Notícias do Mercado

-

16:41

Oil: an overview of the market situation

Oil futures rose today, restoring previously lost ground, as the data on the US labor market, reported an increase in employment of more than 200 million, improved the prospects of demand for fuel. Nevertheless, by the end of this week the price is still showing a negative trend.

Restrain the growth of yesterday's statements by the President of the European Central Bank, Mario Draghi, who noted that in a short time the bank will purchase the securities, and pointed to the implementation of innovative measures to support in the future.

Market participants are also watching developments in Libya, as local officials said they hope to soon resume work on the south field El Shararah after the country resolve the conflict between the local tribes after the attack militants who on Wednesday closed the place of production .

"The direction of the market will depend on the decision of OPEC production at a meeting on November 27. Chance of production cuts of 30-40%, "- said the director of the analysis of commodity markets, Societe Generale Singapore Mark Keenan. Add OPEC predicts the decline of its share of the global oil market by 5% by 2018 due to rapid growth of shale oil in the US. The Secretary General of the cartel, Abdullah al-Badri expressed confidence that prices will rise in the coming year.

Meanwhile, experts The Wall Street Journal citing representatives of the organization said that OPEC is likely to take action to stop the decline in oil prices, as soon as its price drops to $ 70 per barrel. Some members of OPEC, which was composed of 12 members met informally this week, ahead of a full meeting of the organization on November 27. This meeting took place against the backdrop of the severe decline in oil prices, at least for four years. Prices have fallen by more than 25% compared with summer rates, which leads to conversations that OPEC countries agreed to reduce the production ceiling to support prices. Especially because some of the group members are growing concerns about a possible attack on their budget.

The cost of December futures on US light crude oil WTI (Light Sweet Crude Oil) rose to $ 78.85 a barrel on the New York Mercantile Exchange (NYMEX).

December futures price for North Sea petroleum mix of mark Brent rose $ 0.81 to $ 83.59 a barrel on the London exchange ICE Futures Europe.

-

16:20

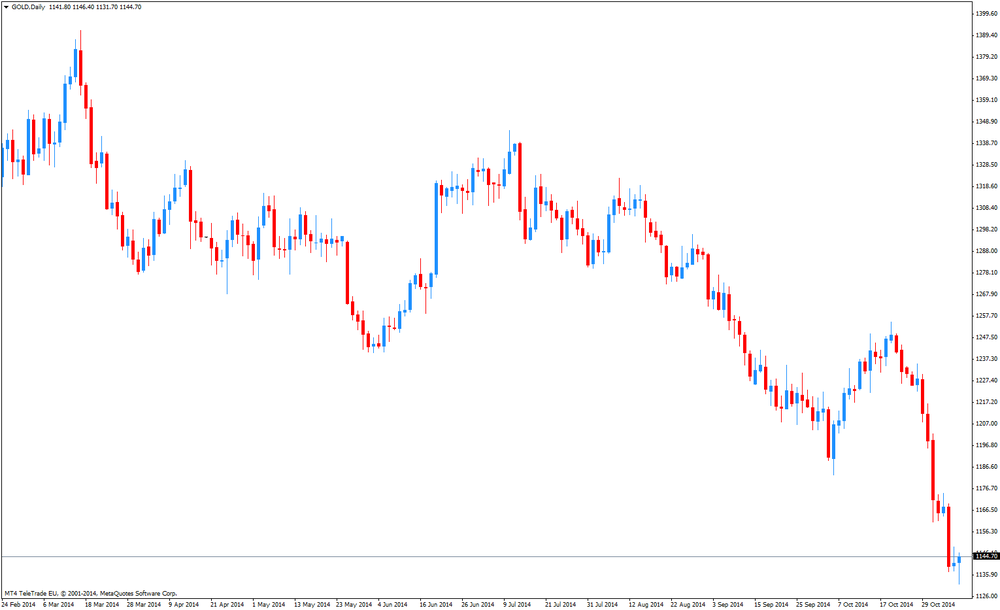

Gold: an overview of the market situation

Gold prices rose more than 1 percent, departing from the 4.5-year low, which was associated with the release of weak data on the US labor market.

As previously reported, a number of US non-farm payrolls rose moderately in October, but the unemployment rate fell and wages rose, a sign of the strengthening of the labor market. Non-agricultural employment increased from a seasonally adjusted 214,000 last month. Since the beginning of the year, employers added more than 220 000 employees on average each month, it is the pace, which in the past has always maintained almost ten years ago. The revised data showed that in the previous two months, the economy has added more than 31,000 jobs than previously estimated. Employers added 256,000 jobs in September compared with the original estimate of 248,000. August reading was revised up to 203,000 from the previously announced 180 000. The unemployment rate, obtained from a separate household survey, fell to 5.8% last month. This is the lowest level since 2008. Economists had expected employment to increase by 229 000 in October, and the unemployment rate will remain at 5.9%.

It is worth emphasizing the price of gold under strong selling pressure in recent weeks amid speculation that the first time in eight years, the Federal Reserve closer to raising interest rates after the last month of its bond-buying program, also known as quantitative easing.

Meanwhile, the data showed the world's largest reserves of the gold-traded exchange-traded fund SPDR Gold Trust on Thursday fell by 0.41 percent - up to 732.83 tons, which is a six-year low.

Analysts also note the weak demand for gold in China, where demand for gold jewelry, bars and coins usually increases with a decrease in prices, but this time it did not. On the Shanghai Gold Exchange in the precious metal is trading Friday on $ 1-2 per ounce more global benchmark, whereas before, the margin reached $ 50.

According to experts, in the near future on the precious metals market conditions do not improve. Now, most central banks have developed measures to stimulate the economy, so to bind to gold assets is no reason. The price of gold is estimated to be around in the near future to around $ 1,100. Experts Goldman Sachs, meanwhile, noted that the precious metal may go down in value and up to $ 1050 per ounce.

The cost of December gold futures on the COMEX today rose to 1162.00 dollars per ounce.

-

11:41

Oil prices rose moderately

Oil prices rose moderately during today's trading after being under further pressure on Thursday due to concerns about supply disruptions in Libya after the seizure of Libya's El Sharara field by armed militia and a damaged pipeline in Saudi Arabia.

Prizes declined this week after Saudi Arabia's announcement to cut official prices for oil destined to the U.S. markets and signs that global supply will stay ahead of demand in the time to come and due to the U.S. shale boom.

"We don't see that much of change in fundamentals. The decline is 28 percent, it's a little bit too much.", OPEC Secretary-General Abdullah al-Badri said on Thursday further stating that the price drop cannot continue as it's threatening investment in production.

Brent Crude, set for a seventh week of consecutive price drops, is currently trading +0.18% at USD83.01, WTI Crude +0.35% at USD78.18.

-

10:58

Gold with new low but with an intraday recovery

Gold, set to fall a third consecutive week, was able to recover from early market losses to 4 ½ year lows at USD1,131.70 in the wake of U.S. non-farm payrolls and a stronger U.S. dollar. If payrolls fail to fuel optimism in the world's largest economy a rally could be triggered after the losses earlier this week. Gold has been bearish for the whole week after breaking the important support at USD1,180.00 last Friday.

GOLD recovered from new low at USD1,131.70 currently trading at USD1,144.70

-

09:29

Press Review: Dollar set for biggest weekly gain in 16 months before U.S. payrolls

REUTERS

U.S. regulators to join UK in forex fines for banks

U.S. regulators plan to join their UK peers in a multi-billion-dollar settlement with a group of the biggest global banks accused of manipulating the foreign exchange market, sources familiar with the matter said, adding the deal could come as early as next week.

Source: http://www.reuters.com/article/2014/11/07/forex-manipulation-fines-idUSL1N0SX02M20141107

BLOOMBERG

Dollar Set for Biggest Weekly Gain in 16 Months Before Payrolls

A gauge of the dollar headed for its biggest weekly gain in more than 16 months before a U.S. government report forecast to show employers added more jobs in October than this year's average.

The U.S. currency approached a seven-year high against the yen set yesterday after Bank of JapanGovernor Haruhiko Kuroda said this week the central bank will maintain stimulus as long as needed. The euro was poised for a third weekly decline after European Central Bank President Mario Draghi deepened his commitment to stimulus yesterday.

REUTERS

SNB forex reserves down in October

The Swiss National Bank's foreign exchange reserves fell in October, data showed on Friday.

The SNB held 460.427 billion Swiss francs in foreign currency at the end of October, compared with 462.117 billion francs in September, revised from an originally reported 462.194 billion francs, preliminary data calculated according to the standards of the International Monetary Fund showed.

Source: http://www.reuters.com/article/2014/11/07/swiss-snb-forex-idUSL6N0SW4O420141107

REUTERS

OPEC concerned, not panicking about oil price: Badri

Fundamental factors do not justify the sharp drop in oil prices, OPEC Secretary-General Abdullah al-Badri said on Thursday, forecasting a price rebound by the second half of 2015.

"We are concerned but we are not panicking," he told reporters at a news conference on the group's 2014 World Oil Outlook.

Source: http://www.reuters.com/article/2014/11/06/us-opec-oil-badri-idUSKBN0IQ1QR20141106

-