Notícias do Mercado

-

20:00

Dow +43.02 16,315.67 +0.26% Nasdaq -20.86 4,298.07 -0.48% S&P +2.54 1,856.83 +0.14%

-

19:20

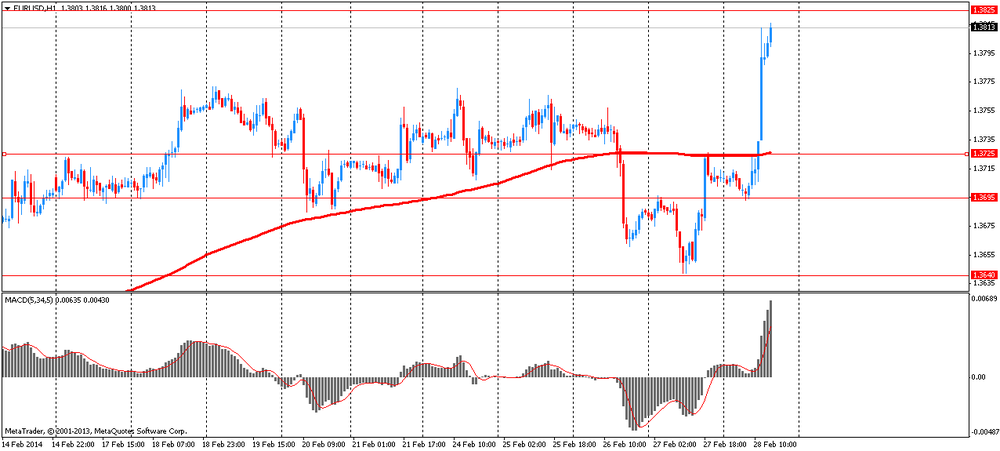

American focus : the euro rose against the dollar significantly

The euro exchange rate rose sharply against the dollar , which was mainly due to the release of data on the euro area. Eurozone inflation was 0.8 percent for the third month in a row in February , showed preliminary estimate of Eurostat , published on Friday . Inflation is projected to slow down to was 0.7 percent. Inflation has remained below the target of the European Central Bank " below but close to 2 percent," the thirteenth consecutive month and is in the four-year low .

The unemployment rate in the euro area remained at 12 per cent from October , showed on Friday Eurostat data . Result is consistent with economists' expectations . In January, 19.17 million people were unemployed in the euro area . The number of people unemployed increased by 17,000 in December , while it fell by 67,000 in January 2013.

Also support euro was U.S. data from the National Association of Realtors (NAR), which showed that at the end of January, the number of pending home sales remained virtually unchanged . The report NAR said that the index of pending home sales rose last month by 0.1 percent - to 95.0 points , after falling 5.8 percent in December - to 94.9 points, which was revised to improve on - 8.7 percent . Economists had expected the index to rise more significantly , namely by 2.9 percent . Recall that open trade - a signed contract , but not yet closed . Usually takes four to six weeks to close a contract for the sale . Despite the modest monthly increase in the index of pending sales are now 9.0 percent below the January 2013 index ( at 104.4 points).

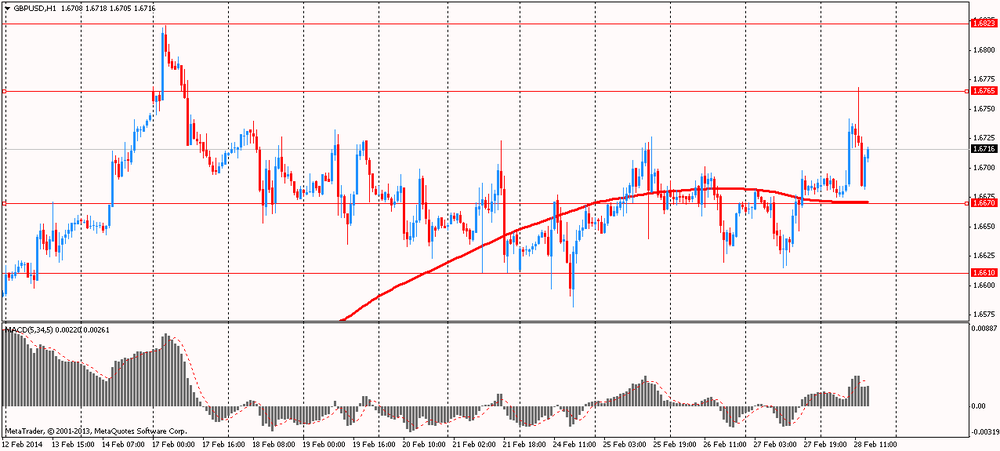

Pound rose against the dollar on housing data and potrebdoveriyu . UK consumer confidence remained unchanged in February at the highest level in more than six years , as personal financial expectations improved by expanding the background of economic recovery. The consumer confidence index remained unchanged at -7 in February , the highest level since September 2007 . Result noted significant improvement since last February , when the index reached -26 . The survey showed that two of the five indicators used to calculate the index , fell this month , the two sub-indices increased , and one remained unchanged.

Housing prices in the UK rose significantly more rapidly in February , with more than economists forecast . The housing price index rose by 9.4 per cent per annum, after increasing 8.8 percent in January. Economists had expected growth in February at 9 percent. Prices rose twelfth consecutive month. The rise in prices reflects an increase in demand for new homes , supported by record low interest rates , improving access to credit and rising consumer confidence . House prices in the UK averaged 177,846 pounds in February , which is higher than 176,491 pounds a month earlier .

-

18:20

European stock close

European stocks were little changed, with equities posting their biggest monthly gain since July, as Ukraine accused Russia of stoking tension on its territory and data showed U.S. fourth-quarter economic growth slowed more than estimated.

The Stoxx Europe 600 Index gained 0.1 percent to 337.55. The benchmark gauge rallied 4.7 percent in February as Federal Reserve Chair Janet Yellen pledged to follow her predecessor Ben S. Bernanke’s policy on economic stimulus. She told Congress any reduction in bond buying will be made in measured steps, based on economic data. The Fed has cut the size of the monthly purchases to $65 billion from $85 billion.

Lawmakers in Kiev approved Turchynov’s call for a session by the United Nations Security Council even as armed troops occupied Crimea’s main airport in Simferopol. The Russian involvement has fueled speculation of a partition of Ukraine between Russian-speaking and Ukrainian-speaking regions. Prime Minister Arseniy Yatsenyuk warned parliament of the growing threat of an economic collapse.

Crimea is the latest flash point in a violent conflict since November that led to the departure of Viktor Yanukovych as Ukraine’s president. At the core of the unrest is Ukraine’s future itself. Yanukovych chose ties with Russia, abandoning a closer association with the European Union that his detractors, who now run the interim government, favor.

The U.S. economy expanded at a slower pace in the fourth quarter than previously estimated. Gross domestic product grew at a 2.4 percent annualized rate from October through December, compared with the 3.2 percent gain estimated last month, revised figures from the Commerce Department showed. The median forecast called for a 2.5 percent increase.

A report from the National Association of Realtors at 10 a.m. New York time may show that contracts to buy previously owned homes rose in January for the first time in eight months. A gauge of pending house sales increased 1.8 percent last month, after dropping in December by the most since May 2010.

National benchmark indexes gained in 13 of the 18 western-European markets.

FTSE 100 6,809.7 -0.57 -0.01% CAC 40 4,408.08 +11.69 +0.27% DAX 9,692.08 +103.75 +1.08%

Erste Group Bank dropped 10 percent to 25.71 euros. Austria’s biggest bank make provisions for bad loans and said it expects operating profit to miss estimates this year.

Pearson fell 6 percent to 1,012 pence, its lowest price since January 2011. Adjusted operating profit fell 21 percent to 736 million pounds ($1.23 billion) in 2013. Sales rose 2.3 percent to 5.18 billion pounds, missing the 5.8 billion-pound estimate by analysts.

Bankia SA, the lender whose losses forced Spain to take a European bailout, retreated 4.3 percent to 1.51 euros. Spain sold 7.5 percent of Bankia to start recovering 22.4 billion euros ($30.7 billion) provided to recapitalize the bank.

Andritz AG added 5.7 percent to 45.42 euros. The world’s second-biggest maker of hydro-power turbines reported a loss for the fourth quarter of 12.2 million euros, narrower than the 19.8 million-euro loss projected by analysts.

-

17:00

European stock close: FTSE 100 6,809.7 -0.57 -0.01% CAC 40 4,408.08 +11.69 +0.27% DAX 9,692.08 +103.75 +1.08%

-

16:40

Oil: an overview of the market situation

Oil prices rose slightly , restoring previously lost ground. Slight pressure on the prices have U.S. data , which were worse than expected .

According to the report , the gross domestic product , the broadest measure of goods and services produced in the economy , rose to a seasonally adjusted annual rate of 2.4% in the last quarter of the year, compared with the initial estimate of 3.2%. About this Ministry of Commerce said on Friday . Economists had forecast a 2.6% increase .

U.S. economy grew in the third quarter of this year by 4.1 % , and the initial estimates for the fourth quarter increased hopes for higher growth , more rapid creation of new jobs and higher wages in 2014

However, pressure also had concerns about the upcoming spring season closing refinery maintenance : investors expect a reduction in oil demand in the U.S., which is the largest consumer of fuel in the world .

Meanwhile , we add that the fall in oil prices restrain currency market trends : euro on Friday rose to the maximum from the beginning of the year against the dollar . Commodities, the prices of many of which are expressed in U.S. dollars, usually rise in price after the weakening of the U.S. currency

"Oil does not respond as other markets risky assets due to winter and geopolitical issues in the Middle East . With the weather improved attractiveness of the market decline and the economic slowdown in China will only aggravate it . Prices should not be at this level " , - believes CEO of research firm Barratt's Bulletin in Sydney Jonathan Barrett .

April futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 102.55 per barrel on the New York Mercantile Exchange (NYMEX).

April futures price for North Sea Brent crude oil mixture rose 17 cents to $ 108.95 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices fell slightly , dropping below $ 1330 per ounce , but are on the way to its biggest monthly gain in seven months as persistent concerns over a slowdown in U.S. economic growth put pressure on the dollar.

Gold rose nearly 7 percent in February - the biggest increase since July , mainly due to weak data on the U.S. and China , and political and economic instability in Ukraine, which has raised the demand for the metal as a hedge against risk.

"In general , whether in Ukraine , economic data on the U.S. or concerns about China is likely there are many more reasons than it was six weeks ago , looking for gold ," said Nomura analyst Tyler Wade .

The dollar fell 0.5 percent against a basket of major currencies, mainly due to the strength of the euro after data on inflation in the euro area , which was higher than expected , easing pressure on the European Central Bank to ease monetary policy next week.

Gold also influenced the U.S. data . As it became known , the U.S. economy expanded at a slower pace than originally anticipated in late 2013 , becoming a sign of slowing growth against bad weather and weak foreign demand for American products .

Gross domestic product , the broadest measure of goods and services produced in the economy , rose to a seasonally adjusted annual rate of 2.4% in the last quarter of the year, compared with the initial estimate of 3.2%. About this Ministry of Commerce said on Friday . Economists had forecast a 2.6% increase .

U.S. economy grew in the third quarter of this year by 4.1 % , and the initial estimates for the fourth quarter increased hopes for higher growth , more rapid creation of new jobs and higher wages in 2014.

Instead, the economy seems to be back to its post-crisis path when overall growth remains stubbornly close to 2 %. Meanwhile, other recent indicators of consumer spending , job creation , industrial production and housing market began warning signs . While severe winter conditions may have exerted pressure and kept active , weak figures expressed concern about the strength of the economy at the beginning of the year.

Meanwhile, it became known that the situation in the physical market in Singapore has remained stable . Premiums for gold bars in Hong Kong fell to $ 1 per ounce from $ 1.70 last week, reflecting a drop in demand from China .

The cost of the April gold futures on the COMEX today dropped to $ 1325.60 per ounce.

-

15:00

U.S.: Pending Home Sales (MoM) , January +0.1% (forecast +2.9%)

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, February 81.6 (forecast 81.4)

-

14:45

U.S.: Chicago Purchasing Managers' Index , February 59.8 (forecast 57.9)

-

14:37

U.S. Stocks open: Dow 16,283.85 +11.20 +0.07%, Nasdaq 4,323.13 +4.20 +0.10%, S&P 1,855.29 +1.00 +0.05%

-

14:24

Before the bell: S&P futures -0.10%, Nasdaq futures -0.07%

U.S. stock futures fell as data showed the world’s largest economy expanded at a slower pace in the fourth quarter than previously estimated.Global markets:

Nikkei 14,841.07 -82.04 -0.55%

Hang Seng 22,836.96 +8.78 +0.04%

Shanghai Composite 2,056.3 +8.95 +0.44%

FTSE 6,810.55 +0.28 0.00%

CAC 4,391.4 -4.99 -0.11%

DAX 9,619.68 +31.35 +0.33%

Crude oil: $101.9 (-0.47%)

Gold: $1331.60 (-0.02%).

-

13:46

Option expiries for today's 1400GMT cut

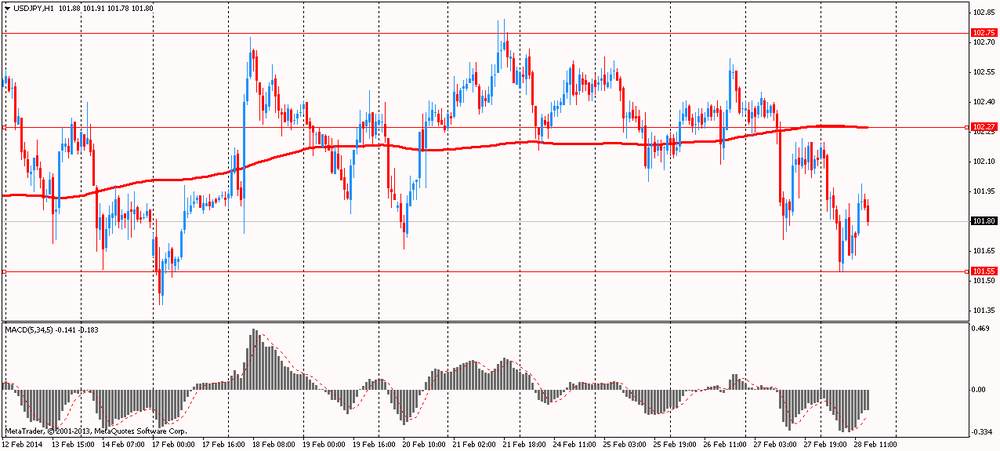

USD/JPY Y101.00, Y101.50, Y101.80, Y102.00, Y102.60, Y102.80, Y103.00, Y103.60

EUR/USD $1.3580/85, $1.3620, $1.3650, $1.3705-10-15, $1.3735, $1.3790, $1.3800

GBP/USD $1.6550, $1.6600, $1.6635, $1.6650, $1.6800,1.6820

EUR/GBP stg0.8150, stg0.8250

AUD/USD $0.8700, $0.8750, $0.8800, $0.8940, $0.8950, $0.9000, $0.9050, $0.9110

USD/CAD C$1.0900, C$1.1085, C$1.1100, C$1.1200

-

13:31

U.S.: PCE price index, q/q, Quarter IV +1.6% (forecast +2.9%)

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter IV +1.3%

-

13:31

Canada: GDP (m/m) , December -0.5% (forecast -0.2%)

-

13:30

U.S.: GDP, q/q, Quarter IV +2.4% (forecast +2.6%)

-

13:16

European session: the euro rose

07:00 United Kingdom Nationwide house price index February +0.7% +0.6% +0.6%

07:00 United Kingdom Nationwide house price index, y/y February +8.8% +9.0% +9.4%

07:00 Germany Retail sales, real adjusted January -2.5% +1.2% +2.5%

07:00 Germany Retail sales, real unadjusted, y/y January -2.4% +0.1% +0.9%

07:45 France Consumer spending January -0.1% -0.8% -2.1%

07:45 France Consumer spending, y/y January +1.4% +1.4% -0.5%

08:00 Switzerland KOF Leading Indicator February 2.01 Revised From 1.98 2.03 2.03

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) February +0.7% +0.7% +0.8%

10:00 Eurozone Unemployment Rate January 12.0% 12.0% 12.0%

The euro rose against the dollar after U.S. data on inflation and unemployment in the eurozone. Eurozone inflation was 0.8 percent for the third month in a row in February , showed preliminary estimate of Eurostat , published on Friday . Inflation is projected to slow down to was 0.7 percent. Inflation has remained below the target of the European Central Bank " below but close to 2 percent," the thirteenth consecutive month and is in the four-year low .

The unemployment rate in the euro area remained at 12 per cent from October , showed on Friday Eurostat data . Result is consistent with economists' expectations . In January, 19.17 million people were unemployed in the euro area . The number of people unemployed increased by 17,000 in December , while it fell by 67,000 in January 2013.

Another report showed that German retail sales rose more than expected in January compared with the previous month , on Friday showed the data published by the Federal Statistical Office. Retail sales rose a seasonally adjusted and calendar corrections by 2.5 percent on a monthly measurement , offsetting a decline of 2 percent in December . Economists had expected an increase of 1 percent. In annual terms, sales rose 0.9 percent in January , after falling 1.5 percent in the previous month . Economists had forecast a decline of 1.7 percent.

The British pound rose against the dollar on housing data and potrebdoveriyu . UK consumer confidence remained unchanged in February at the highest level in more than six years , as personal financial expectations improved by expanding the background of economic recovery. The consumer confidence index remained unchanged at -7 in February , the highest level since September 2007 , data showed on Friday, the latest survey GfK NOP. Result noted significant improvement since last February , when the index reached -26 . The survey showed that two of the five indicators used to calculate the index , fell this month , the two sub-indices increased , and one remained unchanged.

Housing prices in the UK rose significantly more rapidly in February , with more than economists forecast , data showed a survey released on Friday Nationwide. The housing price index rose by 9.4 per cent per annum, after increasing 8.8 percent in January. Economists had expected growth in February at 9 percent. Prices rose twelfth consecutive month. The rise in prices reflects an increase in demand for new homes , supported by record low interest rates , improving access to credit and rising consumer confidence .

House prices in the UK averaged 177,846 pounds in February , which is higher than 176,491 pounds a month earlier . House prices rose a seasonally adjusted 0.6 percent compared to January , when the index recorded an increase of 0.8 percent , which was revised from 0.7 per cent . In February, a result in line with expectations of economists.

EUR / USD: during the European session, the pair rose to $ 1.3813

GBP / USD: during the European session, the pair rose to $ 1.6768 and retreated

USD / JPY: during the European session, the pair dropped to Y101.55

At 13:30 GMT , Canada will release the GDP change in December. In the U.S. at 13:30 GMT will be released updated information on changes in the volume of GDP, the GDP price index , the index of personal consumption expenditures , the main index of personal consumption expenditures for the 4th quarter , in 14:45 GMT - Index Chicago PMI, at 14:55 GMT - indicator consumer confidence from the University of Michigan in February, at 15:00 GMT - the change in volume of pending home sales for January.

-

11:30

European stocks dropped for a third day

European stocks dropped for a third day, paring a monthly gain for the Stoxx Europe 600 Index, as investors awaited U.S. economic reports and weighed the impact of Russian military involvement in the Ukraine conflict. U.S. index futures and Asian shares were little changed.

A U.S. report from the National Association of Realtors at 10 a.m. New York time may show that contracts to buy previously owned homes rose in January for the first time in eight months. A gauge of pending house sales increased 1.8 percent last month, after dropping in December by the most since May 2010, economists in a Bloomberg survey predicted.

Separate data may show the world’s largest economy expanded 2.5 percent in the fourth quarter, slower than a preliminary estimate of 3.2 percent, economists projected. Consumer spending grew 2.9 percent in the last three months of 2013, lower than an earlier estimate of 3.3 percent, they said. The Thomson Reuters/University of Michigan Survey of Consumer Confidence Sentiment will stay at 81.2 in February, in line with a preliminary forecast, according to another survey.

In the U.K., a consumer-confidence index from GfK NOP Ltd. came in at minus 7 this month, the same level as in January, a release showed. That matched the median forecast economists in a Bloomberg News survey.

Erste Group Bank dropped 7.9 percent to 26.38 euros. Austria’s biggest bank expects operating profit to miss estimates this year.

Serco climbed 9 percent to 447.8 pence, its biggest increase since March 5, 2013. The outsourced-services provider appointed Aggreko Plc’s CEO Rupert Soames as its CEO with effect from June. 1. Aggreko lost 3 percent to 1,581 pence.

Old Mutual rose 4.7 percent to 195 pence. Africa’s biggest insurer acquired Intrinsic Financial Services Ltd. for an undisclosed sum. Intrinsic has 3,000 financial advisers and brings a broad distribution network.

FTSE 100 6,802.01 -8.26 -0.12%

CAC 40 4,374.14 -22.25 -0.51%

DAX 9,587.43 -0.90 -0.01%

-

10:20

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.50, Y101.80, Y102.00, Y102.60, Y102.80, Y103.00, Y103.60

EUR/USD $1.3580/85, $1.3620, $1.3650, $1.3705-10-15, $1.3735, $1.3790, $1.3800

GBP/USD $1.6550, $1.6600, $1.6635, $1.6650, $1.6800,1.6820

EUR/GBP stg0.8150, stg0.8250

AUD/USD $0.8700, $0.8750, $0.8800, $0.8940, $0.8950, $0.9000, $0.9050, $0.9110

USD/CAD C$1.0900, C$1.1085, C$1.1100, C$1.1200

-

10:00

Eurozone: Unemployment Rate , January 12.0% (forecast 12.0%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, February +0.8% (forecast +0.7%)

-

09:39

Asia Pacific stocks close

Asian stocks swung between gains and losses after the yuan posted its steepest one-day loss against the dollar. The regional equity benchmark is on course for its first monthly advance since October.

Nikkei 225 14,841.07 -82.04 -0.55%

S&P/ASX 200 5,404.82 -6.63 -0.12%

Shanghai Composite 2,056.3 +8.95 +0.44%

Agricultural Bank of China Ltd. slipped 1.2 percent as the Hang Seng China Enterprises Index of mainland firms listed in Hong Kong fell 0.7 percent.

James Hardie Industries Plc surged 6.1 percent after the Australian provider of building materials said profit jumped last quarter.

Foster Electric Co. tumbled 12 percent, the largest decline on Japan’s Topix index, as the maker of audio equipment cut its forecast.

-

08:59

FTSE 100 6,815.04 +4.77 +0.07%, CAC 40 4,400.23 +3.84 +0.09%, Xetra DAX 9,618.03 +29.70 +0.31%

-

07:45

France: Consumer spending , January -2.1% (forecast -0.8%)

-

07:45

France: Consumer spending, y/y, January -0.5% (forecast +1.4%)

-

07:01

United Kingdom: Nationwide house price index, y/y, February +9.4% (forecast +9.0%)

-

07:01

Germany: Retail sales, real adjusted , January +2.5% (forecast +1.2%)

-

07:01

Germany: Retail sales, real unadjusted, y/y, January +0.9% (forecast +0.1%)

-

07:00

United Kingdom: Nationwide house price index , February +0.6% (forecast +0.6%)

-

06:43

European bourses are initially seen narrowly mixed Friday: the FTSE seen up 0.1% and the CAC and DAX seen unchanged to 0.1% lower

-

06:29

Asian session: Japan’s currency headed

00:00 New Zealand ANZ Business Confidence February 64.1 70.8

00:05 United Kingdom Gfk Consumer Confidence February -7 -6 -7

00:30 Australia Private Sector Credit, m/m January +0.5% +0.5% +0.4%

00:30 Australia Private Sector Credit, y/y January +3.9% +4.1%

05:00 Japan Housing Starts, y/y January +18.0% +15.3% +12.3%

China’s yuan slid by the most since 2008 on speculation the government will broaden the currency’s trading band.

Japan’s currency headed for its biggest weekly advance in a month amid speculation its central bank may delay expanding stimulus with the inflation rate at a five-year high. In Japan, consumer prices excluding fresh food increased 1.3 percent in January from a year ago, statistics bureau data showed today. That matched the median estimate of economists in a Bloomberg News survey and the December figure which was the most since October 2008.

The dollar was set for a monthly drop against major counterparts before U.S. data economists say will show weaker fourth-quarter growth. The U.S. Commerce Department may say today that the world’s largest economy expanded 2.5 percent in the fourth quarter, compared with the previous reported growth of 3.2 percent, economists forecast. Yellen appeared before the Senate Banking Committee yesterday after the previously scheduled hearing was postponed on Feb. 13 owing to a snowstorm.

The Swiss franc reached the strongest in 10 months per euro after Russian President Vladimir Putin put fighter jets on alert.

EUR / USD: during the Asian session the pair fell to $ 1.3695

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6675-95

USD / JPY: on Asian session the pair fell to Y101.95

There is no easy roll into the weekend, with another full calendar Friday, will a full programme on both sides of the Atlantic. The main data release will likely be the Eurozone inflation data, which could tip the balance of opinions on the ECB Council ahead of next week's meeting. The European calendar gets underway at 0700GMT, when the German January retail sales data are published. At 0745GMT, French January consumer spending and January PPI numbers will cross the wires. Ahead of the integrated EMU inflation data, Spanish and Italian flash February data will be published at 0800GMT and 0900GMT respectively. In between, at 0815GMT, the Swiss February KOF economic barometer numbers are set to be released. At 0900GMT, ECB Executive Board member Sabine Lautenschlaeger will deliver a speech on banking, in Frankfurt. Also at 1000GMT, the session's main data is expected, when the EMU January unemployment data and the February flash HICP numbers cross the wires. Unemployment is seen unchanged at 12%, with HICP seen down 0.1% on month, higher by 0.6% on year.

The US events calendar gets underway early, when Dallas Federal Reserve Bank President Richard Fisher delivers a speech on monetary policy, in Zurich at 1000GMT. The US data calendar starts at 1200GMT, when the MBA Mortgage Index for the February 21 week crosses the wire. Canadian fourth quarter GDP data will be released at 1330GMT. Halle Institute's Claudia Buch, BOE Gov. Mark Carney, BBK Board member Andreas Dombret and BaFin President Elke Koenig appear at a conference to discuss financial regulation, in Frankfurt also at 1330GMT. The afternoon sees two Fed appearances. At 1515GMT, Federal Reserve Gov. Jeremy Stein and Minneapolis Fed President Narayana Kocherlakota appear on a panel discussing monetary policy and financial stability, in New York. Later, at 1830GMT, Chicago Fed's Charles Evans and Philadelphia Fed's Charles Plosser appear on the same panel to discus communications and unconventional monetary policy

-

05:00

Japan: Housing Starts, y/y, January +12.3% (forecast +15.3%)

-

00:35

Australia: Private Sector Credit, m/m, January +0.4% (forecast +0.5%)

-

00:02

United Kingdom: Gfk Consumer Confidence, February -7 (forecast -6)

-

00:01

New Zealand: ANZ Business Confidence, February 70.8

-