Market news

-

23:26

Currencies. Daily history for Feb 06’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0749 -0,28%

GBP/USD $1,2468 -0,10%

USD/CHF Chf0,991 -0,14%

USD/JPY Y111,73 -0,85%

EUR/JPY Y120,10 -1,13%

GBP/JPY Y139,28 -0,98%

AUD/USD $0,7658 -0,30%

NZD/USD $0,7320 +0,10%

USD/CAD C$1,3083 +0,43%

-

23:00

Schedule for today, Tuesday, Feb 07’2017 (GMT0)

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

03:30 Australia RBA Rate Statement

05:00 Japan Leading Economic Index (Preliminary) December 102.8

05:00 Japan Coincident Index (Preliminary) December 115

07:00 Germany Industrial Production s.a. (MoM) December 0.4% 0.4%

07:45 France Trade Balance, bln December -4.4

08:30 United Kingdom Halifax house price index January 1.7% 0.2%

08:30 United Kingdom Halifax house price index 3m Y/Y January 6.5% 6%

13:30 Canada Trade balance, billions December 0.53 0.1

13:30 Canada Building Permits (MoM) December -0.1% -1.5%

13:30 U.S. International Trade, bln December -45.2 -45

15:00 Canada Ivey Purchasing Managers Index January 60.8

15:00 U.S. JOLTs Job Openings December 5.522

20:00 U.S. Consumer Credit December 24.53 20.6

23:50 Japan Current Account, bln December 1416 1294.5

-

22:30

Australia: AiG Performance of Construction Index, January 47.7

-

15:29

Gold prices continued to rise

Gold prices continued to rise on Monday in the wake of a mixed set of U.S. employment data that weakened the case for a rapid course of U.S. interest-rate hikes, according to Dow Jones.

Gold was up 0.2% at $1,222.05 a troy ounce in late-morning trade in London, with other precious metals also in positive territory.

Gold climbed late Friday after the publication of Labor Department figures that showed wages rose less than economists had forecast in January, despite stronger-than-expected employment growth.

Analysts said the data undermined the case for the U.S. Federal Reserve to increase rates in March--already considered an outside chance. Expectations of higher rates in the U.S. sap demand for gold as it doesn't pay a return.

-

15:01

U.S.: Labor Market Conditions Index, January 1.3

-

14:59

-

14:09

Draghi: Inflation Set to Pick Up Over Coming Years

-

Acute Deflation Risks Have Disappeared

-

Economic Conditions Have Been Steadily Improving

-

Support from Monetary Policy Still Needed

-

Underlying Inflation Pressures 'Very Subdued', to Pick Up 'Only Gradually'

-

Labor Market Slack, Weak Productivity Weighing on Wage Growth

-

-

13:42

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0779-80 (1.33bln)1.0950 (880m)

USDJPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBPUSD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUDUSD: 0.7400 (AUD 571m)

USDCAD 1.2975 (USD 485m)

-

13:29

BCC Poll: the weakness of the pound has brought mixed benefits for British exporters

The sharp depreciation of the pound sterling against the US dollar and euro still hurt almost as many exporters as it helps. These are the findings of the latest survey conducted by the Association of British Chambers of Commerce (BCC).

A cheaper currency usually helps exporters in the medium term, but the BCC said that the weakness of the currency had a ambiguous impact on member organizations, mainly small and medium-sized businesses. About 25 percent of companies said that the weakness of sterling has allowed them to increase their export earnings, but 22 percent said that the dynamics of the pound has led to a decrease in the profitability of their overseas sales. Meanwhile, almost half of the companies surveyed said they do not manage their foreign exchange risk, and do not plan to do so.

-

13:14

Copper and nickel prices edged higher on Monday, erasing some of Friday's losses as concerns over potential supply disruptions dogged both metals - Dow Jones

-

12:59

Orders

EUR/USD

Offers 1.0780-85 1.0800 1.0830 1.0850-55 1.0885 1.0900

Bids 1.0730 1.0700 1.0680 1.0655-60 1.0630 1.0600

GBP/USD

Offers 1.2485 1.2500 1.2520 1.2560 1.2580 1.2600 1.2620 1.2650

Bids 1.2445-50 1.2420 1.2400 1.2380 1.2350 1.2300

EUR/GBP

Offers 0.8635 0.8650 0.8685 0.8700

Bids 0.8600 0.8580-85 0.8550 0.8530 0.8500

EUR/JPY

Offers 121.30 121.50 121.80-85 122.00 1.2230 122.60 122.80 123.00

Bids 120.80 120.50 120.30 120.00 119.80 119.50 119.00

USD/JPY

Offers 112.60 112.85 113.00 113.20 113.50 113.80 114.00

Bids 112.20-25 112.00 111.80 111.65 111.50 111.30 111.00

AUD/USD

Offers 0.7685 0.7700 0.7730 0.7750 0.7780 0.7800

Bids 0.7655-60 0.7630 0.7600 0.7580 0.7550 0.7520 0.7500

-

11:41

UK's May says government will not allow attempts to keep UK in EU - Forexlive

-

11:10

The Swiss National Bank appears to be tolerating a slightly stronger Swiss franc - Capital Economics

-

10:39

RBNZ to remain in holding pattern. Mixed signals for NZD - ANZ

"Directional signals for the NZD remain mixed as conflicting global forces (reflation and prospects for a turn in the liquidity cycle) weigh, and the USD oscillates. The localised story remains very NZD-supportive and needs to be acknowledged.

That said, we consider the interest rate market (and NZD) to be a little too aggressive in erring towards an OCR hike (with ~18bps priced in by September).

We expect the RBNZ to remain in a holding pattern until the first half of 2018. Given two false starts to the tightening cycle, having inflation near its 2% target and merely projected to get there is insufficient; the whitesof-the-eyes of inflation need to turn up.

Moreover, interest rates have already started to rise via the credit channel of monetary policy, which takes pressure off the RBNZ to follow suit. Tighter financial conditions flag a potential turn in New Zealand's economic credentials".

Copyright © 2017 ANZ, eFXnews™

-

10:01

The sentix headline index for the Eurozone experiences a slight setback in February

The sentix headline index for the Eurozone experiences a slight setback in February (-0.8 points MoM). In contrast, the current situation value increases 4 points and has reached the highest value since May 2011.

Investors' expectations retreat for all world regions as the first acts of the new US President causes caution among the investment community. Nevertheless, investors positively review the current situation of the US economy.

The current situation value for the US remains fairly stable at 45 points. In comparison to other world regions, expectations for the US economy fall the most in February (-8.7 points MoM).

-

09:48

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

Информационно-аналитический отдел TeleTrade

-

09:29

Euro zone retail sales little changed in January

According to the latest Eurozone Retail PMI , sales across the euro area were little-changed in January following a fractional upturn in the previous month. The non-movement in sales volumes was indicative of increases in France and Germany being counterbalanced by a further fall in Italy.

The headline Markit Eurozone Retail PMI - which tracks the month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - dipped to 50.1 in January, from 50.4 in December, and signalled a broad stagnation of sales.

-

08:58

SNB’s Maechler: CHF Would Be Stronger Without Negative Rates, Which Would Have Heavy Impact On Economy & Pension Funds - Reuters

-

08:09

Today’s events

-

At 14:00 GMT the ECB president Mario Draghi will deliver a speech

-

At 21:30 GMT FOMC member Patrick T. Harker will deliver a speech

-

-

07:52

Upside moves unlikely to be sustained on AUD/USD says BTMU

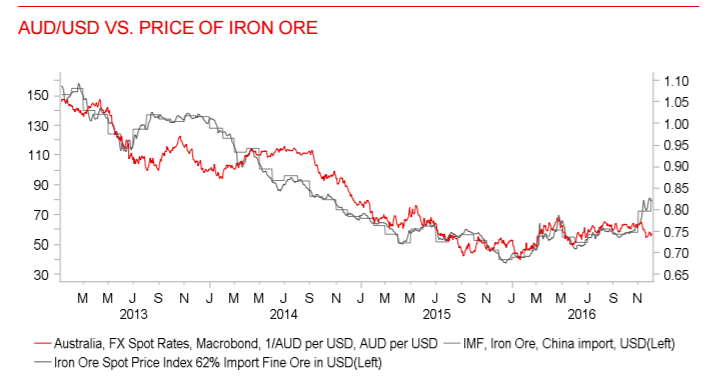

"The broad retracement of US dollar strength in January reflecting increased protectionist steps by the Trump administration in the early stages of his presidency explains a good portion of the rebound in AUD/USD.

Optimism over improved global growth prospects have also been maintained which helps support the Australian dollar as well. That's evident by the price of iron ore, which closed January close to recent highs over USD 83 and close to 50% higher since October when the current rally began. But while the global picture currently is supportive for the Australian dollar, domestic factors are likely to continue weighing on AUD/USD.

The key event in January was the release of the Q4 inflation data that pointed to continued weak inflationary pressures that at the very least ensures a shift in monetary stance toward lifting rates remains a long way off. After four consecutive months of short-term yield increases, the weaker inflation resulted in a modest retracement in yields that points to limited upside for the Australian dollar from here.

Given our view that China growth is set to decelerate this year, we are also not expecting further notable advances in commodity prices generally. With the RBA side-lined and with the Fed set to raise rates at least on two occasions this year, we continue to expect offsetting forces (global reflation / policy divergence) to result in a relatively narrow trading range for AUD/USD implying that any notable moves, like that in January, are unlikely to be sustained".

Copyright © 2017 BTMU, eFXnews™

-

07:48

A slight softening of growth momentum across China at the start of 2017 - Markit

The Caixin China Composite PMI data (which covers both manufacturing and services) signalled a slight softening of growth momentum across China at the start of 2017. At 52.2 in January, the Composite Output Index fell from December's 45-month high of 53.5 to indicate a moderate rate of expansion that was the slowest since September 2016.

The decline in the composite index coincided with slower increases in both manufacturing and services activity at the start of the year. Notably, manufacturing companies saw the rate of output expansion ease from December to a four-month low. Although services activity growth also slowed, it remained solid overall and similar to that recorded in the prior two months.

-

07:41

Australian retail turnover fell 0.1 per cent in December 2016

Australian retail turnover fell 0.1 per cent in December 2016, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a rise of 0.1 per cent in November 2016.

In seasonally adjusted terms, there were falls in household goods retailing (-2.3 per cent), and other retailing (-0.2 per cent). These falls were offset by rises in food retailing (0.5 per cent), clothing, footwear and personal accessory retailing (1.4 per cent), cafes, restaurants and takeaway food services (0.2 per cent), and department stores (0.3 per cent).

The fall in household goods retailing is the result of a fall in the Hardware, building and garden supplies retailing industry subgroup, which fell 6.6 per cent in December after rises in each of the previous four months.

-

07:39

German factory orders up 5.2% in December

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in December 2016 a seasonally and working-day adjusted 5.2% on November 2016. For November 2016, revision of the preliminary outcome resulted in a decrease of 3.6% compared with October 2016 (primary -2.5%). Price-adjusted new orders without major orders in manufacturing had increased in December 2016 a seasonally and working-day adjusted 0.4% on November 2016.

In December 2016, domestic orders increased by 6.7% and foreign orders by 3.9% on the previous month. New orders from the euro area were up 10.0% on the previous month, new orders from other countries remained unchanged compared to November 2016.

-

07:00

Germany: Factory Orders s.a. (MoM), December 5.2% (forecast 0.5%)

-

06:07

Options levels on monday, February 6, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0944 (3950)

$1.0883 (4518)

$1.0840 (3077)

Price at time of writing this review: $1.0775

Support levels (open interest**, contracts):

$1.0699 (1669)

$1.0641 (3190)

$1.0568 (4200)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 68656 contracts, with the maximum number of contracts with strike price $1,0800 (4518);

- Overall open interest on the PUT options with the expiration date March, 13 is 79053 contracts, with the maximum number of contracts with strike price $1,0000 (5180);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from February, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.2803 (3025)

$1.2706 (2831)

$1.2609 (2180)

Price at time of writing this review: $1.2488

Support levels (open interest**, contracts):

$1.2390 (1894)

$1.2293 (3587)

$1.2195 (1509)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33118 contracts, with the maximum number of contracts with strike price $1,2500 (3559);

- Overall open interest on the PUT options with the expiration date March, 13 is 36890 contracts, with the maximum number of contracts with strike price $1,2300 (3587);

- The ratio of PUT/CALL was 1.11 versus 1.14 from the previous trading day according to data from February, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:45

China: Markit/Caixin Services PMI, January 53.1 (forecast 53.6)

-

00:31

Australia: ANZ Job Advertisements (MoM), January 4.0%

-

00:30

Australia: Retail Sales, M/M, December -0.1% (forecast 0.3%)

-

00:00

Japan: Labor Cash Earnings, YoY, December 0.1%

-