Market news

-

23:28

Currencies. Daily history for Nov 03’2016:

(pare/closed(GMT +3)/change, %)

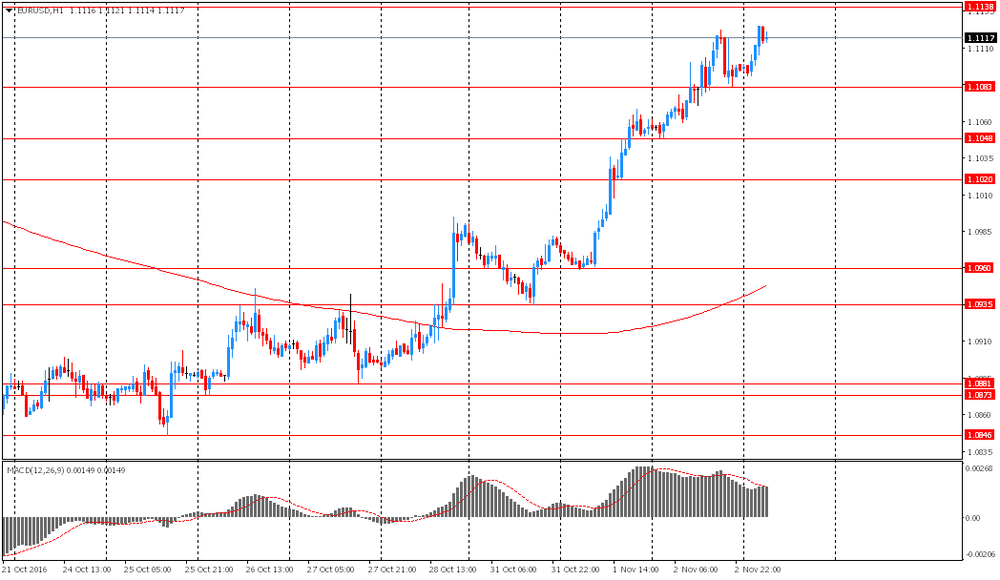

EUR/USD $1,1105 +0,09%

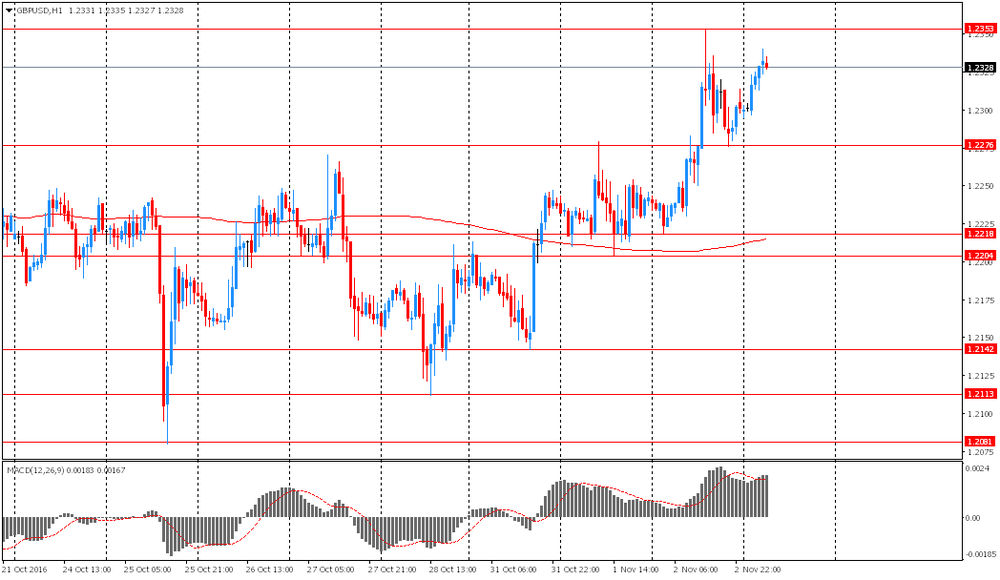

GBP/USD $1,2463 +1,30%

USD/CHF Chf0,9739 +0,09%

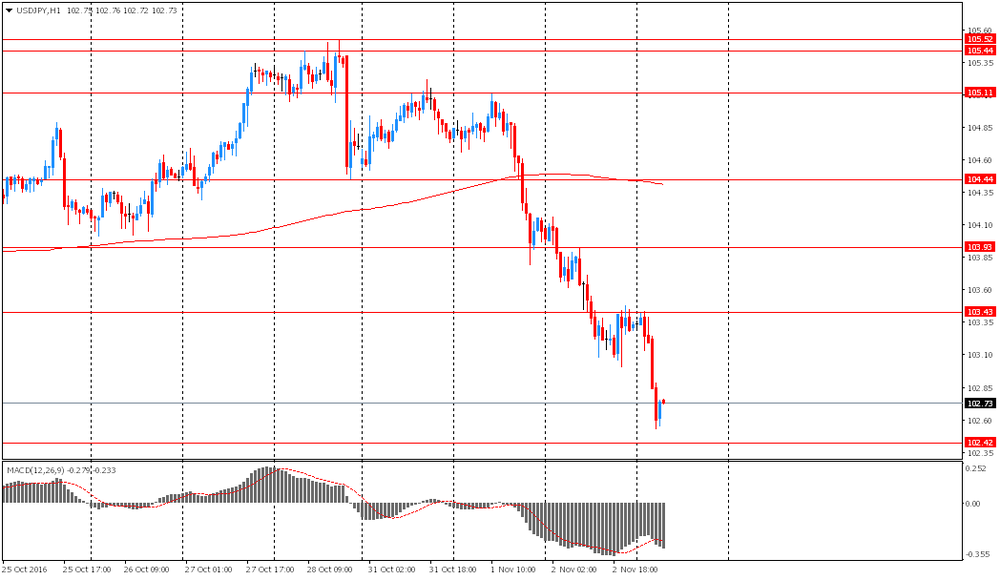

USD/JPY Y102,96 -0,36%

EUR/JPY Y114,34 -0,26%

GBP/JPY Y128,31 +0,96%

AUD/USD $0,7679 +0,30%

NZD/USD $0,7334 +0,67%

USD/CAD C$1,3396 +0,08%

-

23:00

Schedule for today, Friday, Nov 04’2016

00:30 Australia Retail Sales, M/M September 0.4% 0.4%

00:35 Canada BOC Gov Stephen Poloz Speaks

08:50 France Services PMI (Finally) October 53.3 52.1

08:55 Germany Services PMI (Finally) October 50.9 54.1

09:00 Eurozone Services PMI (Finally) October 52.2 53.5

10:00 Eurozone Producer Price Index, MoM September -0.2% 0.0%

10:00 Eurozone Producer Price Index (YoY) September -2.1% -1.8%

12:30 Canada Trade balance, billions September -1.94 -1.7

12:30 Canada Unemployment rate October 7% 7%

12:30 Canada Employment October 67.2 -10

12:30 U.S. Average workweek October 34.4 34.4

12:30 U.S. International Trade, bln September -40.73 -37.8

12:30 U.S. Average hourly earnings October 0.2% 0.3%

12:30 U.S. Nonfarm Payrolls October 156 175

12:30 U.S. Unemployment Rate October 5% 4.9%

14:00 Canada Ivey Purchasing Managers Index October 58.4

20:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-

15:19

A CNN/ORC poll in Nevada shows Trump ahead 46% to 43%

-

14:30

Danske: We Still Hold The Non-Consensual View Of No Fed Hikes This Year

"For some time, we have had the non-consensual view that the Fed will not raise the Fed funds target range this year. Although the probability of a December hike has definitely increased, as economic data have been better than we had expected, we still think it is too early to say a December hike is a done deal, as there are still valid arguments for not hiking at all this year".

-

14:11

US factory orders improves slightly

New orders for manufactured durable goods in September decreased $0.3 billion or 0.1 percent to $227.3 billion, the U.S. Census Bureau announced today. This decrease, down following two consecutive monthly increases, followed a 0.3 percent August increase. Excluding transportation, new orders increased 0.2 percent. Excluding defense, new orders increased 0.7 percent. Transportation equipment, also down following two consecutive monthly increases, drove the decrease, $0.6 billion or 0.8 percent to $77.5 billion.

-

14:09

US ISM non-manufacturing 2.3 percentage points lower than the September reading

Economic activity in the non-manufacturing sector grew in October for the 81st consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management Non-Manufacturing Business Survey Committee. "The NMI registered 54.8 percent in October, 2.3 percentage points lower than the September reading of 57.1 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 57.7 percent, 2.6 percentage points lower than the September reading of 60.3 percent, reflecting growth for the 87th consecutive month, at a slower rate in October. The New Orders Index registered 57.7 percent, 2.3 percentage points lower than the reading of 60 percent in September. The Employment Index decreased 4.1 percentage points in October to 53.1 percent from the September reading of 57.2 percent. The Prices Index increased 2.6 percentage points from the September reading of 54 percent to 56.6 percent, indicating prices increased in October for the seventh consecutive month. According to the NMI®, 13 non-manufacturing industries reported growth in October. There has been a slight cooling-off in the non-manufacturing sector month-over-month, indicating that last month's increases weren't sustainable. Respondent's comments remain mostly positive about business conditions and the overall economy. Several comments were made about the uncertainty on the impact of the upcoming U.S. presidential election."

-

14:00

U.S.: Factory Orders , September 0.3% (forecast 0.2%)

-

14:00

U.S.: ISM Non-Manufacturing, October 54.8 (forecast 56)

-

13:49

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0900 (EUR 2.38bn) 1.0960 (250m) 1.1000 (686m) 1.1010 (447m) 1.1050 (336m) 1.1100 (718m) 1.1150 (2.14bn)

USDJPY 101.10 (USD 400m) 101.25 (1.56bn) 101.90 (222m) 102.00 (270m) 103.00 (287m) 103.30-40 (910m) 103.50 (462m) 103.70-80 (1.1bn) 104.35 (1.05bn) 105.00 (716m) 105.75 (1.6bn) 106.00 (1.53bn)

GBPUSD 1.2120 (GBP 251m) 1.2400 (515m) 1.2485 (376m) 1.2500 (251m) 1.2650 (205m)

EURGBP 0.8900 (EUR 899m)

USDCHF 0.9900 (USD220m)

AUDUSD 0.7450 (AUD 499m) 0.7500 (247m) 0.7610 (226m) 0.7670 (297m)0.7750(496m)

USDCAD 1.3200 (USD 549m) 1.3275 (255m) 1.3400 (375m) 1.3650 (372m)

NZDUSD 0.7200 (NZD 225m) 0.7240 (218m)

EURJPY 115.00 (EUR 1.06bn) 116.75 (617m)

AUDNZD 1.0550 (AUD 409m) 1.0750(819m)

-

13:45

U.S.: Services PMI, October 54.8 (forecast 54.8)

-

13:15

Orders

EUR/USD

Offers 1.1125-30 1.1150 1.1180 1.1200 1.1250

Bids 1.1050 1.1030 1.1000 1.0980 1.0950 1.0935 1.0900

GBP/USD

Offers 1.2500 1.2600 1.2620

Bids 1.2300 1.2280 1.2250 1.2230 1.2200 1.2185 1.2170 1. 1.2150 1.2130 1.2100

EUR/GBP

Offers 0.8900 0.9000 0.9030 0.9050 0.9070 0.9100 0.9125-30 0.9150

Bids 0.8850 0.8830 0.8800

EUR/JPY

Offers 114.50 114.80 115.00 115.20-25 115.50 115.75-80 116.00

Bids 114.00 113.85 113.50 113.00 112.60 112.00

USD/JPY

Offers 103.30 103.50 103.85 104.00 104.20 104.50 104.75 105.00

Bids 102.50 102.20 102.00 101.85 101.50 101.30 101.00

AUD/USD

Offers 0.7700-10 0.7730 0.7750 0.7780 0.7800

Bids 0.7650 0.7630 0.7600 0.7580 0.7550 0.7500 0.7480 0.7450

-

12:41

BOE Carney: MPC Now "Monitoring Closely" The Development of Inflation Expectations

-

12:40

US Nonfarm business sector labor productivity increased in Q3

Nonfarm business sector labor productivity increased at a 3.1-percent annual rate during the third quarter of 2016, the U.S. Bureau of Labor Statistics reported today, as output increased 3.4 percent and hours worked increased 0.3 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates.) The quarterly increase in nonfarm business sector labor productivity was the first increase after three consecutive declines in the measure. From the third quarter of 2015 to the third quarter of 2016, productivity was unchanged.

Unit labor costs in the nonfarm business sector increased 0.3 percent in the third quarter of 2016, reflecting a 3.4-percent increase in hourly compensation and a 3.1-percent increase in productivity. Unit labor costs increased 2.3 percent over the last four quarters.

-

12:35

BOE Carney: August Stimulus Measures Are Working

-

Business Investment "Somewhat Less Soft" Than Expected

-

Inflation Expectations Have Picked Up "Notably"

-

Households Have "Looked Through" Brexit Uncertainties

-

Early Days In Adjustment Process, MPC Will Continue To Learn

-

-

12:34

US initial claims a little higher than expected

In the week ending October 29, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 7,000 from the previous week's unrevised level of 258,000. The 4-week moving average was 257,750, an increase of 4,750 from the previous week's unrevised average of 253,000.

There were no special factors impacting this week's initial claims. This marks 87 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

12:31

U.S.: Nonfarm Productivity, q/q, Quarter III 3.1% (forecast 2%)

-

12:30

U.S.: Unit Labor Costs, q/q, Quarter III 0.3% (forecast 1.3%)

-

12:30

U.S.: Initial Jobless Claims, 265 (forecast 258)

-

12:30

U.S.: Continuing Jobless Claims, 2026 (forecast 2044)

-

12:16

Bank of England inflation report: expects inflation in 2019 at 2.5%, which is above the target level of 2%

-

need some time to observe the growth of inflation, rate hike could damage economic growth and the labor market

-

Bank of England sees "the limits in terms of the extent to which you can let inflation rise above the target level"

-

Members of the Monetary Policy Committee voted unanimously in favor of continuing the bond purchase program worth 70 billion pounds

-

Forbes and McCafferty continue to express doubts about the necessity of QE.

-

The Bank of England raised its inflation forecasts after the sharp drop of the pound, is now expected to achieve the target level of inflation in 2020

-

The Bank of England's recent decline of the pound connects with the idea that trade with the EU will be less open

-

The Bank of England raised its forecast for inflation in 2017 to 2.7% from 2.0% in August

-

raised the forecast for inflation in 2018 to 2.7% from 2.4% in August

-

expects inflation in 2019 at 2.5%, which is above the target level of 2%

-

The Bank of England raised its forecast for GDP growth in the UK in 2017 to 1.4% from 0.8% in August

-

-

12:11

U.K. government bonds sell off sharply after the Bank of England revised its inflation forecasts higher

-

12:07

Sterling Rises to 4-Week High of 0.8871 Per Euro

-

12:06

BOE now says that the interest rate could move "in either direction"

According to Dow Jones, BOE delivered a big surprise by backing away from an earlier signal that it was likely to cut its key interest rate for a second time in the wake of the June vote to leave the European Union. Instead, the BOE now says that the interest rate could move "in either direction"

-

12:03

Bank of England votes 9-0 to hold rates and QE unchanged. GBP/USD rally continue

"The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 2 November 2016 the Committee voted unanimously to maintain Bank Rate at 0.25%. The Committee voted unanimously to continue with the programme of sterling non-financial investment-grade corporate bond purchases totalling up to £10 billion, financed by the issuance of central bank reserves. The Committee also voted unanimously to continue with the programme of £60 billion of UK government bond purchases to take the total stock of these purchases to £435 billion, financed by the issuance of central bank reserves.

At the time of the August Inflation Report, the Committee announced a package of supportive measures that it judged was appropriate to balance the trade-off that had emerged in the economic outlook. On the one hand, economic activity was expected to weaken and unemployment to rise, given the period of uncertainty likely to follow the referendum on EU membership. On the other hand, inflation was expected to rise to a rate above the 2% target, for an extended period, as a result of the depreciation of sterling that had accompanied the referendum result. At the August meeting, a majority of Committee members also expected to support a further cut in Bank Rate at one of the remaining MPC meetings of 2016 if the outlook remained broadly consistent with the one set out in the August Report"

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.25% (forecast 0.25%)

-

12:00

United Kingdom: Asset Purchase Facility, 435 (forecast 435)

-

10:45

ECB may discuss limits to bond buying in Dec - Dijsselbloem

-

10:16

Euro Area unemployment rate stable in September

The euro area (EA19) seasonally-adjusted unemployment rate was 10.0% in September 2016, stable compared to August 2016 and down from 10.6% in September 2015. This is the lowest rate recorded in the euro area since June 2011. The EU28 unemployment rate was 8.5% in September 2016, stable compared to August 2016 and down from 9.2% in September 2015. This is the lowest rate recorded in the EU28 since February 2009. These figures are published by Eurostat, the statistical office of the European Union. Eurostat estimates that 20.789 million men and women in the EU28, of whom 16.181 million were in the euro area, were unemployed in September 2016. Compared with August 2016, the number of persons unemployed decreased by 150 000 in the EU28 and by 101 000 in the euro area. Compared with September 2015, unemployment fell by 1.596 million in the EU28 and by 905 000 in the euro area.

Among the Member States, the lowest unemployment rates in September 2016 were recorded in the Czech Republic (4.0%) and Germany (4.1%). The highest unemployment rates were observed in Greece (23.2% in July 2016) and Spain (19.3%).

-

10:11

-

10:09

Bids on GBP/USD as UK court says Brexit is a issue of law and is justifiable

-

10:00

Eurozone: Unemployment Rate , September 10 (forecast 10%)

-

09:32

Big gain for UK’s services sector in October driven by weaker pound

The latest PMI survey data from IHS Markit and CIPS signalled that the dominant UK service sector moved up a gear at the start of the final quarter of 2016. The rate of growth of total business activity accelerated to the fastest since January, as did new business expansion. The sector continued to generate more jobs, albeit at a weaker rate than the average seen over the past three years. Latest data also revealed a marked build up of inflationary pressures in the sector, linked to the weak pound.

David Noble, Group Chief Executive Officer at the Chartered Institute of Procurement & Supply: "Though weaker than the 20-year survey average, growth of overall activity sped up to its highest since January this year. Concerns over the EU referendum result showed some signs of dissipating as respondents commented on a refocus on opportunities and ramped up marketing and sales promotions. "However, business optimism remained lukewarm in spite of the spike in new orders and was below the long-term average of the survey's history. Staffing levels showed a moderate improvement but at weaker levels than seen over the past three years".

-

09:30

United Kingdom: Purchasing Manager Index Services, October 54.5 (forecast 52.4)

-

09:17

Italian unemployment rate increased significantly

In September 2016, 22,836 million persons were employed, +0.2% compared with August. Unemployed were 3,016 million, +2.0% over the previous month.

Employment rate was 57.5%, +0.1 percentage points over August, unemployment rate was 11.7%, +0.2 percentage points in a month and inactivity rate was 34.8%, -0.3 percentage points over the previous month. Youth unemployment rate (aged 15-24) was 37.1%, -1.2 percentage points over August and youth unemployment ratio in the same age group was 9.8%, -0.3 percentage points in a month.

-

09:15

ECB Economic Bulletin: moderate but steady recovery of the euro area economy

"The information that has become available since early September confirmed a continued moderate but steady recovery of the euro area economy and a gradual rise in inflation, in line with previous expectations. The euro area economy has continued to show resilience to the adverse effects of global economic and political uncertainty, aided by the ECB's comprehensive monetary policy measures, which ensure very favourable financing conditions for firms and households. Overall, however, the baseline scenario remains subject to downside risks.

Available global indicators point to a modest rebound in global activity and trade growth in the third quarter. At the same time, global headline inflation has remained at low levels as past energy price declines have weighed on price increases. Risks to the outlook for global activity remain on the downside and relate in particular to political uncertainty and financial imbalances.

Since early September, sovereign yields have risen and the EONIA forward curve has edged upwards, with yields on intermediate maturities in particular reaching levels close to those reached after the UK referendum on EU membership in late June. Corporate bond spreads rose marginally and overall remained significantly lower than in early March 2016, when the corporate sector purchase programme was announced. Equity prices have declined marginally, with valuations in the banking sector remaining particularly depressed relative to early 2016".

-

08:19

UK Super Thursday ahead. GBP/USD at the upper limits of the monthly range. Can a break be sustained?

-

08:16

Credit Agricole: BoE's Carney To 'Talk Up' GBP today

"This week's inflation report will attract considerable attention with investors keen to know how the growing risk of stagflation in the UK (eg, weak growth and soaring inflation) will affect the bank's policy outlook. We suspect that the MPC will revise its inflation projections to the upside while revising its annual growth projections for 2017 down (in part to account for the stronger economic performance since the EU referendum). The projections need not point at imminent stagflation, however. In addition, we suspect that the MPC will want to convey the message that they are still able and ready to ease again if needed. Even so, the Governor will also highlight that any surge in inflation, on the back 'substantial' FX depreciation, can severely limit the bank's ability to respond to future economic shocks. We believe that Carney will use the IR conference to talk up GBP and highlight that the prospect for any future easing will depend upon the future path of the currency. This could help support GBP if only because it will be seen as delaying future BoE easing. Needless to say, this can only be positive for GBP so long as investors do not think that the UK economy needs further stimulus".

-

08:14

Today’s events

-

At 09:00 GMT, the Economic Bulletin of the ECB

-

At 10:00 GMT France will place 10-year bonds

-

At 12:00 GMT Bank of England interest rate decision

-

At 12:30 GMT the Bank of England Governor Mark Carney will deliver a speech

-

At 20:55 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

-

At 21:00 GMT ECB board member Benoit Koeure deliver a speech

-

-

08:13

Spanish unemployment better than forecasts in October

The number of unemployed registered at the offices of the Public Employment Services increased in October at 44,685 persons in relation to the previous month. In the last 10 years, this month registered unemployment increased by an average of 92.859 people Thus, the total number of registered unemployed stood at 3,764,982, and continues at lower levels of the last 7 years. In seasonally adjusted terms, unemployment is reduced by 48,007 people in October. This is the strongest reduction in October. The monthly change of seasonally adjusted unemployment has fallen in 41 of the last 42 months.

-

08:02

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 2.38bn) 1.0960 (250m) 1.1000 (686m) 1.1010 (447m), 1.1050 (336m) 1.1100 (718m) 1.1150 (2.14bn)

USD/JPY 101.10 (USD 400m) 101.25 (1.56bn) 101.90 (222m) 102.00 (270m), 103.00 (287m) 103.30-40 (910m) 103.50 (462m) 103.70-80 (1.1bn), 104.35 (1.05bn) 105.00 (716m) 105.75 (1.6bn) 106.00 (1.53bn)

GBP/USD 1.2120 (GBP 251m) 1.2400 (515m) 1.2485 (376m) 1.2500 (251m) 1.2650 (205m)

EUR/GBP 0.8900 (EUR 899m)

USD/CHF 0.9900 (USD220m)

AUD/USD 0.7450 (AUD 499m) 0.7500 (247m) 0.7610 (226m) 0.7670 (297m) 0.7750(496m)

USD/CAD 1.3200 (USD 549m) 1.3275 (255m) 1.3400 (375m) 1.3650 (372m)

NZD/USD 0.7200 (NZD 225m) 0.7240 (218m)

EUR/JPY 115.00 (EUR 1.06bn) 116.75 (617m)

AUD/NZD 1.0550 (AUD 409m) 1.0750(819m)

-

07:58

Asian session review: The dollar fell against the yen

The dollar fell against the yen to a month low after yesterday's decline of 0.8%. Market participants believe the Japanese currency a safe haven, so in times of uncertainty the demand for it is growing. Over the past two weeks, the dollar lost more than 1% against the yen, due to increased uncertainty regarding the results of the US presidential election, to be held next week. The results of the poll this week showed that the popularity of the Republican candidate Donald Trump rose after FBI announced the resumption of the investigation on Clinton's emails. "A week before the election, the markets finally began to take into account the volatility which may occur on the voting results, - wrote Credit Suisse - closing the gap between the candidates.

The Australian dollar rose on positive data from Australia and China. According to the data released today, the index of activity in the service sector by AiG, published by the Australian Industry Group, in October was 50.5 points higher than September's 48.9 value. The index of business activity in China's services sector in October was 52.4, higher than the previous value of 52.0.

Also today, it was reported that the deficit of the foreign trade of Australia in September amounted to $ 1.23 billion, which is less than the deficit recorded in August $ 1,89.

EUR / USD: during the Asian session, the pair rose to $ 1.1125

GBP / USD: during the Asian session, the pair rose to $ 1.2335

USD / JPY: fell to Y102.55

-

07:39

Aussie trade balance deficit improves in September

-

In trend terms, the balance on goods and services was a deficit of $1,784m in September 2016, a decrease of $127m (7%) on the deficit in August 2016.

-

In seasonally adjusted terms, the balance on goods and services was a deficit of $1,227m in September 2016, a decrease of $667m (35%) on the deficit in August 2016.

-

In seasonally adjusted terms, goods and services credits rose $426m (2%) to $27,254m. Non-rural goods rose $578m (4%) and rural goods rose $174m (5%). Non-monetary gold fell $353m (19%). Net exports of goods under merchanting remained steady at $47m. Services credits rose $29m.

-

In seasonally adjusted terms, goods and services debits fell $241m (1%) to $28,481m. Consumption goods fell $223m (3%), non-monetary gold fell $124m (17%) and capital goods fell $75m (1%). Intermediate and other merchandise goods rose $179m (2%). Services debits rose $3m.

-

-

07:36

China Composite PMI indicated the fastest expansion in business activity since early 2013

Caixin China Composite PMI data (which covers both manufacturing and services) indicated the fastest expansion in Chinese business activity since early 2013 during October.

This was shown by the Composite Output Index rising from 51.4 in September to 52.9 at the start of the fourth quarter.

October survey data indicated that activity growth was predominantly supported by stronger growth in manufacturing output, though services activity growth also picked up from the previous month. Furthermore, goods producers registered the quickest expansion in production since early 2011. Business activity at services companies meanwhile rose at a moderate pace that was the fastest for four months. This was illustrated by the seasonally adjusted Caixin China General Services Business Activity Index rising from 52.0 to 52.4 in October.

-

07:31

Options levels on thursday, November 3, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1254 (3166)

$1.1209 (3767)

$1.1171 (2583)

Price at time of writing this review: $1.1120

Support levels (open interest**, contracts):

$1.1072 (3575)

$1.1038 (3733)

$1.0995 (6651)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 44485 contracts, with the maximum number of contracts with strike price $1,1200 (3767);

- Overall open interest on the PUT options with the expiration date November, 4 is 45378 contracts, with the maximum number of contracts with strike price $1,1000 (6651);

- The ratio of PUT/CALL was 1.02 versus 1.00 from the previous trading day according to data from November, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.2600 (1658)

$1.2501 (1299)

$1.2403 (1209)

Price at time of writing this review: $1.2338

Support levels (open interest**, contracts):

$1.2293 (1775)

$1.2197 (1310)

$1.2099 (1468)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 33731 contracts, with the maximum number of contracts with strike price $1,2800 (2006);

- Overall open interest on the PUT options with the expiration date November, 4 is 32761 contracts, with the maximum number of contracts with strike price $1,2250 (2762);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from November, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:30

US naval base in Sasebo Japan on lock down after reports of gunshots - Reuters

-

07:26

FOMC: policy makers said the case for a rate hike has strengthened. USD rally over?

The Federal Reserve on Wednesday kept interest rates unchanged, as expected, but policy makers said the case for a rate hike has strengthened.

FOMC members voted 8 to 2 to maintain interest rates in a range of 0.25 to 0.5%.

"The committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of further progress toward its objectives," the Fed said in its policy statement.

It was the first time the Fed qualified such a statement to say that only "some" further evidence was needed.

Analysts say that as long as inflation continues to pick up the Fed will hike interest rates at its December 13-14 meeting.

This will give the markets time to digest a potential shock if "status quo" presidential candidate loses to GOP man Donald Trump.

Cleveland Fed President Loretta Mester and Kansas City Fed President Esther George dissented for a second meeting in a row, but Boston Fed President Eric Rosengren was on board this time - rttnews.

-

07:21

Swiss consumer sentiment in line with expectations

The latest survey shows that there was hardly any change in consumer sentiment in Switzerland between July and October 2016. The index currently stands at -13 points and has consistently come in at a value below its long-term average for over a year now. However, consumers believe that the outlook for the economy over the coming months is considerably better than in July. The assessment of price trends also underwent an upward adjustment.

The consumer sentiment index from October 2016 stands at -13 points, meaning it has seen almost no change since last July (-15 points). This is the sixth time in a row that the survey has revealed a below-average consumer climate among roughly 1,200 randomly selected households (long-term average value: -9 points).

-

07:17

Article 50 author Lord Kerr says Brexit not inevitable

-

01:45

China: Markit/Caixin Services PMI, October 52.4 (forecast 52.5)

-

00:31

Australia: Trade Balance , September -1.23 (forecast -1.7)

-