Notícias do Mercado

-

23:50

USD/CAD displays a rebound at around 1.2800 ahead of US ISM data

- USD/CAD has witnessed a modest rebound as inverts expect higher US ISM New Orders index data.

- The Canadian economy has remained flat on the GDP front.

- Oil prices are expecting more downside n accelerating recession risks.

The USD/CAD pair is getting bids around the psychological support of 1.2800 in the early Tokyo session. The asset defended the monthly support of 1.2788 on Friday and is displaying downside exhaustion signals near the critical support area. The pair has advanced to near 1.2820 in early Tokyo and more upside looks possible if the asset oversteps the critical hurdle of 1.2855.

The asset is attempting to regain its glory on higher expectations of US Institute of Supply Management (ISM) New Orders Index data, which is seen decently higher at 52 than the prior release of 49.2. A higher New Orders data indicates that the demand from consumers is robust in times of higher price pressures. Consumers have not dropped their spending, which has been upholding the recession risks ahead.

However, the critical ISM Manufacturing PMI data is expecting an underperformance as estimates dictate landing at 52 vs. the prior print of 53. A drop in the economic data may accelerate a downside move in the US dollar index (DXY).

On the loonie front, the Canadian economy reported on Friday that the economy has remained flat on the Gross Domestic Product (GDP) front. The Canadian GDP has landed at 0%, lower than the expansion of 0.3% reported last month but higher than the expectation of -0.2%.

Talking about oil, the oil prices are likely to extend their losses if the asset drops below the crucial support of $97.60. The black gold has remained in the grip of bears as recession fears are advancing sharply. Soaring price pressures in the world economy have triggered the requirement of more rate hikes ahead, which have trimmed optimism over oil prices.

-

23:48

AUD/USD retreats towards 0.6950 on China PMIs, geopolitics with eyes on RBA, US NFP

- AUD/USD seesaws around six-week high, renews intraday low to pare recent gains.

- Market sentiment dwindles on China’s downbeat PMIs, Beijing’s warnings over US-Taiwan ties.

- US PCE data, Fedspeak also weigh on the prices even as recession woes, rate neutrality favor bulls.

- RBA’s 50 bps move may not favor bulls if US jobs report prints strong data.

AUD/USD bulls take a breather after a two-week upside, recently easing to 0.6975 during Monday’s initial Asian session, amid mixed clues. Among them, the cautious mood ahead of the Reserve Bank of Australia’s (RBA) monetary policy meeting and the US employment report for July, as well as fresh fears surrounding the Sino-American tussles appear to have gained major attention. On the same line were the recently hawkish concerns surrounding the US Federal Reserve (Fed) and downbeat Purchasing Managers Index (PMI) data from Australia’s biggest customer China.

During the weekend, China’s official PMIs for July portrayed an unclear picture of the world’s second-largest economy. That said, the headline NBS Manufacturing PMI dropped back into contraction after the previous monthly improvement, down to 49.0 versus 50.4 expected and 50.2 prior. Further, the Non-Manufacturing PMI rose past 52.3 market forecast to 53.8, against 54.7 in previous readouts.

At home, Australia’s AiG Performance of Manufacturing Index for July also eased to 52.5 from 54.00.

Elsewhere, Beijing warns the White House over US House Speaker Nancy Pelosi’s plan to visit Taiwan. Also weighing on the sentiment, as well as the AUD/USD prices, is the news that US President Joe Biden got a covid infection.

That said, the US Dollar Index (DXY) marked the second consecutive weekly fall after the US Federal Reserve (Fed) Chairman Jerome Powell highlighted data-dependency and neutral rates. Also drowning the greenback was the “technical recession” in the US after the Annualized readings of the US Q2 Gross Domestic Product (GDP) dropped for the second straight quarter.

Even so, comments from Minneapolis Fed President Niel Kashkari and the Fed’s preferred inflation gauge appeared to have probed the greenback bears of late. “The fed is still a long way away from backing off rate hikes,” said Fed’s Kashkari to the New York Times (NYT). The policymaker added, “Hiking rates by half a point at coming Fed meetings seems reasonable to me.” Furthermore, the US Core Personal Consumption Expenditures (PCE) Price Index, the Fed's preferred gauge of inflation, rose to 4.8% YoY for June versus 4.7% prior.

Amid these plays, Wall Street closed positive and the US Treasury yields were pressured. However, the S&P 500 Futures print mild losses of late.

Although the recently sour sentiment weighs on the AUD/USD prices, hopes of 50 basis points (bps) of the RBA rate hike keep the pair buyers hopeful. However, the US PMIs and Nonfarm Payrolls (PMI) should remain softer to keep the USD bulls away in that case.

Technical analysis

The 50-DMA level surrounding 0.6965 restricts AUD/USD pair’s immediate downside but the bears are likely to wait for a clear downside break of the 0.6905 support confluence, comprising the previous resistance line from April and 38.2% Fibonacci retracement (Fibo.) of June-July downside. That said, buyers may aim for the 61.8% Fibo. level near 0.7050 during the further upside.

-

23:45

New Zealand Building Permits s.a. (MoM) registered at -2.3%, below expectations (-0.3%) in June

-

23:30

Australia AiG Performance of Mfg Index down to 52.5 in July from previous 54

-

23:23

GBP/USD oscillates near one-month high below 1.2200, BOE, US NFP in focus

- GBP/USD bulls take a breather at multi-day top as the key week begins.

- Sunak unveils plan to cut income tax in long-term, Truss gets UK Chancellor Zahawi’s formal endorsement as PM.

- Recession fears, Fed’s Powell weighed on the USD even as inflation data came in firmer.

- PMIs can entertain traders ahead of BOE, US jobs report for Thursday.

GBP/USD prices grind higher as it begins the key week comprising the Bank of England (BOE) monetary policy meeting and the US employment data for July. That said, the cable pair rose during the last two consecutive weeks amid a softer US dollar, as well as political optimism in the UK.

Recently, ex-UK Chancellor Rishi Sunak vows a 20% income tax cut by 2029 in a bid to become the next British Prime Minister. However, Reuters showed the latest results of the YouGov poll that showed Foreign Minister Liz Truss held a 24-point lead over Sunak among Conservative Party members. It’s worth noting that the UK Telegraph came out with the news suggesting current Chancellor Nadhim Zahawi formally endorse Liz Truss to be the next Conservative Party Leader. Given that both contestants have sound plans and no major political negative, except for Truss’ strong Brexit support, the cable cheers the hopes of better days after multiple political hiccups in the past.

Elsewhere, the US Dollar Index (DXY) marked the second consecutive weekly fall after the US Federal Reserve (Fed) Chairman Jerome Powell highlighted data-dependency and neutral rates. Also drowning the greenback was the “technical recession” in the US after the Annualized readings of the US Q2 Gross Domestic Product (GDP) dropped for the second straight quarter.

Even so, comments from the uber dove Minneapolis Fed President Niel Kashkari and the Fed’s preferred inflation gauge appeared to have probed the greenback bears of late. “The fed is still a long way away from backing off rate hikes,” said Fed’s Kashkari to the New York Times (NYT). The policymaker added, “Hiking rates by half a point at coming Fed meetings seems reasonable to me.” Furthermore, the US Core Personal Consumption Expenditures (PCE) Price Index, the Fed's preferred gauge of inflation, rose to 4.8% YoY for June versus 4.7% prior.

It should be noted that the easing fears of the tighter rate hikes joined mixed US data to help Wall Street witness another positive week while the US Treasury yields closed on a softer side by the end of Friday.

On a different page, the US-China tussles escalate as Beijing warns the White House over US House Speaker Nancy Pelosi’s plan to visit Taiwan. Also, US President Joe Biden got a covid infection and offer an additional burden for the risk appetite.

Looking forward, multiple PMIs to entertain the GBP/USD traders ahead of the BOE’s “Super Thursday” and Friday’s US Nonfarm Payrolls (NFP). Given the recently firmer sentiment and the market’s move against the US dollar, hawkish BOE could have a more positive impact on the Cable pair than previously. That said, the “Old Lady” is expected to announce a 0.25% rate hike but the market does anticipate a stronger move.

Also read: GBP/USD Weekly Forecast: Bulls on the lookout for 1.2500 ahead of BOE, NFP

Technical analysis

Despite breaking the 14-week-old resistance line, which now support around 1.2075, GBP/USD buyers need validation from the 50-DMA hurdle of 1.2210 to keep reins. That said, RSI (14) and MACD are both in favor of the upside momentum of late.

-

23:13

Gold Price Forecast: XAU/USD sees establishment above $1,770 ahead of mix US ISM data

- Gold price is set for a fresh upside rally after breaching the demand zone in a $1,768.32-1,772.22 range.

- A higher US PCE print indicates that rising interest rates are failing to slow down the inflation rate.

- The US ISM Manufacturing PMI is expected to remain lower at 52 vs. 53 reported earlier.

Gold Price (XAU/USD) is expected to carry forward the optimism displayed last week in the Asian session as accelerating recession fears in the US economy have underpinned the appeal for the precious metal. The bright metal turned sideways after printing a fresh three-week high around $1,768.00, however, the upside remains warranted despite soaring price pressures in the US economy.

On Friday, the US Personal Consumption Expenditure (PCE) landed at 6.8%, higher than the expectations and the prior release of 6.7% and 6.3% respectively. Well, an improvement of 50 basis points (bps) in the Federal Reserve (Fed) preferred tool of inflation indicator displays no signs of exhaustion in the price pressures. However, recession fears have escalated abruptly.

In today’s session, investors will keep an eye on the release of the US Institute of Supply Management (ISM) data. The ISM Manufacturing PMI is likely to shift lower to 52 from the prior release of 53. A drop in Manufacturing PMI indicates that vigorous interest rates elevation by the Fed has started displaying its consequences, however, inflation has not got caught now, which is a big reason to worry. However, the New Orders Index is warranting a decent improvement as the economic data is seen higher at 52 vs. the prior release of 49.2. This displays that consumer spending is gaining sharply despite the runaway inflation.

Gold technical analysis

On an hourly scale, the gold prices are facing minor barricades around the supply zone placed in a $1,768.32-1,772.22 range after a juggernaut rally. The precious metal is hinting a time correction ahead in hopes of attracting more bids.

Advancing 20-and 50-period Exponential Moving Averages (EMAs) at $1,762.03 and 1,753.25 respectively adds to the upside filters.

Also, the Relative Strength Index (RSI) (14) is attempting to get back inside the bullish range of 60.00-80.00, which will underpin an upside momentum again.

Gold hourly chart

-

22:31

EUR/USD bulls move out as market correct with a focus on US jobs data

- EUR/USD bulls are shying away in the open but could be encouraged by a discount.

- The week ahead will be yet again a busy one on the US calendar.

EUR/USD was ending the day higher by some 0.28% following a move from 1.0145 to 1.0254 the high for the day as US stocks headed in for the best month since late 2020 in a risk-on environment. In turn, the US dollar was sliding, bleeding out from a dovish tilt at the Federal Reserve and perceived softening in sentiment on the part of policymakers.

US Gross Domestic Product had shrunk 0.9% last quarter, which also weighed on both US yields and the greenback as this data added to a 1.6% contraction in the quarter before that. Last week the US Federal Reserve raised its policy rate by 75bp for the second consecutive meeting and Chair Powell was noting the Fed could slow the pace of its hike at future meetings.

Meanwhile, Eurozone GDP growth beat expectations, rising 0.7% for the second quarter (exp: 0.2%, prev: 0.5%), in spite of German growth stalling, as France and Spain beat expectations. However, given the energy supply pressures facing the continent, traders may wish to focus on those implications instead.

NFP in focus

Elsewhere, markets shrugged off data suggesting slightly stronger-than-expected inflationary pressures in the US and perhaps the main focus now will be this week's critical Nonfarm Payrolls jobs data. US employment likely continued to advance firmly in July, analysts at TD Securities said, but at a more moderate pace after four consecutive job gains at just below 400k in March-June. ''High-frequency data, including Homebase, still point to above-trend job creation. We also look for the UE rate to stay at 3.6% for a fifth straight month, and for wage growth to remain steady at 0.3% m/m (4.9% YoY).''

Meanwhile, with this week's PMIs, US surveys already released point to further deceleration for both manufacturing and services activity in July, as both hard data and sentiment measures have continued to worsen in recent months (particularly the flash estimate for the July services PMI).'' While we are looking for a decline in both ISM surveys, we expect them to remain above the 50 mark which would still signal expansion,'' analysts at TD Securities said.

EUR/USD technical analysis

The hourly W-formation is pulling in the price towards the neckline for the open, so we could see bulls move in at a discount for the sessions ahead at the start of the week.

-

21:13

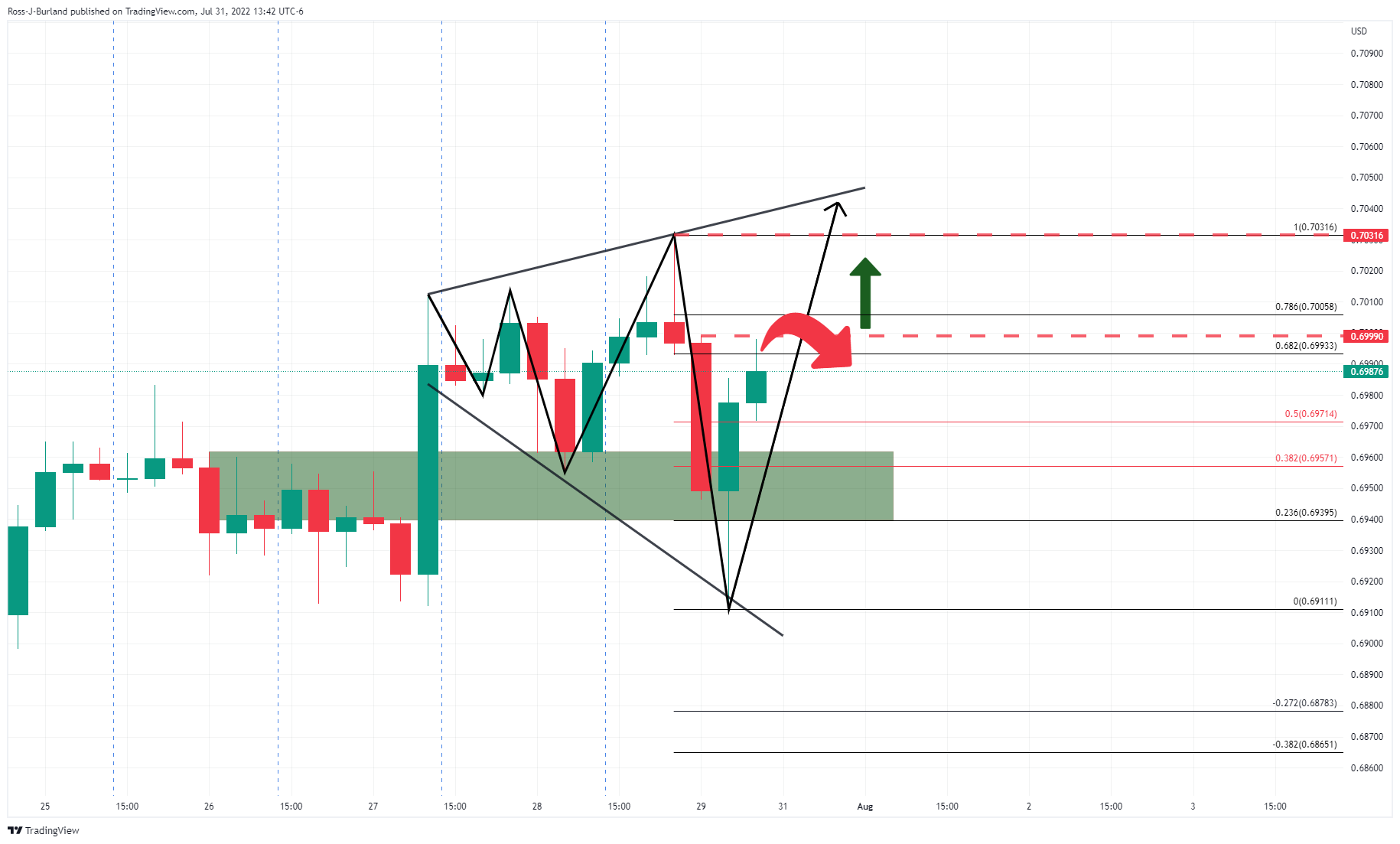

AUD/USD Price Analysis: Bulls are trying to pull away with eyes set on the 0.7000s

- AUD/USD bulls have been in charge and eye a continuation for the week ahead.

- The 0.7000s are calling but a meanwhile reversion to the downside could be on the cards.

AUD/USD is setting up for a compelling bullish scenario for the open, although the weekly chart's W-formation offers the risk of a significant reversion.

AUD/USD H4 chart

The price has been carving out a broadening formation and should the bulls commit, then there is room to go to the upside for the week ahead.

AUD/USD weekly chart

However, the weekly chart's W-formation is worth noting as a potential hindrance with the 50% mean reversion level aligning with the neckline of the pattern.

AUD/USD H1

For the open, the bulls could well emerge from the presumed support base and the confluence of the 50% mean reversion area and a prior hourly high/resistance. A bullish extension of the prior hourly impulse could see the bulls in charge all the way into the 0.7000s in the very near term.

-

02:33

China Non-Manufacturing PMI came in at 53.8, above expectations (52.3) in July

-

02:32

China NBS Manufacturing PMI came in at 49, below expectations (50.4) in July

-