Notícias do Mercado

-

23:31

Commodities. Daily history for Feb 19’2014:

Gold $1,311.7 -6.60 -0.50%ICE Brent Crude Oil $110.42 -0.04 -0.04%

NYMEX Crude Oil $103.45 +0.62 +0.62%

-

16:40

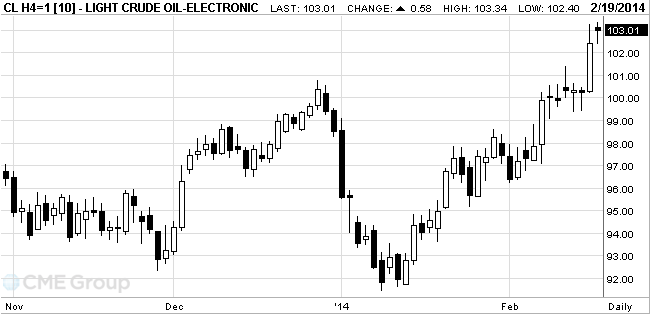

Oil prices fluctuate

The cost of WTI crude oil is kept at close to $ 103 level on the background of continuing severe weather conditions in the United States .

Extremely cold weather in the U.S. boosts demand for heating oil , which in turn increases the price of WTI, which serves as a raw material.

Extreme cold, observed in most of the U.S. this winter, led to a sharp rise in demand and prices for fuels such as natural gas or fuel oil. Stocks of distillates , including heating oil , are 22% below average levels for this time of year . Published on Tuesday revised forecasts indicate that next week in the United States resumed heavy frosts , whereas previously predicted steady warming.

Later investors awaited the publication of a number of important market data from the U.S. and China. So , later on Wednesday the American Petroleum Institute will present data on the dynamics of the weekly wholesale inventories of raw materials in the United States . Distillate stocks in the country is forecast down 1.8 million barrels .

Analysts also believe that oil stocks at Cushing ( the largest terminal in the U.S.) for the week ended February 20 fell by 1.4 million barrels .

In addition, the dynamics of trade can affect publication of the minutes of the last meeting of the U.S. Federal Reserve , as well as data on the index of business activity in the manufacturing sector in China , calculated by the bank HSBC, in February.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) traded in the range $ 102.40 - $ 103.34 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture rose 21 cents to $ 110.67 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold fell

Gold prices retreated on Tuesday marked maximum 3.5 months on profit and reduce purchases in the physical market .

Margins on gold bars in Hong Kong are held at $ 1.30-1.70 to the spot price in London. Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Friday fell by 0.63 percent , while the stocks of the largest secured silver fund iShares Silver Trust - 0.59 percent.

Gold demand fell 15 percent in 2013 , as a massive outflow of funds from the ETF- funds outweighed record demand in the consumer market , said the World Gold Council .

Investors are waiting for the January meeting, the Fed report , which will be published today at 19:00 GMT. Demand for precious metals waned on expectations that within the current protocol will still make the Fed 's commitment to reduce the current $ 65 -billion program of monthly purchases of assets. However, investors will also seek out hints of willingness by the Central Bank to " take your foot off the brake pedal " in case of deterioration in the labor market or the economy as a whole.

This year gold has risen in price by 9.5 % on purchases due to the volatility of emerging markets and concern the U.S. economic recovery process .

The cost of the April gold futures on the COMEX today from bottom up to $ 1314.20 per ounce.

-