Notícias do Mercado

-

16:41

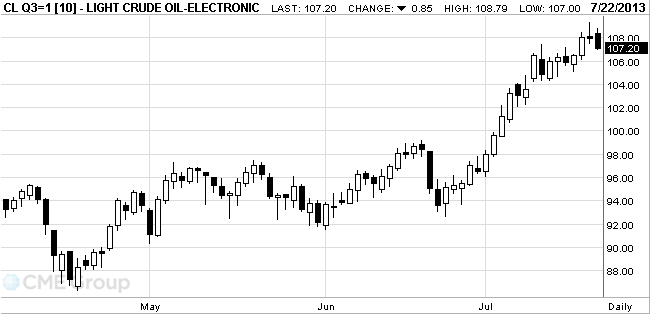

Oil fell from a 16-month high

West Texas Intermediate fell from a 16-month high as weaker-than expected existing home sales and company earnings raised concern that U.S. growth will stall.

WTI for August delivery, which expires today, slid 80 cents, or 0.7 percent, to $107.25 a barrel at 10:43 a.m. on the New York Mercantile Exchange. The volume of all futures traded was about 16 percent below the 100-day average for the time of day The contract settled at $108.05 on July 19, the highest closing price since March 2012. The more actively traded September futures were down 65 cents at $107.22.

Brent for September settlement decreased 32 cents, or 0.3 percent, to $107.75 a barrel on the London-based ICE Futures Europe exchange. Volume was 32 percent below 100-day average. The European benchmark grade’s premium to WTI widened to as much as 79 cents.

-

16:21

Gold rose to a month high

Gold prices rose to a month high due to technical buying after the decline of the dollar.

The dollar continues to decline after the data on sales of existing homes. Fed Chairman Bernanke's speech last week contained a reference to the housing market as the main reason for the reduction is expected to start stimulating the economy. Therefore, an unexpected drop in June, the pace of home sales in the secondary market support the feeling that the reduction in the Fed's stimulus may not start as fast as expected in the markets.

Sales in the secondary market in June fell, but remained at a level consistent with a strong housing market. Meanwhile, prices continued to rise, as stocks remained low. This is evidenced by a report published on Monday by the National Association of Realtors (NAR). It reported sales of existing homes in June fell by 1.2% compared to the previous month and adjusted for seasonal variations were 5.08 million homes for a year. However, it is the second highest level of sales since November 2009. May's value, which was revised a slight decrease, to 5.14 houses per year with 5.18 homes per year - the highest level since November 2009. Compared with the same period of the previous year, sales in June rose by 15.2%.

Buyers in the physical market a little bit, but dealers in Hong Kong reported a decrease in supply of gold bars and coins after the price drop to near three-year low of $ 1.180 at the end of June. Prices in Shanghai for about $ 22 per ounce above the spot price.

The cost of the August gold futures on COMEX today rose to a high of $ 1328.60 an ounce.

-