Market news

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0450 (EUR 2.38bln) 1.0500 (1.41bln) 1.0550 (1.86bln) 1.0600 (2.83bln) 1.0650 (2.23bln) 1.0700 (2.3bln) 1.0800 (1.48bln)

USDJPY 110.00 (USD 1.09bln) 111.50 (1.16bln) 111.75 500m) 112.00 (411m) 112.50 (1.6bln) 113.00-05 (422m) 115.00 (420m)

GBPUSD 1.2450 (GBP 531m) 1.2500 (788m) 1.2700 (497m)

AUDUSD 0.7320 (AUD 943m) 0.7425 (337m)

NZDUSD 0.7050 (NZD 834m)

USDCAD 1.3375-80 (USD 472m) 1.3500 (932m) 1.3600 (786m)

AUDNZD 1.0500 (AUD 1.15bln)

-

13:44

Labour productivity of Canadian businesses rose in the third quarter

Labour productivity of Canadian businesses rose 1.2% in the third quarter, after declining 0.2% in the second quarter.

Although this was the highest rate of growth since the second quarter of 2014 (+1.9%), the increase in productivity reflects a rebound in business output following a decline in the second quarter. Hours worked continued to decrease, but at a slower pace than in the previous quarter.

After decreasing 0.7% in the second quarter, real gross domestic product (GDP) of businesses rose 1.0% in the third quarter. Goods-producing businesses contributed the most to the gain, as mining and oil and gas extraction and manufacturing activities increased. In the second quarter, output was disrupted by the forest fires in northern Alberta and scheduled maintenance shutdowns in the oil and gas extraction industry.

-

13:41

Canadian employment beats expectations. USD/CAD tests major support at 1.3250

After two consecutive months of notable increases, employment was little changed in November (+11,000 or +0.1%). With fewer people searching for work, the unemployment rate fell by 0.2 percentage points to 6.8%.

Compared with November 2015, overall employment rose by 183,000 (+1.0%), with the number of people working part time increasing by 214,000 (+6.4%). Over the same period, the total number of hours worked was up 1.1%.

More people were employed in the finance, insurance, real estate and leasing industry, in information, culture and recreation, in the "other services" industry and in agriculture. On the other hand, declines were observed in construction, in manufacturing, as well as in transportation and warehousing.

There were fewer self-employed workers in November, while the number of employees was little changed in both the public and private sectors.

-

13:39

US Non Farm Payrolls in line with estimates, poor average hourly earnings limit USD bids

Total nonfarm payroll employment rose by 178,000 in November. Thus far in 2016, employment growth has averaged 180,000 per month, compared with an average monthly increase of 229,000 in 2015. In November, employment gains occurred in professional and business services and in health care.

Employment in professional and business services rose by 63,000 in November and has risen by 571,000 over the year. Over the month, accounting and bookkeeping services added 18,000 jobs. Employment continued to trend up in administrative and support services (+36,000), computer systems design and related services (+5,000), and management and technical consulting services (+4,000).In November, average hourly earnings for all employees on private nonfarm payrolls declined by 3 cents to $25.89, following an 11-cent increase in October. Over the year, average hourly earnings have risen by 2.5 percent. Average hourly earnings of private-sector production and nonsupervisory employees edged up by 2 cents to $21.73 in November.

-

13:36

US unemployment rate declined to 4.6 percent in November

The unemployment rate declined to 4.6 percent in November, and total nonfarm payroll employment increased by 178,000, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in professional and business services and in health care.

The number of unemployed persons declined by 387,000 to 7.4 million. Both measures had shown little movement, on net, from August 2015 through October 2016.Among the major worker groups, the unemployment rate for adult men declined to 4.3 percent in November. The rates for adult women (4.2 percent), teenagers (15.2 percent), Whites (4.2 percent), Blacks (8.1 percent), Asians (3.0 percent), and Hispanics (5.7 percent) showed little or no change over the month.

-

13:30

U.S.: Unemployment Rate, November 4.6% (forecast 4.9%)

-

13:30

U.S.: Nonfarm Payrolls, November 178 (forecast 175)

-

13:30

U.S.: Average hourly earnings , November -0.1% (forecast 0.2%)

-

13:30

Canada: Employment , November 10.7 (forecast -20)

-

13:30

U.S.: Average workweek, November 34.4 (forecast 34.4)

-

13:30

Canada: Labor Productivity, Quarter III 1.2% (forecast 1%)

-

13:30

Canada: Unemployment rate, November 6.8% (forecast 7%)

-

13:09

Some upside risks for NFP as jobless claims dropped to a 43year low says UniCredit

US nonfarm payrolls likely rose another solid 175,000 in November. That is slightly faster than the 161,000 seen in October, but broadly in line with the average seen over the past three months. If anything, the most timely labor market indicator points to some upside risks, as jobless claims dropped to a 43year low in the middle of the month. In addition to very low layoffs, labor demand has remained strong with the number of jobs close to a record high. The jobless rate likely stayed at 4.9%, after declining in October. As the US economy approaches full employment, wage gains continue to rise, while payroll gains slow gradually towards the trend growth rate in the labor force.

-

13:05

BOE's Haldane: The Bank of England shouldn't be hasty about tightening

-

Risk Growth Could Underperform

-

Rise in Inflation Expectations Would Be Unhelpful

-

Comfortable With Stance of Policy

-

Sees Falling Pound Depressing Consumer Spending

-

-

13:00

Orders

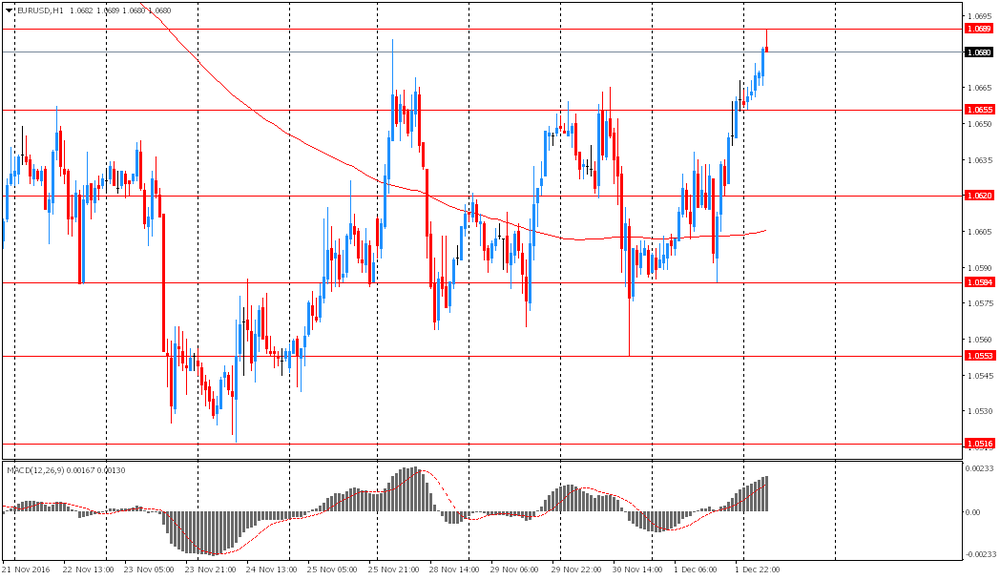

EUR/USD

Offers 1.0685 1.0700 1.0730 1.0745-50 1.0780 1.0800 1.0820 1.0850

Bids 1.0650 1.0630 1.0600 1.0580 1.0550-55 1.0530

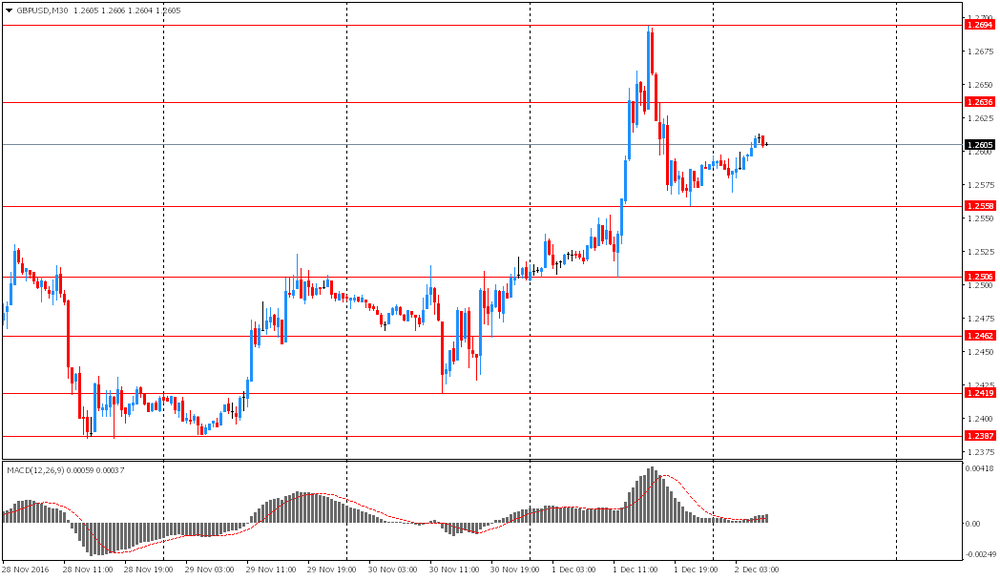

GBP/USD

Offers 1.2635 1.2650 1.2665 1.2680 1.2700 1.2725-30 1.2750 1.2780 1.2800

Bids 1.2600 1.2585 1.2560 1.2520-25 1.2500 1.2475-80 1.2455-60 1.2430 1.2400

EUR/GBP

Offers 0.8465 0.8480-85 0.8500 0.8525-30 0.8560 0.8575-80 0.8600

Bids 0.8420-25 0.8400 0.8370-75 0.8350 0.8330 0.8300

EUR/JPY

Offers 122.00 122.30 122.65-70 123.00 123.50 124.00

Bids 121.50 121.20 121.00 120.85 120.50 102.20 120.00 119.60 119.30 119.00

USD/JPY

Offers 114.20 114.35 114.50 114.80-85 115.00 115.25 115.45-50

Bids 113.80 113.50 113.20 113.00 112.85 112.50 112.20 112.00 111.80 111.50

AUD/USD

Offers 0.7425-30 0.7450 0.7485 0.7500-05 0.7520 0.7545-50

Bids 0.7400 0.7380 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:34

Danske Sees EUR/NOK Up As "Oil Market Is Overreacting" to OPEC

-

11:40

Barclays see asymmetric risks to the USD before NFP

We see asymmetric risks to the USD this week as the employment report takes central stage. A number close to our expectation of 175k or even lower would keep the Fed on track as it is assumed that a deceleration in job creation is normal as the labour market is near full employment. On the other hand, a higher number (closer to 200k) would signal that the momentum is still strong, and that additional stimulus would probably lead the Fed to act faster, accelerating USD trend. We expect the unemployment rate to decline to 4.8% from 4.9%, average hourly earnings to rise 0.2% m/m and 2.8% y/y, and the average workweek to remain unchanged at 34.4 hours.

-

10:34

-

10:09

Euro area industrial producer prices rose mostly due to energy sector

In October 2016, compared with September 2016, industrial producer prices rose by 0.8% in the euro area (EA19) and by 1.0% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In September 2016 prices increased by 0.1% in both zones. In October 2016, compared with October 2015, industrial producer prices fell by 0.4% in the euro area, while it rose by 0.2% in the EU28.

The 0.8% increase in industrial producer prices in total industry in the euro area in October 2016, compared with September 2016, is due to rises of 2.6% in the energy sector, of 0.3% for non-durable consumer goods and of 0.1% for both intermediate goods and durable consumer goods, while prices remained stable for capital goods. Prices in total industry excluding energy rose by 0.1%.

-

10:00

Eurozone: Producer Price Index, MoM , October 0.8% (forecast 0.2%)

-

10:00

Eurozone: Producer Price Index (YoY), October -0.4% (forecast -1%)

-

09:35

November data indicated that the UK construction sector continued to rebound - Markit

November data indicated that the UK construction sector continued to rebound from the weak patch recorded on average during the third quarter of 2016. Business activity and incoming new work increased at the strongest pace since March, although both rates of expansion remained much softer than the peaks achieved at the start of 2014.

Greater workloads underpinned a further solid rise in employment levels and input buying among construction firms.

However, average cost burdens rose sharply, with the rate of inflation the steepest since April 2011.

The seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index picked up slightly to 52.8 in November, from 52.6 in October, thereby signalling an expansion of total business activity for the third month running.

Reports from survey respondents cited improved order books, alongside resilient client confidence and strong demand for residential projects. There were again reports that heightened economic uncertainty was a key factor weighing on output growth across the construction sector.

-

09:30

United Kingdom: PMI Construction, November 52.8 (forecast 52.2)

-

09:01

Nomura: steady US employment activity expected

We forecast that nonfarm payrolls increased by 160k in November, comparable with the gains seen in October. We expect a modest rise of 5k in government payrolls, implying that private payrolls increased by 155k. Incoming data on the labor market, for the most part, imply steady employment activity with limited involuntary layoffs in NovemberWe expect the unemployment rate to decline further to 4.8% in November. On wages, we expect growth in average hourly earnings to slow to 0.1% m-o-m (2.7% y o-y) following a sharp increase of 0.4% m-o-m in the previous month. We think that the prior month's strong wage growth was artificially amplified by inclement weather holding down the average weekly hours worked during the survey reference period. To that end, we think that some payback is warranted in November as conditions returned back to normal.

-

08:58

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0450 (EUR 2.38bln) 1.0500 (1.41bln) 1.0550 (1.86bln) 1.0600 (2.83bln) 1.0650 (2.23bln) 1.0700 (2.3bln) 1.0800 (1.48bln)

USD/JPY 110.00 (USD 1.09bln) 111.50 (1.16bln) 111.75 500m) 112.00 (411m) 112.50 (1.6bln) 113.00-05 (422m) 115.00 (420m)

GBP/USD 1.2450 (GBP 531m) 1.2500 (788m) 1.2700 (497m)

AUD/USD 0.7320 (AUD 943m) 0.7425 (337m)

NZD/USD 0.7050 (NZD 834m)

USD/CAD 1.3375-80 (USD 472m) 1.3500 (932m) 1.3600 (786m)

AUD/NZD 1.0500 (AUD 1.15bln)

Информационно-аналитический отдел TeleTrade

-

08:07

Spanish unemployment rises

The number of unemployed registered in the offices of Public Employment Services has increased in November by 24,841 people in relation to the previous month. In the last 8 years in the same month registered unemployment increased, on average, by 43,219 people In this way, the total number of registered unemployed reaches the figure of 3,789,823 and continues in the lowest levels of the last 7 years.

In seasonally adjusted terms, unemployment rose by 14,543 people in November. With respect to November 2015 unemployment has fallen by 359,475 people. The annual reduction rate of recorded unemployment is 8.66%.

-

08:05

Brexit secretary suggests UK would consider paying for single market access - The Guardian

-

08:02

Today’s events

-

At 16:45 GMT FOMC member Lyell Braynard will deliver a speech

-

At 21:00 GMT FOMC Member Daniel Tarullo will deliver a speech

-

-

07:43

Asian session review: USD weakness across the board

Australian dollar in the early session rose slightly on more positive than expected data on retail sales in Australia. As reported today by the Australian Bureau of Statistics, retail sales rose 0.5% in October, lower than the previous value of 0.6%, but higher than analysts' forecast of 0.3%. Previously, many analysts have expressed concerns about the growth of Australia's GDP in the third quarter, which will be published on December 7.

The US dollar is consolidating in anticipation of today's labor market data. Economists polled by Wall Street Journal, expects NFP at 175,000, and the unemployment rate stable at 4.9%. This report will be the last before the meeting of the Federal Reserve on 13-14 December. At this meeting, a decision with respect to interest rates will be made and it is expected (and probably priced in) that the Fed will raise its key interest rate for the first time for the year amid signs of improvement in the labor market and the continued growth of the economy.

EUR / USD: during the Asian session, the pair rose to $ 1.0690

GBP / USD: during the Asian session, the pair was trading in the $ 1.2570-20 range

USD / JPY: fell to Y113.60

-

07:33

Options levels on friday, December 2, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0932 (3503)

$1.0856 (4937)

$1.0793 (2938)

Price at time of writing this review: $1.0674

Support levels (open interest**, contracts):

$1.0597 (3329)

$1.0560 (2997)

$1.0509 (5172)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 87162 contracts, with the maximum number of contracts with strike price $1,1400 (6421);

- Overall open interest on the PUT options with the expiration date December, 9 is 72053 contracts, with the maximum number of contracts with strike price $1,0500 (6359);

- The ratio of PUT/CALL was 0.83 versus 0.82 from the previous trading day according to data from December, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.2901 (575)

$1.2802 (1181)

$1.2704 (1832)

Price at time of writing this review: $1.2633

Support levels (open interest**, contracts):

$1.2591 (1168)

$1.2495 (2487)

$1.2397 (1572)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35672 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 34792 contracts, with the maximum number of contracts with strike price $1,1750 (2539);

- The ratio of PUT/CALL was 0.98 versus 1.00 from the previous trading day according to data from December, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:20

Bank of America Merrill expects NFP at 170K

Recent labor market data has continued to show solid improvement. We expect the trend to continue in November with 170,000 in nonfarm payroll growth, a slight deceleration from the 176,000 average over the prior three months. We expect 165,000 in private payroll growth, with a modest 5,000 expansion in government payrolls.

We expect the labor force participation rate to remain at 62.8% and the unemployment rate to also remain unchanged at 4.9%. We expect a softer 0.2% mom gain in average hourly earnings after the strong 0.4% mom pop last month, leaving the year-over-year rate at 2.8%.

This shows continued improvement in wage growth, but still a less-thanhealthy 3%-4% pace of growth. Remember that the strong gain in average hourly earnings last month was concentrated in three categories: mining, utilities and information technology. We think that there is propensity for a modest reversal given the magnitude of the increase in all three. There are some risks of a weaker print and/or a downward revision to September wage growth. We expect average weekly hours to remain unchanged at 34.4.

-

07:17

USD / RUR recovers losses

USD / RUR fell sharply at the opening of trading to around 62.80, however, soon recovered and is now trading around 63.04. The pair is currently committed to the nearest resistance that is 63.19 (1 December high).

-

07:15

Reuters: The Reserve Bank of Australia will keep policy unchanged

According to a survey conducted by Reuters, the Reserve Bank of Australia will keep interest rates at a record low 1.5% on 6 December. 17 of 29 respondents forecast a loose RBA policy by mid-2017. 20 predict a rate hike in the 1st quarter of 2018.

-

07:13

U.S. Jobs Report in focus. EUR/USD up for the week, USD/JPY in distribution phase?

-

07:09

French President Francois Hollande will not run for another term in May

The current French President Francois Hollande announced his intention not to run for another term. This was seen as an unexpected solution for market participants, which enhances the risk of uncertainty on the European political scene, and the markets in general.

-

07:07

Australian retail sales rose more than expected in October

Australian retail turnover rose 0.5 per cent in October 2016, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a 0.6 per cent rise in September 2016.

In seasonally adjusted terms, there were rises in food retailing (0.6 per cent), household goods retailing (0.7 per cent), other retailing (0.8 per cent) and cafes, restaurants and takeaway food services (0.4 per cent). There were falls in clothing, footwear and personal accessory retailing (-0.4 per cent) and department stores (-0.4 per cent) in October 2016.

-

07:04

Swiss GDP flat in Q3

Switzerland's real gross domestic product (GDP) has remained almost unchanged in the 3rd quarter of 2016 (+0.0%).* Consumption has contributed very little to growth. Investment in construction and equipment has supported GDP growth, while the trade balance in goods and services had a negative effect.

On the production side, the growth of value added has been below its historical mean in most sectors, with trade as well as health and social work activities having a negative impact. Manufacturing and the accommodation and food service industry have made positive contributions. Real GDP has grown by 1.3% in comparison to the 3rd quarter of 2015.

-

06:45

Switzerland: Gross Domestic Product (QoQ) , Quarter III 0.0% (forecast 0.3%)

-

06:45

Switzerland: Gross Domestic Product (YoY), Quarter III 1.3% (forecast 1.8%)

-

00:30

Australia: Retail Sales, M/M, October 0.5% (forecast 0.3%)

-