Market news

-

23:27

Stocks. Daily history for Feb 06’2017:

(index / closing price / change items /% change)

Nikkei +58.51 18976.71 +0.31%

TOPIX +5.43 1520.42 +0.36%

Hang Seng +219.03 23348.24 +0.95%

CSI 300 +8.72 3373.21 +0.26%

Euro Stoxx 50 -34.80 3238.31 -1.06%

FTSE 100 -16.15 7172.15 -0.22%

DAX -141.65 11509.84 -1.22%

CAC 40 -47.34 4778.08 -0.98%

DJIA -19.04 20052.42 -0.09%

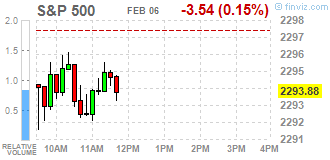

S&P 500 -4.86 2292.56 -0.21%

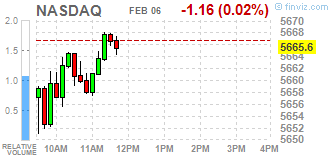

NASDAQ -3.21 5663.55 -0.06%

S&P/TSX -19.45 15456.94 -0.13%

-

20:03

DJIA 20041.94 -29.52 -0.15%, NASDAQ 5656.10 -10.66 -0.19%, S&P 500 2290.83 -6.59 -0.29%

-

17:02

European stocks closed: FTSE 7172.15 -16.15 -0.22%, DAX 11509.84 -141.65 -1.22%, CAC 4778.08 -47.34 -0.98%

-

16:48

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday amid a lack of major catalysts, including economic data, and uncertainty over President Donald Trump's policies. Markets rallied sharply after Trump's election victory in November, riding on hopes that his plans including simpler regulations, higher infrastructure spending and tax cuts will boost the economy. However, investors have become wary about Trump's focus on isolationist policies, including a travel ban on seven mainly Muslim nations that was blocked by a federal judge on Friday.

Most of Dow stocks in negative area (18 of 30). Top loser - Johnson & Johnson (JNJ, -0.83%). Top loser - United Technologies Corporation (UTX, +1.01%).

All S&P sectors in negative area. Top loser - Conglomerates (-1.8%).

At the moment:

Dow 20004.00 +18.00 +0.09%

S&P 500 2290.25 -0.75 -0.03%

Nasdaq 100 5161.50 +6.50 +0.13%

Oil 53.34 -0.49 -0.91%

Gold 1229.90 +9.10 +0.75%

U.S. 10yr 2.44 -0.06

-

16:35

WSE: Session Results

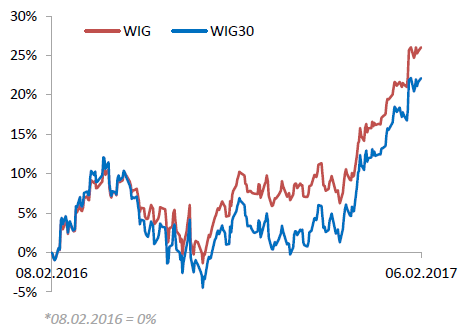

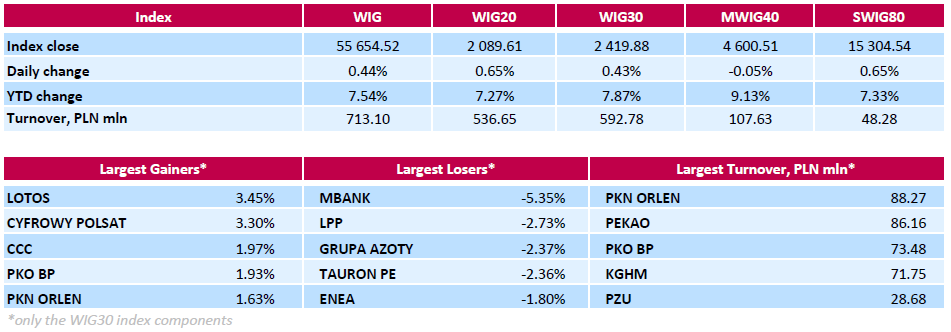

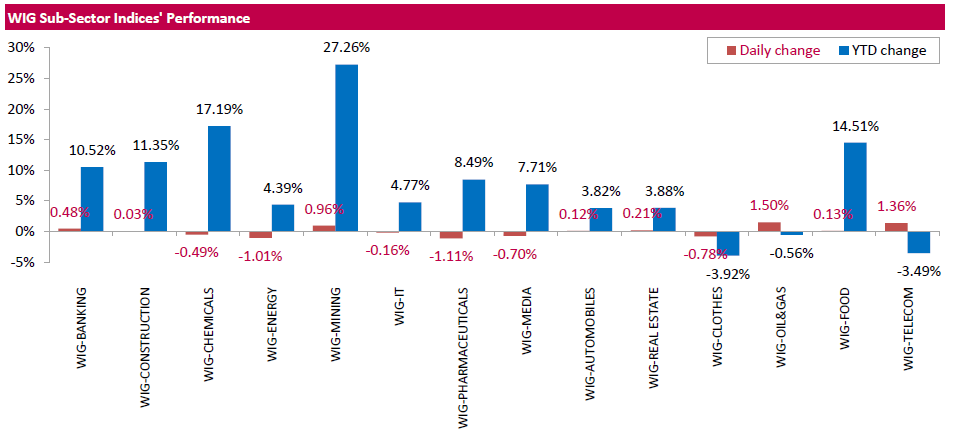

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.44%. Sector-wise, oil and gas sector stocks (+1.50%) outperformed, while pharmaceuticals names fared the worst (-1.11%).

The large-cap stocks' measure, the WIG30 Index, surged by 0.43%. Oil refiner LOTOS (WSE: LTS) was the best-performing name within the indicator's components, gaining 3.45% as the company announced it estimated its 2016 full-year EBITDA at PLN 2.8 bln (+119% y/y). The company also said its 2016 revenues could amount to PLN 20.9 bln (-8% y/y). Other largest outperformers were media group CYFROWY POLSAT (WSE: CPS), footwear retailer CCC (WSE: CCC) and bank PKO BP (WSE: PKO), surging by 3.3%, 1.97% and 1.93% respectively. At the same time, the session's biggest loser was bank MBANK (WSE: MBK), which tumbled by 5.35%. It was followed by clothing retailer LPP (WSE: LPP), chemical producer GRUPA AZOTY (WSE: ATT) and genco TAURON PE (WSE: TPE), declining by 2.73%, 2.37% and 2.36% respectively.

-

15:06

WSE: After start on Wall Street

After the successful Friday's session trading on Wall Street started today from light drops, thereby mimicking the atmosphere from European markets. On the WSE we may see cooling sentiment and today the Warsaw market rather will not overcome the level of 2,100 points in the case of the WIG20 index.

-

14:32

U.S. Stocks open: Dow -0.23%, Nasdaq -0.20%, S&P -0.20%

-

14:27

Before the bell: S&P futures -0.20%, NASDAQ futures -0.18%

U.S. stock-index futures fell after Friday's strong performance on Wall Street.

Global Stocks:

Nikkei 18,976.71 +58.51 +0.31%

Hang Seng 23,348.24 +219.03 +0.95%

Shanghai 3,157.37 +17.20 +0.55%

FTSE 7,169.01 -19.29 -0.27%

CAC 4,781.59 -43.83 -0.91%

DAX 11,532.73 -118.76 -1.02%

Crude $53.65 (-0.33%)

Gold 1,230.40 (+0.79%)

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

175.79

-0.03(-0.0171%)

1227

American Express Co

AXP

77.81

-0.23(-0.2947%)

16840

Apple Inc.

AAPL

128.82

-0.26(-0.2014%)

79713

Caterpillar Inc

CAT

93.05

-0.23(-0.2466%)

1882

Cisco Systems Inc

CSCO

31.3

-0.02(-0.0639%)

20398

E. I. du Pont de Nemours and Co

DD

75.95

-0.48(-0.628%)

861

Exxon Mobil Corp

XOM

83.55

0.01(0.012%)

6401

Facebook, Inc.

FB

130.71

-0.27(-0.2061%)

60522

FedEx Corporation, NYSE

FDX

189.17

0.96(0.5101%)

6181

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.89

0.06(0.379%)

50311

Goldman Sachs

GS

239.6

-1.35(-0.5603%)

34741

Google Inc.

GOOG

15.89

0.06(0.379%)

50311

HONEYWELL INTERNATIONAL INC.

HON

175.79

-0.03(-0.0171%)

1227

International Business Machines Co...

IBM

175.79

-0.03(-0.0171%)

1227

International Paper Company

IP

52.4

-0.61(-1.1507%)

14005

JPMorgan Chase and Co

JPM

175.79

-0.03(-0.0171%)

1227

McDonald's Corp

MCD

124.54

0.30(0.2415%)

1035

Merck & Co Inc

MRK

175.79

-0.03(-0.0171%)

1227

Microsoft Corp

MSFT

63.54

-0.14(-0.2198%)

17976

Nike

NKE

52.17

-0.19(-0.3629%)

2190

Pfizer Inc

PFE

32.05

-0.04(-0.1247%)

2105

Tesla Motors, Inc., NASDAQ

TSLA

251

-0.33(-0.1313%)

3213

The Coca-Cola Co

KO

41.55

0.01(0.0241%)

17771

Twitter, Inc., NYSE

TWTR

15.89

0.06(0.379%)

50311

United Technologies Corp

UTX

109.13

-0.52(-0.4742%)

705

Verizon Communications Inc

VZ

48.67

0.09(0.1853%)

10640

Visa

V

85.83

-0.25(-0.2904%)

7374

Walt Disney Co

DIS

32.05

-0.04(-0.1247%)

2105

Yandex N.V., NASDAQ

YNDX

32.05

-0.04(-0.1247%)

2105

-

13:51

Upgrades and downgrades before the market open

Upgrades:

FedEx (FDX) upgraded to Outperform from Mkt Perform at Raymond James

Downgrades:

Intl Paper (IP) downgraded to Underweight from Equal Weight at Barclays

Other:

-

13:01

Earnings Season in U.S.: Major Reports of the Week

February 7

Before the Open:

General Motors (GM). Consensus EPS $1.17, Consensus Revenues $40082.48 mln.

After the Close:

Walt Disney (DIS). Consensus EPS $1.49, Consensus Revenues $15289.44 mln.

February 9

Before the Open:

Coca-Cola (KO). Consensus EPS $0.37, Consensus Revenues $9169.94 mln.

Twitter (TWTR). Consensus EPS $0.12, Consensus Revenues $738.74 mln.

-

12:34

WSE: Mid session comment

After the disappointment of the morning weakness, the situation in Europe has stabilized and both in Frankfurt and Paris we may see a slight increase. Positively distinguished are commodity producers and banks except for Italian institutions, where started selling shares of UniCredit.

Against this background stands out Warsaw market, where the WIG20 index approached the level of 2100 points.

-

08:57

Major stock markets in Europe trading mixed: FTSE + 0.1%, DAX -0.2%, CAC40 + 0.1%, FTMIB + 0.2%, IBEX flat

-

08:16

WSE: After opening

WIG20 index opened at 2078.45 points (+0.11%)*

WIG 55456.89 0.09%

WIG30 2410.46 0.04%

mWIG40 4603.75 0.02%

*/ - change to previous close

The cash market (the WIG20 index) opened with slightly increase, with modest turnover concentrated on the shares of KGHM, PKN and Polimex (WSE: PXM). In the environment the German DAX is weak in the morning and go down approx. 0.4%. Unfortunately, the attitude of the environment is not conducive for increases.

After fifteen minutes of trading WIG20 index was at the level of 2,077 points (+0,04%).

-

07:49

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.4%, CAC40 + 0.2%, FTSE + 0.2%

-

07:21

WSE: Before opening

New weekly markets begins in the shadow of Friday's report from the US labor market. At first glance, he was a good 227 thousand. new jobs, however, clearly negatively surprised by the level of wage growth, with an increase of 0.1% m / m and a negative revision for the previous month of 0.4% to barely 0.2%.

This lowered pressure on the central bank to raise interest rates and the positive impact on earnings forecasts of companies and consequently on the rise on Wall Street.

In the morning, futures on Wall Street are listed on neutral levels in Asia and we see a slight increase. We can therefore expect a quiet early trading in | Europe for the light increases.

In the morning, the Polish zloty slightly weakened the US dollar and strengthened against the euro.

-

06:37

Global Stocks

U.K. stocks closed at a two-week high Friday, achieving a small weekly rise, as bank shares climbed on plans by U.S. President Donald Trump to dismantle some U.S. regulations on the financial-services sector. On Friday, banks climbed on reports Trump plans to sign an executive action to scale back the 2010 Dodd-Frank financial-overhaul law, as part of a push to peel back much of the regulatory system put in place after the financial crisis.

U.S. stocks closed near session highs, with the Dow industrials reclaiming a close above 20,000 and the Nasdaq reached a record. Steps by President Donald Trump to roll back bank regulations and a stronger-than-expected January jobs report contributed to the upbeat sentiment. A led by a sharply higher financial sector.

Most Southeast Asian stock markets edged higher on Monday, with prospects of a rate hike next month by the U.S. Federal Reserve dimming as data showed wages barely rose, softening the dollar and lending support to emerging markets. Nonfarm payrolls increased by 227,000 jobs, the largest gain in four months, the U.S. Labor Department said on Friday, but wages increased by only three cents, suggesting that there was still some slack in the labor market.

-