34 area. Nevertheless, USD/JPY traders are again lifting the spot price towards the 145.00 mark, as the USD/JPY trades at around 144.66, above its opening price at the time of writing.

USD/JPY Price Analysis: Technical outlook

The USD/JPY remains upward biased after dipping towards the 140.00 region. Worth noting that following the BoJ intervention in the markets, the Relative Strength Index (RSI) edged lower. However, at the time of typing, RSI crossed above its 7-day RSI SMA, suggesting that buyers are gathering momentum as the major hits the 144.00 thresholds.

Short term, the 4-hour scale portrays the USD/JPY strength, with the major clearing the R2 daily pivot at 144.52. Furthermore, after diving towards oversold conditions, oscillators, mainly the Relative Strength Index (RSI), are back in positive territory.

Suppose the USD/JPY clears the 144.99 area, that could pave the way for another FX intervention by Japanese authorities. If it does not, the next USD/JPY resistance would be the September 21 daily high at 145.39, followed by the R3 daily pivot at 145.63.

On the other hand, failure at 145.00 could send the major sliding towards the S1 daily pivot at 143.95. Break below will expose the confluence of the 20 and 50-EMAs around 143.34/36, followed by the daily pivot at 142.85.

USD/JPY Key Technical Levels

-

18:20

United States 2-Year Note Auction rose from previous 3.307% to 4.29%

-

17:48

GBP/USD back into negative territory after BoE statement

- Bank of England is monitoring developments in financial markets.

- Pound remains under pressure, still looking for support.

- GBP/USD back under 1.0700, heads for record low close.

The GBP/USD pair is at the lowest level since the European session following a statement from the Bank of England and also amid risk aversion. Cable is back into negative territory trading around 1.0660, down almost 200 pips from Friday’s close.

On Asian hours the pound suffered a historic drop to 1.0315, a record low and then rebounded 600 pips. The recovery lost momentum and GBP/USD is back under pressure.

The dramatic depreciation of the pound weighed on global market sentiment on Monday and also prompted a statement from the Bank of England. The central bank said it is monitoring development in financial markets very closely and welcomed government’s commitment to sustainable economic growth. The comments did not help the pound which lost momentum afterwards.

Equity markets also turned to the downside during the last hours also affecting the pound, that has become more sensitive to risk aversion. In Wall Street the Dow Jones is falling by 1.05% and the Nasdaq 0.43%.

Technical levels

-

17:29

AUD/USD tumbles to two-year lows below 0.6450 on risk-off impulse

- AUD/USD registers two-straight days of consecutive losses, down by 1,2% on Monday.

- Risk aversion sparked by central bank tightening and UK tax cuts shifted sentiment sour; consequently, the greenback is rising.

- Fed officials continue to emphasize that inflation is “too high.”

The AUD/USD is dropping almost 1%, due to a strong US Dollar, amidst flows seeking the safety of the greenback, which rises against most G8 currencies due to concerns that worldwide central banks tightening, could trigger a recession.

The AUD/USD began trading at around 0.6515 before hitting the day’s high at 0.6537. But as sentiment continued sour, the major fell toward a fresh two-year low at about 0.64426, breaking below the May 20, 2020 low of 0.6452. At the time of writing, the AUD/USD is trading at 0.6444 below its opening price.

AUD/USD stumble to fresh 2-year lows on a buoyant US dollar

Worldwide recession fears have augmented since the US Federal Reserve hiked rates by 75 bps last week. That said, alongside speculation that the UK’s economy keeps the Bank of England’s (BoE) under pressure, it sent the pound towards a fresh YTD low. At the same time, most G8 currencies followed suit, weakening against the already strong US dollar.

A light US economic calendar revealed the Chicago National Activity Index for August, which decelerated to 0. In the meantime, some Fed speakers are crossing news wires.

On Sunday, Atlanta’s Fed President Raphael Bostic commented that he believes the Fed can bring inflation without substantial losses in the labor market, given the current economic slowdown. He reassures that inflation s “too high,” adding that the US central bank needs to do all it can to control it.

Earlier, the Boston Fed’s President Sussan Collins said that the unemployment rate needs to get higher for the Fed to achieve its inflation objective. Collins added that she would like “clear and convincing signs” that inflation is cooling while saying that “a significant economic or geopolitical event could push our economy into a recession as policy tightens further.”

Analysts at Westpac lowered the AUD/USD exchange rate target from 0.6900 to 0.6500. “That means that over the remainder of 2022, there will be periods when the AUD will trade below the USD0.65 level given the high volatility in currency markets to date.”

AUD/USD Key Technical Levels

-

17:06

USD/MXN Price Analysis: More gains likely, first target 20.45

- USD/MXN is breaking a range to the upside, looking to more gains.

- Next target seen around 20.45 and then 20.70.

- Decline back below 20.20 should weaken the US dollar.

The USD/MXN is breaking above a range that held since mid-August. As long as the pair remains above 20.25 the outlook is bullish. The next target may be seen at 20.45 and above the next barrier emerges around 20.70. As of writing, it trades at fresh two-month highs at 20.37.

Basically, most technical indicators are pointing to the upside, offering bullish signs. RSI is up, not yet in overbought territory.

The bullish tone is strong. During the session, the pair pulled back many times to the 20.20/25 zone but held above. A consolidation below would alleviate the pressure and could even suggest a potential short-term top.

USD/MXN daily chart

-637998051229325067.png)

-

16:57

ECB's Nagel: Decisive ECB rate hikes are neede

European Central Bank (ECB) Governing Council member and German central bank head Joachim Nagel said on Monday that decisive rate hikes are needed amid rising risks of inflation expectations getting de-anchored.

"The risk that long-term expectations get de-anchored remains high," Nagel explained. "Further decisive action is required to bring the inflation rate down to 2% in the medium term."

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and it was last seen losing 0.7% on the day at 0.9625.

-

16:50

EUR/USD approaches 0.9600 lows as recovery loses momentum

- US Dollar is solid as markets fail to stage recovery.

- EUR/USD is hovering around 0.9620, far from the daily highs.

- Dollar overbought but not offering signs of a correction.

The EUR/USD is moving toward 0.9600 after the recovers from fresh multi-year lows faded. The euro could not hold above 0.9700 and started to decline as stocks in Wall Street printed fresh session lows.

Risk aversion prevails across financial markets supporting the dollar. In the US, the Dow Jones is down 0.61% and the S&P 500 declines by 0.40%. The Nasdaq is up 0.20%. Crude oil is erasing gains and metals are back into negative territory.

Economic data released in the US showed a decline in the Chicago Fed National Activity Index dropped more than expected to 0 from 0.08%. Earlier, IFO reported a decline in Sentiment Index in September.

The dollar remains firm across the board amid Fed rate hike expectations and risk aversion. The euro found some support from the rally in EUR/GBP that climbed to two-year highs.

Still looking to the downside

The recovery of the EUR/USD was short-lived and is approaching 0.9600. Below attention would turn to the cycle low at 0.9549. Despite oversold readings across charts, the negative momentum is solid with the pair still looking for support.

On the upside, if the euro consolidates above 0.9700 it could gain support from a more sustainable rebound in the very short term. The next strong resistance is seen at 0.9805.

Technical levels

-

16:34

BoE: Monitoring developments in financial markets very closely

In a statement published on Monday, the Bank of England (BoE) said that they are monitoring developments in financial markets very closely in light of the significant repricing of the financial assets.

The BoE further noted that they welcome the government’s commitment to sustainable economic growth and to the role of the Office for Budget Responsibility.

"The role of monetary policy is to ensure that demand does not get ahead of supply in a way that leads to more inflation over the medium term," the BoE said. "As the MPC has made clear, it will make a full assessment at its next scheduled meeting of the impact on demand and inflation from the government’s announcements, and the fall in sterling."

Market reaction

With the initial reaction, the GBP/USD pair fell sharply and was last seen trading at 1.0686, where it was down 1.5% on a daily basis.

-

16:29

Gold Price Forecast: XAU/USD falls for three straight days, below $1650

- Gold price edges down but above the YTD low in the Asian session, around $1626.40.

- Risk aversion keeps traders’ flows toward the greenback, weighing on the yellow metal.

- Gold Price Analysis: In the near term could test the $1650 mark.

The gold price and the precious metals continue to be battered by dismal market sentiment, with US equities extending their losses and rising US T-bond yields, now with 2s and 5s, above the 4% threshold, while the 10-year gains almost seven bps, a headwind for the non-yielding metal. At the time of writing, XAU/USD is trading at $1640 a troy ounce, below its opening price by 0.09%.

Sentiment remains depressed. Worldwide recession worries, spurred by Fed’s aggressive tightening, alongside stickier than estimated inflation readings, keeps investors assessing if the economy may tap into a recession or not. In the meantime, the greenback remains in the driver’s seat, as the US Dollar Index has shown rising 0.40%, sitting at 113.585.

Meanwhile, the gold price dropped and hit a fresh 2-year low during the Asian session at around $1626.40, but it recovered some ground, falling short of hitting a daily high at $1650. With the lack of US economic data, with just the Chicago National Activity Index for August dropping to the 0 levels, Fed speakers began crossing newswires.

Atlanta’s Fed President Raphael Bostic said that he still believes the Fed can tame inflation without substantial losses in the labor market, given the current economic slowdown. He reassures that inflation s “too high,” adding that the US central bank needs to do all it can to control it.

Of late, the new Boston Fed’s President Sussan Collins said that for the Fed to achieve its inflation target, the unemployment rate needs to get higher without causing a spike in layoffs. She added that she would like “clear and convincing signs” that inflation is falling. She said, “a significant economic or geopolitical event could push our economy into a recession as policy tightens further.”

What to watch

The US economic docket will feature Durable Good Orders, Building Permits, Consumer Confidence and New Home Sales on Tuesday. Also, more Fed speakers would cross wires, led by Regional Fed Presidents Logan, Mester, Evans, Bullard and Daly.

Gold Price Analysis (XAU/USD): Technical outlook

From a daily chart perspective, XAU/USD remains downward biased, even though RSI shifted to oversold conditions. Breaking below the bottom trendline of a descending wedge at $1650 exacerbated the fall towards new YTD lows. In the one-hour scale, XAU/USD made a base nearby the S1 daily pivot at $1630, bouncing toward the current spot price, reclaiming the 20-EMA. Therefore, a re-test of the $1650 is on the cards.

-

16:15

Fed's Collins: Quite likely inflation is near peaking

"It's quite likely inflation is near peaking, or has peaked already," Boston Fed President Susan Collins said on Monday, per Reuters.

Additional takeaways

"Fed's credibility is key part of why medium and longer-term inflation expectations remain well anchored."

"It's part of why we have to move expeditiously on rates, to maintain that credibility."

"My outlook is for much slower growth in 2022."

"We'll also have slower economic growth next year as well."

"That is part of what is needed to get inflation back down, as well as a modest increase in unemployment, but there are many uncertainties."

Market reaction

The US Dollar Index was last seen rising 0.42% on the day at 113.50 following these comments.

-

15:40

Fed's Collins: Waiting to bring inflation down will make it harder

Boston Fed President Susan Collins said on Monday that their priority is to bring inflation down and argued waiting to do that would only make it harder, as reported by Reuters.

"A softish landing is challenging but some aspects of the current economy favor it," Collins added but also acknowledged that there are risks on both sides.

Market reaction

These comments don't seem to be impacting the dollar's performance against its major rivals in a significant way. As of writing, the US Dollar Index was up 0.35% on the day at 113.43.

-

15:31

United States Dallas Fed Manufacturing Business Index registered at -17.2 above expectations (-17.7) in September

-

15:05

GBP/USD Price Analysis: Bearish flag pattern spotted on 1-hour chart, BoE statement expected

- GBP/USD recovers early lost ground to an all-time low, though lacks follow-through.

- Bulls struggle to find acceptance above the 38.2% Fibo. level of the monthly downfall.

- The formation of a bearish flag pattern also warrants some caution for bullish traders.

The GBP/USD pair builds on its solid intraday recovery move from an all-time low and hits a fresh daily peak, around the 1.0930 region during the early North American session. Spot prices, however, retreat a few pips from highs and now seem to have stabilised around the 1.0900 round figure.

Expectations that the Bank of England will step in to stall the recent free-fall in the British pound triggered the initial leg of an intraday short-covering move around the GBP/USD pair. The US dollar, on the other hand, surrenders its early gains to a fresh two-decade high and offers additional support to the major.

From a technical perspective, the GBP/USD pair is seen struggling to find acceptance above the 38.2% Fibonacci retracement level of the steep decline from the monthly peak touched on September 13. Furthermore, the intraday recovery has been along an ascending channel, which constitutes the formation of a bearish flag pattern.

Meanwhile, oscillators on the daily chart are still holding deep in the oversold territory and warrant some caution. This makes it prudent to wait for a convincing break below the ascending channel support, currently around the 1.0765-1.0770 region, before positioning for the resumption of the recent depreciating move.

On the flip side, the 1.0900 mark now seems to act as an immediate hurdle ahead of the daily swing high, around the 1.0930 region. Any further recovery is likely to confront stiff resistance near the top end of the ascending channel, currently around the 1.0975 zone. This is followed by the 1.1000 mark, which if cleared decisively will suggest that the GBP/USD pair has formed a near-term bottom.

GBP/USD 1-hour chart

-637997976284296913.png)

Key levels to watch

-

15:05

Fed's Collins: Getting inflation down will require slower employment growth

"Getting inflation down will require slower employment growth, somewhat higher unemployment rate," Boston Fed President Susan Collins said on Monda, as reported by Reuters.

Additional takeaways

"Goal of a more modest economic slowdown is challenging but achievable."

"Important to see clear and convincing signs inflation is falling."

"My policy decisions will be guided by range of incoming data."

"Committed to getting inflation back down to 2%."

"Harder to bring down inflation if higher inflation expectations become entrenched."

"Price stability a precondition to achieving sustainable maximum employment."

"Inflation remains too high."

"US labor market is very hot."

"Some of the global supply chain issues are beginning to fade."

"There is uncertainty on when Ukraine war will end, pandemic inflation effects will fully abate."

"Demand clearly exceeds economy's productive capacity right now."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen clinging to modest daily gains at 113.35.

-

14:56

Lagarde speech: Will decide if more action is needed once we reach neutral

Christine Lagarde, President of the European Central Bank (ECB), said on Monday that they will decide whether further policy action is needed once they reach the neutral rate, as reported by Reuters.

"We may have to take further measures if inflation is not at the target when rates reach neutral," Lagarde explained.

Market reaction

These comments don't seem to be having a significant impact on the shared currency's market valuation. As of writing, EUR/USD was trading at 0.9675, where it was down 0.2% on a daily basis.

-

14:51

USD/TRY looks firm and prints fresh tops around 18.4500

- USD/TRY adds to Friday’s advance and clinches new record highs.

- The dollar remains well bid amidst the Fed’s tightening bias.

- Türkiye’s Capacity Utilization improved a tad in the current month.

The Turkish lira unsurprisingly extended its march southwards and pushed USD/TRY to fresh all-time tops around 14.85 at the beginning of the week.

USD/TRY: Next on the upside comes 18.5000

USD/TRY trades with gains for the second session in a row on Monday and saw its upside reinvigorated following another bout of solid demand for the greenback, which continue to hurt the risk complex and the EM FX galaxy.

Indeed, it has been all about the greenback since the Federal Reserve raised rates last week and Powell reinforced the hawkish rhetoric, all supportive of a tighter-for-longer stance from the central bank.

Data wise In Türkiye, Capacity Utilization improved to 77.4% in September (from 76.7%) and the Manufacturing Confidence receded to 99 (from 102.1) in the same period.

What to look for around TRY

USD/TRY picked up extra pace following another unexpected interest rate cut by the CBRT, while the persevering rally in the dollar also helped the pair to print record highs almost on a daily basis.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: Capacity Utilization, Manufacturing Confidence (Monday)- Economic Confidence Index (Thursday) – Trade Balance (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.20% at 18.4407 and faces the next hurdle at 18.4583 (all-time high September 26) followed by 19.00 (round level). On the downside, a break below 17.9798 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low

-

14:17

USD/CAD eases from over two-year peak, bullish potential remains intact

- USD/CAD retreats a few pips from its highest level since June 2020 touched earlier this Monday.

- The USD surrenders its intraday gains to a two-decade high and acts as a headwind for the pair.

- Aggressive Fed rate hike bets, rising US bond yields should limit any meaningful USD pullback.

- Bearish crude oil prices could undermine the loonie and supports prospects for additional gains.

The USD/CAD pair attracts some sellers in the vicinity of the 1.3700 mark and retreats a few pips from its highest level since June 2020 touched during the early North American session. The pair is now trading around the 1.3635-1.3630 region, still up over 0.30% for the day.

The US dollar surrenders a major part of its intraday gains to a two-decade high and turns out to be a key factor acting as a headwind for the USD/CAD pair. The USD pullback could be solely attributed to some profit-taking amid a solid recovery in the British pound and extremely overbought conditions.

That said, growing acceptance that the Fed will tighten its monetary policy at a faster pace should limit the USD corrective pullback. It is worth recalling that the Fed signalled last week that it will likely undertake more aggressive increases at its upcoming meetings to tame inflation.

The Fed's hawkish outlook pushes the yield on the rate-sensitive 2-year US government bond to a 15-year peak and the benchmark 10-year Treasury note to its highest level in 11 years. This, along with the prevalent risk-off environment, should continue to boost demand for the safe-haven greenback.

Apart from this, the underlying bearish sentiment surrounding crude oil prices, amid fears that a deeper global economic downturn will dent fuel demand, is seen undermining the commodity-linked loonie. This, in turn, supports prospects for a further near-term appreciating move for the USD/CAD pair.

In the absence of any major market-moving economic releases, either from the US or Canada, traders on Monday will take cues from speeches by influential FOMC members. This, along with the US bond yields and the broader risk sentiment, will influence the USD and provide impetus to the USD/CAD pair.

Technical levels to watch

-

14:10

Lagarde speech: Depreciation of euro adds to buildup of inflationary pressures

Christine Lagarde, President of the European Central Bank (ECB), said on Monday that they expect the economic activity in the eurozone to slow substantially in the coming quarters, as reported by Reuters.

Additional takeaways

"As of the first quarter of 2023, we will start publishing climate-related information on our corporate bond holdings."

"The depreciation of the euro has also added to the build-up of inflationary pressures."

"The best contribution monetary policy can make to the euro area economy is to ensure price stability over the medium term."

"Signs of recent above-target revisions to some indicators of inflation expectations warrant continued monitoring."

"The risks to the inflation outlook are primarily on the upside."

"We expect to raise interest rates further over the next several meetings."

"The strong demand for services that came with the reopening of the economy is losing steam."

Market reaction

These comments were largely ignored by market participants and the EUR/USD pair was last seen losing 0.25% on the day at 0.9670.

-

14:00

Belgium Leading Indicator dipped from previous -5.8 to -11.8 in September

-

13:55

EU members plan to delay Russian oil cap – Bloomberg

Citing sources familiar with the matter, Bloomberg reported on Monday that the European Union could delay enforcing a price cap on Russian oil imports due to divisions within member states.

Market reaction

This headline doesn't seem to be having a significant impact on crude oil prices. As of writing, the barrel of West Texas Intermediate (WTI), which touched its lowest level since January near $77, was trading at $78.85, where it was down 0.55% on a daily basis. Meanwhile, the barrel of Brent was last seen losing 0.6% on the day at $86.25.

-

13:40

USD/IDR: Room for a probable visit to 15,150 – UOB

FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research notes USD/IDR could extend the advance to the 15,150 hurdle in the short-term horizon.

Key Quotes

“We expected USD/IDR to advance last week. We held the view that ‘the July’s peak of 15,033 is likely out of reach for now’. The anticipated advance exceeded our expectations as USD/IDR rose to 14,042 last Friday.”

“USD/IDR jumped higher upon opening today and appears to be on track for further gains. The next resistance is at 15,150 followed by 15,200. Support is at 15,050 followed by 15,000.”

-

13:37

Winter is coming for the EUR – Nordea

According to Dane Cekov, Senior Macro & FX Strategist at Nordea Markets, a break below the 0.9500 mark for the EUR/USD pair will open the room for a move down to as low as 0.9000 mar.

Key Quotes:

“Europe has lately been the epicentre of a perfect storm in energy markets. The energy price shock has and will continue to impact the industrial sector, leading to a negative terms-of-trade shock for the Euro Zone. Goods that were previously produced in Europe will now have to be imported from countries elsewhere where energy prices have not risen as much as in Europe. Worsening terms of trade argue for a weaker Euro ahead.”

“It is extremely difficult for Europe and Germany in particular to diversify its gas supply quickly in the short-term. More LNG will come, but it will be costlier than the Russian gas Germany has been accustomed to and it will take time before the infrastructure is in place for significant volumes. More rainfall ahead will help European hydropower production – we need the weather gods to be benevolent with Europe with a wetter and warmer winter. Moreover, France needs to get its atomic power reactors back on track, this will also take time but should be resolved during next year. Some of the factors behind the energy crises should improve in the coming period, but the winter heating season is nearly upon Europe and the risks for energy rationing are hanging over Europe’s head.”

“Political fragmentation in Europe has increased with far-from-the-centre political parties winning elections – look at Italy and Sweden. The Euro is a political project and if EU’s politicians suddenly don’t get along, then we could see the Euro’s existence brought into question – similar to the case during the 2010 Euro crisis.”

-

13:36

US: Chicago Fed National Activity Index drops to 0 in August vs. 0.08 expected

- Chicago Fed National Activity Index declined to 0 in August.

- US Dollar Index trades in positive territory near 113.50.

The Federal Reserve Bank of Chicago's National Activity Index (CFNAI) declined to 0 in August from 0.29 in July. This reading came in weaker than the market expectation of 0.08.

According to the Chicago Fed, a zero value for the CFNAI is associated with the national economy expanding at its historical trend (average) rate of growth.

Market reaction

This data doesn't seem to be having a significant impact on the dollar's performance against its major rivals. As of writing, the US Dollar Index was up 0.45% on the day at 113.55.

-

13:31

Brazil Current Account: $-4.136B (May) vs previous $-3.506B

-

13:30

United States Chicago Fed National Activity Index came in at 0 below forecasts (0.08) in August

-

13:23

USD/JPY sticks to gains above 144.00 mark, bulls still seem to have the upper hand

- USD/JPY gains traction for the second straight day and seems poised to climb further.

- The Fed-BoJ policy divergence weighs on the JPY and continues to act as a tailwind.

- Sustained USD buying remains supportive of the move and reaffirms the positive bias.

The USD/JPY pair attracts some buying for the second successive day on Monday and maintains its bid tone through the mid-European session. The pair is currently hovering near the top end of its daily trading range, around the 144.20 region, up over 0.60% for the day.

The yen did get a strong boost last week after the Japanese government intervened to stem the rapid fall in the domestic currency. The initial market reaction, however, turned out to be short-lived amid a big divergence in the monetary policy stance adopted by the Bank of Japan and other major central banks. In fact, the BoJ has reaffirmed its commitment to ultra-low interest rates and vowed to keep purchasing bonds so that 10-year yields remain pinned at zero.

In contrast, the Federal Reserve signalled that it will likely undertake more aggressive rate increases at its upcoming meetings to combat stubbornly high inflation. This remains supportive of elevated US Treasury bond yields, widening the US-Japan rate differential and weighing on the JPY. Meanwhile, a more hawkish stance adopted by the US central bank continues to underpin the US dollar, which is seen as another factor pushing the USD/JPY pair higher on Monday.

That said, the prevalent risk-off environment offers some support to the safe-haven JPY and keeps a lid on any meaningful upside for the major, at least for the time being. Nevertheless, the fundamental backdrop seems tilted in favour of bullish traders and suggests that the path of least resistance for the USD/JPY pair is to the upside. Hence, some follow-through strength, back towards reclaiming the 145.00 psychological mark, remains a distinct possibility.

There isn't any major market-moving economic data due for release from the US on Monday. Traders, meanwhile, will take cues from speeches by influential FOMC members Boston Fed President Susan Collins, Atlanta Fed President Raphael Bostic and Dallas Fed President Lorie Logan. This, along with the US bond yields, will influence the USD. Apart from this, the broader market risk sentiment might produce short-term trading opportunities around the USD/JPY pair.

Technical levels to watch

-

12:47

The dollar remains firm as the new week begins – BBH

Economists at Brown Brothers Harriman & Co. (BBH) maintain a bullish outlook for the US dollar amid the prevalent risk-off environment and last week's hawkish FOMC decision.

Key Quotes:

“Markets were already nervous last week as major central banks tightened aggressively but the huge fiscal policy mistake from the U.K. added further fuel to the fire. MSCI World tumbled -5% in its worst week since mid-June and is adding to those losses today. With global growth also slowing significantly, the backdrop for risk assets remains challenging. We expect the dollar to continue strengthening in this environment even as Fed tightening expectations remain elevated.”

“WIRP suggests another 75 bp hike is almost fully priced in for November 2, as is a follow-up 50 bp hike December 14. Elsewhere, the swaps market is pricing in a terminal rate of 4.75%. As a result, U.S. rates continue to rise. The 2-year yield traded near 4.35% today, the highest since 2007, while the 10-year yield traded near 3.82% Friday, the highest since 2010. The real 10-year yield traded near 1.40% today, the highest since 2010. This generalized increase in U.S. yields is likely to continue and will ultimately support the dollar. Of note, the 3-month to 10-year curve remains positively sloped near 61 bp, the steepest since July, and so we are not yet ready to call for an imminent recession in the U.S.”

-

12:26

Looking for Fed terminal rate at 4.75%-5% – TDS

Economists at TD Securities note that the Fed's September meeting provided an even more hawkish policy message than markets were already anticipating.

Attention will be on PCE report for August

"As a result, we're now looking for additional rate hikes in Q1 2023 and, therefore, a higher terminal rate at 4.75%-5.00%."

"Following last week's FOMC meeting and the corresponding blackout period for communications, a number of Fed officials are slated to provide remarks throughout the week, which are likely to build upon the discussions held last week.

"In terms of the data, most of the attention will be on the PCE report for August. We are looking for core PCE prices to have gained speed again following a strong CPI report where core inflation surprised significantly to the upside at 0.6% m/m in August."

-

12:18

UK PM Spokesman: No plans to change measures set out in mini-budget

When asked whether the government is planning to change the measures set out in the mini-budget, British Prime Minister Lis Truss' spokesman responded by simply saying "no," as reported by Reuters.

Additional takeaways

"Finance minister has made it clear we don’t comment on market movements."

"Finance minister will come forward with a medium-term fiscal plan in coming months."

"Finance minister speaks regularly to the Governor of Bank of England (BoE), do not know when their next conversation will be."

"We have seen positive reaction from business groups to the fiscal statement."

"Inflation is something we are very conscious of, it is right we consider how best to control inflation."

"Important BoE independence remains, we don’t comment on interest rates."

Market reaction

Following these comments, the GBP/USD pair was last seen trading at 1.0740, where it was down 1% on a daily basis.

-

11:52

USD/MYR: Next resistance comes at 4.62 – UOB

Extra upside could lift USD/MYR to the 4.62 level in the near term, according to FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“While we expected USD/MYR to strengthen last week, we were of the view that ‘overbought short-term conditions could ‘limit’ gains to 4.5550’. We underestimated the upward momentum as USD/MYR easily took out 4.5550.”

“USD/MYR extended its sharp rise today and in view of the rapid upward acceleration, a break of 4.6000 would not be surprising. The next resistance is at 4.6200, followed by 4.6500. On the downside, the rising trend-line support at 4.5700 is likely strong enough to hold any pullback.”

-

11:48

EUR/USD Price Analysis: Scope for further losses near term

- EUR/USD bounces off fresh cycle lows near 0.9550.

- Extra downside could revisit the 0.9411 level near term.

EUR/USD keeps the bearish note well in place and drops to new 2-decade lows near 0.9550, where some initial contention seems to have emerged.

Rising prospects for extra weakness in the European currency remain well on the table for the time being. That said, the loss of the 2022 low at 0.9552 (September 26) should leave the pair vulnerable to a challenge to the round level at 0.9500 prior to the weekly low at 0.9411 (June 17 2002).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0685.

EUR/USD daily chart

-

11:38

USD/THB: All the attention is now on 38.00 – UOB

FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research suggests USD/THB could retest and surpass the 38.00 barrier in the near term.

Key Quotes

“Last Monday (19 Sep, spot at 36.25), we highlighted that USD/THB ‘could consolidate for a few days before heading higher to 37.20’. USD/THB rose above on 37.20 on Wednesday and continued to rise and today in Asia, it took out another strong resistance at 37.80.”

“The impulsive momentum suggests USD/THB is likely to rally further. A break of 38.00 seems likely and will shift the focus to 38.25. On the downside, 37.35 is a solid support and this level is unlikely to come under threat this week.”

-

11:35

US Dollar Index Price Analysis: Further upside now targets 115.00

- DXY surpasses the 114.00 mark and prints new cycle peaks.

- Immediately to the upside now comes the 115.00 hurdle.

DXY adds to the ongoing rally and climbs above the 114.00 barrier for the first time since May 2002.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 106.80. That said, occasional bouts of weakness could be deemed as buying opportunities with the immediate target now emerging at the round level at 115.00 ahead of the May 2002 high at 115.32.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.12.

DXY daily chart

-

11:23

Sterling’s anti-safe-haven status reaffirmed – SocGen

Kit Juckes, Macro Strategist at Societe Generale, explains key aspects behind the GBP/USD pair's recent slump to an all-time low. The sterling has recorded its biggest monthly fall since the Brexit referendum result in 2016 and according to Kit, the major might struggle to stage a meaningful recovery until the US dollar rally runs out of steam.

Key Quotes:

“There is both a domestic and an international aspect to sterling’s weakness. The international backdrop is a combination of global inflationary pressures and US economic out-performance that supports the dollar as rates rise everywhere. The energy crisis, the US’ terms of trade advantage, Europe’s vulnerability to the war in Ukraine, all add to that. US rates are rising as the market reprices peak Fed Funds higher, and equities are being repriced lower. This has all the hallmarks of the start of the final stage of the dollar’s rally (a stage which has the capacity to be violent and volatile). “

“On the domestic front, the UK has a worse growth/inflation trade-off than most of its competitors, and a policy mix of fiscal profligacy and tight money, that is hurting confidence and encouraging dollar bulls to use sterling as the short side of a dollar long. I can’t remember the last time Far Eastern investors were so keen in discussing the UK economy and assets.”

“GBP/USD will struggle to stage a meaningful recovery until the dollar rally runs out of steam. I didn’t think we would go below GBP/USD 1.10, but sterling’s capacity for overshoot is well understood. The divergence between the Gilt/Treasury spread and GBP/USD (below) is even more dramatic now than it was in March 2020. That time, the Fed came to the rescue (for sterling and other currencies), but I’m not holding out any hope of easier Fed policy, and not much of any co-ordinated policy move to stop the dollar’s rise.”

-

11:20

Malaysia: Inflation could have peaked in August – UOB

Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group comment on the latest inflation figures in Malaysia.

Key Takeaways

“Consumer price index (CPI) increased for the fifth consecutive month by 4.7% y/y in Aug (Jul: +4.4%), coming in a tad lower than our estimate (4.8%) but matching Bloomberg consensus. It also marked the highest reading since Apr 2021, continuously lifted by costlier food & beverages, housing, utilities & other fuels, household equipment & appliances, recreation services & culture, and restaurants & hotels amid base effects.”

“We think that inflation may have peaked in this reporting month as the impact of price adjustments for various price-administered items and minimum wage hikes could have been fully reflected since May. However, the base effects will likely keep CPI growth above 4.0% for the rest of the year before decelerating towards the 2% level in 2023. This will bring full-year inflation to an average of 3.5% for 2022 (BNM est: 2.2%-3.2%, 2021: 2.5%) and 2.8% for 2023, barring any changes in domestic policy particularly the existing blanket fuel subsidies, electricity tariffs, and ceiling prices for staple food.”

“Notwithstanding forceful responses by most central banks to rein in inflation, we believe that BNM will tread more cautiously while monitoring the effects of cumulative 75bps rate hikes so far this year on the economy and inflation before deciding on the next move. Measures announced in the coming Budget 2023 particularly on subsidies could also steer the rate decision at the next monetary policy meeting on 2-3 Nov. We keep our view for BNM to hold policy rates at 2.50% for the rest of the year before resuming its rate hikes to 3.00% by mid-2023 should growth conditions hold up.”

-

11:16

EUR/JPY Price Analysis: Door open to a test of the 200-day SMA

- EUR/JPY manages to reverse an earlier steep drop to 137.30.

- Chances of a potential test of the 200-day SMA look on the rise.

EUR/JPY now regains ground lost and flirts with the positive territory following the strong pullback to the 137.30 region during early trade.

The continuation of the downtrend appears likely in the very near term, particularly against the backdrop of a weaker euro and the prospects for further FX intervention by the BoJ/MoF.

That said, a deeper pullback to the 200-day SMA, today at 135.61, should not be ruled out yet.

EUR/JPY daily chart

-

11:08

BoE delivered a divided 50 bps rate hike – UOB

Economist at UOB Group Lee Sue Ann reviews the latest interest rate decision by the BoE.

Key Takeaways

“The Bank of England (BOE)’s Monetary Policy Committee (MPC), at its meeting in Sep, voted by a majority of 8-1 to increase the Bank Rate by 50bps to 2.25%, its seventh consecutive policy meeting since Dec that it has raised its key interest rate. Once again, the BOE warned that ‘policy is not on a pre-set path’, though it will act forcefully in response to persistent inflationary pressures. Notably, this is the first time since the great financial crisis, a three-way split was seen.”

“But with some more hawkish MPC members citing worries about rising short and medium term inflation expectations, we are now expecting the BOE to increase rates to 3.25% by year-end (50bps hikes at the Nov and Dec meetings), before taking its foot off the brakes in this current hiking cycle.”

“While financial markets are pricing a Bank Rate of close to 5% next year, we think that market expectations of rate hikes are overdone, and the latest split outcome within the MPC reinforces our view those expectations are unlikely to be met. We will, nonetheless, continue to monitor developments. The next monetary policy meeting is on 3 Nov.”

-

11:03

GBP/USD recovers further from all-time low and climbs to 1.0700, not out of the woods yet

- GBP/USD stages a goodish intraday bounce from an all-time low touched earlier this Monday.

- Speculations for BoE intervention offer support to sterling and prompt intraday short-covering.

- A modest USD profit-taking slide from a fresh two-decade high contributes to the momentum.

- A combination of factors should keep a lid on any meaningful upside for the pair, at least for now.

The GBP/USD pair manages to recover a major part of its early lost ground to an all-time low and moves back to the 1.0700 mark during the first half of the European session. The attempted recovery, however, lacks follow-through buying and runs the risk of fizzling out rather quickly.

Speculations that the Bank of England will have to step in to stabilise the domestic currency helped the British pound to stall its free-fall following the new UK government's mini-budget on Friday. This, in turn, is leadsing to an intraday US dollar profit-taking slide from a fresh two-decade high, which further contributes to the GBP/USD pair's intraday recovery of over 400 pips from the 1.0330 area.

That said, a more hawkish stance adopted by the Fed, along with a further rise in the US Treasury bond yields and the prevalent risk-off mood, should help limit any meaningful USD corrective slide. In fact, the Fed last week delivered another supersized rate hike and signalled that it will likely undertake more aggressive increases at its upcoming meetings to combat stubbornly high inflation.

This, in turn, pushes the yield on the rate-sensitive 2-year US government bond to a 15-year peak and the benchmark 10-year Treasury note to its highest level in 11 years. Meanwhile, the rapidly rising borrowing costs, along with the risk of a further escalation in the Russia-Ukraine conflict, have been fueling concerns about a deeper global economic downturn and weighing on investors' sentiment.

The anti-risk flow is evident from a generally weaker tone around the equity markets, which could lend some support to the safe-haven greenback. Furthermore, the lack of confidence in the government’s ability to manage the ballooning debt might continue to act as a headwind for sterling. This, in turn, should keep a lid on any meaningful upside for the GBP/USD pair, at least for now.

Technical levels to watch

-

10:32

RBNZ terminal OCR forecast revised higher to 4.5% from 4% – TDS

TD Securities economists announced that they have lifted the Reserve Bank of New Zealand's terminal OCR forecast to 4.5% from 4% previously.

We don't expect RBNZ rate cuts in 2023

"Offshore developments have not influenced our terminal OCR upgrade."

Activity has not taken a hit despite the rapid round of rate hikes, while financial conditions overall have probably eased. If the RBNZ is to get on top of inflation it needs wages growth to slow. A 4% terminal cash rate is unlikely to do the job.