Market news

-

23:27

Commodities. Daily history for Feb 06’2017:

(raw materials / closing price /% change)

Oil 53.10 +0.17%

Gold 1,237.30 +0.42%

-

23:27

Stocks. Daily history for Feb 06’2017:

(index / closing price / change items /% change)

Nikkei +58.51 18976.71 +0.31%

TOPIX +5.43 1520.42 +0.36%

Hang Seng +219.03 23348.24 +0.95%

CSI 300 +8.72 3373.21 +0.26%

Euro Stoxx 50 -34.80 3238.31 -1.06%

FTSE 100 -16.15 7172.15 -0.22%

DAX -141.65 11509.84 -1.22%

CAC 40 -47.34 4778.08 -0.98%

DJIA -19.04 20052.42 -0.09%

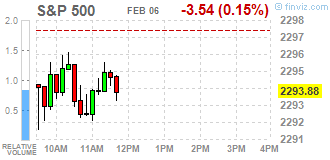

S&P 500 -4.86 2292.56 -0.21%

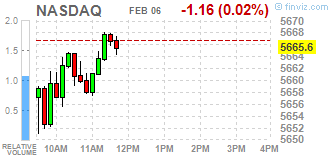

NASDAQ -3.21 5663.55 -0.06%

S&P/TSX -19.45 15456.94 -0.13%

-

23:26

Currencies. Daily history for Feb 06’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0749 -0,28%

GBP/USD $1,2468 -0,10%

USD/CHF Chf0,991 -0,14%

USD/JPY Y111,73 -0,85%

EUR/JPY Y120,10 -1,13%

GBP/JPY Y139,28 -0,98%

AUD/USD $0,7658 -0,30%

NZD/USD $0,7320 +0,10%

USD/CAD C$1,3083 +0,43%

-

23:00

Schedule for today, Tuesday, Feb 07’2017 (GMT0)

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

03:30 Australia RBA Rate Statement

05:00 Japan Leading Economic Index (Preliminary) December 102.8

05:00 Japan Coincident Index (Preliminary) December 115

07:00 Germany Industrial Production s.a. (MoM) December 0.4% 0.4%

07:45 France Trade Balance, bln December -4.4

08:30 United Kingdom Halifax house price index January 1.7% 0.2%

08:30 United Kingdom Halifax house price index 3m Y/Y January 6.5% 6%

13:30 Canada Trade balance, billions December 0.53 0.1

13:30 Canada Building Permits (MoM) December -0.1% -1.5%

13:30 U.S. International Trade, bln December -45.2 -45

15:00 Canada Ivey Purchasing Managers Index January 60.8

15:00 U.S. JOLTs Job Openings December 5.522

20:00 U.S. Consumer Credit December 24.53 20.6

23:50 Japan Current Account, bln December 1416 1294.5

-

22:30

Australia: AiG Performance of Construction Index, January 47.7

-

20:03

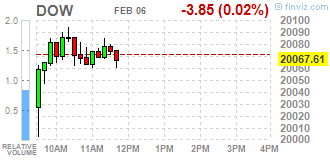

DJIA 20041.94 -29.52 -0.15%, NASDAQ 5656.10 -10.66 -0.19%, S&P 500 2290.83 -6.59 -0.29%

-

17:02

European stocks closed: FTSE 7172.15 -16.15 -0.22%, DAX 11509.84 -141.65 -1.22%, CAC 4778.08 -47.34 -0.98%

-

16:48

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday amid a lack of major catalysts, including economic data, and uncertainty over President Donald Trump's policies. Markets rallied sharply after Trump's election victory in November, riding on hopes that his plans including simpler regulations, higher infrastructure spending and tax cuts will boost the economy. However, investors have become wary about Trump's focus on isolationist policies, including a travel ban on seven mainly Muslim nations that was blocked by a federal judge on Friday.

Most of Dow stocks in negative area (18 of 30). Top loser - Johnson & Johnson (JNJ, -0.83%). Top loser - United Technologies Corporation (UTX, +1.01%).

All S&P sectors in negative area. Top loser - Conglomerates (-1.8%).

At the moment:

Dow 20004.00 +18.00 +0.09%

S&P 500 2290.25 -0.75 -0.03%

Nasdaq 100 5161.50 +6.50 +0.13%

Oil 53.34 -0.49 -0.91%

Gold 1229.90 +9.10 +0.75%

U.S. 10yr 2.44 -0.06

-

16:35

WSE: Session Results

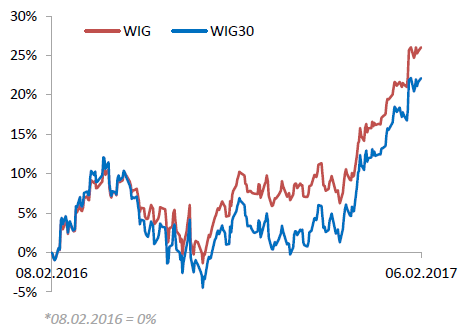

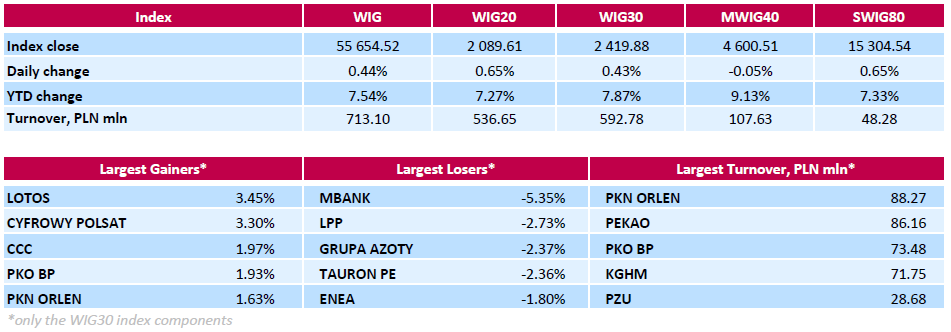

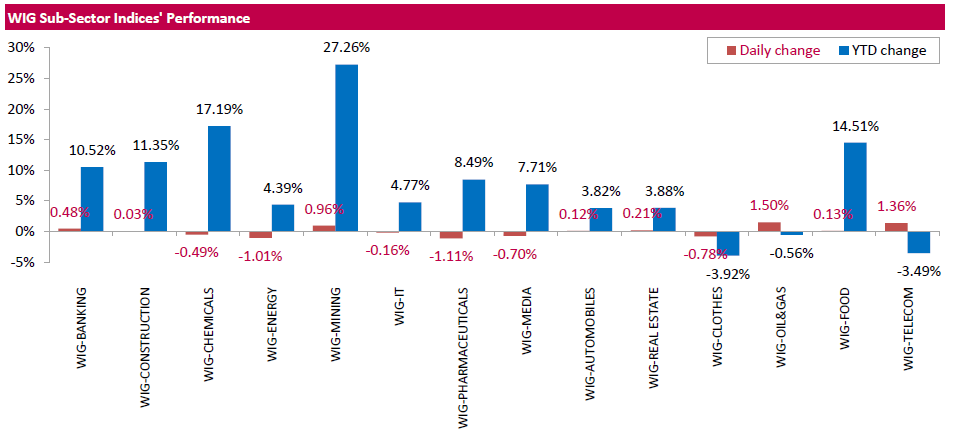

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.44%. Sector-wise, oil and gas sector stocks (+1.50%) outperformed, while pharmaceuticals names fared the worst (-1.11%).

The large-cap stocks' measure, the WIG30 Index, surged by 0.43%. Oil refiner LOTOS (WSE: LTS) was the best-performing name within the indicator's components, gaining 3.45% as the company announced it estimated its 2016 full-year EBITDA at PLN 2.8 bln (+119% y/y). The company also said its 2016 revenues could amount to PLN 20.9 bln (-8% y/y). Other largest outperformers were media group CYFROWY POLSAT (WSE: CPS), footwear retailer CCC (WSE: CCC) and bank PKO BP (WSE: PKO), surging by 3.3%, 1.97% and 1.93% respectively. At the same time, the session's biggest loser was bank MBANK (WSE: MBK), which tumbled by 5.35%. It was followed by clothing retailer LPP (WSE: LPP), chemical producer GRUPA AZOTY (WSE: ATT) and genco TAURON PE (WSE: TPE), declining by 2.73%, 2.37% and 2.36% respectively.

-

15:29

Gold prices continued to rise

Gold prices continued to rise on Monday in the wake of a mixed set of U.S. employment data that weakened the case for a rapid course of U.S. interest-rate hikes, according to Dow Jones.

Gold was up 0.2% at $1,222.05 a troy ounce in late-morning trade in London, with other precious metals also in positive territory.

Gold climbed late Friday after the publication of Labor Department figures that showed wages rose less than economists had forecast in January, despite stronger-than-expected employment growth.

Analysts said the data undermined the case for the U.S. Federal Reserve to increase rates in March--already considered an outside chance. Expectations of higher rates in the U.S. sap demand for gold as it doesn't pay a return.

-

15:06

WSE: After start on Wall Street

After the successful Friday's session trading on Wall Street started today from light drops, thereby mimicking the atmosphere from European markets. On the WSE we may see cooling sentiment and today the Warsaw market rather will not overcome the level of 2,100 points in the case of the WIG20 index.

-

15:01

U.S.: Labor Market Conditions Index, January 1.3

-

14:59

-

14:32

U.S. Stocks open: Dow -0.23%, Nasdaq -0.20%, S&P -0.20%

-

14:27

Before the bell: S&P futures -0.20%, NASDAQ futures -0.18%

U.S. stock-index futures fell after Friday's strong performance on Wall Street.

Global Stocks:

Nikkei 18,976.71 +58.51 +0.31%

Hang Seng 23,348.24 +219.03 +0.95%

Shanghai 3,157.37 +17.20 +0.55%

FTSE 7,169.01 -19.29 -0.27%

CAC 4,781.59 -43.83 -0.91%

DAX 11,532.73 -118.76 -1.02%

Crude $53.65 (-0.33%)

Gold 1,230.40 (+0.79%)

-

14:09

Draghi: Inflation Set to Pick Up Over Coming Years

-

Acute Deflation Risks Have Disappeared

-

Economic Conditions Have Been Steadily Improving

-

Support from Monetary Policy Still Needed

-

Underlying Inflation Pressures 'Very Subdued', to Pick Up 'Only Gradually'

-

Labor Market Slack, Weak Productivity Weighing on Wage Growth

-

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

175.79

-0.03(-0.0171%)

1227

American Express Co

AXP

77.81

-0.23(-0.2947%)

16840

Apple Inc.

AAPL

128.82

-0.26(-0.2014%)

79713

Caterpillar Inc

CAT

93.05

-0.23(-0.2466%)

1882

Cisco Systems Inc

CSCO

31.3

-0.02(-0.0639%)

20398

E. I. du Pont de Nemours and Co

DD

75.95

-0.48(-0.628%)

861

Exxon Mobil Corp

XOM

83.55

0.01(0.012%)

6401

Facebook, Inc.

FB

130.71

-0.27(-0.2061%)

60522

FedEx Corporation, NYSE

FDX

189.17

0.96(0.5101%)

6181

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.89

0.06(0.379%)

50311

Goldman Sachs

GS

239.6

-1.35(-0.5603%)

34741

Google Inc.

GOOG

15.89

0.06(0.379%)

50311

HONEYWELL INTERNATIONAL INC.

HON

175.79

-0.03(-0.0171%)

1227

International Business Machines Co...

IBM

175.79

-0.03(-0.0171%)

1227

International Paper Company

IP

52.4

-0.61(-1.1507%)

14005

JPMorgan Chase and Co

JPM

175.79

-0.03(-0.0171%)

1227

McDonald's Corp

MCD

124.54

0.30(0.2415%)

1035

Merck & Co Inc

MRK

175.79

-0.03(-0.0171%)

1227

Microsoft Corp

MSFT

63.54

-0.14(-0.2198%)

17976

Nike

NKE

52.17

-0.19(-0.3629%)

2190

Pfizer Inc

PFE

32.05

-0.04(-0.1247%)

2105

Tesla Motors, Inc., NASDAQ

TSLA

251

-0.33(-0.1313%)

3213

The Coca-Cola Co

KO

41.55

0.01(0.0241%)

17771

Twitter, Inc., NYSE

TWTR

15.89

0.06(0.379%)

50311

United Technologies Corp

UTX

109.13

-0.52(-0.4742%)

705

Verizon Communications Inc

VZ

48.67

0.09(0.1853%)

10640

Visa

V

85.83

-0.25(-0.2904%)

7374

Walt Disney Co

DIS

32.05

-0.04(-0.1247%)

2105

Yandex N.V., NASDAQ

YNDX

32.05

-0.04(-0.1247%)

2105

-

13:51

Upgrades and downgrades before the market open

Upgrades:

FedEx (FDX) upgraded to Outperform from Mkt Perform at Raymond James

Downgrades:

Intl Paper (IP) downgraded to Underweight from Equal Weight at Barclays

Other:

-

13:42

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0779-80 (1.33bln)1.0950 (880m)

USDJPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBPUSD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUDUSD: 0.7400 (AUD 571m)

USDCAD 1.2975 (USD 485m)

-

13:29

BCC Poll: the weakness of the pound has brought mixed benefits for British exporters

The sharp depreciation of the pound sterling against the US dollar and euro still hurt almost as many exporters as it helps. These are the findings of the latest survey conducted by the Association of British Chambers of Commerce (BCC).

A cheaper currency usually helps exporters in the medium term, but the BCC said that the weakness of the currency had a ambiguous impact on member organizations, mainly small and medium-sized businesses. About 25 percent of companies said that the weakness of sterling has allowed them to increase their export earnings, but 22 percent said that the dynamics of the pound has led to a decrease in the profitability of their overseas sales. Meanwhile, almost half of the companies surveyed said they do not manage their foreign exchange risk, and do not plan to do so.

-

13:14

Copper and nickel prices edged higher on Monday, erasing some of Friday's losses as concerns over potential supply disruptions dogged both metals - Dow Jones

-

13:01

Earnings Season in U.S.: Major Reports of the Week

February 7

Before the Open:

General Motors (GM). Consensus EPS $1.17, Consensus Revenues $40082.48 mln.

After the Close:

Walt Disney (DIS). Consensus EPS $1.49, Consensus Revenues $15289.44 mln.

February 9

Before the Open:

Coca-Cola (KO). Consensus EPS $0.37, Consensus Revenues $9169.94 mln.

Twitter (TWTR). Consensus EPS $0.12, Consensus Revenues $738.74 mln.

-

12:59

Orders

EUR/USD

Offers 1.0780-85 1.0800 1.0830 1.0850-55 1.0885 1.0900

Bids 1.0730 1.0700 1.0680 1.0655-60 1.0630 1.0600

GBP/USD

Offers 1.2485 1.2500 1.2520 1.2560 1.2580 1.2600 1.2620 1.2650

Bids 1.2445-50 1.2420 1.2400 1.2380 1.2350 1.2300

EUR/GBP

Offers 0.8635 0.8650 0.8685 0.8700

Bids 0.8600 0.8580-85 0.8550 0.8530 0.8500

EUR/JPY

Offers 121.30 121.50 121.80-85 122.00 1.2230 122.60 122.80 123.00

Bids 120.80 120.50 120.30 120.00 119.80 119.50 119.00

USD/JPY

Offers 112.60 112.85 113.00 113.20 113.50 113.80 114.00

Bids 112.20-25 112.00 111.80 111.65 111.50 111.30 111.00

AUD/USD

Offers 0.7685 0.7700 0.7730 0.7750 0.7780 0.7800

Bids 0.7655-60 0.7630 0.7600 0.7580 0.7550 0.7520 0.7500

-

12:34

WSE: Mid session comment

After the disappointment of the morning weakness, the situation in Europe has stabilized and both in Frankfurt and Paris we may see a slight increase. Positively distinguished are commodity producers and banks except for Italian institutions, where started selling shares of UniCredit.

Against this background stands out Warsaw market, where the WIG20 index approached the level of 2100 points.

-

11:41

UK's May says government will not allow attempts to keep UK in EU - Forexlive

-

11:10

The Swiss National Bank appears to be tolerating a slightly stronger Swiss franc - Capital Economics

-

10:39

RBNZ to remain in holding pattern. Mixed signals for NZD - ANZ

"Directional signals for the NZD remain mixed as conflicting global forces (reflation and prospects for a turn in the liquidity cycle) weigh, and the USD oscillates. The localised story remains very NZD-supportive and needs to be acknowledged.

That said, we consider the interest rate market (and NZD) to be a little too aggressive in erring towards an OCR hike (with ~18bps priced in by September).

We expect the RBNZ to remain in a holding pattern until the first half of 2018. Given two false starts to the tightening cycle, having inflation near its 2% target and merely projected to get there is insufficient; the whitesof-the-eyes of inflation need to turn up.

Moreover, interest rates have already started to rise via the credit channel of monetary policy, which takes pressure off the RBNZ to follow suit. Tighter financial conditions flag a potential turn in New Zealand's economic credentials".

Copyright © 2017 ANZ, eFXnews™

-

10:01

The sentix headline index for the Eurozone experiences a slight setback in February

The sentix headline index for the Eurozone experiences a slight setback in February (-0.8 points MoM). In contrast, the current situation value increases 4 points and has reached the highest value since May 2011.

Investors' expectations retreat for all world regions as the first acts of the new US President causes caution among the investment community. Nevertheless, investors positively review the current situation of the US economy.

The current situation value for the US remains fairly stable at 45 points. In comparison to other world regions, expectations for the US economy fall the most in February (-8.7 points MoM).

-

09:48

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

Информационно-аналитический отдел TeleTrade

-

09:31

Oil is trading higher

This morning the New York futures for Brent increased 0.18% to $ 56.91 and WTI rose 0.28% to $ 53.97. Thus, the price of black gold traded higher due to the weakening of the dollar, as well as fears that the introduction of new US sanctions against Iran can affect the export of Iranian oil. Tensions between the US and Iran began after the launch of a ballistic missile. United States on Friday imposed sanctions on 13 people and 12 companies linked to Iran.

-

09:29

Euro zone retail sales little changed in January

According to the latest Eurozone Retail PMI , sales across the euro area were little-changed in January following a fractional upturn in the previous month. The non-movement in sales volumes was indicative of increases in France and Germany being counterbalanced by a further fall in Italy.

The headline Markit Eurozone Retail PMI - which tracks the month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - dipped to 50.1 in January, from 50.4 in December, and signalled a broad stagnation of sales.

-

08:58

SNB’s Maechler: CHF Would Be Stronger Without Negative Rates, Which Would Have Heavy Impact On Economy & Pension Funds - Reuters

-

08:57

Major stock markets in Europe trading mixed: FTSE + 0.1%, DAX -0.2%, CAC40 + 0.1%, FTMIB + 0.2%, IBEX flat

-

08:16

WSE: After opening

WIG20 index opened at 2078.45 points (+0.11%)*

WIG 55456.89 0.09%

WIG30 2410.46 0.04%

mWIG40 4603.75 0.02%

*/ - change to previous close

The cash market (the WIG20 index) opened with slightly increase, with modest turnover concentrated on the shares of KGHM, PKN and Polimex (WSE: PXM). In the environment the German DAX is weak in the morning and go down approx. 0.4%. Unfortunately, the attitude of the environment is not conducive for increases.

After fifteen minutes of trading WIG20 index was at the level of 2,077 points (+0,04%).

-

08:09

Today’s events

-

At 14:00 GMT the ECB president Mario Draghi will deliver a speech

-

At 21:30 GMT FOMC member Patrick T. Harker will deliver a speech

-

-

07:52

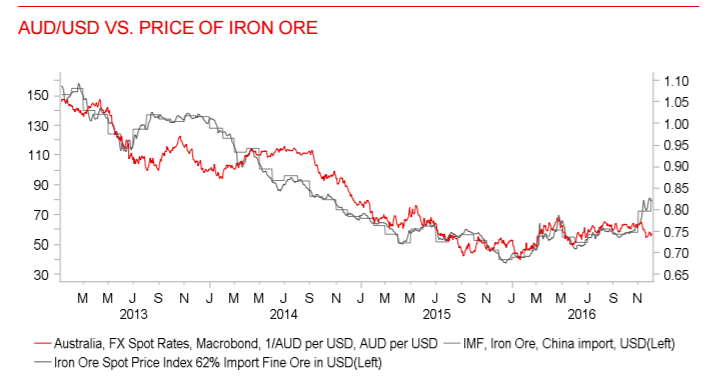

Upside moves unlikely to be sustained on AUD/USD says BTMU

"The broad retracement of US dollar strength in January reflecting increased protectionist steps by the Trump administration in the early stages of his presidency explains a good portion of the rebound in AUD/USD.

Optimism over improved global growth prospects have also been maintained which helps support the Australian dollar as well. That's evident by the price of iron ore, which closed January close to recent highs over USD 83 and close to 50% higher since October when the current rally began. But while the global picture currently is supportive for the Australian dollar, domestic factors are likely to continue weighing on AUD/USD.

The key event in January was the release of the Q4 inflation data that pointed to continued weak inflationary pressures that at the very least ensures a shift in monetary stance toward lifting rates remains a long way off. After four consecutive months of short-term yield increases, the weaker inflation resulted in a modest retracement in yields that points to limited upside for the Australian dollar from here.

Given our view that China growth is set to decelerate this year, we are also not expecting further notable advances in commodity prices generally. With the RBA side-lined and with the Fed set to raise rates at least on two occasions this year, we continue to expect offsetting forces (global reflation / policy divergence) to result in a relatively narrow trading range for AUD/USD implying that any notable moves, like that in January, are unlikely to be sustained".

Copyright © 2017 BTMU, eFXnews™

-

07:49

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.4%, CAC40 + 0.2%, FTSE + 0.2%

-

07:48

A slight softening of growth momentum across China at the start of 2017 - Markit

The Caixin China Composite PMI data (which covers both manufacturing and services) signalled a slight softening of growth momentum across China at the start of 2017. At 52.2 in January, the Composite Output Index fell from December's 45-month high of 53.5 to indicate a moderate rate of expansion that was the slowest since September 2016.

The decline in the composite index coincided with slower increases in both manufacturing and services activity at the start of the year. Notably, manufacturing companies saw the rate of output expansion ease from December to a four-month low. Although services activity growth also slowed, it remained solid overall and similar to that recorded in the prior two months.

-

07:41

Australian retail turnover fell 0.1 per cent in December 2016

Australian retail turnover fell 0.1 per cent in December 2016, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a rise of 0.1 per cent in November 2016.

In seasonally adjusted terms, there were falls in household goods retailing (-2.3 per cent), and other retailing (-0.2 per cent). These falls were offset by rises in food retailing (0.5 per cent), clothing, footwear and personal accessory retailing (1.4 per cent), cafes, restaurants and takeaway food services (0.2 per cent), and department stores (0.3 per cent).

The fall in household goods retailing is the result of a fall in the Hardware, building and garden supplies retailing industry subgroup, which fell 6.6 per cent in December after rises in each of the previous four months.

-

07:39

German factory orders up 5.2% in December

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in December 2016 a seasonally and working-day adjusted 5.2% on November 2016. For November 2016, revision of the preliminary outcome resulted in a decrease of 3.6% compared with October 2016 (primary -2.5%). Price-adjusted new orders without major orders in manufacturing had increased in December 2016 a seasonally and working-day adjusted 0.4% on November 2016.

In December 2016, domestic orders increased by 6.7% and foreign orders by 3.9% on the previous month. New orders from the euro area were up 10.0% on the previous month, new orders from other countries remained unchanged compared to November 2016.

-

07:21

WSE: Before opening

New weekly markets begins in the shadow of Friday's report from the US labor market. At first glance, he was a good 227 thousand. new jobs, however, clearly negatively surprised by the level of wage growth, with an increase of 0.1% m / m and a negative revision for the previous month of 0.4% to barely 0.2%.

This lowered pressure on the central bank to raise interest rates and the positive impact on earnings forecasts of companies and consequently on the rise on Wall Street.

In the morning, futures on Wall Street are listed on neutral levels in Asia and we see a slight increase. We can therefore expect a quiet early trading in | Europe for the light increases.

In the morning, the Polish zloty slightly weakened the US dollar and strengthened against the euro.

-

07:00

Germany: Factory Orders s.a. (MoM), December 5.2% (forecast 0.5%)

-

06:37

Global Stocks

U.K. stocks closed at a two-week high Friday, achieving a small weekly rise, as bank shares climbed on plans by U.S. President Donald Trump to dismantle some U.S. regulations on the financial-services sector. On Friday, banks climbed on reports Trump plans to sign an executive action to scale back the 2010 Dodd-Frank financial-overhaul law, as part of a push to peel back much of the regulatory system put in place after the financial crisis.

U.S. stocks closed near session highs, with the Dow industrials reclaiming a close above 20,000 and the Nasdaq reached a record. Steps by President Donald Trump to roll back bank regulations and a stronger-than-expected January jobs report contributed to the upbeat sentiment. A led by a sharply higher financial sector.

Most Southeast Asian stock markets edged higher on Monday, with prospects of a rate hike next month by the U.S. Federal Reserve dimming as data showed wages barely rose, softening the dollar and lending support to emerging markets. Nonfarm payrolls increased by 227,000 jobs, the largest gain in four months, the U.S. Labor Department said on Friday, but wages increased by only three cents, suggesting that there was still some slack in the labor market.

-

06:07

Options levels on monday, February 6, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0944 (3950)

$1.0883 (4518)

$1.0840 (3077)

Price at time of writing this review: $1.0775

Support levels (open interest**, contracts):

$1.0699 (1669)

$1.0641 (3190)

$1.0568 (4200)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 68656 contracts, with the maximum number of contracts with strike price $1,0800 (4518);

- Overall open interest on the PUT options with the expiration date March, 13 is 79053 contracts, with the maximum number of contracts with strike price $1,0000 (5180);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from February, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.2803 (3025)

$1.2706 (2831)

$1.2609 (2180)

Price at time of writing this review: $1.2488

Support levels (open interest**, contracts):

$1.2390 (1894)

$1.2293 (3587)

$1.2195 (1509)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33118 contracts, with the maximum number of contracts with strike price $1,2500 (3559);

- Overall open interest on the PUT options with the expiration date March, 13 is 36890 contracts, with the maximum number of contracts with strike price $1,2300 (3587);

- The ratio of PUT/CALL was 1.11 versus 1.14 from the previous trading day according to data from February, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:45

China: Markit/Caixin Services PMI, January 53.1 (forecast 53.6)

-

00:31

Australia: ANZ Job Advertisements (MoM), January 4.0%

-

00:30

Australia: Retail Sales, M/M, December -0.1% (forecast 0.3%)

-

00:00

Japan: Labor Cash Earnings, YoY, December 0.1%

-