Notícias do Mercado

-

20:00

Dow -15.77 14,825.18 -0.11% Nasdaq -25.03 3,595.27 -0.69% S&P -3.22 1,634.95 -0.20%

-

19:20

American focus : the dollar against the euro has increased markedly

The dollar rose significantly against the euro, though it has lost some of the previously -earned positions. Note that a positive impact on the U.S. currency had reports of the United States. As it became known, PMI Managers Association in Chicago with correction for August rose to 53.0 against 52.3 in July. The growth was slightly weaker than economists' expectations of 53.2 . Recall that values above 50 are an indicator of accelerated growth in the economy. All the components in July were in the expansion , with growth compared to the previous month showed the sector procurement prices and new orders , a decrease was observed in the sectors of employment and deliveries.

Meanwhile, even the same data that were presented Thomson-Reuters and the Michigan Institute in August, U.S. consumers are feeling more pessimistic about the economy than had been recorded in the last month, but slightly better than those reported in the preliminary reading. According to the data, in August consumer sentiment index fell to 82.1 , compared with a final reading for July at 85.1 . It is worth noting that according to the average estimates of experts , the index had only grow to the level of 81.2 .

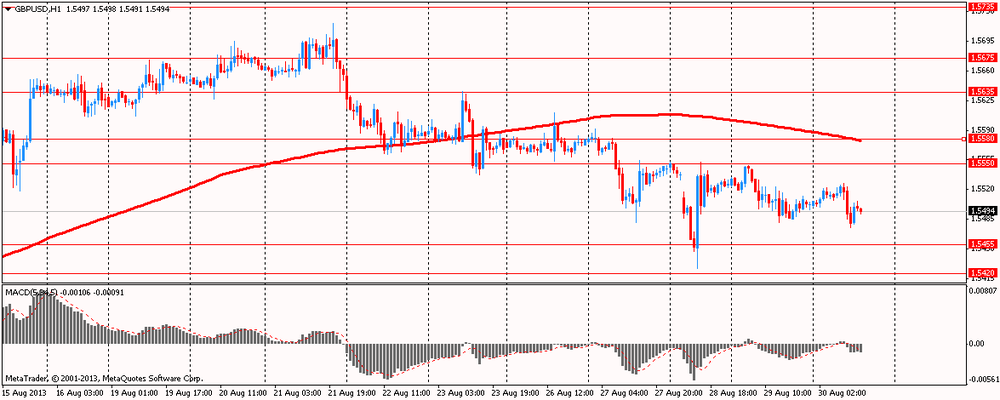

The British Pound was lower against the U.S. dollar. Statistics published today reflected the increase in the index of housing prices and the growth of approved applications for mortgage loans.

House prices in August rose 11 th consecutive month amid growing demand due to government interference and low supply . This is according to the mortgage operator Nationwide Building Society, published today . The data showed that in August rates increased by 0.6 % compared to July and was 3.5% higher compared to the same period the previous year. House prices rose by 1.4 % during the period from June to August , compared with the period from March to May. This is the highest growth since mid- 2010 and is an acceleration compared with growth of 1.0 % in the three months from May to July .

The number of mortgage approvals in the UK in July rose to a maximum of more than five years to a level that confirms the fruitfulness of efforts to address the problems in lending . On Friday the Bank of England said . According to published reports, the number of mortgage approvals in July was 60 624 and was the highest since March 2008 . The volume of consumer loans, both secured and unsecured , net of redemptions in July rose by 1.3 billion British pounds ( U.S. $ 2 billion ) . The average interest rate on new housing loans in July fell to 3.17 %, reaching its lowest level since the beginning of the comparable observations in 2004 .

-

18:20

European stock close

European stocks fell, extending a weekly loss, as oil and gas companies dropped, outweighing better-than-expected euro-area economic confidence data.

The Stoxx Europe 600 Index lost 0.8 percent to 297.62 at 4:30 p.m. in London. The measure is heading for a 2.4 percent drop this week, its second weekly decline, amid concern that the U.S. and its allies will take military action against Syria. It has still risen 8 percent since a June 24 low as central banks pledged to support the global economy and data showed the euro area emerged from a record-long recession in the second quarter.

Economic confidence in the euro area soared to a two-year high in August. An index of executive and consumer sentiment rose for a fourth month to 95.2 from 92.5 in July, the European Commission in Brussels said. The median of economists’ forecasts was for a gain to 93.8.

In the U.S., the MNI Chicago Report business barometer rose to 53 in August from a reading of 52.3 the prior month. Numbers greater than 50 signal expansion. The median forecast of economists was 53. The regional index is viewed as an indicator of business activity across the U.S.

Separate data from the Commerce Department showed consumer spending, which accounts for about 70 percent of the U.S. economy, rose 0.1 percent after a revised 0.6 percent increase the prior month that was larger than previously estimated. The median forecast of economists called for a 0.3 percent rise.

National benchmark indexes fell in all western European markets except Greece.

FTSE 100 6,412.93 -70.12 -1.08% CAC 40 3,933.78 -52.57 -1.32% DAX 8,103.15 -91.40 -1.12%

KPN slid 3.1 percent to 2.22 euros, paring earlier losses of as much as 8.4 percent. The company’s independent foundation yesterday exercised an option to acquire preferred shares, giving it almost 50 percent of issued and voting stock. America Movil said today it may withdraw its offer of 2.40 euros a share for majority control of the Dutch phone company if blocked by the KPN foundation.

Danone SA (BN) declined 1.5 percent to 56.40 euros after saying baby-nutrition sales will fall in Asia in the third quarter. The company said it had to recall infant-formula products after milk-powder supplier Fonterra Cooperative Group Ltd. warned of a contaminated ingredient. Danone, which gets 20 percent of revenue from baby nutrition, recalled the products in eight markets, including New Zealand, China and Hong Kong, as a precautionary measure.

ThromboGenics NV (THR) tumbled 19 percent to 22.76 euros, the biggest drop since July 2012. The Belgian drugmaker said sales of Jetrea, the eye drug approved by the U.S. last year, will not increase in the second half of the year. That implies full-year sales will be 36 percent less than estimates for 39.4 million euros,.

Bwin.Party Digital Entertainment Plc (BPTY) plunged 14 percent to 110 pence, the biggest drop since April 2011, after the online gaming company said 2013 sales will be 14 percent to 17 percent lower than last year’s figures. Analysts on average had forecast a sales drop of 9.2 percent.

Hermes (RMS) added 3 percent to 255.85 euros. The French maker of Kelly bags reported first-half operating profit rose 14 percent to 584.1 million euros ($773.6 million), exceeding the 569 million-euro average estimate of analysts. It also confirmed its July forecast that sales in 2013, excluding currency swings, will increase more than 10 percent.

L’Oreal SA (OR) advanced 3.7 percent to 126.90 euros, the biggest gain in more than four months, after saying first-half operating profit rose to 2.04 billion euros, or 17.4 percent of sales. That’s a record percentage for a six-month period.

-

17:00

European stock close: FTSE 100 6,412.93 -70.12 -1.08% CAC 40 3,933.78 -52.57 -1.32% DAX 8,103.15 -91.40 -1.12%

-

16:41

Oil: an overview of the market situation

Oil prices fell slightly today , demonstrating the fickle course of trading , as concerns about supply disruptions from the Middle East decreased after Britain said it would not join any military action against Syria.

Note that the price of oil is still on the way to the biggest monthly gain in a year: in August, the price of oil rose more than 6 %, as the unrest in Libya reduced the volume of production by about 1 million barrels a day. In addition, there was a decline of production in Iraq , Nigeria and other countries.

The upward trend in prices seemed stalled after the British Parliament rejected a proposal by Prime Minister David Cameron , which would make Britain complicit in the attack on Syria. This decision was a big surprise to many , especially to the U.S., as Britain was to become allies in the fight against Syria. It should be noted that U.S. officials , meanwhile, said they were ready to take action against Syria , even without specific promises of support for the union . Recall that the situation around Syria escalated after the Aug. 21 media quoted a statement reported by the opposition about the alleged use of chemical weapons in the suburbs of Damascus. After that, in the West, where the earlier application called sarin Syrian authorities condition of direct intervention in the conflict, openly talking about a possible military intervention in the Arab republic.

Analysts from Commerzbank claim that if the tension on the market once again weakened , investors will reduce a significant number of previously accumulated long positions. Without a doubt, this is true even in the case of a direct attack , provided that the conflict does not spread to other countries in the region . As a result, oil prices could fall sharply , as has often happened in the past.

The cost of the October futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 108.16 a barrel on the New York Mercantile Exchange.

October futures price for North Sea Brent crude oil mixture rose to $ 114.85 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

The cost of gold futures declined moderately , falling below $ 1,400 an ounce on speculation that a U.S. military strike on Syria is already looking less likely. In addition, the course of trade continue to impact the stronger U.S. data that confirm expectations that the Federal Reserve may reduce the size of the program to purchase assets in the near future .

Note that yesterday , U.S. officials acknowledged that they did not have conclusive evidence that Syrian President Bashar al- Assad personally ordered the use of chemical weapons against civilians in the past week. In addition, we add that the UK Parliament has decided not to participate in any military operation led by the United States against Syria.

As for the data, one of the reports in the U.S. showed that the PMI Managers Association in Chicago with correction for August rose to 53.0 against 52.3 in July. The growth was slightly weaker than economists' expectations of 53.2 . Recall that values above 50 are an indicator of accelerated growth in the economy. All the components in July were in the expansion , with growth compared to the previous month showed the sector procurement prices and new orders , a decrease was observed in the sectors of employment and deliveries.

Investors scrutinize economic data to gauge the strength of the economic recovery and to predict when the Federal Reserve will cut back its program to purchase assets , which now costs $ 85 billion a month. The early termination of stimulation may impair such assets like gold, which received support from the central bank in the past four years.

The cost of the October gold futures on COMEX today dropped to $ 1396.80 per ounce.

-

15:29

U.K. mortgage approvals highest since 2008

U.K. mortgage approvals increased to the highest level in more than five years, adding to signs that the housing market recovery is gathering pace in July.

Mortgage approvals for house purchases increased to 60,624 in July, the highest since March 2008, from 58,238 in June, the Bank of England said Friday. The approvals for lending secured on dwelling also exceeded the consensus forecast of 58,800.

Net mortgage lending grew by GBP 707 million compared to GBP 1.02 billion rise in June. Meanwhile, net consumer credit increased GBP 619 million, bigger than last month's GBP 371 million rise.

However, Samuel Tombs at Capital Economics said talk of a renewed boom in the housing market still seems to be wide of the mark.

In a separate communique, the BoE said M4 money supply grew at a faster pace of 1.8 percent annually after rising 1.5 percent in June. Month-on-month, M4 climbed 0.6 percent. -

15:15

Eurozone inflation slows more than expected in August

Consumer price inflation in the euro area weakened in August, and to a larger extent than economists had forecast, latest data showed Friday.

Inflation as per the harmonized index of consumer prices (HICP) slowed to 1.3 percent, after staying unchanged at 1.6 percent in July, preliminary estimated published by statistical office Eurostat revealed. Economists had forecast inflation to ease to 1.4 percent.

The deceleration was driven mainly by a 0.4 percent fall in energy prices. Non-energy prices, meanwhile, increased 0.3 percent annually. Costs of food, alcohol and tobacco were higher by 3.3 percent than in August 2012.

Core inflation, excluding energy, food, alcohol and tobacco, stayed unchanged at 1.1 percent in August. The outcome matched economists' forecast. -

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, August 82.1 (forecast 81.2)

-

14:45

U.S.: Chicago Purchasing Managers' Index , August 53.0 (forecast 53.2)

-

14:36

U.S. Stocks open: Dow 14,842.10 +1.15 +0.01%, Nasdaq 3,619.57 -0.73 -0.02%, S&P 1,639.53 +1.36 +0.08%

-

14:33

Option expiries for today's 1400GMT cut

EUR/USD $1.3200, $1.3235, $1.3250, $1.3350, $1.3275, $1.3360, $1.3400

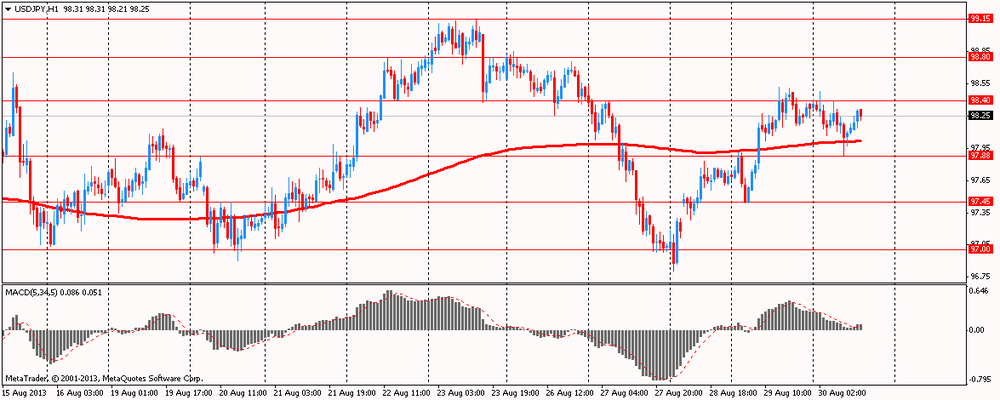

USD/JPY Y97.00, Y97.20, Y97.30, Y97.50, Y97.85-90, Y98.00, Y98.50, Y98.90, Y99.00, Y99.15, Y99.50

GBP/USD $1.5400, $1.5500, $1.5520

EUR/GBP stg0.8575

GBP/CAD C$1.6400

USD/CHF Chf0.9220, Chf0.9300

EUR/CHF Chf1.2350

AUD/USD $0.8860, $0.8880, $0.8890, $0.8900, $0.8925, $0.8940, $0.8950, $0.8970, $0.9000

AUD/CAD C$0.9300

NZD/USD $0.7745, $0.7900

CAD/JPY Y93.30

-

14:26

Before the bell: S&P futures +0.11%, Nasdaq futures +0.11%

U.S. stock-index futures were little changed after data showed personal spending in July rose less than forecast and as concerns over Syria eased.

Global Stocks:

Nikkei 13,388.86 -70.85 -0.53%

Hang Seng 21,731.37 +26.59 +0.12%

Shanghai Composite 2,098.38 +1.15 +0.06%

FTSE 6,448.82 -34.23 -0.53%

CAC 3,956.17 -30.18 -0.76%

DAX 8,136.69 -57.86 -0.71%

Crude oil $108.05 -0.69%

Gold $1394.80 -1.28%

-

13:54

Upgrades and downgrades before the market open:

Upgrades:

Intel (INTC) upgraded to Buy from Hold at Argus

Downgrades:

Other: -

13:31

Canada: GDP (m/m) , June -0.5% (forecast -0.3%)

-

13:30

U.S.: Personal Income, m/m, July +0.1% (forecast +0.3%)

-

13:30

U.S.: PCE price index ex food, energy, m/m, July +0.1% (forecast +0.2%)

-

13:30

U.S.: PCE price index ex food, energy, Y/Y, July +1.2% (forecast +1.3%)

-

13:30

U.S.: Personal spending , July +0.1% (forecast +0.3%)

-

13:20

European session: the euro sta,ilized

06:00 United Kingdom Nationwide house price index August +0.8% +0.6% +0.6%

06:00 United Kingdom Nationwide house price index, y/y August +3.9% +3.3% +3.5%

06:00 Germany Retail sales, real adjusted July -1.5% +0.5% -1.4%

06:00 Germany Retail sales, real unadjusted, y/y July -2.8% +1.7% +2.3%

07:00 Switzerland KOF Leading Indicator August 1.23 1.34 1.36

08:30 United Kingdom Net Lending to Individuals, bln July 1.5 1.7 1.3

08:30 United Kingdom Mortgage Approvals July 57.7 59.0 60.6

09:00 Eurozone Business climate indicator July -0.53 -0.36 -0.2

09:00 Eurozone Economic sentiment index August 92.5 93.8 95.2

09:00 Eurozone Industrial confidence August -10.6 -9.6 -8.0

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August +1.6% +1.4% +1.3%

09:00 Eurozone Unemployment Rate July 12.1% +12.1% +12.1%

The Euro is trading without a trend against the U.S. dollar after the release of mixed statistics : business sentiment in the euro zone improved, German retail sales disappoint , while the number of unemployed in the euro zone fell a second straight month , while the unemployment rate remained at the same level.

Eurozone economic confidence improved fourth consecutive month in August , data released by the European Commission. Economic sentiment index rose to 95.2 from 92.5 in July. The value was higher than the consensus forecast of 93.8 .

The strong increase was due to the pronounced increase confidence among consumers and managers in industry, services and retail trade.

Thanks to a more positive assessment of the current level of general managers of orders and production expectations , the index of business optimism in the industry rose to -7.9 in August from 10.6 in the previous month .

In addition, confidence among service providers improved to -5.3 from -7.8 . The improvement was due to a sharp increase in estimates of managers past business situation and the important improvements on past demand and expectations of the proposal.

German retail sales for July disappoint : the fall was the second consecutive month. Thus, the shopkeepers at best get mixed results for the year. According to published data, the volume of retail sales fell in July by 1.4 % compared with the previous month , after the June sales were down 0.8 %. The data are adjusted for inflation and seasonal factors .

Eurozone unemployment rate remained at 12.1 percent in July , being in line with expectations , Eurostat data showed . The unemployment rate remained at this level for the fourth consecutive month. According to Eurostat for the euro area in July registered 19,231,000 unemployed. Compared with June, the unemployment rate fell to 15,000 , but rose to 1.008 million , compared with July last year.

The British Pound was lower against the U.S. dollar. Statistics published today reflected the increase in the index of housing prices and the growth of approved applications for mortgage loans.

House prices in August rose 11 th consecutive month amid growing demand due to government interference and low supply . This is according to the mortgage operator Nationwide Building Society, published today . The data showed that in August rates increased by 0.6 % compared to July and was 3.5% higher compared to the same period the previous year . House prices rose by 1.4 % during the period from June to August , compared with the period from March to May. This is the highest growth since mid- 2010 and is an acceleration compared with growth of 1.0 % in the three months from May to July .

The number of mortgage approvals in the UK in July rose to a maximum of more than five years to a level that confirms the fruitfulness of efforts to address the problems in lending . On Friday the Bank of England said . According to published reports, the number of mortgage approvals in July was 60 624 and was the highest since March 2008 . The volume of consumer loans, both secured and unsecured , net of redemptions in July rose by 1.3 billion British pounds ( U.S. $ 2 billion ) . The average interest rate on new housing loans in July fell to 3.17 %, reaching its lowest level since the beginning of the comparable observations in 2004 .

EUR / USD: during the European session, the pair is trading in the range of $ 1.3221 - $ 1.3241

GBP / USD: during the European session, the pair fell to $ 1.5475

USD / JPY: during the European session, the pair fell to Y97.88

At 12:30 GMT Canada will release the Gross Domestic Product for June. In the U.S., will be released at 12:30 GMT the main index for personal consumption expenditures , changes in the level of spending, deflator of personal consumption expenditures for July will be released at 13:45 GMT Chicago PMI index for August.

-

13:02

Orders

EUR/USD

Offers $1.3340/50, $1.3300/10, $1.3255/65

Bids $1.3220, $1.3210/00, $1.3198, $1.3180, $1.3150/40

GBP/USD

Offers $1.5680/85, $1.5640/50, $1.5615/20, $1.5600, $1.5545/55

Bids $1.5460/50, $1.5425/20, $1.5410/00, $1.5380

AUD/USD

Offers $0.9045/50, $0.9020, $0.8995/00, $0.8980, $0.8960/70

Bids $0.8910/00, $0.8890, $0.8880/75, $0.8800

EUR/JPY

Offers Y131.80, Y131.55/60, Y131.20, Y130.80/00, Y130.45/50

Bids Y129.50, Y129.20, Y129.05/00, Y128.80

USD/JPY

Offers Y99.50, Y99.15/20, Y98.90/00, Y98.45/50

Bids Y97.85/80, Y97.50, Y97.25/20, Y97.05/00

EUR/GBP

Offers stg0.8650/55, stg0.8620, stg0.8590/600, stg0.8550/55

Bids stg0.8520-10, stg0.8505/00

-

11:29

European stocks declined

European stocks declined, with the Stoxx Europe 600 Index heading for a second weekly loss, before a report on euro-area economic confidence. U.S. index futures and Asian shares rose.

The Stoxx 600 lost 0.3 percent to 299.35 at 8:37 a.m. in London. The measure has dropped 1.8 percent this week, heading for a 0.1 percent monthly loss, amid concern that the U.S. and its allies will take military action against Syria after Secretary of State John Kerry said his government will hold the Middle Eastern country accountable for using chemical weapons on its own people.

A report at 11 a.m. in Brussels may show euro area economic confidence rose to the highest level since March 2012. The index of executive and consumer sentiment climbed to 93.8 in August, from 92.5 in July, economists forecast in a survey.

Separate data in the U.S. may show business activity in the world’s biggest economy expanded in August. The MNI Chicago Report’s business barometer increased to 53 from 52.3 in July, economists predicted in a survey.

Royal KPN NV slid 5.2 percent after the company’s independent foundation yesterday exercised an option to acquire preferred shares in a bid to block America Movil SAB’s takeover offer.

Danone SA dropped 1.2 percent after saying baby-nutrition sales will fall in Asia in the third quarter.

FTSE 100 6,455.06 -27.99 -0.43%

CAC 40 3,965.18 -21.17 -0.53%

DAX 8,149.02 -45.53 -0.56%

-

11:15

Eurozone jobless rate unchanged at record 12.1%

Unemployment rate in Eurozone held steady at record 12.1 percent in July, in line with forecasts, data from the Eurostat showed Friday.

The jobless rate has remained at this level for the fourth consecutive month. According to Eurostat estimates, 19.231 million people were unemployed in euro area in July. Compared with June, unemployment decreased by 15,000, but rose by 1.008 million year-on-year.

Among the EU member states, the lowest unemployment rate was recorded in Austria, followed by Germany and Luxembourg. The highest were in Greece and Spain.

In July, 3.500 million persons under the age of 25 were unemployed in the region. Compared with July 2012, their unemployment has decreased by 16,000. The youth unemployment rate was 24 percent.

In EU28, including Croatia, the overall unemployment rate was 11 percent, steady compared with June. There were 26.654 million unemployed persons in the EU during the month.

-

11:00

Eurozone economic confidence rises for fourth straight month

Eurozone economic confidence improved for the fourth consecutive month in August, survey data from the European Commission showed Friday.

The corresponding index climbed to 95.2 from 92.5 in July. The reading was above the consensus 93.8.

The strong increase resulted from pronounced improvements in confidence among consumers and managers in industry, services and retail trade.

Fueled by managers' much more positive assessment of the current level of overall order books and production expectations, confidence in industry rose to -7.9 in August from -10.6 in the prior month.

Similarly, confidence among service providers improved to -5.3 from -7.8. The improvement was driven by a sharp rise in managers' assessment of the past business situation and important improvements concerning past demand and demand expectations.

Consumer confidence continued its upward trend that started in December 2012. Consumer sentiment rose to -15.6 from -17.4 in July, thanks to more optimistic views on the future general economic situation.

Retailers' sentiment rose to -10.7 in August from -14 a month ago. Managers were particularly more confident about the future business situation. Also their assessments of the present business situation and their volume of stocks improved markedly.

However, confidence in construction weakened to -33.5 from -32.6 in July, resulting from managers' worsened assessment of both order books and employment expectations.

The business climate indicator climbed by 0.31 points to -0.21 in August. The assessment of past production, the level of overall order books and production expectations improved sharply.

Also the level of export order books and the stocks of finished products were appraised more positively, survey results showed. -

10:26

Option expiries for today's 1400GMT cut

EUR/USD $1.3200, $1.3235, $1.3250, $1.3350, $1.3275, $1.3360, $1.3400

USD/JPY Y97.00, Y97.20, Y97.30, Y97.50, Y97.85-90, Y98.00, Y98.50, Y98.90, Y99.00, Y99.15, Y99.50

GBP/USD $1.5400, $1.5500, $1.5520

EUR/GBP stg0.8575

GBP/CAD C$1.6400

USD/CHF Chf0.9220, Chf0.9300

EUR/CHF Chf1.2350

AUD/USD $0.8860, $0.8880, $0.8890, $0.8900, $0.8925, $0.8940, $0.8950, $0.8970, $0.9000

AUD/CAD C$0.9300

NZD/USD $0.7745, $0.7900

CAD/JPY Y93.30

-

10:04

Eurozone: Industrial confidence, August -8.0 (forecast -9.6)

-

10:02

Eurozone: Business climate indicator , July -0.2 (forecast -0.36)

-

10:02

Eurozone: Harmonized CPI, Y/Y, August +1.3% (forecast +1.4%)

-

10:01

Eurozone: Economic sentiment index , August 95.2 (forecast 93.8)

-

10:00

Eurozone: Unemployment Rate , July +12.1% (forecast +12.1%)

-

09:40

Asia Pacific stocks close

Asian stocks swung between gains and losses, with energy producers leading declines as the price of oil fell after the U.K parliament voted against military strikes on Syria. Japanese utilities rose.

Nikkei 225 13,388.86 -70.85 -0.53%

Hang Seng 21,678.1 -26.68 -0.12%

S&P/ASX 200 5,134.96 +42.55 +0.84%

Shanghai Composite 2,098.38 +1.15 +0.06%

Inpex Corp., Japan’s No. 1 energy explorer, dropped 2 percent.

Hokkaido Electric Power Co. added 3.5 percent in Tokyo as the utility forecast a smaller-than-expected net loss.

Ping An Insurance Co., China’s second-largest insurer, gained 1 percent in Hong Kong after saying first-half profit rose.

Shanghai Industrial Holdings Ltd., a shopping-mall operator, lost 1 percent in Hong Kong after reporting first-half profit fell 34 percent.

-

09:33

United Kingdom: Mortgage Approvals, July 60.6 (forecast 59.0)

-

09:32

United Kingdom: Net Lending to Individuals, bln, July 1.3 (forecast 1.7)

-

09:00

FTSE 100 6,483.51 +0.46 +0.01%, CAC 40 3,982.25 -4.10 -0.10%, Xetra DAX 8,184.93 -9.62 -0.12%

-

08:00

Switzerland: KOF Leading Indicator, August 1.36 (forecast 1.34)

-

07:21

Asian session: The dollar reached the highest in four weeks

01:30 Australia Private Sector Credit, m/m July +0.4% +0.4% +0.4%

01:30 Australia Private Sector Credit, y/y July +3.1% +3.1% +3.2%

05:00 Japan Housing Starts, y/y July +15.3% +14.5% +12.0%

The dollar reached the highest in four weeks against a basket of its peers before data forecast to show U.S. consumer spending rose for a third month, building the case for the Federal Reserve to reduce stimulus next month. Purchases of goods and services in the U.S. probably increased 0.3 percent last month after a 0.5 percent advance in June, according to the median forecast in a Bloomberg News survey of economists before today’s Commerce Department figures.

The final reading of the Thomson Reuters/University of Michigan index of consumer sentiment for August will probably be revised to 80.5, from an initial reading of 80, economists forecast. The gauge was at 85.1 in July.

U.S. gross domestic product expanded at a 2.5 percent annualized rate, up from an initial estimate of 1.7 percent, data showed yesterday. Economists projected a 2.2 percent gain.

Fed policy makers are debating whether the U.S. economy is strong enough to allow them to pare back monthly purchases of $85 billion in Treasuries and mortgage debt. Officials will reduce the amount at their next meeting on Sept. 17-18, according to 65 percent of economists in an Aug. 9-13 Bloomberg survey.

The yen rose against most of its major peers amid amid speculation the country’s exporters are repatriating overseas earnings.

Turkey’s lira headed for its biggest gain on a closing basis in three weeks. The U.K. parliament yesterday rejected Prime Minister David Cameron’s motion seeking endorsement for military strikes against Syria. Cameron had sought approval to join the U.S. in holding the Syrian government accountable for alleged chemical-weapon attacks against its own civilians.

EUR / USD: during the Asian session the pair rose to $ 1.3255

GBP / USD: during the Asian session, the pair rose to $ 1.5520

USD / JPY: during the Asian session the pair fell to Y98.05

UK Nationwide house prices at 0600GMT ahead of UK mortgage data at 0830GMT. Eurozone data begins with Germany retail sales at 0600GMT, EZ confidence data at 0900GMT, with US personal income at 1230GMT followed by confidence reports, beginning with Chicago at 1345GMT, UofM at1355GMT.

-

07:01

United Kingdom: Nationwide house price index, y/y, August +3.5% (forecast +3.3%)

-

07:00

Germany: Retail sales, real adjusted , July -1.4% (forecast +0.5%)

-

07:00

Germany: Retail sales, real unadjusted, y/y, July +2.3% (forecast +1.7%)

-

07:00

United Kingdom: Nationwide house price index , August +0.6% (forecast +0.6%)

-

06:21

Commodities. Daily history for Aug 29’2013:

Change % Change Last

GOLD 1,407.50 -11.00 -0.78%

OIL (WTI) 108.31 -1.79 -1.63%

-

06:21

Stocks. Daily history for Aug 29’2013:

Nikkei 225 13,459.71 121,25 0,91%

Hang Seng 21,704.78 180,13 0,84%

S & P / ASX 200 5,092.41 +5.25 +0.10%

Shanghai Composite -4,07 -0,19 2,097.23%

FTSE 100 6,483.05 +52.99 +0.82%

CAC 40 3,986.35 +25.89 +0.65%

DAX 8,194.55 +36.65 +0.45%

Dow +19.82 14,844.33 +0.13%

Nasdaq +27.31 3,620.66 +0.76%

S&P +3.68 1,638.64 +0.23%

-

06:20

Currencies. Daily history for Aug 29'013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3237 -0,77%

GBP/USD $1,5502 -0,15%

USD/CHF Chf0,9311 +1,00%

USD/JPY Y98,33 +0,64%

EUR/JPY Y130,16 -0,12%

GBP/JPY Y152,42 +0,49%

AUD/USD $0,8921 -0,19%

NZD/USD $0,7756 -0,55%

USD/CAD C$1,0538 +0,49%

-

06:01

Schedule for today, Friday, Aug 30’2013:

01:30 Australia Private Sector Credit, m/m July +0.4% +0.4%

01:30 Australia Private Sector Credit, y/y July +3.1% +3.1%

05:00 Japan Housing Starts, y/y July +15.3% +14.5%

06:00 United Kingdom Nationwide house price index August +0.8% +0.6%

06:00 United Kingdom Nationwide house price index, y/y August +3.9% +3.3%

06:00 Germany Retail sales, real adjusted July -1.5% +0.5%

06:00 Germany Retail sales, real unadjusted, y/y July -2.8% +1.7%

07:00 Switzerland KOF Leading Indicator August 1.23 1.34

08:30 United Kingdom Net Lending to Individuals, bln July 1.5 1.7

08:30 United Kingdom Mortgage Approvals July 57.7 59.0

09:00 Eurozone Business climate indicator July -0.53 -0.36

09:00 Eurozone Economic sentiment index August 92.5 93.8

09:00 Eurozone Industrial confidence August -10.6 -9.6

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August +1.6% +1.4%

09:00 Eurozone Unemployment Rate July 12.1% +12.1%

12:30 Canada GDP (m/m) June +0.2% -0.3%

12:30 U.S. Personal Income, m/m July +0.3% +0.3%

12:30 U.S. Personal spending July +0.5% +0.3%

12:30 U.S. PCE price index ex food, energy, m/m July +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y July +1.2% +1.3%

13:00 U.S. FOMC Member James Bullard Speaks

13:45 U.S. Chicago Purchasing Managers' Index August 52.3 53.2

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 80.0 81.2

-

06:00

Japan: Housing Starts, y/y, July +12.0% (forecast +14.5%)

-