Notícias do Mercado

-

23:32

Commodities. Daily history for Jan 5’2016:

(raw materials / closing price /% change)

Oil 36.27 +0.83%

Gold 1,077.10 -0.12%

-

16:39

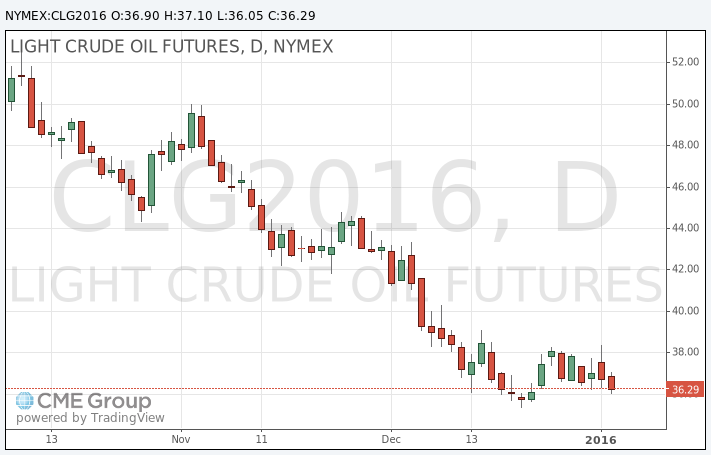

Oil prices decline on concerns over the global oil oversupply

Oil prices decline on concerns over the global oil oversupply. Oil producing countries do not want to reduce their oil output.

The weak Chinese manufacturing data also weighed on oil prices. The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0. Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

WTI crude oil for February delivery declined to $36.05 a barrel on the New York Mercantile Exchange.

Brent crude oil for February fell to $36.61 a barrel on ICE Futures Europe.

-

16:34

Gold continues to rise

Gold price rose on concerns over the slowdown in the Chinese economy and over the situation in the Middle East. Saudi Arabia, Bahrain and Sudan had broken off diplomatic ties with Iran.

Kuwait said that it would recall its ambassador from Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0. Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

February futures for gold on the COMEX today rose to 1081.50 dollars per ounce.

-

10:49

The People’s Bank of China adds 130 billion yuan to the financial system

The People's Bank of China today added 130 billion yuan to the financial system. The central bank offered seven-day reverse repos at an interest rate of 2.25%. It was the biggest injection since September 2015.

-

09:11

Cleveland Fed President Loretta Mester: it was the right decision to start raising interest rates in December

Cleveland Fed President Loretta Mester said on Sunday that it was the right decision to start raising interest rates in December.

"I fully supported the FOMC's December action: Based on the economic outlook, I thought it was prudent to take the first step on the path of gradual normalization of interest rates," she said.

Mester pointed out that further interest rate hikes will depend on the incoming economic data.

"The actual path the fed funds rate will follow will depend on the economic outlook as informed by incoming information, but according to the FOMC's current assessment of the outlook, monetary policy is expected to remain accommodative for some time to come, with rates expected to move up only gradually to more normal levels," Cleveland Fed president noted.

"Starting on the gradual normalization path now helps ensure that policy doesn't lag too far behind the economy," she added.

-

06:39

Oil prices climbed

West Texas Intermediate futures for February delivery climbed to $36.89 (+0.35%), while Brent crude advanced to $37.35 (+0.35%). Price increases continued to be driven by tensions between two major oil producers Saudi Arabia and Iran. However the global supply glut remained in place keeping lid on gains. In fact, some analysts believe that the conflict will only intensify the oversupply issue as now Saudi Arabia and Iran are even less likely to co-operate in order to support oil prices. Meanwhile Iran is preparing to raise supplies.

-

06:03

Gold extended gains

Gold climbed to $1,077.80 (+0.24%) amid demand for safe-haven assets, which rose after Saudi Arabia cut diplomatic relations with Iran on Sunday in response to an attack of its embassy in Tehran. On Monday Bahrain cut its diplomatic ties with Iran. A selloff in stocks supported bullion too.

Investors traditionally turn to gold at times of crisis and geopolitical tensions, but such gains are normally short-lived. Fundamentals remained unchanged: the dollar is expected to be strong on higher rates, which are expected to grow further in 2016.

-

00:04

Commodities. Daily history for Jan 4’2016:

(raw materials / closing price /% change)

Oil 36.88 +0.33%

Gold 1,073.90 -0.12%

-