Notícias do Mercado

-

16:47

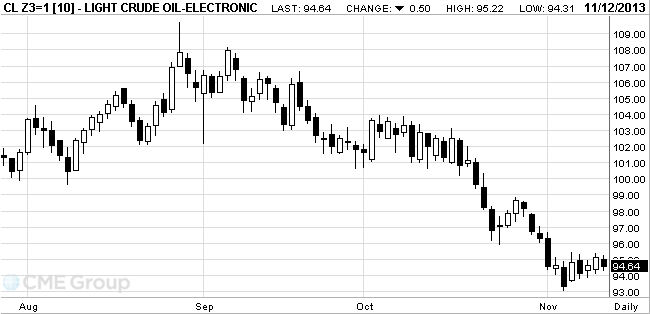

Oil fell

West Texas Intermediate fell for the first time in three days amid forecasts that U.S. crude inventories rose to the most since June.

Prices dropped as much as 0.9 percent as stockpiles in the world’s biggest oil-consuming country climbed for an eighth week. Inventories added 650,000 barrels through Nov. 8, according to a Bloomberg survey before an Energy Information Administration report on Nov. 14. The U.S. will become the largest oil producer by 2015, the International Energy Agency said today. Gasoline prices advanced for a third day.

WTI for December delivery dropped 60 cents, or 0.6 percent, to $94.54 a barrel at 11:08 a.m. on the New York Mercantile Exchange. It advanced to $95.14 yesterday, the highest settlement since Oct. 31. The volume of all futures traded was 12 percent below the 100-day average.

Brent for December settlement rose 30 cents, or 0.3 percent, to $106.70 a barrel on the London-based ICE Futures Europe exchange. The volume was 18 percent above the 100-day average. The European benchmark crude’s premium over WTI widened to $12.16 from $11.26 yesterday.

-

16:23

Gold continues to become cheaper

The price of gold fell to 3.5 -week low below $ 1,290 an ounce, as investors are uncertain in timing reduce the incentives the Fed , and physical demand is not high enough .

Gold fell nearly 3 percent in the last three sessions , as the high levels of employment in the U.S. increased concerns that the Fed will soon start buying bonds to reduce the amount to $ 85 billion a month.

If prices fall below $ 1,300 does not help attract buyers in the physical market in Asia , as they are waiting for further decline. According to dealers , the buyers return to the market if the price is closer to $ 1,200 .

Bank BNP Paribas raised its gold price forecast to $ 1,415 an ounce by the end of this year , but lowered the forecast average price in 2014 to $ 1,095 .

The cost of the December gold futures on COMEX today dropped to $ 1274.00 per ounce.

-

06:23

Commodities. Daily history for Nov 11’2013:

GOLD 1,283.00 -1.60 -0.12%

OIL (WTI) 95.08 0.48 0.51%

-