Market news

-

23:30

Commodities. Daily history for Feb 07’2017:

(raw materials / closing price /% change)

Oil 51.69 -0.92%

Gold 1,235.20 -0.07%

-

23:29

Stocks. Daily history for Feb 07’2017:

(index / closing price / change items /% change)

Nikkei -65.93 18910.78 -0.35%

TOPIX -4.27 1516.15 -0.28%

Hang Seng -16.67 23331.57 -0.07%

CSI 300 -7.53 3365.68 -0.22%

Euro Stoxx 50 -2.60 3235.71 -0.08%

FTSE 100 +14.07 7186.22 +0.20%

DAX +39.60 11549.44 +0.34%

CAC 40 -23.61 4754.47 -0.49%

DJIA +37.87 20090.29 +0.19%

S&P 500 +0.52 2293.08 +0.02%

NASDAQ +10.67 5674.22 +0.19%

S&P/TSX +41.86 15498.80 +0.27%

-

23:28

Currencies. Daily history for Feb 07’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0682 -0,63%

GBP/USD $1,2509 +0,33%

USD/CHF Chf0,9976 +0,66%

USD/JPY Y112,37 +0,57%

EUR/JPY Y120,04 -0,05%

GBP/JPY Y140,56 +0,91%

AUD/USD $0,7626 -0,42%

NZD/USD $0,7299 -0,29%

USD/CAD C$1,3183 +0,76%

-

23:00

Schedule for today, Wednesday, Feb 08’2017 (GMT0)

05:00 Japan Eco Watchers Survey: Current January 51.4 51.9

05:00 Japan Eco Watchers Survey: Outlook January 50.9

13:15 Canada Housing Starts January 207 200

15:30 U.S. Crude Oil Inventories February 6.466 2380

20:00 New Zealand RBNZ Interest Rate Decision 1.75% 1.75%

20:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

21:45 New Zealand Building Permits, m/m December -9.2%

23:50 Japan Core Machinery Orders December -5.1% 3.1%

23:50 Japan Core Machinery Orders, y/y December 10.4% 4.6%

-

20:01

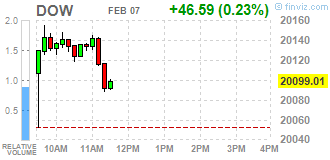

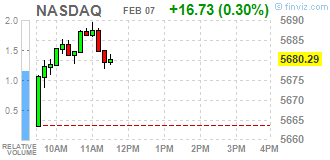

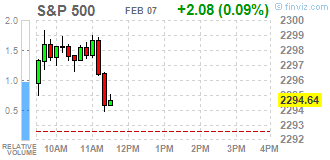

DJIA 20092.26 39.84 0.20%, NASDAQ 5671.68 8.13 0.14%, S&P 500 2293.09 0.53 0.02%

-

20:00

U.S.: Consumer Credit , December 14.16 (forecast 20)

-

17:01

European stocks closed: FTSE 7186.22 14.07 0.20%, DAX 11549.44 39.60 0.34%, CAC 4754.47 -23.61 -0.49%

-

16:44

WSE: Session Results

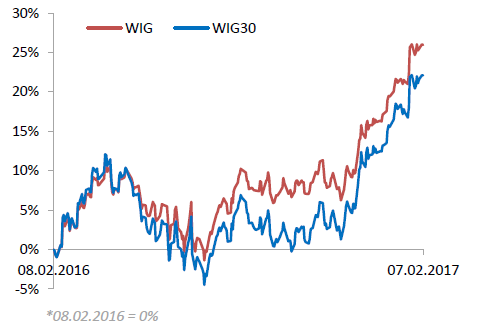

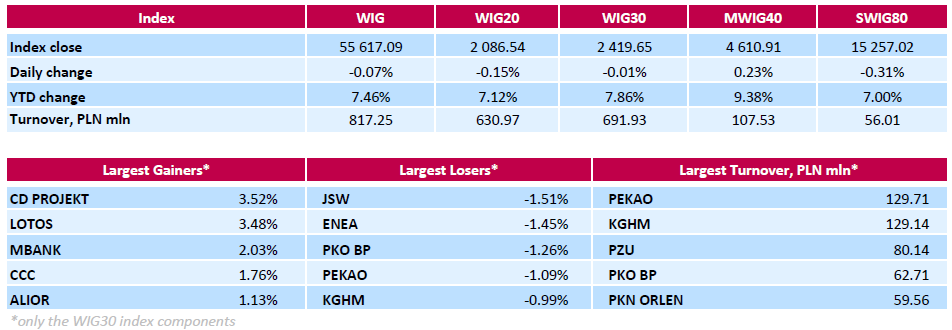

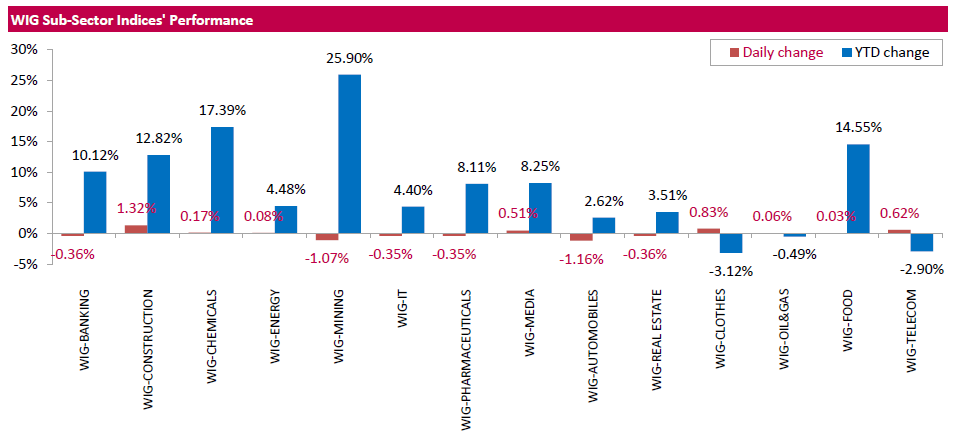

Polish equity market closed flat on Tuesday. The broad market measure, the WIG index, edged down 0.07%. From a sector perspective, automobiles stocks fared the worst, dropping by 1.16%. On the contrary, the best-performing group was construction, gaining 1.32%.

The large-cap stocks' measure, the WIG30 Index, inched down 0.01%. In the index basket, coking coal miner JSW (WSE: JSW), genco ENEA (WSE: ENA), copper producer KGHM (WSE: KGH) and two banking names PKO BP (WSE: PKO) and PEKAO (WSE: PEO) were the weakest performers, dropping by 0.99%- 1.51%. At the same time, videogame developer CD PROJEKT (WSE: CDR) and oil refiner LOTOS (WSE: LTS) recorded the strongest daily results, soaring by 3.52% and 3.48% respectively. The former announced the release of the latest update to its game GWENT: The Witcher Card Game, which is currently available in closed beta. The later continued to appreciate following yesterday's report the company's management estimated its FY 2016 EBITDA at PLN 2.8 bln, up 119% y/y. Other major gainers were bank MBANK (WSE: MBK), footwear retailer CCC (WSE: CCC) and bank ALIOR (WSE: ALR), adding 2.03% 1.76% and 1.13% respectively.

-

16:40

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes slightly rose on Tuesday. Investors are assessing corporate earnings to see if stock valuations are justified after a post-election rally drove U.S. equities to record highs. Fourth-quarter earnings are estimated to have risen 8,1% - the best in nine quarters.

Most of Dow stocks in positive area (20 of 30). Top loser - Chevron Corporation (CVX, -0.98%). Top gainer - The Boeing Company (BA, +1.83%).

All S&P sectors in positive area. Top gainer - Industrial goods (+0.4%). Top loser - Basic Materials (-0.7%).

At the moment:

Dow 20017.00 +45.00 +0.23%

S&P 500 2289.00 +2.50 +0.11%

Nasdaq 100 5181.50 +23.75 +0.46%

Oil 52.12 -0.89 -1.68%

Gold 1235.80 +3.70 +0.30%

U.S. 10yr 2.40 -0.01

-

15:36

BOE's Forbes: Could Soon Support an Increase in Interest Rates

-

Policy Should Not Go On Hold Because of Uncertainty

-

Inflation May Pick Up Faster Than Expected

-

Deterioration in Growth, Jobs Has Not Transpired

-

Growing Uncomfortable With Growth, Inflation Trade-Off

-

-

15:16

US economic optimism rose

The IBD/TIPP Economic Optimism Index gained 0.8 points, or 1.4%, in February, posting a reading of 56.4 vs. 55.6 in January 2017. The index is 6.4 points above its 12-month average of 50.0, 12.0 points above its reading of 44.4 in December 2007 when the economy entered the last recession, and 7.3 points above its all-time average of 49.1.

-

15:08

WSE: After start on Wall Street

The market in the United States opened with an increase of 0.18%, which also means a return to the vicinity of the Friday's closing and close to the record levels. We may see that the European political unrest is unnoticed on the Wall Street, and investors are still under the influence of potential policies Donald Trump, the latest of which - related to the deregulation has been received positively. The Warsaw indices in the last hour before closing are also on the green side of the market.

-

15:03

US job openings little changed at 5.5 million on the last business day of December

The number of job openings was little changed at 5.5 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.3 million and 5.0 million, respectively. Within separations, the quits rate was little changed at 2.0 percent and the layoffs and discharges rate was unchanged at 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.

-

15:00

Canada: Ivey Purchasing Managers Index, January 57.2 (forecast 58.3)

-

15:00

U.S.: JOLTs Job Openings, December 5.501 (forecast 5.568)

-

14:34

U.S. Stocks open: Dow +0.27%, Nasdaq +0.13%, S&P +0.11%

-

14:29

Before the bell: S&P futures +0.22%, NASDAQ futures +0.21%

U.S. stock-index futures rose as investors analyzed a raft of earnings and economic data.

Global Stocks:

Nikkei 18,910.78 -65.93 -0.35%

Hang Seng 23,331.57 -16.67 -0.07%

Shanghai 3,153.65 -3.33 -0.11%

FTSE 7,221.96 +49.81 +0.69%

CAC 4,774.74 -3.34 -0.07%

DAX 11,575.37 +65.53 +0.57%

Crude $52.73 (-0.53%)

Gold $1,231.00 (-0.09%)

-

14:27

Change in GDT Price Index from previous event +1.3%. Average price (USD/MT, FAS) $3,537. NZD/USD unchanged

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

38.15

0.40(1.0596%)

15811

ALTRIA GROUP INC.

MO

71.5

0.21(0.2946%)

1328

Amazon.com Inc., NASDAQ

AMZN

806.95

-0.69(-0.0854%)

13970

AMERICAN INTERNATIONAL GROUP

AIG

64.99

0.09(0.1387%)

100

Apple Inc.

AAPL

130.52

0.23(0.1765%)

75882

Barrick Gold Corporation, NYSE

ABX

19.22

-0.20(-1.0299%)

91855

Caterpillar Inc

CAT

94.12

1.25(1.346%)

32230

Cisco Systems Inc

CSCO

31.37

0.07(0.2236%)

9907

Citigroup Inc., NYSE

C

58.05

0.41(0.7113%)

2131

Deere & Company, NYSE

DE

108.89

0.83(0.7681%)

111

E. I. du Pont de Nemours and Co

DD

76.38

0.09(0.118%)

200

Exxon Mobil Corp

XOM

83.2

-0.11(-0.132%)

7624

Facebook, Inc.

FB

132.25

0.19(0.1439%)

59369

FedEx Corporation, NYSE

FDX

188.38

0.18(0.0956%)

161

Ford Motor Co.

F

12.46

-0.06(-0.4792%)

132097

General Electric Co

GE

29.74

0.08(0.2697%)

16405

General Motors Company, NYSE

GM

36.45

-0.38(-1.0318%)

870329

Goldman Sachs

GS

241.4

1.42(0.5917%)

6400

Google Inc.

GOOG

802.64

1.30(0.1622%)

2241

Intel Corp

INTC

36.43

0.16(0.4411%)

13761

International Business Machines Co...

IBM

176

0.14(0.0796%)

2517

International Paper Company

IP

51.66

0.06(0.1163%)

294

Johnson & Johnson

JNJ

113.6

0.20(0.1764%)

1104

JPMorgan Chase and Co

JPM

87.19

0.42(0.484%)

4478

Merck & Co Inc

MRK

64.95

0.01(0.0154%)

1283

Microsoft Corp

MSFT

63.79

0.15(0.2357%)

12018

Nike

NKE

52.91

0.11(0.2083%)

707

Pfizer Inc

PFE

32.3

0.07(0.2172%)

2851

Starbucks Corporation, NASDAQ

SBUX

55.6

0.12(0.2163%)

1114

Tesla Motors, Inc., NASDAQ

TSLA

258.49

0.72(0.2793%)

27458

The Coca-Cola Co

KO

41.63

0.07(0.1684%)

4066

Twitter, Inc., NYSE

TWTR

18.12

0.19(1.0597%)

174408

Verizon Communications Inc

VZ

48.1

0.07(0.1457%)

2718

Visa

V

86.28

0.45(0.5243%)

5304

Wal-Mart Stores Inc

WMT

66.85

0.45(0.6777%)

172

Walt Disney Co

DIS

109.75

0.18(0.1643%)

14944

Yahoo! Inc., NASDAQ

YHOO

44.64

0.22(0.4953%)

1545

Yandex N.V., NASDAQ

YNDX

23.19

0.18(0.7823%)

536

-

13:50

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Other:

UnitedHealth (UNH) initiated with a Overweight at Cantor Fitzgerald; target $200

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0625 (EUR 307m) 1.0700 (858m) 1.0740-50 (E905mn) 1.0805 (E1.22b)

USDJPY: 111.50 (USD 961m) 113.50 (300m) 115.00 (720m)

EURGBP: 0.8525-40 (EUR 1.03bln)

USDCHF: 0.9950 (USD 700m)

AUDUSD: 0.7500 (AUD 504m) 0.7700 (AUD 955m)

AUDNZD: 1.0470 (AUD 391m)

-

13:43

Canadian building permits declined more than expected in December

Municipalities issued $7.2 billion worth of building permits in December, down 6.6% from November. Lower construction intentions were recorded for all components, led by commercial buildings and multi-family dwellings. In the residential sector, eight provinces posted declines while Ontario reported a record high.

In the non-residential sector, the value of building permits fell for the second time in six months, down 11.5% to $2.3 billion in December, led by lower construction intentions for commercial buildings. Decreases were reported in seven provinces, with Ontario, Alberta and Quebec posting the largest declines.

The value of residential building permits was down 4.1% to $4.9 billion in December. The decrease mainly stemmed from lower construction intentions for multi-family dwellings. Declines were reported in eight provinces. A record high in Ontario was insufficient to offset the declines in British Columbia and Alberta.

-

13:36

Canada's merchandise trade balance with the world recorded its second consecutive monthly surplus

Canada's merchandise trade balance with the world recorded its second consecutive monthly surplus, narrowing from a revised $1.0 billion in November to $923 million in December. Exports were up 0.8% on the strength of higher energy product prices. Imports increased 1.0%, mainly on stronger imports of aircraft and industrial machinery.

In real (or volume) terms, exports were down 1.4% in December as a result of declines in metal ores and non-metallic minerals as well as motor vehicles and parts. Import volumes were up 0.4% on higher real imports of industrial machinery, equipment and parts. Consequently, Canada's trade surplus with the world in real terms narrowed from $2.9 billion in November to $2.1 billion in December.

-

13:35

US trade balance deficit declined in December

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $44.3 billion in December, down $1.5 billion from $45.7 billion in November, revised. December exports were $190.7 billion, $5.0 billion more than November exports. December imports were $235.0 billion, $3.6 billion more than November imports.

The December decrease in the goods and services deficit reflected a decrease in the goods deficit of $1.2 billion to $65.7 billion and an increase in the services surplus of $0.3 billion to $21.4 billion.

-

13:30

Canada: Trade balance, billions, December 0.92 (forecast 0.35)

-

13:30

U.S.: International Trade, bln, December -44.3 (forecast -45)

-

13:30

Canada: Building Permits (MoM) , December -6.6% (forecast -2.5%)

-

13:05

Former French president Nicolas Sarkozy to face trial over campaign funding - the telegraph

-

13:01

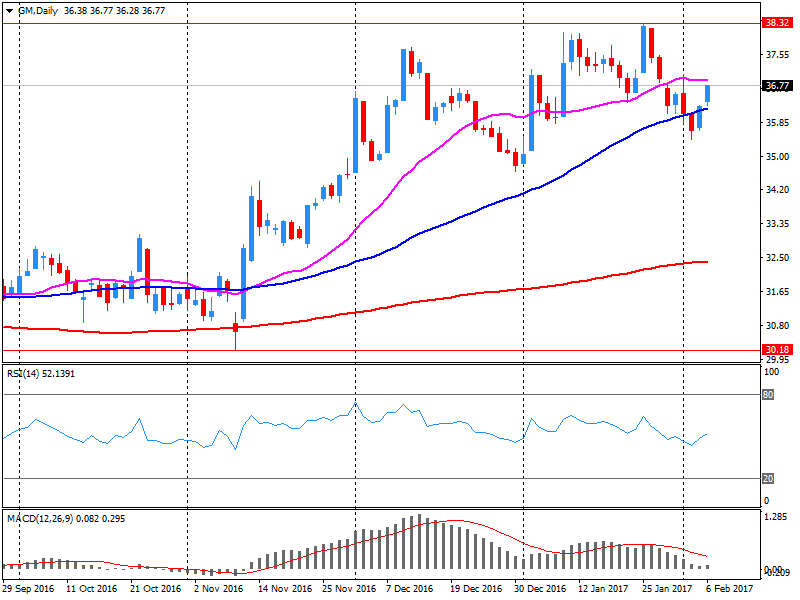

Company News: General Motors (GM) Q4 results beat analysts’ expectations

General Motors reported Q4 FY 2016 earnings of $1.28 per share (versus $1.39 in Q4 FY 2015), beating analysts' consensus estimate of $1.17.

The company's quarterly revenues amounted to $41.231 bln (+9.2% y/y), beating analysts' consensus estimate of $40.082 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $6.00-6.50 versus analysts' consensus estimate of $6.14.

GM rose to $37.40 (+1.55%) in pre-market trading.

-

13:00

Orders

EUR/USD

Offers 1.0685 1.0700-05 1.0730 1.0750 1.0780-85 1.0800

Bids 1.0655-60 1.0630 1.0600 1.0580 1.0550 1.0520 1.0500

GBP/USD

Offers 1.2380 1.2400 1.2420-25 1.2450 1.2485 1.2500

Bids 1.2345-50 1.2320 1.2300 1.2280-85 1.2250 1.2230 1.2200

EUR/GBP

Offers 0.8635 0.8650 0.8685 0.8700

Bids 0.8620 0.8600 0.8580-85 0.8550 0.8530 0.8500

EUR/JPY

Offers 120.00 120.20-25 120.50 120.80 121.00 121.30 121.50

Bids 119.50 119.00 118.60 118.30 118.00

USD/JPY

Offers 112.30 112.50-55 112.85 113.00 113.20 113.50

Bids 112.00 111.80 111.65 111.50 111.30 111.00

AUD/USD

Offers 0.7650 0.7685 0.7700 0.7730 0.7750

Bids 0.7600 0.7580 0.7550 0.7520 0.7500

-

12:30

Romania's national bank kept its key interest rate unchanged, as expected

Romania's central bank kept its key interest rate unchanged for the 14th consecutive session on Tuesday.

The Board of the National Bank of Romania kept the monetary policy rate at 1.75 percent, the bank said in a statement, cited by rttnews.

The minimum reserve requirement ratio on foreign currency-denominated liabilities of credit institutions and the ratio on the leu-denominated liabilities were maintained at 10 percent and 8 percent, respectively.

The board also decided to pursue adequate liquidity management in the banking system.

-

11:41

EUR/JPY Hits 2-Month Low; Morgan Stanley Sees More Falls

-

11:09

-

10:29

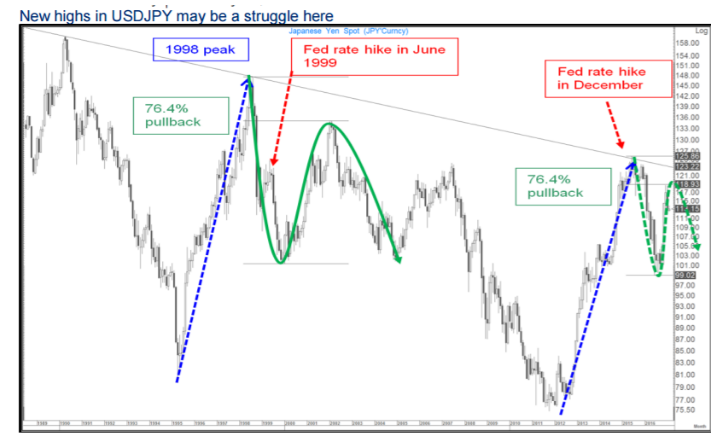

USDJPY looks like it has topped out similar to how it did after the Fed started hiking rates in 1999 - Citi

"USDJPY looks like it has topped out similar to how it did after the Fed started hiking rates in 1999.

We've also held the 76.4% Fibonacci retracement of the fall from the 2015 high, and it is worth noting that that high was posted after we stalled at the long term trendline from the highs going back to 1990, which is presently at 123.96.

Long term Fibonacci retracements have been a good signal in the past and the 76.4% retracement level of the fall from the 1998 high also marked the high of the trend in 2002.

These developments suggest that USDJPY will struggle to make higher highs in the trend even if our medium term USD and US Yields view is correct.

We have set lower lows in the trend in each of the past seven weeks and a continuation of the correction lower should see us test support around 108.90-109.66 where the 55 and 200 week moving averages converge".

Copyright © 2017 CitiFX, eFXnews™

-

10:04

ECB Coeure: France Leaving Euro Would Raise Interest Rates, Debts

-

France Leaving Euro Would Threaten Jobs, Savings

-

France Does Not Have Room For Fiscal Stimulus

-

Greece Needs Overhauls to Prosper in Euro

-

Euro is at "Appropriate" Level for Economic Situation

-

-

10:01

Oil is trading lower

This morning the New York futures for Brent fell by 0.45% to $ 55.47 and WTI was down 0.34% to $ 52.83. Thus, the black gold prices traded in the red zone, continuing yesterday's decline, which is associated with the overproduction of fuel in the world market. In addition, analysts predict a rise in inventories of black gold in the United States by 2.5 million barrels. The growth has been observed for 5 consecutive week and reached thirty years high.

-

08:48

UK house prices declined 0.9% in January

House prices in the three months to January were 5.7% higher than in the same three months a year ago. Prices in the last three months (NovemberJanuary) were 2.4% higher than in the preceding quarter.

Martin Ellis, Halifax housing economist, said: "House prices in the three months to January were 2.4% higher than in the previous quarter; marginally down on 2.5% in December. The annual rate of growth eased to 5.7% from December's 6.5%, and is well below last March's peak of 10.0%. "The quarterly and annual rates of house price growth remain robust even though they are lower than in spring 2016. UK house prices continue to be supported by an ongoing shortage of property for sale, low levels of housebuilding, and exceptionally low interest rates. These factors are unlikely to change materially during 2017".

-

08:47

Major stock markets in Europe trading mixed: FTSE 100 7,179.76 7.61 0.11%, DAX 11,507.85 -1.99 -0.02%, CAC 40 4,771.72 -6.36 -0.13%, IBEX 35 9,315.30 -42.00 -0.45%

-

08:30

United Kingdom: Halifax house price index, January -0.9% (forecast 0%)

-

08:30

United Kingdom: Halifax house price index 3m Y/Y, January 5.7% (forecast 6%)

-

08:19

WSE: After opening

WIG20 index opened at 2089.06 points (-0.03%)*

WIG 55606.83 -0.09%

WIG30 2416.44 -0.14%

mWIG40 4593.44 -0.15%

*/ - change to previous close

The cash market opened with slight decrease at fairly modest turnover. The environment is also dominated by the color red, but discounts are cosmetic. In the following minutes, the control was taken by the supply side and after fifteen minutes of trading the WIG20 index reported the level of 2,080 points (-0.44%).

-

08:15

Chinese FX reserves below $3 trillion for first time since Feb 2011. They've fallen $1 trillion from peak of $3.993 trillion in June 2014

-

07:45

France: Trade Balance, bln, December -3.4 (forecast -4.2)

-

07:31

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.1%

-

07:30

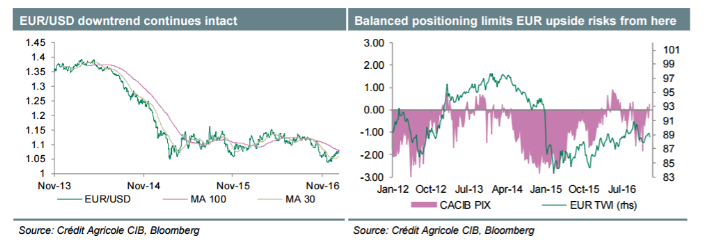

We stay short EUR/USD - Credit Agricole

"This week will be quiet in terms of top tier data releases. As such we expect majors such as EUR/USD to be driven still by external factors like global risk sentiment and Fed rate expectations.

With investors' Fed monetary policy expectations unlikely to rise in the short-term and as global risk sentiment appears more unstable given rising uncertainty when it comes to protectionist developments, as driven by US President Trump, it cannot be excluded that the pair face further upside risks. However, intact uncertainty related to French elections and the scope of an early election in Italy, should keep the upside fairly limited from the current levels.

We believe that any further upside from current levels is corrective rather than a change in trend and fairly balanced speculative positioning, as confirmed by our FX positioning gauge, supports such a view.

As such we are of the view that rallies should be sold and we remain short EUR/USD.*

Credit Agricole maintains a short EUR/USD from 1.0705 targeting 1.0300".

Copyright © 2017 Credit Agricole CIB, eFXnews™

-

07:25

No major change for AUD as RBA holds interest rates

"At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent.

Conditions in the global economy have improved over recent months. Business and consumer confidence have both picked up. Above-trend growth is expected in a number of advanced economies, although uncertainties remain. In China, growth was stronger over the second half of 2016, supported by higher spending on infrastructure and property construction. This composition of growth and the rapid increase in borrowing mean that the medium-term risks to Chinese growth remain. The improvement in the global economy has contributed to higher commodity prices, which are providing a boost to Australia's national income.

Headline inflation rates have moved higher in most countries, partly reflecting the higher commodity prices. Long-term bond yields have also moved higher, although in a historical context they remain low. Interest rates have increased in the United States and there is no longer an expectation of further monetary easing in other major economies. Financial markets have been functioning effectively and stock markets have mostly risen".

-

07:21

WSE: Before opening

The US stock markets began the week with light falls. The causes may be sought in the fact that the promises of Donald Trump on growth, which supported post-election boom, exhausted its potential, and the market is waiting for the specifics of the business plan of the new US president.

In the morning in Asia we may also see slight declines. Morning mood in Europe is therefore close to neutral and promises a calm opening of trading.

The Warsaw index of the largest companies approached the level of 2,100 points, while small and medium-sized companies on the WSE behave well also.

-

07:18

Consumer sentiment in Switzerland has significantly improved according to the latest survey

The index has climbed to -3 points, rising above its long-term average. Consumers are clearly more optimistic about where they feel the economy is going as well as being less gloomy about the future development of unemployment and their own financial situation. This is thus the first time that consumers have rated the outlook in many areas as positively as they did shortly before the Swiss franc shock in early 2015.

-

07:16

Options levels on tuesday, February 7, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0871 (4543)

$1.0825 (3154)

$1.0781 (2209)

Price at time of writing this review: $1.0696

Support levels (open interest**, contracts):

$1.0637 (3401)

$1.0603 (3589)

$1.0565 (4483)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 69149 contracts, with the maximum number of contracts with strike price $1,1000 (4636);

- Overall open interest on the PUT options with the expiration date March, 13 is 79700 contracts, with the maximum number of contracts with strike price $1,0000 (5060);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from February, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.2705 (2837)

$1.2608 (2174)

$1.2512 (3621)

Price at time of writing this review: $1.2441

Support levels (open interest**, contracts):

$1.2390 (1904)

$1.2293 (3580)

$1.2196 (1541)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33251 contracts, with the maximum number of contracts with strike price $1,2500 (3621);

- Overall open interest on the PUT options with the expiration date March, 13 is 36917 contracts, with the maximum number of contracts with strike price $1,2300 (3580);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from February, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:12

German industrial production down 3% in December

In December 2016,production in industry was down by 3.0% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In November 2016, the corrected figure shows an increase of 0.5% (primary +0.4%) from October 2016.

In December 2016, production in industry excluding energy and construction was down by 3.4%. Within industry, the production of capital goods decreased by 5.4% and the production of consumer goods by 3.1%. The production of intermediate goods showed a decrease by 1.1%. Energy production was down by 0.9% in November 2016 and the production in construction decreased by 1.7%.

-

07:00

Germany: Industrial Production s.a. (MoM), December -3.0% (forecast 0.3%)

-

06:33

Global Stocks

European stocks finished lower Monday, with election-related worries prompting investors to step away from equities, while downbeat developments left shares of Volkswagen AG and Ryanair Holdings PLC in the red. Stocks found no relief Monday after European Central Bank President Mario Draghi reiterated his stance that monetary stimulus will be available if warranted for the eurozone economy.

Stocks closed lower Monday following a mixed bag of earnings and continued friction against President Donald Trump implementing a wave of executive orders last week. The Dow Jones Industrial Average DJIA, -0.09% fell 19.04 points, or 0.1%, to finish at 20,052.42, with shares of Verizon Communications Inc. VZ, -1.13% and Home Depot Inc. HD, -1.08% weighing on the average.

Appetite for Asian stocks and the euro ebbed on Tuesday as a rising tide of economic and political concerns added to anxiety over expectations China's foreign exchange reserves fell again in January. But some economists said reserves may have actually risen due to tighter controls on moving money out of the country, as well the impact of a weaker dollar. Nevertheless, as foreign exchange reserves linger at around $3 trillion, concerns remain over the speed at which China has depleted its cash resources to defend the currency.

-

05:02

Japan: Coincident Index, December 115.2

-

05:02

Japan: Leading Economic Index , December 105.2 (forecast 105.6)

-

03:30

Australia: Announcement of the RBA decision on the discount rate, 1.5% (forecast 1.5%)

-