Market news

-

20:00

DJIA 19156.71 -35.22 -0.18%, NASDAQ 5252.33 1.22 0.02%, S&P 500 2189.98 -1.10 -0.05%

-

17:26

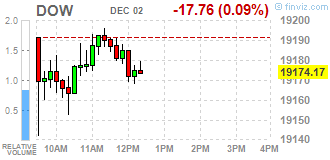

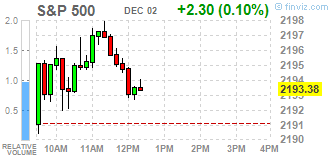

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed. Industrial and banks stocks have been the biggest gainers of a post-election rally as investors expect these sectors to benefit the most from President-elect Donald Trump's policies. U.S. employers boosted hiring in November and the unemployment rate dropped to a more than nine-year low of 4.6 percent, making it almost certain that the Federal Reserve will raise interest rates later this month. Nonfarm payrolls increased by 178,000 jobs last month after increasing by 142,000 in October, the Labor Department said on Friday.

Most of Dow stocks in positive area (19 of 30). Top gainer - Merck & Co., Inc. (MRK, +1.04%). Top loser - The Goldman Sachs Group, Inc. (GS, -1.93%).

Most S&P sectors also in positive area. Top gainer - Healthcare (+1.1%). Top loser - Conglomerates (-0.5%).

At the moment:

Dow 19165.00 -32.00 -0.17%

S&P 500 2192.00 0.00 0.00%

Nasdaq 100 4742.25 +5.75 +0.12%

Oil 51.37 +0.31 +0.61%

Gold 1178.40 +9.00 +0.77%

U.S. 10yr 2.36 -0.06

-

17:00

European stocks closed: FTSE 6730.72 -22.21 -0.33%, DAX 10513.35 -20.70 -0.20%, CAC 4528.82 -31.79 -0.70%

-

16:30

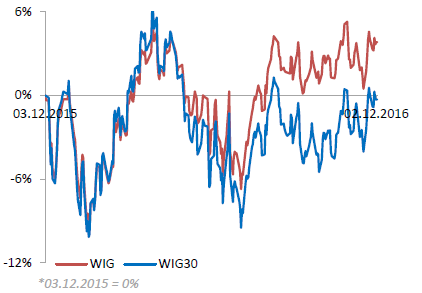

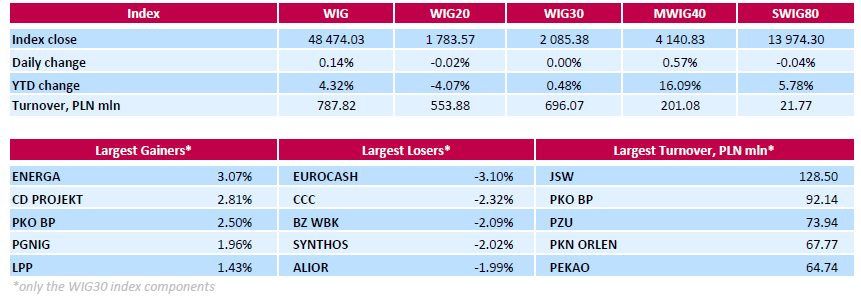

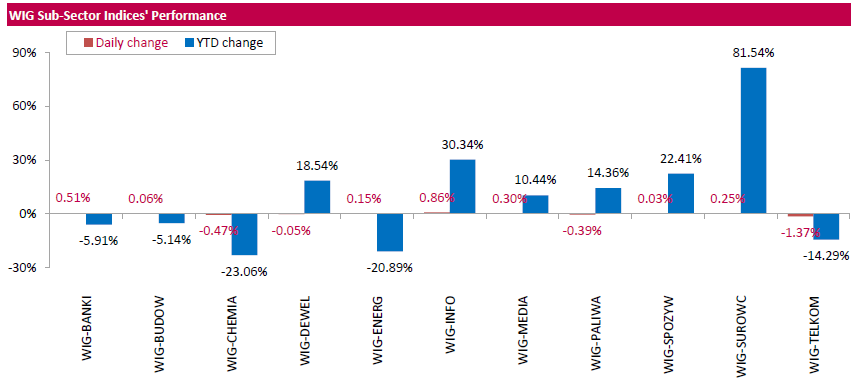

WSE: Session Results

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.14%. Sector performance within the WIG Index was mixed. Informational technology (+0.86%) outperformed, while telecoms (-1.37%) lagged behind.

The large-cap WIG30 Index was unchanged. Within the index components, genco ENERGA (WSE: ENG) was the best-performing name, climbing by 3.07%. It was followed by videogame developer CD PROJEKT (WSE: CDR), bank PKO BP (WSE: PKO), oil and gas producer PGNIG (WSE: PGN) and clothing retailer LPP (WSE: LPP), advancing 1.43%-2.81%. On the other side of the ledger, FMCG-wholesaler EUROCASH (WSE: EUR) and footwear retailer CCC (WSE: CCC) fell the most, down 3.1% and 2.32% respectively. Among other noticeable underperformers were chemical producer SYNTHOS (WSE: SNS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and two banking names ALIOR (WSE: ALR) and BZ WBK (WSE: BZW), which retreated by 1.9%-2.09%.

-

14:38

WSE: After start on Wall Street

The afternoon data from the US labor market were consistent with expectations but disappointed investors who expect fireworks. Quiet market expectations, however, were higher than read 178 thousand. The data should not change market expectations against the December price of the loan increase, but will not be an element that eventually convince the market that the Fed will raise rates in mid-December.

The beginning of trading on Wall Street took place at neutral level, what was already heralded by previous behavior of futures on the US indices. Our the WIG20 index also does not leave today's volatility level and after entering the game by Americans was at the level of 1,784 points (+0,00%).

-

14:34

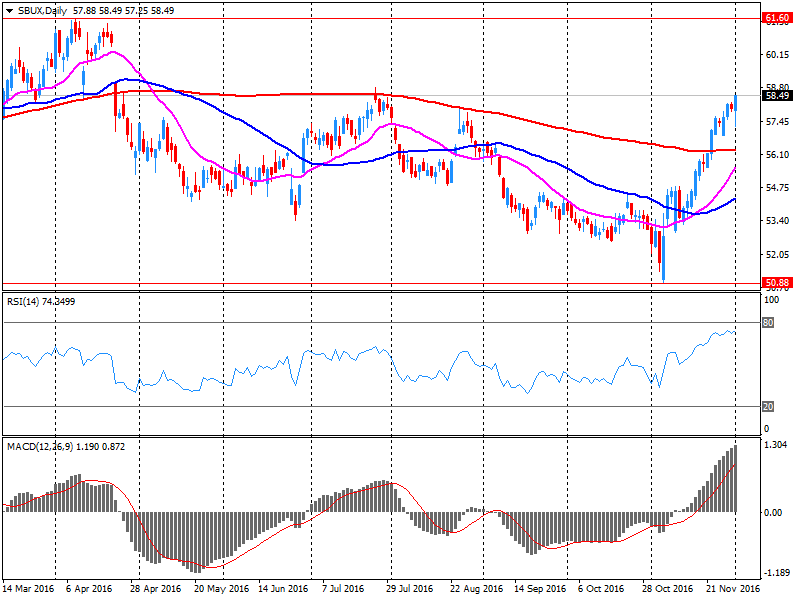

Starbucks CEO (SBUX) Howard Schultz to leave in April

Starbucks, confirmed the information that CEO Howard Schultz will leave on April 3, 2017. According to the report, Mr. Schultz will be appointed Chairman of the Board of Directors and will focus on innovation, design and Starbucks Reserve Roasteries development around the world, expanding the format of the retailer and the company's social initiatives.

SBUX shares fell in premarket trading to $ 56.85 (-2.84%).

-

14:33

U.S. Stocks open: Dow -0.11%, Nasdaq -0.08%, S&P 0.00%

-

14:12

Before the bell: S&P futures -0.19%, NASDAQ futures -0.25%

U.S. stock-index futures slipped after the latest jobs report delivered a mixed picture on the strength of the labor market as investors assess the Federal Reserve's plans to raise interest rates..

Global Stocks:

Nikkei 18,426.08 -87.04 -0.47%

Hang Seng 22,564.82 -313.41 -1.37%

Shanghai 3,244.48 -28.83 -0.88%

FTSE 6,699.25 -53.68 -0.79%

CAC 4,505.44 -55.17 -1.21%

DAX 10,449.58 -84.47 -0.80%

Crude $50.75 (-0.61%)

Gold $1,174.30 (+0.42%)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

28.78

-0.10(-0.3463%)

2389

ALTRIA GROUP INC.

MO

62.8

-0.09(-0.1431%)

1608

Amazon.com Inc., NASDAQ

AMZN

743

-0.65(-0.0874%)

8739

Apple Inc.

AAPL

109.3

-0.19(-0.1735%)

48491

Barrick Gold Corporation, NYSE

ABX

15

-0.02(-0.1332%)

122097

Caterpillar Inc

CAT

95.74

-0.50(-0.5195%)

6397

Chevron Corp

CVX

113.39

0.10(0.0883%)

14910

Citigroup Inc., NYSE

C

57.05

-0.22(-0.3841%)

84017

Deere & Company, NYSE

DE

102.05

-0.65(-0.6329%)

2098

Exxon Mobil Corp

XOM

86.97

-0.27(-0.3095%)

23277

Facebook, Inc.

FB

115

-0.10(-0.0869%)

61512

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.76

-0.27(-1.7964%)

110847

General Electric Co

GE

31.28

-0.11(-0.3504%)

14678

General Motors Company, NYSE

GM

36.21

-0.22(-0.6039%)

11062

Goldman Sachs

GS

225.91

-0.72(-0.3177%)

43888

Google Inc.

GOOG

745.2

-2.72(-0.3637%)

3689

Home Depot Inc

HD

128.5

-0.97(-0.7492%)

3776

Intel Corp

INTC

33.73

-0.03(-0.0889%)

7182

International Business Machines Co...

IBM

158.9

-0.92(-0.5757%)

149

Johnson & Johnson

JNJ

111

-0.38(-0.3412%)

2097

JPMorgan Chase and Co

JPM

81.4

-0.39(-0.4768%)

40857

McDonald's Corp

MCD

118.42

-0.05(-0.0422%)

885

Merck & Co Inc

MRK

60.765

0.005(0.0082%)

446

Microsoft Corp

MSFT

59

-0.20(-0.3378%)

9485

Nike

NKE

50.59

-0.06(-0.1185%)

2024

Pfizer Inc

PFE

31.54

0.08(0.2543%)

5715

Procter & Gamble Co

PG

82.24

0.38(0.4642%)

296

Starbucks Corporation, NASDAQ

SBUX

56.68

-1.83(-3.1277%)

233133

Tesla Motors, Inc., NASDAQ

TSLA

182.15

0.27(0.1484%)

18325

The Coca-Cola Co

KO

40.18

0.01(0.0249%)

2601

Twitter, Inc., NYSE

TWTR

18.1

0.07(0.3882%)

31554

Verizon Communications Inc

VZ

49.93

0.06(0.1203%)

1464

Visa

V

75.4

-0.03(-0.0398%)

9108

Wal-Mart Stores Inc

WMT

70.83

0.16(0.2264%)

101

Walt Disney Co

DIS

98.74

-0.20(-0.2021%)

2787

Yahoo! Inc., NASDAQ

YHOO

39.68

0.05(0.1262%)

125

Yandex N.V., NASDAQ

YNDX

18.82

0.21(1.1284%)

18157

-

13:50

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Pfizer (PFE) initiated with a Neutral at Guggenheim

Exxon Mobil (XOM) initiated with a Market Perform at BMO Capital Mkts

-

12:11

WSE: Mid session comment

As expected and follow the usually played on the first Fridays of the month scenario, the WIG20 ended the first half of the session with modest change. The first three session hours were dominated by the consolidation, which the focal point was the region of 1,785 points. Entry into the afternoon phase brought withdrawal in the region of 1,780 pts., but the movement is in the range of today's volatility.

Stabilization is supported by the environment where the DAX drifting close to the opening level and by the currency market, where you may not see any major shifts.

Markets are waiting for the 14:30 (Warsaw time) when the data from the US should bring a little life to trade.

In the middle of today's session the WIG20 index was at the level of 1,781 points, and with the turnover of PLN 220 million.

-

08:31

Major stock markets trading in the red zone: FTSE -0.8%, DAX -0.9%, CAC40 -0.7%, FTMIB -0.6%, IBEX -0.6%

-

08:21

WSE: After opening

WIG20 index opened at 1787.79 points (+0.22%)*

WIG 48399.33 -0.01%

WIG30 2083.48 -0.09%

mWIG40 4132.80 0.37%

*/ - change to previous close

The future contracts December series (FW20Z1620) started the day from the decline of approx. 0.4%, roughly in line with a shift visible on major European stock exchanges.

The opening of the cash market (WIG20) was inscribed in sentiment in Europe and after the first transactions the market retreated in the region of 1,780 points and then rebounded to 1,789 points. From the standpoint of market activity the first minutes of trading may be considered as consolidation.

After fifteen minutes of trading, the WIG20 index was at the level of 1,789 points (+ 0.29%).

-

07:44

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.3%

-

07:22

WSE: Before opening

Thursday's close on Wall Street took place in mixed moods - the Dow Jones index at the end of the day gained 0.36 percent, the S&P 500 fell by 0.35 percent, and the Nasdaq Comp. went down by 1.36 percent. Another day rise oil, after reaching the agreement by OPEC to reduce output.

The highest increases in the US were recorded by fuel companies and the financial sector, and strongest went down the computing enterprises.

The US economy released further data that reinforces expectations of a rise in interest rates in the US. At the same time, the prospect of higher oil prices next year in connection with the OPEC agreement affects the strengthening of inflation expectations in the United States.

Today is the first Friday of the month and a traditional meeting of the market with the monthly data from the US Department of Labor. The macro calendar today has no other report of a comparable impact on the market. This data also carry a risk of a strong reaction in the currency market, so the Warsaw market will depend on the relationship of the zloty to the dollar.

Today, the S&P Agency will revise the rating for Poland. The reduction in the retirement age, weaker economic data (disappointing GDP figures for the third quarter 2016 and the most recent data on industrial production and retail sales) - can be essential factors for the agency, at least as an excuse. It is doubtful, however, that S&P will lower the rating for the second time, when Moody's and Fitch have not done it yet, even for the first time. The decision probably will be announced in the evening.

-

06:16

Global Stocks

European stocks ended lower for the first time in three days Thursday as investors opted for caution ahead of Italy's weekend referendum, which is feared to spark a political crisis in the eurozone.

The Dow Jones Industrial Average bucked the broader market's weakness on Thursday to close at a record high, even as large-cap technology stocks weighed down the Nasdaq Composite index for a second straight session.

The significant international exposure among tech companies makes them more vulnerable given the recent rise in the U.S. dollar, said Karyn Cavanaugh, senior market strategist at Voya Financial.

Asian shares were broadly lower Friday, tracking losses on Wall Street, as equity markets indicate the " Trump trade" could be overdone. Some traders have started asking if the market has overestimated U.S. president-elect Donald Trump's impact on inflation and U.S. growth.

-