Notícias do Mercado

-

20:00

Dow -19.49 16,724.14 -0.12% Nasdaq -5.93 4,231.27 -0.14% S&P -1.28 1,923.69 -0.07%

-

17:07

European stocks close: stocks traded lower due to the weaker-than-expected inflation data in the Eurozone

Stock indices declined due to the weaker-than-expected inflation data in the Eurozone and increasing expectations for further stimulus measures by the European Central Bank (ECB). Eurozone’s inflation increased 0.5% in May, after a 0.7% gain in March. Analysts had expected a 0.7% rise. Inflation target by the European Central Bank (ECB) is 2%.

Investors are awaiting the ECB will cut interest rates and announce measures to boost lending to smaller businesses.

The unemployment rate in the Eurozone fell to 11.7% in April from 11.8% in March. Analysts had expected the unemployment rate remains unchanged.

The number of unemployed people in Spain decreased by 111,900 in May, after a 111,600 decline in April. Analysts had forecasted a 112,300 drop.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,836.30 -27.80 -0.41%

DAX 9,919.74 -30.38 -0.31%

CAC 40 4,503.69 -12.20 -0.27%

-

17:00

European stock close: FTSE 100 6,831.48 -32.62 -0.48% CAC 40 4,504.12 -11.77 -0.26% DAX 9,920.76 -29.36 -0.30%

-

14:56

-

14:43

U.S. Stocks open: Dow 16,691.17 -52.46 -0.31%, Nasdaq 4,226.20 -11.00 -0.26%, S&P 1,921.70 -3.27 -0.17%

-

14:27

Before the bell: S&P futures +0.01%, Nasdaq futures -0.28%

U.S. stock-index futures are mixed as investors awaited data to gauge the strength of the recovery in the world’s biggest economy.

Global markets:

Nikkei 15,034.25 +98.33 +0.66%

Hang Seng 23,291.04 +209.39 +0.91%

Shanghai Composite 2,038.31 -0.91 -0.04%

FTSE 6,818.12 -45.98 -0.67%

CAC 4,501.59 -14.30 -0.32%

DAX 9,907.33 -42.79 -0.43%

Crude oil $102.51 (+0.04%)

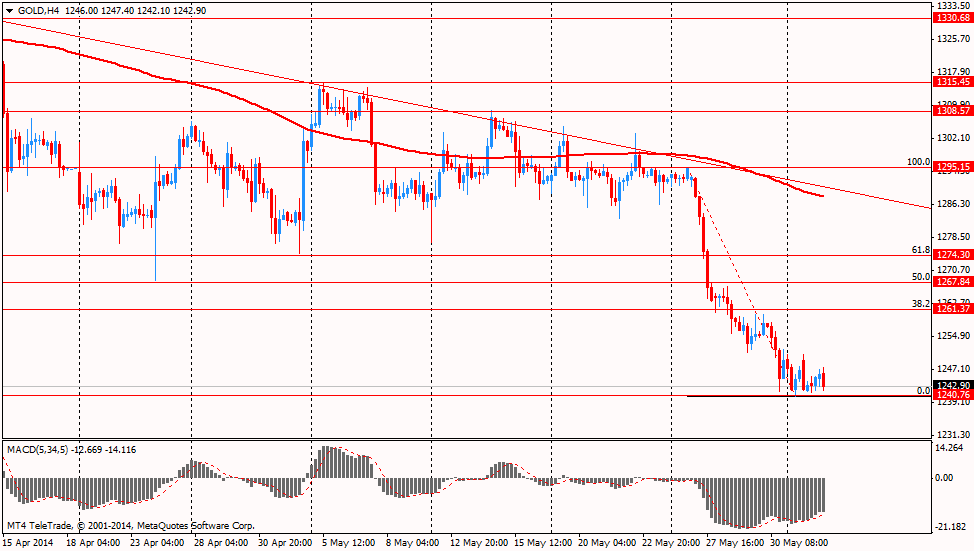

Gold $1245.20 (+0.09%)

-

14:11

DOW components before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

76.90

+0.23%

0.6K

United Technologies Corp

UTX

117.68

+0.24%

4.0K

Travelers Companies Inc

TRV

94.38

+0.71%

0.1K

Chevron Corp

CVX

122.21

0.00%

0.1K

Home Depot Inc

HD

80.37

0.00%

0.1K

Pfizer Inc

PFE

29.70

-0.03%

0.7K

Walt Disney Co

DIS

84.23

-0.05%

0.1K

Boeing Co

BA

135.78

-0.09%

0.1K

International Business Machines Co...

IBM

185.45

-0.13%

0.5K

Microsoft Corp

MSFT

40.71

-0.20%

1.6K

3M Co

MMM

142.00

-0.22%

0.1K

Exxon Mobil Corp

XOM

99.71

-0.23%

1.0K

Merck & Co Inc

MRK

57.79

-0.24%

1.2K

The Coca-Cola Co

KO

40.76

-0.24%

2.3K

Procter & Gamble Co

PG

80.16

-0.25%

2.8K

Johnson & Johnson

JNJ

101.90

-0.26%

0.9K

Goldman Sachs

GS

159.60

-0.27%

1.4K

JPMorgan Chase and Co

JPM

55.15

-0.36%

0.1K

Intel Corp

INTC

27.16

-0.37%

1.2K

Verizon Communications Inc

VZ

49.85

-0.40%

42.9K

General Electric Co

GE

26.72

-0.41%

11.6K

Cisco Systems Inc

CSCO

24.67

-0.44%

0.1K

AT&T Inc

T

35.25

-0.54%

227.7K

Caterpillar Inc

CAT

103.15

-0.59%

0.8K

-

13:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised from $660 to $710 at Canaccord Genuity

-

12:04

European stock markets mid session: stocks declined due to the weaker-than-expected inflation data in the Eurozone

Stock indices declined due to the weaker-than-expected inflation data in the Eurozone. Eurozone’s inflation increased 0.5% in May, after a 0.7% gain in March. Analysts had expected a 0.7% rise. Inflation target by the European Central Bank (ECB) is 2%.

Market participants expect the European Central Bank will add further stimulus measures on Thursday. Investors are awaiting the ECB will cut interest rates and announce measures to boost lending to smaller businesses.

The unemployment rate in the Eurozone fell to 11.7% in April from 11.8% in March. Analysts had expected the unemployment rate remains unchanged.

The number of unemployed people in Spain decreased by 111,900 in May, after a 111,600 decline in April. Analysts had forecasted a 112,300 drop.

Current figures:

Name Price Change Change %

FTSE 100 6,831.72 -32.38 -0.47%

DAX 9,925.00 -25.12 -0.25%

CAC 40 4,509.94 -5.95 -0.13%

-

10:53

Asian Stocks close: most stocks increased due to weaker yen and economic data from China

Most Asian stock indices increased due to weaker yen and economic data from China. The Japanese stock index Nikkei was supported by the weaker yen. The stock indices in China were supported by Chinese economic data.

China’s final HSBC manufacturing purchasing managers’ index increased to 49.4 in May from 48.1 in April, missing expectation of a gain to 49.7.

Chinese non-manufacturing purchasing managers’ index climbed to 55.5 in May from 54.8 in April. That was the highest figure since November 2013.

Indexes on the close:

Nikkei 225 15,034.25 +98.33 +0.66%

Hang Seng 23,291.04 +209.39 +0.91%

Shanghai Composite 2,038.31 -0.91 -0.04%

-

08:42

FTSE 100 6,850.72 -13.38 -0.19%, CAC 40 4,508.6 -7.29 -0.16%, Xetra DAX 9,941.6 -8.52 -0.09%

-

06:40

Another early uptick seen for the European bourses Tuesday: the FTSE, DAX and CAC are 0.2/0.4% higher.

-

00:25

Stocks. Daily history for June 02’2014:

(index / closing price / change items /% change)Nikkei 14,935.92 +303.54 +2.07%

Hang Seng 23,081.65 +71.51 +0.31%

Shanghai Composite 2,039.21 -1.38 -0.07%

S&P 1,924.97 +1.40 +0.07%

NASDAQ 4,237.2 -5.42 -0.13%

Dow 16,743.63 +26.46 +0.16%

FTSE 1,380.46 +3.00 +0.22%

CAC 4,515.89 -3.68 -0.08%

DAX 9,950.12 +6.85 +0.07%

-