Market news

-

23:51

Japan: Core Machinery Orders, y/y, December 6.7% (forecast 4.6%)

-

23:50

Japan: Core Machinery Orders, December 6.7% (forecast 3.1%)

-

23:29

Commodities. Daily history for Feb 08’2017:

(raw materials / closing price /% change)

Oil 52.38 +0.08%

Gold 1,243.10 +0.29%

-

23:28

Stocks. Daily history for Feb 08’2017:

(index / closing price / change items /% change)

Nikkei +96.82 19007.60 +0.51%

TOPIX +8.00 1524.15 +0.53%

Hang Seng +153.56 23485.13 +0.66%

CSI 300 +17.61 3383.29 +0.52%

Euro Stoxx 50 +2.33 3238.04 +0.07%

FTSE 100 +2.60 7188.82 +0.04%

DAX -6.06 11543.38 -0.05%

CAC 40 +12.13 4766.60 +0.26%

DJIA -35.95 20054.34 -0.18%

S&P 500 +1.59 2294.67 +0.07%

NASDAQ +8.24 5682.45 +0.15%

S&P/TSX +55.24 15554.04 +0.36%

-

23:27

Currencies. Daily history for Feb 08’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0697 +0,14%

GBP/USD $1,2538 +0,23%

USD/CHF Chf0,9945 -0,31%

USD/JPY Y111,92 -0,40%

EUR/JPY Y119,74 -0,25%

GBP/JPY Y140,33 -0,16%

AUD/USD $0,7643 +0,22%

NZD/USD $0,7263 -0,50%

USD/CAD C$1,3142 -0,31%

-

23:00

Schedule for today, Thursday, Feb 09’2017 (GMT0)

00:00 Australia HIA New Home Sales, m/m December 6.1%

00:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

00:30 Australia National Australia Bank's Business Confidence January 6

06:00 Japan Prelim Machine Tool Orders, y/y January 4.4%

06:45 Switzerland Unemployment Rate (non s.a.) January 3.5% 3.6%

07:00 Germany Current Account December 24.6

07:00 Germany Trade Balance (non s.a.), bln December 22.6

09:00 Australia RBA's Governor Philip Lowe Speaks

13:30 Canada New Housing Price Index, MoM December 0.2% 0.2%

13:30 U.S. Continuing Jobless Claims 2064 2060

13:30 U.S. Initial Jobless Claims 246 250

15:00 U.S. Wholesale Inventories December 1% 1%

16:35 Canada BOC Deputy Governor Lawrence Schembri Speaks

18:10 U.S. FOMC Member Charles Evans Speaks

-

21:45

New Zealand: Building Permits, m/m, December -7.2%

-

20:00

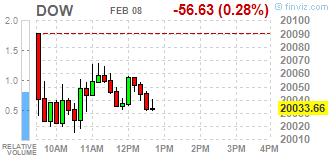

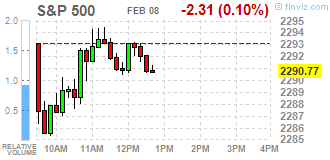

DJIA 20050.31 -39.98 -0.20%, NASDAQ 5681.85 7.63 0.13%, S&P 500 2294.19 1.11 0.05%

-

20:00

New Zealand: RBNZ Interest Rate Decision, 1.75% (forecast 1.75%)

-

17:50

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes slightly fell on Wednesday as investors assessed a flood of quarterly earnings reports. More than half of the S&P 500 companies have reported results so far, with their combined earnings estimated to have risen 8,2% - the most in nine quarters.

Most of Dow stocks in positive area (18 of 30). Top loser - The Boeing Company (BA, -1.55%). Top gainer - NIKE, Inc. (NKE, +1.61%).

Most of S&P sectors in negative area. Top gainer - Utilities (+0.8%). Top loser - Conglomerates (-0.8%).

At the moment:

Dow 19985.00 -33.00 -0.16%

S&P 500 2286.75 -1.75 -0.08%

Nasdaq 100 5183.25 +6.50 +0.13%

Oil 52.37 +0.20 +0.38%

Gold 1244.70 +8.60 +0.70%

U.S. 10yr 2.34 -0.05

-

16:41

WSE: Session Results

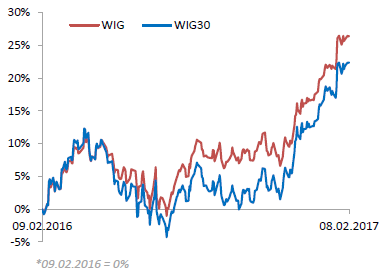

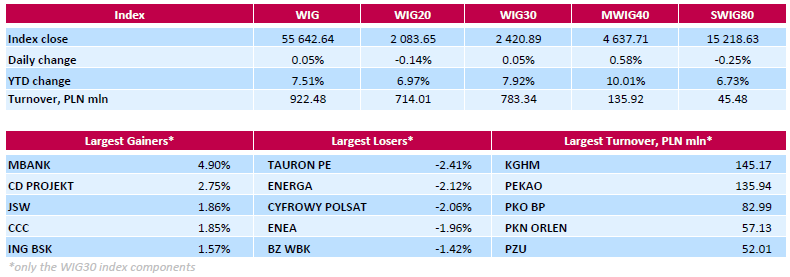

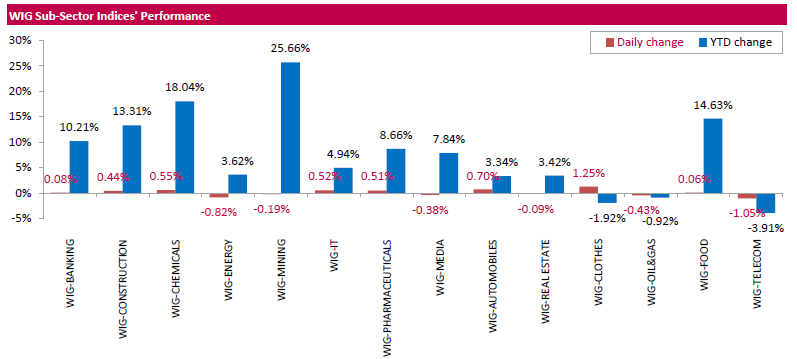

Polish equity market closed flat on Wednesday. The broad market measure, the WIG Index, edged up 0.05%. Sector performance within the WIG Index was mixed. Clothes sector (+1.25%) outperformed, while telecoms (-1.05%) lagged behind.

The large-cap WIG30 Index inched up 0.05%. Within the index components, bank MBANK (WSE: MBK) was the best-performing name, climbing by 4.9% on the back of better-than-expected Q4 FY 2016 earnings. The bank reported its net profit fell by 5% y/y to PLN 292.5 mln in Q4, but was above analysts' consensus estimate of PLN 263.4 mln. In addition, MBANK's CEO Cezary Stypulkowski stated that the bank is unlikely to pay out dividend from its 2016 profit. Other largest outperformers were videogame developer CD PROJEKT (WSE: CDR), coking coal producer JSW (WSE: JSW) and footwear retailer CCC (WSE: CCC), gaining 2.75%, 1.86% and 1.85% respectively. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) and three gencos TAURON PE (WSE: TPE), ENERGA (WSE: ENG) and ENEA (WSE: ENA) were biggest decliners, tumbling by 1.96%-2.41%.

-

15:48

TD staying cautious USD near-term. Chatter from the Trump administration will remain the key driver

"With major currencies approaching key technical levels, the markets are closely following the movements in the broad USD index.

The first chart shows the 20d rolling correlation of the BDXY to the major G10 currencies. It shows that the moves in the BDXY and the broader G10 are closely synchronized. This correlation has averaged around 65% over the past few years so the lift in the correlation indicates the importance of the broader USD move at the moment.

We think chatter from the Trump administration regarding its key policy objectives over the first 100 days will remain the key driver. The second week in office showed little appetite to discuss broader tax reform. Indeed, policy makers spent more time discussing 'bad' trade deals and the value of international exchange rates than fiscal stimulus or tax reform. The scope for a BAT is still unknown with the Senate mulling the idea of proposing its own tax reform bill. Recall, the House's budget plan relies on the tax to fund the personal and corporate tax cuts so it is key to broader reform.

These complications and lack of consensus over them keep us cautious on the USD in the near-term".

Copyright © 2017 TD Securities, eFXnews™

-

15:32

Huge rise for US crude oil inventories

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 13.8 million barrels from the previous week. At 508.6 million barrels, U.S. crude oil inventories are above the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 0.9 million barrels last week, but are above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week.

Distillate fuel inventories remained unchanged last week and are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 6.9 million barrels last week but are in the middle of the average range. Total commercial petroleum inventories increased by 1.4 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, February 13.83 (forecast 2380)

-

14:32

U.S. Stocks open: Dow -0.27%, Nasdaq -0.19%, S&P -0.23%

-

14:15

Before the bell: S&P futures -0.12%, NASDAQ futures -0.02%

U.S. stock-index futures were flat as investors focused on corporate earnings reports.

Global Stocks:

Nikkei 19,007.60 +96.82 +0.51%

Hang Seng 23,485.13 +153.56 +0.66%

Shanghai 3,167.45 +14.36 +0.46%

FTSE 7,167.57 -18.65 -0.26%

CAC 4,763.85 +9.38 +0.20%

DAX 11,528.46 -20.98 -0.18%

Crude $51.75 (-0.81%)

Gold $1,241.90 (+0.47%)

-

14:00

-

13:58

The yield on the benchmark US 10-year note trading at 2.36%

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

37.99

0.02(0.0527%)

4890

ALTRIA GROUP INC.

MO

72.09

-0.11(-0.1524%)

2550

AMERICAN INTERNATIONAL GROUP

AIG

65

0.12(0.185%)

152

Apple Inc.

AAPL

131.5

-0.03(-0.0228%)

77459

AT&T Inc

T

41.19

0.07(0.1702%)

4272

Barrick Gold Corporation, NYSE

ABX

19.52

0.19(0.9829%)

102762

Boeing Co

BA

165.12

0.04(0.0242%)

3017

Caterpillar Inc

CAT

93.1

-0.21(-0.2251%)

6495

Chevron Corp

CVX

111.05

-0.34(-0.3052%)

656

Citigroup Inc., NYSE

C

56.9

-0.29(-0.5071%)

4742

Exxon Mobil Corp

XOM

81.97

-0.05(-0.061%)

17104

Facebook, Inc.

FB

132.28

0.44(0.3337%)

77789

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.4

-0.12(-0.7732%)

169281

General Electric Co

GE

29.55

-0.01(-0.0338%)

3675

Goldman Sachs

GS

238.23

-1.39(-0.5801%)

7767

Google Inc.

GOOG

807.44

0.47(0.0582%)

2138

Home Depot Inc

HD

137.5

0.85(0.622%)

1500

Intel Corp

INTC

36.4

0.05(0.1376%)

1765

International Business Machines Co...

IBM

177.15

0.09(0.0508%)

4556

JPMorgan Chase and Co

JPM

86.3

-0.42(-0.4843%)

11191

Merck & Co Inc

MRK

64.15

-0.05(-0.0779%)

3165

Microsoft Corp

MSFT

63.45

0.02(0.0315%)

6812

Pfizer Inc

PFE

32.18

0.10(0.3117%)

565

Tesla Motors, Inc., NASDAQ

TSLA

256.98

-0.50(-0.1942%)

4544

Travelers Companies Inc

TRV

117.6

-0.16(-0.1359%)

375

Twitter, Inc., NYSE

TWTR

18.66

0.40(2.1906%)

327843

Verizon Communications Inc

VZ

48.1

0.06(0.1249%)

1116

Visa

V

86

0.22(0.2565%)

5979

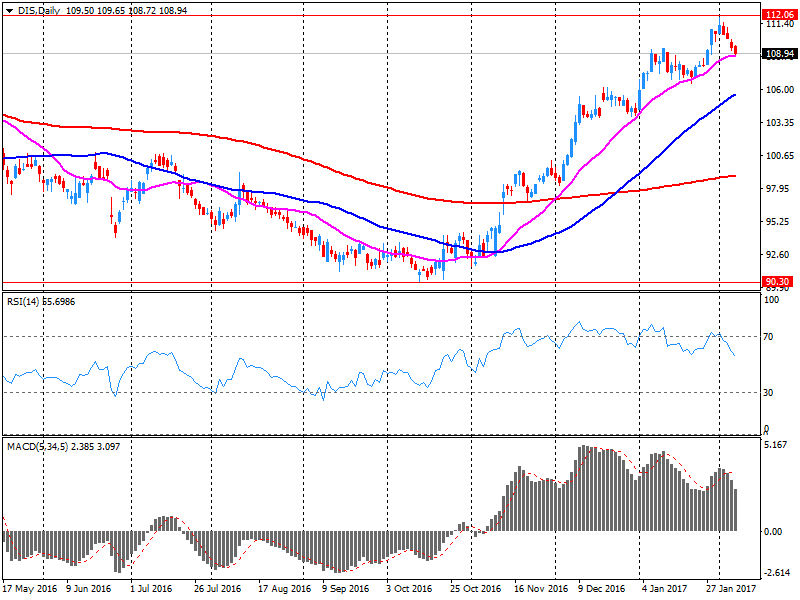

Walt Disney Co

DIS

108.95

-0.05(-0.0459%)

130399

Yahoo! Inc., NASDAQ

YHOO

44.56

0.19(0.4282%)

980

-

13:46

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Buy at BTIG Research

Downgrades:

Other:

Facebook (FB) added to US 1 List at BofA/Merrill

Walt Disney (DIS) reiterated with an Outperform at RBC Capital Mkts; target $130

Walt Disney (DIS) reiterated with a Hold at Stifel; target $100

Walt Disney (DIS) reiterated with a Hold at Needham

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0570-1.0575 (EUR 230 M) 1.0600 (EUR 600 M) 1.0650 (EUR 1,364 M) 1.0700-1.0710 (EUR 251 M) 1.0740-1.0755 (EUR 509 M) 1.0775-1.0780 (EUR 314 M) 1.0840-1.0850 (EUR 403 M)

GBP/USD 1.2550 (GBP 645 M)

USD/JPY 111.00 (USD 525 M) 111.50-111.60 (USD 195 M) 112.95-113.00 (USD 533 M) 113.15-113.30 (USD 241 M) 113.35-113.50 (USD 735 M)

AUD/USD 0.7400 (AUD 311 M) 0.7425 (AUD 644 M) 0.7485-0.7500 (AUD 280 M) 0.7585-0.7600 (AUD 362 M) 0.7650 (AUD 754 M) 0.7693-0.7710 (AUD 260 M)

USD/CAD 1.3015-1.3030 (USD 260 M) 1.3150-1.3155 (USD 202 M) 1.3200-1.3203 (USD 508 M) 1.3400 (USD 1,000 M)

-

13:19

Canadian housing starts rose in line with expectations in January

The trend measure of housing starts in Canada was 199,834 units in January compared to 197,881 in December, according to Canada Mortgage and Housing Corporation (CMHC). The trend is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"New home construction started off strong in 2017, both in terms of single-detached homes and multi-unit residential," said Bob Dugan, CMHC Chief Economist. "While Ontario starts continue to drive the national trend upwards, construction has slowed in BC since last July when it reached a near record high. This slowdown can be partly attributed to builders focusing on projects still underway."

-

13:15

Canada: Housing Starts, January 207.4 (forecast 200)

-

13:02

Company News: Walt Disney (DIS) beats on Q1 FY 2017 EPS, misses on revenues

Walt Disney reported Q1 FY 2017 earnings of $1.55 per share (versus $1.63 in Q1 FY 2016), beating analysts' consensus estimate of $1.49.

The company's quarterly revenues amounted to $14.784 bln (-3% y/y), missing analysts' consensus estimate of $15.298 bln.

DIS rose to $109.10 (+0.09%) in pre-market trading.

-

13:00

Orders

EUR/USD

Offers 1.0680-85 1.0700-05 1.0730 1.0750 1.0780-85 1.0800

Bids 1.0625-30 1.0600 1.0580 1.0550 1.0520 1.0500

GBP/USD

Offers 1.2520-25 1.2550-55 1.2580 1.2600 1.2630 1.2650 1.2685 1.2700

Bids 1.2475-80 1.2450 1.2430 1.2400 1.2380 1.2345-50 1.2320 1.2300

EUR/GBP

Offers 0.8550 0.8585 0.8600 0.8630-35 0.8650

Bids 0.8500 0.8485 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers 119.80 120.00 120.20-25 120.50 120.80 121.00

Bids 119.30 119.00 118.60 118.30 118.00

USD/JPY

Offers 112.50-55 112.85 113.00 113.20 113.50

Bids 112.00 111.80 111.65 111.50 111.30 111.00

AUD/USD

Offers 0.7650 0.7685 0.7700 0.7730 0.7750

Bids 0.7620 0.7600 0.7580 0.7550 0.7520 0.7500

-

11:58

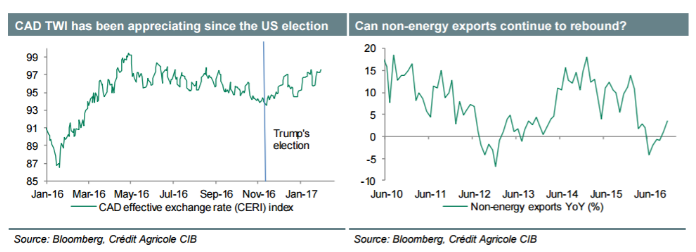

USD/CAD still moves in 'Mysterious' way, according to Credit Agricole

"There does not appear to be much of a driver behind the move higher in USD/CAD beyond a generally more negative risk backdrop and a 1.4% decline in oil prices on Monday.

CAD's cross asset correlations have been very weak lately: 30-day rolling correlation between CAD and oil is close to zero, while USD/CAD continues to trade below the levels suggested by US-Canada 2Y rate differentials.Positioning is also close to neutral according to both IMM CFTC data and our in-house positioning indicator, which suggests low levels of investor participation.

This week is busy for Canadian data starting with Wednesday's international trade, building permits and Ivey PMI, while January employment report will also be release on Friday. CAD is the best performing G10 currency (along with SEK) since President Trump's election, which we find puzzling.

In our view USD/CAD should rise to 1.40 by Q3 as US-Canada rate differentials continue to widen (we expect the BoC to remain on hold this year). Furthermore, CAD is now pricing in little risk of US protectionism, which appears overly optimistic".

Copyright © 2017 Credit Agricole CIB, eFXnews™

-

11:00

Germany sells EUR 2.483 bln February 2027 Bund, average yield 0.33% vs 0.36% on Jan 11, Bid-to-Cover ratio 2.2 vs 1.8 on Jan 11

-

10:21

Bank of England Agents’ summary of business conditions

-

Consumer spending growth had remained resilient, but was expected to ease during the year as prices rose. Investment intentions had edged higher and pointed to small increases in spending during 2017. Export volumes growth had risen due to the fall in sterling and stronger world growth.

-

Hiring plans had edged up, but pointed to little change in staffing overall in the next six months. A survey indicated a modest rise in total labour cost growth in the year ahead (see box on page 2). That was partly due to difficulties in hiring and holding on to staff and costs from the forthcoming apprenticeship levy.

-

Price pressures had continued to build through supply chains following sterling's fall. So far, the main effect on consumer prices had been higher food and fuel prices. But a wider range of goods prices were expected to be affected over the coming year, causing inflation to rise further.

-

-

09:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

Информационно-аналитический отдел TeleTrade

-

09:36

Oil is trading lower

This morning the New York futures for Brent fell 0.44% to $ 54.82 and WTI was down 0.82% to $ 51.74. Thus, the black gold prices traded in the red zone, on the background of the increase in US oil inventories and weakening demand from China. US crude stocks rose by 14.2 million barrels to 503.6 million over the week, according to API while analysts had expected an increase of 2.5 million barrels.

-

09:12

Reserve Bank of India kept the policy repo rate unchanged at 6.25%

"On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

• keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.25 per cent.

Consequently, the reverse repo rate under the LAF remains unchanged at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving consumer price index (CPI) inflation at 5 per cent by Q4 of 2016-17 and the medium-term target of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below".

-

08:47

Major stock markets in Europe trading in the green zone: FTSE flat, DAX + 0.2%, CAC40 + 0.3%, FTMIB + 0.3%, IBEX + 0.3%

-

08:16

The French economy will grow 0.3% quarter on quarter at the start of the year - Bank of France survey

-

07:34

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0.1%, FTSE -0.1%

-

07:33

Options levels on wednesday, February 8, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0793 (3163)

$1.0756 (2486)

$1.0734 (2202)

Price at time of writing this review: $1.0664

Support levels (open interest**, contracts):

$1.0615 (3420)

$1.0586 (3532)

$1.0552 (4616)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 68949 contracts, with the maximum number of contracts with strike price $1,1000 (4603);

- Overall open interest on the PUT options with the expiration date March, 13 is 80496 contracts, with the maximum number of contracts with strike price $1,0000 (5055);

- The ratio of PUT/CALL was 1.17 versus 1.15 from the previous trading day according to data from February, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.2704 (2997)

$1.2706 (2859)

$1.2610 (2120)

Price at time of writing this review: $1.2504

Support levels (open interest**, contracts):

$1.2391 (1978)

$1.2294 (3507)

$1.2196 (1559)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33220 contracts, with the maximum number of contracts with strike price $1,2500 (3646);

- Overall open interest on the PUT options with the expiration date March, 13 is 37070 contracts, with the maximum number of contracts with strike price $1,2300 (3507);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from February, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:30

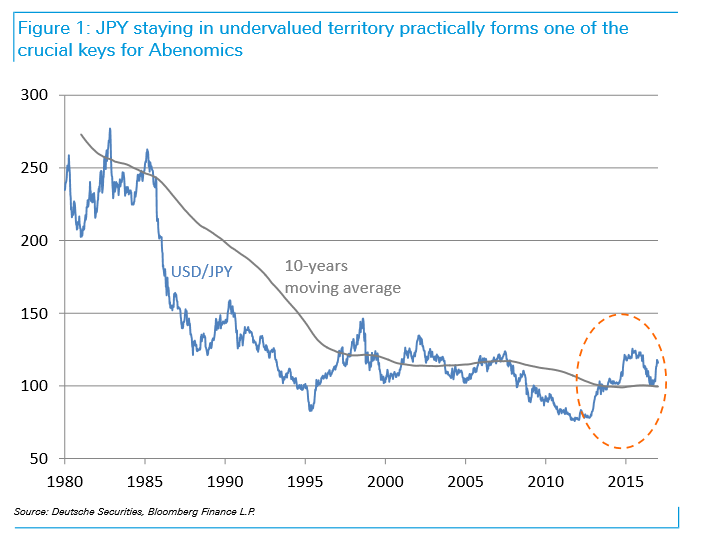

USD/JPY - Deutsche Bank is a buyer into 110

"Prime Minister Shinzo Abe appears to be preparing pro-active proposals for President Trump to boost US growth and employment. If the Trump administration delivers on its promised aggressive fiscal policy, we can expect the current account deficit to widen (reflecting expanded domestic demand) and the dollar to strengthen owing to rising interest rates. If Japan's proposals prove effective, we think they would be certain to at least reinforce this change. While President Trump will likely welcome Japan's proposals, he will very likely hold dissatisfaction over the trade deficit against Japan and the weak yen.

...We calculate that after correcting at the low 110 level recently, the dollar/yen cycle will move toward 120-125 as fiscal policy accelerates US growth to 3-4% from 2017 into 2818 and the Fed hikes policy rate repeatedly.

However, a level above 120 would be politically sensitive, and we cannot exclude the possibility that the Japanese authorities may start talking about self-restraint regarding yen depreciation before the currency reaches 120. Coming dollar/yen appreciation will unlikely be unidirectional.

We recommend building long positions by buying on decline strategically at around 110 and tactically at over-115 level".

Copyright © 2017 DB, eFXnews™

-

07:28

Today’s events

-

At 10:30 GMT Germany will hold an auction of 10-year bonds

-

At 13:00 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

-

At 18:01 GMT the United States will hold an auction of 10-year bonds

-

At 20:00 GMT the RBNZ decision on the basic interest rate

-

-

07:23

The surplus of the current account of Japan's balance of payments in December totaled 1.112 trillion yen

According to the data released today, the current account surplus of Japan's balance of payments in December totaled 1.112 trl yen, while analysts had expected growth to 1.302 trl yen. It is + 18.3% higher than the same period a year earlier. The recent figure was the highest since 2007.

-

net sales of foreign bonds by Japanese investors in January amounted to 1.621 trillion yen

-

net acquisitions of foreign stocks by Japanese investors in January amounted to 519.5 billion yen

-

net purchases of Japanese bonds by foreign investors in January amounted to 1.684 trillion yen

-

net sales of Japanese equities by foreign investors in January amounted to 119.2 billion yen

-

-

07:18

Overall performance of the Japanese banking system remains stymied - Fitch

Overall performance of the Japanese banking system remains stymied despite sound domestic asset quality and credit costs, says Fitch Ratings. Fitch's Special Report on the Japanese 'mega' banks, published today, summarises the challenges of Abenomics and Japanese mega banks' multiple headwinds under the current operating environment.

Fitch sees the Japanese government's policy launched in 2012 as at a crossroads, which has triggered the authorities' introduction of unconventional policies - Qualitative-Quantitative Easing (QQE) and Negative Interest Rate Policy (NIRP).

.

-

07:17

GBP/USD broke above its 20-period moving average and accelerated on the upside, while the 20-period moving average crossed above the 50-period one and is playing a support role

-

06:30

Global Stocks

U.K. stocks closed higher Tuesday, with Rio Tinto PLC among the notable advancers, but BP PLC shares tumbled after some disappointing financial figures from the oil heavyweight.

U.S. stocks closed slightly higher Tuesday, but off session highs, with the Nasdaq notching a new record while oil prices declined and the U.S. trade deficit hit its highest level in four years. The Nasdaq Composite Index COMP, +0.19% rose 10.67 points, or 0.2%, to close at a record of 5,674.22. The index hit an intraday all-time high of 5,689.60 during the session.

Global investors reeled in their risk taking on Wednesday, with many stock markets across Asia drifting lower under the pressure of falling oil prices. Equities in the region kicked off the week positively, but that momentum has flatlined as political uncertainty in Europe and the U.S. lingers.

-

05:16

Japan: Eco Watchers Survey: Outlook, January 49.4

-

05:01

Japan: Eco Watchers Survey: Current , January 49.8 (forecast 51.9)

-